Table of Contents

Do Like Me on Facebook if you enjoy reading the various investment and personal finance articles at New Academy of Finance. I do post interesting articles on FB from time to time that might not be covered here in this website.

Join our Instagram channel for more tidbits on all things finance!

Join our Youtube channel for short and sweet videos on all things finance!

Syfe Trade: Why you should sign up for this platform now

Back in mid-December, Syfe, one of Singapore’s most prominent Robo Advisor, announced that it will be launching Syfe Trade. What exactly is Syfe Trade?

Unlike its typical wealth management Robo Advisor platform, Syfe Trade is similar to your typical discount brokerage platform where users can now purchase US stocks and ETFs for as low as $1 in capital.

This is called fractional investing, one where investors NEED NOT purchase 1 share of a counter but could partake in the growth of the company even if he/she owns < 1 share.

Take, for example, Amazon. The current share price of this blue-chip tech company is $3,251 as of 10 Jan 2022. Through a typical brokerage platform, one will need to purchase at least 1 share of Amazon which will cost $3,251, pretty hefty for a beginner investor.

However, with fractional investing, one can invest in Amazon with a capital as low as US$1. It probably does not make sense to invest with just a dollar, especially if there are commission costs involved (more on this later) but the main gist is that fractional investing has now made partaking in the US market a lot more affordable for beginner investors.

In the first portion of this article, I will do a quick review on the main features of Syfe Trade while the second portion will cover my personal experience in using this new platform, with early trial access. Do note that the official launch of Syfe Trade to the general public will be on 18 Jan 2022.

For those who are interested, here are some of my previous Syfe review articles that I have written:

- Guide to Syfe and how to open an account in less than 10 minutes

- Syfe Equity 100 Review: does this portfolio make sense to you?

- Syfe Review: Which of its portfolio offering will I select?

- Syfe Review: Is this now the most comprehensive Robo Advisor in Singapore?

Syfe Trade review: Key features (Part 1)

Fractional Investing

As previously mentioned, the main feature of Syfe Trade that is “unique” vs. all the other discount brokerages out there is its fractional investing feature.

This means that instead of being limited to buying a minimum of 1 share in a US counter, one can now buy 0.5 shares or 0.1 shares for example. From as little as US$1, you get to invest in any US stock or ETF you care about.

Fractional investing, to be honest, is not a new concept and is very prevalent in the US where many Robo Advisors and standard brokerages do already have such features for their clients.

Here in Singapore, the only other brokerage firm that provides fractional investing is Interactive Brokers, or IBKR as it is commonly known. According to IBKR’s website, fractional investing is commission-free and one can invest with an order as low as US$1 or 0.0001 share.

IBKR’s platform is a lot more established vs. Syfe and hence one can probably expect more features available. However, the key downside to using IBKR is that its platform is seen as being “overly complicated” for new investors to navigate.

Fees

Syfe Trade currently offers 5 commission-free trades per month for its launch (this might not last forever though). Subsequent trades in excess of the 5 trades each month will incur a commission fee of US$0.99/trade.

Unlike its wealth management Robo Advisor platform which users will incur an annual fee of around 0.65% for a typical investor with less than S$20k invested in its platform, Syfe Trade WILL NOT incur this platform fee.

Hence, just like TD Ameritrade with its Thinkorswim (TOS) platform, users will now be able to invest commission-free into US stocks and ETFs. The key difference is that TOS does not offer fractional investing features to Singaporean investors at present, hence the minimum investable amount on the TOS platform is 1 share.

In this sense, Syfe Trade has the edge for being more affordable, especially for a beginner investor starting with a small capital.

I hope that Syfe Trade will provide its 5 free trades/month as a permanent feature for users.

If the US$0.99/trade is incurred, then a minimum investment of around $300-400 will translate to an equivalent commission cost of 0.25-0.3%, which is typical of what the standard brokerages here in Singapore charge.

It does not make sense to invest the minimum US$1 allowed under fractional investing but incur the US$0.99 in commission costs (assuming no more free trades). Your commission cost is essentially 99% in this scenario.

Safety of your capital

Syfe is licensed by the Monetary Authority of Singapore (MAS). Syfe Trade is also SIPC protected. The Securities Investor Protection Corporation (SIPC) is a non-profit corporation created by the US Congress to protect customers if their brokerage firm fails. While brokerage firm failures are rare, the securities in your account are insured by SIPC up to US$500k against brokerage failure.

Available only on mobile platform

Please take note that Syfe Trade is currently only available through its mobile platform and NOT AVAILABLE for those using PC/Desktop. Hence do make sure to download Syfe’s app to get started on this new platform.

How to get started

Getting started on Syfe Trade is pretty simple. Just follow these steps to make your first trade.

- Download (if new) or use the most updated Syfe App. If you are new, you can register for Syfe Trade using Singpass.

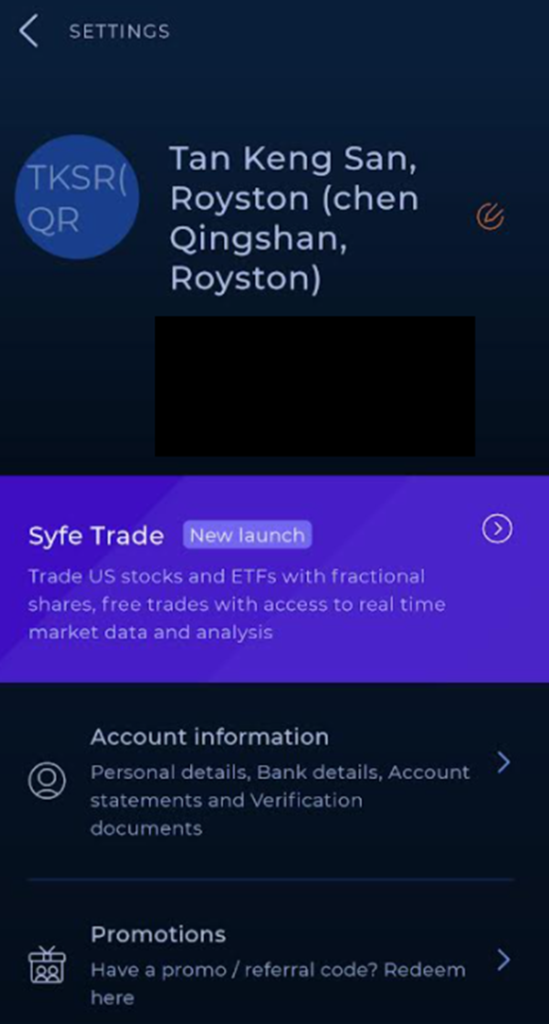

- If you are already a Syfe, you do not need to re-register for a separate Syfe Trade account. You can access Syfe Trade within your app. On the top right-hand corner of your Syfe App, click on your settings and you will see the Syfe Trade feature. You will need to complete an assessment of your investment knowledge to use Syfe Trade. This process will take less than 5 minutes.

- Once your Syfe Trade account is set up, next up is funding the account. You can transfer funds using PayNow, FAST/GIRO, or wire transfer. Remember to add the reference code (if any) to your transaction reference. Funds can be transferred from an SGD or USD account. If funds are being transferred from an SGD account, then it will be converted to USD based on the day rates which Syfe received from their partner institutions.

- Funds are typically received within 1-2 hrs of the transfer and once it has been added to your account, you can start trading within the same business day.

For more information on the technicalities of Syfe Trade, do refer to its Help Page.

Syfe Trade Review: Using the platform (Part 2)

With a basic understanding of Syfe Trade, its main features, and how to get started covered in Part 1, let’s proceed to Part 2 where I will talk about using Syfe Trade mobile platform to execute trades and how it might compare with other mobile brokerage platforms out there.

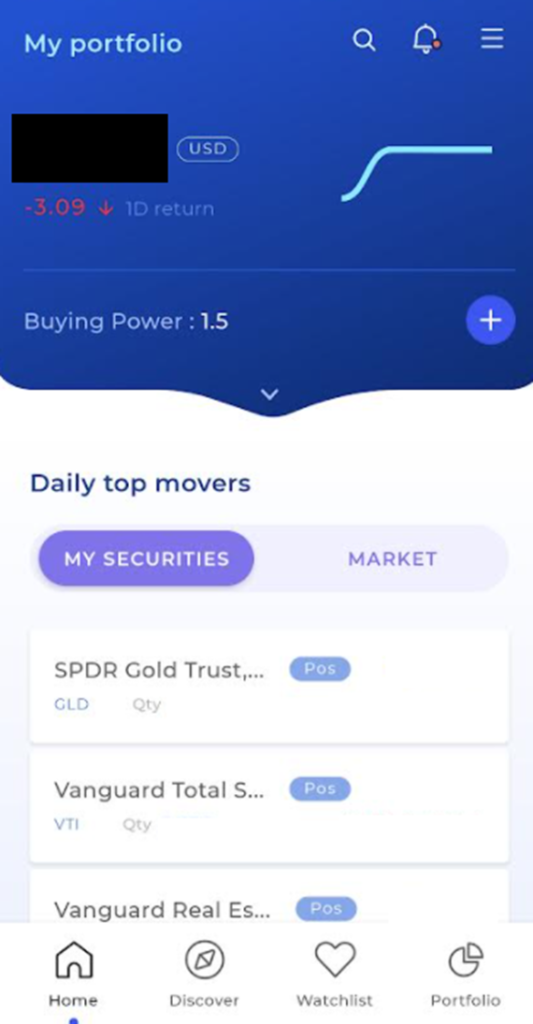

Home Tab

Under the Home tab, you will have a summary of your portfolio value as well as the daily top movers for your securities. You can also select to show the market top movers.

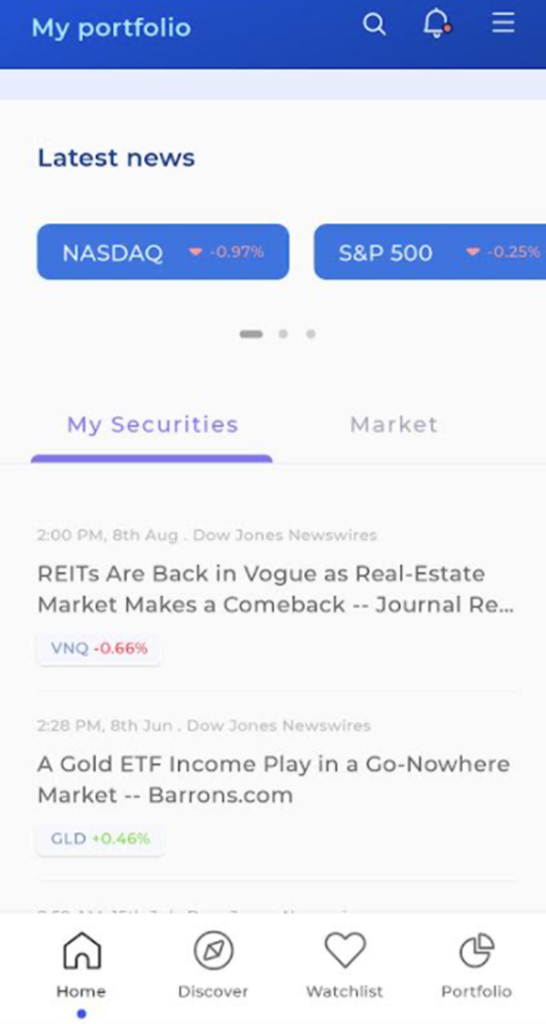

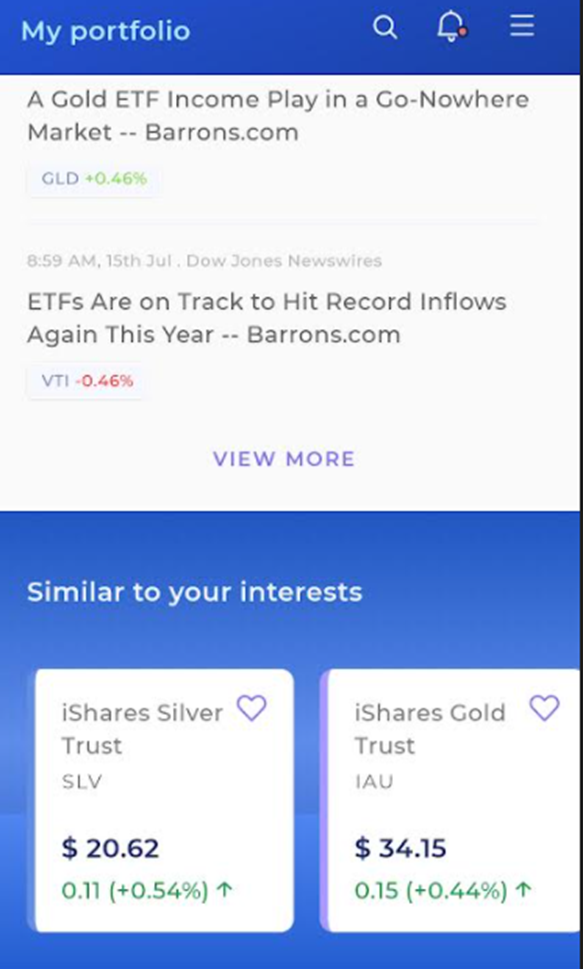

Scrolling down, you will see the latest news on your securities as well as on the market. However, the news feature for Syfe Trade is pretty basic, in my opinion, with the platform subscribing to news being wired from Dow Jones Newswires, with articles typically from WSJ and Barrons.

Last but not least in this tab, it will also show other possible stocks/ETFs that you might be interested in based on your current portfolio purchases.

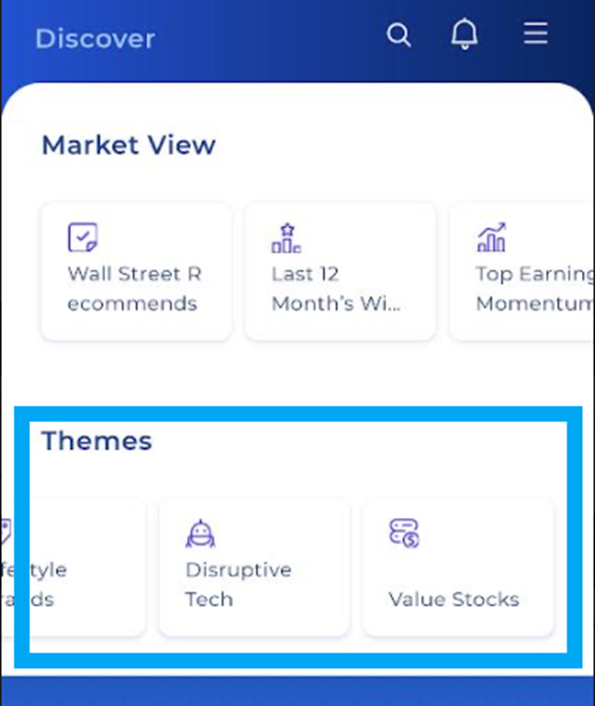

Discover Tab

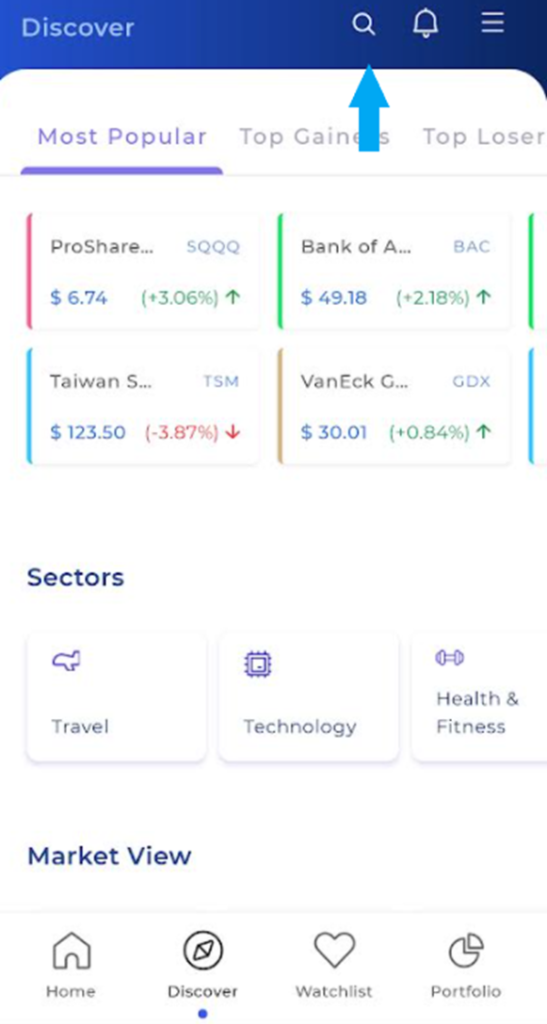

This is where you look for stock ideas. Do note that you can also click on the search icon on the top right corner of the app to find US stocks/ETFs by entering their name or their ticker.

In this tab, Syfe Trade provides some trade ideas by giving you a quick snap-shot on which are the Most Popular stocks currently in the market, the Top Gainers as well as the Top Losers.

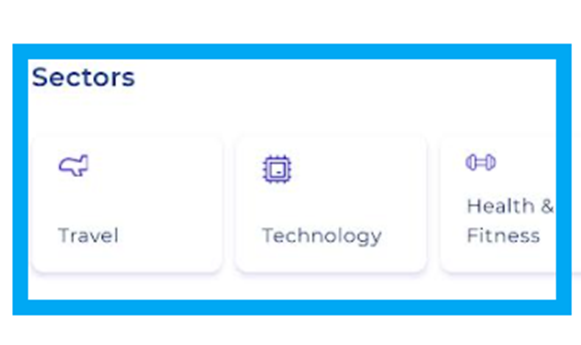

You can also find sectorial ideas. For example, if you believe that the travel industry is set for a rebound, you can click into their Travel theme and find 20 of their recommended travel-related stocks to purchase.

You can also find related stories on these sector stocks.

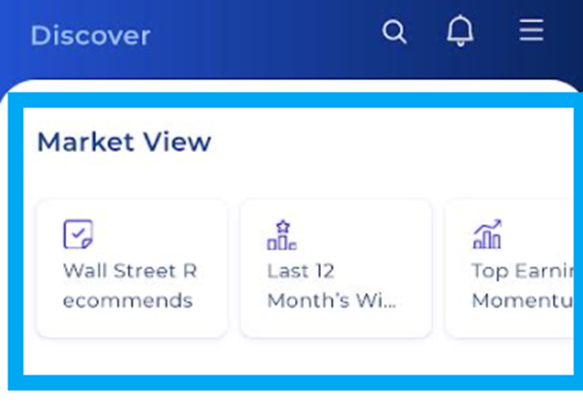

If you wish to find ideas based on market view such as stocks having the highest potential upside based on top Wall Street analysts, you can click onto the Wall Street Recommends icon and be brought to a list of 20 stocks that have the highest upside based on current price vs. the street’s fair value price of the counter.

You can also look at top-performing large-cap stocks over the past 12 months as well as stocks that have seen turbo-charged earnings power over the last 12-months.

If you are interested in growth themes, for example, China plays or ESG names, Syfe Trade also has several thematic stock recommendations which you might find interesting. For example, it has a value stock theme, one which highlights 20 value stocks which include the likes of General Motors (GM), Ford (F), AT&T (T), etc.

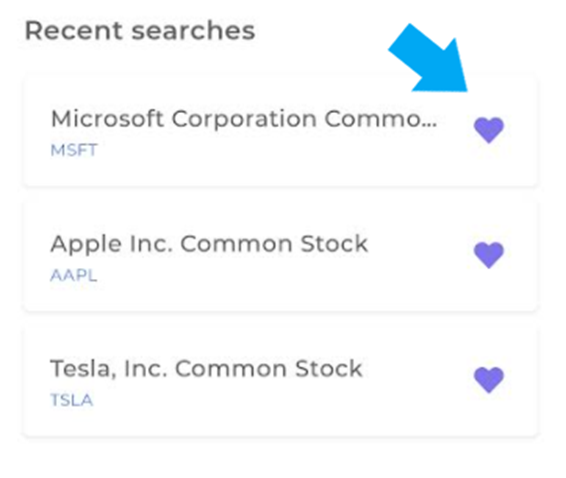

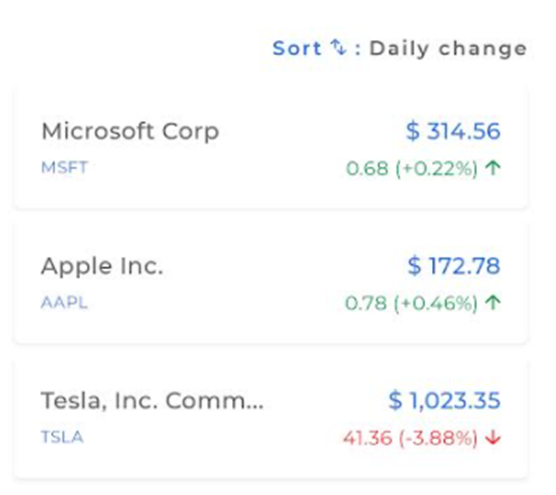

Watchlist Tab

This is where you can create your watchlist. Pretty simple to do. Just search for the stocks which you are interested in, for example, MSFT, click onto the heart icon, and save it under your desired watchlist.

You will then be able to monitor the daily price movements of these stocks in your watchlist.

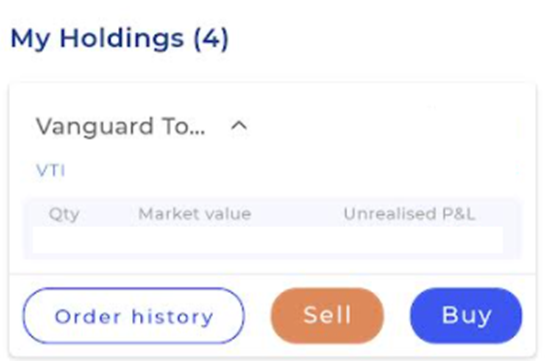

Portfolio Tab

This is where all your portfolio holdings can be viewed. Nothing particularly fanciful over here with the basic trade details like total holdings value, cash balance, 1-day return, and total unrealized return of the portfolio.

By clicking onto the individual holdings, you can look at your order history or select to Sell (all or part of your existing holdings) or Buy more of these stocks.

There is scope for improvement for its Portfolio Tab function, for example by providing additional analytical points for the investor. This could include visually appealing pie charts on portfolio breakdown based on stocks and sectors, monthly portfolio performance bar charts, and dividends received on stock holdings on a monthly rolling basis, etc.

These are the 4 key tabs that you can find on the Syfe Trade app. I would say it serve the basic functions for a beginner investor but for someone more advanced or looking at possibly some basic screening features, these functions are currently lacking.

I have the intention of dollar-cost averaging into a portfolio of 4 key stocks monthly (more on this later). It will be good to have a clear visual representation of how much I have injected vs. portfolio value. This is something which their wealth platform can show clearly.

Being able to track the portfolio performances with clear bar diagrams on a rolling monthly basis will also be very helpful for new investors, in my view.

Looking at individual stocks

Overview

When we select an individual stock, for example, MSFT, we will be able to have a quick overview of the counter’s price performance over a specific period as well as some key statistics (52-weeks High/Low, market cap, etc) on the company.

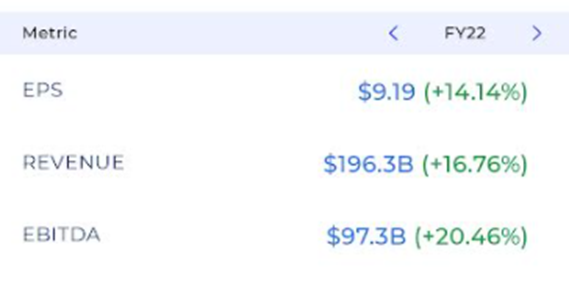

Syfe Trade provides you with 3 financial metrics to look at 1. EPS, 2. Revenue and 3. EBITDA. Financial numbers are provided for the previous year, current year (est), and 1-year forward (est) based on the street’s forecast.

I would say these financial numbers are pretty basic but likely serve the purpose for an investor who just wishes to know the quick trends which are: 1. Is the company growing its revenue? 2. If revenue is growing, is that translating into earnings (EPS) growth?

Analysis

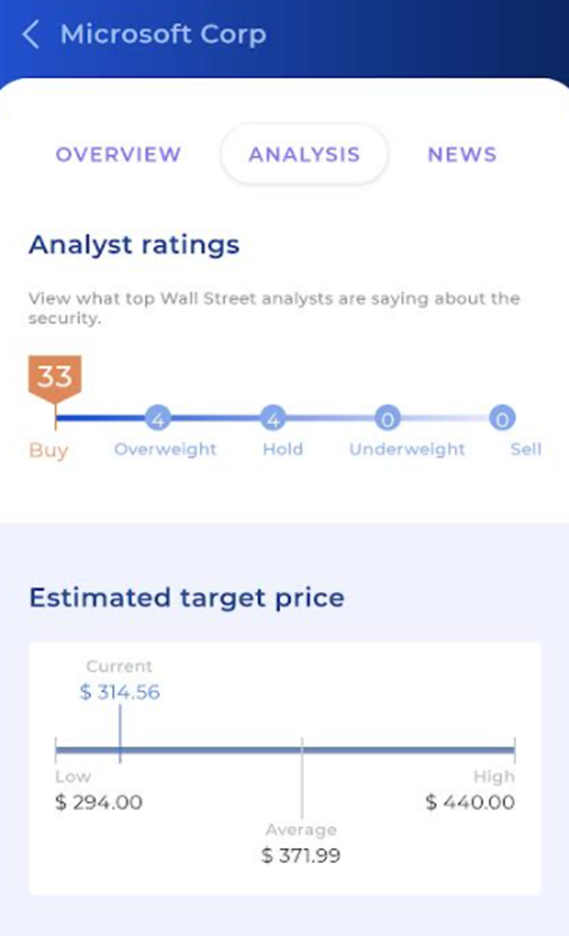

The analysis tab will show you what the top analyst ratings are for this counter. For example, MSFT has 33 analysts having a BUY call, 4 analysts having an Overweight call, and 4 analysts having a Hold call on the counter.

The estimated fair value price of the counter is $371.99 based on price estimates from these 41 analysts, with the most bullish accruing a target price of $440/share on the counter and the most bearish at $294/share.

Last but not least, Syfe Trade also provides a valuation analysis based on forward P/E trend.

I would say that this analysis tab, which is information derived from 3rd party sources, is pretty unique and differentiated from most brokerage firms that will not provide such information.

At the end of the day, it is up to the individual investor to discern if they should base their investment decisions/actions on analysts’ recommendations and fair value target prices.

News

Individual stock news can also be retrieved from the News tab. As I mentioned before, its news function is pretty basic but likely sufficient for beginner investors.

Buying of stocks

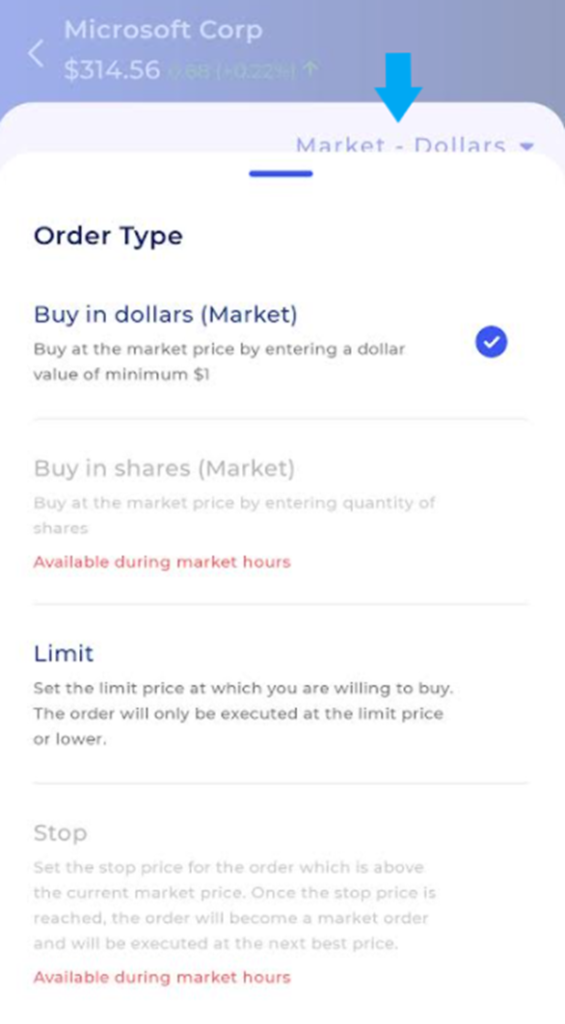

The purchase of stocks can be based on a few order types. First, for most beginner investors looking at fractional investing, you will likely have a specific dollar amount in mind that you will want to invest in a single stock/ETF counter.

Let say for example you will like to invest $100 in MSFT. This will entitle you to 0.317 shares of MSFT. Syfe Trade will prompt you if you do not have enough value in your account to purchase this amount.

To enter a trade based on a fixed notional amount you have in mind, you can click on the top right-hand dropdown function and select Buy in Dollars.

Alternatively, you can also select to purchase the counter based on the number of shares by selecting Buy in Shares. You can select to buy 0.5 shares of MSFT, by which it will cost you approx. US$157 to fund this purchase.

Do note that these fractional purchases, will be executed immediately, ie market orders. For “Buy in shares”, the function is also only available during market hours.

For non-fractional trades, ie purchase of 1 or more shares, you can select to place the order on a Limit or Stop basis.

For limit order, you are placing the purchase price below the current price, ie wait for the share price to decline to a lower value before buying the counter. You can place a limit order on a Good till day basis (expire at the end of the day) or Good till canceled basis (will remain in force until you manually cancel the order)

For stop orders, you are placing the purchase price above the current price. This is typically used for momentum trading where you wish for the stock to break a certain resistant level before looking to enter/trade the counter, in anticipation that its positive momentum will continue.

Stop orders are also only available to be placed during market hours.

For all pending/executed orders, you can click on the Top Right-hand corner on the “hamburger icon – three lines” to see details of it.

Other details

By clicking on the hamburger icon, you can also do the following:

- Toggle between your Syfe Wealth Robo Advisor platform and Syfe Trade platform

- Fund, convert, and withdraw your account.

- Look at your order details (pending and executed)

- View your account setting. This is where you state your details and set your reporting currency for your portfolio.

DCA into NAOF portfolio

I recently updated the performance of the NAOF portfolio alongside all the other portfolio allocation strategies in this article: NAOF Portfolio. Still one of the best portfolio allocation strategies in 2022?

The NAOF portfolio was ranked #2 in terms of portfolio performances in 2021, achieving total returns of almost 20%. This is rather credible considering that it has 40% invested in 2 asset classes: bonds and gold, which did not fare well in 2021.

I am looking at an easy way to dollar cost average a small capital into the NAOF portfolio, which consists of 4 US ETFs: 1) VTI (20%), 2) TLT (20%), 3) VNQ (40%), and 4) GLD (20%)

Unfortunately, no brokerage in Singapore allows an investor to dollar cost average into a portfolio of their selected stocks/ETFs in a simple manner. For zero-commission brokerages such as TOS, I can set up a standing order to transfer a fixed amount of money into the account monthly and manually purchase these 4 ETFs. However, the purchase amount is limited by the share base (at least 1 share) as well as the cost of the equity.

Hence, I will not be able to fix the ratio of my capital for each ETF.

For example, if I wish to DCA $1k into the NAOF portfolio every month, I am looking to assign $200 to VTI, $200 to TLT, $400 to VNQ, and $200 to GLD.

A brokerage like TOS will NOT be able to allow me to invest in these ETFs based on my fixed dollar amount.

This is where fractional investing from Syfe Trade comes into the picture.

While it is not as convenient as simply DCA into a portfolio where I set the ratio of the different stocks/ETFs to be invested based on a recurring amount (automated process), I can still do it manually by:

- Setting up a standing order to transfer $1k into the Syfe Trade account every particular day of a month.

- Note the converted amount in USD (assuming you set a standing order to transfer SGD every month). For example, SGD 1k translates to US$730

- Calculate the amount to be invested in each ETF based on the fixed ratio. For VTI, I am looking to invest 20% * US$730 = US$146

- Manually fractional purchase US$146 worth of VTI every month.

As mentioned, there are some manual processes here in Steps 3 and 4 but this is likely one of the simplest methods for an investor who wishes to dollar cost average a small amount of capital into his/her selected portfolio of individual stocks/ETFs every month without incurring significant commission costs. (Do note that Syfe Wealth Management platform allows you to select individual ETFs (not all-encompassing) to form a portfolio and DCA into it, however, it does not allow you to do so with individual stocks. There are also annual platform fees of c.0.65% incurred for this.)

Since Syfe Trade provides me with 5 free trades/month (for now) there are no commission costs involved for me to purchase these 4 ETF counters monthly (only costs are the expense ratios for ETFs). If and when they do remove the 5 free trades/month, the 1x commission costs will be approx. 0.5-1% in my scenario.

Conclusion

I have written a pretty detailed review article on Syfe Trade which I hope my readers will find useful. Do decide for yourself if Syfe Trade is suitable for you.

I believe the key advantage is that it allows for fractional investing, which is the key differentiating feature of Syfe Trade vs. all the other discount brokerages such as Tiger and MooMoo here in Singapore.

This allows a beginner investor to start investing “cost-free”. Using its Robo Advisory platform, while one can get started for as low as $100, it does incur the additional 0.65% platform fee.

Investors using the Syfe Trade platform will need to know what US stocks and ETFs they are interested to buy instead of following a “standard” portfolio as advised by Syfe Robo Advisor platform.

At present, Syfe Trade only has US stocks and US ETFs available for purchase. For Singaporean investors who are used to investing purely in SG counters, fractional investing is not possible.

For investors who are ready to open a Syfe Trade account, do note that Syfe is now having a new Welcome promo (which ends on 31 March 2022) that will entitle you to earn more than S$200 in cash credits to buy new stocks or ETFs of their choice on Syfe Trade. Do note that your first funding should be at least SGD 1,000.

Do check out this link for more information on this Welcome bonus.

For those who are interested in opening a new Syfe Trade account, I would appreciate it if you can type my referral code: NAOFPROMO-OLD into the referral segment when you open and fund your Syfe Trade account. This is applicable even if you already have an existing Syfe Wealth management account.

For those who do not have any Syfe account, you can use my promo link to have your first $30,000 managed free for 6 months.

Promotion by Syfe:

I hope I have presented the relevant information in an unbiased format with my own opinion for you to make an informed decision. You might agree or disagree and the decision to invest with Syfe is totally up to you.

Syfe has kindly reached out to NAOF readers and you can choose to sign up through this affiliate link where I may receive a share of the revenue from your sign-ups.

Syfe Wealth

Fee waivers up to a cap of S$30,000 for the first 3 months, regardless of the amount deposited.

Syfe Trade

You will be entitled to a special S$70 in cash credit if you decide to deposit a minimum of S$2,000 and execute 1 trade. Both the funding of the account and trade must be done within 30 days.

Just click on the button below to sign up for your Syfe account today.

Whether you decide to use my link to get started on the Syfe Robo Advisor, you are invited to access my FREE Video Tutorial Robo Advisor Guide which will highlight to you the best Singapore Robo Advisors to use based on your investing style (passive, dividend income, international etc).

Disclosure: The accuracy of the material found in this article cannot be guaranteed. Past performance is not an assurance of future results. This article is not to be construed as a recommendation to Buy or Sell any shares or derivative products and is solely for reference only.