If you have been following the market, the new talk of the town these days has been interest and inflation rates. With Dow Jones Index ending February by shaving off more than 1,000points (-3.22%), you might wonder how we can best position ourselves to brace for potential market volatility. In this article, I will share why REITs are still my choice of investment for 2021 and key catalysts for the market! I will follow up with a brief write-up on 2 SG blue-chip reits I am currently positive on. Ready?

First Catalyst – Treasury yields and Inflation Rates

Treasury Yields

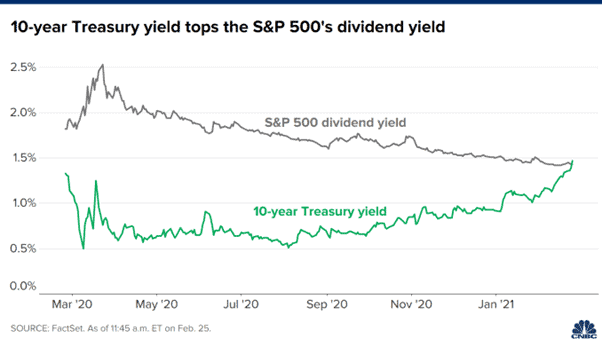

Treasury yields are one of the common indicators that investors use to manage their investments. As these instruments are issued by the government, these yields are seen as “risk-free” returns. When the economy was halted due to Covid-19, the 10-year treasury yield plunged to its 234-year low at 0.52%! Concurrently, the S&P 500’s return was over 2% at that time.

Therefore, the huge disparity resulted in funds flowing out of bonds to equities throughout the pandemic. However, the improving economic outlook and the projected inflation rate have changed the financial landscape. Just in February, the 10-year treasury yield rose to its one-year high at 1.6%. The sudden rise in the rates resulted in the “risk-free” returns from 10-year treasuries to overtake the S&P 500’s dividends. This caused jitters in the market and many started to rebalance their portfolio towards fixed income instruments.

Why face the risk of market volatility and potential capital losses when the government guarantees a higher return?

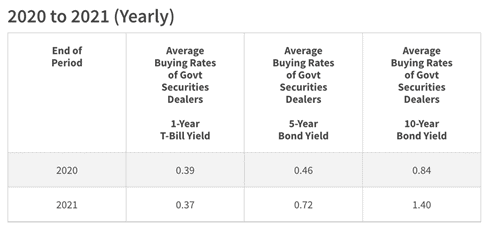

After reading about Treasury yields peaking, are REITs still a good asset to hold? I believe so! On average, S-REITs yields a return of 6% yearly. However, the sector took a hit due to Covid-19 and they ended 2020 at about 4.2% to 4.3% returns. Despite the underperformance, their returns are still very high compared to Singapore government bonds.

The table below was extracted from MAS and the average yield of a 10-year bond is at 1.4%. It is almost 3 times lesser than REITs!

Inflation rates

Still not convinced after reading about Treasury yields? Let’s talk about inflation rates! Real estates are classified under “Real Assets” which are known to be a good hedge against inflation. Therefore, an increase in inflation should see property prices increase in tandem. With the land scarcity in Singapore, most prime locations are already snapped up by REITs! The appreciation in property value will definitely benefit investors of REITs in terms of higher capital gains.

As our economy continues to open up gradually, REITs are expected to recover and perform better in 2021. As rental and football begin to pick up, we’re likely to see better yields this year!

Additional Reading: Ultimate Guide to REITs in Singapore

Second Catalyst – Covid-19 (Vaccinations & Potential second wave)

Before moving on to the second catalyst, this was one of the biggest lessons I’ve learned from the pandemic. When Covid-19 first broke out, I underestimated the importance of studying both vaccine production and progress. I thought that it was irrelevant but vaccination made a huge impact in terms of market direction!

By understanding the entire process, it allows one to gain an upper hand and react quickly should the market turn south. These are the two key factors to look out for – Vaccine rollout and possible delays, Potential second wave.

Vaccination Progress

As of March 2021, only the Pfizer-BioNTech and Moderna’s vaccine has been approved by Singapore. The list of vaccines may increase progressively with the likes of Johnson & Johnson gaining approvals from CDC in the United States.

During our Prime Minister’s speech over Chinese New Year, it was reported that over 250,000 Singaporeans have received their first dose of vaccination. Further, 110,000 of them have received their second dose. Singapore is expected to start vaccination for residents age 60 to 69 in March and the entire population vaccinated by the end of 2021! As Singapore is progressively vaccinated, we can expect life to return to a sort of normalcy. Businesses should start picking up soon and this can prove to be a turning point for REITs.

However, one should always look out for potential supply chain disruption or new strains that may slow down the vaccination process. It was reported early this year that the likes of Pfizer have been facing manufacturing disruption that may see several weeks of production delay.

Opening up & Potential second wave

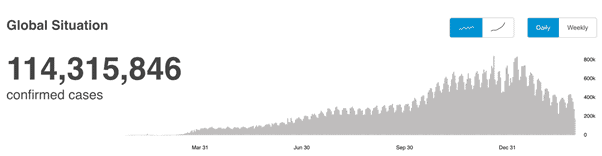

Globally, the number of Covid-19 cases has been falling gradually. From a peak of over 800,000 global cases recorded in a day, this number has fallen to 280,000 cases. As the situation improves, more countries are looking towards the resumption of global travel.

Just last month, Singapore is exploring the possibility of Vaccine Certification that may potentially open up the borders. This is definitely welcoming news for REITs as many of them stand to benefit from tourism! However, this may serve as a double-edged sword as investors must be wary of any potential second wave of Covid-19. However, I believe that the pros outweigh the cons and REITs are ideal for 2021!

- Third Catalyst – Valuation & Risks

Ever since Covid-19 started, valuation and fundamentals have been thrown out of the window. Many conventional indicators such as P/E, P/B ratios, or even Buffet Indicator have been ignored. At a point in time, we were seeing the likes of Hertz, a bankrupt company surging while pizza companies like Papa John trading at over 2000 P/E ratio! The market may be irrational but I believe that they will always fall back to fundamentals.

From a valuation standpoint, I believe that S-REITs are currently undervalued. Historically, their P/B ratios are at an average of 1.2 to 1.4. However, S-REITs are currently undervalued as they are trading below this threshold! I personally believe that trading with the backing of fundamentals gives one the conviction during turbulent times. To learn more about REITs and their valuation, please refer to this link.

2 SG Blue-Chip REITs I am positive on

Have your views on REITs as a viable investment vehicle for 2021 improved after reaching this section? I hope so! But you might wonder which sector or even REIT to purchase to tide through 2021. With over 42 REITs in Singapore ranging in more than 5 sectors, it is also essential to pick the right companies. Personally, my top two picks for S-REITs are Fraser Centrepoint (SGX: J69U) and Ascendas REIT (SGX: A17U). Here’s why!

Fraser Centrepoint Trust (FCT)

Portfolio Overview

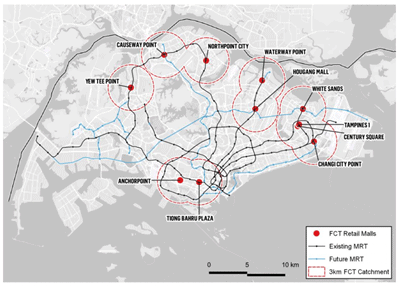

Fraser Centrepoint (FCT) is the only suburban retail-focused REIT in Singapore with 11 properties in its portfolio. The number of properties is expected to be 10 on 22nd March this year when the divestment of Anchorpoint is completed. The expected net proceeds from the divestment are approximately S$108.8million and it might be used for debt repayment or working capital needs.

I believe that this is a good move for FCT as Anchorpoint accounts for only 1.8% of its portfolio’s property asset value. Further, it opens up avenues for FCT to explore and many have begun to speculate if funds will be channeled to acquire an additional stake in properties such as Waterway Point where FCT owns a 40% ownership!

Reach of Suburban malls

Diving deeper into FCT’s properties, they are all strategically located in prime suburban areas with close proximity to homes and transport amenities. Through the malls, FCT is able to access a catchment of approximately 3 million of the population within 3km of their properties. That’s more than 50% of Singapore’s population!

Leasehold

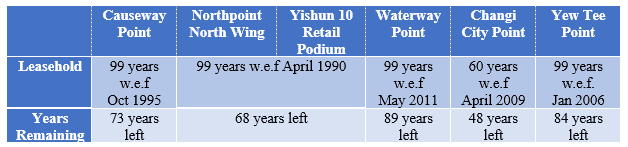

In Singapore, a high proportion of properties are on a 99-year leasehold. Naturally, a property will start to depreciate in its value as the lease period begin to drop. This would be especially concerning if the properties are left with 20 to 30 years in their leases! How does FCT fare in terms of this?

Below is the table I’ve compiled based on their leaseholds! The earliest property to run off its lease is Changi City Point which is 48 years from now. This was one of the key reasons for me to invest in FCT as they are immune to any risk from leases. Furthermore, the properties will serve as an effective asset to hedge against inflation!

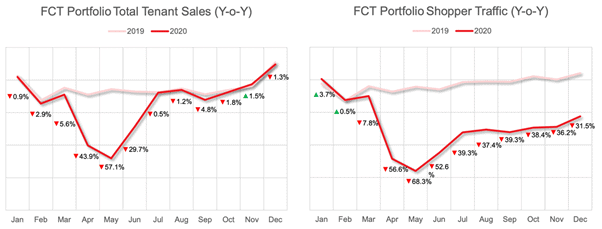

Shopper Traffic

Compared to other S-REITs, FCT was the only one with flat rental reversion throughout the pandemic. This is a testament to the quality of assets under its portfolio! Tenant sales have recovered to near pre-covid levels and I expect shopper traffic to pick up once our population is gradually vaccinated. Further, FCT is less susceptible to tourism as most of the footfall is dominated by locals! By putting the pointers together, I believe that FCT stands to benefit in 2021 as our economy gradually opens up.

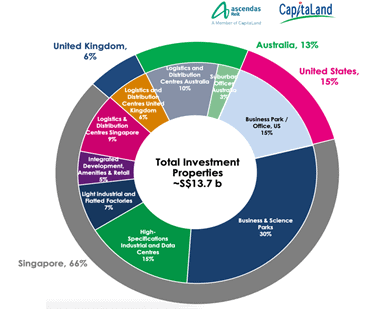

Ascendas REIT (AREIT)

Ascendas is one of the few resilient REITs with the ability to provide increasing Dividend Per Unit (DPU) on a year-on-year basis. They are Singapore’s largest industrial REIT with a diversified portfolio ranging from business space to industrial properties. Last year, they expanded their portfolio by initiating a slew of acquisitions with properties in the United States and Australia. As they are also looking into data centers, I believe that Ascendas will continue to be a formidable S-REIT.

Performance expected to rebound in 2021

In H2 of 2020, Ascendas reported a 0.9% fall in DPU to 7.418cents and the underperformance brought some negativity to Ascendas. However, I believe that this is partly due to Ascendas’ private and public offering which saw over 300million shares added to the company. As the acquisitions were done between November 2020 to January 2021, the profits from these properties were not enjoyed by Ascendas in the second half! Furthermore, the enlarged shareholding base resulted in a lower DPU. Judging by Ascendas’ track record, I believe that the DPU will continue to rise and overperform next year!

Resilience to after-effects of Covid-19

Comparing Ascendas to other REITs in the commercial space, its diversified portfolio will allow them to be more resilient to any market turbulence in 2021. There’s an overhanging fear that the after-effects of Covid-19 may impact certain sectors of the market. For example, commercial spaces may see a slower rebound with flexible working and WFH arrangements.

Conclusion

Putting together the three catalysts mentioned, I believe that REITs are the ideal asset class for 2021. They have weathered the storm of last year and are poised to recover in 2021 from the improving economic condition and vaccination process. Further, both Fraser Centrepoint and Ascendas will be primed to recover the situation gradually improves. Despite the recent dip in prices, it is an opportunity for investors to buy REITs and a lower valuation!

For those who do not wish to go through the hassle of selecting individual REIT counters or wish to diversify one’s capital across a portfolio of REITs, this can be easily achieved through a low-cost manner by investing in a product such as Syfe’s REIT+ portfolio.

Syfe REIT+ Portfolio

Syfe REIT+ portfolio allows an investor to easily invest in a basket of SG Blue-Chip REITs on a low-cost basis. Find out why this might be one of the easiest manners to get started investing in SG REITs today.

Alternatively, one can also select to purchase a basket of REITs through a locally-listed ETF such as the Lion-Phillip S-REIT ETF.

Do Like Me on Facebook if you enjoy reading the various investment and personal finance articles at New Academy of Finance. I do post interesting articles on FB from time to time which might not be covered here in this website.

Join our Telegram broadcast: https://t.me/gemcomm

SEE OUR OTHER WRITE-UPS

- Best Performing Singapore REITs [Update December 2020]

- Ultimate Guide to REITs in Singapore (2020)

- WHY I AM STILL BUYING REITS EVEN WHEN THEY LOOK EXPENSIVE

- 10 Great Reasons to Buy Singapore REITs and 3 Reasons to be cautious [Update 2021]

- How to buy REITs in Singapore. 10-key S-REIT quantitative filter (part 1)

Disclosure: The accuracy of the material found in this article cannot be guaranteed. Past performance is not an assurance of future results. This article is not to be construed as a recommendation to Buy or Sell any shares or derivative products and is solely for reference only.