How to invest when everything is falling

It seems as if all the markets can do of late is drop. When you read headlines such as those below, you know that something is amiss.

Well, seems like every dog has got its days and while a +1% YTD performance is nothing to shout about in a normal context, when compared against global developed peers which are down by more than 20% YTD, Singapore’s +1% performance now seems like a big deal.

Can the Singapore market’s outperformance last? Only time will tell.

It is only natural for us human beings that, when there is so much red flashing in the markets, the natural reaction would be to stay away at all costs.

The pessimist in me will concur. “Sell everything and get out first as there will be more pain ahead”.

However, the other part of me has got to be thinking: “what if my pessimistic self is wrong and we are prime for a rebound?” Shouldn’t I continue to stay vested with a long-term horizon in mind, since the market has shown to ALWAYS generate positive returns in the long run? My future self will thank me for buying today when everyone is so fearful, am I right”?

A common dilemma

This is likely a common dilemma that every investor out there is facing at present. Get out or stay invested?

If I may just look into my crystal ball (and this is a “shot in the dark”), I would say there will likely be more pain ahead. A part of me is saying that I should totally cash-out.

Nonetheless, I remain partially vested. Why so you might ask? Because I know from past experiences that if I indeed do stay out of the market totally, I will never get back in until it is deemed too late (ie market has rebounded substantially).

And because I have already “missed the boat”, the natural reaction is to remain on land instead of boarding the next boat.

No action will be taken and this is where my FUTURE ME will look back at the past and lament.

I don’t wish to make the same mistake. Hence, I continue to partake in the market but of course with a strategy in mind.

Before I elaborate on that strategy, let’s just go over the key points as to why almost everything (the exception being the US Dollar) is selling off right about now.

Why is everything selling off now?

The main culprit as we all know by now is INFLATION. This is a new phenomenon for younger investors who have never experienced a prolonged period of high inflation, like what we are seeing at present.

We have all gotten comfortable with inflation being benign for the past two decades. But inflation risk is now pretty evident. From our daily necessities, food, petrol, and rentals, everything has gotten more expensive.

And the fear here is that if high prices persist, that will lead to a recession (Europe is already in one) and the dreaded scenario of STAGFLATION, which last bore its ugly head in the 1970s. This is an environment where GDP growth is negative while prices continue to stay elevated.

The result: Sufferings for the man-in-the-street where expenses are rising much faster than their income.

Consequently, the Fed is looking to battle inflation by the act of raising interest rates. Higher rates ==> higher product/service cost ==> lower demand ==> lower prices. Or at least that is what the Fed is looking to achieve here.

Those two data, 1) Inflation and 2) Rising interest rates are the components fuelling a sell-off in just about every asset.

Stocks suffer as inflation tends to erode the margins of corporations. Most companies will not be able to pass on higher input costs to end customers fast enough. Earnings start to disappoint and the street will rush to downgrade their forecast.

Bonds suffer as rising interest rates are negatively correlated to bond performance

Commodities, which tend to do well, or are often seen as a preferred asset class to hedge against inflationary risks, are also suffering at present because of the fear of a recession triggering demand destruction.

Everything seems to be falling except for the US Dollar. Even CASH is worth less TODAY vs. TOMORROW in an inflationary environment like what we are witnessing.

Base case vs. Worst case vs. Best case scenario

Base Case

Looking into my crystal ball once again, the worst-case scenario will be one where the high-interest rate persists for the rest of 2022 and this will result in the Fed maintaining its hawkish stance, thus pushing the economy into a recession.

Jobless rates will start to rise and as consumers get increasingly conscientious of their financial situation, demand will fall off the cliff and that will result in lower prices (aka lower inflation) based on the supply/demand concept.

This is when the much talked about Fed Pivot will likely happen, with the Fed cutting interest rates to support the economy and the job market.

In such a scenario, all asset classes such as stocks, bonds, and commodities could continue to suffer in the interim but could rebound strongly when “Fed tapers” start once again.

Those who are prepared and have the ammunition and courage to BUY when everyone else is selling, he/she will be hugely rewarded when that rebound truly materializes.

Worst Case

This is a scenario that could happen as a result of the current Russia-Ukraine War persisting or even other nations joining in the fray. The key one will be a China-Taiwan skirmish, with the US taking a direct involvement.

The US has so far avoided being “directly” involved in the ongoing Russia-Ukraine war, with its part being the supply of weapons to Ukraine to help them repel Russian forces.

If there I going to be a China-led skirmish with Taiwan, the US is unlikely to be just a “weapon supplier” but could be directly involved as a result of potential “shared interest”, with Taiwan being the largest supplier of semi-chips to the world.

High inflation can no longer be countered by demand destruction as this will now be a global supply problem, similar to the effects of COVID-19 which have always been deemed transitory but its effects on the global supply chain are still be felt to this very day, almost 3 years since the start of the pandemic.

This is no longer a case of an interim sell-off in all assets. With inflation remaining high as a result of supply-led issues and the world plunging into a major recession, or possibly depression triggered by global wars, all assets will likely see a prolonged decline in value. Government Bonds and precious metals could, however, be the first to recover.

Best Case

The Fed manages to raise rates just enough to slow down inflation, without tipping its economy into a recession. While JP Morgan CEO Jamie Dimon has warned that the US is likely to tip into recession in 6-9 months-time, by some miracle, if a soft landing can indeed be orchestrated, that will be the dream scenario that the bulls will be praying hard for.

In this case, stocks, commodities, and even bonds are likely to do well.

I am sticking to a base-case scenario. That means I am NOT ALL-IN on stocks, bonds, or commodities as I don’t think a rebound is imminent. But neither am I just sitting by the sideline in cash.

I am preparing myself for the Great Market Sale.

How to take advantage and profit from this market

The truth is, no one has got that perfect hindsight to say that the market has truly bottomed, not till it is extremely evident, by which the market will already have appreciated significantly from its bottom.

Given how aggressive the Fed currently is in its attempt to tame inflation at all costs, and I don’t think there is a chance that Cathie Wood’s open letter will be heeded by Mr. Jerome Powell, there’s a fair chance that everything sells off a bit more or much more for the rest of 2022.

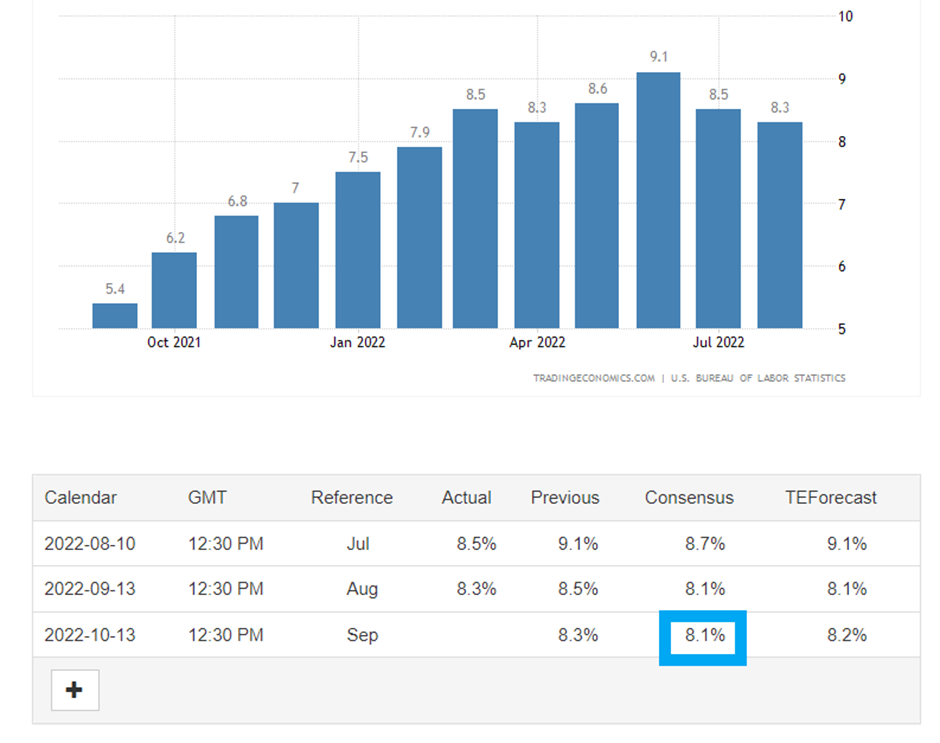

All eyes will be on the upcoming CPI figure to be released on Thursday 13 October (expectation is for YoY inflation to rise by 8.1%) as well as the subsequent 3Q22 results announcement in Oct/Nov.

A persistently high CPI figure could kick off the first silo of the next round of sell-off, followed by earnings disappointment as the reality of high inflation eating into corporates’ margins is now increasingly evident.

Short-term wise is likely to be volatile, to say the least.

However, if you have got spare cash to invest, then you should be looking at every fall in asset prices as an opportunity to build a robust portfolio at a discounted price for the long run.

For equities, I would be looking to invest in high-quality alpha blueprint stocks in tranches at 1) regular time intervals or 2) if the price hits my target level.

Take, for example, I have got $6k allocated to invest in a high-quality stock which I am confident of investing in the long run.

Instead of investing all $6k in one go (I am not that bullish, yet), I would divide it into 3 parts. I would invest the first part today and invest the 2nd and 3rd parts in 3 months and 6 months from the date of my first investment respectively, or if the stock has fallen by 20% or 40% respectively, whichever comes first.

Assuming that 1 month after my initial $2k investment, the counter dropped by 20% as a result of a broad-based market sell-off that hasn’t structurally affected the stock’s fundamentals, I would deploy the 2nd $2k investment.

If the stock continues to maintain or even appreciate subsequently, I would deploy the 3rd and final $2k after 6 months of my initial investment.

In this way, I have managed to capitalize on a lower price (when there is blood and fear everywhere) for my second tranche. On the flip side, when the price recovers, I will still be looking to enter my 3rd tranche, just not at the bottom. The most I missed is the first few months of positive returns from the stock bottom.

Selecting the right stocks – Alpha Blueprint Stocks

The above that I highlight is a simple portfolio positioning strategy. The goal here is to remain vested and partake in the long-term appreciation potential of the stock market but yet ensure that we are not over-leveraged on a particular stock at any single point in time.

The challenge, however, is to find the right stock to be buying when everyone else is selling.

This is where if you can capitalize on the market weakness of top-notch blue-chip stocks that are the market leaders in their respective industries (but not necessarily immune to a bear market), you will stand to outperform the market significantly when the rebound happens.

These are stocks that are highly profitable.

These are stocks that are generating tons of cash to fund their operations organically or the bandwidth to engage in M&A activities.

These are stocks that are not affected by a rising rate environment as a result of their strong balance sheet.

These are stocks that are LONG-TERM SURVIVORS.

For those who are interested to capitalize on some of these high-quality stocks that are now trading at a substantial discount as a result of Mr. Market’s tantrums, do check out the link below to find out more about Alpha Blueprint Stocks.

Conclusion

While I believe it is early days to call a market bottom and the start of a new bull market, not with CPI figures remaining stubbornly high and the Fed’s persistent hawkish stance to fight inflation, I am also not staying totally out of the market.

Instead, I am waiting for that Great Market Sale to happen. The sale is actually already underway, with the Nasdaq index down > 30% from its peak and the S&P 500 index down > 20%.

As the sale intensifies, I will be readying my ammunition to deploy, based on the portfolio positioning strategy I have highlighted earlier, on my Alpha Blueprint Stocks. I am confident that my future self will thank me for the action that I am taking today.

Do Like Me on Facebook if you enjoy reading the various investment and personal finance articles at New Academy of Finance. I do post interesting articles on FB from time to time that might not be covered here in this website.

Join our Instagram channel for more tidbits on all things finance!

Join our Youtube channel for short and sweet videos on all things finance!

SEE OUR OTHER WRITE-UPS

- GUIDE TO SYFE AND HOW TO OPEN AN ACCOUNT IN LESS THAN 10 MINUTES

- SYFE GUIDE: DID SYFE’S ARI ALGORITHM OUTPERFORM IN TODAY’S MARKET VOLATILITY?

- Pricing Power: Stocks that can do well amid inflation concerns

- 5 Small-Cap US Stocks with 10 years of consecutive earnings growth

- How to invest in Dividend stocks

- 9 Strong Free Cash Flow Stocks that you need to own

Disclosure: The accuracy of the material found in this article cannot be guaranteed. Past performance is not an assurance of future results. This article is not to be construed as a recommendation to Buy or Sell any shares or derivative products and is solely for reference only