Table of Contents

Best Singapore Stocks Screener

Imagine you have got access to a Bloomberg terminal that allows you to screen for some of the best Singapore Blue-Chip stocks.

For most retail investors, that is out of the question because a Bloomberg terminal access literally costs an “arm and a leg”, and by that, I meant potentially thousands of dollars per month.

But what if I tell you that there is an alternative resource to Bloomberg? The only difference: It is FREE.

My readers will know that I am a big fan of the stock screening platform called Stock Rover, which I use extensively to research and screen for new stock ideas based on various strategies.

While there is a free version that ALL serious fundamental investors should check out, I subscribe to its premium version for access to all its functions. The ideas generated from the Stock Rover platform pay for its subscription fees multiple times over.

Alas, Stock Rover does not include stock coverage outside of the US/Canada region.

I have been searching for a Singapore Stocks Screener platform that is both FREE and WORTHY of a recommendation to my NAOF readers and I believe that I have found it.

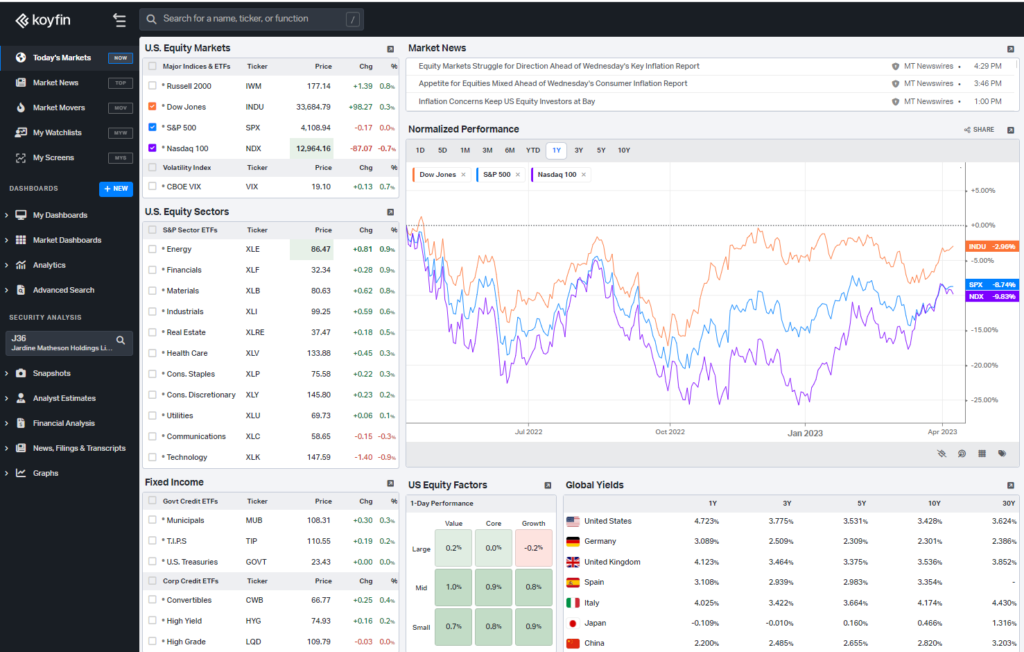

This free Singapore Stocks Screener platform that is almost comparable to the likes of your Bloomberg terminal is none other than Koyfin.

Introducing Koyfin: A FREE Alternative to Bloomberg

Koyfin is a stock screening platform that goes beyond just SGX stocks. It can be used to screen for tens of thousands of stocks worldwide, which is why this is an extremely useful platform to have.

It is not just Koyfin’s access to global stock markets that makes it so attractive, but also its various fundamental and technical screening functions that makes it one of the best free stock screener out there.

I will go through some of its functionality in a bit, with a focus on screening for Singapore Blue-chip Stocks with a dividend angle.

I will be doing a separate article on the key functionalities of the Koyfin platform.

For this article, the focus will be on using its screening platform to identify a selected pool of Singapore Blue-Chip Stocks that yield more than 4%.

Which of them is worth taking a closer look at?

Using the Koyfin Screening Platform

Key screening functions

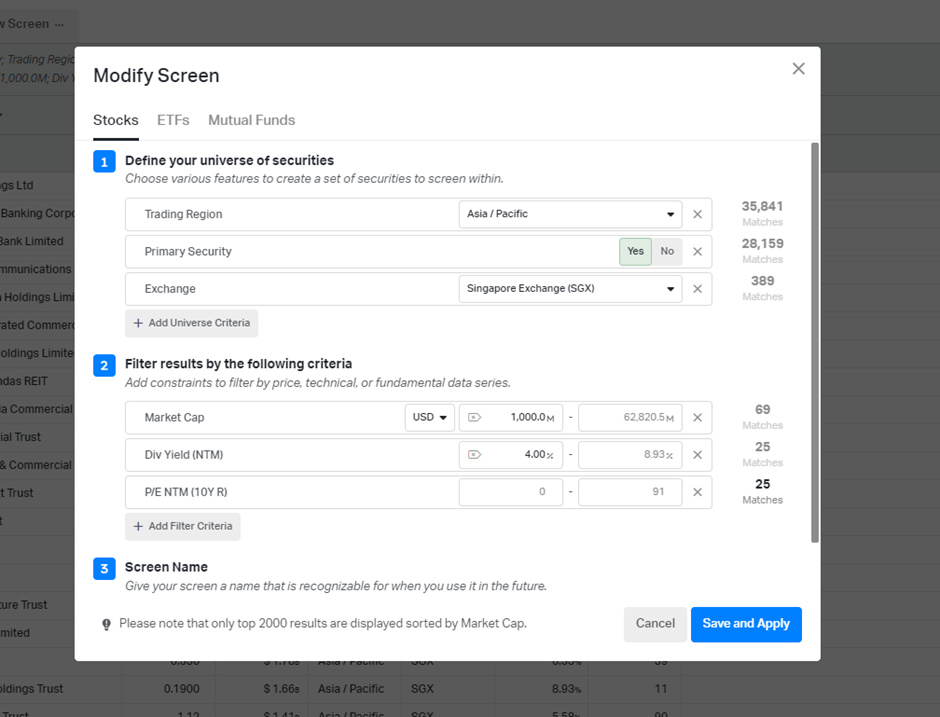

To use its screening function, users will just have to “My Screens” from the left side panel. Click on the “+” sign to add a screener.

You can select to screen your stocks from scratch where you can input your screening parameters.

As I mentioned earlier, there is a wide array of stock markets that you can select, beyond the Asia Pacific region. For this article, I will be selecting the Singapore Exchange.

Next up is to input the screening criteria.

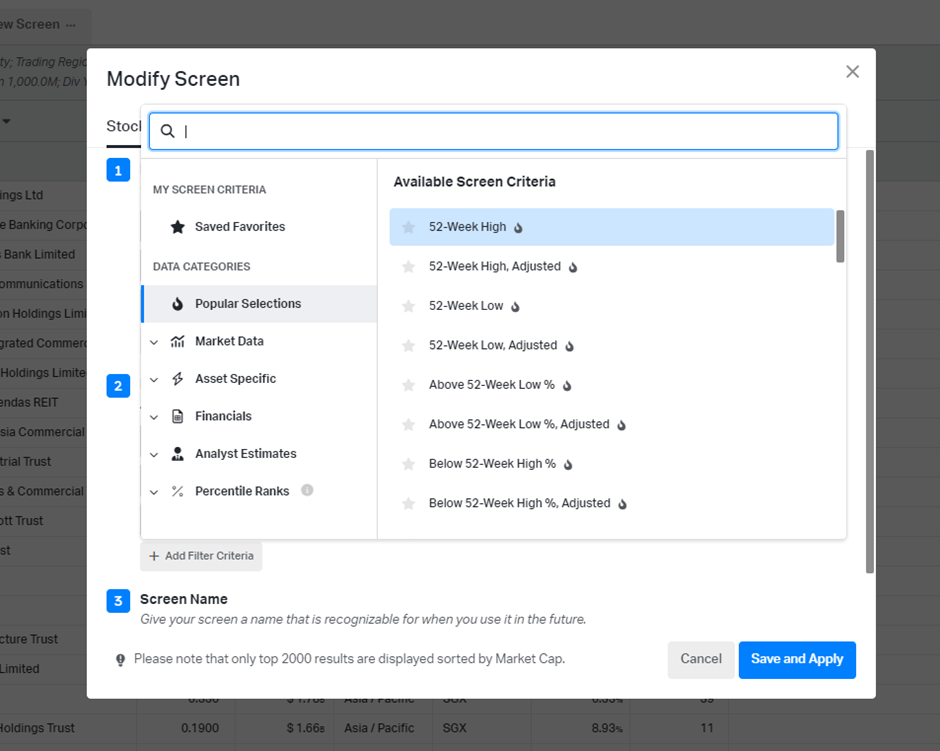

While its screening parameters are not as robust as that of Stock Rover, it is likely more than sufficient for most retail investors, with more than a hundred filters (both fundamental or technical) that one can select as a screening filter.

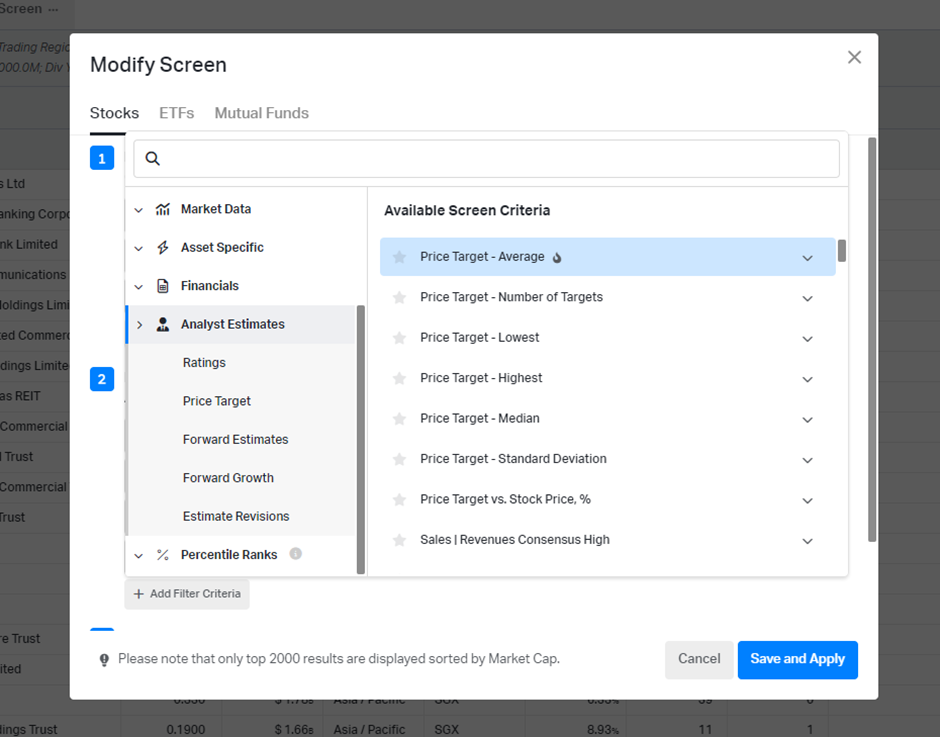

Not very common for free stock screeners is the access to the street’s estimate. However, the Koyfin stock screener allows users to screen for the various analyst estimates which include: 1) Rating, 2) Price Targets, 3) Forward Estimates, 4) Forward Growth, and 5) Estimate Revision.

Such information will usually require paid access or through a more advanced platform like Bloomberg, Reuters, etc.

Screening for Singapore Blue Chip Stocks with Yield > 4%

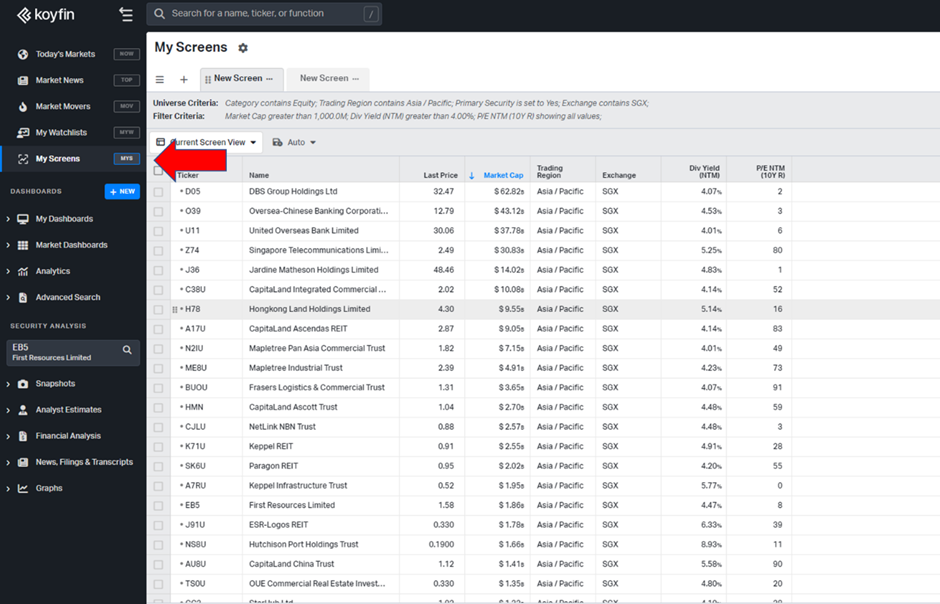

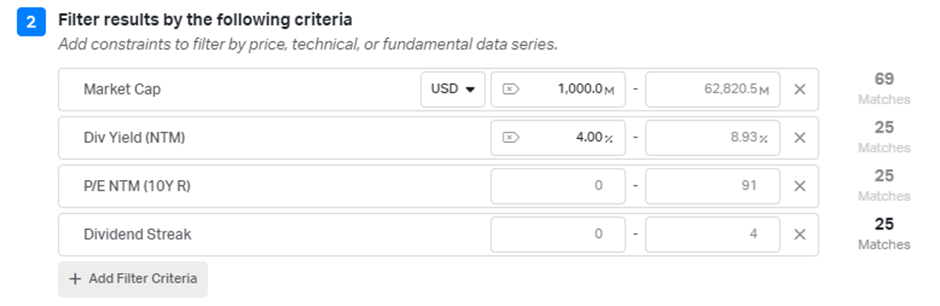

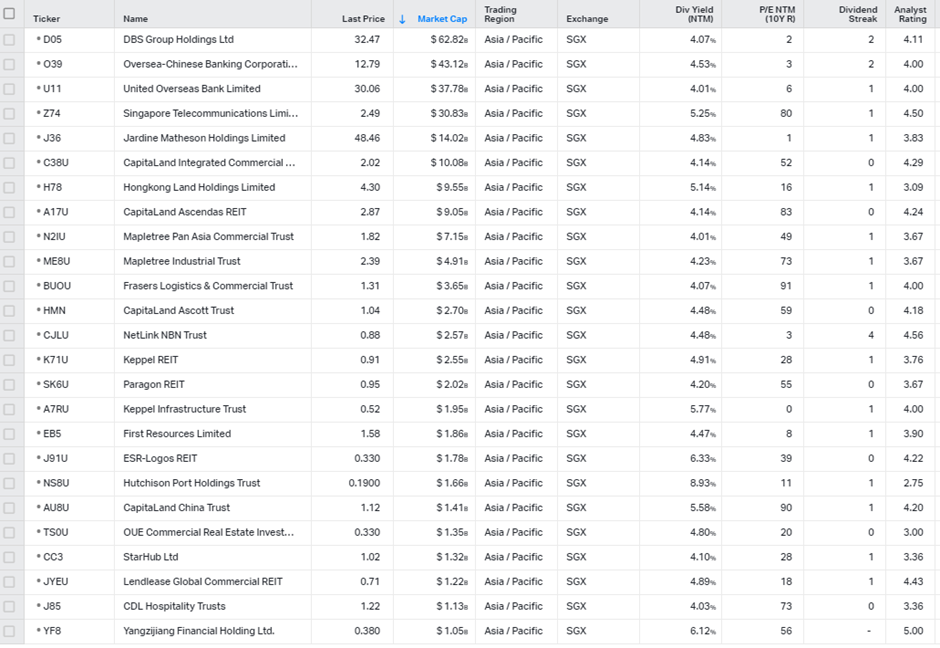

I selected a few parameters as shown in the diagram below to screen for Singapore blue-chip stocks (market cap > $1bn) that yield above 4%.

In addition, I will like to know the current ranking of the stocks based on their current next twelve months (NTM) P/E multiple vs. their historical 10-years history.

A number above 50 will represent that the stock’s P/E NTM multiple is currently above average (based on the past 10 years) and vice versa for a number below 50.

Very useful information to have at a glance. I do not add any constraints to it.

Lastly, I will also like to these dividend counters’ dividend streak (as defined by the number of years of consecutive increases in dividend payments)

There are currently 25 Singapore Blue Chip Stocks that fulfill the above screening criteria.

List of Singapore Blue Chip Stocks with Dividend Yield > 4%

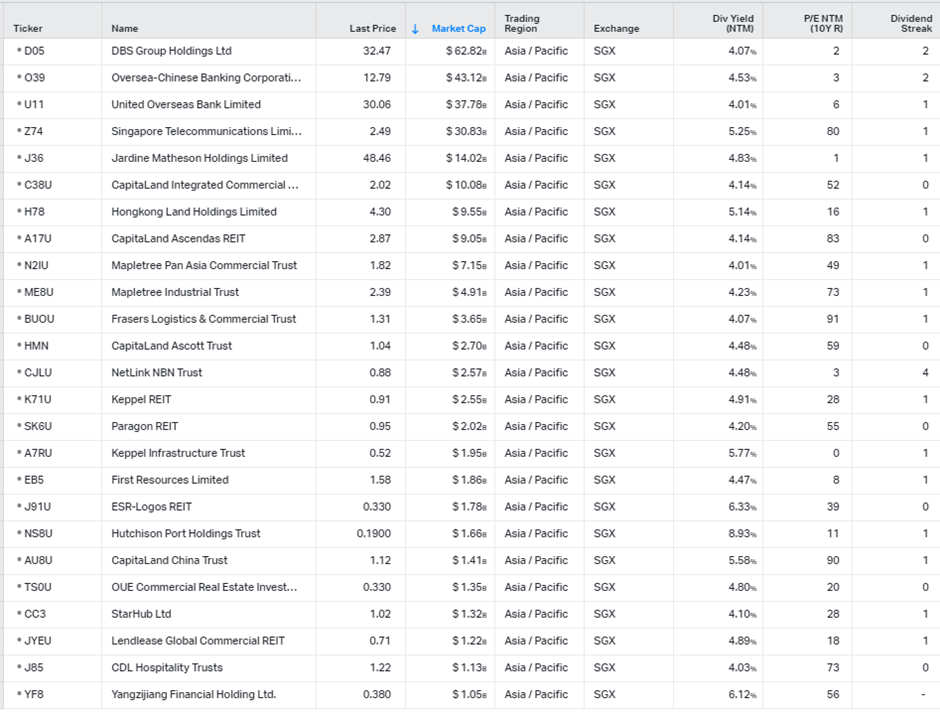

The diagram below shows the list of 25 stocks based on our screening parameters.

Many of the Singapore Blue Chip Dividend-paying stocks do not have a good track record of increasing their dividend payments, unlike their US counterparts.

Only 1 stock, NetLink NBN Trust has continued to increase its dividend payments consecutively for the past 4 years.

In this list, filtered by market cap, the stock with the largest dividend yield is Hutchison Port Holdings Trust (8.93%), followed by ESR-Logos REIT (6.33%), and rounding up the top 3 is Yangzijiang Financial Holdings (6.12%).

Yangzijiang Financial Holdings is not classified as a REIT and is a recently listed entity (spin-off from Yangzijiang Shipbuilding), hence it does not have a dividend streak record.

Which of these stocks are trading in value territory?

Among this list of dividend-paying Singapore blue-chip stocks, you might be wondering, which of them is worth considering right now.

As can be seen from the table, DBS Group Holdings, the largest Singapore blue-chip dividend stock in this list (yield just slightly more than 4%) has a P/E NTM multiple ranks of just 2, which means that its forward P/E multiple is currently in the lowest 2 percentile range (over last 10 years)

That could imply a certain level of “undervaluation”. However, valuing bank stocks often go beyond just using a simple forward P/E multiple criteria. One might also have to include other common valuation metrics such as P/B etc.

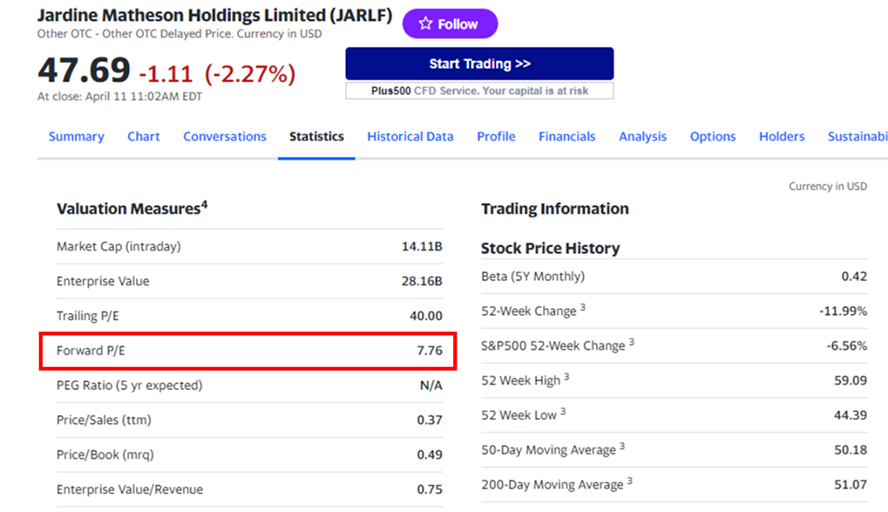

Another stock that is looking interesting is Jardine Matheson Holdings, with this conglomerate trading at an extremely low forward P/E multiple of 7.6x, according to Koyfin.

This is validated using another source like Yahoo Finance. However, investors will need to dig deeper to validate if such a low P/E multiple is a “one-off” in nature or is there really value in the counter.

To gather the sentiments of the street, I added another filter: “Analyst Rating”. The stocks with the most number of analysts with a “Strong Buy” will be rated closer to 5 and those with “Strong Sells” will be closer to 1.

Only Yangzijiang Financial Holding has a 5-star rating (strong buy) from the street.

Additional Reading: Top Websites and Apps for Free Stock Screeners

Is the premium version of Koyfin worth subscribing for?

I am just hitting the tip of the iceberg in terms of Koyfin’s screening platform functionality. While still not as comprehensive as that of Stock Rover when it comes to customizing your screening metrics, it is robust enough for most retail investors, as demonstrated in this article.

This is all using the FREE version.

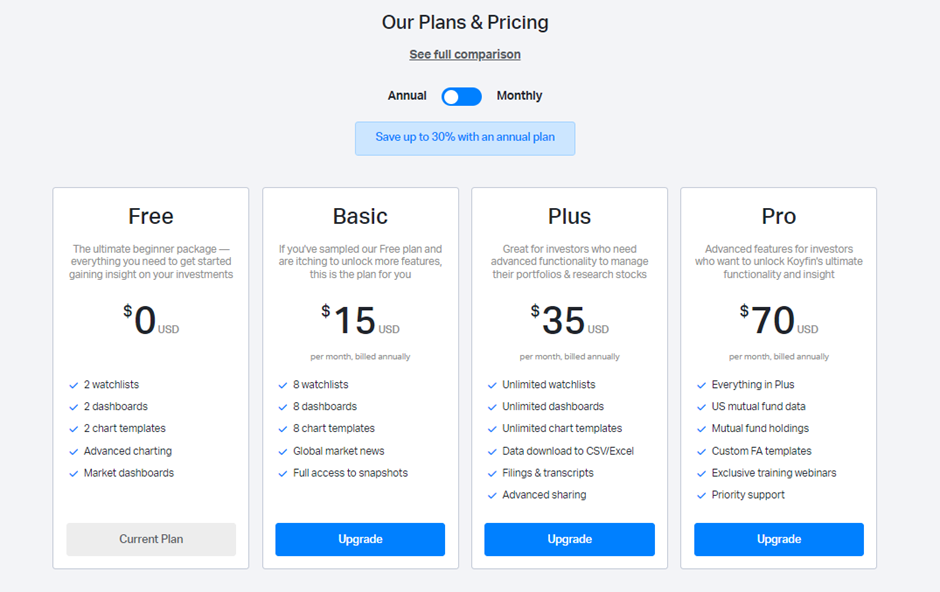

However, do note that the free version will only allow you to have 2 save screens. For more saved screens and added functionality in terms of watchlist, dashboard, chart template, global market news, and full access to snapshots where one can obtain the historical financial figures, etc, one will need to upgrade to the Basic or Plus feature.

The diagram above shows the monthly pricing (based on annual subscription) on the various Koyfin Plans.

For serious investors who wish to save a set of screening criteria, it will be ideal to go for at least the Basic Plan so that you do need to always override the existing screening parameters due to the lack of saved screens, for example.

For those who need to download the data to Excel, then the PLUS plan will be required.

My recommendation would be to just start with the free plan and get yourself familiar with the functionality of the platform, and if you believe that having access to more watchlists/dashboards/financial features is useful for your analysis, then subscribe to the paid plans.

They are likely worth the money for serious fundamental/technical investors.

For those who are interested to try out Koyfin, click on the button below to sign up for an account today. Do forward this article to your friends who are interested to know of a Singapore stocks screener platform.

Disclosure: There are affiliate links in this article. The opinions in this article are solely that of the writer and may not be representative of the general/market consensus.