Finding multi-bagger stocks

The first ever iPad was launched in 2010 and retailed at a price of USD$499. Now all of us know that it was one of the first great and revolutionary gadgets of this generation and is a must-have in everyone’s suite of tech arsenal.

How do I know that? Well, it’s because even a cheapo like me also owns an iPad Air 2.

Now if it’s not too much to ask, indulge me for a minute and imagine this. Let’s say I had that $499 in 2010 when the first iPad was launched and instead of being a fanboy and buying the iPad which I didn’t need, I opened a brokerage account and bought myself some Apple shares.

The iPad was launched on a Saturday so let us assume I got my Apple shares at the price of the next market day’s closing of $8.52. That would mean that I would get filled for 58 shares of Apple and have some change for an extra-value meal at Macdonald’s.

As of 13th September 2022, Apple’s share price is $163.

That means that if I had held my shares through the last 12 years that my Apple shares are now worth 58 X 163 = $9,454 which is around an impressive 1,900% return.

The S&P 500 was 1,187.43 on the same day I purchased the iPad. It last closed at 4,110 as of 13th September.

That would mean that it has comparatively risen ‘only’ 346%. The same capital of $499 would have grown to a ‘miserable’ $1,726 comparatively. And that ladies and gentlemen, is the reason why people invest in stocks.

[Note: In the previous version of this article, we highlighted that the AAPL stock would have risen to $264,000. This is erroneous as the original AAPL price of $8.52 has been already adjusted for the share split. We apologize for this mistake]

So, is it all good to just invest in stocks?

If only the investing world is a bed of roses. And everyone can invest like the great Warren Buffett. Unfortunately, while partaking in individual stocks could generate very attractive returns for your portfolio, when done right, the risk associated with just having a single stock exposure vs. a diversified approach using ETFs, can also be significant.

According to Portfoliolabs.com, the biggest drawdown Apple ever experienced was between Sep 2012 to April 2013 when it dropped a total of 43.8%. It took a total of 310 days to recover which meant that the whole cycle totaled 454 days. That was almost 1.5 years!

So, with great returns, come great risks. Ask yourself if you are suited to be buying into individual stocks. For most people, unfortunately, that answer is NO because they are often constrained by a lack of time and resources.

Now that we have gotten that out of the way, what are stocks exactly?

Well, that’s simple, buying a stock of a company is also referred to as buying equity of a company. I usually like to use the latter because it makes me sound more sophisticated.

When you buy into the equity of a company, you are a part owner of the company and get to have things like voting rights and sharing of profits in the form of dividends.

At the same time, if the company performs well as in the case of Apple, people will scramble to buy up their shares which will then cause an increase in demand for it, resulting in price spikes.

On the other hand, if the company performs poorly vs. the market expectations, then the price will drop conversely.

Once again, for those interested to know the nitty-gritty details of what stocks are all about, you can refer to this article that I have written previously on the different asset classes.

What are the challenges in investing in a stock?

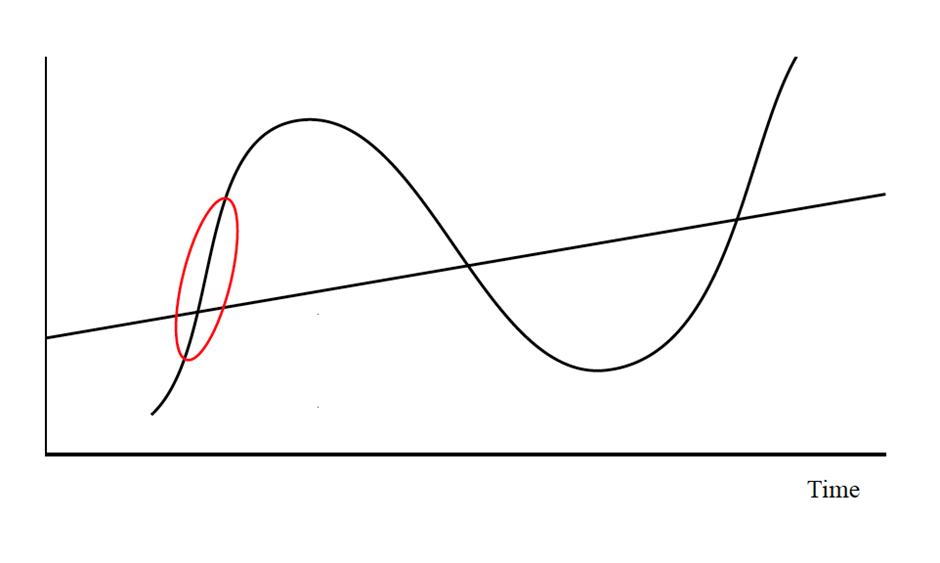

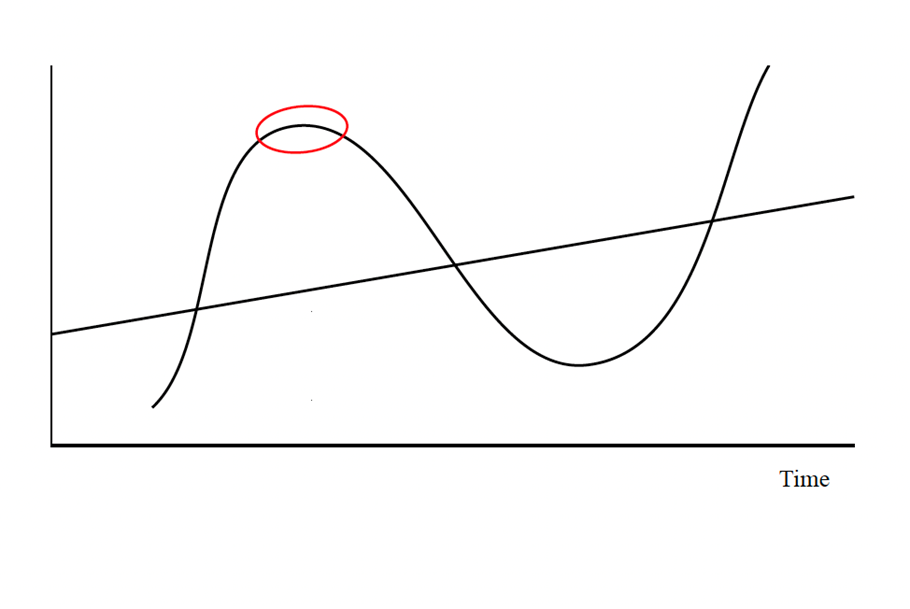

The biggest challenge in my view is that most retail investors do not know what they are buying. They assume they know the stock well and typically buy into it when the hype is at its greatest.

However, when the stock starts to decline in price, sometimes significantly, self-doubt creeps in and most will now have second thoughts about their stock holding, uncertain as to what they should be doing.

Very often, they will sell at the bottom due to a lack of conviction. Is there a solution to resolve this common problem that investors face? Well, the short answer is Yes!

But first, when it comes to investing in stocks, there are typically 3 main categories that retail investors often associate with.

Growth Stocks

Growth stocks are counters which are exhibiting “above-average” growth and are primed to grow their businesses strongly over the foreseeable future. These stocks are often “bleeding” or loss-making at present as management focuses on “heavy-spending” to increase their market outreach.

Companies like Sea Ltd, Shopify, and Etsy are examples of growth stocks. They usually have not yet turned a profit as they would reinvest a lot of money back into the company thus outpacing their peers in terms of their growth trajectory.

Source: Tradingview.com

Most retail investors love to invest in growth stocks because they are often marketed as the “next big thing”. Everyone wishes to invest in the next group of FAANG. The reality however is that for every single growth stock that “makes it big”, there are probably nine others that will fall into obscurity.

Investing in growth stocks is not as simple as buying a fast-growing counter. To excel in growth investing, one will need to have absolute conviction of the counters’ business model to succeed in a hyper-competitive environment.

Unfortunately, most growth retail investors lacked that conviction.

Growth Investing – https://newacademyoffinance.com/how-to-find-growth-stocks/

Dividend Stocks

Dividend stocks are companies that are consistently profitable and then distribute these profits in the form of dividends to their investors. This way, your investments are consistently generating cash flow for you.

These companies usually have found a steady footing and are mature in their sector. Using the previous example, here’s Apple’s dividend history.

You can see that Apple has a history of paying out dividends quarterly. This means to say that not only would you experience the growth in the value of the stock, but you will also consistently receive dividends distribution from Apple.

This is not much of a surprise considering that Apple is famously flushed with cash. Just take a look at their 2021 numbers in this table. It is a whopping $26,913,000,000!

Aside from being able to pay out dividends from their secret stash, they can also use that money to do share buybacks from time to time to bring up their share price.

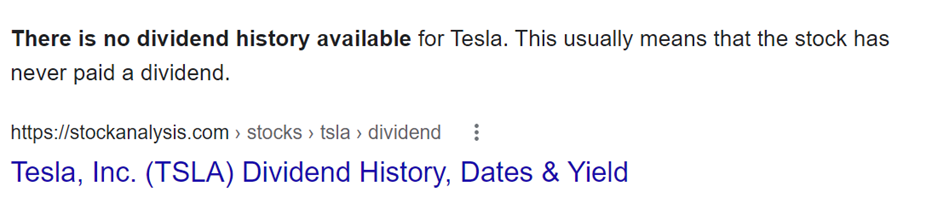

For comparison’s sake, here is Tesla’s dividend history ladies and gentlemen.

Yes, you are right. An astounding $0 of dividends paid so far.

Dividend stocks typically appeal to investors looking at growing their stream of dividends as a form of alternative income. This is extremely relevant to those investors who are preparing for retirement.

How does consistently generating dividend payments from your dividend stocks every single month that is sufficient to cover your full monthly expenses sound to you? That is the goal of every soon-to-be retiree.

Do note that dividend stocks, as I previously highlighted, typically are companies with a mature business that is not expected to grow rapidly anymore.

Hence, management tends to return excess capital to shareholders in the form of dividend payments or share buybacks. This is unlike growth stocks where the bulk of profits/cash generated (if any) tends to be recycled back to grow the existing business (i.e. spending on client acquisitions, marketing, etc).

Dividend Investing – https://newacademyoffinance.com/how-to-invest-in-dividend-stocks/

Value Stocks

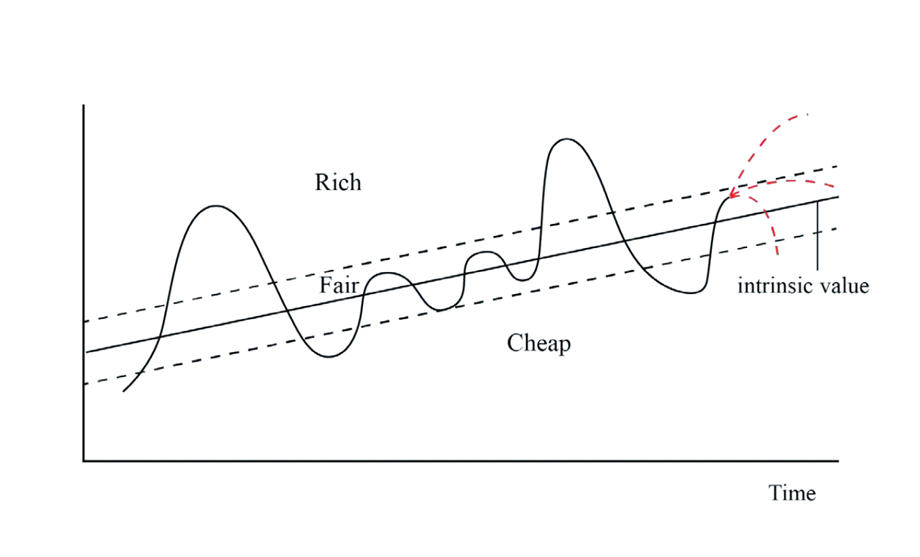

If you have read my other articles, you would have read about me talking about quantifying and deriving the intrinsic value of the share price of a company. That is exactly what investing in value stocks is all about. Essentially, by deriving the intrinsic value of a share, we can tell whether or not it is undervalued by comparing it to the price it is trading for.

This is a very popular methodology of investing that was first made famous by Benjamin Graham, famed author of the book The Intelligent Investor. He was also a mentor to Warren Buffett who is one of it not the most successful investors to have ever lived.

Most value investors typically use financial ratios like Price to Earnings ratios or Price to Book ratios as a means to determine the valuation of a company. However, investing in value stocks is often not as simple as pulling out a couple of financial ratios.

The “art” of real value investing revolves around a wide array of financial terms such as margin of safety, discount rate, intrinsic value, a margin of safety, etc, terms which are extremely confusing to the man-in-the-street.

Additional Reading: Basic Investing Terms (part 1)

Additional Reading: Basic Investing Terms (part 2)

Even if one is familiar with the various terminology involved with value stocks, determining if a stock is indeed undervalued is more of an art than science, since the counter’s “fair value” is often determined based on one’s assumptions which could be irrelevant or extremely erroneous.

Value Investing – https://newacademyoffinance.com/4-easy-steps-to-getting-started-on-value-investing/

Alpha Blueprint Stocks

There are pros and cons when selecting to invest in value, dividend, or growth stocks. For those who are interested in having a basic understanding of these 3-investing styles, I have written some articles on these topics which might be of interest to you. The links are attached at the end of each segment.

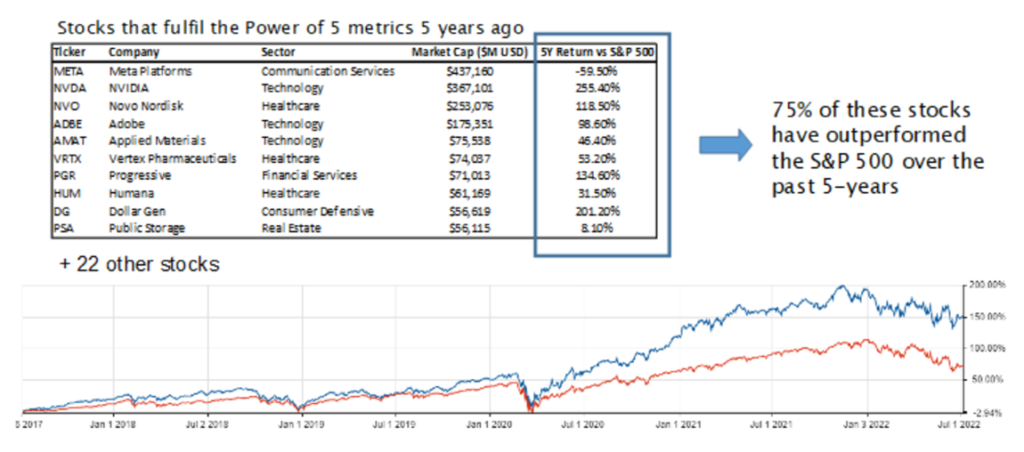

For those who are interested in finding quality stocks that you can invest with peace of mind and sleep well at night, I do urge you to check out my Alpha Blueprint Stocks.

Alpha Blueprint Stocks aims to address the shortfalls of value, dividend, and growth stocks while incorporating the “essence” of these investing styles.

These winning stocks are not your typical “boring/value/dividend” counters. Neither are they your loss-making hyper-growth stocks. While they exhibit growth characteristics that aim to “excite”, these alpha stock candidates are also highly profitable, highly efficient, and highly cash-rich, traits that will not only ensure their survivability in an economic downturn but also increase the likelihood of them emerging out a bigger, better entity as they capitalize on increasing their market share from financially-weaker corporates who are no longer able to survive when liquidity dries up.

I will show you how to screen for these companies the easy way. By investing in these companies, WITH CONFIDENCE, when there is blood on the street, this is how we, as normal retail investors, can “stick it” to the big boys and achieve strong outperformance vs. the market.

That is how you can potentially generate your 1,900% AAPL-like returns over the next 12 years, something only possible by selecting the right stocks to invest in.

If you are looking for outsized returns but find the amount of information available overwhelming, you can take a gander at our Alpha Blueprint Stock Selection process.

It is a no-frills, straightforward, easy-to-understand screening process that will accelerate your journey in deciphering the markets! You can find out more about it by clicking on the link below:

Do Like Me on Facebook if you enjoy reading the various investment and personal finance articles at New Academy of Finance. I do post interesting articles on FB from time to time that might not be covered here in this website.

Join our Instagram channel for more tidbits on all things finance!

Join our Youtube channel for short and sweet videos on all things finance!

SEE OUR OTHER WRITE-UPS

- GUIDE TO SYFE AND HOW TO OPEN AN ACCOUNT IN LESS THAN 10 MINUTES

- SYFE GUIDE: DID SYFE’S ARI ALGORITHM OUTPERFORM IN TODAY’S MARKET VOLATILITY?

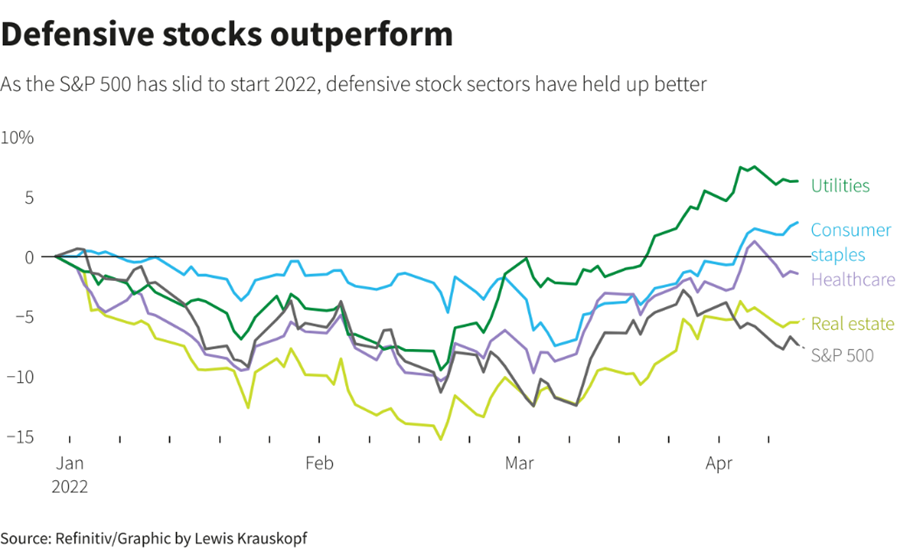

- Pricing Power: Stocks that can do well amid inflation concerns

- 5 Small-Cap US Stocks with 10 years of consecutive earnings growth

- How to invest in Dividend stocks

- 9 Strong Free Cash Flow Stocks that you need to own

Disclosure: The accuracy of the material found in this article cannot be guaranteed. Past performance is not an assurance of future results. This article is not to be construed as a recommendation to Buy or Sell any shares or derivative products and is solely for reference only