I have written about Robo-advisors on a number of occasions. The advent of Robo-advisors here in Singapore provides an additional option for Singaporeans to start their investment journey with a low capital requirement (a minimum amount of $1k can usually get you started).

I do believe that Robo-advisors are good investment platforms for the typical Singaporean who wants to get started on investing but lack the expertise or time to engage a Do-It-Yourself (DIY) approach.

While it might not be the most cost-effective manner of investing (I have written previously that engaging a DIY approach through strategic ETF-investing is typically the lowest cost method), the fund management fees are not atrocious (typically around 0.5-1.0%) although I do look forward to further downward fee adjustments. This is probably only possible with scale.

US Robo advisors have platform fees somewhere in the arena of 0.25%.

You can read more about the fund fees and a summary of Robo-advisors in Singapore in this comprehensive article I have written previously.

In this article, I look to do a little write-up on Dimensional Fund Advisors (DFA), which is now available for retail investors through Financial Advisors and Robo Advisor platforms such as MoneyOwl and Endowus.

Before I briefly highlight the Dimensional Fund offerings by our local Robo Advisors, it will be useful to discuss about the history of Dimensional Fund Advisory itself and what makes it investment methodology “stands out” against its competitors, particularly against index powerhouse Vanguard, which it has often been pitted against.

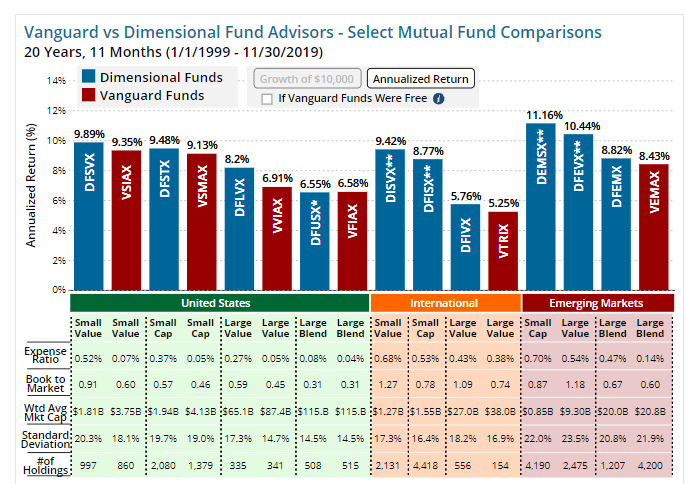

The conclusion has generally been that Dimensional is often superior in terms of performance. Is that always the case?

Dimensional Fund Advisors (DFA)

Brief introduction

DFA is probably one of the largest fund management company that you have not heard before ($579 billion in AUM), prior to their introduction here in Singapore in 2018. However, it is only in this past year where some of their funds are available through our local Robo advisor platforms, have we been aware of its existence.

DFA is a cross-over between Active Investing and Passive Investing, with a “tilt” towards the latter. The funds under DFA is “passive” in a similar sense to index funds where their turnover ratio is low. The average turnover ratio for equity strategies was approx. 12%, according to data from IFA (based on 28 mutual funds offered by DFA that IFA utilizes in their IFA Index Portfolios). This implies an average holding period of 8.4 years for their equity funds.

Dimensional Fund is a passive fund but not an index fund

However, unlike a traditional index fund that looks to replicate a particular index performance that generates no alpha, a Dimensional Fund is NOT an INDEX FUND. Instead, DFA was the first to tilt their passively-managed portfolios toward various “factors”, a tilt that is known today as “Smart Beta”. These are strategies that weigh stocks by factors such as valuation or volatility, rather than the traditional market capitalization.

To put it in a simpler context, all index funds are passive but not all passively managed funds are index funds. The Dimensional fund is an example of a passively managed fund that is not an index fund. It will have its own set of criteria for defining the types of stocks it should own, how much it should own and when it should own them.

For example, when new companies come into the indexes, index funds such as the Vanguard funds must buy them, no matter how inflated their value might be. Dimensional funds have the luxury to wait out for a cheaper entry price. It also does not necessarily follow the weighting of that particular stock in a comparable index. In fact, one might notice that Dimensional funds are more heavily diversified vs. Index funds, typically with a skew towards value and small-cap counters (we will discuss more on this later).

Dimensional funds typically show outperformance over longer horizons. This is where it becomes difficult for investors because they prefer to see the premiums on a consistent basis over a shorter duration.

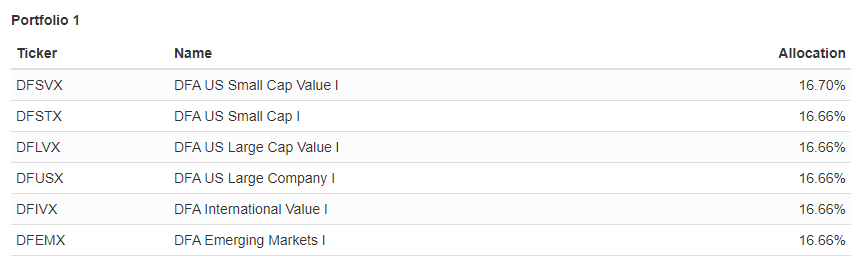

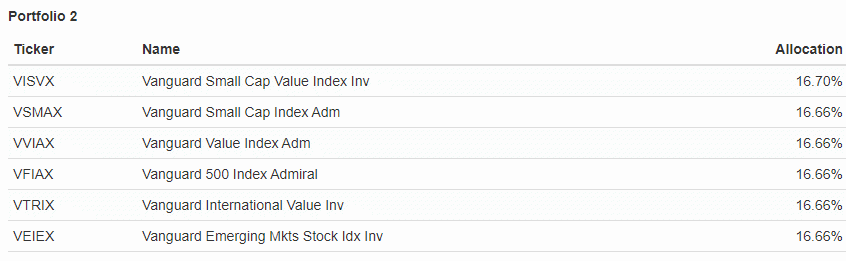

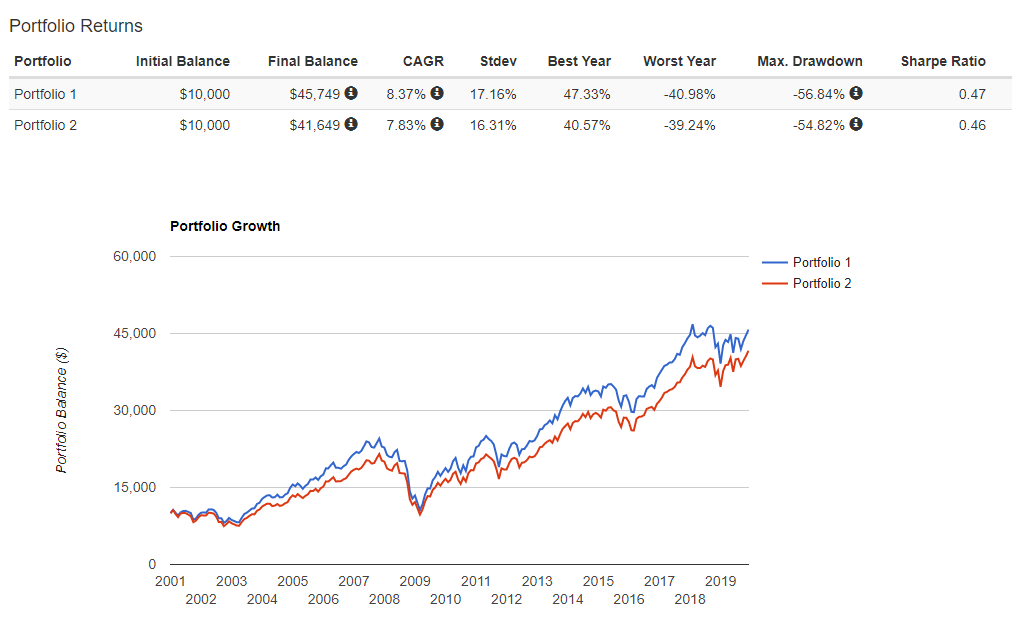

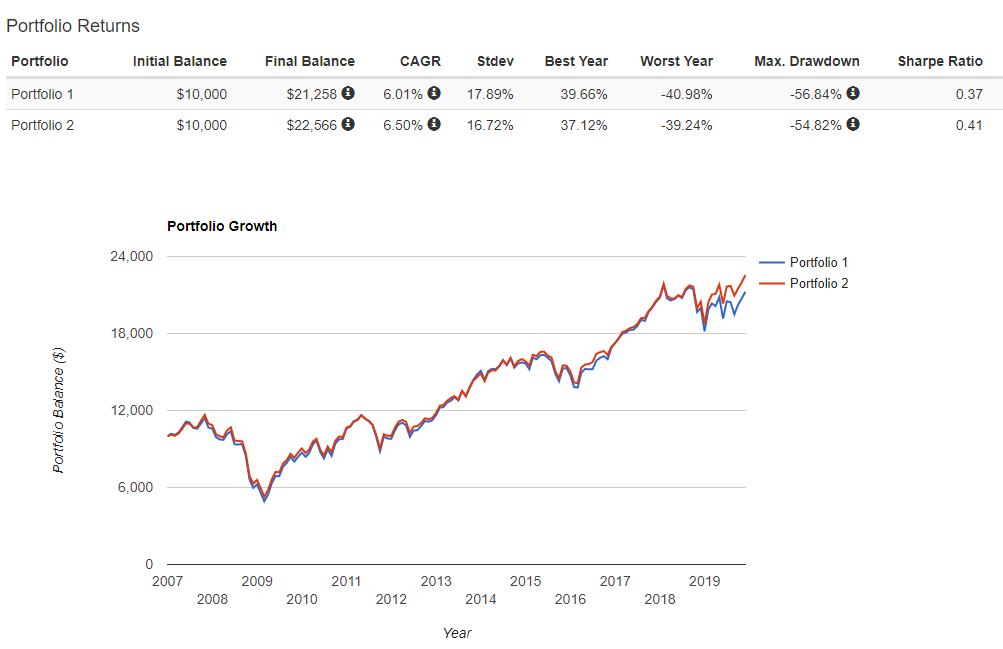

As can be seen from the charts below, DFA funds (Portfolio 1) tend to outperform their Vanguard counterparts (Portfolio 2) over a longer horizon period stretching approx. 20 years but have marginally underperformed over the past decade since the onset of the GFC. The underperformance has been more pronounced in 2019. This could be due to DFA’s tilt towards value vs. growth.

A potential reversion favoring value-investing in the coming decade could, however, see DFA outperforming its peers once again.

Focus on small, value and profitable stocks

A core strategy of DFA, develop by Eugene Fama of the University of Chicago and Kenneth French of Dartmouth College (finance professors who also advise DFA and serve as directors there) has shown that stocks with smaller market capitalizations, as well as those trading at low prices relative to their asset values (a value approach) and those with above-average profitability, outperform in the long run.

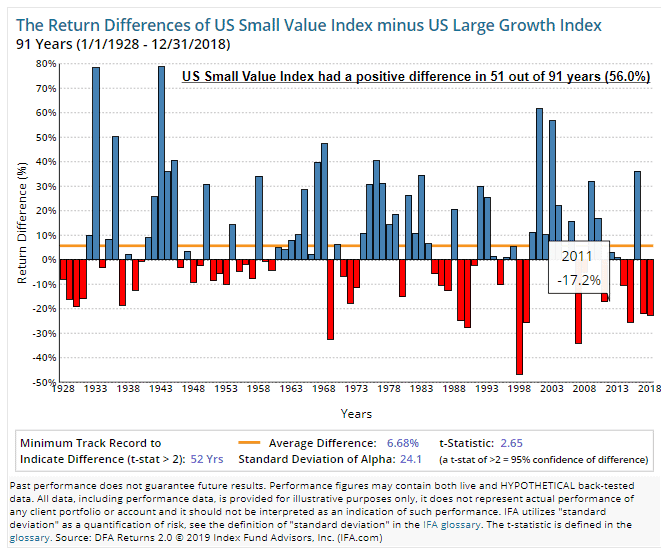

The return differences of the US Small Value Index minus US Large Growth Index over 91 years has shown a positive difference in 51 out of 91 years with an average positive difference of 6.68%.

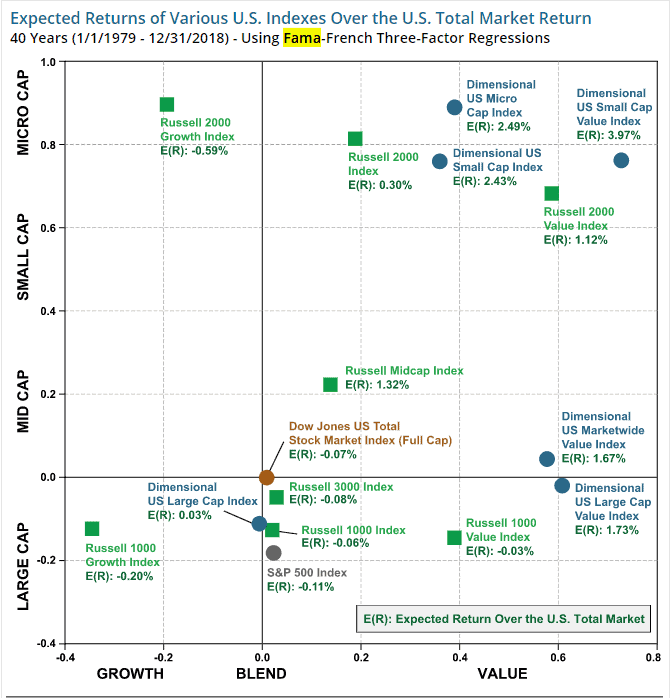

Over a 40 years-time frame, the US Small Cap Value Index would have generated close to 4% ADDITIONAL returns over the market, using Fama-French Three-Factor Regressions.

That is why DFA funds typically have a higher percentage of weighting in value and small-cap counters as compared to their counterparts. We will provide an example when we talk about the DFA World Equity Fund provided by Endowus.

Why are DFA funds only marketed through FAs?

DFA has once been referred to as a religion (or a cult, if you like to term it in a dismissive manner). In order to have access to their funds, an individual will need to buy them through financial advisors and even those people must apply for the privilege, where part of the process involves coming, at their own expense, to the company’s two-day introductory session.

Why do they limit access to their funds?

According to an answer from Quora, it is all part of a unique and brilliant business model ensuring everyone gets much better results.

“By marketing to advisors, DFA gains access to high-net-worth* individuals who will be disciplined, long-term investors, with great behavioral guardrails in the form of advisors to keep them calm in market turbulence. This ends up being a win for everyone involved. Advisors get great funds and can attract clients with the lure of exclusivity, DFA gets an army of motivated advisors to pitch their products, and investors get low-cost, evidence based investments with a shot at outperforming their benchmarks over the long term”.

Jeff Clark, Investment Advisor Representative at BrightPlan

So it seems like DFA does not want “anybody” to just have access to their funds. These investors might just take flight at any sign of a downturn instead of having the discipline to invest for the long term. This might result in disruptive redemptions for DFA which is not what they wish to achieve.

Hence, they likely opt for the slow and steady approach by selling their product only through a limited pool of FAs. These FAs have the added “responsibility” of keeping investors vested rather than bailing out at the first sign of underperformance.

A recent trend would be their partnerships with Robo-advisors (instead of just the traditional FAs and Wealth Advisors) such as Endowus and MoneyOwl here in Singapore which avails their product to a much broader spectrum of the investment community: in particular, retail investors with smaller investment accounts.

DFA is likely banking on the Robo-advisors to provide the necessary education to retail investors in terms of its investment process, just like how a traditional FA would.

However, access to DFA funds here in Singapore is still extremely limited. Endowus only offers 1 Dimensional fund for their equity exposure while MoneyOwl has 2 Dimensional equity funds and 1 Dimensional bond fund in its offerings.

Endowus:

Dimensional World Equity Fund (SGD Insti Class Accumulation Shares). Expense ratio:0.43%

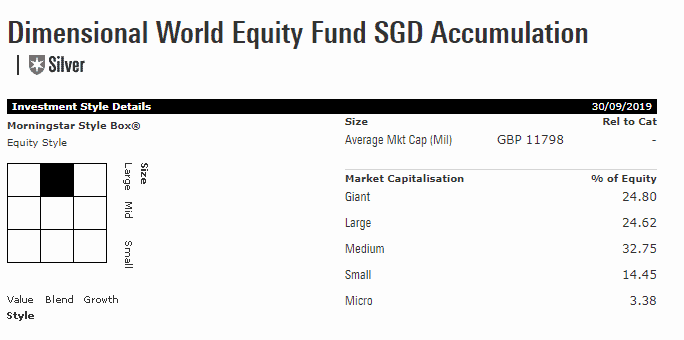

The Fund is a globally diversified portfolio of equities with over 10,000 holdings (10,958 to be exact as of Sep 2019). According to Endouwus, the fund uses a core strategy that has general exposure to the overall stock market with a greater allocation to shares of smaller sized companies, value companies, and profitable companies.

However, according to data from Morningstar, there seems to be some discrepancy in that. The fund seems to have a heavy-weighting in US mega-cap stocks with the fund Top 5 holdings in Apple, Microsoft, Amazon, Verizon, and JP Morgan. Giant and Large-cap stocks account for close to 50% of the total portfolio while small and micro-cap stocks only take up approx. 18%.

The “greater allocation to small, value and profitable companies” is relative. It is relative to its comparable index fund.

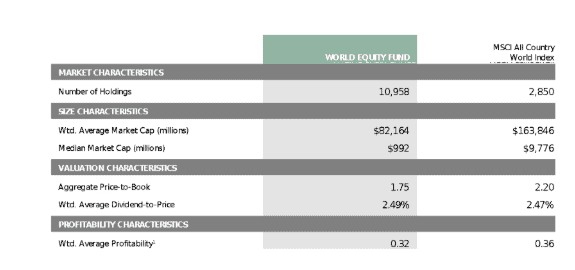

For example, DFA World Equity Fund is often benchmarked against the MSCI All Country World IMI Index (MSCI). While the median market cap for the MSCI counters is $9.8 billion, that of the DFA World Equity Fund is only $992 million.

In terms of strategy, one can also observe that the World Equity Fund has a higher percentage allocation to small-cap and value compared to the index. It is this heavier skew towards value and small-cap that forms the basis of DFA’s potential outperformance over the longer horizon vs. the index and comparable index funds.

MoneyOwl and Providend:

Dimensional Global Core Equity Fund (SGD accumulation shares). Expense ratio: 0.35%

Similar to the Dimensional World Equity Fund, while the Product Highlight Sheet of the fund claims that the fund will generally be overweight in small companies and in shares which the Investment Manager deems to be eligible value stocks and underweighted in large growth companies, the Top 5 holdings, according to Morningstar is again the same 5 mega-cap technology companies as in the World Equity Fund.

This fund has an even higher weighting in US Stocks with 62% of its portfolio comprising of US equities. Only 13% of the portfolio is considered small/macro cap stocks. The structure of the fund is probably similar to that of the World Equity Fund.

The Core Equity fund holds 7818 counters vs. the MSCI All Country World Index holdings of 2,850 as of Sep 2019. This additional diversification allows for smaller cap and value counters to be included in the fund as compared to the index counters.

Dimensional Emerging Markets Large Cap Core Equity Fund (SGD accumulating shares). Expense ratio: 0.50%

As per what the name implies, the stocks in this fund are mainly large-cap stocks. According to its Product Highlight Sheet, the eligible universe of securities that the Fund intends to invest in will generally comprise the largest companies within each Approved market, collectively representing 80-90% of each Approved Market.

Dimensional Global Short Fixed Income Fund (SGD accumulating shares). Expense ratio: 0.29%

The investment policy of this Fund is to purchase high quality, fixed or floating rate investment grade short term instruments including bonds and other instruments issued by government, quasi-governmental and corporate issuers predominantly in developed countries.

Why are there no specific small-cap/value funds?

DFA is best known for its “Smart Beta”, with a key investment strategy that focuses on small-cap and value plays. IFA has also demonstrated that a strategy that focuses on US Small Value has outperformed its US Large Growth counterpart by an average of 6.7%/annum over a 91-year horizon.

Why are there no specific funds targeting small-cap, value-focus or even better, a combination of both being offered to Singaporeans? Most of the Dimensional equity funds available here seems to offer a global focus.

In comparison, its global value fund has more high-dividend-paying counters like AT&T, Royal Dutch Shell, Exxon Mobil as well as exposure to relatively undervalued bank plays such as Wells Fargo, Bank Of America, all of which are trading at a relatively low PER multiple and likely falls under the category of value.

This fund is currently not being offered. A potential consideration that our Robo-advisors might have taken into account is the withholding tax charges of such a global “high-yield” value fund, on the fund-level, despite Dimensional already tax-efficient structure.

Will I be investing in Dimensional Funds through either MoneyOwl or Endowus?

To evaluate this question, one will need to first weigh the superiority of Dimensional funds vs. investing in a similar Index ETF, if the former is really worth its weight in gold for the additional cost (higher TER + Robo fees vs. DIY approach in a low-cost ETF) to be paid.

Based on data provided by management, Dimensional funds (represented by the World Equity Fund) beat its benchmark (even after including TER for dimensional funds) when the evaluation period is from 2003 to 2019. Annualized return is 7.79% for Dimensional vs. 6.92% for the benchmark.

Using data from Portfoliovisualizer, we generated the performance of VTI ETF, which is the Vanguard Total Stock Market ETF during the same period. The returns are 10.4% CAGR (before TER, but VTI’s TER is extremely low).

If the VTI ETF is a comparable peer to the Dimensional World Equity Fund, then clearly, the Dimensional World Equity Fund has not outperformed during this period. Unfortunately, VTI ETF only covers the US market. A more comparable ETF will be VT but that is only incepted in 2008.

Let’s assume we compare VTI (the US all market) “Portfolio 2” vs. one of Dimensional best performing funds, US Small Cap Value (DFSVX) “Portfolio 1” over a 2003-2019 period. VTI’s CAGR of 10.4% marginally edges out that of DFSVX CAGR of 10.3%.

If we took into consideration DFSVX higher expense fee of 0.52% vs. VTI extremely low expense ratio of 0.03%, then the latter’s outperformance might be significantly higher. If we are to add an additional layer of Robo-advisors fee to Dimensional Funds, in this case, another 0.60% from Endowus, then the disparity of the results will be even more evident.

Finally, we remove the impact of dividend reinvestment into the equation. The lack of dividend reinvestment will result in DFSVX generating a CAGR of 4.8% vs. VTI CAGR of 8.3% from 2003-2019. This is likely due to the high level of dividend payment for a “value” counter like DFSVX.

Is this result conclusive? Probably not, given the lack of a longer time horizon for this comparison to be made. However, based on my preliminary analysis, it does not seem like Dimensional funds have outperformed its passive ETF counterpart, more so if we add on the additional cost from the Robo advisors to justify a strong investment case.

There are however other factors to take into consideration. 1) the impact of withholding taxes and estate duties etc if one is to engage in a DIY approach for a US-domiciled ETF like VTI, 2) the ability to invest regularly in such ETF through an RSP and 2) the lack of dividend reinvestment impacting returns for a DIY approach vs. engaging the Dimensional World Equity Fund through Endowus which is accumulating in nature.

Emerging value to outperform in the next decade?

I am definitely looking at a passive way to invest in a fund with a tilt towards emerging small-cap value play such as the DEMSX fund, Dimensional Emerging Small Cap Value fund that has shown the strongest annualized performance over the past 21 years across Dimensional funds as illustrated below but significantly underperformed in the recent decade.

If we believe there is going to be a mean reversion like what the GMO folks propose, then emerging value counters is where you want to be positioned.

Conclusion

The recent performance of these Dimensional funds offered within the local context has not been outstanding when benchmarked against both the respective index as well as its peers.

However as highlighted, the outperformance of DFA’s a factor/evidence-based investing is much more pronounced over a longer-horizon, somewhere in the 20-years region.

At present, I don’t have conclusive evidence to point to the fact that investing in DFA through a Robo-advisor is a superior way to generate higher returns vs. a DIY approach through a low-cost ETF. Hence, I will likely do more study in this arena.

As a retail investor, I do also embrace the fact that charges are coming down. Dimensional recently announced that it is reducing its US Mutual Fund management fees, although not applicable to Singapore Dimensional Funds.

However, this is likely a continuing trend of “race to zero”. As technology continues to reduce the cost of fund operations, fund companies are able to pass those savings to investors in the form of lower annual fees.

Investors will ultimately be a key winner in this trend, having greater access to cheaper investment products.

Do Like Me on Facebook if you enjoy reading the various investment and personal finance articles at New Academy of Finance. I do post interesting articles on FB from time to time which might not be covered here in this website.

Join our Telegram broadcast: https://t.me/gemcomm

SEE OUR OTHER WRITE-UPS

- THE CONFUSING MATH BEHIND RETIREMENT SUM SCHEME AKA CPF LIFE PREDECESSOR

- DIVIDENDS ON STEROIDS: A LOW-RISK STRATEGY TO DOUBLE YOUR YIELD

- STASHAWAY SIMPLE. CAN YOU REALLY GENERATE 1.9% RETURN?

- WHY I AM STILL BUYING REITS EVEN WHEN THEY LOOK EXPENSIVE

- TOP 10 FOOD & BEVERAGE BRANDS. ARE THEY WORTHY RECESSION-PROOF STOCKS?

- TOP 10 HOTTEST STOCKS THAT SUPER-INVESTORS ARE BUYING

Disclosure: The accuracy of the material found in this article cannot be guaranteed. Past performance is not an assurance of future results. This article is not to be construed as a recommendation to Buy or Sell any shares or derivative products and is solely for reference only.

4 thoughts on “Dimensional Funds: Are they worth their weight in gold?”

Recent performance has been such that growth did better for the past 10 years. Thus their performance look atrocious. I refer to your question regarding the global value fund. Not sure which fund you are referring to but if its Global Targeted Value, then it is a small small part of our portfolio. That has not done well recently because… the fund is really tilted towards the factors and in general, the factors have not done well recently.

Hey Kyith, I am referring in general to the notion of having a more value-based targeted fund rather than a global exposure fund (which I understand also has a tilt towards value).

If we believe in mean reversion, then value and small-cap which has underperformed the growth and large-cap counterpart over the past decade could potentially excel in 2020, then doesn’t it make sense to bring in those targeted funds rather than a globalized one?

Do your charts of performance of Vanguard vs DFA portfolios include all the fees associated with both providers? I’m assuming if DFA only sells through advisors that the advisors are getting some kind of a fee in addition to what DFA charges.

No, the performance charts do not include the associated fees. Hence if you include in the TER, the performances will likely be lower, particularly for DFA funds where the TER is higher than that of Vanguard. That’s from a fees perspective.