Like any business, the world of investing has its fair share of super stars. These are renowned investors who have achieved sensational results over a long period of time. It’s easy to be a one-hit-wonder but a mountain of a challenge to achieve consistent long-term success. This requires not only discipline but a sometimes a knack for stock-picking, a skill that can prove elusive to many.

Some of the biggest gains ever achieved came during periods when there is blood in the street. Committing capital when it looks like the world is ending ain’t an easy task and most investors are not “hard-wired” to react in such a way, not when one’s portfolio is deeply in the red. This is what differentiates a mediocre investor with that of super-investors.

In this article, we highlight the Top 10 stocks that super-investors have just recently bought in the last quarter (according to Dataroma) and why these stocks should be part of your portfolio consideration.

Hot Stock 1: CVS Health Corp (4 super investors bought)

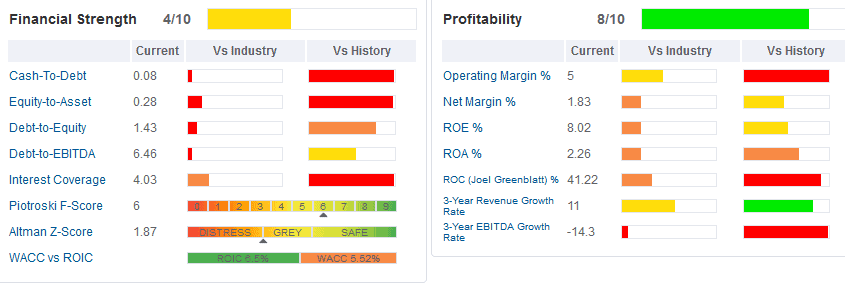

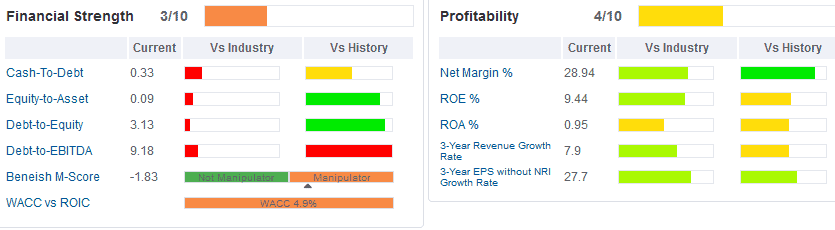

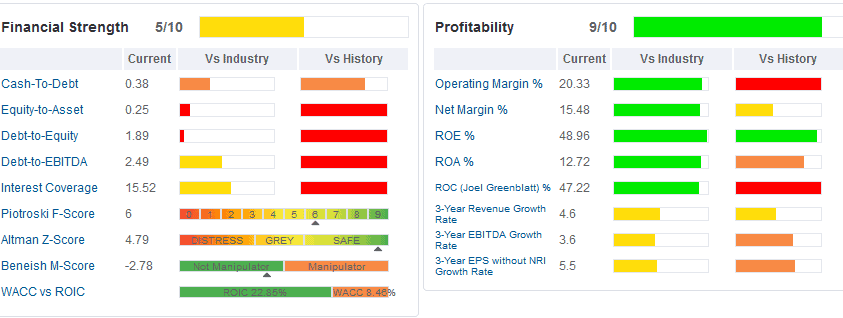

CVS Health is an American healthcare company that owns 1) CVS Pharmacy, a retail chain, 2) CVS Caremark, a pharmacy benefits manager, 3) Aetna, a health insurance provider among other brands. The stock reported better-than-expected 3Q earnings on 6 Nov and the stock powered higher as the turnaround story gains momentum.

CVS has now beaten EPS estimates in 15 consecutive quarters. The turnaround story began on Nov 2018 when CVS completed the purchase of Aetna, setting the stage for CVS to become “the nation’s premier health innovation company”.

Hot Stock 2: Wells Fargo (4 super investors bought)

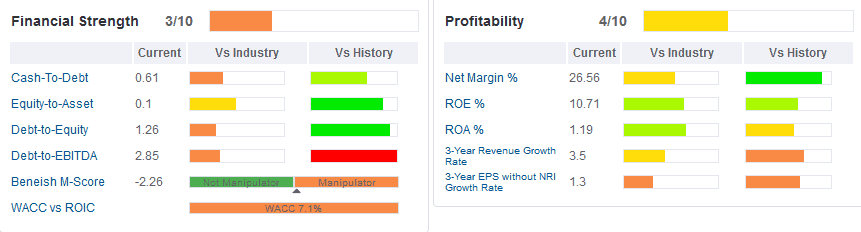

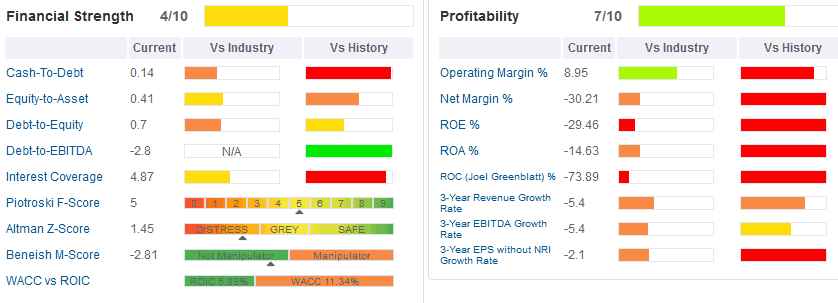

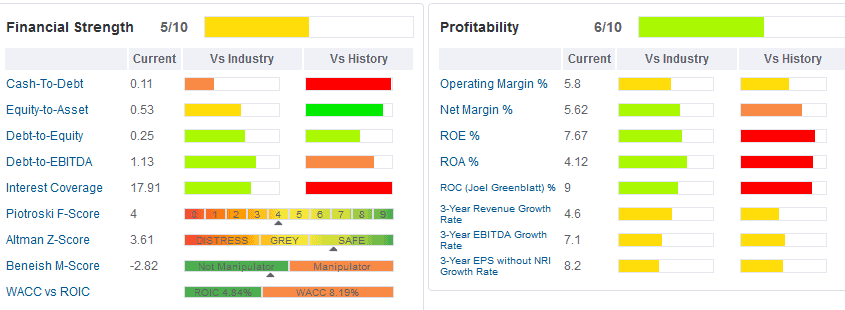

When compared to the other “Big Four” banks, Wells Fargo has trailed in terms of its share price performance. This could be due to investors’ concern of a bleak future, with the company without a CEO for 7-months before Charles Scharf was named as CEO. Mr Scharf’s tenures at Bank of New York Mellon, Visa and JP Morgan Chase bodes well for the bank’s future.

The company remains one of America’s most profitable companies. More importantly, valuations are not demanding with a PER of around 11-12x. This makes the stock a very interesting one to bet on if the turnaround does in fact materialise. Wells Fargo biggest challenge will be in winning the support of regulators. The FED froze USD$2trillion of assets back in 2018 due to “widespread abuses and other compliance breakdowns” and Scharf’s number one priority is to address that regulatory issue.

It will be interesting to see if its new CEO can in fact turn the bank’s “toxic” corporate culture around.

Hot Stock 3: Charles Schwab (4 super investors bought)

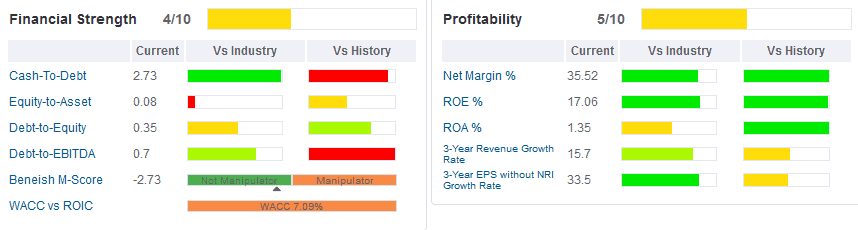

The company’s share price plunged in early October when they announced they were eliminating equity-trading commissions. Trading commissions makes up 6% of Schwab’s total revenue, a relatively small number but investors worry that the loss of revenue comes at a tough time for the company and for the industry as a whole.

Its latest earnings report tells a different story, with the company earnings 70 cents a share in the quarter, beating consensus estimate of 64 cents. The company also reported revenue of USD$2.71bn, up from 5% from USD$2.58bn a year ago.

The company is planning to launch “fractional” stock ownership in a bid to woo younger investors. That could make it possible for individual investors to buy shares in companies and ETFs in smaller or exact-dollar amounts. This will be a win for investors who are handling small amounts of money and for those who want to invest a certain mount of money each month into retirement accounts.

Hot Stock 4: Pfizer Inc (3 super investors bought)

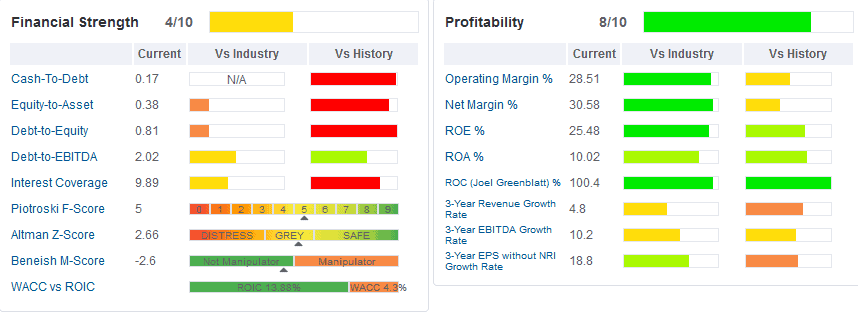

The pharmaceutical firm’s quarterly earnings per share were more than 20% higher than Wall Street expected, with management raising its forecast of earnings for the full fiscal year. Its share price was battered back in end-July when it announced that its off-patent drug division, Upjohn (maker of Viagra and Lipitor), will spin off and merge with the generic drugmaker Mylan.

Pfizer will be left as a dedicated biopharma company following the divestment. While the company’s outlook is positive over the coming years, a wave of patent expirations after 2025 could pose a risk to its medium to longer-term growth. Factoring in longer-term patent expirations, some analysts believe that the New Pfizer’s valuation remain stretched despite the decline in share price.

Apparently some super investors do not think so.

Hot Stock 5: Goldman Sachs Group (3 super investors bought)

Banks have plenty of headwinds to worry about, with falling interest rates, ongoing trade war (that ain’t fully resolved) and fears of a global slowdown. However, for value investors, banks might just be the place to park your money in, with most banks trading at a low PER multiple. Goldman for one is trading at a multiple of only 10x PER. It is also trading at only 0.9x the value of its assets, among the lowest of the biggest US banks.

Hot Stock 6: Schlumberger Ltd (3 super investors bought)

An interesting stock in the list, Schlumberger might have finally seen a bottom in its share price after posting operating earnings that beat the street’s expectations. This was despite announcing a massive USD$12.7bn in asset write downs.

The company has a new CEO that is expected to make aggressive changes. It is also viewed as a value play at a time when investors won’t touch most energy stocks. However, even as the company celebrated rising revenues from a rebound in offshore production outside of the US, slumping global oil demand and continued struggles in the US will create more challenges ahead.

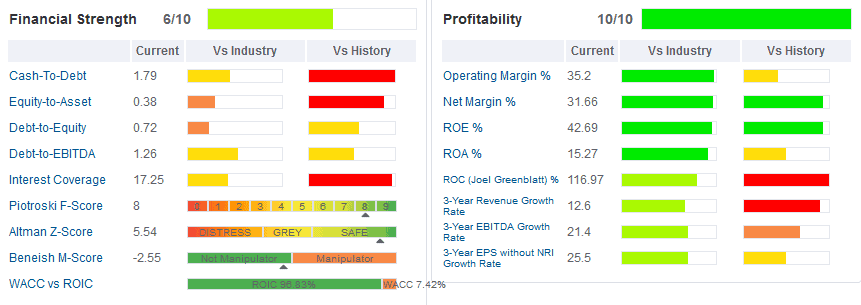

Hot Stock 7: Microsoft Corp (3 super investors bought)

A hot favourite among investors, Microsoft has amply rewarded the trust of its shareholders, with its current share price at all-time high. The software giant bested Amazon.com in a key cloud contract competition that has fuelled even more gains for the former’s price, up more than 40% YTD.

The company is in an enviable position heading into 2020 on the heels of its cloud success and is firing on all cylinders around its office 365 and its cloud computing business, Azure. About 90% of analysts covering Microsoft stock rate the share a BUY.

Hot Stock 8: Amazon Corp (3 super investors bought)

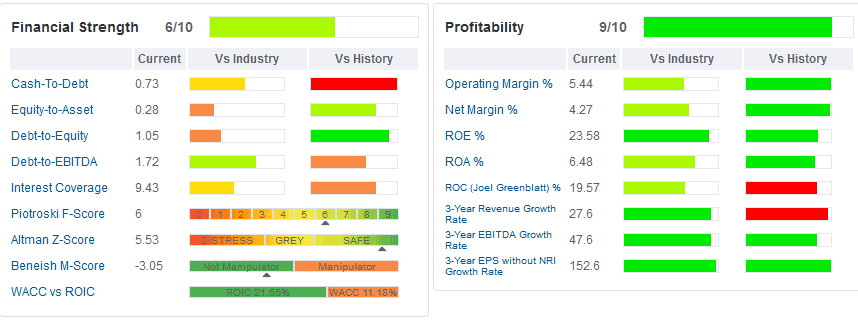

The market leader in cloud computing, Amazon’s loss to Microsoft for the JEDI contract was a major surprise to the market. Nonetheless, the company remains a favourite tech stocks among investors and is considered one of the Big Four technology companies along with Google, Apple and Facebook.

Amazon is also a Buffett stock although Berkshire Hathaway’s stake in it is relatively modest at only USD1bn, with a recent increase of 11%. Some viewed Amazon as a recession-proof stock, with its core e-commerce and cloud business seen as structurally growing industries.

Hot Stock 9: 3M Co. (3 super investors bought)

3M, formerly known as the Minnesota Mining and Manufacturing Company, is an American multinational conglomerate corporate operating in the fields of industry, worker safety, healthcare and consumer goods. Best known for their adhesive tape products, have been roiled by Chinese economic weakness tied to trade. 3M generates more than 30% of sales in the Asia Pacific region of which a big portion come from China.

The stock has been down 11% YTD and some super investors are probably seeing it as an opportunity to buy into a strong consumer brand. However, 3M’s exposure to the Chinese economy could be why the company recently cut its forecast for its annual earnings for the second time this year.

Hot Stock 10: Exxon Mobil (3 super investors bought)

Another energy stock in the list, Exxon Mobil has long been touted as the grand daddy of Oil majors in the world. Its shares are down approx. 13% this year and the counter is currently trading at an attractive yield of 5%. Despite recent quarterly earnings of 75 cents was higher than the street’s estimates, it was still down from $1.46 from a year back.

Falling commodity prices have no doubt hurt Exxon’s price. With oil demand looking relatively weak, this macro factor could be a major headwind to future earnings. What Exxon can control is to ramp up production, with management commenting that the company has made “excellent progress on their long-term growth strategy”.

Do Like Me on Facebook if you enjoy reading the various investment and personal finance articles at New Academy of Finance. I do post interesting articles on FB from time to time which might not be covered here in this website.

Join our whatsapp broadcast: txt hello to https://api.whatsapp.com/send?phone=6587407951&text=&source=&data=

SEE OUR OTHER STOCKS WRITE-UP

- SEMBCORP MARINE 3Q19 LOSSES BALLOONED TO S$53M. WHAT YOU SHOULD KNOW

- VENTURE 6% PRICE DECLINE POST-RESULTS; SATS’ 2QFY20 COULD REMAIN WEAK

- YANGZIJIANG’S SHARE PRICE IS UP 7%. CAN MOMENTUM PERSIST POST-RESULTS ON 7TH?

- SINGAPORE AIRLINES 2QFY20 PREVIEW. HERE IS WHAT TO EXPECT.

- RIVERSTONE 3Q19 PREVIEW: POTENTIAL TO SURPRISE?

- HOW TO PLAY THE PARTIAL OFFER FOR KEPPEL?

Disclosure: The accuracy of material found in this article cannot be guaranteed. Past performance is not an assurance of future results. This article is not to be construed as a recommendation to Buy or Sell any shares or derivative products and is solely for reference only.

2 thoughts on “Top 10 hottest stocks that super-investors are buying”

Great article! Very helpful list for narrowing down the searches on what to focus on.

Hi Jeannie, thanks for stopping by. Do look-out for more of such articles, particularly from the context of US Stocks.