thinkorswim review: First zero-comms broker for US stocks in Singapore

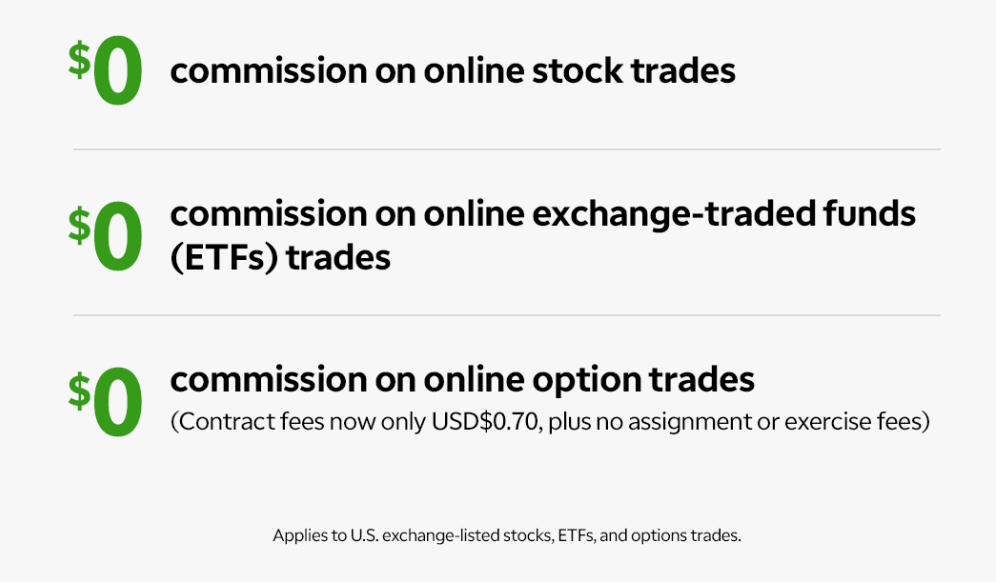

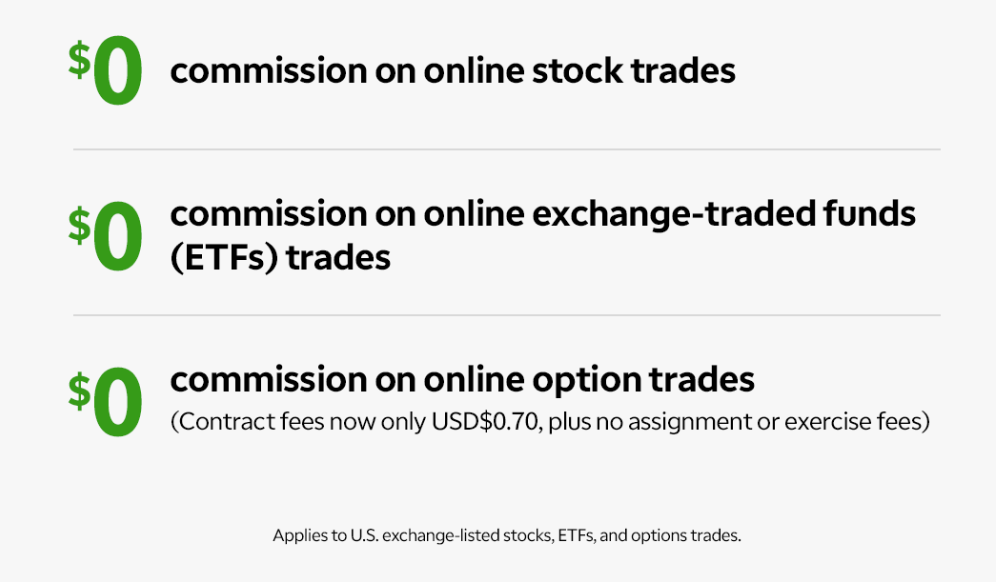

TD Ameritrade which owns the thinkorswim trading platform announced on 29 July 2020 that it will eliminate commissions on online exchange-listed stock, exchange-traded fund (ETF), and options trades for its clients trading the US markets in Singapore.

This will be a comprehensive article, providing guidance on how to open an account with TD Ameritrade, how to fund it as well as a quick overview of the various functionalities of the thinkorswim platform.

The move will take effect on August 3 2020 where it will be slashing its stock purchase fees from US10.65/trade to ZERO. For investors who are trading in options, they now have to pay just US$0.70/contract with no exercise or assignment fees.

With that, the company is now the first and only (for now) brokerage firm to bring commission-free US stocks trading for Singaporean investors.

Mr. Chris Brankin, the CEO of TD Ameritrade Singapore said: “Beyond zero commissions, we are committed to giving our clients the best possible investing experience, with cutting-edge technology and award-winning investor education and service teams. Now, that experience just got better for our Singapore clients”.

How do online brokerages make money charging zero trading fees?

It might surprise you that there are many ways in which a trading platform can make money beyond its traditional “bread and butter” commission charges on trades. Intense competition driving commission rates down to zero means that brokerage firms have to “innovate” to survive and possibly prosper in this cut-throat industry.

For online brokerages now charging zero trading fees, they make money a few ways. One is through data collation where they collect the trading data of their users and consequently sell that info to hedge funds.

Second, they act as a bank. For example, Charles Schwab generates the bulk of its revenue by paying you a lower interest rate on your cash deposits with the firm and earns a higher interest in lending or investing the money elsewhere. For example, Charles Schwab could pay you a 0.1% interest rate on your cash and buy a 10-year treasury bond paying 1.5%. This becomes their Net Interest Margin (NIM) business, similar to that of banks.

Third, they make money through margin and options trading. A lot of this trading platform provides margin services and when you buy stocks/options on margin, you will be charged an interest amount, typically in the region of 9% on an annualized basis.

Fourth, new customers might even join their money management business that invests money in mutual funds with higher fees than index funds and ETFs. For example, Schwab has an Intelligent Portfolio Premium business that costs a fixed amount to join and has a monthly fee.

By cutting their trading fees to zero, these brokerages are hoping to attract more customers and their idle cash into their trading platform.

A little background on TD Ameritrade

Combination with Charles Schwab

For those who are not familiar with TD Ameritrade, they are one of the US’s biggest discount brokers, competing alongside Interactive Brokers. The company announced a very strong set of 3QFY20 results which ended June-2020, one which is its last as an independent-listed company.

In June 2020, shareholders of TD Ameritrade overwhelmingly approved the brokerage’s merger with long-time rival Charles Schwab, in a blockbuster all-stock deal announced in November 2019 that was valued at US$26bn in total. The merger has received antitrust approval from the DOJ, a major regulatory hurdle, and is expected to be completed before the end of the year.

Such a combination will make Charles Schwab the third-largest asset manager in assets under management (AUM) with approx. US$5.3trn in AUM as of end-2019, behind BlackRock and Vanguard.

Zero commission trading

When Charles Schwab first announced back in October 2019 that it will be shifting towards a zero-commission model as a result of pressure from online brokers such as Robinhood that already offer commission-free trading, it shook the brokerage industry and compelled competitors such as E*Trade and TD Ameritrade to follow suit.

The changing landscape made it harder on a firm like TD Ameritrade, which relied more on commissions, than Schwab, which is more diversified and has assets in deposits, fixed income, and other areas. Hence, a consolidation wasn’t exactly a surprise when Charles Schwab announced its intent to acquire TD Ameritrade just a month later.

US investors cheered the zero-commission structure. Who likes paying fees to their brokerage?

Alas, here in sunny Singapore, investors continue to pay the same fee structure that seems to disadvantage TD Ameritrade vs. other overseas brokerage firms such as Interactive Brokers, Saxo, Standard Chartered and the latest addition being Tiger Brokers, the latter further intensifying the price war with its extremely low-cost commission structure.

That was until now.

Following the US structure, TD Ameritrade is now bringing commission-free trading to US stocks/ETFs for local investors here in Singapore while options trading will now be a fraction (just US$0.70/contract) vs. the original US$5/contract.

Award-winning platform

TD Ameritrade owns the award-winning platform thinkorswim. The thinkorswim trading platform was voted the Shareinvestor Awards 2019 “Most Preferred Trading Platform” by INVEST Fair 2019 attendees. The platform was also named #1 Desktop Platform and thinkorswim Mobile was named #1 trader App in the StockBrokers.com 2020 Online Broker Review. These platforms also helped TD Ameritrade, Inc receive a #1 ranking in the Trader Community category and first-place finishes for Platforms & Tools and Education.

I will provide a comprehensive sharing of the thinkorswim platform in the latter part of the article.

Who is TD Ameritrade/thinkorswim suitable for?

This is a trading platform that is suitable for those who are interested to engage or trade stocks, ETFs and options trading at ZERO or extremely low cost

For those who are looking at a broader range of markets, for example, wishing to trade in our SG market, or the increasingly popular HK market or other foreign stock markets will be disappointed that these markets are not available on thinkorswim.

Hence, its catered to investors wishing to partake in US stocks and their relevant ETFs at ZERO commission cost. Alternatively, for active options traders who can now purchase or sell options at just a fraction of the previous cost structure. You can also be using the platform to purchase closed-end funds, futures, and forex.

Beginner users – Although this platform has a lot to impress the advanced trader, the novice trader will also enjoy the broker’s wide range of investment tools such as its impressive charting system, its relatively comprehensive stock screening criteria as well as other educational interactive resources on topics like futures and options.

There is also it’s proprietary paperMoney trading which allows a newbie trader to replicate a live trading scenario without actual funding.

Expert traders – As an advanced trader, you have a lot to reap from the thinkorswim platform. You will have access to options and equity trading as well as customizable options tools. For options traders, in particular, the thinkorswim platform also incorporates advanced tools, free data, sophisticated charts, and smooth trade execution.

Its mobile app allows you to access, pick, and execute trades with just a push of a button.

There are also many other features such as free excess to CNBC Video, a wide array of news feeds, research functions, etc to cater to the everyday investors/traders.

I will provide a more detailed run-through of the thinkorswim platform later.

How to set up your TD Ameritrade account

The online application usually takes 15-20 mins and is a 5-steps process. You will need to upload certain documents such as your ID, Address verification, and Employment verification (if applicable).

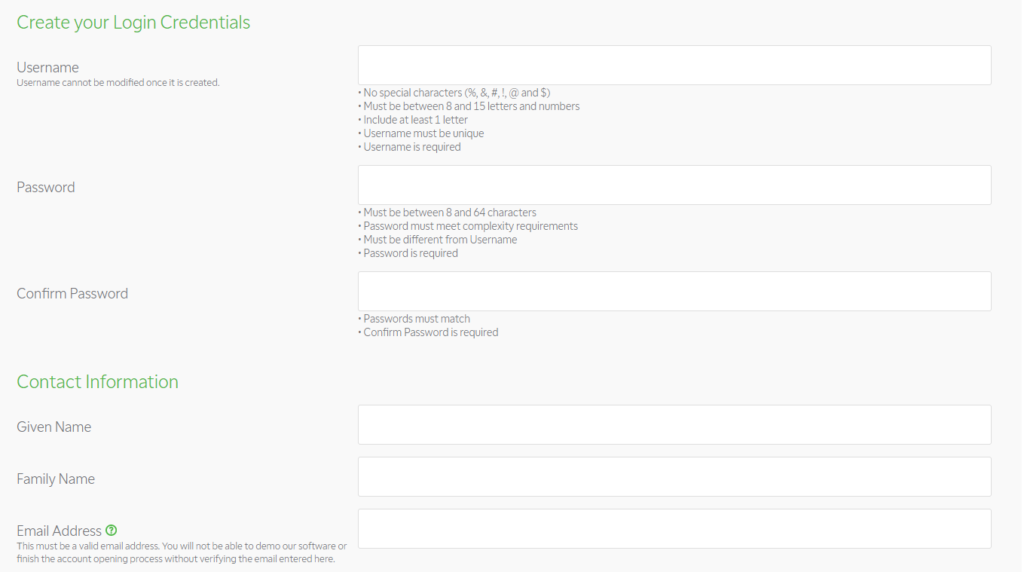

Step 1: Registration

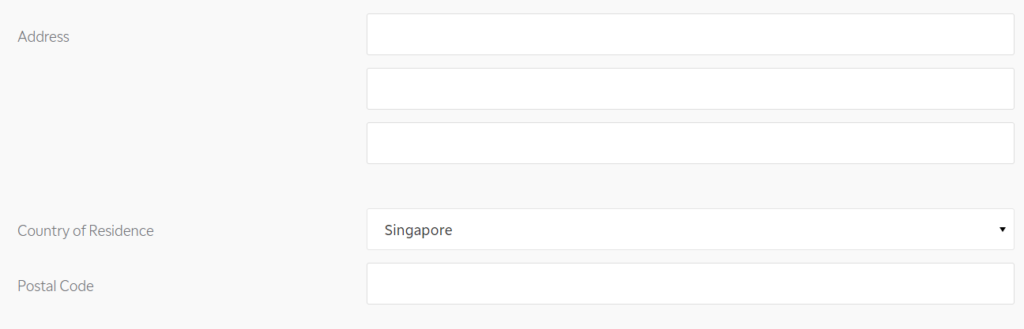

You will select if this is an individual account or a joint tenant account or corporate account etc as well as the option of applying for futures trading. A drop-down segment will appear which will allow you to input your login credentials

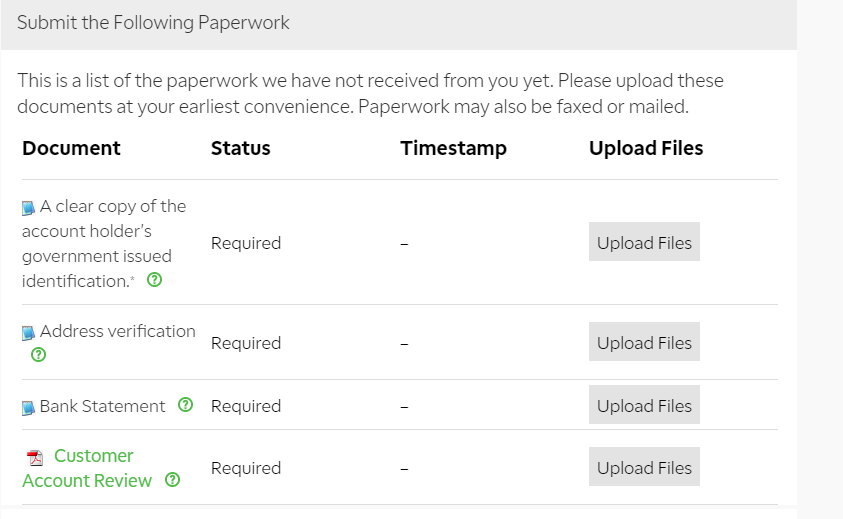

Once you have finish Step 1, you can download their thinkorswim platform and try their paperMoney trading system, by logging into the platform using the username and password you just created.

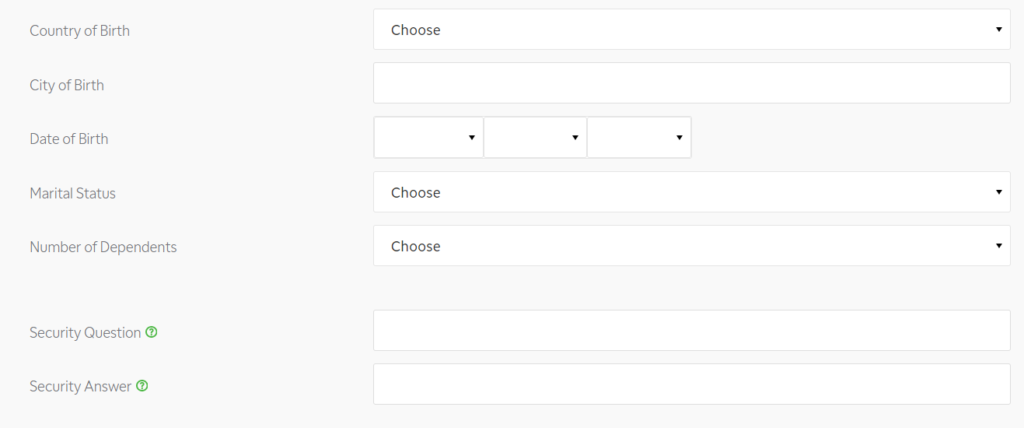

Step 2: Personal Information

You will start filling up all your personal information which includes address, NRIC, DOB, education, etc etc.

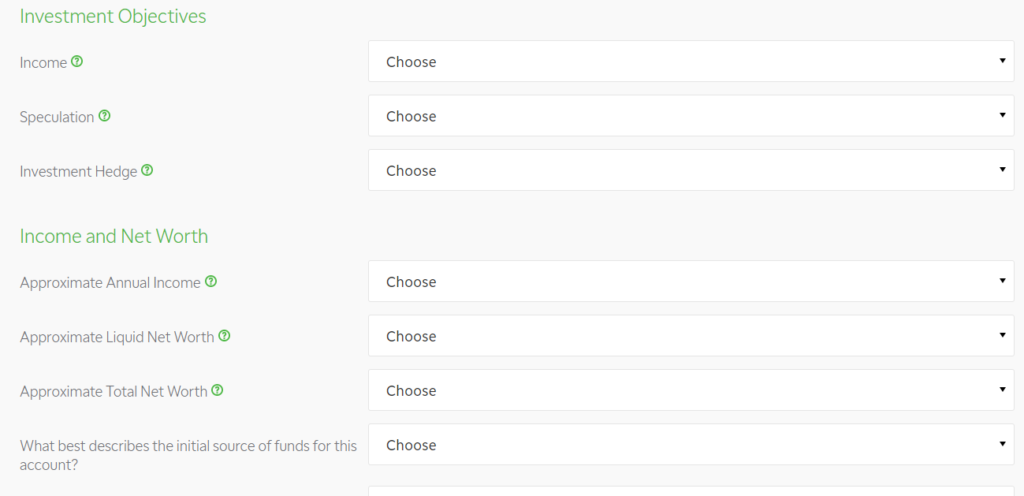

You will also need to disclose your employment information, bank details as well as investment objectives and income and net worth, etc.

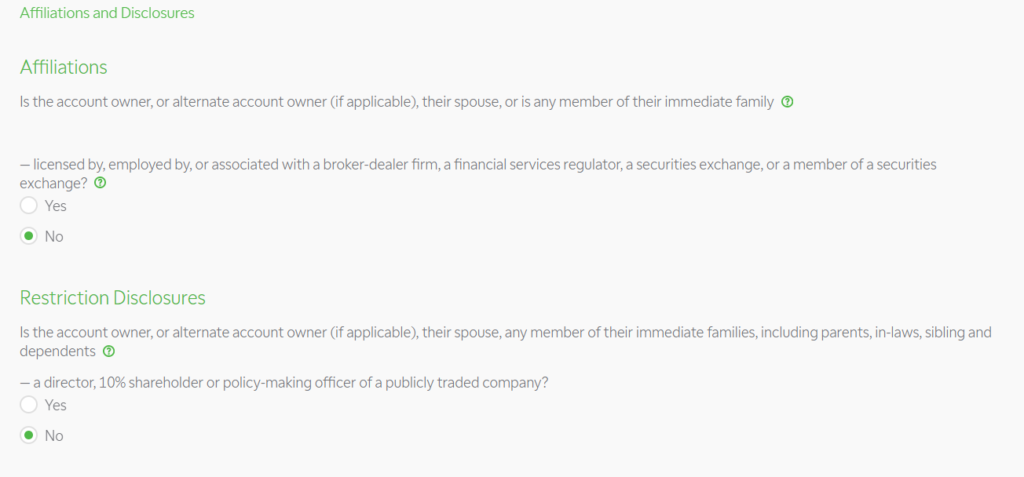

You will then need to fill in details about affiliations and disclosure.

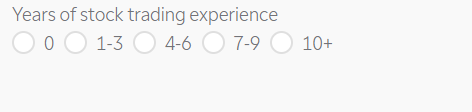

Followed by your trading experience

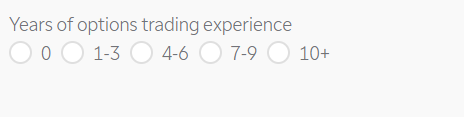

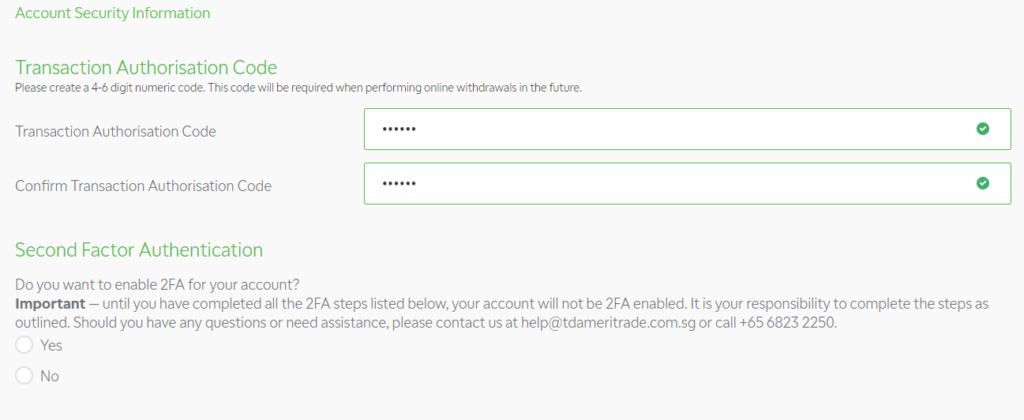

And your notification preferences followed by security information.

With that, you completed Step 2

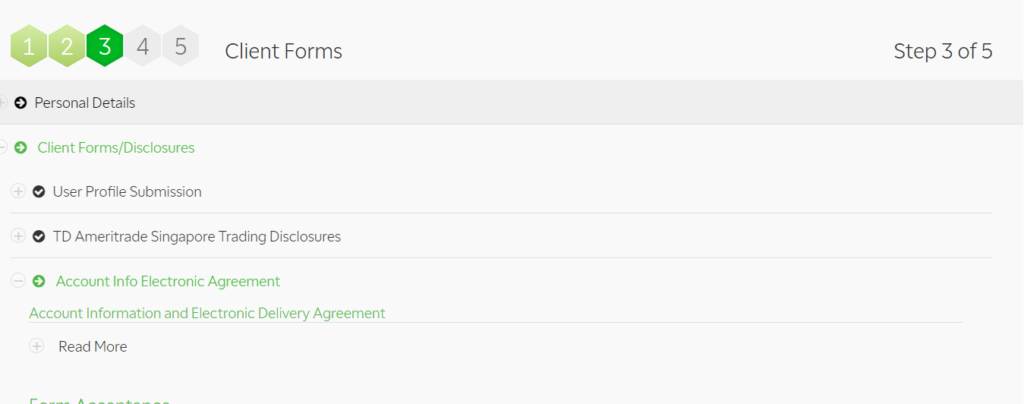

Step 3: Client Forms

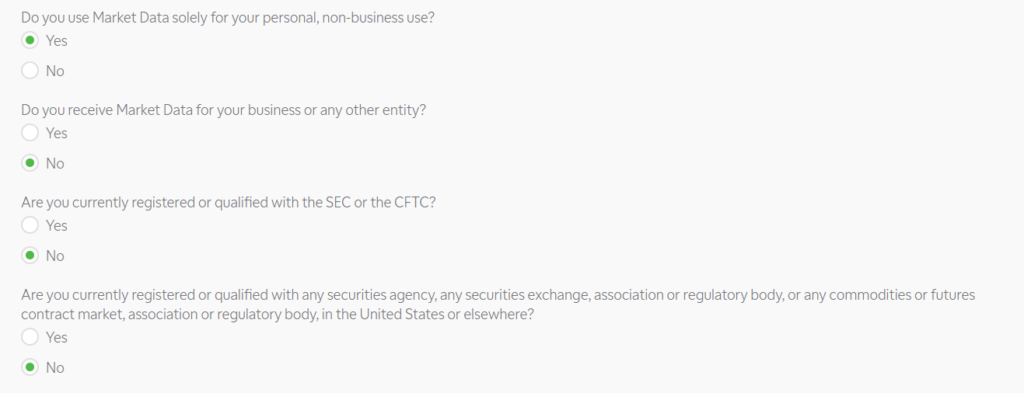

You just have to acknowledge the various forms

Step 4: Account Forms

This is where you need to submit your electronic W8Ben form

Once you have read and accepted all the forms, TD will ask you to click a link which will then prompt TD to send a verification code to your email account.

After that you almost done.

Step 5: Submitting paperwork

You will then need to submit the following paperwork and then wait for TD Ameritrade to approve your account.

It will take 5-7 business days to review and approve the application. Upon approval, you will receive a welcome email with funding instructions. After successfully uploading the documents and receiving account opening confirmation from TD, you can then proceed to fund your account.

How to fund your TD Ameritrade account

Their account funding process is not the most seamless as compared to some other online brokerages such as Tiger Brokers.

For TD Ameritrade, you will need to make an initial deposit of at least US$3,500. Which means you need to be one of those active traders. However, I believe you can fund an account to trade stocks and not trade or do anything with it and not incur any inactivity fees.

TD Ameritrade provides various options to fund your account, which can be done through DBS/POSB electronic transfer, a cheque deposit, telegraphic transfer, or Transfer from another broker (ACAT). All deposits must be made in US Dollars. If you transfer from a local SGD bank account, TD will change it into USD and deposit it into your TD Ameritrade account.

Do note that the custodian of your account, TD Ameritrade Clearing Inc is a member of the Securities Investor Protection Corporation (SIPC). Funds are available to meet customer claims up to a ceiling of USD$500,000, including a maximum of USD$250,000 for cash claims plus other insurance protection. Hence for those who are concern that bankruptcy of TD Ameritrade might jeopardize your cash holding, that concern is well-allayed.

I will run through the various process of funding your account which can be found over at TD Ameritrade’s website as well. You can skip this segment and head directly to the thinkorswim user guide if funding is not something you are concern with at the moment.

DBS/POSB Electronic Transfer

You may now perform an electronic fund transfer to DBS bank account 072‑003122‑9.

- All fundings are for fully opened TD Ameritrade Singapore accounts only

- This funding method is for DBS/POSB bank account holders only

- The crediting of funds to your TD Ameritrade Singapore account is not immediate

- The turnaround time for the funds to be posted into your TD Ameritrade Singapore account is around 2 to 3 business days

- Our daily cut-off time for electronic transfer is at 11 pm or 8:30 pm for the last day of the month. Funds received before the cut-off time will be processed the next business day.

Do’s:

- The name of the bank account holder must match the name registered with your TD Ameritrade Singapore account

- Transfers can only be made payable in Singapore Dollar currency

- Please enter your 9-digit TD Ameritrade Singapore account number, starting with 220, under “Comments for Recipient” on the DBS/POSB funds transfer banking portal or mobile application to ensure it goes to the correct account

- The electronic transfer transaction has to be done via the DBS/POSB internet banking portal or banking app only

Don’ts:

- No third-party deposit will be accepted. The name of the bank account holder used to do the funds transfer must match the registration of the account.

- No cash or ATM deposit

- No transferring via FAST from other Singapore banks

- No transferring of funds unless the account paperwork is approved. To know whether your account is approved, you will receive a welcome email from us confirming the approval of your account.

Cheque Deposit

- Make cheques payable to TD Ameritrade Singapore Pte. Ltd.

Mail or deliver crossed cheques to:

TD Ameritrade Singapore Pte. Ltd.

1 Temasek Avenue

#15-02 Millenia Tower

Singapore 039192

- Please write your TD Ameritrade Singapore 9-digit account number, your account name, and your contact number on the back of your cheque.

- Funds will normally be available in your account within 3 to 5 business days. Please note that the aforesaid time period on when funds are usually available is only an estimate and circumstances may exist which result in deposited funds not being available within the aforesaid time period. Please check your account by logging in to the trading software for confirmation that funds deposited by you have been credited into your account.

- Cheques received after 1 p.m. (Singapore time) will be processed the following business day

- Cheque deposits will not be available for withdrawal for up to 6 business days after deposit and during this time only marginable securities can be traded with the funds

- Third-party deposits are NOT accepted. The name on the cheque to be deposited must match the registration of the account

- Cheques must be made payable in SGD or USD currency only

- Cheques will only be accepted from Singapore banks. Cheques received from a location outside of Singapore will not be accepted.

- Traveler’s cheques, money orders, and bank drafts will not be accepted

Wire Transfers

Send Wires to:

Wells Fargo Bank, NA

420 Montgomery Street

San Francisco, CA 94104

SWIFT Code: WFBIUS6SXXX

(Use when sending funds from an institution outside the U.S.)

ABA transit routing #121000248

(Use when sending funds from an institution within the U.S.)

Beneficiary:

TD Ameritrade Clearing, Inc.

200 South 108th Ave.

Omaha, NE 68154-2631

Account #4123214561

Payment details or for further credit to:

[Your name]

Your 9 digit TD Ameritrade Singapore account number

[Your address]

Click this link for a printable version of the TD Ameritrade Singapore wiring instructions to provide to your financial institution.

Please note that inbound international wires (telegraphic transfers) from an institution outside the U.S. typically take 3 to 5 business days.

Transfer from another broker (ACAT)

Transferring your account into TD Ameritrade Singapore from another broker is known as an ACAT transfer (Automated Client Account Transfer). ACAT transfers generally take approximately 7 to 10 business days to complete. All securities are frozen during the transfer process and all trading activity must cease in the delivering account once the transfer has been initiated.

A statement showing the account title, account number, and positions must be included with the transfer form.

No third-party transfers can be processed when transferring assets between brokerage firms. Assets must be transferred between identical registered accounts.

Thinkorswim review

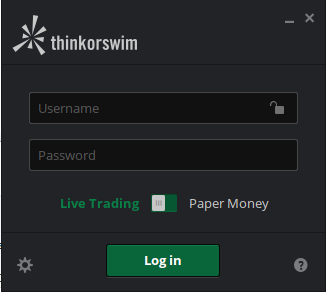

The second segment of this article will be an in-depth review of the thinkorswim platform. On your desktop, thinkorswim is an advanced platform with all the bells and whistles a serious trader could desire. I will talk about its functions in the following segment.

Thinkorswim also has a mobile app for both Apple and Android users. Unlike most trading apps that only offer core functions, thinkorswim mobile has much of the functionality and features of its desktop platform. You can also sync it with your desktop.

Once you have installed the thinkorswim platform onto your laptop, you will see this login screen where you can toggle between live trades as well as paperMoney.

The simulated paper money trade is a great way to learn about the software which might be a little complex in some areas. It’s available for both the desktop and mobile versions and it’s an excellent tool to use in combination with backtesting to perfect one’s trading strategies.

Once you are logged in, you will be able to see 2 segments: The left sidebar which is represented by the area encompassed by the red box as well as the main trading area which is the area encompassed by the green box.

Let’s start with the left sidebar.

Left Sidebar functions

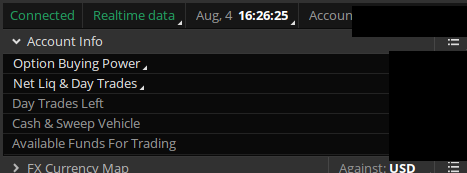

The left sidebar is a pretty useful area for new or advanced traders. Right at the top, you will have your account summary. This area is fixed and will provide you with a brief overview of your account balance as well as your buying power etc.

The other areas below the account info segment are customizable. These are termed as gadgets.

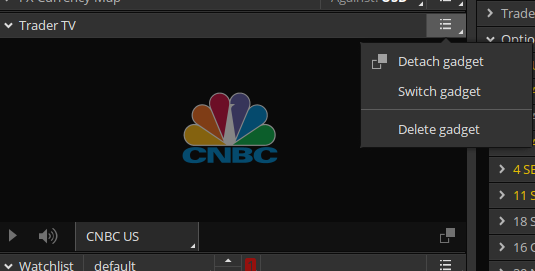

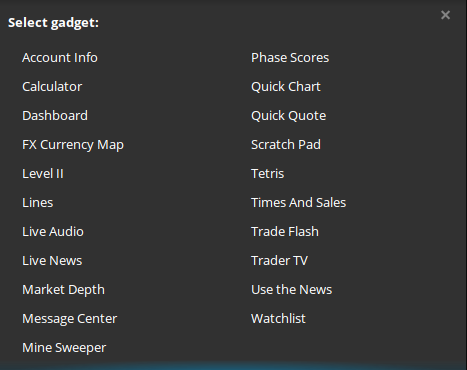

You can switch the gadgets according to what you will like. They have an array of gadgets for you to choose ranging from watchlist and live news to games.

You can detach these gadgets to make them into an individual window itself for a bigger view. This will come in handy for your watchlist. So some of my favorite gadgets are the Trader TV, the Watchlist, the Live News, and FX Currency Map.

So you customized your left sidebar by adding on new gadgets or deleting them accordingly using the customized gadget function found at the bottom of this area.

With that, I pretty summarized the function of the left sidebar, let’s proceed to the main area where you execute your trades as well as where you can find various research and charting functions.

Main Window

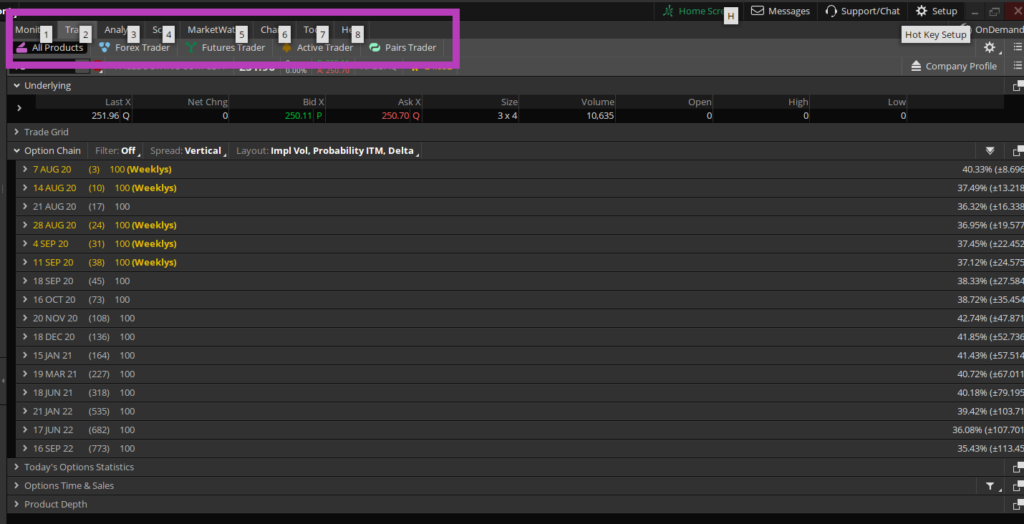

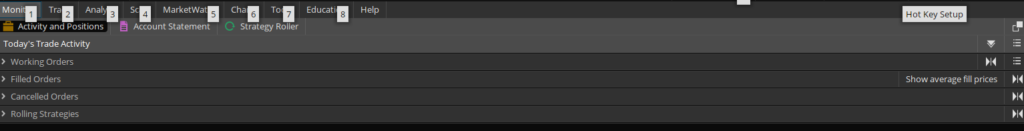

There are a few key tabs in the main window area which is the 1. Monitor, 2. Trade, 3. Analyze, 4. Scan, 5. MarketWatch, 6. Charts, 7. Tools and 8. Help functions.

Let’s go through them one by one.

Monitor Tab

This is where you see the details of your activity and positions. It will provide you with a snapshot of your day’s working orders, filled orders, canceled orders, etc as well as the P&L of your outstanding positions.

You can track historical records of your purchases under “account statement” dating back more than 370 days.

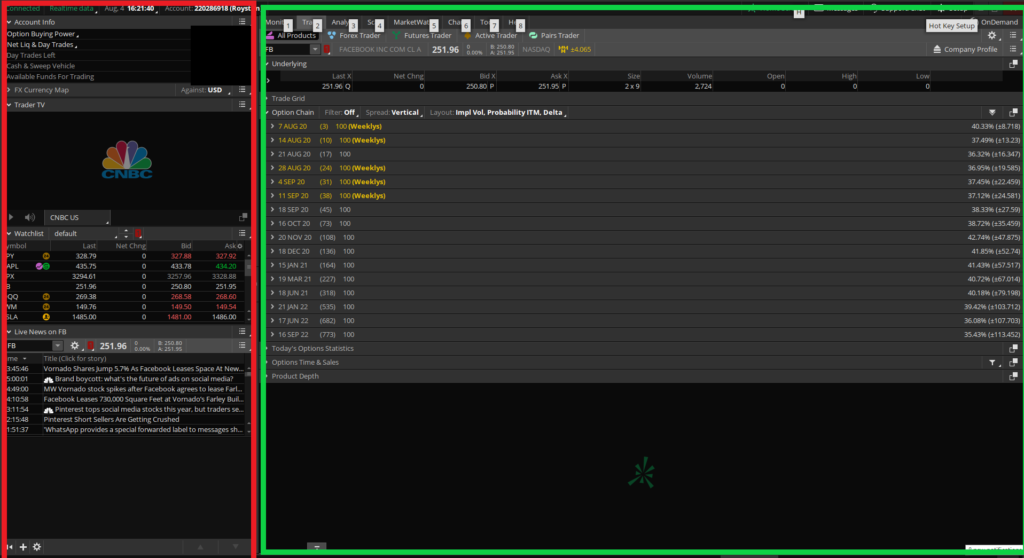

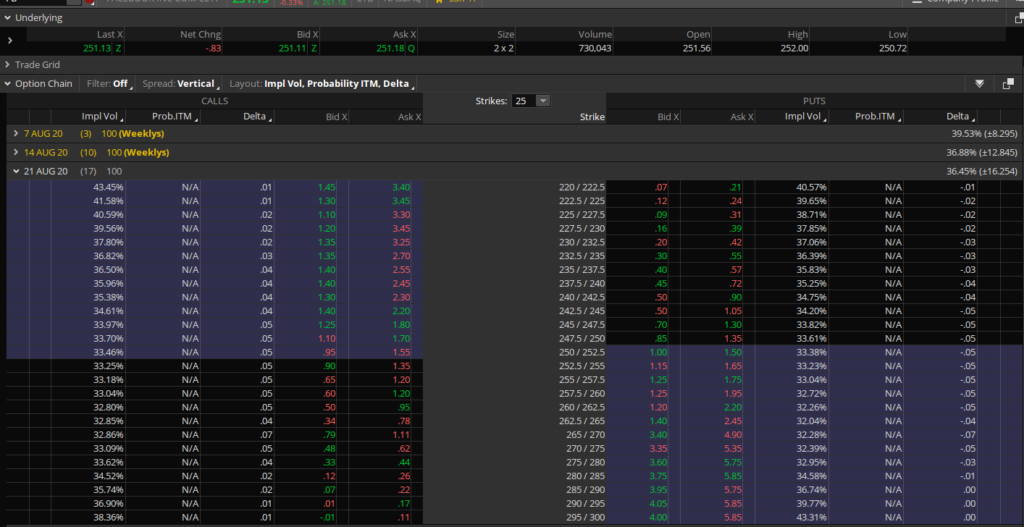

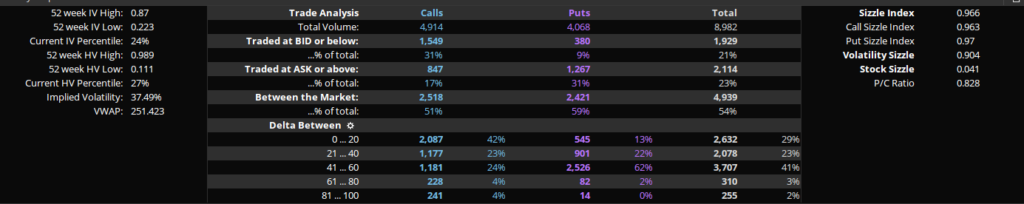

Trade Tab

The trade tab is where you execute all your orders, be it individual stock purchases or options trades. The origin of thinkorswim is predominantly one that is created with trading options in mind, hence its options trading platform is particularly strong.

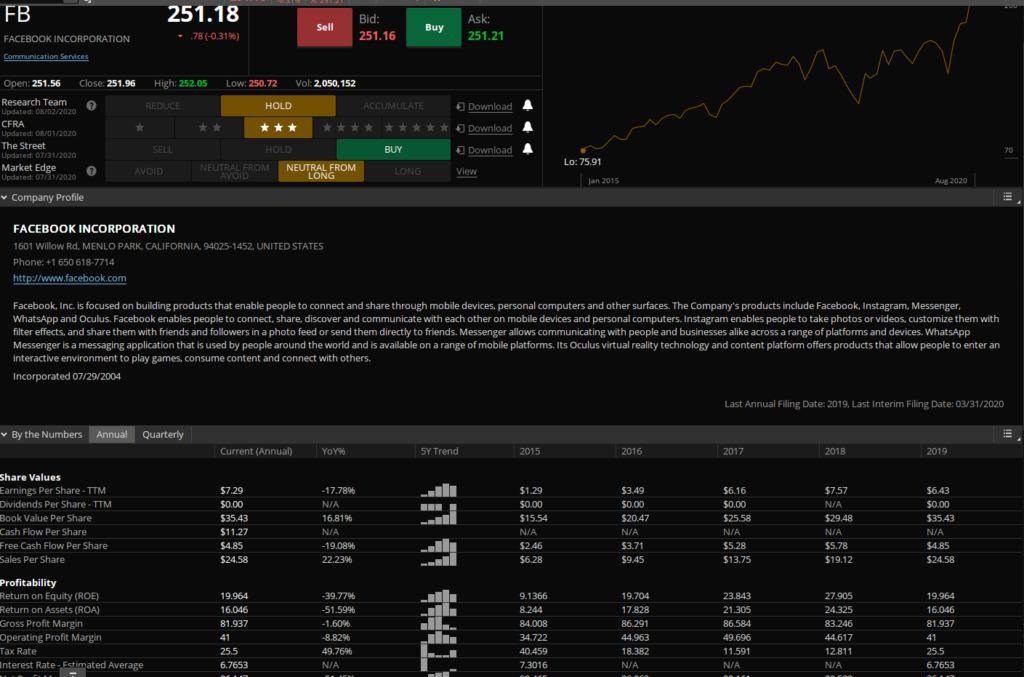

In this example which we use FB, we can track the current option trade analysis of the stock based on its options statistics, which shows which are the most popular options being traded at the moment for the counter.

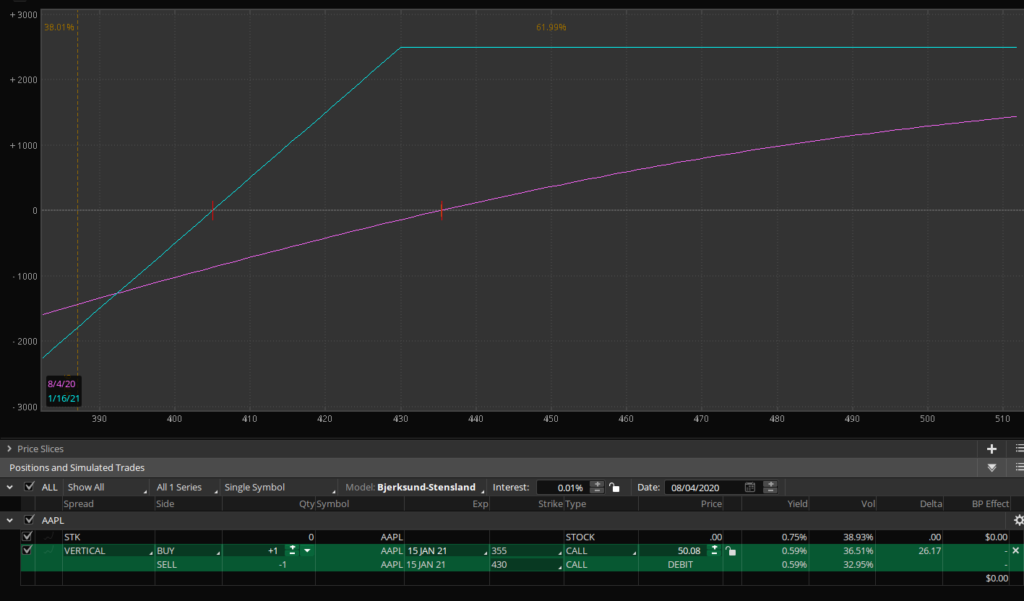

Analyze Tab

There are several functions in the Analyze tab. This is where you can do simulated trades as well as look at the risk profile of the stock or options that you are purchasing.

This is an area where I go to look at the probability of profit of a particular option trade which I might be executing.

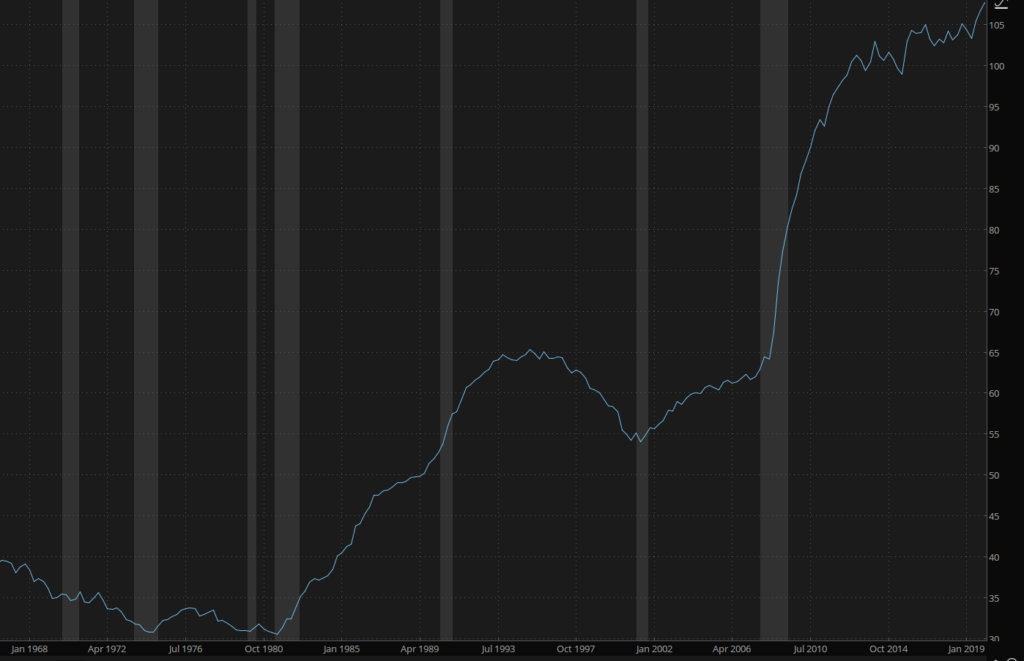

There are other interesting functions in this tab that allows one to track key economic data such as CPI, PPI, House Price indexes, Interest rates, and this fantastic chart below showing the federal debt as a % to GDP. Why does it even matter right?

Another key feature of the analyze tab is its fundamentals research that provides one with a snapshot of a company’s fundamentals as well as its key financials and ratios. There are also free research reports from TheStreet as well as CFRA research.

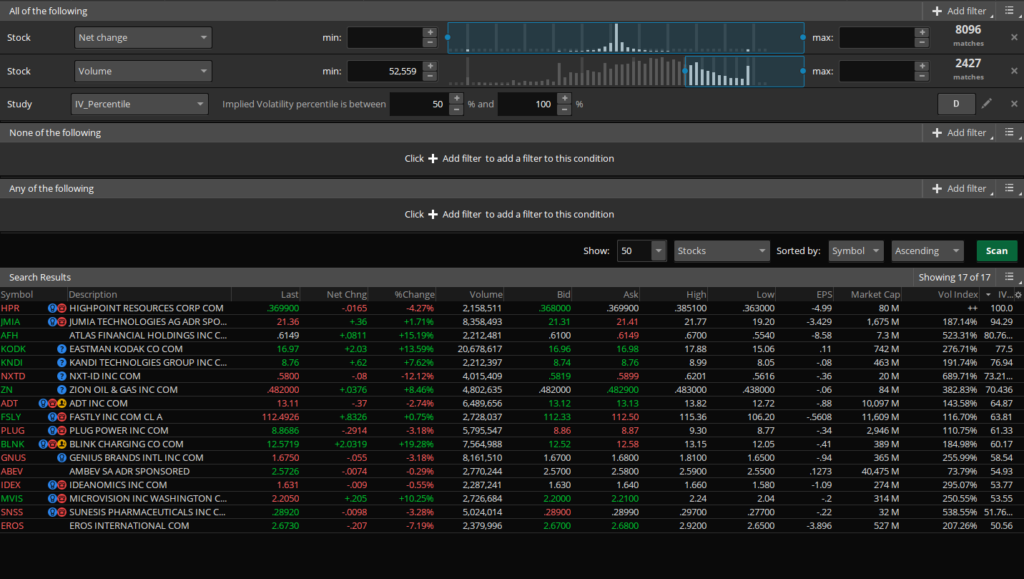

Scan tab

This is thinkorswim proprietary scanner that can be used to scan for stock as well as option ideas. You can add in various filters which include stock-specific filters such as market cap, volume, yield, etc to more fundamental criteria such as P/E, ROE, Cash flow per share, etc.

Alternatively, you can also screen based on Put/call ratio, Sizzle index, industry, etc, and much more.

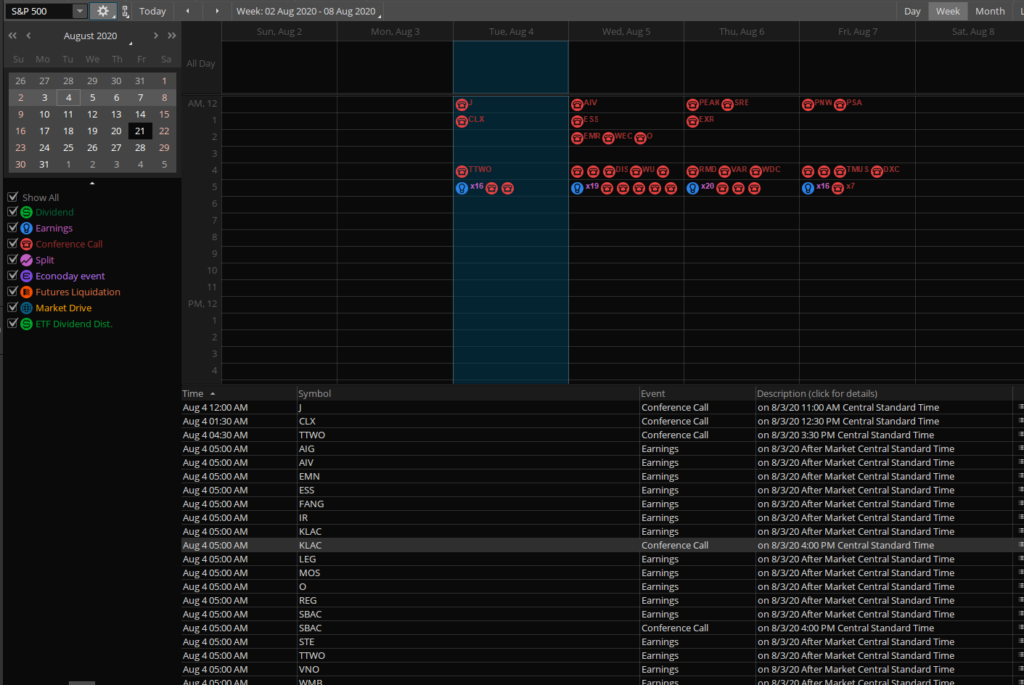

MarketWatch tab

This is where you get a big picture overview of the state of the market based on their heat map. The heat map can be customized accordingly, for example, looking at the indices or ETFs, etc.

Within MarketWatch, there is also a very useful calendar function which shows which are the companies that reporting earnings in the coming weeks.

Charts Tab

A good place for short-term traders to start on thinkorswim is with the software’s very powerful charting program. There are several hundred technical indicators on the platform which will likely satisfy the needs of all the chartist out there. Some examples include alpha studies, volatility studies, John Carter’s studies, etc etc. What these studies exactly are is honestly beyond my comprehension. For technical lovers, this is essentially heaven.

The charts are highly customizable with ample types available. Traders can choose time charts, tick charts, range charts, or even seasonal charts with an assortment of tools to draw on them.

You can also add in your studies if you are familiar with the thinkscript editor.

And there are also drawing tools such as trendlines, Fibonacci retracements, regression lines, etc.

The chart can be detached from its small window and blown up full-screen. This allows for better viewing.

One of the best features on thinkorswim’s charts is a right-click menu that offers both alerts and an order ticket.

Tools Tab

This is where you can get trade ideas from a community of traders under myTrade as well as view historical videos from CNBC and Reuters.

Help tab

Last but not least, there is also the help tab for contact information and live chats with thinkorswim administrators.

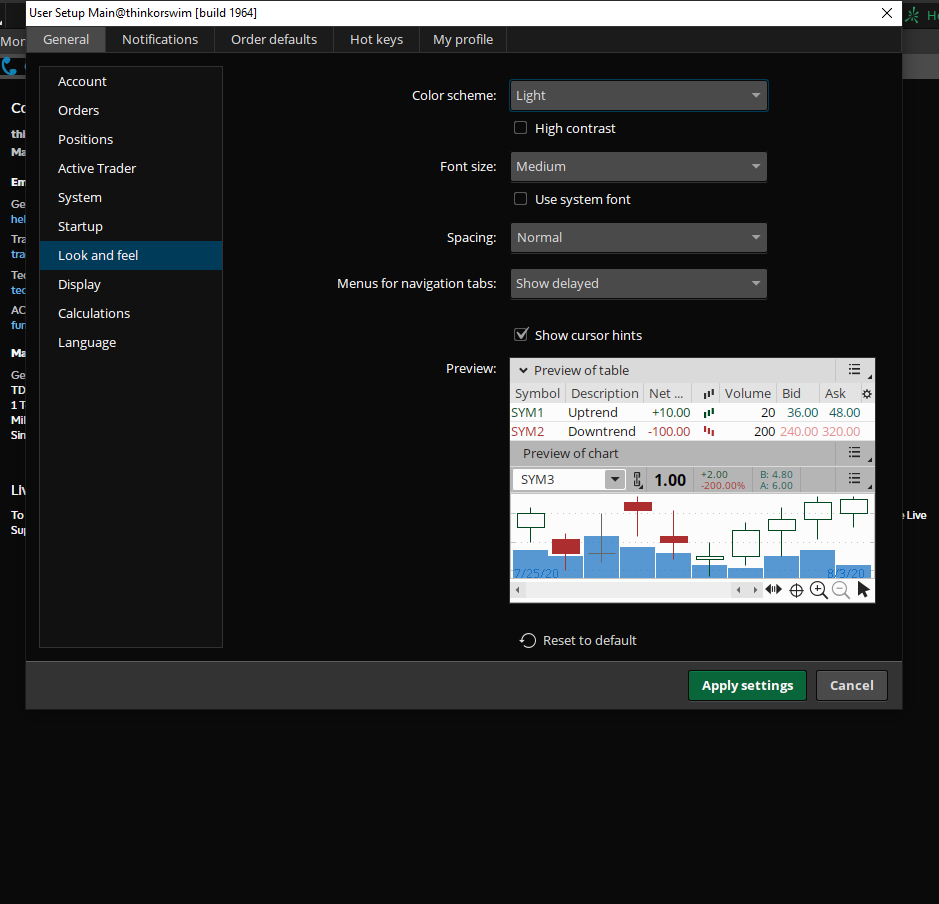

Other setting functions

There are also other setting functions where you can customize the look and feel of your thinkorswim platform. If you don’t like the dark background of thinkorswim, you can change the feel into a white one by clicking on the “setup” tab on the top right-hand corner followed by the application setting where you can then adjust the look and feel of your platform plus other platform settings.

Key summary points on thinkorswim

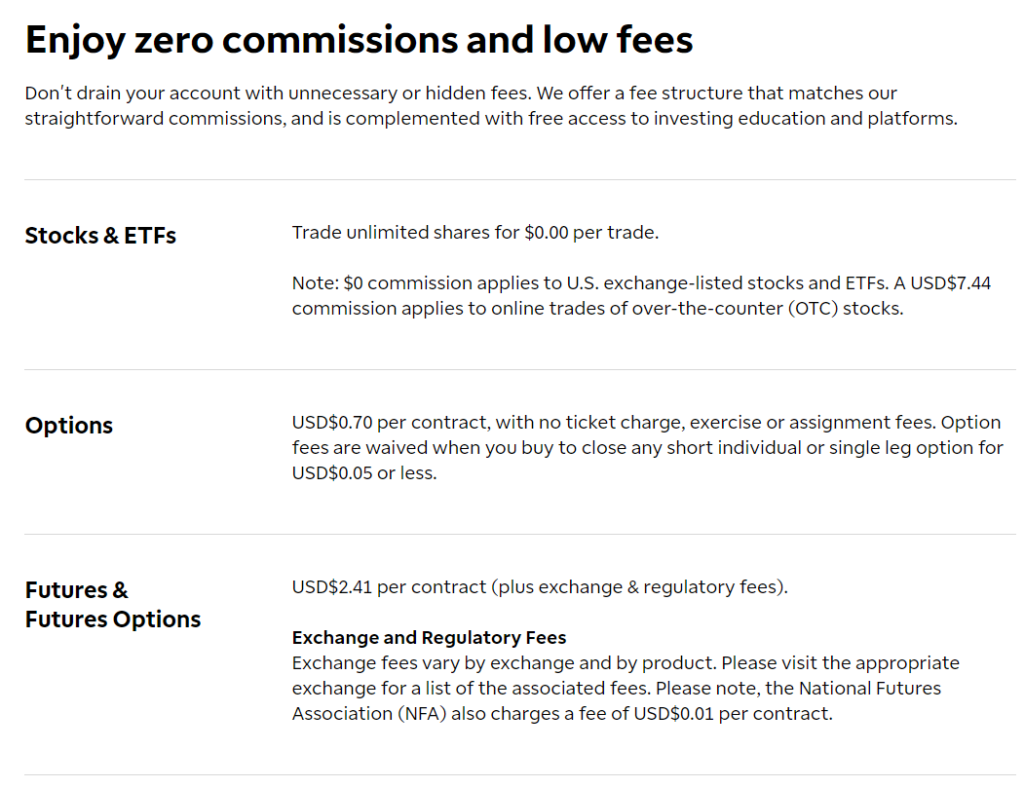

- $0 cost to open a TD Ameritrade account to trade using thinkorswim.

- A minimum deposit of US$3,500 to get started on live trading. However, likely no inactivity fees

- Can paper trade using paperMoney

- $0 commissions of US Stocks and ETFs. USD$7.44 comms for OTC stocks

- USD$0.70/contract for options with zero ticket charge, exercise, or assignment fees.

- USD$2.41/contract for futures

- Forex – cost is reflected in the spread

- Level 2 data included

- 3rd party research reports

Referral

If you find the above information helpful and wish to open an account, do drop me an email at newacademyoffinance@gmail.com. If you open an account using my referral, I will provide you with a free comprehensive Video Tutorial on using the ThinkorSwim platform to start your first online trade.

Conclusion

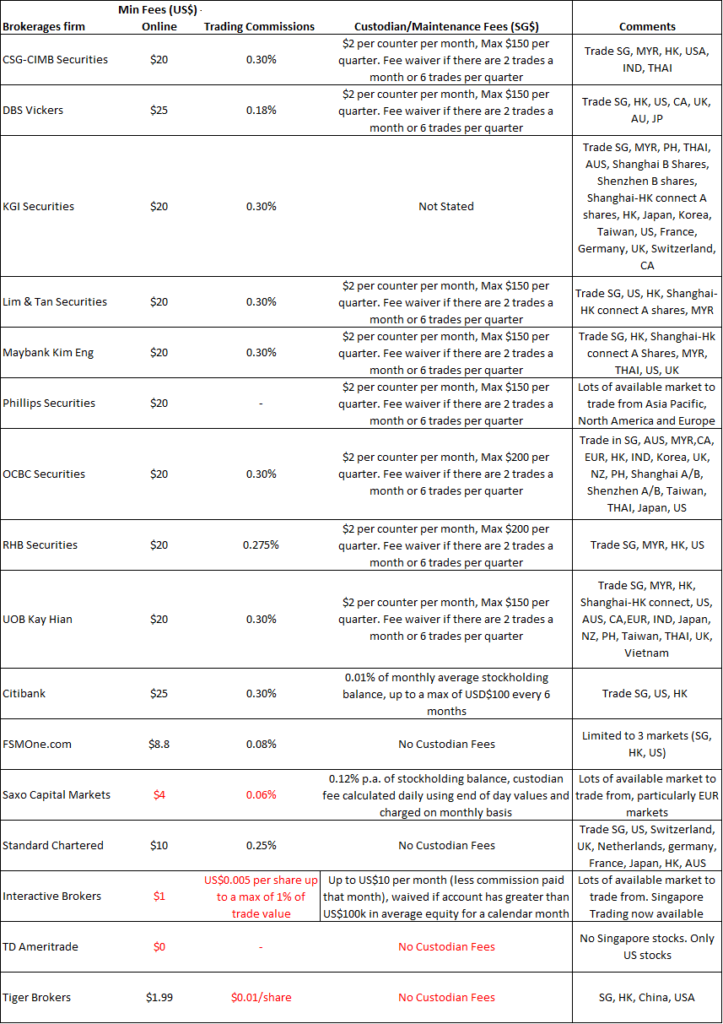

The table below summarizes the brokerage fees for a Singaporean investor trading in the US market. For a more comprehensive look on the best brokerages to trade SG, HK, and US stocks, do check out this article where I have provided a comprehensive write up on which are the best brokerages for Singaporeans to trade in these stock markets.

BEST STOCK BROKERAGE IN SINGAPORE [UPDATE JULY 2020]

For TD Ameritrade and its thinkorswim platform, it is now the low-cost leader when it comes to brokerage fees for trading in the US market as there is almost none to speak of and the firm does not charge a custodian fee, unlike Interactive Brokers which charges US$10/month (less commission paid) for account size less than US$100k.

However, the main drawback of thinkorswim is its lack of market availability, unlike that of its peers such as Interactive Brokers and Saxo which offers a wide array of markets available to trade in for their clients.

Do Like Me on Facebook if you enjoy reading the various investment and personal finance articles at New Academy of Finance. I do post interesting articles on FB from time to time which might not be covered here in this website.

Join our Telegram broadcast: https://t.me/gemcomm

SEE OUR OTHER WRITE-UPS

- FSMONE SINGAPORE: STEP-BY-STEP GUIDE TO OPEN YOUR FSMONE ACCOUNT AND START TRADING

- BEST STOCK BROKERAGE IN SINGAPORE [UPDATE MAY 2020]

- SYFE GUIDE: DID SYFE’S ARI ALGORITHM OUTPERFORM IN TODAY’S MARKET VOLATILITY?

- GUIDE TO SYFE AND HOW TO OPEN AN ACCOUNT IN LESS THAN 10 MINUTES

- FSMONE FEES: THE CHEAPEST REGULAR SAVINGS PLAN (RSP) FOR ETF (2020)

- TOP 5 BEST STOCK MARKET MOVIES AND HOW TO WATCH THEM FREE

Disclosure: The accuracy of the material found in this article cannot be guaranteed. Past performance is not an assurance of future results. This article is not to be construed as a recommendation to Buy or Sell any shares or derivative products and is solely for reference only.

2 thoughts on “TD Ameritrade thinkorswim review: A comprehensive write-up on this zero-cost brokerage firm”

Hi

how about withdrawal fees , any fees charges if withdraw fund to SG bank account

thanks

No withdrawal fees