Best Types of Investment in Singapore

Given the myriad of investment classes and products available in the market, it can be difficult knowing where to start. Fortunately, we have compiled some of the best investments for your reference, hand-picked with the criteria of good historical performance and easy access.

Here’s a look at the 4 most favored types of investment in Singapore, and the best ways you can go about investing in them.

Types of Investment in Singapore #1: Stocks

What are stocks?

Stocks (also known as equities or shares) may be the most basic and popular type of investment. When you buy stock, you’re taking up an ownership stake in a publicly traded company.

As an investor, you profit from owning stock in two ways: the company can return money to its shareholders via dividends, or the business grows and the value of the shares increases, enabling you to sell at a higher price.

Benefits of Stocks

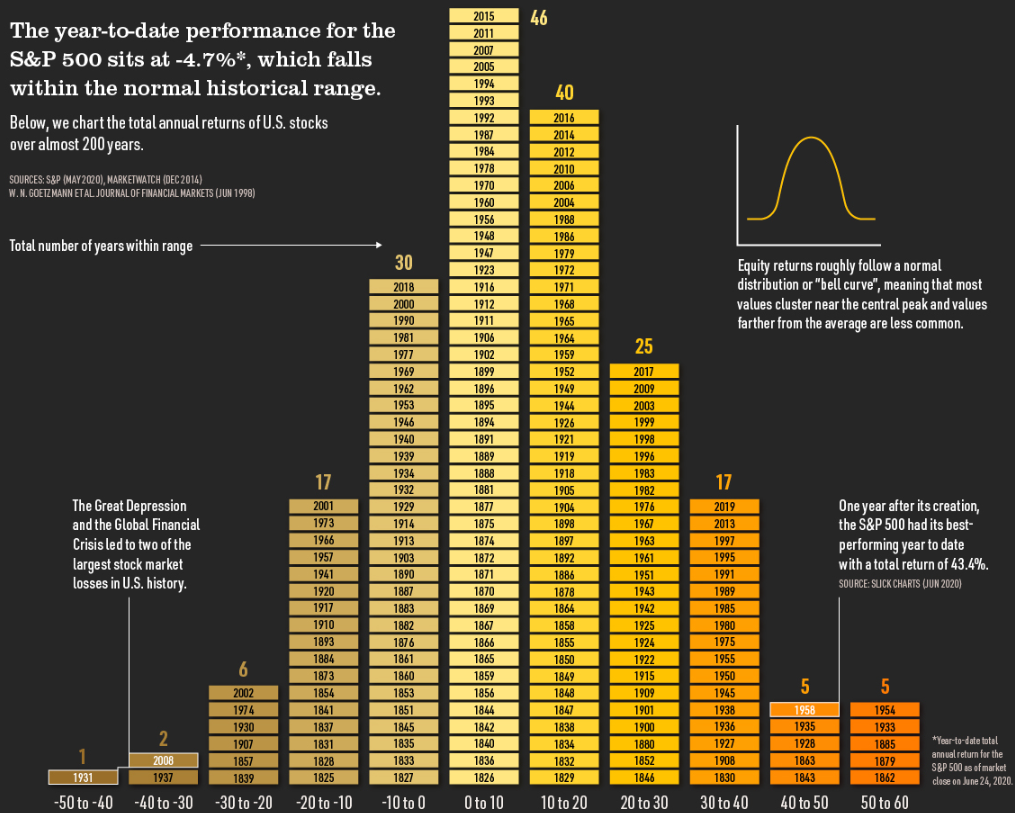

Historical evidence has shown that stocks offer the greatest potential for higher returns over the long run, compared to other investments like bonds. From 1926 to 2010, the average yearly return on common stock investments has been +10.3%, according to John C. Bogle, founder of The Vanguard Group. The diagram below, as compared by Visual Capitalist, shows the average stock market returns based on individual years, as of June 2020.

However, buying stock also comes with higher risks. Investors always do their due diligence in stock researching before investing in a particular company.

Cheapest ways to buy stocks

Here are the best low-cost platforms to buy stocks for Singapore, the US and Europe:

SG Stocks: DBS Vickers (CDP); FSMOne (Custodian)

US Stocks: TD Ameritrade

International Stocks: Interactive Brokers

Additional reading: Top 10 Best performing SG Blue-Chip Stocks [1Q21]

For those who are interested to find out more about brokerage fees comparison in Singapore, you can refer to this article: Best Stock Brokerage in Singapore

Types of Investment in Singapore #2: Exchange Traded Funds (ETFs)

What are ETFs?

An ETF is a basket of stocks that is benchmarked against a certain index. Traded like stocks on an exchange, ETFs are one of the most popular investment vehicles due to their versatility.

An ETF you may have heard of is the S&P 500 ETF (SPY), which tracks the S&P 500 index in the US. The most popular Singapore ETF is the Straits Times Index (STI), which tracks the performance of the top 30 companies listed on SGX.

Benefits of ETFs

ETFs play an essential role in many investors’ portfolio as they possess numerous advantages.

Diversification

ETFs can provide exposure to various asset classes. Instead of holding just one stock such as Microsoft or Apple, by buying an ETF like the SPY, you are automatically a stakeholder in the top 500 US companies.

High liquidity

It is easy to buy and sell out of an ETF position, unlike other investment types such as mutual funds.

Low Cost

Management fees for ETFs are generally lower than other investment types, like actively managed mutual funds.

According to Morningstar and Vanguard, the average ETF expense ratio in 2019 was 0.25%, compared with the average expense ratio of 0.73% for passive mutual funds and 1.45% for actively managed mutual funds. Vanguard ETFs have an average expense ratio of as low as 0.06%.

Types of ETFs To Buy In Singapore

The three most popular types of ETFs in Singapore are Singapore ETFs, US ETFs, and UCITs ETFs.

1. SG ETFs

These are simple-to-purchase ETFs listed on the SGX. Popular ones include the SPDR STI ETF, which tracks the top 30 companies on the SGX; and the Phillip Sing Income ETF, which holds high dividend stocks on the SGX.

The advantages of buying SG ETFs include lower currency risks, lower costs, and investing in companies you are more familiar with.

However, SG ETFs are not as liquid as US ETFs, which are more actively traded. US ETFs may also present better growth opportunities.

Nevertheless, the SGX is a good place for Singapore investors to start, with many quality blue-chip companies in various sectors and real estate investment trusts (REITs) that you can choose from.

Additional reading: Top 4 ETFs in Singapore to structure your passive portfolio

How to purchase SG ETFs

You can purchase SG ETFs through your brokers such as DBS Vickers using a lump sum investing approach.

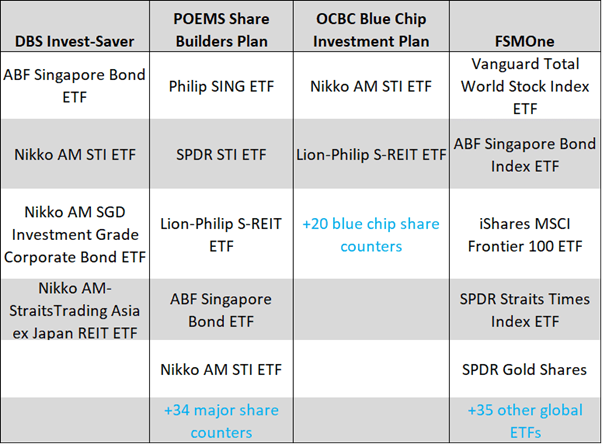

If you want to dollar-cost average into your investments, the POEMS Share Builder provides Regular Savings Plans (RSP) for popular ETFs like the SPDR STI ETF for stocks, ABF Singapore Bond ETF for bonds, and the Lion-Phillip S-REIT ETF for REITs.

2. US ETFs

These are ETFs listed on US stock exchanges such as the New York Stock Exchange (NYSE) and the Nasdaq. Names of common US ETFs include Invesco QQQ Trust (QQQ), SPDR S&P 500 ETF (SPY), and iShares MSCI Emerging Markets ETF (EEM).

US ETFs have the highest trading volume and liquidity, and also offer the best exposure to growth. Typically, US ETFs have lower expense ratios than SG or UCITs ETFs.

In Singapore, the flip side of investing in US ETFs is that you are liable for a 30% tax on all your dividends, and an estate tax of 18-40% if you pass away while holding assets worth more than US$60,000 in the US.

Additional reading: 4 Best US ETFs For Beginners To Buy In 2021

The cheapest way to purchase US ETFs

Currently, the most cost-efficient way to invest in US ETFs is through TD Ameritrade, with its $0 commissions on US ETFs.

Another viable choice that may be more accessible to Singapore investors is FSMOne, where you can make monthly contributions to a Regular Savings Plan.

3. UCITs ETFs

One way to get around paying extra taxes while still gaining that international exposure is to invest in UCITS ETFs. These are Irish-domiciled ETFs. With only a 15% tax on dividends and no estate taxes, UCITs ETFs are more tax-efficient than US ETFs.

Consider this simple comparison between VUSD and VOO, two ETFs that track the same S&P 500 index. VUSD is listed on the London Stock Exchange while VOO is listed on the NYSE.

Dividend withholding tax

VOO: 30%

VUSD: 15%

Expense ratio

VOO: 0.03%

VUSD: 0.07%

Without considering commissions, the total costs are VOO: 0.58% vs VUSD: 0.29%.

This is not to say that UCITs ETFs are always a better buy than US ETFs. Generally, UCITs ETFs have higher expense ratios, higher commission costs and lower liquidity, which is undesirable for frequent traders. In the end, you might be incurring lower costs if you invest in US ETFs.

The cheapest way to purchase UCITs ETFs

However, if you invest on a lump-sum basis, and are concerned about dividend-withholding taxes, UCITs ETFs are a safe bet.

The cheapest way to invest in UCITs ETFs is to invest a large sum all at once (as opposed to regular monthly investments) through Interactive Brokers.

You can also invest in them through your standard brokerages e.g. DBS Vickers, POEMS, Saxo Capital, and Standard Chartered.

Types of Investment in Singapore #3: Singapore Savings Bonds (SSB)

What are SSBs?

Singapore Savings Bonds (SSBs) is an investment product offered by the Singapore Government, with expected returns of about 1% per annum. (The projected 10-year return for the March 2021 tranche of SSBs is 1.15%)

Contrary to high-risk, high-reward stocks, SSB is a relatively safer investment type for risk-averse investors to grow their money passively.

SSBs have an investment period of 10 years, but investors are free to withdraw their investments at any point in time, with no penalty for early redemption. However, the longer they hold their positions, the higher the interest rates.

Benefits of SSBs

SSBs are favoured by many Singapore investors as it usually offers higher returns as compared to bank fixed deposits.

Low risk

SSBs are backed by the Singapore Government and have displayed historically-stable returns.

High liquidity

Similar to stocks, investors can withdraw their money from SSBs at any time.

However, when buying SSBs, the minimum requirement is $500, and the maximum you can invest is $200,000.

Moreover, there is a trend of declining SSB rates in recent years.

Despite these drawbacks, SSBs are still one of the easiest ways for investors to combat the prevailing inflation rate (1.9%) without having to experience the perils of market ups and downs.

How to invest in SSBs

Step 1: make sure you have a CDP (Central Depository) account that is linked to your local bank account (DBS, POSB, UOB, OCBC).

Step 2: Apply for SSBs through a physical ATM OR internet banking portals provided by DBS/POSB, OCBC and UOB, and OCBC’s mobile application.

And voila! Your work here is done.

Money will be automatically deducted from the bank account tied to your ATM card or your internet banking account.

Note: A non-refundable $2 transaction fee will be charged by the bank for each application request.

Types of Investment in Singapore #4: Real Estate Investment Trusts (REITs)

A Real Estate Investment Trust (REIT) is a firm that owns and invests in real estate by pooling together capital from individual investors.

With REITs, you can earn passive income from investments in real estate without having to buy, own or manage the property yourself.

Benefits of REITs

High returns

REITs yield stable and sustainable returns ranging from 4-9%.

The REIT leases out spaces within the property, collecting rent in return. At least 90% of their taxable income will be distributed back to shareholders as dividends – the reason behind their high yields.

Affordability

Most people do not have the millions of dollars to purchase commercial estates for investment. If you lack such funds, REITs offer a great investment opportunity for exposure to real estate including shopping malls, offices, hotels, industrial buildings, etc. Traded at an affordable price on the SGX, the average investor can also take a stake in these mega properties, and generate passive income in the process.

Liquidity

A physical property takes time and money (in terms of commissions, fees and taxes) to sell. A REIT, on the other hand, offers high liquidity. You can buy and sell REITs on the SGX anytime you want.

Inflation Hedge

When most investors think of a hedge against inflation, they often think of gold or commodities. Few stop to consider the power of REITs as an inflationary hedge.

With rising inflationary pressures around the world, owning a tangible asset – one that will always be valuable even when money devalues – is a vital part of any smart investment portfolio.

And what better choice than real estate? Shelter is an essential need of every living person, and with the limited land space in Singapore, property has the potential to become more valuable in the future.

However, as with all investment classes, investing in REITs comes with certain risks.

Unlike the relatively stable bonds, REITs are subject to price volatility, much like stocks and ETFs. During the COVID-19 market sell-down in March 2020, REITs were amongst the hardest hit, with prices dropping nearly 30%.

For example, the Frasers Logistics & Commercial Trust nosedived close to 50% from $1.27 on 2 March 2020 to $0.665 on 23 March 2020. However, the good news is that REITs have since bounced back. Frasers Logistics & Commercial Trust returned to a price of $1.47 in April 2021.

How to Invest in REITs

There are generally three ways to purchase REITs:

- Purchase individual REITs

- Purchase REITs ETFs in a lump sum

- Purchase REITs ETFs through a Regular Savings Plan

- Purchase REITs ETFs through a Robo-advisor

Purchase individual REITs

In Singapore, REITs are traded on the SGX and much like how you purchase a stock, investors can purchase REITs using their brokerage accounts.

Purchase REITs ETFs in a lump sum

Alternatively, one can also purchase a basket of REITs through an ETF such as the Lion-Phillip S-REIT ETF. You can easily purchase REITs on a lump sum basis through your brokerage account, much like you would purchase individual REITs.

Do note that as compared to buying individual REIT counters, buying an ETF will incur an annual expense ratio.

Purchase REITs ETFs through a Regular Savings Plan

To purchase REIT ETFs through an RSP method (instead of lump-sum), there are currently 4 platforms that are available which is shown below.

These are DBS, POEMS, OCBC, and FSMOne.

Purchase REITs ETFs through a Robo-advisor

Last but not least, perhaps the most hassle-free and low-cost method is to invest through the Syfe REIT+ portfolio, or the Syfe 100% REIT portfolio.

The REIT+ portfolio has no minimum investment and the total fees start from 0.4%, going up to 0.65% for those with less than S$20k in AUM.

This recurring fee structure is pretty similar to investing on a DIY basis where the total expense ratio is somewhere in the region of 0.60%.

Moreover, one-off transaction fees (commissions, SGX Fees, etc) will not be incurred in the case of Syfe.

Syfe

Invest in one of the up-and-coming Robo Advisors in Singapore. Syfe is the only Robo Advisor that allows Singaporeans to invest in a 100% REIT basket.

For a more extensive read on REITs, click here.

Additional Reading: Why REITs are ideal for a market in 2021 and 2 SG Blue-Chip REITs I am currently positive on

Do Like Me on Facebook if you enjoy reading the various investment and personal finance articles at New Academy of Finance. I do post interesting articles on FB from time to time which might not be covered here in this website.

Join our Instagram channel for more tidbits on all things finance!

SEE OUR OTHER WRITE-UPS

- Thematic ETFs partaking in the hottest trends

- Best China ETFs to buy [2020]

- Best performing ETFs which consistently outperform the S&P500 over the past decade

- Best ETFs in Singapore to structure your passive portfolio

- Lion-Phillip S-Reit ETF: Should you be buying this REIT ETF?

- Top 5 Best Growth ETFs that beat ARK funds in 2021

Disclosure: The accuracy of the material found in this article cannot be guaranteed. Past performance is not an assurance of future results. This article is not to be construed as a recommendation to Buy or Sell any shares or derivative products and is solely for reference only.