Table of Contents

Stocks on sale and trading under the street’s most bearish target price

It is natural for us, as humans, to drive a hard good bargain. We like things to be on sale: 50% off, Clearance Sale, Everything Must Go. These words are music to our ears.

Value investors ascribe to the mantra of buying stocks when they are trading “cheaply”. Of course, the definition of cheap can be a subjective matter. My precious could well be your junk.

Value investors are also rather susceptible to falling into the “value trap” conundrum. They buy into cheap stocks that can remain cheap for a prolonged period (think IBM). The reason why such stocks remain on sale “indefinitely” is because their fundamentals have been eroded.

These stocks are often incumbents who have lost market shares to new entrants. They have rested on their laurels for far too long and consequently lost their competitive edge.

These “value traps” will remain on sale if they fail to regain their operational edge and win back market share from peers.

How does one then find stocks on sale which are unlikely to be value traps, and ideally one which has bottomed out and is prime to rally?

In this article, I will be highlighting 5 stocks on sale that are defined by several criteria to illustrate “cheapness”:

- Trading below the most bearish target price given by wall street

- Trading at < 50% of their 5-year Price/Earnings range

- Trading at < 50% of their 5-year Price/Cash Flow range

However, to avoid buying into value traps, where fundamentals such as earnings are continuously being downgraded by the street, I would also screen for stocks based on the street’s EPS forecast ahead.

- Net EPS Revision Current Quarter > 0

- Net EPS Revision Current Year > 0

- Net EPS Revision Next Year > 0

- This Year’s Growth Estimate > 0

- Next Year’s Growth Estimate > 0

Net EPS Revision is the net number of estimate increases for the stated period to have been published in the past 30 days.

For example, if a stock has 4 analysts upgrading its EPS for this quarter and 1 analyst lowering, the net EPS revision will be +3 for the current quarter.

In addition to the street’s EPS upgrades, these stocks will also need to witness YoY EPS growth for both the current year as well as next fiscal year.

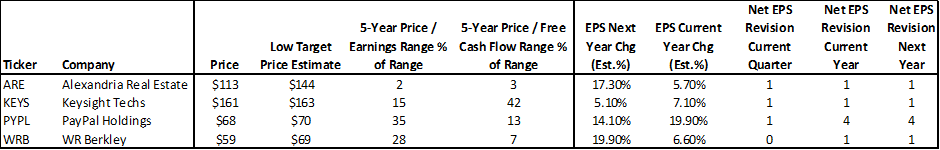

Here are the 4 stocks on sale which are prime to rally as the street starts to recognize the counters’ stronger fundamentals. A summary table of the key screening parameters is provided at the end of the article.

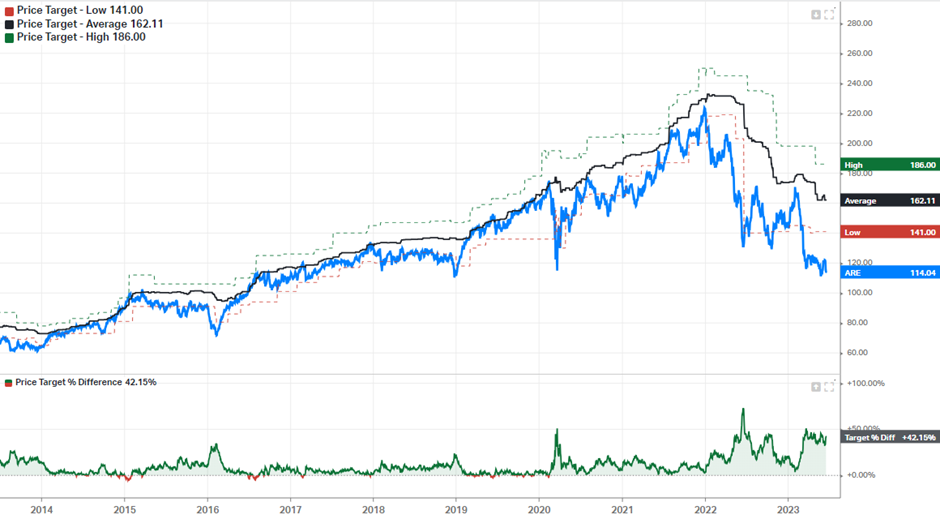

Stock on Sale #1: Alexandria Real Estate (ARE)

Alexandria Real Estate Equities (ARE) is a real estate investment trust (REIT) whose share price has been weak recently. Here are some reasons why:

Firstly, the tenant list is heavy on life-sciences tenants, and the jobs don’t lend themselves to working from home. Secondly, the Fed’s increasingly hawkish stance and rapidly rising interest rates have caused investors to flee from the once high-flying name even while the underlying business is performing fantastically. Thirdly, when REIT prices get too low, it chokes off capital availability. Equity issuance becomes far too expensive.

Despite these factors, some investors still believe that Alexandria Real Estate is a good buy. The life science market is notorious for its recession-resistant nature and given the roster of tenants Alexandria leases to are generally not the speculative biotechs that may be wiped out in liquidity crunches, the company appears to have relatively calm waters ahead.

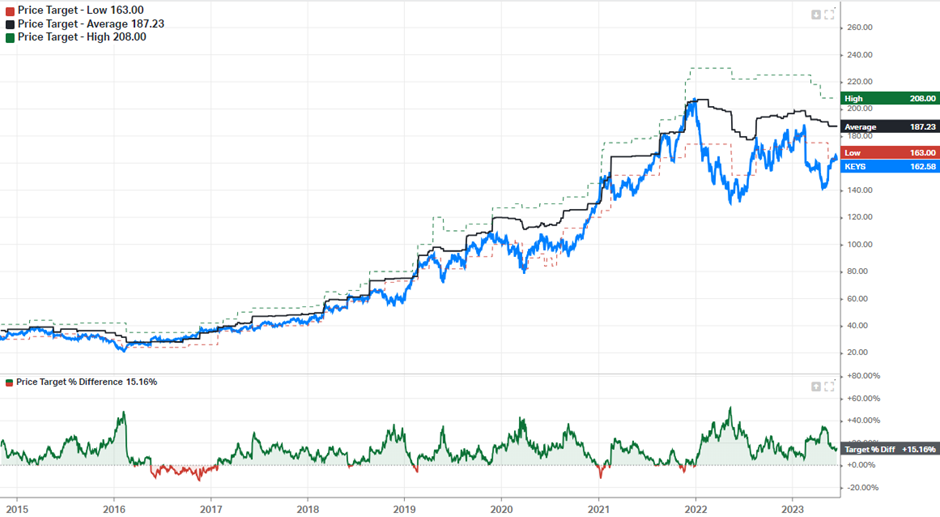

Stock on Sale #2: Keysight Techs (KEYS)

Keysight Technologies (KEYS) is a design and test solutions technology company whose shares have been weak lately. A key reason could be due to the weaker-than-expected 1QFY23 results, where after the close of trading on February 21, 2023, CFO Neil Dougherty said that Keysight’s top smartphone customer would take a couple of quarters to reduce its inventory and that “if the current demand environment persists through our fourth quarter,” Keysight would likely generate low-single-digit revenue growth for the full year.

However, its 2QFY23 financial performance beat the street’s expectations which might potentially signal a bottom in its share price. According to data from Stock Rover, KEYS is expected to grow its EPS by single digit for both 2023 and 2024 and there has been some positive street EPS revision of late.

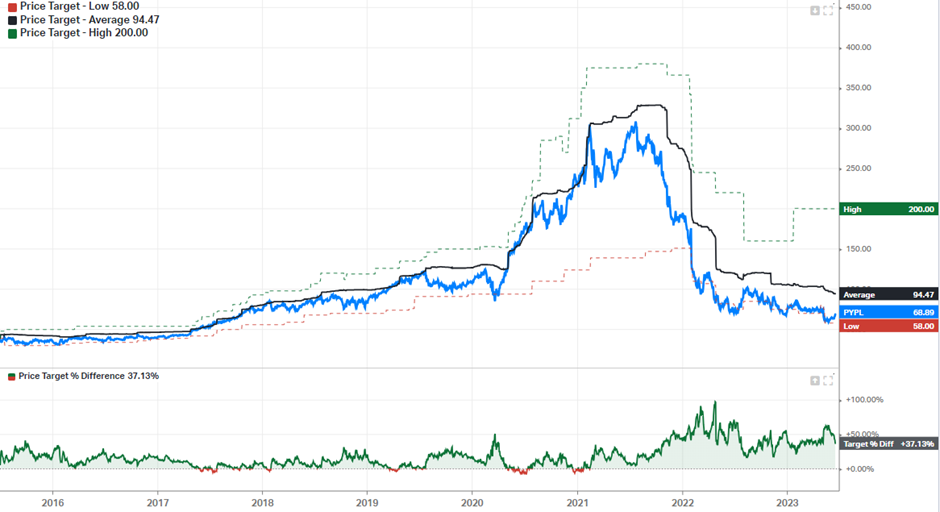

Stock on Sale #3: PayPal Holdings (PYPL)

PayPal’s share price has been weak since mid-2021 due to several factors:

- A slowdown in e-commerce spending: As pandemic restrictions began to ease, PayPal’s stock trajectory started to fall off. The company’s growth has been squeezed by a slowdown in e-commerce spending.

- Rising competition in the digital-payment space: PayPal’s growth has also been affected by rising competition in the digital payment space.

- Overheated valuations: PayPal’s stock has pulled back about 80% after hitting a record high of $308.53 on July 23, 2021. That decline was largely driven by concerns about its slowing growth, macro challenges, and overheated valuations.

Despite these challenges, some analysts still see PayPal as a good investment. For example, analysts at UBS Securities see PayPal shares as “undervalued,” given that they expect the company can deliver 20% earnings-per-share growth this year.

There have been more EPS upgrades by the street over the past 30 days as well. This could signal a much-awaited reversal in PYPL’s share price.

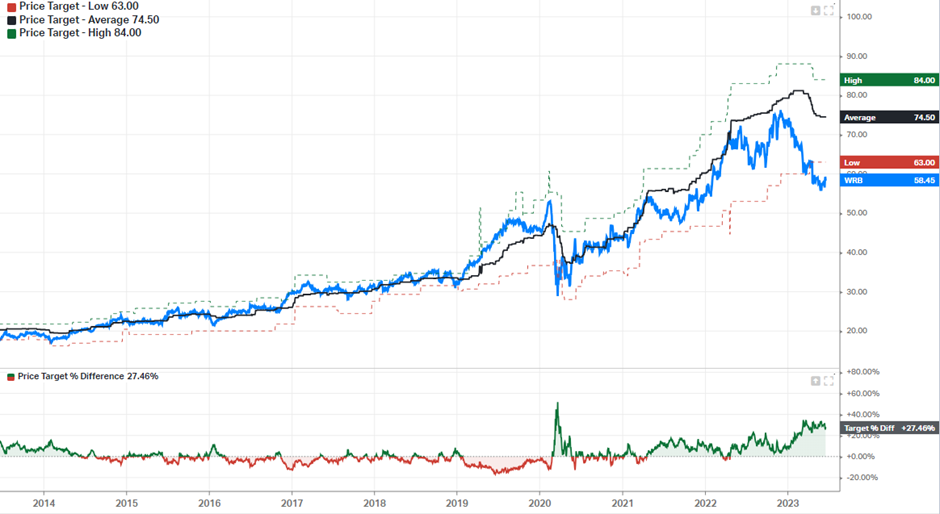

Stock on Sale #4: WR Berkley (WRB)

W. R. Berkley Corporation (WRB) is an insurance holding company that operates in the property casualty insurance business. It is based in Greenwich, Connecticut, and has more than 50 entities that specialize in different lines of property and casualty insurance.

Its share price has been weak since the start of 2023, with its price decline accelerated by its less-than-ideal 1Q23 financial performance.

However, there is some positive net revision seen in its share price and the counter is expected to grow EPS strongly in 2024. With the counter trading at an undemanding valuation in terms of its 5-year historical P/E and P/FCF range, the stock could be primed for a rebound ahead.

The table above summarizes the key screening parameters that I used to identify these stocks on sale. ARE looks to be the “cheapest”, with the counter trading at the 2 percentile of its 5-year P/E range and the 3 percentile of its 5-year P/FCF range. While EPS growth is likely to be marginal in 2023 for the company, this ratio is set to accelerate to the high teens in 2024.

Finding high-quality stocks the easy way

One of the stocks in this list is a Stock Alpha Blueprint (SAB) counter. A SAB stock is typically a high-quality blue-chip stock that is a market leader in its respective industry. These are stocks that can not only survive an economic recession but also often emerge stronger from the crisis, winning market share from their peers.

I have formulated an easy way for retail investors to identify these multi-bagger winners that can help supercharge and generate alpha for your equity portfolio.

Investors who are interested to find out more about the Stock Alpha Blueprint process can click on the link below for more details.