Table of Contents

MNST: Best Performing Stocks of all time

According to data from Gurufocus, Monster Beverage (MNST) is one of the best performing stocks of all time. From 2002 to 2022, Monster Beverage is the best-performing stock in the S&P 500, generating an annualized return of 42%. This is followed by Apple which generated an annualized return of 38% over the past 20 years.

Imagine what a 42% annualized return can do for your portfolio. Assume that you have accurately identified Monster Beverage as the stock to purchase 20 years ago. You invest $10,000 into the counter.

How much will your stock be worth now?

Answer: $11.1m.

Sounds like an easy way to become a millionaire multiple times over, right? If only we can turn back time. Unfortunately, that is not going to happen in reality.

The bigger question now is: What are the financial factors which contributed to the strong price performance of Monster Beverage over the past two decades and can we use that to identify the next 1000-bagger stock?

In this article, I will be highlighting some of the salient financial characteristics of Monster Beverage which likely attributed to its strong price performance since the start of the millennium.

I will conclude the article with a potential small-cap stock candidate that possesses similar financial features that Monster Beverage characterizes 20 years ago. Might the stock be the next 1000-bagger?

Monster Beverage: A monster of a company

Monster Beverage was a stock that was listed back in 2003 and has since skyrocketed by more than 100,000%. Its share price was below $0.10 back in Jan 2003 and is currently at an all-time high level of $54.01/share, after undergoing multiple rounds of share split.

Monster Beverage’s market cap is now $56bn (as of 3rd April 2023)

The strong price performance of Monster Beverage shows that a company need not be a “high-tech” sophisticated conglomerate that deals with smartphones, search engines, “everything stores” etc to do well.

It can be selling a simple consumer product, like an energy drink, that appeals to the masses.

Here are some financial characteristics which Monster Beverage displayed since being a listed company, that likely attributed to its strong price performance over the past 2 decades.

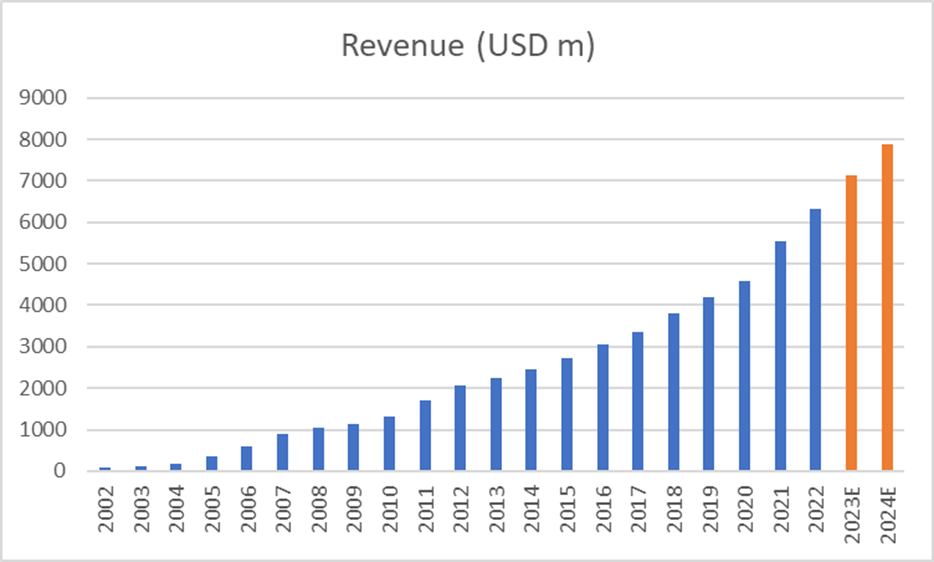

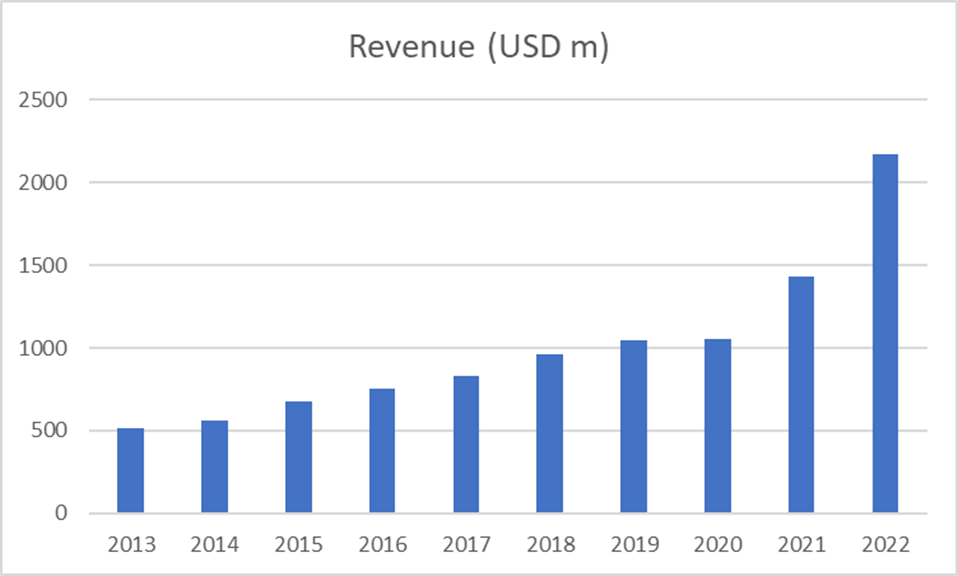

Factor #1: Growing Sales

As can be seen from the bar chart above, MNST has had one of the most consistent sales growth over the past 2 decades. Despite having been growing its revenue since the start of the millennium, the street still expects sales growth to be relatively robust in 2023 and 2024.

Consistent sales growth, with a CAGR of 23.5% over the past 2 decades, has likely been one of the key contributing factors towards MNST’s robust price performance.

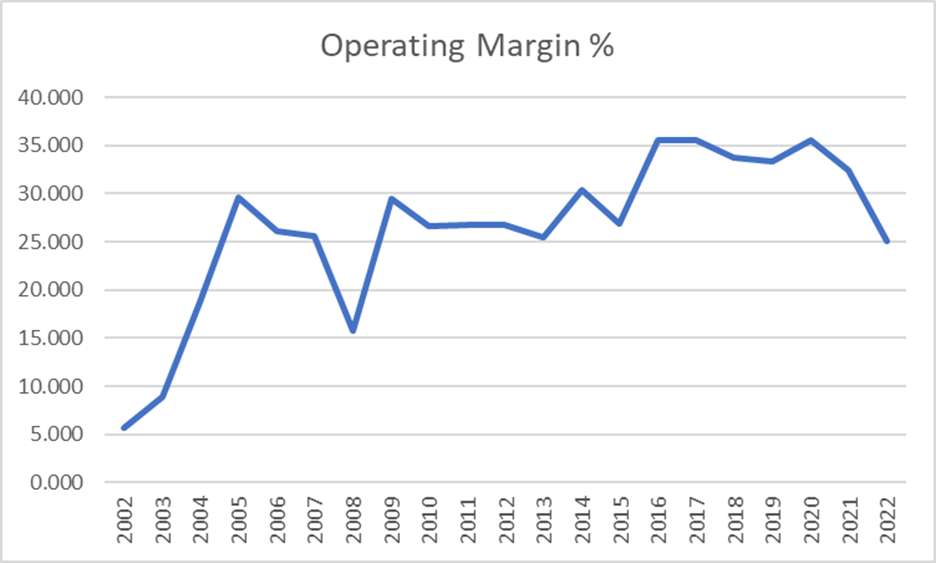

Factor #2: Operating Leverage

Operating leverage is one defined simply by earnings growing faster than sales. This is evident from a rising margin profile. When a company can raise its profits without having to rely on sales growth, but instead, by streaming its operations into a more efficient entity, that company has achieved operating leverage.

As can be seen from the above line chart, MNST has been growing its operating margins from a single-digit level to a recent peak of 35%. While 2022 saw a dipped in operating margins to 25%, this decline is likely a “one-off” event, with the street expecting MNST’s operating margins for 2023 to be resuming its growth trajectory (forecasted at 29% in 2023)

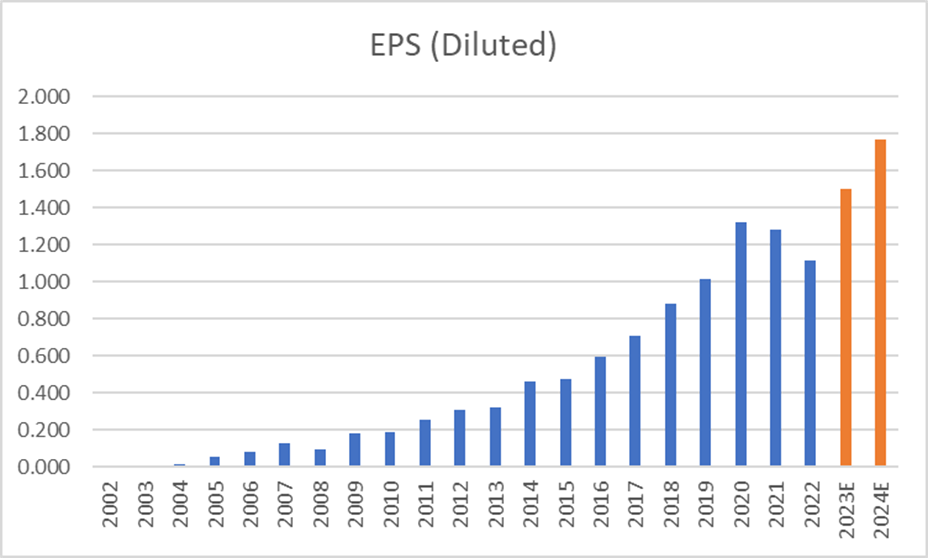

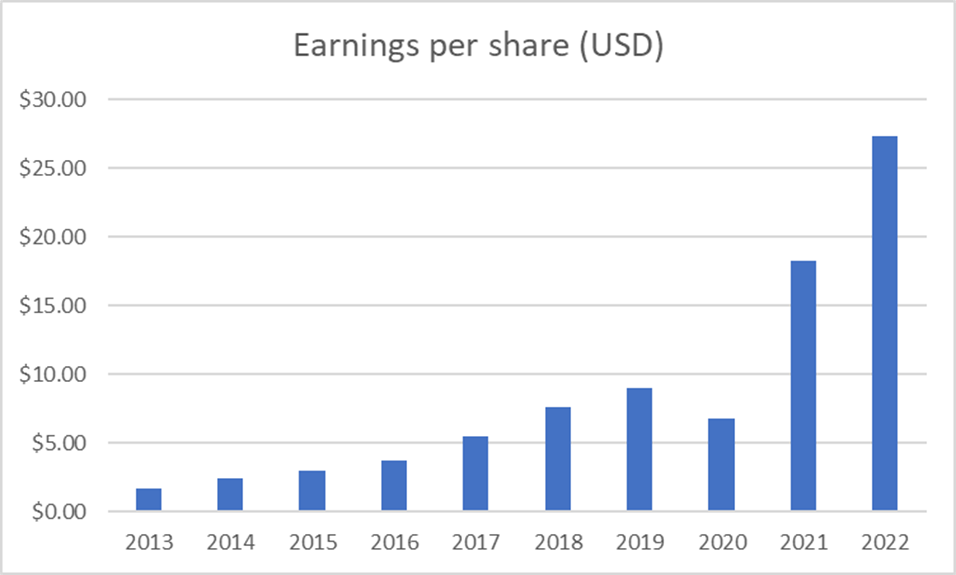

Factor #3: Growing Earnings

MNST has been a profitable company since 2002. This is not a hyper-growth company, typically characterized by strong revenue/sales growth (50-100%/annum) but loss-making in nature. MNST has not only been a steady grower of its top line but has also been growing its Earnings Per Share (EPS) relatively consistently as well.

The company generated $0.003 EPS in 2002. This has grown to $1.115 in 2022, a CAGR of 34%, much faster than its sales CAGR of 23.5%, as evidence of operating leverage in play.

While the past couple of years have been relatively tougher for MNST in terms of a dip seen in its EPS, the street expects the company to generate record EPS in 2023 and 2024. Based on an expected EPS of $1.5 in 2023, the company is trading at a forward PER multiple of 36x.

The forward multiple of 36x is higher than the average forward PE multiple of 32x over the past 10 years, which could imply a slight over-valuation at present.

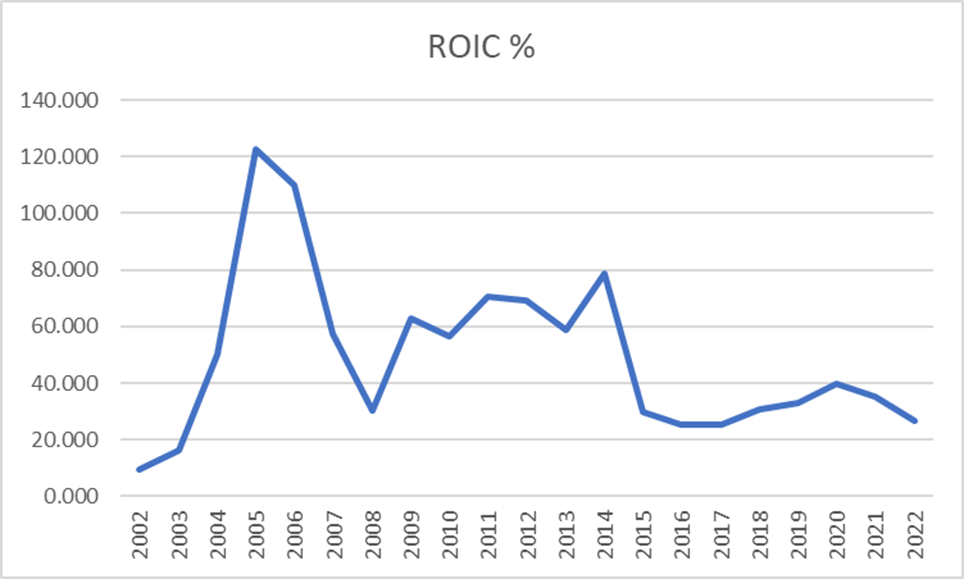

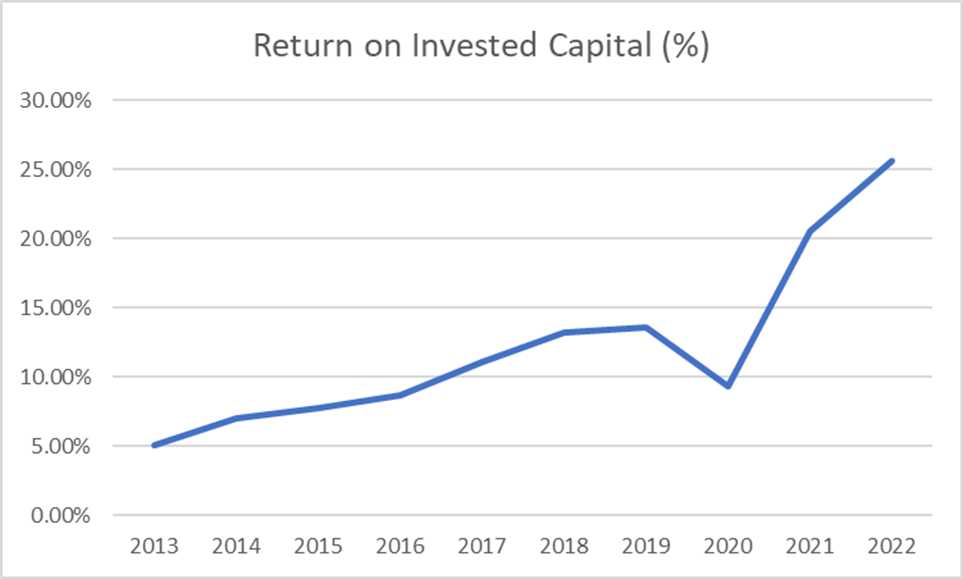

Factor #4: High Efficiency

One way to measure a company’s efficiency level is to look at its Return on Invested Capital, or ROIC for short. MNST has consistently demonstrated very high ROIC over the past 20 years and this is also likely one of the key reasons to explain its price outperformance.

ROIC is one of the most important metrics that I use to sieve out highly efficient companies, companies that likely have a competitive edge, or some would term that as a moat, to stay ahead of the competition.

A more common metric to use as a means of evaluating the efficiency of a company is the Return on Equity (ROE) metric.

Additional Reading: How to outperform the market by 100%

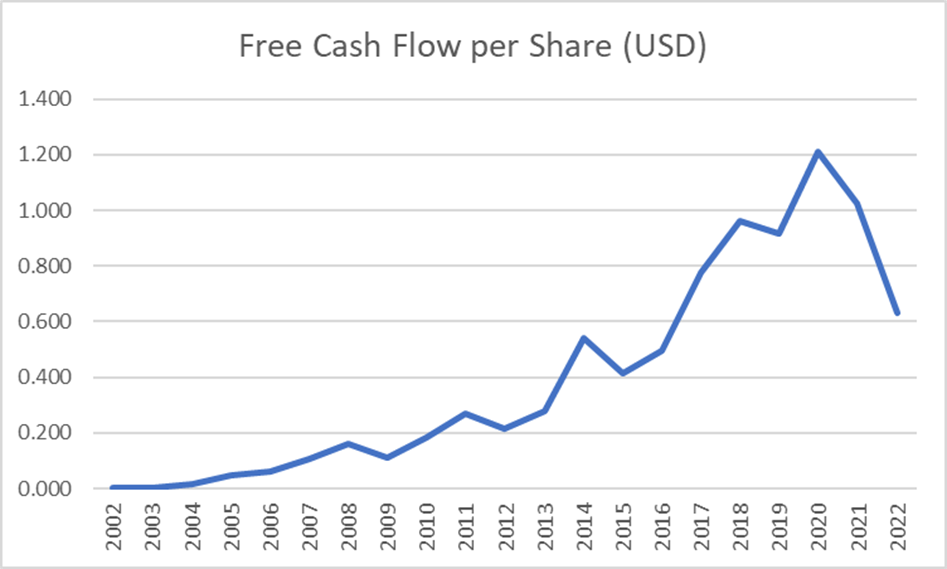

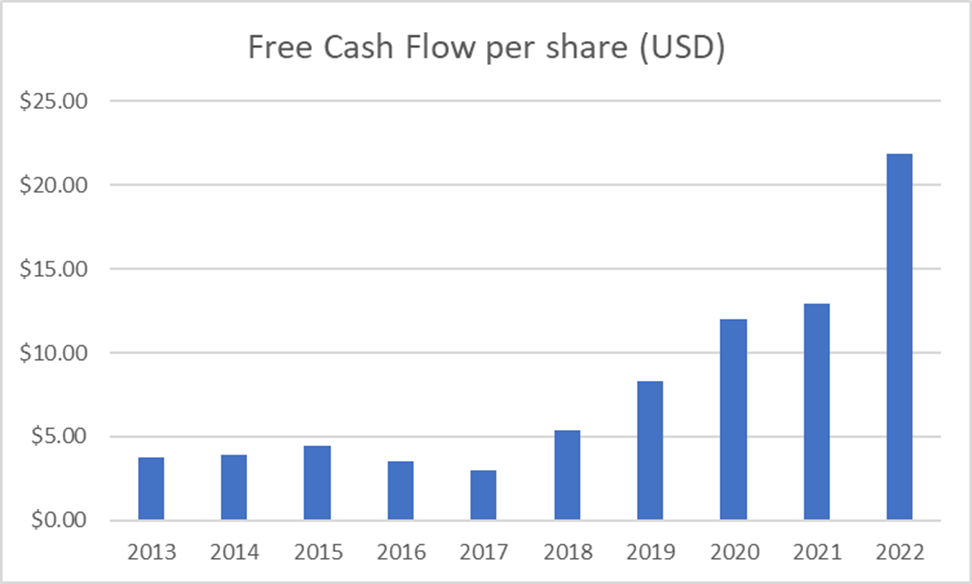

Factor #5: Growing Free Cash Flow

A strong company needs to not only demonstrate increasing profitability, but should also be generating excess cash beyond its operational needs, or what is commonly termed as the free cash flow (FCF) of the company.

Free cash flow = Operational cash flow – Capital expenditure requirements

Free cash flow is derived after subtracting capital expenditure requirements which the company needs to maintain/grow its operations from operational cash flow.

The excess cash (free cash flow) can be used for multiple purposes: 1) Build up cash coffer for rainy days, 2) Pay dividends, 3) Buyback shares, 4) Inorganic acquisitions, etc

MNST has been growing its free cash flow alongside its Earnings (EPS) consistently over the past 20 years.

The recent dip (2021 and 2022) in FCF was a result of lower EPS, which should not be too big of a concern.

A major red flag would be a company that has been growing its EPS consistently, which is not accompanied by a corresponding increase in FCF as well.

In some cases, FCF was consistently negative despite the company’s growing profitability profile and the company needs to sustain that growth through external borrowings.

Additional Reading: The Best Predictor of Stock Price Performance

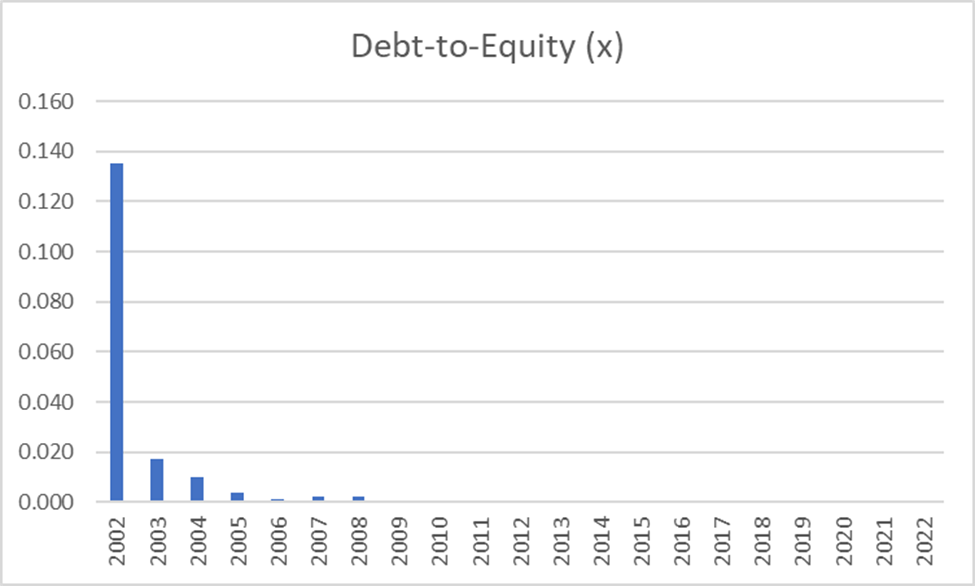

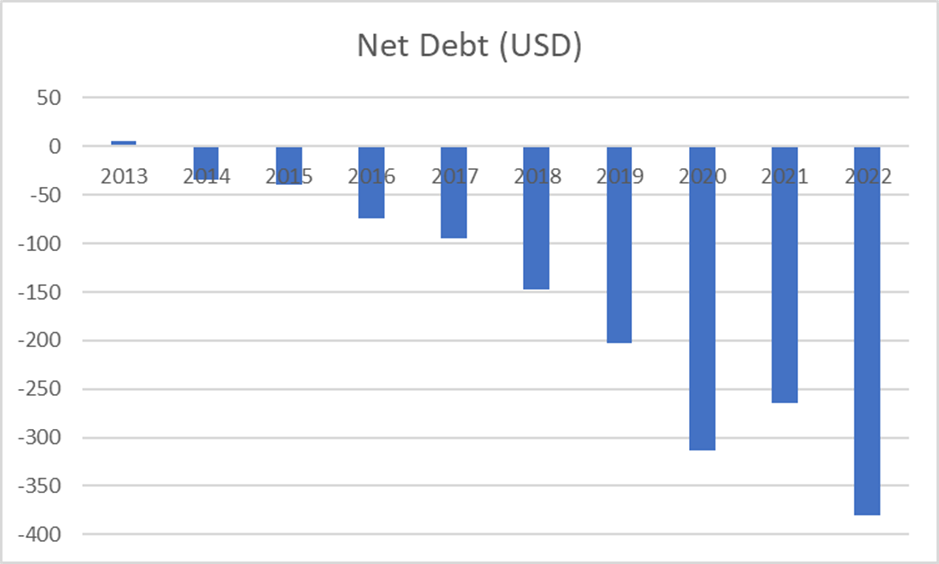

Factor #6: Low Leverage

The debt-to-equity ratio is a common metric used to evaluate the debt leverage level of a company. A figure above 1x is typically not viewed favorably upon, although this might differ from industry to industry.

MNST has paid off all its debt since 2009 and has since been consistently growing its cash pile. With a healthy cash pile of approx. $2.7bn, shareholders of MNST need not be concerned over credit-related issues associated with the company, nor should they be worried over the current rising rate environment that is likely a major issue for highly geared corporations.

Best small/mid-sized company: Cavco Industries (CVCO)

One of the stocks that I currently have my eyes on is Cavco Industries (ticker: CVCO), a small/medium cap company (current market cap of US$2.7bn) that has been identified as one of the best mid-sized companies by Forbes

While most investors would not be familiar with this company, you would probably have heard of its products: modular homes.

CVCO currently possesses some of the key financial traits that MNST used to possess in the past.

The company has not only been growing its revenue and EPS consistently, but it has also been demonstrating operating leverage (EPS growing faster than sales). Sales CAGR at 17.4% vs. EPS CAGR at 36.4%

Growing EPS is accompanied by growing free cash flow. CVCO is also pretty efficient in terms of managing its resources, as evident from its high ROIC level.

Last but not least, the company is in a negative net debt position (aka net cash).

How to find high-quality growth companies

Both Monster Beverage and Cavco Industries are what I termed as quality growth stocks, counters that possess both quality + growth features in a stock, a powerful combination that often outperforms the broader market in both a bull and bear market environment.

These are the companies that will not only survive an economic recession but likely emerge in a stronger position, having “outlast” their competitors.

In good times, these are the companies exhibiting sales/earnings growth that is being favored by investors.

Investors who like to learn a systematic approach to screening and sourcing for these high-quality growth stocks can check out the Stock Alpha Blueprint Course by clicking on the button below.