Table of Contents

Ways to Make Money in a Bear Market

While almost anyone on the street looks like an investing “genius” in a bull market, it is the ability to make money in a bear market that differentiates the “wheat from the chaff”.

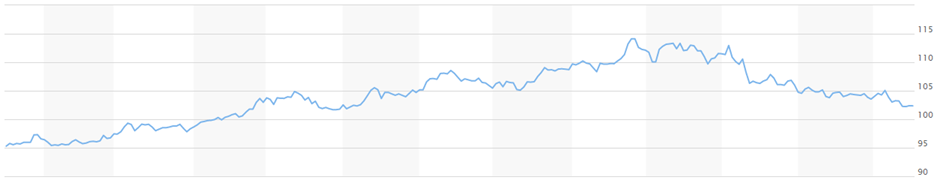

While 2023 has started in a relatively positive mood, with the market feeling a tinge of bullishness stemming from waning inflationary data, it is still all too early to declare that the “coast is clear”.

I think we are still in a bear market bounce, and I have stated 4 reasons why the current bear market rally might not last as we move into earnings season.

While I am taking a cautious stance, it is by no means an indication that I am staying OUT of the market, even if a bottom in the market is yet upon us.

There are multiple ways to make money in a bear market and in this article, I will be detailing 5 investing strategies that I will be adopting in 2023, regardless of whether the year turns out to be a bearish or bullish one.

Bear Market Investing Strategy #1: Invest in the right assets

While some might find it challenging to make money in a bear market, others can achieve great success making money in a bear market because they are focused on the right assets.

2022 has the story of elevated inflation and a rising interest rate environment. Traditional “hedge” instruments against an equity market downfall, such as bonds, fell drastically due to this asset class inverse relationship with interest rates.

When interest rates go higher, bond prices fall. And boy, interest rates “flew through the roof” in 2022. As a result, bond prices collapsed in value.

For bonds to see a substantial reversal in their value, interest rates will need to start coming down, a scenario not likely to happen in any major way in 2023.

So, what are the right assets to look at? I am proposing one here, but this is not a recommendation to buy or sell this asset without doing YOUR necessary due diligence.

The first asset is GOLD. I believe 2023 might finally be the year this asset class starts to shine brightly. Three key reasons:

Reason #1: Rates are no longer expected to keep increasing higher. Since gold yields nothing, investors tend to shun this asset class in a rising rate environment. However, when interest rate expectations have peaked, then this asset class might again find favor with investors, partly also to reason #2 being in play.

Reason #2: We are still in a high inflationary environment, despite recent data highlighting that inflation might already have peaked. Still, a > 6% inflationary environment is nothing to be joyful about and if the downtrend in inflation starts to waver, then gold, traditionally seen as a strong inflation hedge, will start to prosper.

Reason #3: Dollar strength starting to wave. Gold tends to have an inverse relationship with the US Dollar. That is one major reason why this asset class did not perform as well as most would have expected in 2022 when inflation was raging, given its status as an inflation hedge. With the dollar losing its luster, we could finally see a resurgent in gold this year.

A leveraged way to partake in the rise of gold prices is to look at stocks of gold miners.

There are many other asset classes or categories of stocks that could do well even in bear markets. For example, the recent re-opening of China has seen many China-related stocks outperforming their US and global stock counterparts. This trend can persist for the rest of 2023.

Bear Market Investing Strategy #2: Opportunistic short-term trading strategies that work

A second way to make money in a bear market is to explore opportunistic short-term strategies that remain largely independent of how the macro environment might be.

One of the opportunistic short-term trading strategies that work well for me is to engage in the use of seasonality.

For example, I recently wrote an article on the top 4 seasonally strong stocks to buy in January.

The second method to use in bear markets is to target stocks with a strong price momentum at present, with the expectation that the strong price momentum will continue over the next couple of days/weeks for one to be profitable.

These short-term trading strategies that work well for me might, however, not be your cup of tea, particularly if you are not comfortable, or lack the necessary time resources, to commit to such short-term trading.

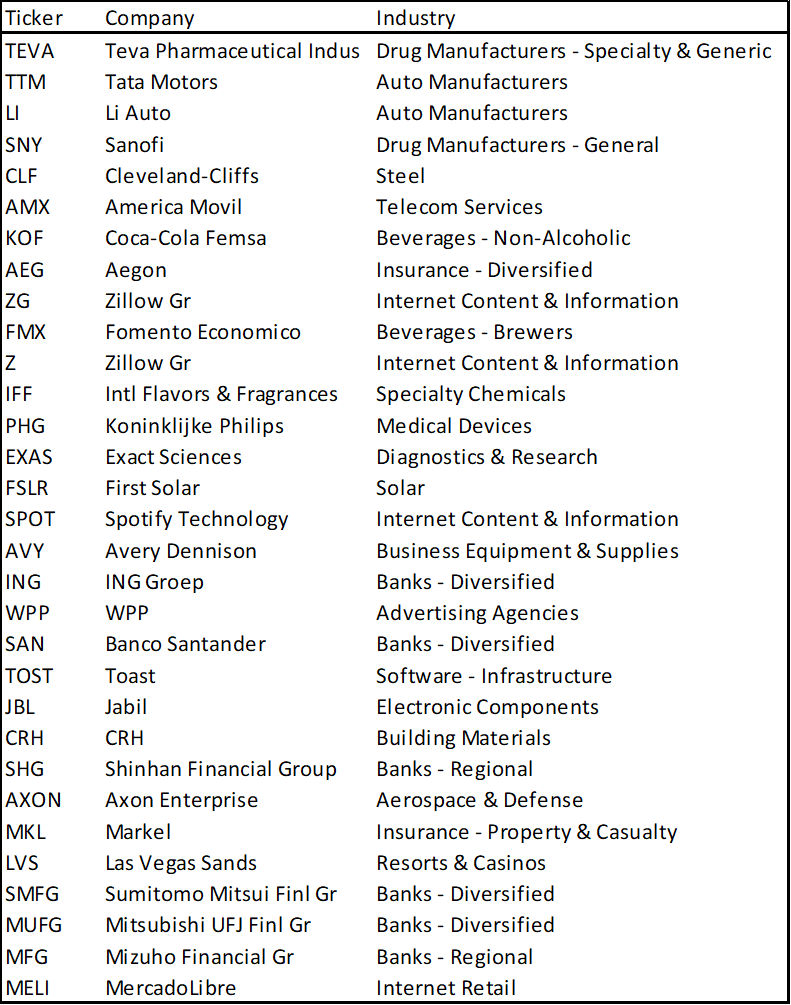

Below is a table that highlights some of the strong momentum stocks in my watchlist for your consideration.

Do note that this list of stocks is screened based on recent positive price action vs. peers

Bear Market Investing Strategy #3: Open to “short-selling stocks”

Short selling is a way to profit from a decline in the price of an asset in the stock market. This is one simple way to make money in a bear market, but most long-term investors are not accustomed to short-selling stocks.

There are a few ways to engage in a “short-selling” activity.

The most direct approach is to borrow shares from your brokerage to sell. When the price of the stock in question declines, you buy it back at a lower price and profit from the price differential.

Sell High, Buy Low. Sounds simple enough. There are, however, associated borrowing costs that your brokerage will charge, which imply that this activity is not suitable to be engaged over a prolonged period.

The second and more common approach in the bear markets is to use certain stock derivatives such as Contracts for Difference, more commonly known as CFDs. Do however note that CFDs are typically leveraged products and you might end up potentially losing more than your original capital.

The third approach to use in bear markets is through the purchase of options, specifically Put Options that seek to profit when the price of an asset class declines.

Short-selling stocks, while not advisable for those untrained, can be a good way to hedge your portfolio against a market downturn as well as benefit from the decline in stock market prices.

Bear Market Investing Strategy #4: Dollar Cost Average into long-term structural growth plays.

While the first 3 bear market investing strategies are shorter-term, one should also be looking to capitalize stock market with a long-term structural growth angle now trading at a discount.

We cannot profit from these stocks in the short term while the bear markets are in play. However, a bear market presents an investor with a “once-in-a-blue-moon” type opportunity to buy these assets at a discount.

It will be wise to start positioning your portfolio in these structural growth plays while they are “unloved” and benefit from them once the market resumes its long-term uptrend.

However, do be prepared for some “short-term pain” in a bid to benefit from that “long-term gain”.

I look to engage in some of these long-term structural growth plays, not through individual stocks, but by engaging a dollar-cost average approach into thematic ETFs.

Some of my favorite long-term structural growth thematic ETFs include the likes of SOXX, CIBR, ICLN, IHF, and IDRV.

These are counters which I look to passively engage in with a 5-10 years horizon in mind.

Once again, the above-mentioned names are my preference and should not be seen as an inducement or recommendation for you to Buy or Sell.

Do also take note that buying ETFs does entail incurring recurring costs (expense ratio).

Bear Market Investing Strategy #5: Buying High-Quality Blue-Chip Stocks at a discount.

Similar to strategy #4, the final bear market investing strategy that I am engaging to capitalize on the current bear market is to start positioning myself in high-quality blue-chip stocks that are now trading at a discount.

While these stocks might be high quality in nature, they are similarly not spared the “market carnage” when the bear starts going on a rampage.

However, these are the stocks that you can be assured will continue to survive and even prosper amid a bear market or recessionary environment, often emerging out of the crisis, not just in one piece, but stronger.

These are the stocks in which I would like to position myself into right now so that my future self will thank me for it.

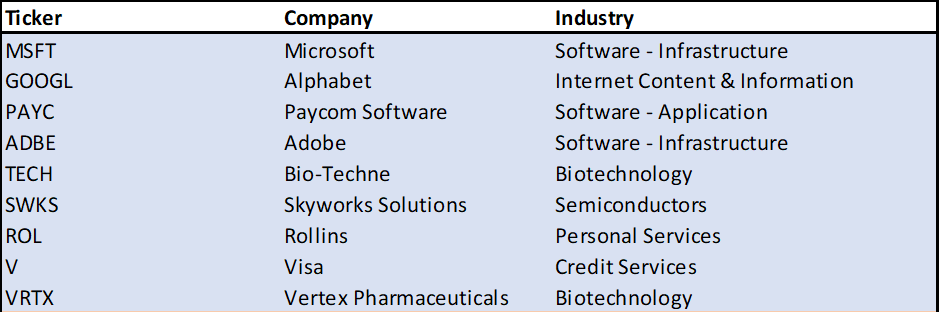

The table below highlights some of the blue-chip counters that I screened for using a data-driven methodology that allows me to identify the Top 1% of high-quality US stocks that are now trading at the right valuation.

For those who are interested, you can check out my Free 3-Part Video where I explain to you some of the finer details of this data-driven approach.

Conclusion

Most investors would like to see the start of a new bull market so that they can start making money again.

On the contrary, I believe that there are also many ways to make money in a bear market, and it is in fact in a bear market that the greatest opportunity presents itself.

It is how you prepare yourself for it that determines your success (or failure) at the end of the day.

I have detailed 5 strategies that I am currently engaging in to make money in a bear market, with the first 3 being more short-term in nature while the last 2 require a longer-term outlook.

I am particularly excited about Investing Strategy #5 in this list, which is to uncover high-quality blue-chip stocks that are now trading at a discount.

I often describe it as having the opportunity to be buying Porsche-like stocks now trading at Cherry QQ prices (no offense to any Cherry QQ lovers over here).

For those who are interested to find out how to engage a simple 5-step process to find these high-quality stocks that are “ripe for the purchase”, do click on the button below:

Do Like Me on Facebook if you enjoy reading the various investment and personal finance articles at New Academy of Finance. I do post interesting articles on FB from time to time that might not be covered here in this website.

Join our Instagram channel for more tidbits on all things finance!

Join our Youtube channel for short and sweet videos on all things finance!

SEE OUR OTHER WRITE-UPS

- GUIDE TO SYFE AND HOW TO OPEN AN ACCOUNT IN LESS THAN 10 MINUTES

- SYFE GUIDE: DID SYFE’S ARI ALGORITHM OUTPERFORM IN TODAY’S MARKET VOLATILITY?

- Pricing Power: Stocks that can do well amid inflation concerns

- 5 Small-Cap US Stocks with 10 years of consecutive earnings growth

- How to invest in Dividend stocks

- 9 Strong Free Cash Flow Stocks that you need to own

Disclosure: The accuracy of the material found in this article cannot be guaranteed. Past performance is not an assurance of future results. This article is not to be construed as a recommendation to Buy or Sell any shares or derivative products and is solely for reference only