Table of Contents

Do Like Me on Facebook if you enjoy reading the various investment and personal finance articles at New Academy of Finance. I do post interesting articles on FB from time to time which might not be covered here in this website.

Join our Instagram channel for more tidbits on all things finance!

Saving your First 100k is not that Difficult

Just as a person cannot run without first learning to walk, one cannot start investing without first learning to save money.

The good news is that the hardest thing about saving money is just getting started.

Twenty years from now, you will be more disappointed by the things that you didn’t do than by the ones you did do.

So don’t be afraid to make mistakes – be afraid of inaction. Now is the time to push yourself to make a change in your financial journey because we will tell you how to do so wisely.

This step-by-step guide on how to save money can help you develop an easy and realistic strategy for all your short- and long-term savings goals.

After reading this article, who knows? Saving your first 100k in 5 years may not seem like such a far-fetched goal anymore.

Step 1: Knowing How Much To Save?

The first step to saving is to determine exactly how much you should save.

The Short Answer: Follow the 50:30:20 rule.

According to this method, at least 20% of your income should go to your savings. If you can do better, that is awesome; if you cannot, it is also fine, but it may mean you have to save for more years for more money.

At least 20% of your income should go towards savings

The other 50% of your income should buy you necessities, while the remaining 30% goes towards discretionary items, such as your AirPods and movie tickets. Life isn’t all about scrimping. Reward yourself from time to time with the little pleasures in life to get the motivation going.

Step 2: Set Savings Goals

“Alice: Would you tell me, please, which way I ought to go from here?

The Cheshire Cat: That depends a good deal on where you want to get to.

Alice: I don’t much care where.

The Cheshire Cat: Then it doesn’t much matter which way you go.”

The 50:30:20 rule provides a quick and straightforward way for you to save your money. However, to determine the exact amount to save in your bank account, you need to examine your personal financial goals.

Short Term

Think Liquid

Building a “rainy day” liquid fund is an essential step before you start investing your money.

Imagine putting all your savings into the stock market which is currently undergoing a “bear moment”. You find yourself requiring cash for an emergency. Without a liquid fund as a buffer, you are forced to sell your investments, likely at a loss. But if you have a cash cushion, you can fall back on this “safety net”.

In general, your emergency fund should cover at least 3 months of your living expenses.

Saving this sum of money is not necessarily a daunting task. Follow the 50:30:20 rule as a start and allocate all your savings (20%) to first build up your 3 months cash cushion.

You can select to save your rainy day fund in a high-yield saving account that is liquid. Many Robo Advisors offer cash management services that might serve as a higher yield alternative (3+%/annum) vs. your typical bank savings account (0.05%).

However, do note that your capital is NOT capital protected and there are risks associated with these higher-yielding instruments. Check out my article here on Robo Advisors’ cash management services: Robo Advisors. High Cash Management Rate Just a Marketing Ploy?

My advice is not to be greedy and go for the highest-interest account. Instead, stick to those offering a “fair return” of 3 %/annum.

Long Term

Retirement

Retirement savings is the goal with the longest time horizon and usually demands the most savings. Generally, it is considered prudent to save 10-15% of your income each month, specifically for retirement savings. Over the long run, the compound interest adds up and can multiply your funds rather substantially.

Once you have built up your cash cushion (3 months’ worth of expenses), you can allocate 50% of your intended savings toward your retirement account (more on that later)

For those interested, I have formulated a 9-step early retirement plan to get you from zero to a hero within the shortest amount of time.

Additional Reading: Early Retirement Plan – A 9 Steps Ultimate Guide

Other Financial Goals

With retirement and emergency funds out of the way (2 of the most important savings you need to prepare for), what is left are your other major financial milestones in life, ranging from buying a car, going on vacation, clearing a student loan debt or credit card debt, and saving up for your kid’s education fund, etc.

Estimate how much you have to save for each of these goals by following these 3 steps:

- Write down the cost of your goal

- Determine when you want to meet the goal

- Divide the cost by the number of months left

As an example, suppose you plan to purchase a car in ten years. The steps are as follows:

- Goal: pay for a $100,000 car in cash (assuming you have accounted for inflation)

- Timeline: 10 years

- Result: you will need to save $833 per month.

As you go through these financial goals, at some point you might realize that you cannot possibly save enough to meet every goal.

You now have two solutions to this problem:

- Earn more money

- Manage your spending

Step 3: Earn more by turning your Passion into a Side-Hustle

“If you are not willing to risk the usual, you will have to settle for the ordinary.”

Being mediocre is easy. It takes hustle and works to fulfill your dreams. And what better way to increase your savings than making more money through a side project?

From engaging in tutoring to reselling items on Carousell or eBay, there are so many ways you can earn extra income or generate a passive stream of income.

The key to making it successful is to know your strengths and be creative in thinking of ways to monetize the hobby or skills you already possess.

Perhaps you are classically trained in piano. It could be a good idea to tutor kids out there who want to learn piano. Maybe you are into photography. Why not sell your best photos online in exchange for a fee?

Whatever your strength is, you can make a side income out of it as long as you are innovative and willing to commit time and effort. As you start making more money, you can channel it to your savings and watch it grow.

Step 4: Track Your Spending

While earning money from a side project is a clever way to add to your savings, a much simpler and often overlooked alternative is to manage your spending.

Chances are, without tracking your expenses, you have no idea how much money you are spending, and you have no concrete way to control it.

By tracking your expenses, you are building a methodical system where you can monitor your progress as you save and invest in your financial goals.

You are also holding yourself accountable for your bad financial choices, allowing yourself to identify and eliminate your wasteful habits.

Ever heard of “the latte factor”? The term refers to the phenomenon where people continually spend money on small purchases, like a latte, which adds up to a surprisingly large amount over their lifetime (as much as 1 million).

The math is perfectly right, and many personal finance experts would advise against succumbing to the temptation. But because there is a good chance these same experts were sipping a hot latte from Starbucks while they wrote that advice, we would like to offer an alternative solution.

Additional Reading: Is drinking a latte costing you one million and the chance to retire well?

Discovering Unnecessary Spending

We all need to satisfy our inner splurge demons once in a while. The point of tracking your spending is to save on what matters to your overall finances.

This could mean coming face to face with the fact that you are paying $50 a month for a cable subscription that you barely even touched in the past year. Or it could mean realizing that you are paying for some insurance you don’t need, such as identity theft insurance or travel insurance when your credit card already provides it.

The biggest opportunity for tracking your spending lies in cutting out the unnecessary spending that you have overlooked. And that is an easy win.

How To Track Your Expenses

Here’s a simple three-step process for tracking your expenses:

- Find a platform that suits you. This could be free-to-use applications like Mint, YNAB, Wally (for iPhone users), or even a simple spreadsheet you can create on your own.

- Monitor your expenses for a month. At the start, refrain from rushing to make any changes or judgments – just watch.

- Review and make changes. With knowledge of your prior spending habits, you can begin to filter out the non-essential expenses. Start from your highest expense, and ask yourself: does this align with any of my financial goals? If the answer is no, try to reduce the size of it or eliminate it.

To be honest, I am not a big fan of having a budget or an expense-tracking mechanism where we keep track of all our daily expenses, down to the dollars and cents. For most of us common folks out there, we lack the willpower to engage in such detailed monitoring for a prolonged period of time.

What I am advocating above is to be able to identify the “unnecessary” expenses, and remove them from our spending. That again does not imply cutting off the “daily lattes” if these mini-luxuries so satisfy your daily cravings.

Once you have achieved that, you can move on to Step 5 by automating your savings and investments every single month.

Step 5: Automate Your Savings/Investments

The number one rule to smart saving is to “pay yourself first”. The concept is simple: every time you receive your paycheck, the first thing you do is set aside a percentage of your income in a savings account.

If you can’t trust yourself to pay yourself first, best automate your savings.

This way, the money left in your account will just be the money for bill-paying and spending. You won’t have to worry about the temptation of spending money you should be saving.

This is typically what I do when I receive my paycheck every month:

Step 1: I will put in a standing order for my receiving bank to transfer 20% of my paycheck into a high-yield savings account like the cash management account offered by my favorite Robo Advisor. All 20% will be allocated to building up my Emergency Fund.

Step 2: Once I have achieved my Emergency Fund target, the next step is to save for both my short-term and long-term goals. This could be an equal amount of 10% each (based on my 20% saving ratio). The 10% short-term goal could be left to compound alongside my Emergency Fund at approx 3 %/annum in the Robo Advisor cash management account.

Step 3: I will transfer the remaining 10% from the cash management account to the investment account offered by the same Robo Advisor. This is to INVEST, with the aim of achieving my long-term goal of early retirement.

By automating the savings/investment process, I no longer leave it to my “willpower” to save every month. I know I am doing it automatically. What is leftover in my bank account is money that I can use to pay the bills and indulge in life’s mini-luxuries.

Refer to this extremely detailed 9-step retirement plan for more details on how to achieve an early retirement.

Is Saving Your First 100k in 5 Years Realistic?

Now you are equipped with the knowledge of how to save more money and allocate them towards investments AUTOMATICALLY. It is time to answer the question: Is saving your first 100k in 5 years a realistic goal?

I am not able to sugarcoat nor give NAOF readers unrealistic expectations. It is possible but challenging, particularly for someone who has just entered the workforce.

Based on certain assumptions which I will elaborate on later, it will entail an average saving of $1,550/month. Assuming that one saves 20% of his take-home pay, that represents a total take-home income of $7,750 which is not exactly plausible when one just started entering the workforce unless he/she is a high flyer.

This would mean that one will need to increase the savings rate way beyond 20%. Assuming a 50% saving rate, that will equate to a take-home pay of $3,100. If you are young with few financial commitments, this is potentially within your means, and don’t forget that the factor of compound interest can still fall into your play, particularly if you start early.

Alternatively, look to increase your savings through the side hustles mentioned in Step 3 or cut your spending in Step 4.

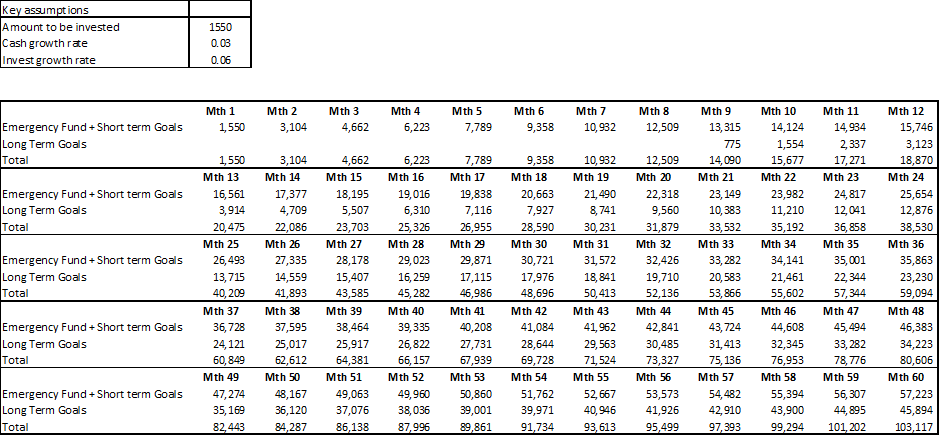

The key assumptions I used here are:

- A fixed amount of $1,550 will be saved/invested monthly for the next 5 years.

- Full monthly savings contribute to building up Emergency Fund for the first 8 months

- Subsequent savings are equally distributed between short-term savings ($775) and long-term investments($775). No increase in savings allocation.

- Short-term savings/Emergency Funds generate a return of 3%/annum while long-term savings are invested in the market and generate a return of 6%/annum

Your target of 100k in savings would be achieved in Month 59. Quite possible with the right strategy. If one is more aggressive in his/her savings regime ie saving more than $1,550/month, that 100k goal can be achieved much earlier.

To summarize, saving your first 100k can be made easy through these simple 5-step processes:

Step 1 is knowing how much to save. As a rough guide, one can start off with saving 20% of your paycheck as an initial goal. If you are young with little commitment, you might want to be more aggressive and increase that percentage amount.

Step 2 is setting a savings goal so you are absolutely clear about what you are looking to achieve so you can better allocate your savings accordingly.

Step 3 and 4 is to look to increase your savings rate, either by engaging a side hustle to generate more income or to reduce your spending. Either one of which can help to supercharge your savings and help you achieve your goals sooner rather than later.

Step 5 is to automate your savings and investment process and let compound interest work its magic.

Supercharging the savings/investment process

In the above example, one will need to “boost” the savings process by investing the portion of his/her capital set for “long-term goals”. Without investing in the market, with the assumption of an annualized 6% average return, it will be a challenge to achieve that 100k savings target within 5 years.

Unfortunately, generating a 6% annualized return through a passive investing approach might no longer be that achievable in the coming decade and I explain why that is the case in this 3-part video series.

A faster way to supercharge your savings and investment process is instead to identify high-quality blue-chip stocks and know when is the right time to invest in them. These stocks have consistently generated annualized returns of 20%!

For those who are interested in learning more about this simple process I regularly used to screen for high-quality growth stocks, do hit the button below for more details:

Disclosure: The accuracy of the material found in this article cannot be guaranteed. Past performance is not an assurance of future results. This article is not to be construed as a recommendation to Buy or Sell any shares or derivative products and is solely for reference only.