5 Ways to Make Money in a Bear Market

Here are 5 ways to make money in a bear market: Strategy #1: Invest in the right asset. Strategy #2: Opportunistic short term opportunities

Here are 5 ways to make money in a bear market: Strategy #1: Invest in the right asset. Strategy #2: Opportunistic short term opportunities

Who needs a bull market when you can generate steady short term returns using the covered call strategy for income

Here are the 4 reasons why we are still in a bear market bounce in 2023: 1) Expect earnings to decline amid a recession, 2) Increase in consumer debt

Do Like Me on Facebook if you enjoy reading the various investment and personal finance articles at New Academy of Finance. I do post interesting articles on FB from time to time which might not be covered here in this website. Join our Instagram channel for more tidbits on all things finance! SEE OUR OTHER VIDEOS Disclosure: The accuracy of

Best Seasonal Stocks to Buy For January As is often said, timing is everything in life. This adage also applies to business and investing. Add the right stock to your portfolio at the perfect time and you’ll reap the financial rewards. The challenge lies in timing your entry into new positions to minimize risk and maximize

Is Tesla stock buy or sell at a price of $60, 40% discount from its current price level? How would a strategy to get paid while you wait sounds?

Find out why a passive investing strategy using the S&P 500 index funds will no longer work as well in the coming decade and what you need to do now

3 Key lessons you need to know from the hyper growth stocks crash. Lesson #1: Beware of hyper growth stocks that are loss-making

What is the difference between good share buyback and bad share buyback? In this article, I will highlight 4 companies that are engaging in share buyback the right way

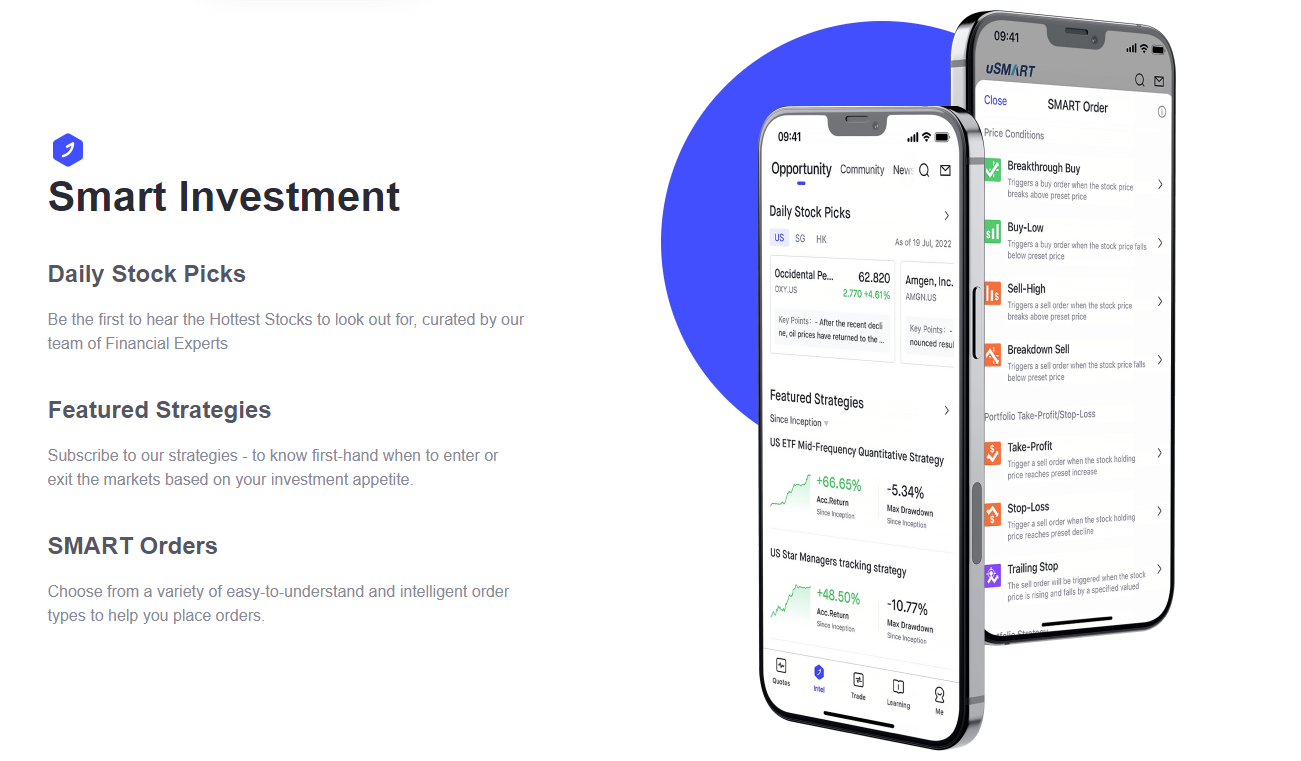

uSMART’s SMART Orders Have you ever been in a situation where you have done so much due diligence and research on a particular investment play such that regardless of what methodology of analysis was used, you have it right down to the numbers and parameters and it looks something like this: Stock ABC Target Entry

How would you look to invest when all asset classes are falling? Amid the current Great Market Sale which is still ongoing, how should we look to invest?

What are ETFs? Exchange Traded Funds or ETFs for short, are often associated with index-tracking funds that trade on the stock exchange like shares. Their tracking feature means that the ETFs hold a basket of shares that match the index. For example, one cannot theoretically buy directly into the S&P 500 index, the most popular

Master the market cycle to supercharge your returns There is a famous saying that goes: “It is futile to time the market. It is time in the market that matters.” Or perhaps you have heard the saying: “The only thing that matters in long-term investing is the company’s fundamentals.” However, while you might not be

Robo Advisors Singapore We know we have got to start investing. Problem is, we DON’T KNOW how to get started. That might be a problem in the past but it is no longer one with Robo Advisors coming into the picture. What are Robo Advisors? Robo advisors are digital platforms that use algorithms to automate

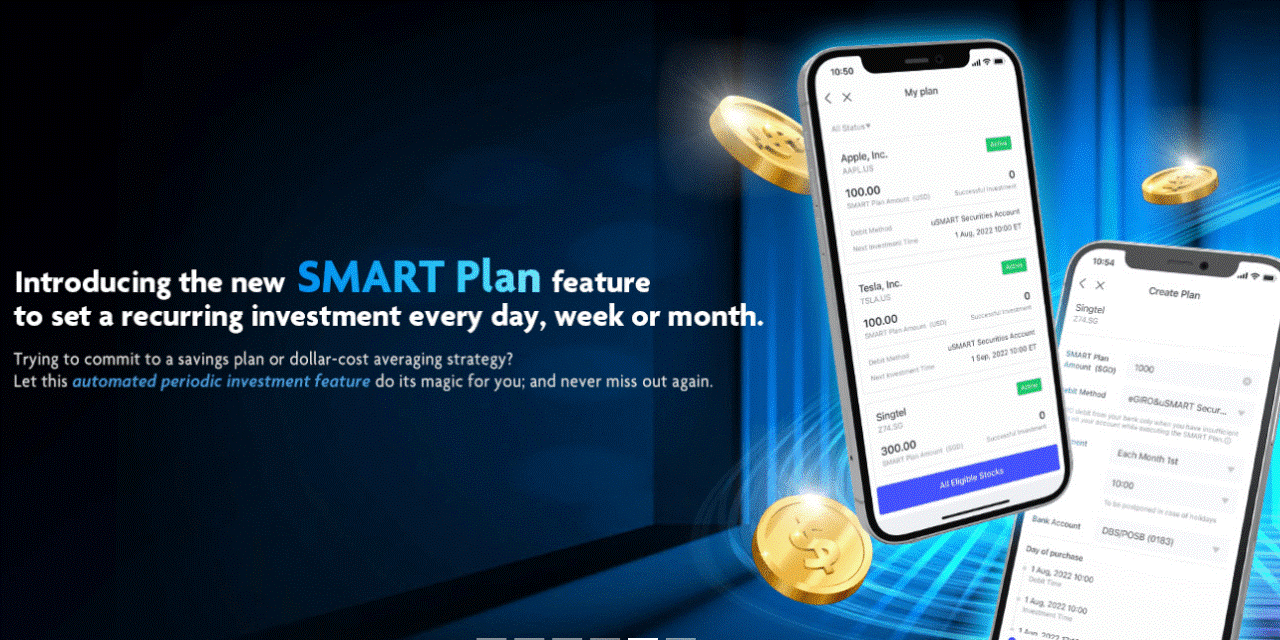

How to engage both Dollar Cost Averaging and Fractional Investing the easy way Imagine you are gifted $18,000 to invest in 2007. You are given 2 strategies. The first strategy is to Lump Sum invest your $18,000 into the S&P 500 ETF (ticker: SPY) and the second strategy is to engage a Dollar Cost Average

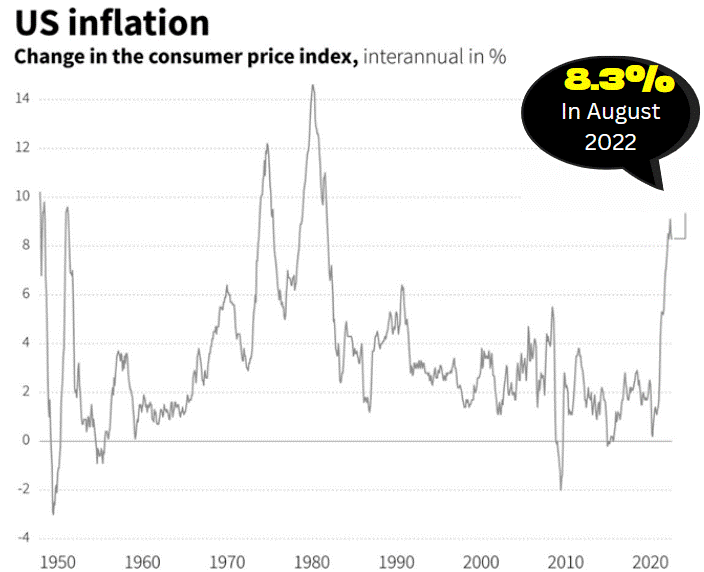

The market has had its most significant drawdown since June 2020, with every sector deep in the red. The key factor driving lower markets was undoubtedly inflation, or how sticky it was. Back in early September, I wrote this article: Has inflation peaked? Don’t bet on that. My thesis was that while inflation showed a