Table of Contents

Do Like Me on Facebook if you enjoy reading the various investment and personal finance articles at New Academy of Finance. I do post interesting articles on FB from time to time that might not be covered here in this website.

Join our Instagram channel for more tidbits on all things finance!

Join our Youtube channel for short and sweet videos on all things finance!

Syfe Review

Syfe if you don’t know is a MAS-licensed investment platform. I have been a long-time user of the Syfe Robo Advisor and have written several review articles on this Singapore-based Robo Advisor that ranks as one of the best in the industry, in my humble opinion.

Why is that so? I will look to detail some of my favorite features of this Robo Advisor and what other “good-to-have” features Syfe should consider implementing in the foreseeable future.

For those who are interested, here are my previous Syfe review articles that I have written:

- Guide to Syfe and how to open an account in less than 10 minutes

- Syfe Equity 100 Review: does this portfolio make sense to you?

- Syfe Review: Which of its portfolio offering will I select?

- Syfe Review: Is this now the most comprehensive Robo Advisor in Singapore?

- Syfe trade Review: Fractional Investing Suited for Beginner Investors

Feature #1: Syfe Cash+

I like that Syfe offers a very simple cash management service without looking too “aggressively” to court investors’ monies by offering them higher-yielding alternatives that are not cash “guaranteed”.

One example is that of Endowus Cash Smart offering where its highest-yielding product, Cash Ultra, can be relatively risky and is not “cash-secured”. This might not be known to retail investors, who believe that most of these cash management services are “capital guaranteed”.

They are NOT.

By offering a simplistic solution that offers a higher yield than the typical bank savings account, without any “lock-up” period, Syfe Cash+ might be the solution you need.

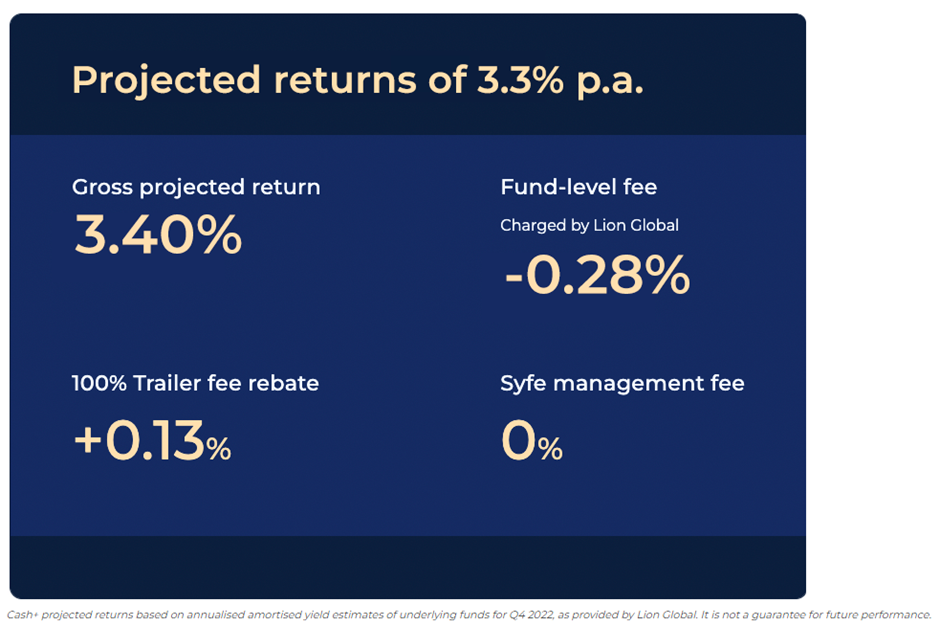

From my own experience, what I typically do is transfer a “lump sum” amount that I already have the intention to invest into Syfe Cash+. This allows me to earn a higher interest rate on my cash, currently at 3.3%.

Next, I will look to engage a dollar cost average approach to invest monies in my Syfe Cash+ every month into some of the long-term investments that I am looking to progressively build a growing position in.

In this way, I know that I am generating higher interest on my cash, which is accrued daily, while yet also having the additional flexibility to withdraw them (if required). Thus lowering my risk management.

As mentioned earlier, Syfe has just increased their Cash+ yield offering from the original amount of 3% to the higher rate of 3.3% (net basis)

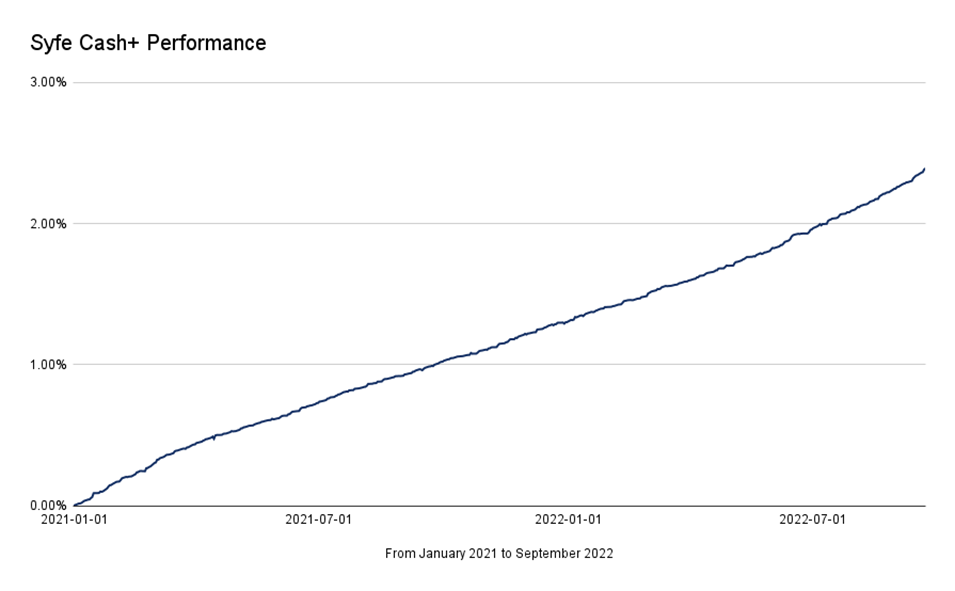

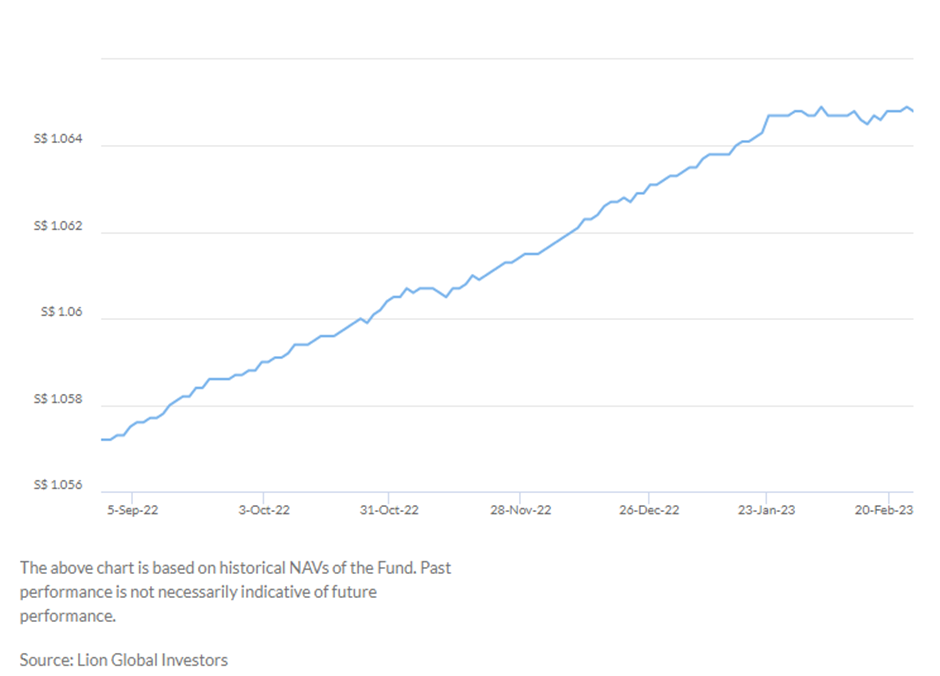

While there is no guarantee that this minimum investment is “capital protected”, the track record of its Cash+ service has been relatively stable as seen from the chart below.

However, I do note that its core product, the LionGlobal SGD Enhanced Liquidity Fund which Syfe allocates 70%, (the other remaining 30% is in LionGlobal SGD Money Market Fund) is witnessing some “plateauing” of its performance of late, based on data from LionGlobal.

Feature #2: Build Your Own Portfolio

This is a service under its “managed wealth” portfolio where an investor can select to customize their portfolio, using ETFs as the underlying products.

This is different from core portfolios which is based on portfolio allocation into different asset classes, depending on the investor’s risk management profile.

An investor who has got an idea as to what Exchange Traded Funds (ETFs) he/she will like to invest in can seek to capitalize on core portfolios which can provide that additional flexibility.

However, there are 2 key limitations to this feature.

First, it is only restricted to ETF/Fund investing. An investor who wishes to invest directly in individual stocks will not be able to do so using this feature. However, there is a solution to that which I would talk about later.

Second, the ETF/Fund options are relatively limited. One can only select from a pool of 100+ ETFs/Funds curated by Syfe’s investment experts using their proprietary method.

Other than those “downsides”, the plus points for this feature are:

- Adjust the weightings of each ETF in the portfolio according to your preference

- Easily dollar cost average into the entire portfolio every month (min of $100) through a single automated transaction without the hassle of executing for each ETF separately

Say, for example, I structure 4 ETFs into this customized portfolio, with the respective weightings:

- ETF A at 25%

- ETF B at 15%

- ETF C at 40%

- ETF D at 20%

I set up an automated dollar cost approach to invest in these 4 ETFs every month, with an investment budget of $1,000.

Like clockwork, once Syfe will deduct $1,000 from my Cash+ account on a particular date every month and invest the capital into these 4 ETFs based on their assigned capital allocation ie ETF A ($250), ETF B ($150), ETF C ($400) and ETF D ($200).

One will just need to set up the fund transfer once and thereafter, the transactions will be automated.

This is one of my favorite features of the Syfe Robo Advisor which allows me to regularly and easily dollar cost average into a portfolio of thematic ETFs that I have the intention to invest in regularly for the long term. No matter how small my minimum investment amount is.

Investing in its wealth management products does not incur any one-off commission costs but will incur recurring platform (or management fees). Being a firm with capital markets services license, I guess they have to make money as many ways as possible. However we will talk more about this later.

Feature #3: Syfe Trade

This is a relatively new feature implemented by Syfe which transcends the platform from a mere Robo Advisory platform into a neobroker with robo advisory offerings as well.

Neobrokers are financial entities that operate solely in the digital space. They typically position themselves as online brokers, trading platforms, social trading platforms, or retail investment platforms.

What this means is that an investor with a Syfe account can leverage the platform like a brokerage platform, buying and selling individual stocks through their Syfe Trade platform.

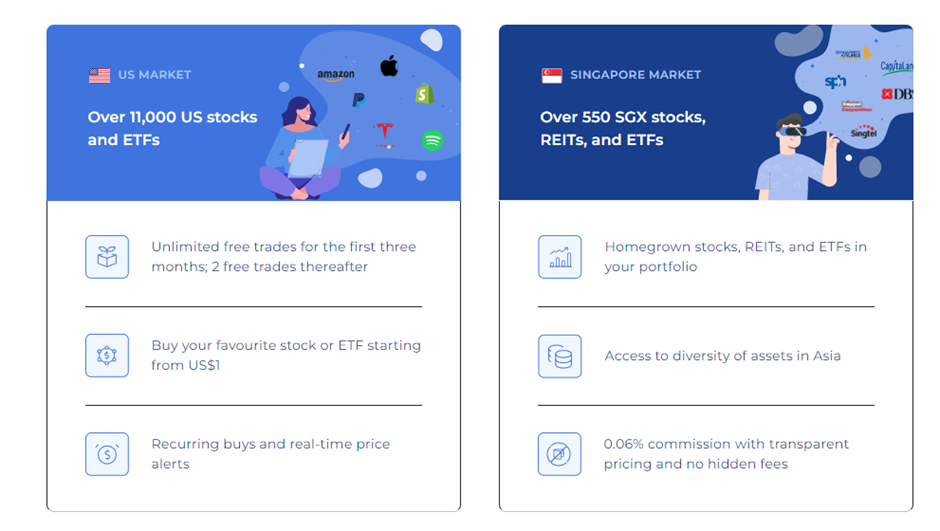

However, there are limitations to Syfe as a brokerage platform. They only offer investors US and SG stocks to trade in. For most retail investors, this probably suffices. However, more sophisticated investors might wish to have access to a greater pool of markets to trade in, an area that is currently lacking.

One key benefit of its Syfe Trade feature is the ability to engage in fractional investing for US stocks where an investor can start investing with a capital as low as US$1. This is a great feature to have for newbie investors who start with minimum investment.

There is thus no more reason not to get started in your investing journey with the fractional investing feature for its US stock offering.

An investor should also capitalize on its unlimited free trade offering (US stocks) for the first 3 months. Thereafter, there will be 2 free trades each month, with subsequent trades’ commission costs at US$1.49.

These free trade offerings are not available for SG stocks and the commission costs for each trade are at 0.06% of traded value, with a minimum of S$1.98 in commission costs.

Earlier we mentioned that a key limitation of its “Wealth Management” services is the inability to use that platform to dollar cost average into individual stocks. Because Syfe portfolio is mainly focused on ETFs.

One can now dollar cost average into individual US stocks using its Syfe Trade feature, with 2 recurring purchases every month incurring no commission costs at this juncture. In addition, those recurring purchases can be made for as low as US$1 for each transaction.

Pricing for using Syfe’s services

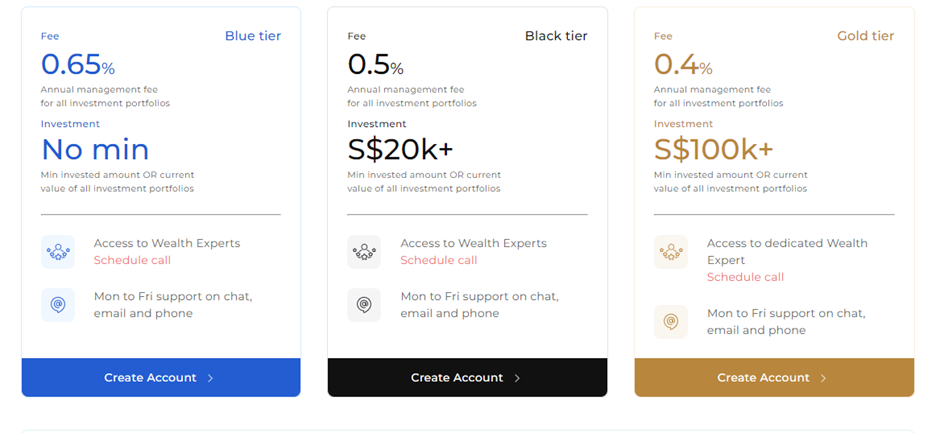

There are recurring platform fees (management fees) for using Syfe’s wealth management products such as Build Your Own Portfolio, fully managed investment portfolios, etc. The table above illustrates the fees associated with using its services.

While not necessarily the cheapest among the key Robo Advisors in Singapore, it is very competitive.

The platform fees are charged every month.

Do note that since Syfe invests in ETF products, there is an additional expense ratio that is incurred for investing in ETFs. Such expenses are directly factored into the prices of the ETFs when they are being incurred.

Recommendations

Syfe remains one of the best robo advisors in Singapore, in my humble opinion, particularly with the introduction of its brokerage service.

Its clean-cut platform for both Syfe Wealth and Syfe Trade makes it easy for an investor to navigate and execute on what truly matters in their investment portfolios.

However, its Syfe Trade feature is only available on mobile. That is one key limitation at present and I hope that Syfe can look to make this feature available on PC for easier access in the future.

There are limitations to its portfolio visuals as well such as offering a pie chart to view all the allocations at one glance.

One is also unable to view his/her monthly profit/loss movement through charts/diagrams on the platform.

Since Singaporeans love to invest in dividend-related counters to receive a recurring stream of monthly income, it will be great to have a bar chart to track the monthly income received. While some dividend data is available for its wealth services, it is not intuitive enough for an investor to track his/her dividend income record easily.

This feature will be great to have for Syfe Trade as well.

I hope that this Syfe Review article on 3 of my favorite features of the Syfe platform is useful for my readers to have a better understanding of this neobroker and how it might fit into one’s investment toolbox.

For those who are ready to sign up for Syfe, you can do so by clicking on the button below at absolutely ZERO cost to you.

Sign Up Benefits Through NAOF

Syfe Wealth

Fee waivers up to a cap of S$30,000 for the first 3 months, regardless of the amount deposited.

Syfe Trade

You will be entitled to a special S$70 in cash credit if you decide to deposit a minimum of S$2,000 and execute 1 trade. Both the funding of the account and trade must be done within 30 days.

Just click on the button below to sign up for your Syfe account today.

Whether you decide to use my link to get started on the Syfe Robo Advisor, you are invited to access my FREE Video Tutorial Robo Advisor Guide which will highlight to you the best Singapore Robo Advisors to use based on your investing style (passive, dividend income, international etc).