In Singapore, about 80% of the population resides in HDB, the building block for affordable home ownership, often lauded by the government. Well we are not going into the discussion of whether you TRULY own a HDB even after full-repayment of your HDB loan (Yes, this might sound weird to foreigners who are unfamiliar with our 99-years lease scheme).

Does it make sense to pre-pay the principal of my HDB loan?

Well for home owners who envision being truly debt-free, the day they pay down their mortgage loan is one worth a major celebration. How many of us can claim to have absolutely zero debt under our liabilities?

In my own personal circumstances, the missus and I have got sufficient savings in our CPF RIGHT NOW to retire our outstanding HDB mortgage loans. Wow! In fact, we made the MISTAKE of pre-paying our principal last year. Wait? Did you just say mistake? How is pre-paying your loan down and being one-step closer to debt-free a mistake? Well give me a minute to explain. (make that a few mins)

The traditionalist in me is screaming “Pay down your debt! No more loans – EVER”. However the practical me has just come to realise that this might not be the wisest move. This is because of the Home Protection Scheme or HPS that I signed up when I gotten a loan with HDB at a concessionary rate of 2.6% (concessionary…. Hmm), with the intention of using my CPF-OA funds to service the loan. HPS? Is this a home insurance in case it gets burn down? You mean I sign up for it when I got my HDB loan? How come I don’t recall? These were some of the burning questions swirling in my mind when I was re-introduced to this scheme, a good 4 years after purchasing my HDB flat.

Confusion amid all the excitement

Well as a financial professional who prides myself as being knowledgeable of the ins and outs of Wall Street, I fail in better understanding the nature of my own finances, in this case, being aware of such a scheme right from Day 1 when I put pen to paper and sign on the dotted line to take ownership of my home.

However, in retrospect, I can’t be faulted for not knowing what I was actually signing when I was given this whole pile of documents by the HDB officer to have my signature imprinted on each and every single one of them. I don’t recall particularly on the fact that there was also a health declaration form for HPS which is extremely crucial because non-disclosure of material health problems would have rendered the HPS void. Absorbing all this information amid the anticipation of getting the keys to my first home is practically MISSION IMPOSSIBLE

What is HPS?

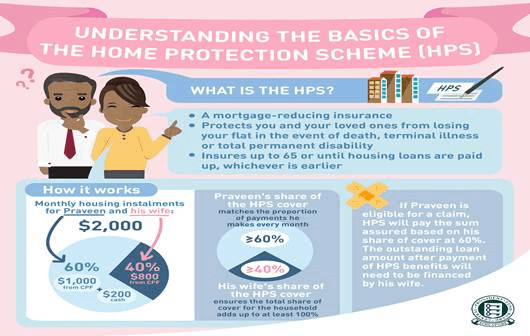

The Home Protection Scheme (HPS) is a mortgage-reducing term insurance that protects you and your family should anything unfortunate happen to you, mainly death, terminal illness or total permanent disability before the housing loan is fully paid.

What this means is that the government will settle ALL or a Portion of your housing loan should something unexpected happen to you. Your wife and kids will hence not have to bear the burden of servicing the outstanding loan.

Who pays for HPS?

You need to be insured under HPS if you are planning to use your CPF funds to pay for your loan, either at HDB (HDB loan) or at your bank (private home loan). If you are servicing your home mortgage with cash, HPS will not be a requirement. HPS only covers HDB or DBSS flats, so for the remaining 20% of the population who stays in private housing (includes ECs), this scheme is not for you (lucky or unfortunate, you make the call after finishing reading this article). The annual premium will be deduced automatically from my CPF-OA to renew my cover to ensure that I remain insured under HPS.

How much coverage will I need?

The total coverage per household should add up to 100%. For example, let’s assume that I am paying SGD600/mth to service my mortgage loan while my wife is paying SGD400/mth. Based on this amount, lets again assume that I am paying SGD200/year in HPS premium while my wife is paying SGD100/year in HPS premium. My coverage will be 60% while my wife coverage will be 40%. This means that if anything unfortunate happens to me, HDB will pay 60% of the outstanding loan to my wife.

If we want to be kiasu (for my foreigner readers, “kiasu” means scared to lose out), like the typical Singaporeans, we can both be insured for 100% each (which means higher HPS premiums to be paid per annum by both of us) but regardless of who suffers the unfortunate, the outstanding home loan will be 100% taken care of. Do note that HPS is only valid until the age of 65. If anything unfortunate happens after that…. All I can say is “ I am sorry”.

The Singapore Central Provident Fund (CPF) website has got a HPS premium calculator which you can access at this site.

Rationale for not pre-paying my HDB loan

This brings us to the focal point of this article. Some of you might already have caught on to the fact that if you are 100% covered under HPS, then your outstanding mortgage loan will be fully paid for by the government if anything unfortunate happens to you/spouse. Hence, there isn’t an incentive for me to actively reduce my outstanding mortgage loan (beyond the fact that I have a dying ambition to be fully debt free).

Let’s use an example for easy illustration

John and Mandy (both 30 years old – born in 1989) took out a SGD300k, 30-years HDB loan today to purchase their first home (a milestone regardless) and intends to service their loan using their CPF-OA funds. Both of them wish to be covered 100% by HPS (kiasu type).

Using the HPS Premium Calculator, John will have to pay SGD267/annum in premium while Mandy will have to pay SGD207/annum in premium (Ladies pay lower as they tend to live longer than us guys). Throughout the course of the 30 years, your outstanding mortgage loan will be progressively reduced. However, the amount of HPS premium will not change (called a Level Premium Plan where the premium amount stays constant throughout the coverage period). John will continue to pay SGD267/annum every year for the next 27 years (you only need to pay 90% of your loan period) and likewise Mandy will continue to pay SGD207/annum in premium for the next 27 years.

John’s SGD267/annum works out to SGD22.25/month or SGD0.75/day, pretty affordable I would say for some peace of mind. If anything unfortunate (death) happens to John in a year where the outstanding loan is now SGD290k, this outstanding amount of SGD290k will be immediately settled by HDB.

Striking a windfall? or not…

What happens if after 6 months, John and Mandy both decides to pre-pay their outstanding loan by SGD100k (strike TOTO perhaps). CPF will adjust the HPS cover accordingly if a partial repayment was made. John and Mandy’s existing HPS cover will end and any unused premium will be paid to their OA account and a new HPS cover will be issued to them. In the event of an unfortunate death incident to John, the government will cover the outstanding loan of SGD190k in this case. The SGD100k, which has been used for principal loan reduction, could have been money kept for rainier days!

Just for Fun

Scenario 1: Lets assume that John and Mandy did not pre-pay and after 15-years, the outstanding loan is SGD150k. John dies in an unfortunate accident and the government pays for the SGD150k. Remember the SGD100k excess capital they won from TOTO? If they choose to voluntarily contribute to Mandy’s CPF-SA account earning 4% interest/annum from Day 1, that figure would have compounded to c.SGD180k in 15 years-time. Scenario 2: If they use the SGD100k into pre-paying their outstanding loan, after 15 years, the outstanding loan amount might be around SGD30-40k. Again, while HDB will settle this outstanding amount due to HPS coverage, Mandy just lost SGD180k in opportunity cost. Ouch! Scenario 1: Fully paid home + SGD180K in CPF-SA, Scenario 2: Fully paid home + REGRET

CONCLUSION: It does not make sense to pre-pay your home loan (practical sense) if you are already covered under HPS. Some might argue on the comprehensive nature of the HPS relative to a Mortgage Reducing Term Insurance (MRTA) but that will be another article for another day.