This is Part 2 of the Basic Investing Terms beginner guide series where I will teach you all the basics of investing that you will need to know so you can invest with confidence. Part 1 of this beginner guide can be found here.

Trading has a language of its own. If you’re new to this arena, there are terms you’ll hear frequently — bullish, bearish, long, short — and learning this jargon is important for understanding the media and when communicating with other investors.

In part one of this series, we have covered the names of common assets you can invest in. You have uncovered the meaning of investments such as stocks, ETFs, options, cryptocurrencies, and their respective advantages and pitfalls.

In this guide, you will understand basic investing strategies and the terms used to describe them.

Bullish, Bearish, Long, Short

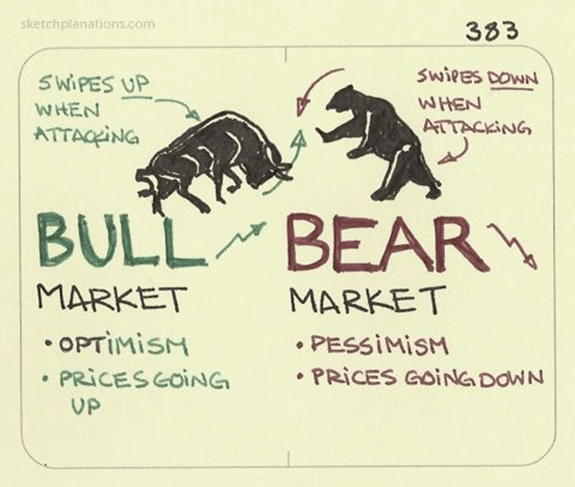

Bull market

The market when stock prices are going up. Investor optimism is high and the economy is buoyant.

Bear market

The market when stock prices are going down. Investors are pessimistic and the economy is slowing down.

The terms bullish and bearish can also be used to describe market trends. To say “there’s a bullish trend in the market” means that asset prices are rising. By the same token, to say “there’s a bearish trend in the market” means that asset prices are falling.

The words bullish and bearish can also be used to describe investor attitude. For example, if an investor believes that Tesla will rise in value, he may say “I’m bullish on Tesla.” If he also believes that Bitcoin is going to fall in value, he may say “I’m bearish on Bitcoin.”

Rally

A rapid increase in the price of a stock or the general price level of a market. E.g., the GameStop rally in Jan 2021 resulted in multiple NYSE trading halts.

Long

You can think of “long” as another word for “buy.” When someone says “I am going long on a stock,” it means he is buying it and expecting its value to increase in the future.

The terms bullish and long are often used interchangeably. For instance, instead of saying “I am bullish on Apple,” an investor may say, “I am long on Apple.” Both statements indicate that he thinks the price of Apple will increase.

Short

Being short in an investment means that you will profit when the value of the investment falls. This is the exact opposite of a long position.

How to short a stock

When you hear about investing, chances are, you think about reaping gains by first buying at a lower price and then selling at a higher price.

However, some investors trade in the opposite time sequence. They sell first at a higher price, then buy back the asset at a lower price if its price decreases. This action is called shorting, or short-selling.

Short-selling works because markets allow us to ‘buy first sell later’, but also to ‘sell first buy later’. The latter is achieved by borrowing the asset from your broker and selling it.

However, you are required to buy back the shares in the future to return them to the broker.

You can make a profit if you buy back the shares at a lower price. However, if the price increases after you sell the shares, you have to buy them back at a higher price and you will incur a loss.

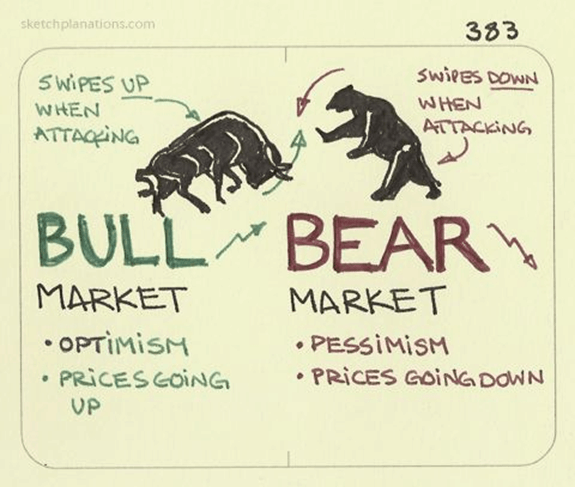

Suppose you short 10 shares of Bitcoin at $10,100. You will receive 10,100 x 10 = $101,000 from that sale. However, your trading account will now show negative 10 shares. You are required to bring this balance back to zero in the future by buying back the 10 shares.

Twelve days later, the price of Bitcoin falls to $10,000. You can now buy the 10 shares back for a total cost of $100,000.

Remember you earned $101,000 from selling the 10 shares, and since you spent only $100,000 buying back the shares, your profit is 101,000 – 100,000 = $1000.

On the other hand, if the price of Bitcoin moves up to $10,200 per share, you need to buy-to-cover (buyback to close the short position) the 10 shares at the current price of $10,200 per share, which amounts to a total loss of 102,000 – 101,000 = $1000, excluding commissions and interest.

A word of caution: although short selling can be an immensely profitable strategy, it comes with additional risk. When you take a long position, the maximum amount you can lose is all your initial investment. However, when you short a stock, your losses can be infinite. This can happen in a short-squeeze scenario, like what we are currently witnessing with “meme” stocks such as Gamestop.

Additional Reading: A smart way to play the short-squeeze game

Bid, Ask, Bid-Ask Spread

Bid

The maximum price the buyer is willing to pay for a share.

Ask (also known as Offer)

The minimum price the seller is willing to put a share up for sale.

A good way to differentiate between the two is to remember that when you bid for something, you are trying to buy it. When you sell something, you are making sure the buyer wants to pay the amount you ask for.

Bid-Ask Spread (Bid-Offer Spread)

The difference between the Bid and Ask price.

The size of the bid-ask spread measures the liquidity of the market and the size of the transaction cost. The greater the bid-ask spread, the less liquid the market and the higher the transaction cost.

Note: Liquidity in stocks is a measure of whether transactions to buy or sell can take place easily. The larger the volume of trades, the higher the liquidity – it is easier to find a buyer or seller. If there are only a few participants trading, there is low liquidity and it may be difficult to sell your shares.

Types Of Orders: Executing A Trade

Market Order

When you place a market order, your trade would be executed as quickly as possible, at the current market price. If the market price is $50, you buy the stock at $50.

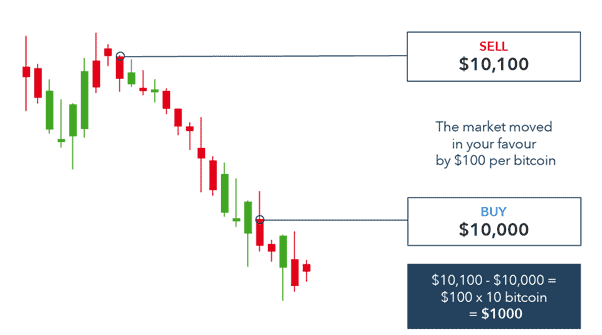

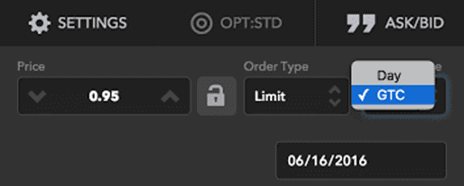

Limit Order

A limit order is an instruction to buy or sell a security at a specified price or better. If you set a buy limit order at $50 per share, you would only purchase the stock when the share price reaches $50 or below.

Likewise, if you set a sell limit order at $50, you would only make the sale when the price reaches $50 or above.

Limit order is more commonly used than market order, as it gives traders control over the exact price to buy or sell a stock.

The biggest limitation of using a limit order is that you are not guaranteed to trade the stock. If the stock does not reach your limit price, your trade will not execute. This can result in missed opportunities. When an asset is quickly rising, it may not pull back to your buy limit price before soaring higher.

Stop Market Order

Stop market orders let you sell as a market order once a predetermined price has been reached. It essentially sets a trigger to release your shares to the market.

Stop Market 100 TWTR at $25. Once your TWTR shares hit $25 they are put on the market for sale.

You may get more or less than $25, depending on which way the market is moving. But $25 is the “trigger” that activates a sale.

Stop Limit Order

Stop limit orders are the same as a Stop Market except you also set a price below which you will not sell.

Stop Limit 100 TWTR at $25, Limit = $23 – When your TWTR shares hit $25 they are put on the market for sale, but you will not accept anything less than $23 per share.

When would I use a Stop Market/Limit Order?

Let’s say you take a month-long, off-the-grid trip to the Himalayas and can’t watch your stocks during that time. You might think about entering a stop market order before you leave. This would protect you from a major loss in case the market were to crash while you’re away.

Beware that as your orders get fancier, your broker’s commissions may go higher. Double-check before you execute a stop or limit order that it’s worth it. Even with all these options (and more) available to you, when buying and holding great companies over the long-term, simple market orders are usually the best way to go.

Good Till Cancelled (G.T.C.) Order

A GTC order means that your order stands until you cancel it. That means your order will be executed when the stock comes to your price, even if that is a few weeks or months later.

Day Order

Day order means that your order is only good for the day it is placed.

Terms You May Encounter While Investing

Stock Exchange

An exchange is a platform where different investments are traded. Major exchanges in the US include the New York Stock Exchange (NYSE) and the NASDAQ. These correspond to the Singapore Exchange (SGX), which is the major stock exchange in Singapore.

Key differences between NYSE and NASDAQ

NYSE lists the stocks of traditional blue-chip and industrial companies, names such as Boeing, Walmart, Visa, and Exxon Mobil.

NASDAQ lists a group of technology companies in growth-oriented sectors. This includes Apple, Microsoft, Amazon, Cisco Systems, and Amgen.

As such, equities on the NASDAQ have higher volatility.

How does an exchange works?

A stock exchange is like a supermarket for shares. Think of the NASDAQ and NYSE as your NTUC Fairprice and Sheng Siong here in Singapore. They sell similar things and they have to compete for customers. The more trades they process, the more money they make.

Any share you want to buy or sell will be listed on an exchange. As the buyer (or seller), it makes no difference to you which one it is. When you go online and place your order, the computer will route your trade to the correct exchange within seconds.

Exchanges pair up buyers and sellers (just like eBay). When shares are for sale, they have an asking price, called the “ask price.”

Buying shares is like being the bidder on eBay, so the buyer has to pay a “bid price.”

There will always be a gap between the two. This is called the “bid-ask spread” (something which we covered earlier on) That spread is how the exchanges make money. It’s their commission.

Volatility

How fast a stock moves up or down.

IPO

A term that stands for initial public offering. It is the process whereby a private company issues shares and becomes a publicly-traded company listed on the stock exchanges. This allows the company to raise money from public investors.

The company can use that money to grow operations, buy new equipment or even acquire other companies.

Original shareholders also like the idea of spreading the risk around. After going public, the owners of a company can cash in some profits while holding onto just a percentage of the company.

Broker

A person who buys and sells investments for you, in exchange for a fee. Common names of brokerage accounts in Singapore include DBS Vickers, TD Ameritrade, POEMS, and Interactive Brokers.

Additional Reading: Best brokerage in Singapore

Dividend

A dividend is money paid regularly (usually annually) by a company to its shareholders, out of the company’s profits. Dividends can be issued in various forms, such as cash or additional stocks.

When a company reaches the point that they are regularly profitable and have little financial liabilities (borrowings) on their balance sheet, they have four choices for what to do with the money:

- Reinvest in the company and look to expand their product line or service offerings

- Build up cash reserves

- Pay dividends to shareholders

- Do share buybacks

When a company chooses not to reinvest excess capital, they can select to pay dividends to their shareholders to keep them happy. Many US blue-chip companies such as Walmart, Microsoft etc are also dividend-paying companies.

While their dividend yield (dividend paid / share price) might not be high, these companies might be attractive candidates because they exhibit both earnings growth + income payout characteristics.

If you’re mature and approaching retirement, strong dividend-paying companies could be a good choice for you. The steady source of income can help you through retirement and the stocks can be passed down to your children. Companies that pay dividends are usually less volatile, as the regular dividend provides confidence to investors.

Younger investors really shouldn’t concern themselves too much with dividends. With time on your side, you should be looking for companies with plenty of room to grow their business and, in turn, your investment. You should thus pay more attention to growth companies, ie those which select Option 1 (reinvest their excess capital for future organic growth in the company)

Additional Reading: 7 Golden Rules of Dividend Investing

Terminologies For Investment Strategies

Averaging down

The act of buying more shares of a stock when its price goes down. This lowers the average price of the investor’s shares.

Lump-sum Investing

This strategy involves investing a large sum of money all at once. If you want to invest $10,000 in a stock, you buy all the shares you can afford at once.

Dollar Cost Averaging

The term may sound intimidating, but the strategy is nothing complicated. Basically, you make small but regular investments on a monthly or quarterly basis. With this method, you take the same $10,000 and invest it in monthly increments of, say, $1,000.

In some months, when the price is higher, you will buy fewer shares with that $1,000. In other months, the share prices might be lower and you can buy more shares. DCA is the strategy behind regular savings plans (RSP).

Lump Sum VS Dollar Cost

Based on statistical evidence, lump sum investing tends to outperform dollar cost averaging in the long run.

Every time you purchase $1,000 worth of the stock, you have to pay a commission, and that cost stacks up. You may also miss out on potential gains when some of your money enters late.

Nonetheless, lump-sum investing exposes you to greater risk in the short term, especially if you buy before a dip. But a more widespread limitation is that many small-time investors do not have enough cash on hand to invest a lump sum.

At the end of the day, it is good advice to not invest more than you can afford, and save your emergency funds for true emergencies.

Additional Reading: A better alternative to Dollar Cost Averaging

Do check out Part 1 of this Basic Investing Terms guide for beginners.

Do Like Me on Facebook if you enjoy reading the various investment and personal finance articles at New Academy of Finance. I do post interesting articles on FB from time to time which might not be covered here in this website.

SEE OUR OTHER STOCKS WRITE-UP

- BEST ETFS IN SINGAPORE TO STRUCTURE YOUR PASSIVE PORTFOLIO

- LION-PHILLIP S-REIT ETF: SHOULD YOU BE BUYING THIS REIT ETF?

- GUIDE TO SYFE AND HOW TO OPEN AN ACCOUNT IN LESS THAN 10 MINUTES

- THE IDEAL RETIREMENT PORTFOLIO STRUCTURE

- WHAT IS A REGULAR SAVINGS PLAN?

- CHEAPEST WAY TO INVEST THROUGH RSP. SHOW ME HOW.

Disclosure: The accuracy of the material found in this article cannot be guaranteed. Past performance is not an assurance of future results. This article is not to be construed as a recommendation to Buy or Sell any shares or derivative products and is solely for reference only.