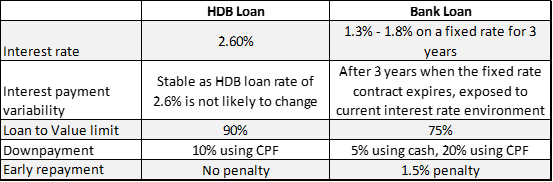

HDB loan vs Bank Loan: which should you choose today? Deciding to buy an HDB flat in Singapore involves more than choosing the property size, number of rooms, and the right location. Unless you received millions of dollars in inheritance or won the TOTO jackpot, you have no choice but to think about your financing … Read more

RT

RT

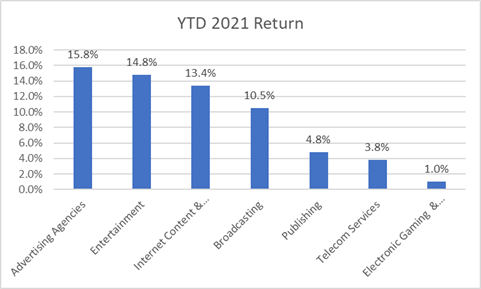

There is no doubt that a sector rotation is currently in play, with rising 10-year bond yields translating to a sell-off in tech-related counters, with more “traditional” sectors such as financials (think banks) and communications companies being favored. You might be wondering why saas stocks should be sold off in a rising yield environment, you … Read more

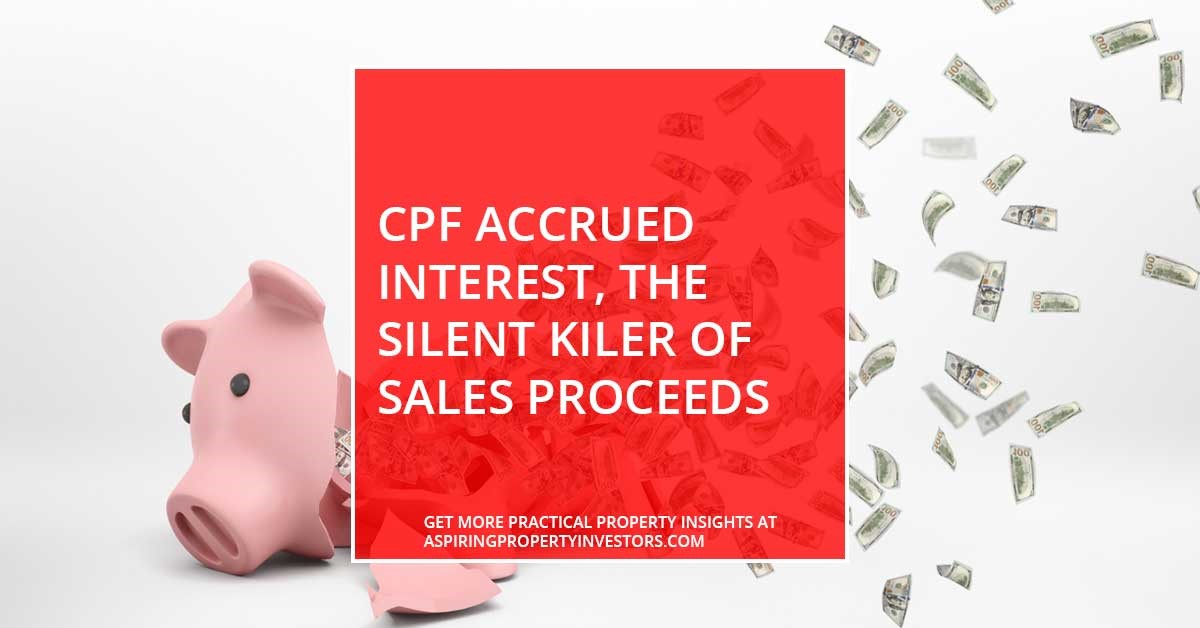

HDB Sales Proceeds vs. CPF accrued interest – What you need to know Most of us Singaporeans go through a typical purchase process when it comes to making our first MAJOR purchase decision: buying a BTO or Build-to-order, which is an initiative taken by the government decades ago to allow the majority of Singaporeans to … Read more

Partaking in 3 hot asset classes to counter the effect of rising inflation I have written about Tiger Brokers, one of the most affordable, low-commission cost fintech brokerage platform available to Singaporean investors in these 2 Tiger Brokers review articles: Possibly the cheapest brokerage in town. Is it right for you? How I use Tiger … Read more

Selling your EC: MOP or Privatization? Like all HDB regulated properties, an executive condo (EC) can only be put on the open market after you have met the five-year Minimum Occupancy Period (MOP). So now that you’ve gotten there, what’s next? Is it time to sell and reinvest in another property, or hold on till … Read more

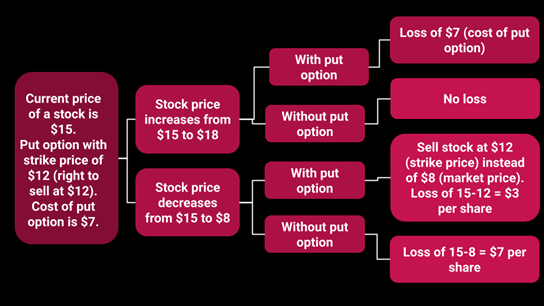

Hedging with options to insure against a market sell-off Previously, I wrote this article: How to hedge stocks. 5 levels of hedging. In that article, I explore various ways of protecting your portfolio, from the easiest way which is to simply keep cash to more advanced methods such as using leveraged inverse ETFs. One of … Read more

Starbucks: Long-term recovery play + Short-term momentum opportunity I believe that everyone is probably familiar with Starbucks, a blue chip US stock that might be the ideal COVID-19 recovery play for your portfolio. The Starbucks brand is likely the undisputed No.1 coffee chain brand globally. Starbucks is the market leader in the retail coffee market … Read more

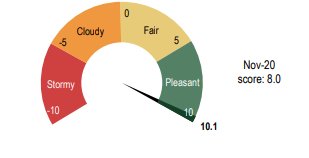

Singapore Trading Festival 2021 The Singapore Trading Festival 2021 is an event jointly organized by Singapore Exchange (SGX) and InvestingNote. This event consists of 2 parts: A full-day virtual summit to hear trading experts share their new trading strategies in navigating the current volatile markets. This will be held on the 27th Feb 2021 A … Read more

Ark Invest: 15 big ideas theme for 2021 and beyond The team at ARK Invest, led by now renowned growth investor, Cathie Wood, recently published 15 Big Ideas themes for 2021. The team seeks to gain a deeper understanding of the convergence, market potential, and long-term impact of disruptive innovation by researching a global universe … Read more

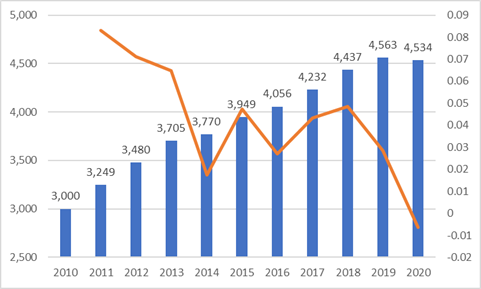

Average Salary in Singapore 2023 The Ministry of Manpower Singapore just formalized the Income statistics of Singaporeans although an earlier tentative report was released back in Dec. The statistics show that the Median income of Singapore residents fell for the first time since 2004 due to COVID-19. It is likely more informative to use the … Read more

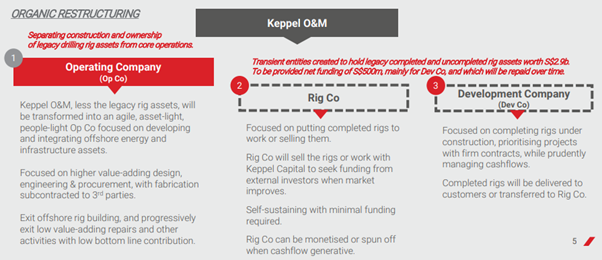

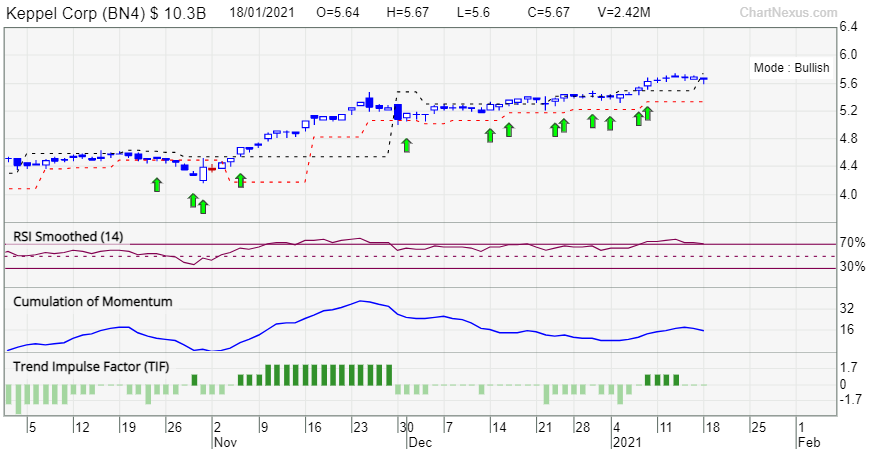

Keppel Corp: A gem that failed to sparkle Readers of NAOF would be familiar with Keppel Corp, a company that I have been recommending over the past 3-4 months, starting when I first made an initial investment at the cost of S$4.40. While I believe that the company remains undervalued, its recent results announcement made … Read more

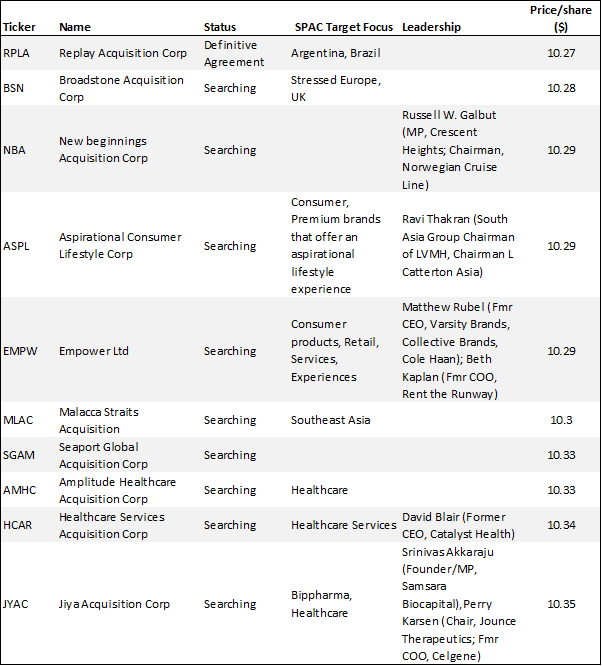

Investing in SPACs in 2021. What you need to know This is a follow-up article on one of the hottest investment assets in 2020 that some readers might not be aware of. I have previously given NAOF readers a brief overview of what SPACs are in this article: How to invest in SPACs like a … Read more

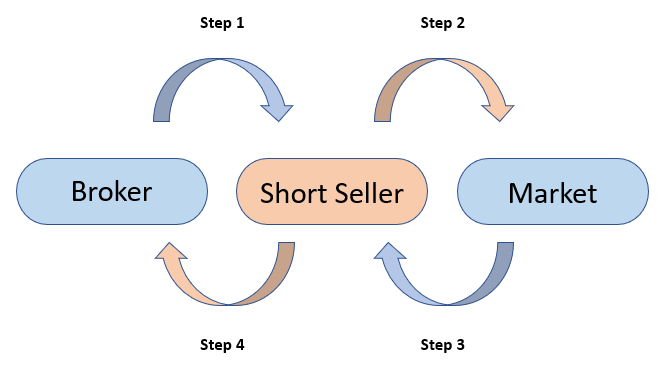

Investor Education Series: Short Squeeze [Update Jan 2021] This is an updated post with the original post first written in November 2020, where I highlighted to NAOF readers some of the most shorted stocks in the universe and how to possibly profit from a powerful phenomenon known as a short squeeze. The list of short … Read more

Best Stocks for 2021 i will be providing a quick summary of the top picks by Bank of America, which includes the following key segments: Best Small-Mid Cap Ideas for 2021 Media & Cable – Six key themes of growth US Semiconductors – Emerging trends in 2021 Food and Discount Retailers – Entering “Discount Store … Read more

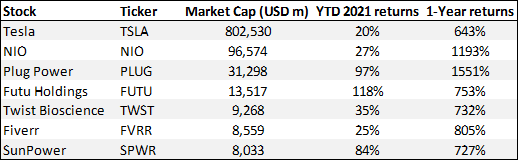

Outperforming stocks for 2021 Tesla stock has been on a roll for the past 1-year and that momentum seems to remain in place for 2020 as the stock has already appreciated by 20% YTD 2021. In this article, we identify 6 outperforming stocks that have appreciated MORE than Tesla and yet might still be better … Read more

How to identify momentum stocks the easy way At the end of 2020, I wrote an article highlighting 4 Singapore momentum stocks to buy into 2021. All 4 SG stocks have appreciated in value of approx. 3-22% over 3 weeks and it does seem like their current price momentum could result in another leg up … Read more