Is there a magic formula to select stocks that consistently beat the market?

When it comes to investing in stock market, we will likely to find an easy solution to grow our wealth and consistently outperform the market. Executing the former is easy if you fortunately have got a long-time horizon to let the power of compounding work its magic. I have written about the power of compound interest and how this “8th wonder of the world” can help you achieve millionaire status.

To consistently outperform the stock market is a whole different ball game and one that active managers and even some hefge funds seems to have struggled to do so. That is one for the man-in-the-street, it is easier to stick with a passive investment strategy of buying into a basket of index stocks vs. selecting individual stocks to generate “alpha”.

In this article, however, I will like to demonstrate a “tested” strategy that will show you how to outperform the market consistently despite of being in a bear market for some time and become a successful investor.

Selecting stocks based solely on these 2 financial criteria has proven to substantially “beat” the market based on back-testing using the Stock Rover platform. I have written about Stock Rover in this review article, highlighting that this platform is one of the best, if not the best fundamental screener which should part of the investment toolkit of all serious fundamental investors.

Stock Rover

An All-in-one Fundamental Stock Screener that EVERY serious investors should have in their investing arsenal.

This is my GO-TO Stock Screener for evaluating US stocks and best ETFs. In short, it’s the very first tool I would recommend you to have access, if you’re trying to beat the current stock market performance.

I will be using the Stock Rover platform to screen for stocks that meet these 2 financial criteria as well as do some back-testing on the robustness of these screening criteria.

Without further ado, let’s jump straight into identifying the 2 stock screening criteria I used in my filtering process.

Stock Screener #1: Return on Invested Capital

I have previously written about Return on Equity in this article which I explained in detail what exactly is the Return on Equity Ratio or ROE ratio for short, how to calculate this ratio for investors as well as highlighted companies with strong ROE ratios.

Return on Invested Capital or ROIC is similar to the ROE ratio but instead of using purely shareholders’ equity in the denominator, we add “debt” as an additional component.

Companies with a huge amount of debt raised to drive profits will exhibit a much lower ROIC ratio compared to their ROE ratio.

The formula for ROIC is as such:

ROIC = Net Profit / (Shareholders Equity + Debt) (Simplified version)

ROIC is a favorite Warren Buffett ratio that is used to assess stock market performace of a company at allocating the capital under its control to generate returns.

Companies with consistently high ROIC (ability to generate a high level of profits relative to its equity + debt base) tend to exhibit economic moats, such as those with strong network effects, which allows them to stay ahead of the competition at all times.

A high ROIC requirement will typically exclude early-stage high growth companies that are still generating losses.

In our screening criteria, we will be looking at finding established companies in the S&P 500 that have demonstrated a high ROIC ratio of at least 20%.

Out of the 500 companies in the S&P 500 index, 80 of them meet this criterion at present.

Next, I will look to combine ROIC with my second financial ratio.

Stock Screener #2: 5-years average EPS growth

Growth companies and such stocks have shown to outperform the market consistently over the past 2 decades. I have written about how to find growth stocks to invest in that can potentially outperform the market even during a bear market. This could be by identifying mass consumer products or finding companies that benefit from certain macro-trends that will be in play for the coming decade or more.

Most investors especially the new ones look to follow established growth investors such as Pat Dorsey, Catherine Wood, Stephen Mandel when researching for growth stocks to invest in.

Do note that many of the current “in-play” growth stocks are currently not profitable or lack any form of earnings growth track record. That elevates the risk of a substantial stock price correction in these counters.

On the counter hand, there are a handful of established stocks that still demonstrates the ability to grow their earnings or EPS (earnings per share) strongly over the past years despite multiple bear market occurences. These are “safer” growth stocks which have demonstrated their ability to not only be profitable vs. many loss-making growth stocks but are also growing their profits strongly over the past 5-years.

In my screening criteria, I look for stocks that have demonstrated 5-years average EPS growth of at least 20%. Such stocks don’t need to grow by >20% every single year (over the past 5-years) but on average, the growth rate has been over 20%.

Based on the screening filter of Stock Rover, there are currently 95 companies in the S&P 500 which meet these criteria in the currennt financial markets.

High ROIC + Strong EPS growth = Consistent outperformance

To summarise, these are the 2 fundamental screening criteria:

Screening criteria #1: ROIC > 20%

Screening criteria #2: 5-years average EPS growth > 20%

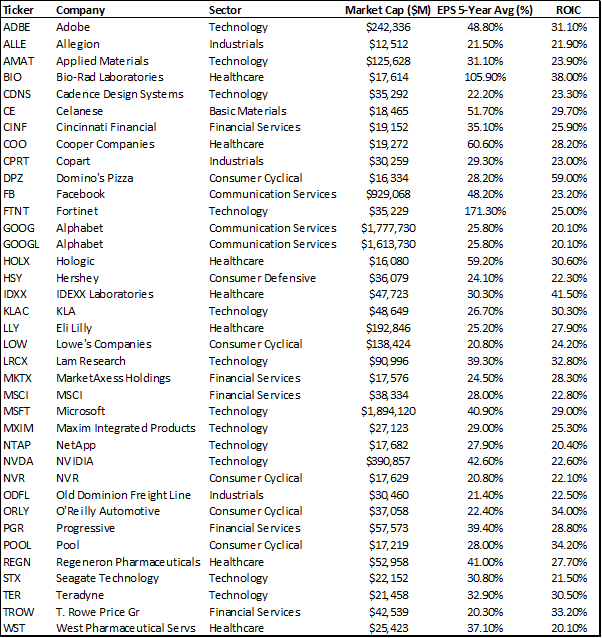

There is currently a total of 37 companies in the S&P 500 that meet both of these screening criteria.

If you invest in this basket of 37 stocks (equal weight) from the beginning of the year, you will have generated a return of c.18.7% vs. the S&P500 12.5% return on a YTD basis.

These stocks have also significantly outperformed the market over the past 5-years and 10-years, generating EXCESS returns (returns above S&P500 returns) of 213% and 704% respectively. Thus outperforming most of the hedge funds and index funds.

If only we can turn back time to invest in these companies!

In hindsight with 20/20 vision, we know that these stocks which have high ROIC ratios and strong 5-years average EPS growth have outperformed the market significantly. The BIG question now is, can one still invest in these stocks for strong future returns?

Back-testing these screening criteria

While these screening criteria have thrown out several strong performing companies in the stock market, it is not good enough to say that the combination of high ROIC and strong 5-years average EPS growth has consistently outperformed stock markets until we do some back-testing.

What if we used these same screening criteria 5 years ago to identify stocks that meet our requirement AT THAT POINT IN TIME. How will these stocks have performed if you put them in your portfolio from the point of identification till today? How about their respectively 5-years and 10-years outperformance/underperformance relative to the S&P 500 index as of May 2021?

Would you also have made money if you invested in companies that meet these 2 key financial criteria stretching back to 2012?

Based on our preliminary back-testing results, it does seem to indicate that the combination of high ROIC companies as well as those that have consistently shown strong EPS growth have consistently outperformed the stock market.

We back-test the screening criteria using Stock Rover’s Freeform Equation by changing the calendar years of the two key criteria.

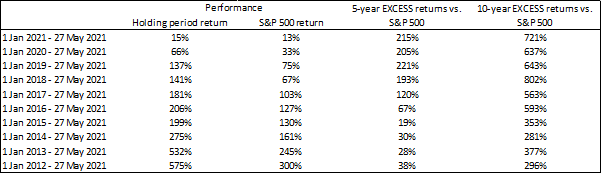

For example, 1-year ago there were 33 companies (vs. 37 companies now) that met our criteria of 20% ROIC and 20% average 5-year EPS growth. If you purchased these companies at the start of 2020 and held these stocks to date, you would have generated a total return of 66% vs. S&P500 index performance of 33%.

This basket of 20 stocks has a 5-years and 10-years excess returns of 205% and 637% respectively.

We back-test these screening criteria for the past 9 calendar years and the results have been encouraging.

Let say for example it is the start of 2015 (6 calendar years ago from today) and we run these same screening criteria. In that year, 24 companies meet these 2 key financial criteria.

Holding this basket of 24 stocks from 1 Jan 2015 till today, the total return would have been 199% vs. the S&P500 return of 130%.

We repeat the same process from 2012 onwards and the table below summarizes the performance of this selection criteria.

The first 2 columns show the total return of a portfolio of S&P 500 stocks that met the above 2 key financial ratio criteria vs. that of the S&P 500 over the specific holding period in the stock market.

The next 2 columns show the 5-year and 10-year EXCESS returns vs. S&P 500 if those portfolios of stocks were held as of today. The interpretation is that these 2 key ratios are much more successful in identifying outperforming stocks in recent years vs. 7-10 years ago.

Using these screening criteria (combining high ROIC and strong 5-year average EPS growth) does not seem to be a “one-trick pony” that can only outperform the market in a particular year.

Based on my back-testing results, it does seem to indicate that selecting stocks based on this screening criteria can consistently identify stocks that are capable of outperforming the market in general.

This gives me more confidence to say that the current 37 companies identified using these screening criteria, when held in a basket, can likely outperform the market over a 5-10 years holding horizon.

Conclusion

Is this the ultimate “holy grail” of investing screener? Likely not. Again, historical performance is never representative of future performance.

The market sentiment might change in favor of value counters moving ahead and, in that sense, many of these stocks which exhibit growth characteristics and are not exactly “cheap” from a value perspective might fall out of favor due to a subsequent “de-rating” of their valuations.

Nonetheless, this screener has been a rather consistent outperformer for me and I am betting that buying high ROIC companies, ie those that likely have the presence of economic moats, while combining strong earnings growth, will continue to be a winning combo in the years ahead.

Note that I am not buying into growth stocks with ZERO earnings in the stock market. These stocks are more susceptible to huge de-rating when market fluctuations happen. What I am identifying are growth stocks that not only are profitable but have also shown a track record of growing their earnings strongly over the past 5-years.

Do Like Me on Facebook if you enjoy reading the various investment and personal finance articles at New Academy of Finance. I do post interesting articles on FB from time to time which might not be covered here in this website.

Join our Instagram channel for more tidbits on all things finance!

SEE OUR OTHER WRITE-UPS

- 8 OUTPERFORMING STOCKS TO BUY NOW (PART 1)

- 4 STOCKS WITH MORE THAN 80% RECURRING REVENUE OWNED BY GURUS

- WHAT DO NETFLIX, ALIBABA, DBS, MICROSOFT HAVE IN COMMON?

- 10 “MUST-HAVE” STOCKS FAVORED BY MOTLEY FOOLS US

- 10 GREAT REASONS FOR REITS INCLUSION IN YOUR PORTFOLIO AND 3 REASONS TO BE CAUTIOUS

- WHY I AM STILL BUYING REITS EVEN WHEN THEY LOOK EXPENSIVE

Disclosure: The accuracy of the material found in this article cannot be guaranteed. Past performance is not an assurance of future results. This article is not to be construed as a recommendation to Buy or Sell any shares or derivative products and is solely for reference only.

1 thought on “How to outperform the market by 100%”