Table of Contents

Do Like Me on Facebook if you enjoy reading the various investment and personal finance articles at New Academy of Finance. I do post interesting articles on FB from time to time that might not be covered here in this website.

Join our Instagram channel for more tidbits on all things finance!

Join our Youtube channel for short and sweet videos on all things finance!

Best Performing Stock Markets

Do you know which is the best performing stock market in 2023 so far? The answer is likely going to be a surprise to many: Argentina.

Argentina’s stock market returned 17% in YTD 2023, followed by Mexico’s 16% return, and in 3rd place, Ireland’s 15% return.

How about the worst performing stock markets in YTD 2023?

That “honor” goes to Egypt, whose stock market is currently down -17%, followed by Pakistan at -11% and South Africa at -9% rounding up the bottom 3 candidates.

Within the Asia region, Taiwan has the best performance, with the country’s stock market up close to 9% thus far. Singapore’s stock market is currently flat in 2023.

On a longer horizon basis (10 years), the best performing stock markets are 1) the USA, 2) Argentina, and 3) the Netherlands.

The table below shows the stock market performance of the various countries.

How to invest in the stock markets

The easiest way to invest in the stock markets of various countries is through Country ETFs. This method will allow an investor to buy into a basket of the largest stocks in the country that best represents it.

The various Country ETFs highlighted in this list are issued by multiple ETF providers such as iShares, Invesco, VanEck, etc and they are listed on the US exchange.

This means that an investor can easily purchase any of these ETFs through their brokerage (that has access to the US market).

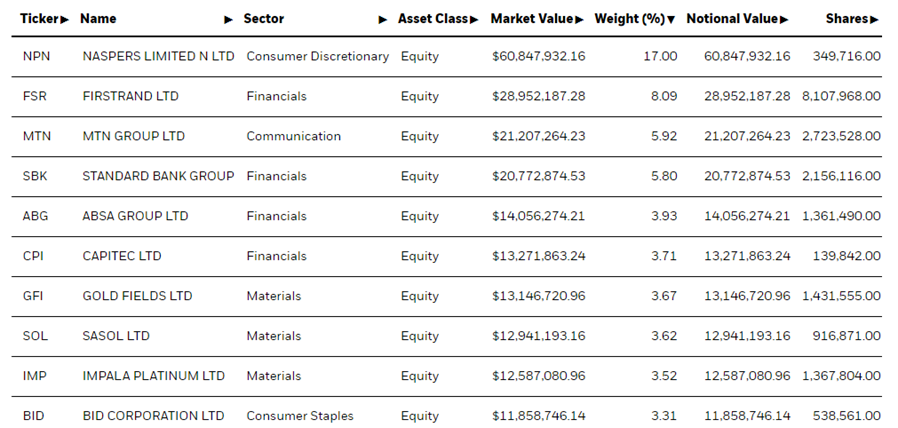

Take for example, if an investor wishes to invest in an “exotic” country like South Africa, most traditional brokerage houses will not provide access to this country’s stock market. While one will not be able to buy individual stocks listed on the South Africa exchange, he/she will be able to buy into a basket of the largest stocks on that market through the iShares MSCI South Africa ETF (EZA).

The table below shows the associated Country ETFs and their stock market performance.

For those who are interested to track the stock market performance of these countries, do remember to bookmark this page as the prices will change dynamically

Points to note when buying Country ETFs

While purchasing Country ETFs is the most convenient option to invest in a particular country’s stock market, do note the following key points:

- ETF might not be extremely liquid.

- The expense ratio might be high.

For a small retail investor, point number 1 might not be too critical but do note the potential wide spread involved with such ETF. Hence, it might not be wise to be trading these ETFs but to view them as long-term investments

The potentially high expense ratio will mean that there is an additional high recurring cost associated with investing in these country ETFs. An investor will need to weigh the pros of investing in that particular country’s ETF to justify if its price performance can outweigh its expense ratio.

Interested to know more about ETFs

For those who are interested to learn more about ETFs, you can check out the list of ETF-related articles that I have written in the link below:

https://newacademyoffinance.com/category/blog/investing/etfs/

For those who are interested in learning more about ETFs, such as the difference between SG, US and UCITS ETFs and how to partake in them, do check out my FREE ETF Video Guide.