Average Salary in Singapore 2023

The Ministry of Manpower Singapore just formalized the Income statistics of Singaporeans although an earlier tentative report was released back in Dec.

The statistics show that the Median income of Singapore residents fell for the first time since 2004 due to COVID-19.

It is likely more informative to use the Median Salary vs. Average Salary in Singapore, the latter potentially being skewed by wealth inequality. What do I mean by that?

Let me give a quick example before I deep dive into the salary situation of Singaporeans and answer the question: Is buying a condo a realistic dream for the typical Singaporean?

Average Salary vs. Median Salary

Assuming that there are just 5 people which represents the entire Singapore population. They are arranged from the smallest income/month to the largest.

Individual 1 Income/month: $2500

Individual 2 Income/month: $3,000

Individual 3 Income/month: $3,500 (Median)

Individual 4 Income/month: $4,000

Individual 5 Income/month: $20,000

The average gross monthly income is calculated by summing up the 5 individuals income/month amount and dividing them by 5, by which we get a figure of $6,600. Whereas the median gross monthly income will be $3,500.

Here the median monthly salary is simply the 3rd individual net worth (or the person representing the 50th percentile) which amounts to $3,500.

One can observe that due to the substantial income disparity between individual 5 and the other individuals, the average income of the 5 individuals becomes substantially higher, giving the false impression that the average income of Singaporeans (represented by just these 5 individuals) is indeed much higher than the norm.

In reality, the skew is due to wealth inequality. Hence a more accurate depiction of the “real” average salary in Singapore would be using the median monthly salary number ($3,500) which is a figure substantially below that of the average amount ($6,600).

For a nation, the median income figure represents the 50th percentile of its population (one where the income of each individual tracked is listed from the smallest to the largest).

With that knowledge in mind, I set out to also explore the gross monthly income ranges of Singaporeans that can indeed afford to own private properties such as condominiums here in sunny Singapore.

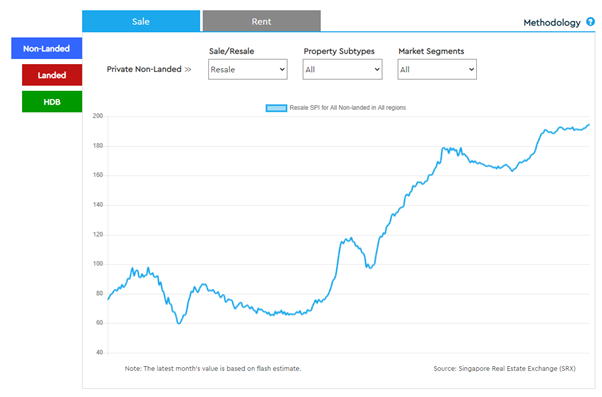

Private property prices continue to rise in the Future

Most of you are probably aware by now that private property prices have continued to escalate in 2020, amid the worst economic recession that the nation faced in recent years due to COVID-19. Consequently, Singapore’s unemployment rates went up from 3.1% in 2019 to 4.1% in 2020.

This scenario is not unique to Singapore but to developed countries such as the US as well.

What is the logic behind the rise in Singapore property prices when the economic outlook ain’t that fantastic, to say the least? Are Singaporeans that cash-rich? Or is that wealth under the façade of an over-leveraged problem catalyzed by easy access to cheap mortgage financing?

Let’s first take a look at the median monthly salary in Singapore before we explore the housing “issue”.

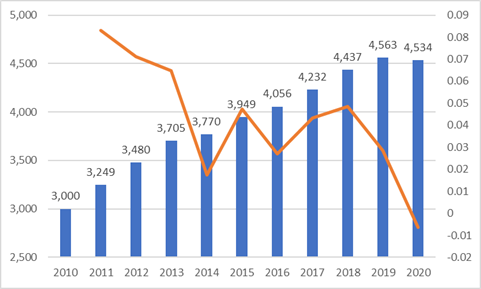

Median Gross Monthly Income in Singapore

In Singapore with a population of approx. 5.8m, there are 1.946m full-time employed residents aged 15-years and over that is in the consensus survey (exclude full-time National Servicemen).

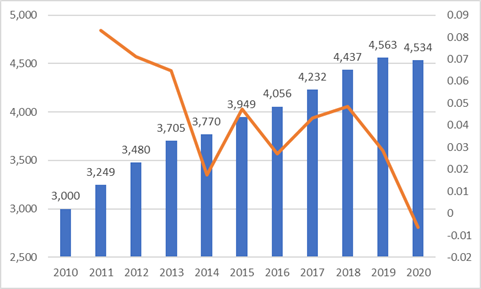

According to the Ministry of Manpower Singapore, the median income in Singapore is S$4,534 (including employer CPF contributions).

This is the first time since 2004 that there was a dip in median income in Singapore.

However, it is also quite evident that the rate of income increment has been moderating over the years. Hence this gross monthly income refers from 2010-2015, is an annualized change in 3.1%/annum in real terms, moderating to 2.6% from 2015-2020.

So today even if you earn a minimum wage of $4,534/month (including employer CPF contribution) you generate more gross monthly income than approx. 1m other working Singaporeans.

What is the actual take-home median monthly salary if you exclude one’s own CPF contribution (20%) as well as employer’s CPF contribution (17%)? That will be approx. $3,100/month.

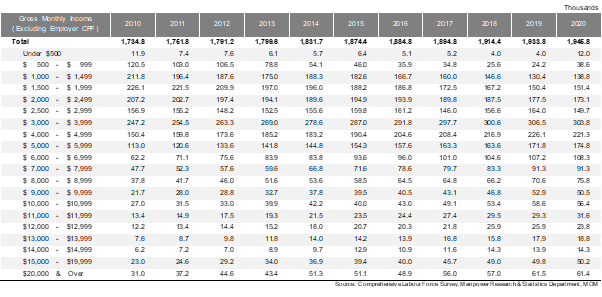

The Ministry of Manpower also disclosed the Gross Monthly Income (excluding employer CPF) for this pool of 1.956m full-time workers as seen from the table below.

As can be seen, the $3,000-$3,999 gross monthly income category is where the greatest number of full-time residents fall under.

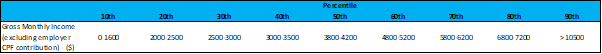

The table does not break-down base on percentile. However, this information can be approximated using the information above which I detailed below:

Do note that this is just an approximated figure on my part.

Today if you fall under the 50th percentile category, your gross monthly salary, excluding employer CPF contribution (but including your own 20% CPF contribution) will be approx. $3,800-4,200.

If you earn more than $10,500/month, you probably fall under the 90th percentile of full-time working residents.

Is the median household member really earning that much?

So far, we have 2 key numbers. One is the reported median Singaporean income which is $4,534. This includes the employer’s contribution.

Second, the estimated median Singaporean income, excluding employer’s contribution based on the figures approximated is around $3,800-$4,200. Let’s go with $4,000.

So far, these figures still make sense. Let us now introduced a couple more data points

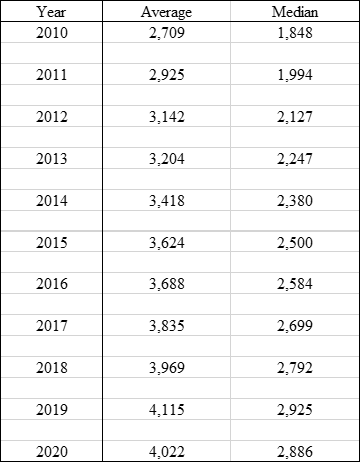

Average and monthly household income from work (including Employer CPF)

The data above was taken from Singstat.gov.sg. It shows that the median household income is approx. $9,189 in 2020.

Assuming that the median household consists of 2 personnel, that gels with the information that the median Singaporean income (including employer CPF contribution) is approx. $4,534.

However, the data also disclose the median household income per household member.

Average and monthly household income from work per household member (including Employer CPF)

This is where the discrepancy sets in. Including the employer’s CPF contribution, each household member’s median income is only $2,886.

This means that on average, here the median gross monthly income refers to household income that consists of income generated from approx. 3 members instead of 2.

This might be due to the fact that 13% of households in Singapore do not have any working person which thus skews the median figure substantially lower.

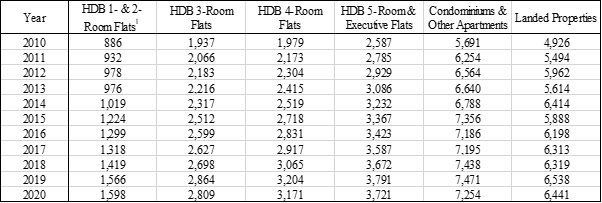

Average monthly household income from work per household member (including employer CPF) by dwelling

Lastly, Singstat data also shows the AVERAGE income from each household member based on the type of dwelling.

On average, for those staying in a condo, they are generating approx. $7,254/month (including employer COF) in salary. This number might however be on the high side due to potential income inequality skew.

Do you really need to be earning this amount to afford a condo?

Can you afford your home?

Buying a home can be considered one of the biggest and most important financial decisions that one has to make. That is why we need to be very mindful when it comes to working out the sums to ensure that a house is well within our affordable range.

As people progress in their careers, they have higher earning power and many will start to consider upgrading their homes. Most typical Singaporean couples will have a HDB as their first home before upgrading to a Condo as their financial status improve (so we hope, instead of over-leveraging to keep up with the Jones).

Upgrading to a Condo comes with a heftier price tag and a higher home loan repayment amount.

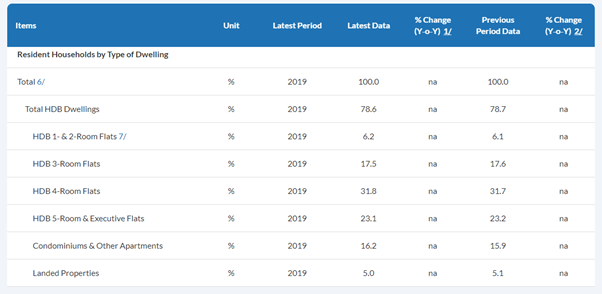

In Singapore, approx. 21% of households fall under the Condominiums and Landed Property segment, according to data from Singstat based on their figures.

Can you afford to upgrade to a condo or private property based on your existing income? We look to do a little analysis on this topic.

Before we get into the actual numbers, here are some of the assumptions we used in making our calculations and analysis.

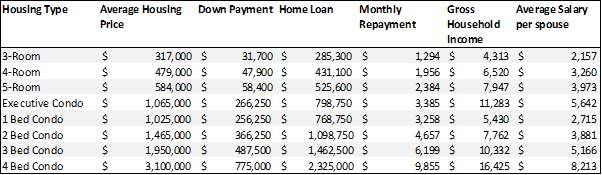

Key Assumptions

- Downpayment: 10% for HDB and 25% for private property

- Loan Tenure: 25 years

- Interest rate: 2.6% for HDB and 2% for private property

- Mortgage Service Ratio of 30% apply for HDB and EC (excluding employer contribution)

- Total Debt Servicing Ratio of 60% apply for private property (excluding employer contribution)

- No ABSD is levied

In the table below, we look at common property types, both public and private to calculate the salary you will need to afford these homes.

I use the mortgage calculator provided by propertyguru.com.sg to come out with the monthly repayment amount for each property category based on their respective max home loan amount (90% for HDB and 75% for Condo)

2-bed condo example

For a 2-Bed Condo, the average price is around $1.47m of which you will need to fork out a downpayment of approx. $366,250. Of this amount, $73,250 will need to be in cash while the remaining amount of $293,000 can be through a couple’s CPF account.

The monthly repayment for the 2-bedroom condo will be approx. $4,657. Based on the TDSR ratio of 60%, this means that the gross household income required to purchase a $1.465m property is in fact just $7,762, translating to an average salary per spouse of $3,881.

Based on our earlier analysis, we can see that the median Singaporean (50th percentile) generates a gross monthly income of $3,800-4,200 (excluding CPF contribution).

Does this mean that there might still be plenty of demand for private properties, given that only 20% of households in Singapore live in private properties?

There are of course other considerations. The couple buying the condo cannot have any other loans so as to be able to allocate all 60% of their gross total income towards their home loan. This might not be the case for the majority of Singaporean couples, who might also be “burden” with loans such as credit card debts and car loan servicing.

There must also be sufficient savings/CPF to afford the downpayment of the private property in the first place.

Coming back to the 2-bed Condo example, while a couple only needs to make a min of $3,881/spouse in terms of gross monthly income, they will need to come out with $366,250 in downpayment, of which $73,250 has to be in cash and $293,000 in CPF.

Assuming that the couple is an HDB upgrader who has recently sold their 4-room HDB flat for the average price of $480,000 just after MOP. Assuming that they purchased this flat with an initial cost of $330,000 and serviced the purchase with a 25-year mortgage loan at a HDB interest rate of 2.6%

After 5-years, their outstanding loan amount is $280,000.

After repaying their outstanding loan amount, the couple is left with $200,000 in their CPF which might not be sufficient to pay for the amount of $293,000 required. Of course, we excluded the fact that their CPF accounts have also been growing from the normal course of employment.

Bare min requirement vs. National Average

Based on the above example, for a couple to own a 2-bed condo, it might not be that difficult, requiring only a gross income of $3,881/spouse. However, the national average is a significantly higher number of $7,254/spouse.

A couple who is just earning a gross income of say $4,000/spouse might “succumb” to the temptation to upgrade to a condo (assuming no other loan liabilities). On paper, they can afford to do so but it will also be prudent to benchmark your income against your “peers” in the private property segment to ensure that one can indeed afford an upgrade.

Conclusion

We come to the rather surprising conclusion that private condo affordability is in fact not out of reach for a large proportion of Singaporeans (with some basic assumptions made which might, however, be overly simplified) on paper.

The median Singaporean generates a gross income of approx. $4,000/month. Assuming that a couple both generate $4,000/month, resulting in a gross household income of $8,000/month, they can actually afford a 2-bed condo (but barely).

Imagine 50% of households might in fact be eligible to stay in condos! (as usual, there are assumptions made, the key one being that there are no other financial liabilities).

In reality, the average household income from work for those staying in condo/private properties is slightly more than $20k, according to Singstat. This number might seem on the high side due to more than 2 working adults generating income.

Many Singaporeans who currently live in HDB aspire to upgrade to a condo. On paper, a couple can do that if they have minimal outstanding liabilities and each draw a gross salary of $4,000, with sufficient savings and CPF to pay the downpayment amount.

However, realistically, it will be more comfortable if the couple each draw a gross salary of at least $6,000, in my view. That will mean falling under the 70th percentile of the nation’s working population.

Do Like Me on Facebook if you enjoy reading the various investment and personal finance articles at New Academy of Finance. I do post interesting articles on FB from time to time which might not be covered here in this website.

Join our Telegram broadcast: https://t.me/gemcomm

SEE OUR OTHER WRITE-UPS

- DIVIDEND YIELD THEORY – THE UNDERAPPRECIATED VALUATION TOOL

- TOP 5 ANALYSTS OF THE DECADE AND THEIR CURRENT FAVORITE STOCKS

- IS DRINKING LATTE REALLY COSTING YOU $1 MILLION AND THE CHANCE TO RETIRE WELL?

- DIMENSIONAL FUNDS: ARE THEY WORTH THEIR WEIGHT IN GOLD?

- THE CONFUSING MATH BEHIND RETIREMENT SUM SCHEME AKA CPF LIFE PREDECESSOR

- DIVIDENDS ON STEROIDS: A LOW-RISK STRATEGY TO DOUBLE YOUR YIELD

Disclosure: The accuracy of the material found in this article cannot be guaranteed. Past performance is not an assurance of future results. This article is not to be construed as a recommendation to Buy or Sell any shares or derivative products and is solely for reference only.

3 thoughts on “The average salary in Singapore 2023: Can you afford a condo with your income?”

Regarding your example with the 2-bedroom condo: It is absolute insanity to pay 60% of one’s income for housing/mortgage. I know that in the US people love to do that – this is why they have such a massive rate of forclosures, private bancrupcies etc.

Coming from Germany I know very well why the financial crisis 2008/2009 didn’t hurt Germans a bit: because almost noone is so catastrophically indebted. 30% is the maximum that banks would even give you a loan for and even there most people already say that this is too high.

Because your assumed 60% mean in reality that this couple lives to work and nothing else. They cannot afford to quit a job, they cannot afford to travel (not that Singaporeans have many holidays in the first place) and enjoy their life, they cannot afford a sabbatical of 6 months or more… oh and actually they cannot really afford to split up because none of the would be able to service the repayment on their own.

This is insaity.

Regarding your example with the 2-bedroom condo: It is absolute insanity to pay 60% of one’s income for housing/mortgage. I know that in the US people love to do that – this is why they have such a massive rate of foreclosures, private bancrupcies etc.

Coming from Germany I know very well why the financial crisis 2008/2009 didn’t hurt Germans a bit: because almost noone is so catastrophically indebted. 30% is the maximum bank would even give you a loan for and even there most people already say that this is too high.

Because your assumed 60% mean in reality that this couple lives only to work. They cannot afford to quit a job, they cannot afford to travel (not that Singaporeans have many holidays in the first place) and enjoy their life, they cannot afford a sabbatical of 6 months or more… oh and actually they cannot really afford to split up because none of the would be able to service the repayment on their own.

This is insaity.

Hi Marko,

Thanks for dropping by. Housing here in Singapore is pretty ex. For a very small condo of say 93sqm, you would probably have to pay in excess of S$1.2-1.3m. This is due to land scarcity. I am not sure what is the housing situation like in Germany?