Small-Cap Singapore Dividend Stocks

In the pursuit of dividends, many investors fall into the trap of purchasing stocks purely on a dividend yield basis. Many of these “high-yielding” stocks generated negative TOTAL returns (capital appreciation + dividend returns) over the mid to long-term horizon.

In this article, we will be exploring 5 Undervalued Small-Cap Singapore dividend stocks. These stocks need to fulfill the following FIVE key criteria to be considered:

1) Current dividend yield more than 4%,

2) current market cap more than $200m-$1bn,

3) Payout ratio less than 70%,

4) low net debt to equity < 1.0 and

5) Low Price to Earnings ratio < 15X

We will be excluding REITs on this list. Companies with a high level of customer concentration risk will also be excluded.

Let’s go through each of these five criteria briefly before disclosing our list of 5 Undervalued Singapore dividend stocks.

Criteria #1: Current dividend yield more than 4%

I want to be paid to wait and I believe that a 4% dividend yield level is attractive in today’s context where short-term government bond yields are all driven down to ZERO.

Within the Singapore context, the interest rate for the Singapore Savings Bond (SSB) over a 1-year horizon is a pitiful 0.35% while if you choose to hold it over a 10-year horizon, it averages out to just 1.15% return/annum.

If I view this as the closest alternative to the risk-free rate in Singapore, then generating a 4+% yield on a stock counter today would mean a more than 2.85% spread over the 10-year rate. If the stock yield is the only criterion, then a 4% yielding stock might not be extremely attractive.

However, if I am to combine it with other criteria which might indicate that the stock is undervalued, the total return of the counter has a high probability of outperforming the risk-free rate over a longer-term horizon.

Criteria #2: Current market cap between S$200m – $$1bn

I look to avoid overly small-cap stocks where there might be significant price volatility. For most small-cap counters, the focus will be on earnings growth vs. dividend stability. Most small-cap stocks will be looking to reinvest their earnings for growth rather than pay out as dividends, the latter being more characteristic of mature companies that tend to generate lots of free cash but tend to have little scope for reinvestment into future earnings growth.

Since this article is about finding Small-Cap Singapore Dividend Stocks, I will screen for stocks that fulfil the criterion of having a market cap between S$200m – S$1bn

Criteria #3: Payout ratio of less than 70%

The dividend payout ratio is the percentage of a company’s earnings paid to investors as cash dividends. It is one of the key indicators that could explain the sustainability of a company’s dividend payment stream.

A payout ratio consistently above 100% might not be sustainable in the long run and is something we look to avoid.

However, there are always exceptions. Companies with a high level of depreciation tend to depress earnings (by which the payout ratio is calculated). This might result in a payout ratio that is “artificially” high.

I typically deem a payout ratio that is less than 70% a comfortable level. Ideally, I will like to find stocks where their payout ratio is less than 50% for greater assurance of long-term sustainability.

Criteria #4: Low net debt to equity

In today’s volatile market climate, a strong balance sheet position is critical to ensure survivability. There is no guarantee that firms will continue to have access to bank funding ahead.

In a scenario where funding liquidity dries up, significantly leveraged stocks will find themselves in trouble.

Hence, I look to identify counters with a strong balance sheet, characterized by a low net debt to equity ratio of < 1.0X

Many of the stocks in this list are in fact in a net cash position.

Criteria #5: Low Price to Earnings ratio

The Price to Earnings ratio or the PER ratio for short is typically used to evaluate the “cheapness” of a counter.

This is defined as the Price of the counter / Earnings per share.

A low PER ratio tends to indicate a certain level of undervaluation although this should be evaluated on a sector to sector basis. For example, REITs tend to have a high PER ratio, however, this sector is often not evaluated based on PER ratio. The healthcare sector typically also commands a much higher PER multiple relative to the industrial sector.

However, as a simple screening criterion, we look for stocks where the PER ratio is less than 15x on a forward basis, based on the market’s latest forecast.

With these 5 criteria in mind, these are the 5 Small-Cap Singapore Dividend Stocks that are potentially undervalued:

Undervalued Small-Cap Singapore Dividend Stocks #1: Valuemax

Current dividend yield: 5%

Current market cap: S$212m

Payout Ratio: 30%

Net debt/equity: >1.0x (special case)

PER multiple: 6x

Business and financial outlook

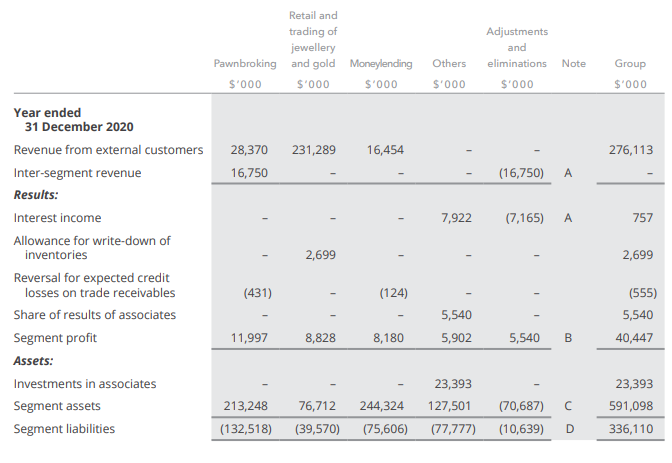

Valuemax is in the “recession-proof” business of running pawn shops as well as operating a money-lending business.

I have written about it previously in the article: Valuemax. A recession-proof business but we see one major risk.

At that point in time, the counter was trading at S$0.32 vs. the current share price level of S$0.36. That is a capital appreciation of >10% over a 1.5 years horizon. Add the 3-4% annual yield and the stock has generated a decent total return of >15-16% over this period.

This is not a sexy small-cap Singapore dividend stock but a boring one that should generate decent earnings in most economic environment.

Valuemax is a household name that most Singaporeans will be familiar with. Their pawnshops can often be found in heartland malls. However, what an investor might not be familiar with is that the company also operates a money-lending business that has been growing steadily through the years and now account for a substantial portion of the Group’s operating profit.

One might notice that this counter is “highly-leveraged”, with its net debt/equity > 1.0x which on first glance, does not seem to fulfil our criterion of finding a lowly-geared counter.

However, this is a unique case where the higher the gearing of the company, the “better” is its growth prospect. That is the “uniqueness” of the lending industry.

With a low payout ratio of just 30%, the company can afford to continue its dividend payment even if there might be a short-term “blip” in its earnings profile. Also, the company is trading at an undemanding 6x forward PER.

Valuemax definitely fits the description of an undervalued small-cap Singapore dividend stock, one which you can be pretty comfortable holding and be paid to wait for Mr Market to re-rate the counter.

Undervalued Small-Cap Singapore Dividend Stocks #2: Fu Yu

Current dividend yield: 5%

Current market cap: S$237m

Payout Ratio: 60%

Net debt/equity: Net cash

PER multiple: 11x (ex-cash PER of 6x)

Business and financial outlook

Fu Yu Corporation Limited (FUYU) is one of the largest manufacturers of high precision plastic parts and moulds in Asia. It offers a one-stop solution by providing vertically integrated services for the manufacturing of precision plastic components and the fabrication of precision moulds and dies. It is specialised in mechanical modules, computer peripherals, medical equipment, telecommunications, and consumer electronics.

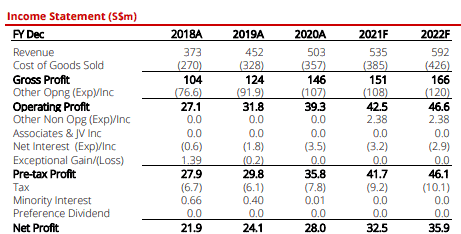

Despite its revenue taking a hit in 2020 as a result of COVID-19, the company was able to control its expenses very well. This translated to a higher operating profit in 2020 vs. 2019, despite the revenue decline in 2020. The company grew its net profit to S$16.9m in 2020 vs. S$12.7m in 2019 and according to the latest forecast by DBS, the brokerage firm expects Fu Yu to maintain its earnings growth profile in 2021, with forecasted earnings of S$20m

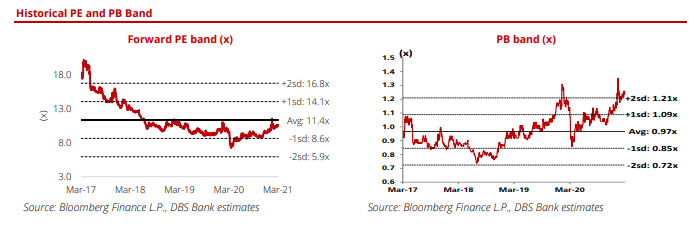

Based on its current share price of S$237m, that translates to a forward PER multiple of approx. 11x.

However, another attractive “profile” of the company is the fact that the company is extremely “cash rich”, with its net cash status at S$107m (no debt) as of end-2020. This means that almost 50% of the company’s market cap is backed by cash and short-term cash-equivalent.

In the event of a slow down in its business, the company is at no risk of a credit-default (since it has no debt at all) and can use its strong cash hoard to make opportunistic acquisitions when the time is right.

On a valuation basis, the counter has since rebounded from a low in terms of its forward PER band but is still trading at a reasonable valuation as compared to its lofty prices back in early 2017 where its forward PER ratio is in excess of 20x.

This is one undervalued Small-Cap Singapore Dividend Stocks that should be in your radar. An investor is also paid an attractive 5% yield based on FU Yu’s current share price.

Undervalued Small-Cap Singapore Dividend Stocks #3: CSE Global

Current dividend yield: 5.2%

Current market cap: S$271m

Payout Ratio: 43%

Net debt/equity: 0.42x

PER multiple: 8.4x

Business and financial outlook

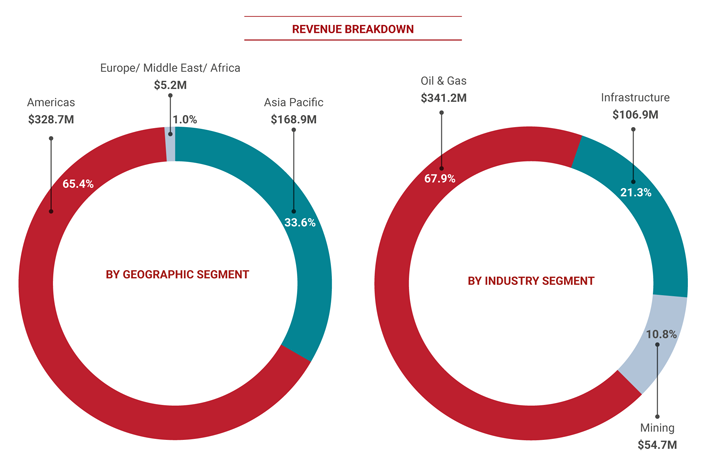

CSE Global is a leading systems integrator targeting the oil and gas, petrochemical, utilities, public infrastructure, environmental and healthcare industries.

With the substantial fall in oil prices over the past 10-years, it is not surprising that CSE Global’s share price has also taken a beating. Its share price peaked back in 2011 at S$1.40/share and has been on a downtrend since then. The counter is looking to break out of its long-term key resistance level of $0.60/share.

The company might be a candidate to play the rise in oil prices, given that a substantial portion of its revenue is pegged to the oil & gas industry, as can be seen from the diagram above, using data from its 2020 financial results.

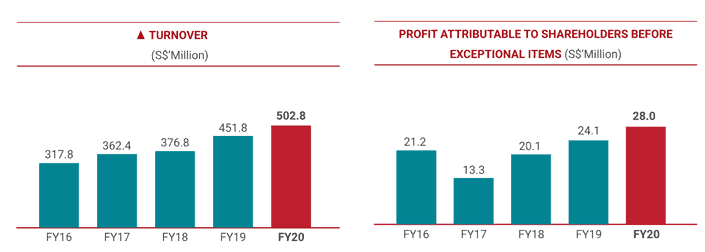

The company has also done a decent job in growing its revenue and earnings over the past 5-years despite the volatility seen in the oil & gas industry. Consequently, the company has been able to maintain a DPS payment of 2.75 cents over the past 5 years.

Assuming that the company can maintain the same DPS payment in 2021, that will translate to a 5.2% yield at its current price.

According to DBS, the brokerage believes the company can continue to grow its earnings in 2021 to S$32.5m from the S$28m generated in 2020.

Based on a forecasted earnings of S$32.5m in 2021, the counter is currently trading at a forward PER multiple of 8.4x which is relatively undemanding and still trades below its 5-year historical forward PER average of 9.9x.

I believe that CSE Global is one of those rare small cap company that will likely maintain its dividend payment ahead and this is one company that investor should have on their radar to ride the uptrend in oil prices.

Undervalued Singapore Dividend Stocks #4: Bumitama Agri

Current dividend yield: 5%

Current market cap: S$824m

Payout Ratio: 31%

Net debt/equity: 0.65x

PER multiple: 8.6x

Business and financial outlook

Bumitama Agri is a pure-play upstream palm oil producer. Unlike Wilmar which is an integrated upstream and downstream palm oil producer, Bumitama is focus solely on upstream plantations.

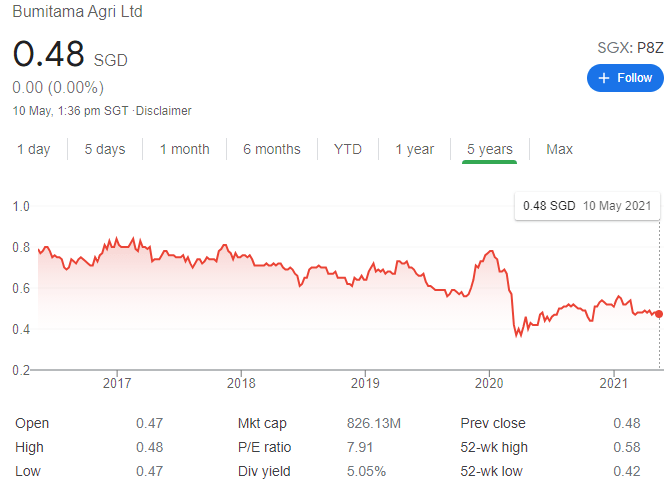

Its share price has underperformed peers such as First Resources and Golden Agri of late, with its share price declining by 6% YTD vs. First Resources price appreciation of 10% and Golden Agri price appreciation of 56%. This is rather perplexing, given that palm oil prices have been rather robust YTD (alongside all other commodity prices).

An explanation could be the fact that Bumitama has committed to sell 35% of its 2021E output to Wilmar at a much lower price of IDR8,364/kg vs. current price > IDR14,000/kg.

Nonetheless, the street generally remain quite positive on the prospect of Bumitama, with the lowest TP at $0.60/share, representing 25% upside from its current share price.

The company also has an expected dividend yield of 5%, in addition to the fact that it is trading at an undemanding forward PER multiple of 8.6x.

While this undervalued small-cap Singapore dividend stock might be seen as the most “risky” in this list due to its exposure to the volatile spot palm oil prices, this might be one relatively cheap counter to consider playing the current upcycle seen in soft commodities such as palm oil.

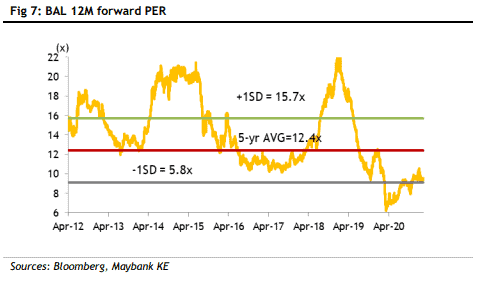

According to Maybank, the forward PER of around 8.6x is closer to its -1 SD band, based on its historical 10-year trading range. While the leverage to palm oil prices might not be as evident vs. First Resources and Golden Agri, Bumitama’s current cheap valuation relative to its peers is definitely a plus point for consideration.

Undervalued Singapore Dividend Stocks #5: Valuetronics

Current dividend yield: 5.0%

Current market cap: S$263m

Payout Ratio: 49%

Net debt/equity: Net cash

PER multiple: 9.6x

Business and financial outlook

Valuetronic’s origin started as an integrated manufacturing service provider for its customers but has since scaled the value chain with more in-depth engagement with its customers in the arena of design and development of products.

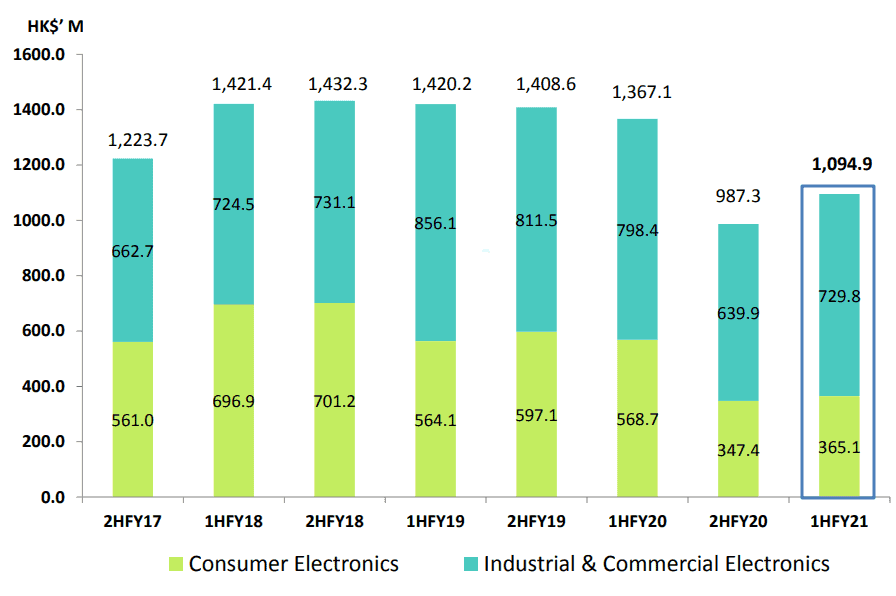

The company operates in 2 key divisions: 1) Consumer Electronics (CE) and 2) Industrial and Commercial Electronics (ICE). Revenue between both divisions is now skewed towards the higher-margin ICE division vs. a few years back where the lower-margin CE division dominated the bulk of the Group’s revenue.

The subsequent decline of LED lighting demand from Philips resulted in both revenue and earnings disappointment as its share price took a tumble in 2014-15.

With demand from mass-market LED lighting dwindling, the company refocuses its attention on diversifying its revenue base through higher-margin projects from the ICE division. Revenue from this segment subsequently increased from c.30% of Group’s revenue to the current level of 67% (based on 1H21), with Valuetronics also benefitting from margins improvement due to better sales mix.

This division also does not present customer concentration risk with no single client encompassing more than 10% of Group’s revenue.

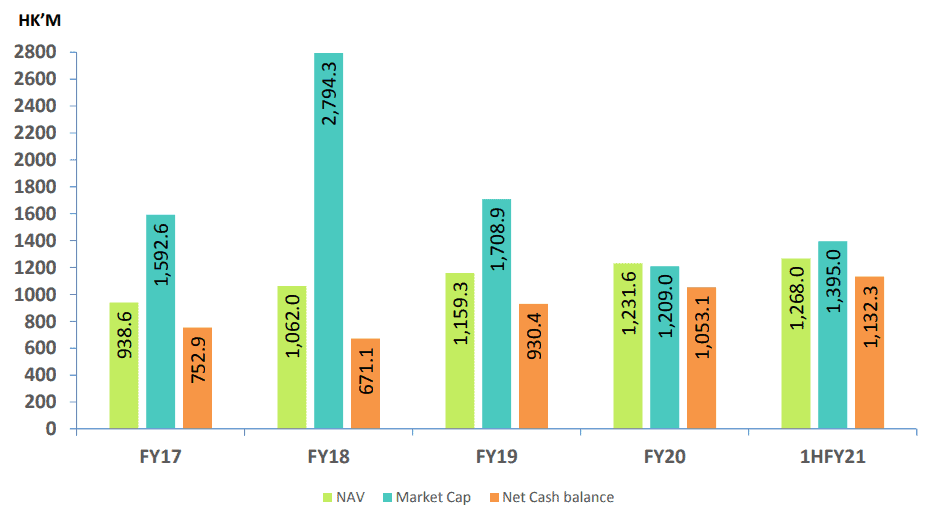

The company has been growing its net cash profile over the years, with net cash increasing from HKD222m in FY13 to HKD1,132m in 1HFY21. Current net cash accounts for approx. 81% of its market cap!

Given its strong balance sheet with a huge cash hoard (likely the envy of many debt-heavy companies), I believe Valuetronics have a bigger than even chance to emerge out of this crisis, not only unscathed but also to gain market share from weaker competitors, many of whom might not survive this current downturn.

One downside has been the fact that the company has reduced its DPS from HK 27 cents in FY18 to HK 20 cents in FY20 in a bid to maintain its payout ratio at the guided range of 30-50%.

Based on the forecasted profit of S$27m in FY2021 and a 50% payout ratio, the company is expected to pay S$13.5m in dividends or S3 cents/share, translating to a yield of 5%.

I have written about Valuetronics previously and I continue to view this small-cap company as a low-risk recovery play due to its strong cash hoard which has been consistently growing. While I have been disappointed with the DPS cut over the past 2-years, I believe the risk of a substantial DPS decline ahead is rather low and the 5% yield remains an attractive proposition for me in today’s low-interest-rate environment.

Conclusion

These are the 5 undervalued small-cap Singapore dividend stocks that investors could consider purchasing on dips. Amid the current market volatility, their best-in-class balance sheet ensures that these companies will remain in existence when funding liquidity dries up.

Investors looking to purchase these counters should be comfortable in the companies’ longer-term fundamentals.

With a yield of at least 4%, investors are paid to wait on these companies as the health pandemic storm blows over. In a positive scenario, they will emerge not only unscathed but with a higher market share as they capitalize on weaker peers exiting from the industry.

Among these 5 stocks, I view Bumitama Agri as having the highest risk due to its forward sales hedge exposure. As a result, the company does not get to benefit as much as its peers from a rise in CPO prices. However, there might be a trading opportunity for the stock, with the counter showing a positive BUY based on the proprietary TGPS system that looks to identify stocks in the early stages of a rebound.

The TGPS is a proprietary platform developed by Collin Seow. For those interested to find out more about his course, which is ranked as the best investing platform by users according to Seedly, can sign up for his free online session this coming Tuesday, 11 May 2021, where he will show you how simple it is to find the RIGHT stocks to enter at the RIGHT time.

The Systematic Trader

A course run by Collin Seow and his team using the proprietary Traders GPS platform, see how easy it is to find the RIGHT stocks to buy at the RIGHT time.

Learn how to trade stocks emotion FREE

The lowest risk to me remains to be Valuemax where I believe the counter is an ideal privatization play ahead. Do, however, note that this is a low-liquidity stock and might not be ideal for trading.

Join our Instagram channel for more tidbits on all things finance!

SEE OUR OTHER WRITE-UPS

- 4 RECESSION-RESISTANT STOCKS WITH A FORTRESS BALANCE SHEET

- 3 REASONS TO KEEP INVESTING EVEN IN A DOWNTURN

- 4 STOCKS WITH MORE THAN 80% RECURRING REVENUE OWNED BY GURUS

- WHEN TO BUY STOCKS IN A RECESSION? THE IDEAL TIME TO PICK A BOTTOM

- HOW TO INVEST IN A RECESSION OR BEAR MARKET (2020 EDITION)

- WHY I AM STILL BUYING REITS EVEN WHEN THEY LOOK EXPENSIVE

Disclosure: The accuracy of the material found in this article cannot be guaranteed. Past performance is not an assurance of future results. This article is not to be construed as a recommendation to Buy or Sell any shares or derivative products and is solely for reference only.

4 thoughts on “Top 5 Undervalued Small-Cap Singapore Dividend Stocks (>4% yield) (2021)”

Thanks for the sharing. Very informative and good to read up your article.

hey darren, thanks for stopping by.