In this article, I will bring you through a step-by-step guide in setting up your early retirement plan. Planning your retirement should not be done when you are in your 40s or 50s. The earlier you start, preferably in your 20s, the easier your retirement journey is going to be.

Millennials have been between a rock and a hard place for years. The global pandemic has made matters worse for this generation but there are some steps they can take to improve their finances going forward.

Let’s go through them now.

Early Retirement Plan Step 1: STOP budgeting

Typically, when you feel that your cash flow is out of control, you turn to budgeting. You have been trained to think that a budget is an answer to all your financial problems. That it is the only way to regain control over your financial future. Unfortunately, budgets often do not work. Many of us have probably tried budgeting once or twice in our lives and how many of us can make it stick? My guess: 1% and I am probably being generous.

Budgeting usually means that you track your historical spending, categorize your expenses, forecast your monthly spending, set targets based on those data, and try to live within those limits. Try, struggle, fail, and repeat. Why?

Because this kind of budgeting system is built to keep money at the forefront of your brain all the time, which can be mentally draining. These kinds of budgets have too many rules and involve far too much work. While it might work for some and that’s great, most people will inevitably throw in the towel, stop tracking altogether and end up feeling like a financial loser.

So, what is the SOLUTION to your financial well-being if budgeting is not the right one?

The solution is simple. You just need to figure out how much money you can spend without sacrificing your financial security. This money is what I termed as my CEILING MONEY. Anything beyond this amount and you risk falling off the roof.

So, the next big question then is: How do you determine one’s CEILING MONEY? This brings us to step 2.

Early Retirement Plan Step 2: Calculating your CEILING MONEY

Calculating your ceiling money is another 5-steps process and it goes like this.

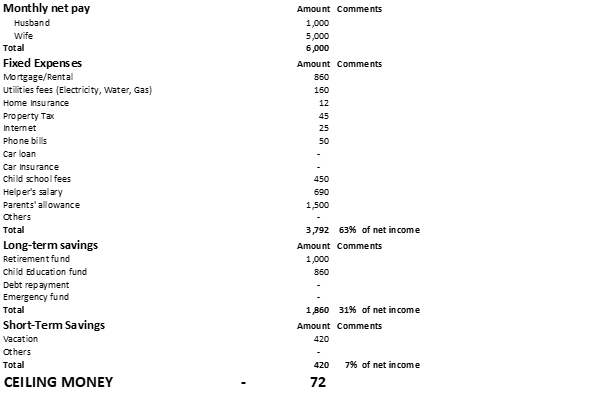

Step A: Calculate your monthly after-tax income.

This is pretty simple and most of you should be aware of what is your monthly after-tax income for your household.

Step B: Add up fixed expenses

This will require some work in terms of rummaging your past 3 months’ bank and credit card statements, looking for the repetitive and predictable fixed expenses each month.

Some of the common household fixed expenses are (not exhaustive):

- Mortgage/Rental

- Utilities

- Home/Personal Insurance

- Property Tax

- Phone Bills

- Car loan/insurance

- Child School fees

- Parents’ allowances

And the list goes on. Build your fixed expenses list. Ideally, your fixed expenses should not exceed 50% of your monthly after-tax income as calculated in Step 1.

Step C: Identify Long-term savings

This is the part where you “pay-yourself-first”. This is where you start saving for your retirement fund or your child’s future education fund.

This is also where you allocate resources to pay down your debt or to fund your emergency savings.

Ideally, it should comprise of 20% of your household take-home after-tax net income.

Step D: Work out short-term savings

Short-term savings should account for approx. 10% of your net income. These are savings with a short-term goal in mind, for example, saving up for a family vacation or to purchase that new iPhone that you have been eyeing for eternity.

Reward yourself periodically so that you will be motivated to keep going.

Step E: Derived your CEILING MONEY

So, you have calculated your take-home net income, your fixed expenses you need to foot every month, your long-term savings that are extremely critical for your future retirement well-being, and your short-term savings to keep you motivated. The remaining amount is your CEILING MONEY and, in my case, that is a NEGATIVE figure.

Well, life ain’t a walk in the park and at times we need to make hard decisions. My current financial picture isn’t the prettiest. It is downright ugly, but at least I finally have a clear idea of my financial situation.

Based on the current scenario (negative CEILING MONEY), I will need to adjust my expenses and savings categories to generate Positive CEILING MONEY which is again critical for my household’s long-term financial health well-being.

This brings us to Step 3

Early Retirement Plan Step 3: Evaluate your Expenses and Savings

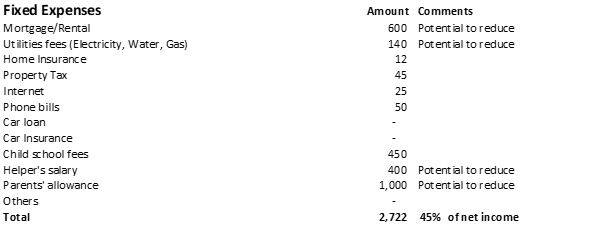

Take out your fixed expense list (which you have done up in Step 2 earlier) again and take another hard look at it. The goal is to make adjustments to bring your CEILING MONEY into a positive number.

Look at ways to reduce your fixed expenses as much as possible and at times, that might mean making sacrifices.

In my example, my fixed expenses used to account for 63% of my net income. After some adjustments, I was able to bring it down to 45%.

With an additional $1,070 free from my fixed expenses, these now go directly into my CEILING MONEY.

With that additional “breathing space”, check to see if you can potentially re-allocate some capital into your long-term savings as well as short-term savings. One can look to target the following allocation

- Fixed expenses: less than 50% of net income

- Long-term savings: above 30% of net income

- Short-term savings: 5-10% of net income

- CEILING MONEY: 10-15% of net income

The next step looks to evaluate if your CEILING MONEY (in my case, I have determined it to be c.$900/month) is sufficient to maintain my current lifestyle.

Early Retirement Plan Step 4: Know that is your Happy Spending

This is where I introduced the concept of spending based on your ROI. Again, this is a 5-steps process.

Step A: Recall your CEILING MONEY from Step 3

Is this amount (in my case $900/month) sufficient to maintain your new lifestyle? Let’s try to find out.

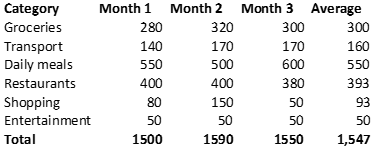

Step B: Calculate your typical monthly spend

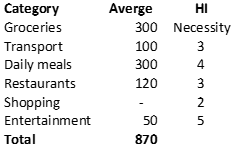

The above might be some of the typical monthly variable spendings. Stuff like groceries, transport (could also be under fixed expenses), meals, etc should be evaluated and averaged out.

In my scenario, it averages out to approx. $1,547 which is substantially higher than my current CEILING money of c.$900.

This is where you might have a problem again. Some items would have to “go” and this is where you rate your spending based on ROI or based on a Happiness Index.

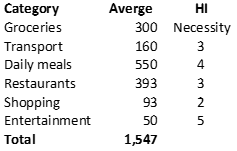

Step C: Rate your average spending based on the Happiness Index

This Happiness Index is a scale of 1 to 5. 1 being spending that you derived no pleasure from while 5 being one where you derived utmost happiness. Beyond 1-5, some spending might be an absolute necessity, for example, groceries and basic toiletries.

Step D: Reduce spending that scores lowly on HI

By trimming down on spending that doesn’t make you happy, you can focus on those with higher ROI or essentially those that you derive great pleasure from when you spend. It could be a monthly night out to the theatres or a fancy restaurant meal? You decide.

Step E: Be mindful and start automating

You now have got specific numbers every month and are no longer “clueless” as to whether you are indeed overspending.

While sacrifices will have to be made in terms of daily/monthly spending, you will feel more confident about achieving financial freedom more so than ever. With the knowledge that your finances are within your control, you are probably ahead of 90% of the population, who are clueless about their money situation.

Most are likely living from one pay-check to another while still having the illusion that they have made it in life by showcasing their glamorous mortgage-ridden assets.

Continue to monitor your progress. The next step (Step 5) will aim to automate your finances so that you will never have to worry about making monthly payments ever.

Early Retirement Plan Step 5: Setting up your strategic automated banking plan

The reason why I believe budget does not work over a long horizon is because most human beings lack the willpower to manually sustain a repetitive course of action, particularly one that we do not enjoy.

Luckily, we are all living in an era where automating such processes is as easy as 1,2,3. Yes, the key to financial success can be made easier with automation.

Step 5 looks to explore a strategic banking plan that will take automate the processes to 1) Ensure all your fixed expenses are taken care of, 2) Paying-yourself-first and 3) have clarity over how much of your CEILING MONEY is left at any particular time of the month.

There will be 3 main accounts:

ACCT SAVE: The main account where your long/short-term savings will reside.

ACCT FIXED: Account where you pay your fixed expenses

ACCT CEILING: Account where your leftover money is for you to freely spend

How to automate your banking plan

When you receive your paycheck, this goes into ACCT CEILING. From this amount, put a standing instruction to transfer $x amount (money you have calculated as your long and short-term savings) into ACCT SAVE. In my example, that is $2,100 every month.

ACCT SAVE is your high-interest savings account (could be using a Robo advisor high-interest account) that you might be able to generate 1.5-2% annual interest.

Next, put another standing instruction to transfer $y amount (for fixed expenses) to ACCT FIXED (easier to be the same bank as ACCT CEILING). In my example, that will be $2,800. This will also be the key GIRO account where you can automate all the fixed expenses like utility bills, HP bills, etc.

Hence, from the very day in which I receive my paycheck, I automate 2 transfer processes, one to ACCT SAVE and the other to ACCT FIXED.

The remaining amount will thus reside in ACCT CEILING and this is the amount which I have absolute visibility on and I will know how much I am entitled to “guilt-free” spending each month to run this account down to ZERO.

Early Retirement Plan Step 6: Build up your emergency bucket

This is Cold, Hard Cash that is kept in separate high-interest savings account from another financial institution that is different from ACCT SAVE/ACCT FIXED/ACCT CEILING.

This should be kept in a separate account so that you don’t get tempted to spend it. It’s for emergencies like, say, your house burning down, a family health issue, you losing your job (thus leaving you without income for a few months).

And it is a good feeling knowing that you have a separate pot of money that can be your “get out of jail free” card when you most need it.

There isn’t any hard and fast rule for how much you should keep in your emergency fund.

Most people should target to have an emergency fund big enough to cover at least 3 months of your living expenses.

For example, I know that my fixed expenses amount to roughly $2,700/month. In the event of an emergency, I can reduce that to $1,700 (putting on hold the allowance to my parents as I know they have got sufficient nest egg).

Hence, my reasonable Emergency bucket amount would be roughly $5,000 and that will be what I am targeting.

Early Retirement Plan Step 7: Build up your Investment bucket

After building up your Emergency bucket, that is where the real excitement begins!

It is now time to build up your investment bucket.

The truth is when it comes to investing in the stock market, it’s akin to gambling for the man-in-the-street.

You might have dabbled in the stock market before, purchasing stocks based on a “hot” tip by your neighbor and getting your fingers “burnt” in the process.

Most people tend to “fail” when it comes to the art of investing. It is not because investing is DIFFICULT. It should be a “brainless” activity, one which you do on a recurring and automated basis without putting much thought into it.

Implementing a successful do-it-yourself investing strategy to build up your Investment bucket and achieve financial independence comes down to just a few simple steps:

- Invest most of your capital in stocks, especially if you are starting your investment journey early.

- Use a low-cost, passive investment strategy

- Stay Invested

- Re-balance your portfolio when necessary

Remember, building up your Emergency bucket (introduced in Step 6) provides you with a financial safety net but it is more of psychological comfort. Successfully managing your Investment bucket will be the crux to achieve financial independence at the end of the day.

The big question is how much to invest to reach financial independence? How long will that take if you start today? I answer that briefly in Step 9. But before that, let’s take a brief look as to how one can start making more money with just a couple of hours of work.

Additional Reading Resources:

How to prepare for a bear market. A simple 3-steps process

Let the Power of Compound Interest help you reach millionaire status

Early Retirement Plan Step 8: Start making more money

I believe that by now, some of you might have heard of the wise advice to “cut your daily latte and invest that money if not you will be pissing hundreds of thousands of dollars down the loo”.

Yeah!

Additional Reading Resources:

Is drinking latte really costing you $1million and the chance to retire well?

The truth is, there is a limit to how much we can save. What is the point of scrimping and saving for years and end up DEAD? Yes, we all come into this world waiting to DIE. If we restrict ourselves to the small pleasure of enjoying a cup of coffee every day, what is our purpose of living?

We want to have full control of our finances, but not at the expense of the little pleasures in life. If you want your cup of latte every day to increase your productivity, I say go for it. If you want to indulge in an “atas” dinner for that special once a year occasion, I say go for it.

If you have followed my step by step process, you will be in a more than comfortable position to “celebrate” minor wins every with these expenses.

But what happens when you start running down your ACCT CEILING to zero before the next paycheck arrives?

Then it is time to start making MORE money.

Listen: there’s a limit to how much you can save, but there’s no limit to how much you can earn. If you want to drink a latte a day or a bottle of champagne every night – all power to you!

Just make the conscious decision to turn your income tap and let the money gush out into your buckets. Let me show you how to make an extra $5k/annum with just a couple of hours of work.

How to earn an extra $5,000 in a couple of hours

Commit: If you are going to earn more money than you did last year, you need to do things you have never done. You need to commit to being the very best in what you do. You need to be the go-to person whenever your boss needs help in your area of expertise because you are the best in what you do. This means committing hours and hours of hard work to hone your skills.

Do your homework: One week before your performance review, take out your position description and look at it from your boss’s point of view. Most jobs can be boiled down to just a few key fundamental tasks. Write them down and make sure that over the next 12 months, you set an ambitious goal to not just perform “well” in these tasks but really “excel” in them.

Take control of your performance review: You may be that one person in the entire organization who is prepared for that performance review. Go in prepared with a list of factual reasons why you should be getting paid more. Also, have a list of prioritized tasks and goals and genuinely ask your boss for feedback. You want to devote your time and commit to being the best at your tasks over the next 12 months, so you want to be crystal clear that you and your boss are on the same page.

Put your goals in your calendar: You now have your ambitious 12-month goals, so put them in your calendar as a daily reminder. The key to progress is doing a little every day and tracking your progress. You will be surprised how much you can get done by focusing on your goals rather than bitching about your boss.

Casually follow up with your boss periodically: You want to frame it in your boss’s mind that you are hungry but yet humble at the same time. Causally follow up with your boss instead of looking like a desperado looking for a second-date. Be cool as you show your boss/es your progress and “inform” them that you are more than ready to take on that added responsibility which will more than justify your next pay raise.

So how long does it take you to plan Steps 1 to 5? Probably a couple of hours of careful planning. Yes, that is probably all that is required to bank that extra $5,000 over the next year.

While the planning process might just entail a couple of hours, it is the commitment to execute your very best over the next 12-months that will ultimately help you achieve that pay-off.

So stop for a minute and think about what a difference this could make to your life.

Then shut down Facebook, or Instagram and JUST DO IT.

Early Retirement Plan Step 9: Pen down your date of financial freedom

Now is the time to do some calculations and find out when you can achieve that coveted Financial Freedom that so eludes the vast majority who remains trap in the rat race.

To calculate your financial freedom date, there are a couple of things you need to do.

Step A: Have an idea what your monthly retirement expenses might be like

Step B: Find out this sum in future dollar terms

Step C: Calculate how much you need from retirement to death

Step D: Calculate your pension payout

Step E: Calculate your required monthly investment amount

Step F: Find out when you can finally escape the Rat Race

Based on my calculation, for a 30-year old, if you invest approx. $490/month, you should be able to retire at Age 65 while “comfortably” meeting your future retirement liabilities, based on a retirement expense of $2,000/month in today’s dollars. This calculation makes certain key assumptions, the two most critical being 1. inflation rate and 2. Average market return.

I will be engaging more on Step A-F in a separate article while also introducing a nifty retirement spreadsheet that you can use to calculate your date of financial freedom.

Additional Reading Resources:

A Step-by-Step Guide to figuring out your retirement sum

Conclusion

Human beings tend to be “lazy” and that is why I believe a conscientious effort to continuously track your budget will not work for the masses in the long run.

What you should do instead is to take sit down with your spouse in a relaxing environment and spend the next 2-3 hours sorting through your key expenses and nailing down your HAPPY SPENDING and ultimately your CEILING MONEY.

Work towards automating every single step of this early retirement plan and you will realize that managing your money will become a breeze.

Last but not least, if you aim to exit the rat race early, there are only 2 solutions available. Either you 1. Strike the lottery or 2. Start Investing. I prefer to place my “bets” on Point 2.

At the end of it all, you can master your finance and yet enjoy the process. Take some time off to celebrate the little successes that you have achieved in better managing your finances. That will motivate you to strive for “greater heights” and aid in your early retirement plan.

This article is meant to be a sharing session from my own personal money management exercise and is not a fool-proof “one-size-fits-all” method that is suitable for everyone. Different people’s financial situation is unique and at times it will be better to seek the assistance of licensed financial planners to manage your financial situation.

I am not a licensed financial planner and don’t plan or claim to be one so take my “advice” with a pinch of salt.

Do Like Me on Facebook if you enjoy reading the various investment and personal finance articles at New Academy of Finance. I do post interesting articles on FB from time to time which might not be covered here on this website.

SEE OUR OTHER STOCKS WRITE-UP

- Singapore Property: JP Morgan says a fall of 10% is likely. To buy or not to buy now?

- Ultimate Robo advisors Singapore Guide. Key facts you need to know (2020)

- Full Retirement Sum (FRS): > S$400k by 2050.

- Home Protection Scheme (HPS): What you need to know

- FSMOne Fees: the cheapest regular savings plan (RSP) for ETF (2020)

Disclosure: The accuracy of material found in this article cannot be guaranteed. Past performance is not an assurance of future results. This article is not to be construed as a recommendation to Buy or Sell any shares or derivative products and is solely for reference only.