This is Part 2 of the Top 20 SaaS stocks to buy screened based on their high gross margin characteristic as well as forward revenue growth potential estimated by the street. This list will feature stocks of a smaller market cap nature, hence more “risky” in a sense but with a higher multi-bagger potential if they can sustain their strong growth momentum.

The Tech market took a big hit last night and many of these SaaS stocks saw their share prices capitulating. Might this be a buying opportunity? This list is meant to be an idea generation ground and not a “hard call” to invest in any of these stocks. At the end of this article, I will provide a summary table of all the 20 SaaS stocks featured in Part 1 and Part 2, with their key financial ratios such as their Price/Sales multiples and Total Debit/Equity ratio to evaluate the attractiveness of these stocks based on their valuation/balance sheet profile.

Without further ado, lets take a look at part 2 of the Top 20 SaaS stocks with high gross margins and strong revenue growth potential.

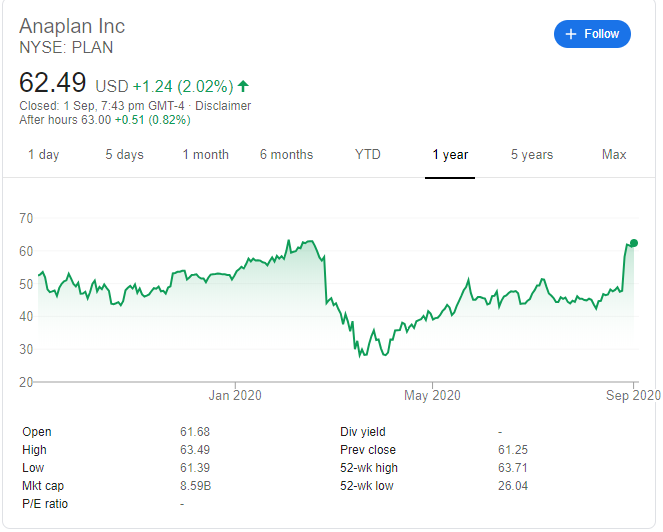

SaaS Stock #11: Anaplan

Another company that is not very well-known, Anaplan provides a cloud-based connected planning platform to connect organizations and people. I talked about this company briefly in this article: Thematic ETFs partaking in the hottest trends where the company is one of the Top 2 holdings in the

Wisdom Tree Cloud Computing ETF (WCLD). This ETF is currently one of the best performing thematic ETFs, with the ETF price up by 75% over the past 1-year vs. S&P500 at 25%. Anaplan accounts for 2% of the ETF portfolio holdings.

Anaplan’s second quarter was strong, with revenue jumping 26% on a 32% boost to subscription-based sales. Although the company is still losing money, it cut its losses by two-thirds during the quarter compared to the year-earlier period.

Investors also liked Anaplan’s expectations for the future. The company sees sales for the full 2021 fiscal year coming in between $437 million and $439 million. That’d be up about 26% from fiscal 2020, and it’s above what most shareholders were previously anticipating. The company sports a gross margin of 76%.

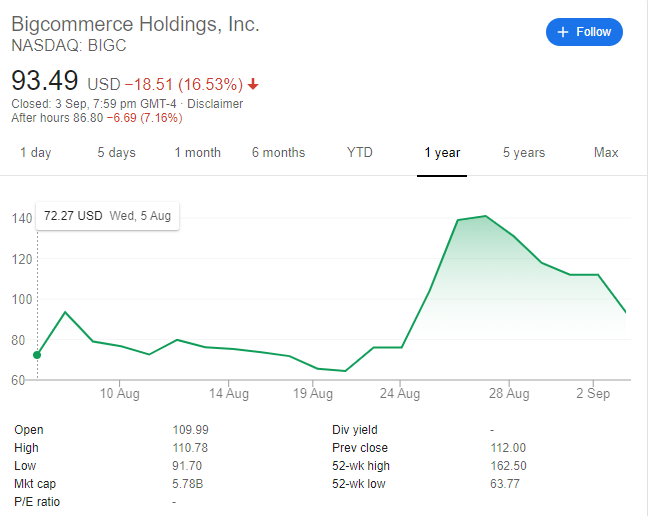

SaaS Stock #12: BigCommerce

BigCommerce became a publicly-traded company earlier this month. This is a company that has operations very similar to Hot stock, Shopify. BigCommerce can do much of what Shopify can do for small businesses and a couple of things Shopify can’t.

In simplest terms, BigCommerce lets businesses outsource the creation and management of their online store. From the digital shopping cart to inventory management to integration with shipping options, it’s a turnkey option for companies without the ability or desire to build such a solution on their own. Aspects where it often rates better than Shopify are in search engine optimization and international selling, and it easily accommodates B2B (business-to-business) selling.

It’s still not nearly as big as Shopify. BigCommerce generated a modest $112 million in revenue last year, versus Shopify’s nearly $1.6 billion. With a market cap of US$6.9bn, the company is operating at a forward Price to Sale multiple of 51x, which is almost the equivalent to the valuation of what Shopify is currently trading at.

BigCommerce’s share price was sold down this past couple of days after a handful of analysts initiated coverage of the company, with some of them saying that the company’s share price may be overvalued right now.

Just a week back, the company popped by as much as 37% on news that BigCommerce’s platform would be used, along with others, to facilitate online sales through Facebook‘s Instagram app. The next day, the company’s stock popped once again. With such wild stock price swings between last week and today, it appears many BigCommerce investors are reacting to daily news instead of investing in this company for the long haul.

The forward revenue growth rate of 24.5% estimated by the street doesn’t scream “exciting” particularly when the company is trading at such a lofty valuation.

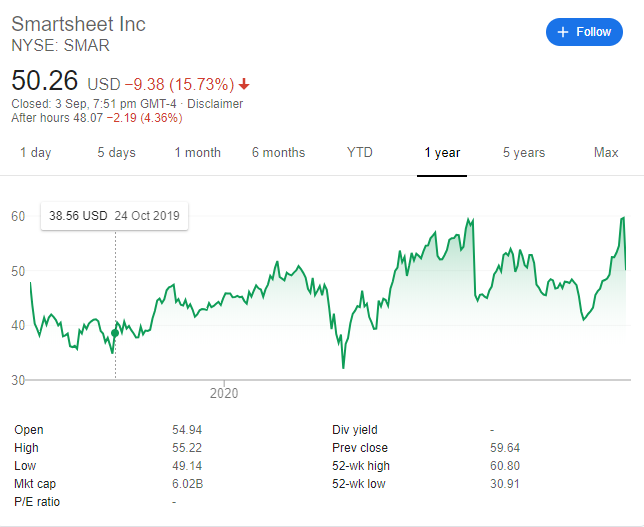

SaaS Stock #13: SmartSheet

Smartsheet’s subscription products help companies organize “unstructured” data (think emails, spreadsheets, chats on the phone, and face-to-face meetings) in a single location, helping teams work more efficiently.

Since its initial public offering in 2018, Smartsheet is up 167% versus a 16% return in the S&P 500. Smartsheet has accomplished these amazing returns by growing its revenue by 50% every quarter, year-over-year. And with its “land-and-expand” strategy, Smartsheet is increasing its popularity with its customers, each of which represents several employees with more subscribers being added all the time.

Smartsheet offers a dynamic work platform that allows multiple people to collaborate over the internet. What makes this stock so intriguing is that more and more white-collar workers are working from home. While for many people this is a temporary situation due to the COVID-19 lockdown, there are many benefits to remote work. It creates a lot of flexibility for employees and allows employers to find the best workers regardless of geography.

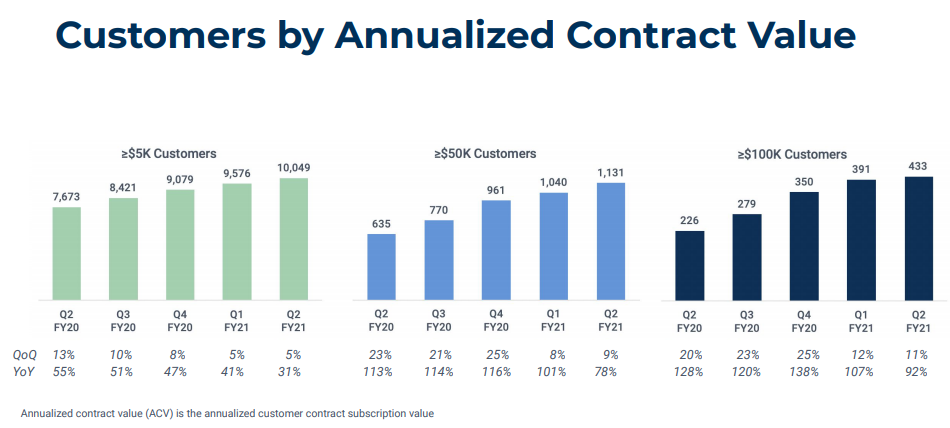

The company just announced its 2Q20 (on 2 September), with revenue up 41% YoY while billings were up 22% YoY. There is however a marked slowdown in new customers’ growth on a QoQ basis, with 1H20 new customers addition dropping rather significantly compared to the previous year as seen in the diagram below.

On a full-year basis, management is guiding revenue growth of approx. 35-38%.

This likely disappointed the street with its share price collapsing by c.8% after-market hours as this article is being written.

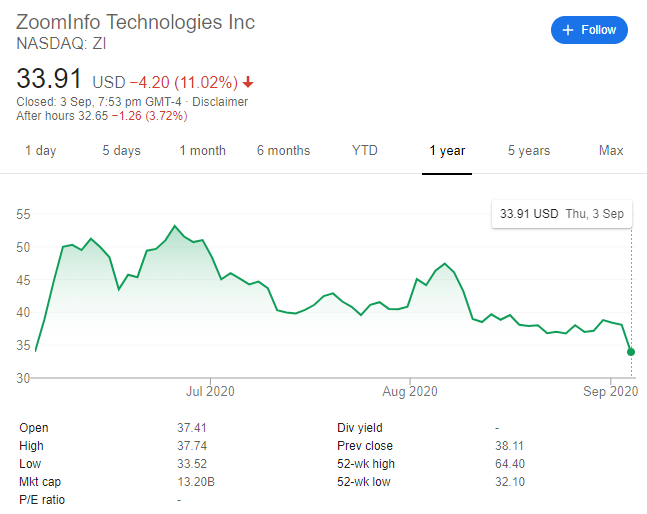

SaaS Stock #14: ZoomInfo

Not to be confused with the ever-popular Zoom stock, ZoomInfo is a new IPO stock that IPOed at US$21/share back in June and is currently trading at US$38/share.

The company concentrates on its subscription-based sales and marketing database platform, giving its clients the ability to work more effectively in identifying and following up with sales leads toward converting them into customers. The ZoomInfo platform uses artificial intelligence and machine learning to help drive clients in the right direction.

Yet despite the enthusiasm, ZoomInfo still faces some headwinds. The software as a service (SaaS) provider said that some hard-hit industries could suffer slowdowns that in turn could hurt ZoomInfo’s business relationship with clients in those areas. Among them are restaurants, retailers, travel-related businesses, and energy.

Despite beating expectations in its latest 2Q20 results announced in mid-August, the share price zoomed lower due to possible lingering concerns about ZoomInfo’s valuation. Based on management’s full-year guidance of US$455m in revenue (35% YoY growth), the company is trading at a hefty 32x forward Price to Sales multiples.

Nonetheless, this is still a company to keep an eye on, with the company generating a high gross margin of 82.5%.

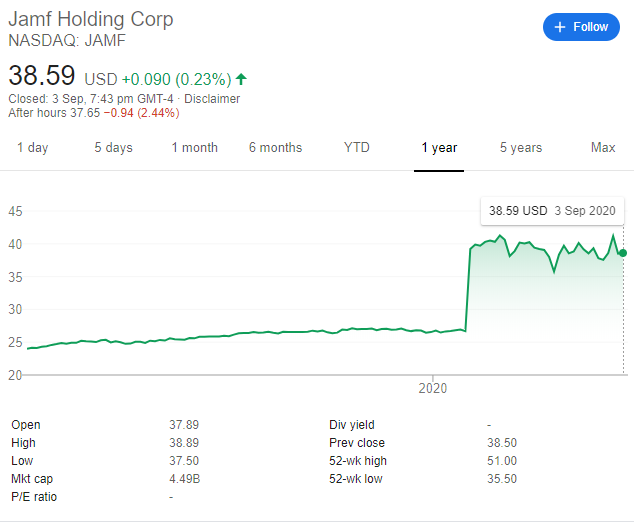

SaaS Stock #15: Jamf Holdings

Another new IPO stock, this is an apple device manager that saw its stock soar as much as 91% on its first day of trading back in late-July.

In recent years, Applehas been making steady progress in the enterprise, partnering with companies including IBM, SAP, and Cisco, among others, to expand its enterprise offerings. Corporate bring-your-own-device (BYOD) programs have also been proliferating, giving the Mac maker another inroad thanks to its popularity among average consumers.

That’s been a boon for Jamf which operates an enterprise management platform for Apple devices. The company focuses exclusively on Apple devices, helping enterprise customers deploy and manage Macs across their organizations. Jamf utilizes the software-as-a-service (SaaS) model that investors know and love, charging a monthly subscription fee that ranges from $2 per month to over $7 per month for various tiers that come with different features catering to small businesses (Jamf Now) to large enterprise IT teams (Jamf Pro). There are also offerings for educational institutions (Jamf School), authentication and identity management (Jamf Connect), and cybersecurity (Jamf Protect).

The company just reported results (2 September) that disappointed the street in terms of earnings although it hikes up its full-year revenue expectations to US$255-257m vs. the street estimate of US$248m.

Based on a market cap of US$4.5bn, the company is trading at a forward P/S multiple of c.17x with an expected revenue growth rate of 21%. Not outrageous valuation but neither is its growth particularly exciting for a smallish SaaS stock. The company boasts a gross margin of 78%.

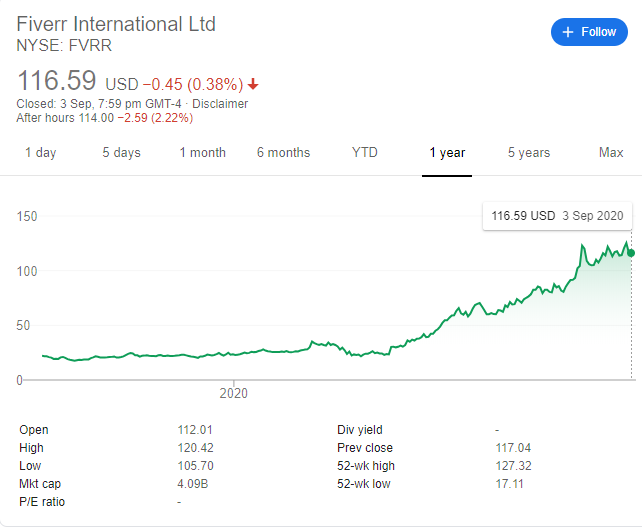

SaaS Stock #16: Fiverr

This is a monster of a stock that has appreciated from a low of about US$20/share back in March 2020 to the current level of US$117/share, a 6-bagger over a course of just a few months.

Characterizing itself as a “global marketplace connecting freelancers and businesses for their digital services needs, Fiverr International provides an opportunity to invest in the gig economy.

Financially, Fiverr isn’t profitable yet, but its financial position is improving rapidly. Revenue grew 82% in the second quarter of 2020, and management expects revenue to grow 66% to 68% in 2020. As the company grows, it should see operating leverage, leading to a quick improvement on the bottom line.

If freelancing continues to grow, Fiverr is well-positioned to capitalize on the market and generate value for both companies and workers. And that could make it a monster stock long-term.

The company is often compared to Upwork which is the market leader in the freelancing and remote work industry. While Fiverr is currently trading at a forward P/S multiple of about 24x, UpWork on the other hand has a price tag of just 5.3x P/S multiple. The latter is sporting a slower 2020 revenue growth rate of approx. 17% compared to Fiverr massive 68% but does that warrant a huge discrepancy in their valuation?

COVID 19 fundamentally disrupted commerce across the world. The changes provoked by COVID 19 together with enabling technologies will secure the future of the freelance revolution: More demand, a greater diversity of assignments, more enterprise-level activity.

SaaS Stock #17: Futu Holding

This is an interesting company that is expected to grow its revenue by 133% in the coming year, according to the street’s expectations. While most might be unfamiliar with Futu, this company is a competitor of UP Fintech, the parent of Tiger Brokers which is an up-and-coming fintech brokerage firm that recently expanded its operations here in Singapore.

I have written about Tiger Brokers in this review, one where I believe this low-cost fintech brokerage firm has the best mobile platform offering among its competitors here in Singapore.

Futu has recently received the CMS license from MAS for its local entity Futu Singapore Pte Ltd and looks set to join in the already crowded brokerage industry here in tiny Singapore.

Futu’s largest investor is Tencent holding. While there is some comfort from the fact that Tencent is backing this company, there is no certainty that its share price will exhibit a one-way direction. Despite achieving strong revenue and net profit in 2Q20, up 165%, and 323% YoY, its shares were sold off from the high of USD$40/share to the current level of USD31/share.

Nonetheless, management believes that the increase in US-listed Chinese companies seeking a secondary listing in HK and the surge of high-profile Hong Kong IPOs will act as a major tailwind to its growth.

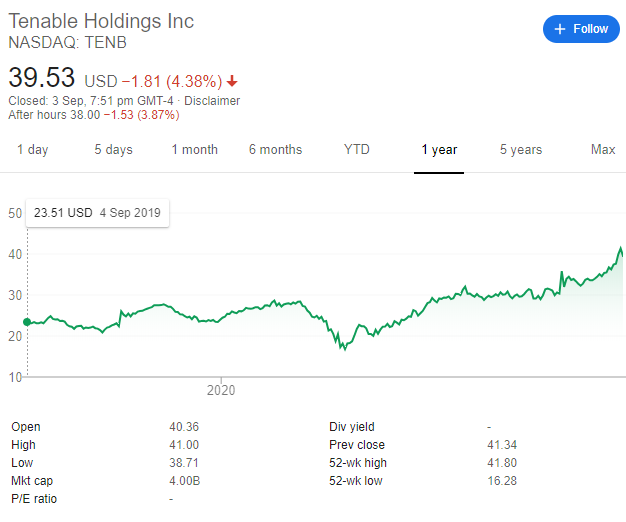

SaaS Stock #18: Tenable Holdings

Tenable helps businesses to both better understand and reduce the cybersecurity risks that they may be exposed to.

The share price has been on a tear since late July when the company reported a strong set of 2Q20 earnings and guided for strong forward performances. Revenue in the second quarter was $107.2 million, beating the $102.2 million in sales that analysts were looking for. That led to an adjusted net income of $4.7 million, or $0.04 per share. The consensus estimate had called for an adjusted net loss of $0.05 per share. Calculated billings increased 13% to $111.2 million, and the cybersecurity technology specialist finished the quarter with $242.1 million in cash on the books.

Tenable is benefiting from increased demand for cybersecurity offerings as companies accelerate digital transformations amid the ongoing COVID-19 pandemic. At the same time, the company said it was able to save $2 million to $3 million related to the coronavirus in the form of reduced travel and field marketing.

On a full-year basis, the street is expecting the stock to grow its revenue by 21%. With a current market cap of US$4.2bn, this counter is trading at a forward P/S multiple of approx. 10x.

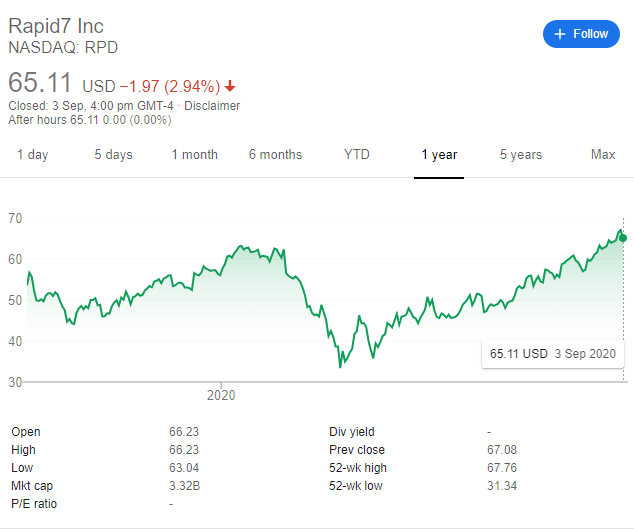

SaaS Stock #19: Rapid7

Not much is known about Rapid7 but the company is another corporate that provides cyber-security solutions. The company collaborates with many well-known companies such as Splunk and IBM for data collaboration, Servicenow, and VMWare for Data workflow and Salesforce, Okta, Cisco, etc for Data Ingestion.

The company has generated revenue CAGR of 31% from 2015-19 although that figure has slowed down to 25% in its latest 2Q20 results. Nonetheless, there is a high level of revenue visibility with 91% of its revenue on a recurring basis and that recurring revenue has demonstrated a YoY growth of 30% in 2Q20.

The company highlighted that its ARR (annual recurring revenue) per customer is currently at $41.6k and that has the potential to scale up to $200k in the coming years. This is the key driver for its overall ARR growth of c.30%

On a full-year basis, the company is expected to generate $400m in revenue or a 23% growth rate. Based on its current market cap of US$3.4bn, the company is trading at a forward PER multiple of 8.5x.

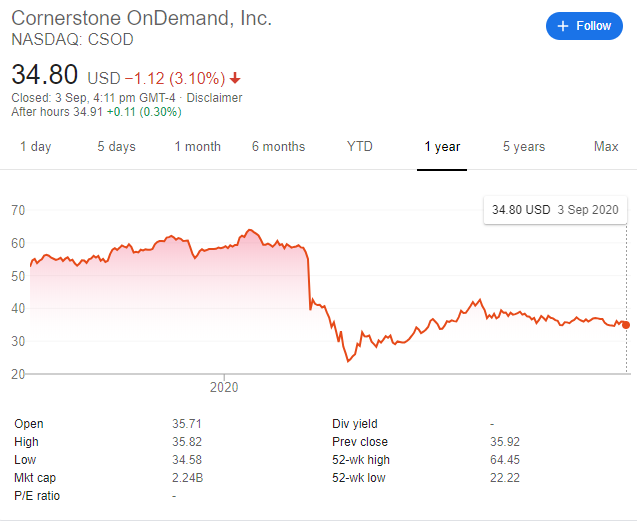

SaaS Stock #20: CornerStone OnDemand

This is the last stock on our list and the smallest one in terms of market cap, currently at USD$2.3bn.

The company helps organizations to recruit, train, and manage their people. They work with hundreds of the world’s largest companies—from Walgreens and Starwood Hotels & Resorts to Deutsche Post DHL and Western Union—and thousands of smaller ones to help them engage their workforces and empower their people.

The street expects the company to grow its core revenue by 24% in the coming year. With the guidance of about US$720m in full-year revenue, the company is trading at a “cheap” forward P/S multiple of 3.2x.

However, the company is highly levered with net debt of US$1.2bn. This might be the street’s major concern and the reason why the share is trading at such a low P/S multiple. Its recent acquisition of saba does not seem to be an entity that is generating a high level of ARR growth (2019: 2%).

Despite its relatively low valuation, this is a stock that investors should continue to monitor instead of jumping on the bandwagon as there remains a high level of uncertainty if the integration of its new saba acquisition can translate to operational synergies over the longer term.

Conclusion

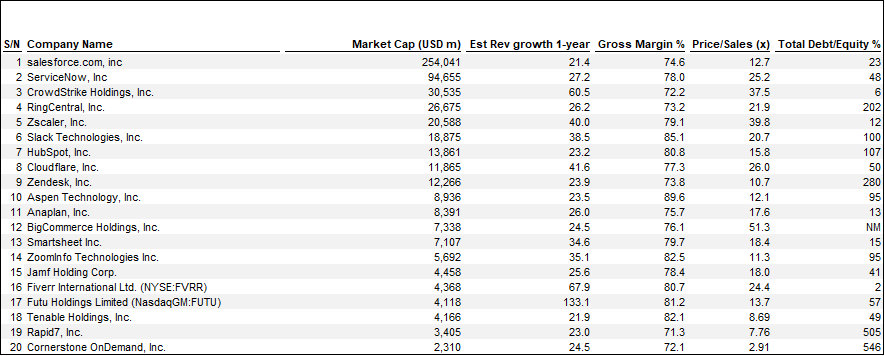

The table above provides a quick snapshot of the 20 Top SaaS companies in terms of high gross margin profile as well as forward revenue growth rate.

Taking the Price to Sales multiple into consideration as well as the debt profile of the company, I believe the smaller stocks that are not well covered such as, Anaplan, Jamf, Futu, and Tenable deserve further investigation. These stocks are trading at less than 20x forward P/S multiple and boast relatively strong balance sheet which will help to alleviate concerns over cash flow.

Do Like Me on Facebook if you enjoy reading the various investment and personal finance articles at New Academy of Finance. I do post interesting articles on FB from time to time which might not be covered here in this website.

SEE OUR OTHER STOCKS WRITE-UP

- Top 20 Best Growth Stocks to buy [2020]

- Thematic ETFs partaking in the hottest trends

- 6 Top Investment trends (2020): Finding safe havens in a pandemic-driven market

- Top 8 technology trends accelerating due to COVID and the stocks to benefit from it

- 5 outperforming stocks that crush the S&P500 in 1Q20

- Best performing ETFs which consistently outperform the S&P500 over the past decade

Disclosure: The accuracy of the material found in this article cannot be guaranteed. Past performance is not an assurance of future results. This article is not to be construed as a recommendation to Buy or Sell any shares or derivative products and is solely for reference only.

1 thought on “Top 20 SaaS Stocks: Which are those with strong Gross Margins and Revenue Growth? [Part 2]”