HPS Singapore: What you need to know

The majority of Singaporeans (approx. 80%) live in HDB flats. But do you know about the Home Protection Scheme (HPS Singapore)? Maybe not. For young Singaporean couples looking to buy their first HDB BTO, do take note of this scheme which is mandatory if you intend to use your CPF funds to pay for your monthly home loan installments.

In this article, I will briefly discuss:

1) the basics of Home Protection Scheme (HPS Singapore),

2) where to find your own personal Home Protection Scheme (HPS) information (if it is eligible to you),

3) why you should not be actively pre-paying your HDB loan and

4) why choosing a term insurance loan might be more appropriate vs. Home Protection Scheme (HPS).

What is Home Protection Scheme (HPS Singapore)

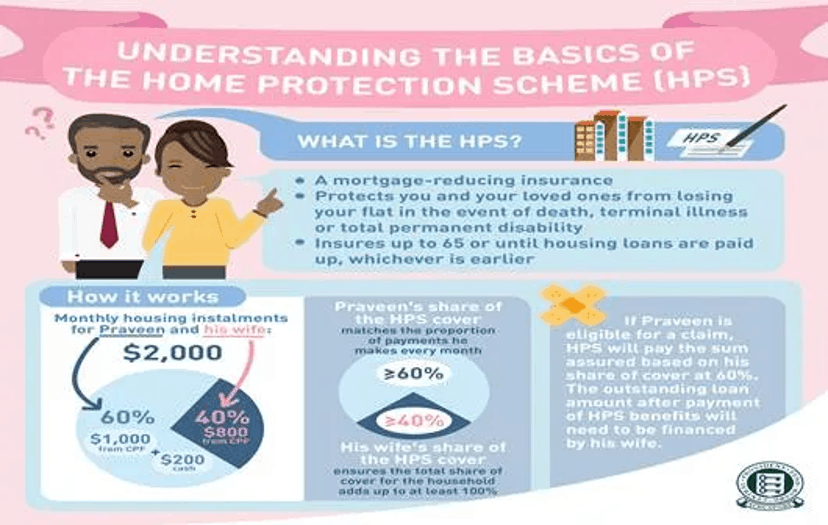

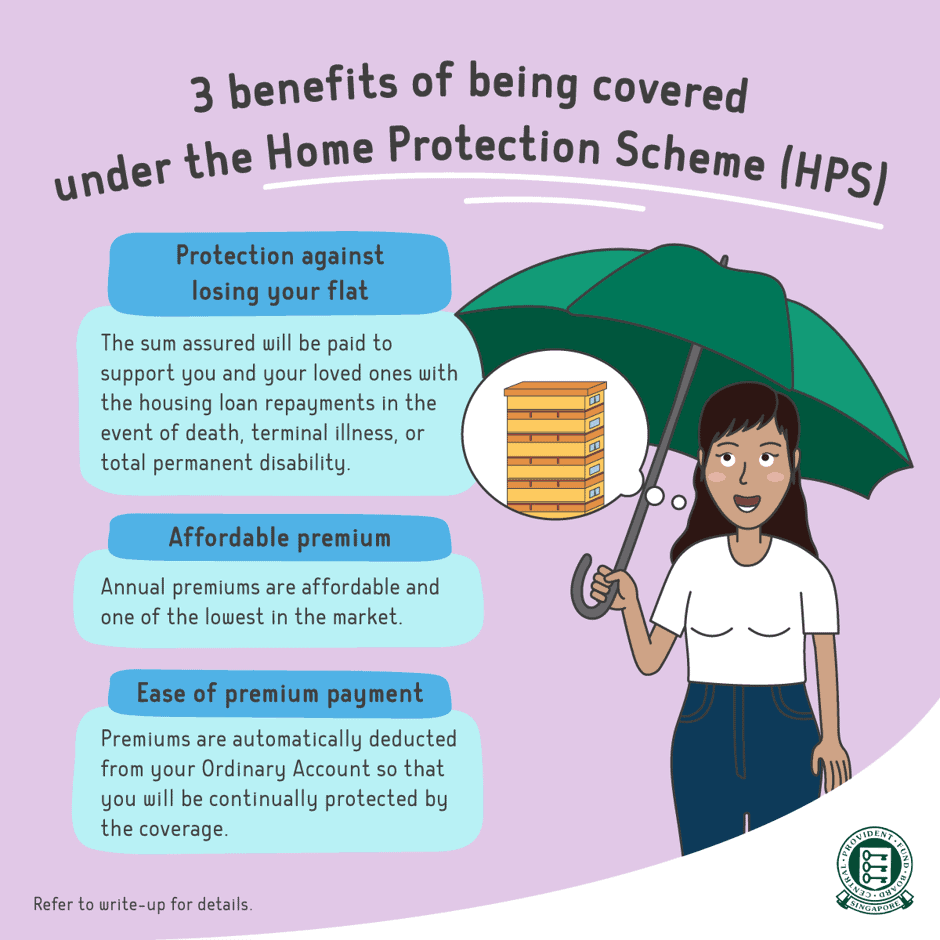

Home Protection Scheme (HPS Singapore) was introduced to protect HDB homeowners and their families from losing their HDB flat in the event of death, terminal illness or total permanent disability before their mortgage is paid up. Note that this is not a home insurance scheme to cover for loss of property due to fire etc.

So let us say for example in the unfortunate event that the sole-breadwinner of the family passed away, his/her spouse will not have the burden of paying for the remaining mortgage on their HDB loan (assuming that the Home Protection Scheme (HPS) of the deceased has 100% coverage, more on this later).

The Home Protection Scheme (HPS Singapore) only covers HDB or DBSS flats, so the remaining 20% of the population who stays in private housing (including ECs) are not included in the scheme.

The HPS premium will be deducted annually from one’s CPF OA account. This premium amount is generally quite affordable. For more detailed information pertaining to the Home Protection Scheme (HPS Singapore), do refer to the CPF website.

So when do you sign up for the Home Protection Scheme (HPS)?

It is compulsory for you to sign up for the Home Protection Scheme (HPS) when you apply for your HDB/DBSS Loan, with the intention of using your CPF monies to service your monthly housing installments.

This is done amid all the confusion and excitement when you and your spouse put pen and paper down to take ownership of possibly your first flat. Do note that there will also be a health declaration form for HPS which is extremely crucial because non-disclosure of material health problems would have rendered the HPS void.

I know, absorbing all this information amid the anticipation of getting the keys to your first home is practically MISSION IMPOSSIBLE.

How much coverage will I need?

The total coverage per household should add up to 100%. For example, let’s assume that I am paying SGD600/mth to service my mortgage loan while my wife is paying SGD400/mth. Based on this amount, let’s again assume that I am paying SGD200/year in HPS premium while my wife is paying SGD100/year in HPS premium. My coverage will be 60% while my wife’s coverage will be 40%. This means that if anything unfortunate happens to me, HDB will pay 60% of the outstanding loan to my wife.

If we want to be kiasu (for my foreigner readers, “kiasu” means scared to lose out), like the typical Singaporeans, we can both be insured for 100% each (which means higher HPS premiums to be paid per annum by both of us) but regardless of who suffers the unfortunate, the outstanding home loan will be 100% taken care of. Do note that HPS Singapore is only valid until the age of 65.

If anything unfortunate happens after that…. All I can say is “ I am sorry”.

To find out if you are 100% (or only partially) covered by the Home Protection Scheme (HPS), you can log in to your CPF portal and click on My Messages (in the left-hand panel for CPF online services). Under Insurance, you can see the total amount you are covered under the Home Protection Scheme based on your share of coverage.

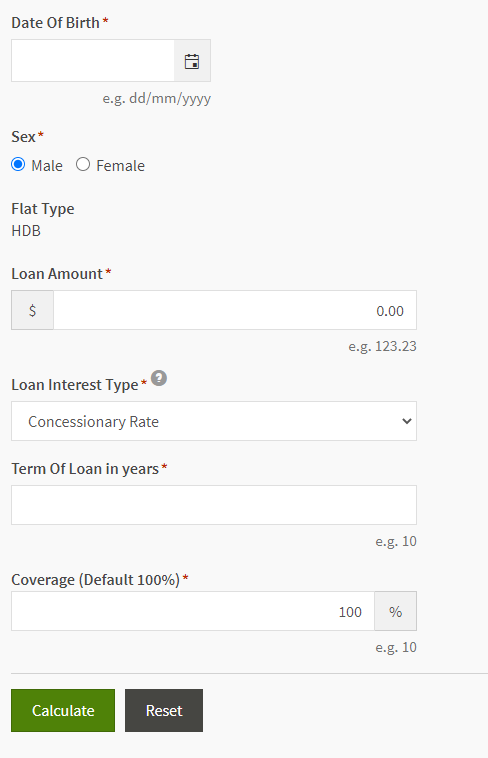

For the amount of HPS premium that you are paying each year, you can refer to the Singapore Central Provident Fund (CPF) website which has got an HPS premium calculator (see diagram) that you can access at this site.

Some of the key information you will need include:

1) outstanding loan amount and

2) Loan repayment period of the flat

3) Type of loan (concessionary or market rate)

4) Age and gender of the member

For 1) and 2) information, login to your HDB portal. Under My Flat, click on Financial Info. You will be able to see your outstanding balance.

Next click on housing loan information and you will be able to see the balance repayment period.

You can then input this info into the HPS calculator to get a rough estimate of your HPS premium. However, to get the exact amount of HPS premium that you are paying each year, the best method is still to look at your annual CPF statement where you can spot the amount under the HPS category.

More info on Home Protection Scheme (HPS Singapore) you might not be aware

HPS Singapore is a Level Premium Plan

Throughout the course of the loan period (you only need to pay HPS premiums for 90% of the loan period i.e. if you take up a loan for 30 years, you will only need to pay premiums for 27 years), your outstanding mortgage loan will be progressively reduced. However, the amount of HPS premium will not change. This is called a Level Premium Plan where the premium amount stays constant throughout the coverage period.

You can see the “issue” here. By the time your mortgage comes to the tail-end, you will have repaid the bulk of your loans but still, pay the same amount of HPS premium (more on this later).

Making early home pre-payments will terminate your existing HPS policy, with a new HPS policy re-issued to you

When you make pre-payments to your outstanding loan, you will effectively change the outstanding housing loan amount as well as the loan repayment period (assuming no change to monthly installments). This will result in the termination of your old HPS cover and any unused premium will be paid to your OA account and a new HPS cover will be issued to you.

If there are no further pre-payments being made, the new HPS premium amount will become the new FIXED constant annual payment.

The other scenario where your HPS payment amount might change is if your share of responsibility in repaying the loan has changed.

You may apply for HPS Singapore regardless of whether you are using a bank loan or HDB Loan

Whether you choose to pay your mortgage via a HDB loan or bank loan, you may apply for HPS, as long as your property is a HDB flat. You may also apply for HPS Singapore if you choose not to use your CPF savings to pay for your mortgage and pay cash instead.

For those using a HDB loan, you can apply for HPS cover at the HDB office or any HDB branch office when you are applying to use your CPF for the monthly housing installment.

For those using a bank loan, you must first apply for HPS online over at the CPF website. This must be completed before applying to withdraw your CPF savings for your monthly housing installments via e-Housing.

HPS premiums take precedence over mortgage loans

Your HPS premiums are automatically deducted from your CPF Ordinary Account (OA), same as with your mortgage instalments.

You should note that HPS premiums are given precedence over mortgage installments, so as to ensure homeowners remain protected under the scheme. It is therefore important to keep an eye on the funds in your OA, although premium shortfalls may be paid up in cash.

The rationale for not pre-paying your HDB Loan

This brings us to the focal point of this article. Some of you might already have caught on to the fact that if you are 100% covered under HPS Singapore, then your outstanding mortgage loan will be fully paid for by the government if anything unfortunate happens to you/spouse. Hence, there isn’t any incentive for me to actively reduce my outstanding mortgage loan (beyond the fact that I have a dying ambition to be fully debt-free).

Let’s use an example for easy illustration

John and Mandy (both 30 years old – born in 1989) took out an SGD300k, 30-years HDB loan today to purchase their first home (a milestone regardless) and intends to service their loan using their CPF-OA funds. Both of them wish to be covered 100% by HPS (kiasu type).

Using the HPS Premium Calculator, John will have to pay SGD267/annum in premium while Mandy will have to pay SGD207/annum in premium (Ladies pay lower as they tend to live longer than us guys).

Throughout the course of the 30 years, your outstanding mortgage loan will be progressively reduced. However, the amount of HPS premium will not change (called a Level Premium Plan where the premium amount stays constant throughout the coverage period as we previously explained). John will continue to pay SGD267/annum every year for the next 27 years (you only need to pay 90% of your loan period) and likewise, Mandy will continue to pay SGD207/annum in premium for the next 27 years.

John’s SGD267/annum works out to SGD22.25/month or SGD0.75/day, pretty affordable I would say for some peace of mind. If anything, unfortunate (death) happens to John in a year where the outstanding loan is now SGD290k, this outstanding amount of SGD290k will be immediately settled by HDB.

Striking a windfall? Or not….

What happens if, after 6 months, John and Mandy both decide to pre-pay their outstanding loan by SGD100k (strike TOTO perhaps). CPF will adjust the HPS cover accordingly if a partial repayment was made. John and Mandy’s existing HPS cover will end and any unused premium will be paid to their OA account and a new HPS cover (lower premium amount) will be issued to them.

In the event of an unfortunate death incident to John, the government will cover the outstanding loan of SGD190k in this case. The SGD100k, which has been used for principal loan reduction, could have been money kept for rainier days!

Just for Fun

Scenario 1: let us assume that John and Mandy did not pre-pay and after 15-years, the outstanding loan is SGD150k. John dies in an unfortunate accident and the government pays for the SGD150k. Remember the SGD100k excess capital they won from TOTO? If they choose to voluntarily contribute to Mandy’s CPF-SA account earning 4% interest/annum from Day 1, that figure would have compounded to c.SGD180k in 15 years’ time.

Scenario 2: If they use the SGD100k into pre-paying their outstanding loan, after 15 years, the outstanding loan amount might be around SGD30-40k. Again, while HDB will settle this outstanding amount due to HPS coverage, Mandy just lost SGD180k in opportunity cost. Ouch!

Scenario 1: Fully paid home + extra SGD180K in CPF-SA, Scenario 2: Fully paid home + REGRET

Choosing term insurance vs. Home Protection Scheme (HPS Singapore)

We previously highlighted that the Home Protection Scheme is compulsory for all HDB/DBSS owners with the intention of using their CPF OA monies to service their monthly housing installments.

However, one can apply to be exempted from Home Protection Scheme (HPS) if he/she has one or more of the following insurance policies:

- Whole Life

- Term Life

- Endowments

- Life Riders (must be attached to a basic policy)

- Mortgage Reducing Term Assurance (MRTA)/Decreasing Term Rider

These policies must cover your outstanding housing loan up to the full term of the loan or 65 years old, whichever is earlier, in the event of death, terminal illness or total permanent disability.

Given how premiums have significantly declined for term life policies, should one be converting their HPS to term life insurance?

Let us use myself as an example. My current HDB loan (outstanding S$88k) will be fully repaid in 15 years and my current annual HPS premium (100% coverage) amounts to S$70.

Heading over to comparefirst.sg, I inputted my personal information with the coverage term selection of 20 years (no 15 years option) and sum assured of S$100k (no S$88k option) and WITHOUT Critical Illness Benefits.

The cheapest annual premiums are S$96/annum for 20 years, offered by Etiqa Insurance which covers Total Permanent Disability.

The S$96/annum payment is slightly higher than my personal S$70/annum payment as it is not exactly a like-for-like comparison (period and sum insured).

The key benefit (in my case) for the term-life option vs. HPS Singapore is that the sum assured (payment) of S$100k is fixed over the next 20 years in the event of my death.

For HPS, assuming that myself and my spouse has already repaid the bulk of my HDB mortgage loan (say in the 10th year, left with 3.5 years of payment as we only pay 90% of loan term), the benefit from my death from HPS coverage is likely much more marginal as the bulk of the mortgage loan would already have been paid.

HDB would likely only “payout” approx. S$25k in my own example to strike off my outstanding loan payment.

$100k vs. $25k. The difference is pretty substantial I would say.

The key benefit of using HPS for me is that the amount of S$70 can be directly deducted from my CPF OA account without me having to fork out any amount in cash. Concurrently the government has also been periodically giving premium rebates from the Home Protection Scheme, with the latest announced in Jan 2020.

My own personal rebate for Jan 2020 was approx. S$274 which amounts to roughly 4 years of annual payment. What this means is that I would have essentially paid close to S$0 in premiums to have free coverage of S$90-100k over the past 4 years.

Is this a given that the government will be dishing out home protection scheme HPS rebates every few years? Definitely not. The last exercise carried out was in Nov 2015. Prior to that, it was in 2006.

For those looking to be exempted from the Home Protection Scheme (HPS Singapore), you can simply:

- login to your CPF account, under My Requests, select Home Protection Scheme and apply to be exempted from HPS

- Key in your property address and select 100% HPS exemption alongside with your spouse CPF number

- Key in your insurance policy provider and existing policies details (policy number etc)

- Repeat step 1-3 for your joint tenant.

- Wait a few business days for CPF to reply to you on your success or failure in the application

Conclusion

Unlike CPF which has garnered a lot of attention from Singaporeans, the Home Protection Scheme (HPS Singapore) might be something that most are not aware of, particularly if you are not in the habit of scrutinizing your CPF statements.

I have provided some key information pertaining to Home Protection Scheme (HPS Singapore) in this article as well as highlight why pre-paying your HDB loan when you are covered by HPS might not be the best use of your spare capital (better to transfer it to SA, perhaps?).

Last but not least, there might be a strong incentive to purchase an individual term life policy vs paying for HPS. There are pros and cons for either solution and one would have to weigh the benefits of switching to a term-life policy rather than sticking to HPS.

All else constant and ignoring the benefits of rebates, I believe that switching to a term-life policy might make sense for an insured amount that is comparatively larger.

For example, using the assumption of a 31-year-old male non-smoker, for a coverage period of 20 years and a loan amount of S$300k, the HPS premium is S$213/annum. Comparatively, the cheapest term insurance amount is only S$139/annum.

If the loan amount is reduced to S$50k (all-else equal), the HPS premium is S$35/annum while the cheapest term insurance amount is S$34/annum.

Do Like Me on Facebook if you enjoy reading the various investment and personal finance articles at New Academy of Finance. I do post interesting articles on FB from time to time which might not be covered here in this website.

Join our Telegram broadcast: https://t.me/gemcomm

SEE OUR OTHER WRITE-UPS

- DIVIDENDS ON STEROIDS: A LOW-RISK STRATEGY TO DOUBLE YOUR YIELD

- 10 GREAT REASONS FOR REITS INCLUSION IN YOUR PORTFOLIO AND 3 REASONS TO BE CAUTIOUS

- WHY I AM STILL BUYING REITS EVEN WHEN THEY LOOK EXPENSIVE

- 4 WAYS PARENTS CAN HELP THEIR CHILDREN (AND THEMSELVES) TO GRADUATE COLLEGE DEBT-FREE

- THE BEST PREDICTOR OF STOCK PRICE PERFORMANCE, ACCORDING TO MORGAN STANLEY

- PRE-PAYING YOUR HDB LOAN? THINK AGAIN

Disclosure: The accuracy of the material found in this article cannot be guaranteed. Past performance is not an assurance of future results. This article is not to be construed as a recommendation to Buy or Sell any shares or derivative products and is solely for reference only.