Financial Freedom in Singapore: Is this out of reach for most?

There have been several articles written around the topic of: How much is required to achieve financial freedom?

This was sparked off by an article from the South China Morning Post where a Juwai survey was done comparing how much it would cost to achieve financial freedom in different cities.

Singapore ranks No. 7, with a requirement of US$3.23m (SGD4.33m) for a typical household who wishes to achieve financial freedom today. This seems like a hell lot of money and makes one wonder if we are all destined to work “till death do us part”.

The survey result is based on what would be needed to attain the following:

- Home measuring 120 square meters in a decent urban area

- Two good cars

- US$1.2m in financial investments

- US90k in household income after tax

The key variable factor between London (ranks No. 1 in the list and requires US$4.57m to achieve financial freedom) vs. Singapore (US$3.23m), I believe, is largely the cost of an urban dwelling.

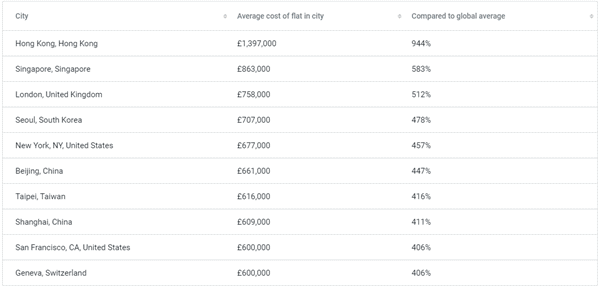

However, according to this Property survey, it is both Hong Kong and Singapore that ranks top in terms of the most expensive cities for a flat. London comes in at No. 3.

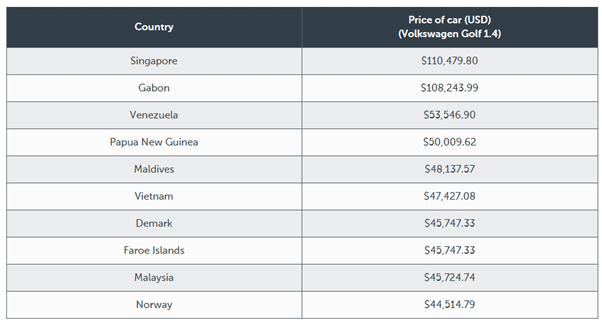

And I refused to believe that the cost of 2 good cars in London, or Shanghai or New York, or anywhere in the world can be substantially more than in Singapore (assuming a like-for-like comparison).

According to the Worldwide Cost of Living survey done back in 2019, based on results from the Economist Intelligence Unit (EIU), the price of a Volkswagen Golf 1.4 in Singapore cost a hefty USD110k, ranking Singapore as the most expensive country when it comes to car ownership.

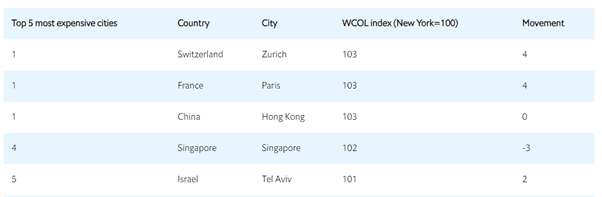

The latest EIU survey also ranks Singapore as having the 4th highest cost of living in 2020, where London, Shanghai, New York, etc, all ranking above Singapore in terms of “cost of financial freedom” in the Juwai survey is not in the Top 5 list.

Why is there such a discrepancy is unknown to me, but that is probably stemming from the expectations of survey respondents?

While Singapore did not “achieve” the dubious honor of being ranked the most expensive place to achieve financial freedom, it is obvious that here in sunny Singapore, it is not going to be cheap to retire well as compared to our neighboring countries.

However, is this household retirement Net Worth figure of SGD 4.3m a realistic number that has to be achieved to retire well?

SG$4.3m: Net Worth or Asset?

First, I questioned if the US$3.23m or SG$4.3m stated is referring to the household net worth figure or the asset figure. Assuming that a large portion of the house value is still under mortgage, this US$3.23m figure used to compute a household net worth will be substantially lower.

Of course, the mortgage cost will now need to be factored as part of the expenses used to compute the US$90k household income requirement.

Assuming that a typical 1,200 sqft condo in Singapore costs S$1.5m and the outstanding loan is approx. S$1m, this will result in a monthly repayment of approx. S$4k or an annual repayment of c.S$50k (based on 1.5% annual interest rate and loan tenure of 25 years).

With a household income of US$90k or S$120k, that leaves a remaining S$70k to cover annual household expenses in today’s terms.

Is this S$70k now a realistic figure for retirement annual expenses? Let’s round that up to $6,000/month or $72,000/annum in retirement expenses.

No mortgage loan consideration

The next question to ask is, can the US$1.2m (or S$1.61m) in financial assets able to generate the required S$72k/annum in household retirement expenses?

S$72k / S$1.6m = 4.5% withdrawal rate which seems to be a tad higher than the 4% withdrawal rate used for most retirement calculation.

A 4% withdrawal rate will correspond to an investment asset figure of S$1.8m.

This means that if you withdraw S$72k/annum, your investment fund of S$1.8m can last you for 25 years.

For most who aspire to retire early, 25 years is too short a period. Realistically, that figure should be closer to 50 years. However, does that mean you need at least S$3.6m in investment assets to retire well? How about the effect of inflation? Your cost of living will not stay stagnant at S$72k/annum for the next 50 years, am I right?

I used several assumptions below:

- Inflation rate at 3%

- Target market return before inflation at 7%

- No pension payout

- Early retirement at Age 45

For someone who wishes to achieve early retirement at the age of 45, with his/her retirement fund potentially lasting to age 95 (or 50 years horizon), one will need approx. S$900k/head (on retirement at age 45) based on an expected retirement expense of S$3k/month (in today’s terms).

This figure will be smaller for someone who is Age 65 at present, whose retirement horizon is 20 years lesser. Based on the same retirement expense of S$3k/month, a person retiring at age 65 will need a retirement portfolio sum of $720k.

There theoretically is no one magic retirement figure for all Singaporeans, even if the monthly/annual expense assumption is the same as different retirement horizons would yield different results.

You would probably expect that someone Age 25 today, wishing to retire in 40 years (Age 65) will require a substantially larger retirement portfolio vs. one who is Age 45 and Age 65 today respectively (assuming the same $3k/month retirement income in today’s terms). This is the direct result of inflation.

Back to our early retirement example, on a household basis, assuming just 2 pax (you and your spouse, both Age 45), that will mean an investment figure of approx. S$1.8m (on retirement) on a household expense of S$72k/annum (in today’s terms).

Retirement goal: S$1.8m investment portfolio at Age 45 (with paid-up home)

However, what if the additional mortgage loan of $50k/annum is included?

With mortgage loan consideration

In this scenario, one will need to generate additional cash flow to the tune of $50k/annum to service the mortgage payment of the house.

Hence, the annual cash flow requirement will be closer to S$122k (S$72k + $50k). The computation of mortgage loan repayment will be a fixed $50k/annum over 25 years horizon.

Taking into consideration this additional mortgage expense which is required, the retirement portfolio will need to be expanded to $2.4m TODAY if one wishes to retire well with a 1200 sqft condo (still with substantial mortgage outstanding) and under a S$72k/annum household expense assumption.

Retirement goal: S$2.4m investment portfolio at Age 45 (with a home mortgage of S$50k/annum)

Early retirement requirements vary from household to household

Assuming that the mortgage has been fully paid up, based on a household annual expenses of $72k, one will need approx. S$1.8m TODAY in liquid investment assets, generating 7% average annual return (before inflation) to have a retirement pool that can last you for the next 50 years as highlighted earlier.

Conversely, if your household retirement expenses amount to just $40k/annum or $3,400/month ($1,700/head/month), the household retirement fund that you need TODAY will now be a more “palatable” S$1m, assuming a fully paid home.

Can your household “survive” based on S$3,400/month in household expenses? Assuming that your mortgage has been fully repaid, your household “magical retirement figure” will be “just” $1m in investment assets TODAY (assuming retirement Age 45).

The figure of S$4.3m concluded in the Juwai’s survey might be slightly misrepresentative, in my own humble opinion, as it includes property valuation that is not used to compute cash flow needed to “finance” a retirement lifestyle.

On the other hand, I think it will be more representative to say that if you wish to retire well, generating S$120k/annum in cash flow that goes towards your annual household expenses and mortgage repayment (for a good-size condo), then a S$2.4m investment portfolio might be what you need TODAY.

If one assumes that a comfortable retirement lifestyle entails S$170k/annum in cash flow ($120k household expenses and $50k mortgage repayment for 25 years), the portfolio figure on early retirement (at age 45) will be approx. S$3.5m.

Conclusion

Depending on your lifestyle requirement, the amount of asset/fund you need to accumulate for early retirement varies from household to household.

If you have a fully paid home and you and your family live a thrifty lifestyle that requires just $3,400/month in household expenses in today’s terms, your financial freedom can be achieved with an investment portfolio of $1m (generating 7%/annum pre-inflation over the next 50-years), assuming a fully-paid home.

On the other hand, if you need a substantially higher amount of $6k/month in household expenses in today’s terms, assuming also a fully paid home, that figure might be a more substantial S$1.8m. This figure balloons to S$2.4m when taking into consideration a fixed S$50k annual mortgage payment over 25 years.

Early retirement is a pretty sensitive and subjective topic, not just in Singapore but globally. Most will aspire to achieve “retirement” status much quicker than their peers and be financially independent but very few achieve that status.

The key to EARLY retirement, in my opinion, is three-fold:

- Get started on your investing journey early

- Save and invest aggressively

- Have a thrifty retirement lifestyle expectation

For a young adult who starts his/her investing journey at Age 25, contributing $1000/month to his investment portfolio, he/she can realistically retire at around age 48, after having accumulated a portfolio value of $630,000. This assumes a monthly retirement expense of $1,500/month in today’s terms, with a pension payout of c.$40k/annum from Age 65 onwards.

For those who aspire to have a very comfortable retirement lifestyle, with a monthly income of $5,000 in today’s terms, you would need to start investing $4,900/month even if your investing journey begins at Age 25. This is somewhat of an unrealistic figure.

NAOF Investing Series

This is a step-by-step quick start guide to get you started on investing immediately. Learn about the benefits of investing early and how to automate that process

The above calculation is based on the NAOF retirement spreadsheet which I formulated. It is meant just for reference.

Do Like Me on Facebook if you enjoy reading the various investment and personal finance articles at New Academy of Finance. I do post interesting articles on FB from time to time which might not be covered here on this website.

Join our Instagram channel for more tidbits on all things finance!

SEE OUR OTHER STOCKS WRITE-UP

- Early Retirement Plan – A 9-Steps Ultimate Guide

- A step-by-step guide to figuring out your retirement sum

- How much to retire in Singapore?

- The IDEAL Retirement portfolio structure

- Inflation: Don’t ignore this silent retirement killer

Disclosure: The accuracy of material found in this article cannot be guaranteed. Past performance is not an assurance of future results. This article is not to be construed as a recommendation to Buy or Sell any shares or derivative products and is solely for reference only.