Companies that engage in aggressive share buyback

I have written about companies doing share buybacks in this article titled: What is Shareholder Yield and why is this ratio more important than dividend yield?

The main difference between Shareholder Yield vs. Dividend Yield is that the former metric includes share buyback, which is an indirect method of returning excess capital to shareholders, vs. the more direct method of a dividend payment.

Foreign investors (like us Singaporeans) who are subjected to a 30% Dividend Withholding Taxes on dividends declared are at a disadvantage when it comes to investing in a high dividend-yielding counter.

Instead, one can focus on investing in companies with a high shareholder yield instead, taking advantage of share buyback activities, which serves to benefit shareholders as well.

How so, you might wonder, since there is no cash coming into our pockets?

How Share Buybacks benefit shareholders

When a corporation engages in a share buyback activity, it reduces the total outstanding shares in the company. With a lower share base, its Earnings Per Share, or EPS, will increase even when the company’s profits remain stagnant.

Let’s take a look at a quick example.

Company A generates $1,000 in net profit in Year 1. It has an outstanding share base of 100 shares. Hence its EPS for Year 1 is calculated as such:

EPS (Year 1) = $1,000 (net profit) / 100 shares = $10/share

During Year 2, the company bought back 10% of its outstanding shares. Thus, its shares at the end of Year 2 are now 90 shares. The company generated the same amount of net income ($1,000) in Year 2.

Year 2 EPS is calculated as such:

EPS (Year 2) = $1,000 (net profit) / 90 shares = $11.11/share

What is happening here? Even with its net income remaining flat at $1,000, the company has managed to increase its key financial metric, EPS, by 11% just through its share buyback action.

Since the company’s share price is often correlated to EPS, this might result in a higher share price, much to the delight of shareholders.

Management, whose remuneration might also be tied to share price performance, could engage in aggressive share buyback activities for his/her benefit.

Good Buyback vs. Bad Buyback

Not all share buyback is good. It does not mean that the corporate doing the most buyback, ie having the greatest buyback yield, is the best. It is like saying: Is a company offering the highest dividend yield the best company in the world? Of course not.

We need to engage a more holistic approach by evaluating other factors that might be in play.

Let’s first talk about bad buybacks.

I mentioned earlier that management often has the incentive to “artificially” boost the company’s reported profitability or EPS, through share buyback activities, to boost their remuneration package.

First, this corporate action might be taken even when the share price is “overvalued”. Engaging in share buyback activities when the price is “expensive”, is more akin to destroying shareholders’ value than enhancing it.

Second, management engages in share buyback activities, not from cash generated internally, but through 3rd party funding (banks). This might make some sense in a low-interest rate environment when its business is booming, and banks rushing to refinance their borrowings.

The whole house of cards comes tumbling down when their operations falter or when interest rates start climbing up, like in the current situation. The banks will come knocking on their door for repayment.

Good buybacks, on the other hand, are often engaged by savvy management who is keenly aware of what might be the company’s fair value. When Mr. Market unfairly punishes the company’s stock, possibly as a result of a broader market sell-off, management will engage in buyback activities more aggressively.

When its share price is deemed “elevated”, management will slow down its share repurchases. They are not fixated on reducing the company’s outstanding share base all the time to possibly give a “boost” to their remuneration package.

Good buybacks are engaged using internally generated free cash flow. When a company continues to generate excess cash organically which it has got no other means to deploy, one way to return this excess cash indirectly to shareholders is through share buybacks, assuming that it does not deem the company’s share price as overvalued.

Without relying on 3rd party organizations (aka banks) to fund their share buyback activities, these corporates have greater control and tend to be able to best capitalize on the right time to engage in such corporate activities. This is often the case when the going gets tough.

Companies bought back a ton of shares. Now they are paying the price for it

In a recent Barron article, it highlighted that Meta and many big banks bought back a ton of their shares in 2021 and 1H21, at average levels well above their current share price.

Big banks such as Citi, JP Morgan, and Wells Fargo have already reported their 3Q22 results, and bought back no stocks in 3Q22, despite their share prices being significantly lower. This is possibly due to them looking to conserve capital in preparation for a recession ahead.

For companies whose fundamentals remain sound, now is the time to be engaging in more aggressive buyback activities when their prices are being unfairly punished. We look to identify 4 such companies that are pretty savvy in their buyback activities.

These are companies that have resisted the allure to engage in aggressive buyback activities when prices are elevated in 2021 and have been more aggressive on a YTD2022 basis to capitalize on the company’s weak price.

4 Best Companies doing share buybacks

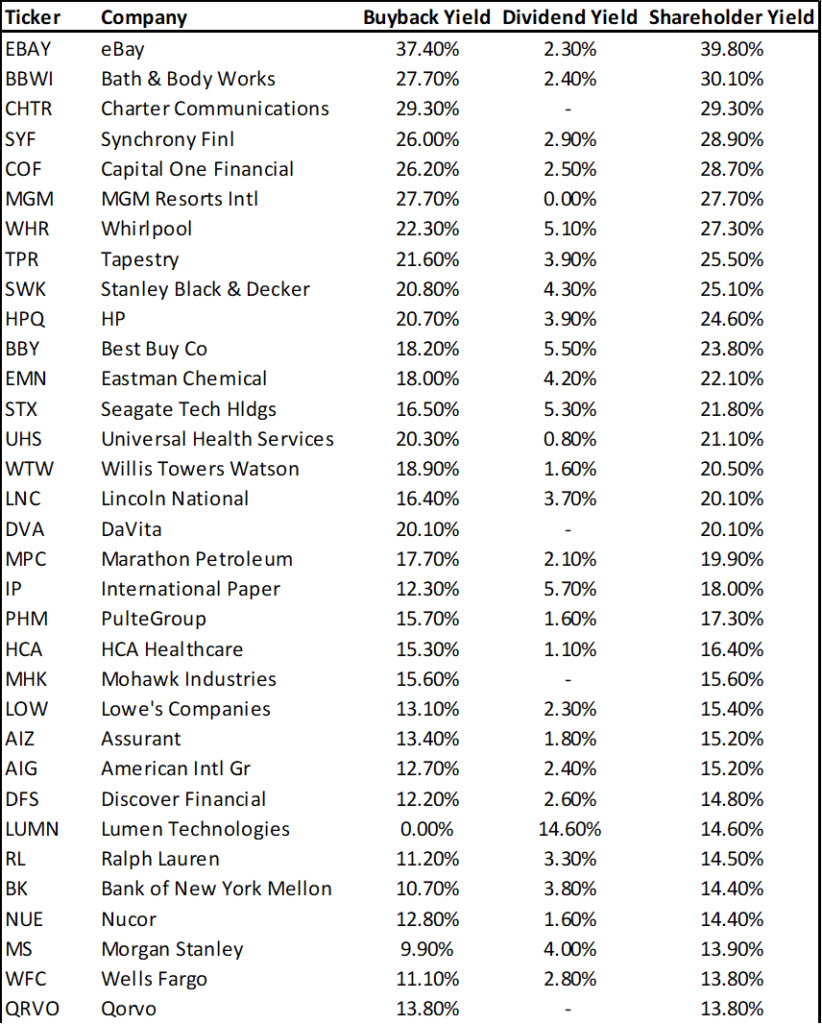

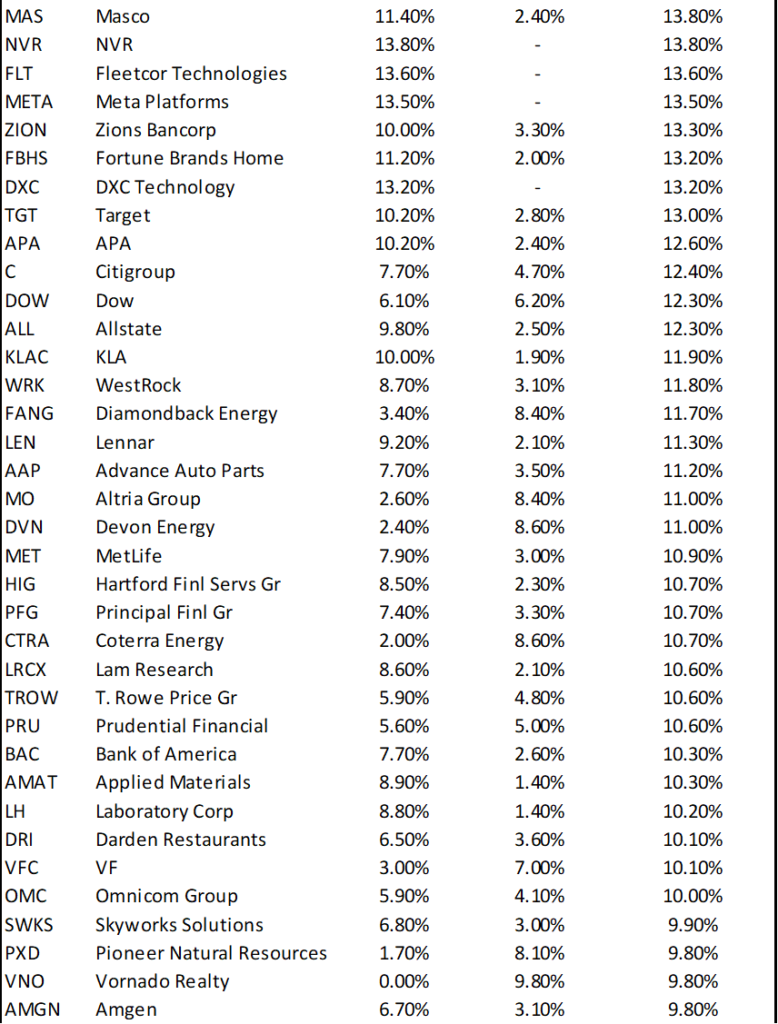

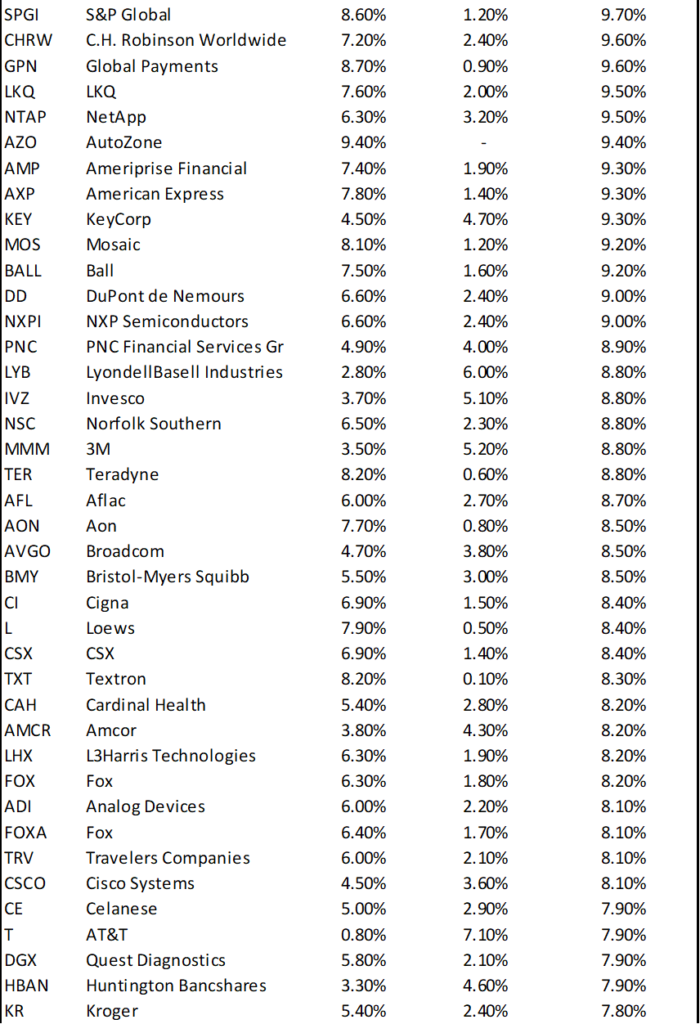

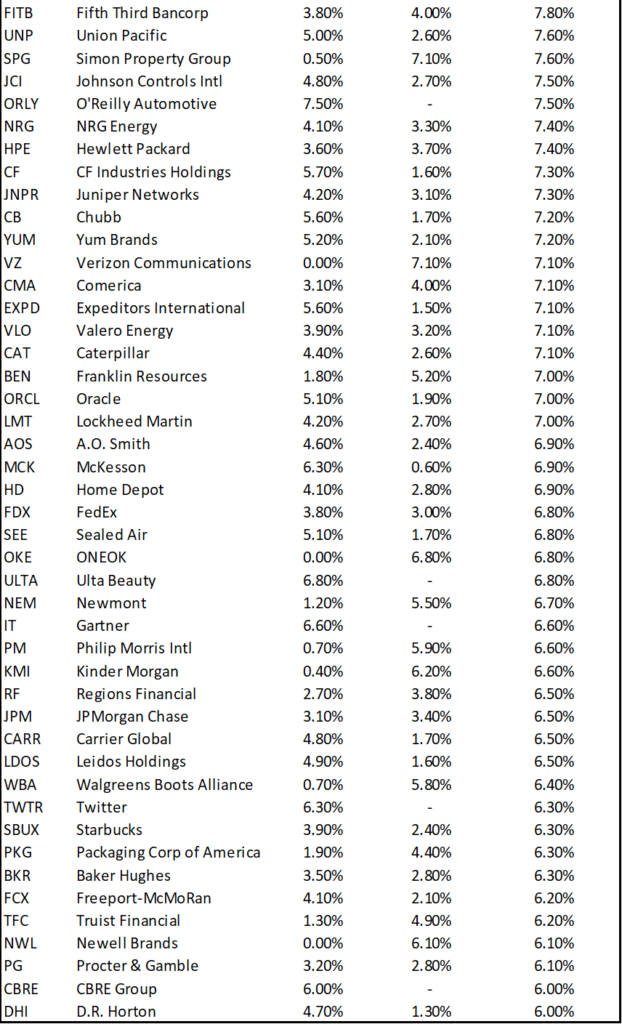

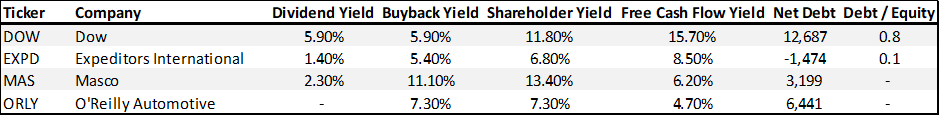

I first used the Stock Rover platform to screen for companies generating Shareholder Yields above 6%.

Remember that shareholder yield includes both dividend yield and buyback yield.

Hence, even for a company not paying any dividends, like Meta, it could still be featured in this list if the company has been aggressive in buying back its shares.

The table shows the full list of companies that meet this criterion, sorted by the highest shareholder yield.

It will be erroneous to just look at the company with the highest shareholder yield, that being eBay, and conclude that the company has been the most efficient in returning excess capital to shareholders.

Just like Meta, eBay has been purchasing its shares aggressively in 2021 and 1H2022 at average prices much higher than where its current price.

What we want to find is instead companies that have been less aggressive in share repurchases in 2021, as many of them are trading at “premium” valuation amid the strong bull market post-COVID-19, and more aggressive in their latest reported quarters.

Similarly, using the Stock Rover platform, I can customize the screening criteria to only include companies that have a buyback yield in their latest reported two quarters GREATER than the entire buyback yield for 2021.

I can streamline the 150+ counters to 49 stocks.

From that list of 49 stocks, I selected 4 stocks that appear the savviest in terms of share buyback engagement. These are companies that were able to capitalize on their price weakness at the right time by aggressively buying back shares.

The 4 companies are highlighted in the table above.

Best Companies doing Share Buybacks #1: DOW Inc (ticker: DOW)

Business Description: Dow Inc is a diversified chemical manufacturing company. It combines science and technology to develop innovative solutions that are essential to human progress. Dow’s portfolio is comprised of six global business units, organized into three operating segments: Packaging & Specialty Plastics, Industrial Intermediates & Infrastructure, and Performance Materials & Coatings

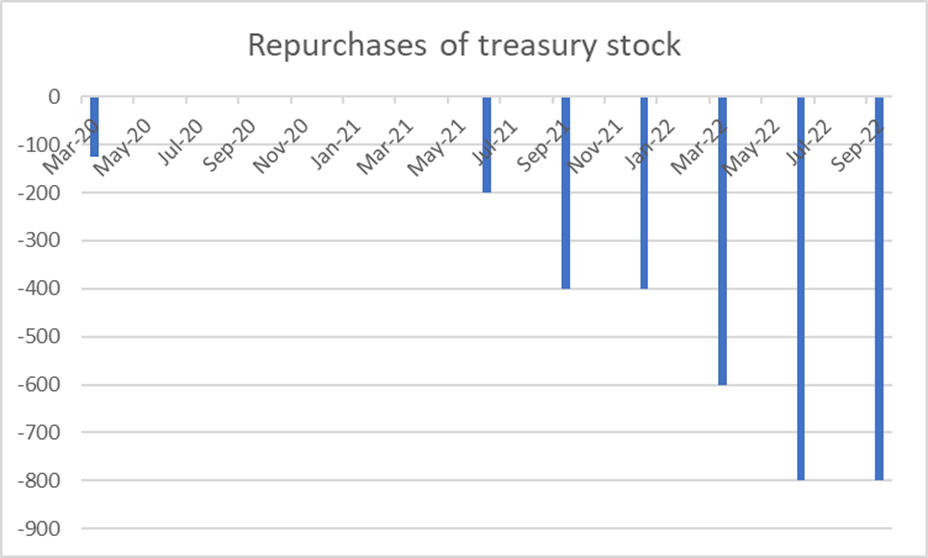

Dow Inc currently spots an attractive Shareholder Yield of 11.8%, contributed equally from both dividend payments and share buyback activities.

It also spots an attractive free cash flow yield of 15.7%, which is the highest in this list. However, this might not be sustainable when earnings decline.

While its debt profile is on the high side, it still has a very manageable debt/equity ratio of 0.8x.

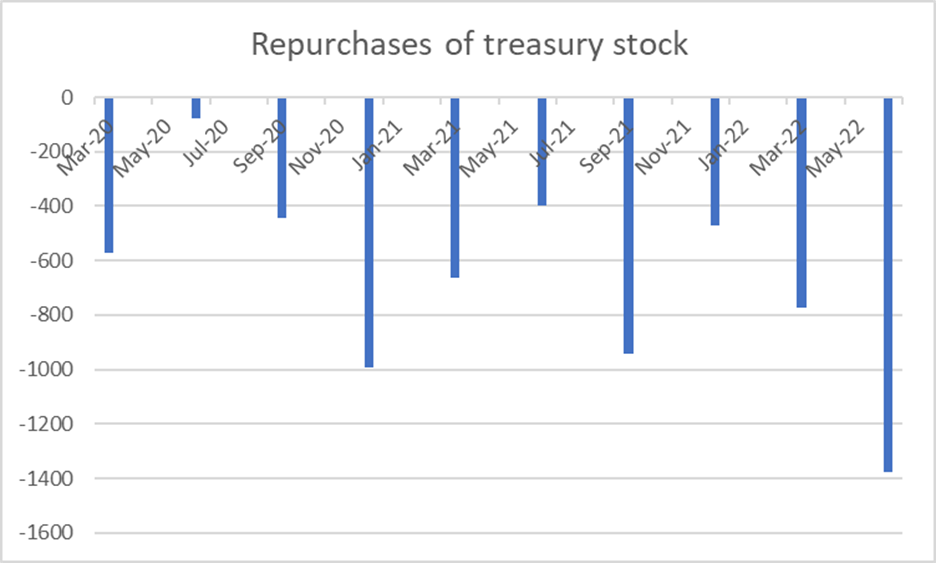

What I like to see is that the company has been pretty aggressive in buying back shares over the last 9 mths when its share price has been beaten down.

Best Companies doing Share Buybacks #2: Expeditors International (ticker: EXPD)

Business Description: Expeditors International of Washington is a non-asset-based third-party logistics provider, mainly focused on international freight forwarding. It employs sophisticated IT systems and contracts with airlines and ocean carriers to move customers’ freight across the globe. The firm operates more than 200 full-service office locations worldwide, in addition to numerous satellite locations. In 2021, Expeditors derived 38% of consolidated net revenue from airfreight, 27% from ocean freight, and 35% from customs brokerage and other services.

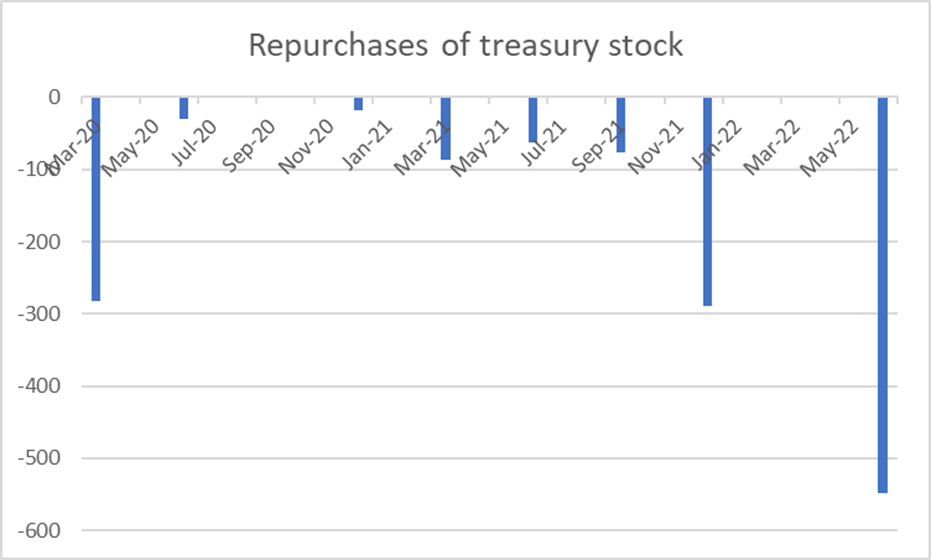

EXPD is the only company in this list with a net cash position, which demonstrates the strength in its balance sheet. In a rising interest rate environment, EXPD will not be burdened by a high level of borrowing.

However, its shareholder yield is the lowest in this list, coming in at 6.8%, with the bulk a result of share buyback activities.

The company has been rather aggressive in buying back shares in the last quarter ending June 22. We will like to see its aggressive buyback activities extending into 3Q22 as well. This is made possible by its strong balance sheet status and a strong free cash flow profile.

Best Companies doing Share Buybacks #3: Masco (ticker: MAS)

Business Descriptions: Masco manufactures a variety of home improvement and building products.

The company’s $5.1 billion plumbing segment, led by the Delta and Hansgrohe brands, sells faucets, showerheads, and other related plumbing fixtures and components. The $3.2 billion decorative architectural segment primarily sells paints and other coatings under the Behr and Kilz brands, but it also sells builder hardware and lighting products.

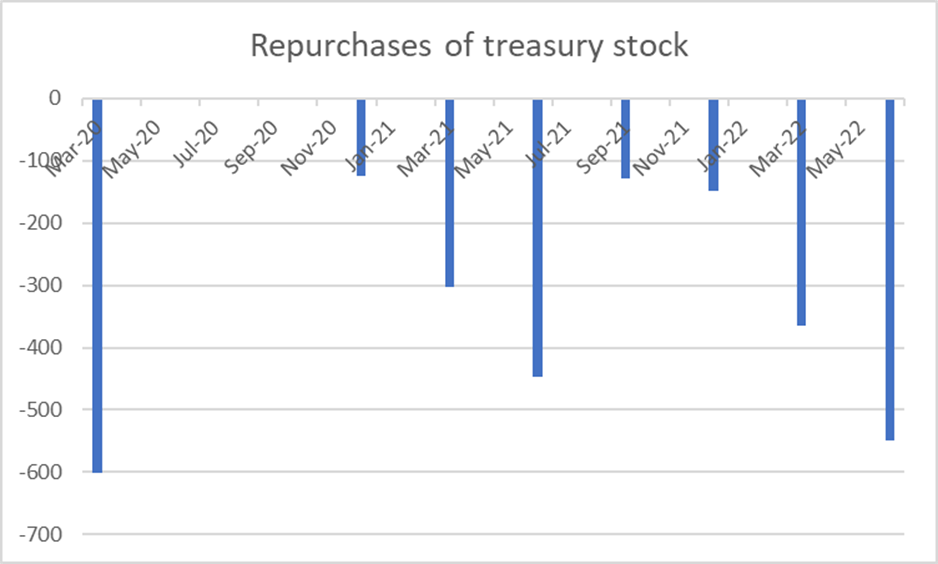

MAS has the highest shareholder yield in this list at 13.8%, a direct result of its aggressive buyback activities.

The company is in a unique position where its equity base is negative, not because it has been loss-making, but because the company has been aggressively buying back its shares.

Since 2012, its outstanding share base has been reduced from 349m shares to the current level of 242m shares.

While it has a track record of consistently buying back shares, the company has been pretty savvy in buying back shares aggressively when prices were low, like in early 2020 and less aggressive when prices were elevated in 2H20 and 2021.

The company has resumed a more aggressive buyback stance since 2022 when its share price declines.

Best Companies doing Share Buybacks #4: O’Reilly Automotive (ticker: ORLY)

Business Descriptions: O’Reilly Automotive is one of the largest sellers of aftermarket automotive parts, tools, and accessories, serving professional and DIY customers (41% and 59% of 2021 sales, respectively). The company sells branded as well as own-label products, with the latter category comprising nearly half of the sales. O’Reilly had 5,784 stores as of the end of 2021, spread across 47 U.S. states and including 25 stores in Mexico.

The firm serves professional and DIY customers through its store network and also boasts approximately 750 sales personnel targeting commercial buyers.

The company doesn’t pay a dividend and its entire shareholder yield of 7.3% is a direct result of its buyback activities.

Similar to MAS, the company spots a negative shareholder equity situation, not because the company has been consistently loss-making, but because of its aggressive buyback activities over the years.

Since 2012, outstanding shares have declined from 123m to 68m, almost a reduction in half.

Hence, while the company generated a net income CAGR of 14% over the past decade, EPS grew at a much faster clip of 21%.

The company buyback activities accelerated in 2Q22 when there was a dip in share price as a result of overall macro weakness.

While the company is in a comfortable position to continue buying back shares due to its strong free cash generation profile, we expect buyback activities to taper ahead due to a strong rebound in its share price.

Conclusion

Companies engaging in share buyback activities is one way of returning excess capital to shareholders. This is considered an indirect method vs. the more direct manner through dividend payments.

Savvy management will select to aggressively buy back shares when they deem their shares “undervalued”. When shares become “pricey”, management will select to return excess capital through dividend payments.

Striking the right balance between share buybacks and dividend payment is not an easy or straightforward task. Only the best management with the interest of shareholders at heart will be able to consistently engage the “right” manner to return capital to its shareholders.

Do Like Me on Facebook if you enjoy reading the various investment and personal finance articles at New Academy of Finance. I do post interesting articles on FB from time to time that might not be covered here in this website.

Join our Instagram channel for more tidbits on all things finance!

Join our Youtube channel for short and sweet videos on all things finance!

SEE OUR OTHER WRITE-UPS

- GUIDE TO SYFE AND HOW TO OPEN AN ACCOUNT IN LESS THAN 10 MINUTES

- SYFE GUIDE: DID SYFE’S ARI ALGORITHM OUTPERFORM IN TODAY’S MARKET VOLATILITY?

- Pricing Power: Stocks that can do well amid inflation concerns

- 5 Small-Cap US Stocks with 10 years of consecutive earnings growth

- How to invest in Dividend stocks

- 9 Strong Free Cash Flow Stocks that you need to own

Disclosure: The accuracy of the material found in this article cannot be guaranteed. Past performance is not an assurance of future results. This article is not to be construed as a recommendation to Buy or Sell any shares or derivative products and is solely for reference only