Read this essential guide that decodes basic investing terms for a smoother investing journey. You can check out Part 2 here.

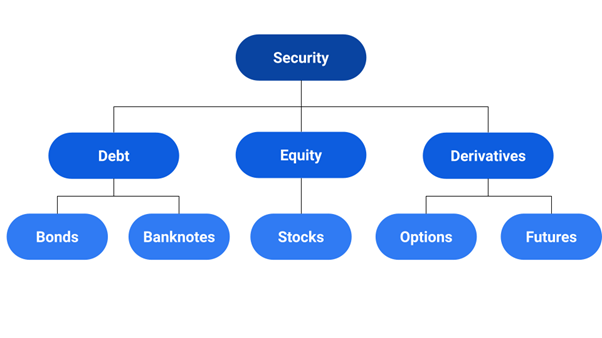

1. Security

A security is any financial asset that can be traded. Most tradable stock market assets you have heard about – including stocks, bonds, and options – are all considered securities.

There are three main types of securities:

- Debt securities – which includes bonds and banknotes

- Equity securities – which includes stocks

- Derivatives – which includes futures and options contracts

2. Equity, Stock, Share

A stock (also known as equity) is a security that represents the ownership of a portion of a company. Individual units of stocks are known as shares.

For a beginner, it is sufficient to know that equities, stocks, and shares are used interchangeably.

However, there are minute differences between the terms. Read on if you are interested to find out.

Stock vs share: If you invest in Amazon stock, you would say “I own stock in Amazon (NASDAQ: AMZN).” However, to convey the exact number of ownership units you have, use “I own 100 shares in Amazon.”

Stock vs equity: Generally, stock refers to traded equity. When equity shares of a company are listed on stock exchanges (like SGX, NYSE) to be traded, it is termed as stocks.

3. Blue-chip stock

Blue-chip stocks are simply the stocks of large and reputable companies. Think names like Apple, Coca-Cola, Walt Disney – or for Singapore – DBS, SIA, or Sheng Siong. They are a popular investment for investors looking for stability, growing dividends, and lower risk in their portfolios.

Additional Reading: 4 Blue-Chip stocks to play the 5G evolution

4. Bond

A bond is a type of debt security. When you invest in a bond, you are lending money to a company or government. Your reward? Repayment of your loan plus a fixed rate of return (interest).

Notwithstanding some risks, bonds are generally safer investments than stocks. If the stock market crashes, bonds often serve to cushion the blow and offset some of your losses.

Additional Reading: Why 60:40 equity/bond allocation isn’t the ideal structure for a 4% withdrawal rule portfolio

5. Options and Futures

Options and futures are derivatives as they derive their value from an “underlying asset”(such as a stock or index). While you can hold a stock forever, options and futures have expiration dates.

In simple terms, they are contracts that give you the right to buy (or sell) an asset at a predetermined price. The main difference is that for futures, you are obliged to buy/sell at an agreed date, whereas for options – as the name may suggest – you have the option to buy/sell anytime before the date of expiry, but not the obligation to do so.

Additional Reading: Selling Put Options. Sell Puts to win in any market scenario

6. Options

Call option: its value rises as the price of the underlying stock rises. Bought when you believe stock prices are going to increase.

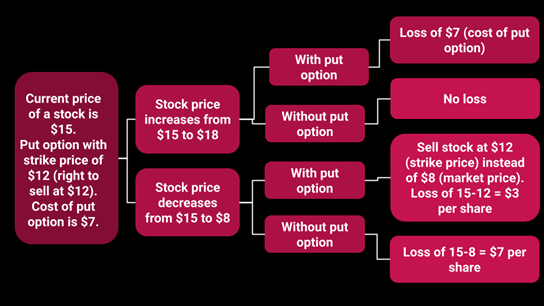

Put option: its value rises as the price of the underlying stock falls. Bought when you believe stock prices are going to decrease.

Strike price: The price at which the buyer of the call option has the right to purchase the security. OR the price at which the buyer of the put option has the right to sell the security.

E.g. Say you buy a call option with a strike price of $500. If the stock price rises to $800 in the future, you still have the right to buy the stock for $500 (your strike price), which is lower than the prevailing market price of $800. In other words, you get a huge discount!

Premium: The price of an option contract. One option contract gives you the right to buy/sell 100 shares.

Note: Usually, an option is not exercised, meaning traders do not buy or sell the underlying stock, like in the above example. Instead, they earn a profit through the changing premium by buying or selling the contract itself. The option price is continually changing because it is affected by the price of the underlying stock and the passage of time.

Why trade options?

Options are versatile instruments; used for both speculating and hedging. The former magnify your returns but increases your risk while the latter reduces your risk.

Speculating

Options are powerful tools that offer traders the potential to earn enormous, disproportionate amounts of profit compared to trading stocks. Because options are cheaper than actual stocks, they have the potential to yield higher percentages of returns.

An example can be used to illustrate this. Let’s assume RIOT shares (a bitcoin miner that one can invest in to have an indirect exposure in bitcoin) are currently trading at $30. To buy 100 shares of the stock outright, you have to pay 30 x 100 = $3000. If the stock rises to $50, you would profit (50-30) x 100 = $2,000, which is 67% of your initial investment ($3000).

Instead, if you bought a call option on RIOT with a strike price of $40, which also represents 100 shares, it would only cost you a premium of, say, $300. When the stock rises to $50, your premium rises to (50-40) x 100 shares, which is $1000. Your profit is 1000-300 = $700, which is a whopping 233% gain from your initial investment of $300.

Now imagine if you bought 10 of these options contracts each priced at $300, spending $3000, the same cost as buying 100 shares of RIOT. Your profit in dealing with options (for the same initial cost) would be $7000, compared to $2,000 if you bought stocks.

Disclaimer: the statistics quoted in this example are for illustration purposes only, and do not reflect actual market prices. Options are leveraged instruments and should be used with care.

When options pay off, the same amount of money you invest can yield more profits. Although, there is a catch. When the trade doesn’t go your predicted way, options can exact a heavier toll than stocks: there is the possibility you will lose 100% of your investment.

Additional Reading: Value Investing using options. Why value investors should also be option traders

Hedging

Are options strictly used for speculative purposes and are inherently high-risk? The answer is no. Most investors use options as a hedge against investment risks.

Hedge: To reduce risk in your investment by taking an opposite position.

A classic hedging strategy is to buy a put option on a stock that you are holding. Whether you anticipate short-term downsides or purely want to reduce risks, this is a great way to offset potential price declines.

How it works

Another simple way to use options for hedging is known as a covered call.

Suppose you own 100 shares of SQ and anticipate short-term price declines. You can simply sell a call option. You will receive a premium from whoever buys this option, which will provide income for your portfolio if SQ share price declines or stagnates.

Strategies including the covered call are known as covered options. Simply put, covered options are sold by writers who own the underlying shares. In contrast, naked options are those where the trader does not own the underlying assets. Sellers of naked options are thus unprotected or “naked” from an unlimited loss.

Covered options vs naked options

Additional Reading: What exactly is a Poor Man’s Covered Call?

7. ETF

An exchange traded fund (ETF) is a security that is a combination of many assets, such as a selection of stocks.

You might have heard of the SPDR STI ETF, which tracks the Straits Times Index (STI), which in turn tracks the performance of the top 30 companies listed on SGX.

A well-known ETF in the US is the SPDR S&P 500 ETF (SPY), which tracks the S&P 500 Index, which in turn tracks the performance of 500 large-cap companies in the US.

ETFs allow you to invest in an entire sector or an entire economy. When you buy an STI ETF, you are essentially betting on the future success of Singapore’s economy.

ETFs offer instant diversification, which individual stocks do not, and you don’t need to spend as much time on stock research.

Additional Reading: Lion-Phillip S-REIT ETF. Should you be buying this REIT ETF?

8. Mutual fund

A mutual fund pools money from many investors to purchase securities such as stocks, bonds, and short-term debt. It is often actively managed by investment companies and has a higher expense ratio (costs more) than ETFs.

Unlike ETFs, mutual funds are not traded on an exchange like the SGX, and can only trade once per day after the markets close.

Some of you might be familiar with Dimensional Funds (one of the core products invested by Endowus for their Robo-advisory services). They are a brand of mutual funds with a strong focus on value/factor investing.

Additional Reading: Dimensional funds. Are they worth their weight in gold?

9. Commodity

Commodities, such as gold, wheat, and oil are basic goods used by investors to diversify their portfolio beyond traditional securities.

The prices of commodities tend to move in the opposite direction as stocks. As such, some investors rely on commodities during periods of market volatility.

Another useful function of commodity is that it often acts as an inflation hedge. Investors tend to increase their exposure to commodities when inflation might be a concern in the foreseeable future.

A commodity by itself is not considered a security.

Most investors look to get direct exposure to commodities through futures trading. Futures trading, similar to options, is a leverage instrument that requires an investor to fork out a relatively small amount of capital to get a large nominal exposure of the underlying asset.

New investors are thus advised to get a proper education in using futures before investing in this particular asset class.

10. Forex

The foreign exchange (also known as FOREX or FX) market is where currencies are traded. The forex market is the largest and most widely traded asset market in the world.

Forex is used to hedge against international currency risks and to diversify portfolios, among other reasons.

11. Cryptocurrency

One of the hottest topics of the decade, cryptocurrency is known by many but understood by few. In the simplest terms, it is a digital currency that can be used to buy goods and services.

Its most famous form is Bitcoin, but names of others like Ethereum and Dogecoin are becoming increasingly popular in recent years.

Its speculators believe it to be the currency of the future. It is backed by a novel technology known as blockchain, a decentralized processing and recording system, and can be more secure than traditional payment systems.

Additional Reading: Bitcoin prediction. 5 reasons why its rise this time around might be sustainable

Do look out for Part 2 of this Beginner’s Guide.

Do Like Me on Facebook if you enjoy reading the various investment and personal finance articles at New Academy of Finance. I do post interesting articles on FB from time to time which might not be covered here in this website.

SEE OUR OTHER STOCKS WRITE-UP

- BEST ETFS IN SINGAPORE TO STRUCTURE YOUR PASSIVE PORTFOLIO

- LION-PHILLIP S-REIT ETF: SHOULD YOU BE BUYING THIS REIT ETF?

- GUIDE TO SYFE AND HOW TO OPEN AN ACCOUNT IN LESS THAN 10 MINUTES

- THE IDEAL RETIREMENT PORTFOLIO STRUCTURE

- WHAT IS A REGULAR SAVINGS PLAN?

- CHEAPEST WAY TO INVEST THROUGH RSP. SHOW ME HOW.

Disclosure: The accuracy of the material found in this article cannot be guaranteed. Past performance is not an assurance of future results. This article is not to be construed as a recommendation to Buy or Sell any shares or derivative products and is solely for reference only.