Ark Invest: 15 big ideas theme for 2021 and beyond

The team at ARK Invest, led by now renowned growth investor, Cathie Wood, recently published 15 Big Ideas themes for 2021. The team seeks to gain a deeper understanding of the convergence, market potential, and long-term impact of disruptive innovation by researching a global universe that spans sectors, industries, and markets. The report offers some of the most provocative research conclusions for 2021.

While ARK Invest “Big Ideas” for 2021 brought our attention to 15 mega themes that could see structural growth over the coming decade, it did not specifically identify any particular stocks that ARK Invest currently holds which fit those Big Ideas 2021 themes.

In this report, we look to provide 15 stocks that fit Cathie Wood ARK Invest Big Ideas for 2021 and stocks that are currently invested in one or more ARK Invest’s suite of ETFs.

ARK Invest Big Idea 2021 theme #1: Deep Learning

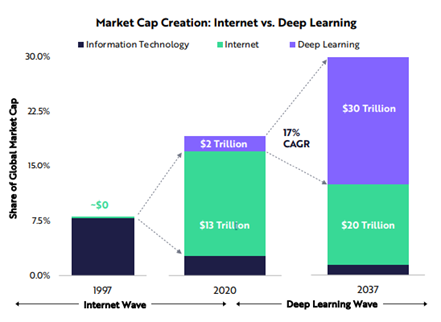

The ARK Invest team believes deep learning could be the most important software breakthrough of our time.

“Until recently, humans programmed all software. Deep learning, a form of artificial intelligence (AI), uses data to write software. By “automating” the creation of software, deep learning could turbocharge every industry”.

This industry will add $30 trn to the global equity market cap during the next 15-20 years.

ARK Invest Deep Learning stock: Palantir Technologies

ARK Invest holds a small position in Palantir Technologies, roughly about 0.13% across the ARK Invest portfolio.

The initial focus for Palantir was on building sophisticated analytics systems for governments. Much of the work was under wraps because of the sensitive nature of the programs.

Palantir has since expanded its business into commercial areas, in industries like healthcare, energy, transportation, and manufacturing.

PLTR stock also looks like a play on the Covid-19 pandemic. According to a report in the Wall Street Journal, the company is working with the federal government to build a system for the rollout of vaccines.

Machine learning technology could prove useful in handling the complex issues of supply chains.

The company recently released its 4Q20 results which disappointed the market in terms of its 2021 revenue outlook, resulting in a substantial correction in its share price.

Might this be an opportunity to accumulate this Deep Learning stock for its long-term growth potential?

ARK Invest Big Idea 2021 theme #2: Reinvention of Data Centre

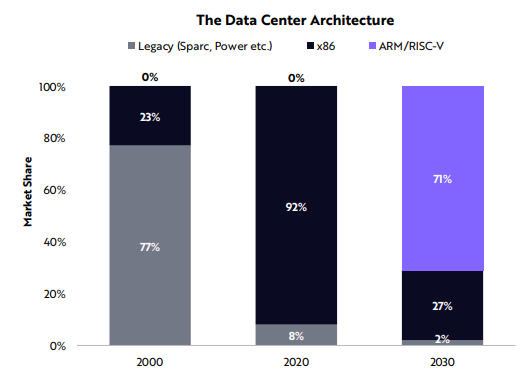

The next mega theme is the reinvention of the data center. Cheaper, faster, and more power-efficient processors are starting to displace Intel – which traditionally had captured over 90% of all processor revenue.

ARK Invest believes that ARM, RISC-V, and graphics processing units are likely to emerge as the new powerhouse processors.

“Together they could scale at a 45% annual rate to USD19 billion in revenue by 2030”.

In the data center, ARK Invest believes accelerators, dominated by GPUs, will become the dominant processors for new workloads, growing 21% at an annual rate to USD41 billion by 2030.

ARK Invest Reinvention of Data Centre stock: NVIDIA

ARK Invest holds a small stake in NVDA which is looking to acquire the market leader in ARM technology, ARM Ltd from Softbank.

However, the deal is taking a lot of heat, with some of the world’s largest technology companies such as Google, Microsoft, Qualcomm, etc complaining to the US antitrust regulators about the acquisition and its potential impact on the supply of ARM chips.

There could be a risk that NVDA price could witness a correction if the acquisition is being shot down. In that scenario, Softbank might be a “winner”, potentially spinning off ARM through an IPO or through its SPAC which could garner much more interest and a higher valuation.

While ARK Invest does not own Softbank, the latter, which is currently trading at an all-time high, might be an indirect way to play the boom in ARM technology ahead.

ARK Invest Big Idea 2021 theme #3: Virtual Worlds

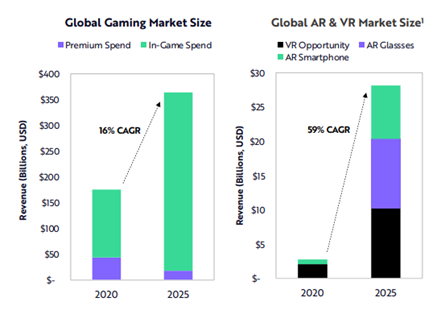

The 3rd big theme is virtual worlds, consisting of video games, augmented reality, and virtual reality.

According to ARK Invest research, revenue from virtual worlds will compound 17% annually from roughly $180bn today to $390bn by 2025

Some of the key sub-themes in this category include video game monetization models shifting to virtual goods as well as augmented reality huge market opportunity, scaling from $1bn today to $130bn by 2030.

According to ARK Invest, the global gaming market size could increase at a 16% CAGR rate from $175bn today to roughly $365bn in 2025, predominantly due to in-game spending.

The AR and VR markets will grow at a 59% CAGR during the next 5-years from $3bn to $28bn in 2025, with VR opportunity, AR Glasses, and AR smartphone all seeing good growth.

ARK Invest Reinvention of Virtual World stock: Unity Software

Unity Software might be a stock that most people are not very familiar with. ARK invest holds a 0.99% stake across its ARKW and ARKK portfolio.

Unity launched its first game development platform in 2004, which bundled together cross-platform rendering, lighting, physics, sound, animation, and user interface tools. In the past, developers created those features individually for different platforms, which was often a buggy, expensive, and time-consuming process.

Unity now serves over 1.5 million monthly active creators, and over half of all mobile, PC, and console games are built with its tools. In 2019, an average of 3 billion apps built with Unity was downloaded each month. Games like Super Mario Run, Among Us, and Monument Valley were all built with Unity.

Unity still generates most of its revenue from traditional gaming companies, but it’s gradually expanding into other markets, including augmented reality, virtual reality, and industrial 3D design.

ARK Invest Big Idea 2021 theme #4: Digital Wallets

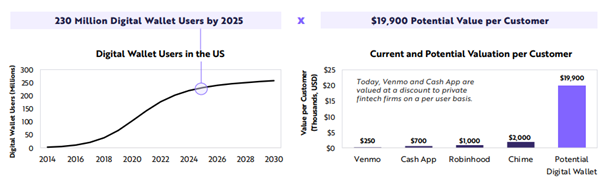

The digital wallet segment represents a $4.6trn opportunity with the team believing that Venmo (Paypal), Cash App (Square), and venture-funded startups are likely to upend traditional banking by activating the mobile phones in users’ pockets and handbags.

According to ARK Invest research, digital wallets are valued between $250 and $1,900 per user today but could scale to $20,000 per user, representing a $4.6trn opportunity in the US by 2025.

A primary driver of the explosive growth in digital wallets is lower customer acquisition costs.

According to ARK Invest research, compared to the roughly $1,000 that a traditional financial institution might pay to acquire a new checking account customer, digital wallets invest only $20 thanks to viral peer-to-peer payment ecosystems, savvy marketing strategies, and dramatically lower cost structures.

Today, Venmo and Cash App are valued at a discount to private fintech firms on a per-user basis

ARK Invest Reinvention of Digital Wallet stocks: Paypal and Square

Square and Paypal are among the largest holdings of ARK Invest, with Square being the 4th largest holding across its portfolio, accounting for 3.74% stake and Paypal at no. 15, accounting for 1.91%

ARK Invest has highlighted that there is huge potential in Venmo, owned by Paypal and Cash App, owned by Square as digital wallets used by an increasing number of users both in the US as well as internationally.

In Asia, you have got WeChat Pay, owned by Tencent (ARK invest Top 12th holding with 1.93% stake) as well as Alipay, owned by Alibaba as potential alternatives for Digital Wallet plays.

Paypal looks to be an interesting stock candidate. According to its CEO, Paypal aspires to be one of the 8-10 apps a person uses every day and hopes to achieve this by leveraging the company’s large customer base, merchant relationships, partnerships across banks, networks, and technology platforms, and global scale to create a connected ecosystem that addresses a more comprehensive set of use cases in a person’s financial and broader commerce journey.

Components in its future connected ecosystem include a broad suite of financial services (e.g. high yield savings accounts, brokerage services, crypto services), recurring payment services (e.g. Bill Pay, subscription management), a richer rewards hub, shopping (including contextual commerce recommendations, Honey integration), and one-click transactional payment functionality in these settings.

ARK Invest Big Idea 2021 theme #5: Bitcoin’s fundamentals

As bitcoin’s price hit an all-time high, ARK Invest’s research indicated that its network fundamentals remained healthy.

Based on search volumes compared to 2017, bitcoin’s price increase seems to be driven less by hype. With bitcoin appearing to gain more trust, some companies are considering it as cash on their balance sheet, with the latest and most well-known example being that of Tesla holding $1.5bn worth of bitcoin on its balance sheet.

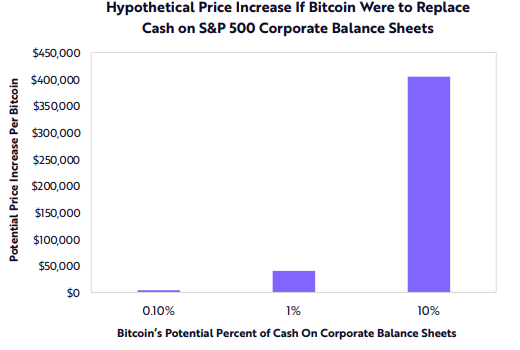

A rather controversial thought, ARK Invest said that the hypothetical price of bitcoin could reach $400,000 if every company in the S&P 500 holds 10% of their cash holdings in bitcoin.

ARK Invest Reinvention of Bitcoin Fundamental stocks: Grayscale Bitcoin Trust

ARK recently bought more shares in Grayscale bitcoin trust BTC, bringing its total holdings to 7.31m shares.

Grayscale Bitcoin Trust, the world’s largest bitcoin fund and the first of its kind enables investors to speculate on and gain exposure to bitcoin in the form of security without having to buy or store the digital token directly.

Shares in the investment vehicle are part of a range of traditional finance products that track bitcoin prices. There are a few valid knocks on Grayscale Bitcoin Trust. It trades at a premium to the Bitcoin tokens it owns. It also charges a stiff 2% annual fee.

For those looking to hold bitcoin for the long term, it might be better to buy bitcoin directly through an exchange like Coinbase, Tokenize, etc.

ARK Invest Big Idea 2021 theme #6: Bitcoin preparing for institutions

ARK believes bitcoin’s rapid growth has positioned it for an allocation in investment portfolios.

“We believe bitcoin offers one of the most compelling risk-reward profiles among assets. As our analysis suggests, it could scale from roughly USD500 billion to USD1-5 trillion in network capitalization during the next five to 10 years.”

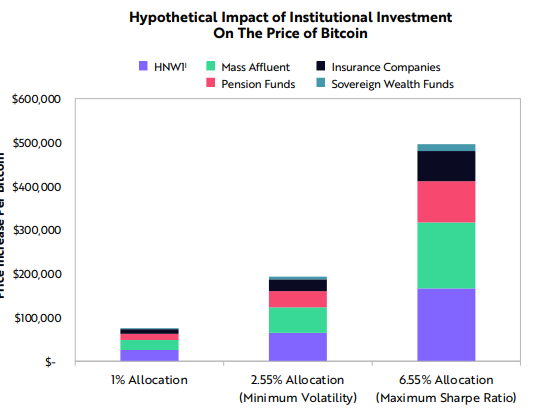

According to ARK’s simulated portfolio allocations, institutional allocations between 2.5% and 6.5% could impact bitcoin’s price by $200,000 to $500,000.

ARK Invest Reinvention of Bitcoin preparing for institution stocks: Tesla, Paypal, Square

Tesla remains ARK Invest biggest holdings, with Tesla accounting for 6.02% of its portfolio

When Tesla allocated $1.5bn or 9% of its cash balance to bitcoin and said that it would start accepting the cryptocurrency as payment for its vehicles, it is greeted by enthusiasm by one of the electric car marker’s most prominent backers: Cathie Wood.

Square is another company that could benefit from its bitcoin ownership. By letting users invest and pay with bitcoin via its app, the company would be able to take significant market share in geographies with fragmented payments and banking infrastructure.

Again, Paypal is another company that has significant exposure to Bitcoin through its holdings. I do prefer Paypal more than Square at this current juncture due to the former’s network effect which I deem as stronger.

ARK Invest Big Idea 2021 theme #7: Electric Vehicles

Electric Vehicles are approaching sticker price parity with gas-powered cars. Leaders in the EV market are developing innovative battery designs to enable longer-range vehicles at lower costs.

Based on Wright’s Law, ARK Invest forecasts that EV sales should increase roughly 20X from 2.2m in 2020 to 40m units in 2025.

The auto market is undergoing a shift to both electric and autonomous. ARK Invest believes that traditional automakers lack the software and electrical engineering talent necessary to succeed.

ARK Invest Electric Vehicle stock: Tesla

It is no surprise that Tesla is a hot favorite with ARK Invest, the counter being its top holding as previously mentioned, with stakes across 3 portfolios: ARKW, ARKK, and ARKQ.

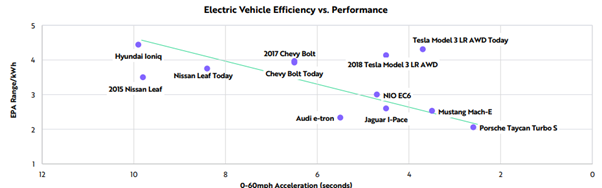

ARK Invest believes that Tesla is the market leader in the arena of Electric Vehicle adoption with its Tesla 3 model. The largest cost component of an EV is its battery. Tesla is the market leader in terms of lowering the cost of its battery component and making it last longer than its competitors.

Of all the EVs registered in the US in 2020, Tesla vehicles made up 79% of them, according to the latest data from an Automotive News released recently.

That leaves just 21% to carve up for the numerous other automakers and highlights an immense challenge for legacy automakers to unseat Tesla’s cache with EVs.

ARK Invest Big Idea 2021 theme #8: Automation

ARK Invest believes that automation has the potential to shift unpaid labor to paid labor. For example, as food services automate, they will transform food preparation, cleanup, and grocery shopping into market activities including food delivery.

ARK Invest believes automation will add 5% or $1.2trn to US GDP during the next 5-years.

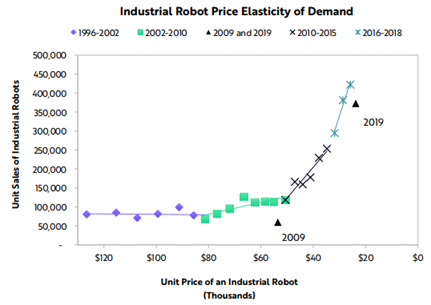

Following the great recession in 2008/2009, industrial robot demand hit an inflection point, scaling rather rapidly, with trade tensions between the US and China adding to its momentum.

COVID-19 created a headwind in 2019-20 with a brief decline seen in demand for industrial robots.

According to ARK Invest research, short-term obstacles will not prevent a rebound in industrial robot sales and could encourage companies to automate and cut costs more aggressively.

ARK Invest Automation stock: Teradyne

Teradyne accounts for 0.52% of the ARK Invest portfolio. The company is a developer and supplier of automatic test equipment with high profile customers to the likes of Samsung, Qualcomm, Intel, Analog Devices, Texas Instruments, and IBM.

The company is the market leader for semiconductor test equipment, accounting for nearly 50% of all semiconductor test equipment sales last year.

In what may just be Teradyne’s most intriguing business segment, Industrial Automation, we have a uniquely well-positioned long-term growth story. IA’s biggest unit by far is Universal Robotics (UR) and all indications point to a recovery based around a lessened impact from Covid-19.

Growing 17% quarter-over-quarter, we are beginning to see the light at the end of the tunnel. Furthermore, this business segment also has its Mobile Industrial Robots and AutoGuide units, which were acquired in 2018 and 2019 respectively.

Other interesting names in this industry not owned by ARK include Cognex, Fanuc, ABB, and Siemens.

ARK Invest Big Idea 2021 theme #9: Autonomous Ride-Hailing

ARK Invest research suggests that autonomous ride-hailing platforms will generate more than $1trn in profits per year by 2030.

Also, automakers and fleet owners could enjoy profits of $250 bn and $70bn respectively.

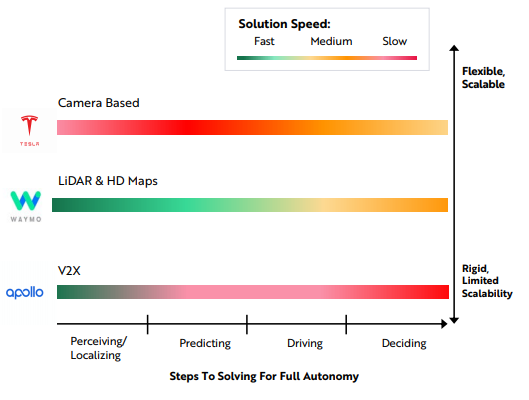

According to ARK Invest, 3 autonomous strategies are evolving:

- Tesla’s approach is camera-based. With less accurate sensors than LiDAR, making the path to full autonomy a more difficult problem to solve, cameras do not rely on HD maps and should enable a much more scalable service. Tesla could be the first autonomous taxi network to scale nationally.

- Alphabet’s Waymo is using LiDAR and HD mapping. Waymo launched its autonomous network in Arizona but probably will need time and significant resources to scale nationally.

- Many Chinese players, including Baidu’s Apollo, are building out infrastructure sensors to help vehicles identify road signs and traffic. Requiring large infrastructure investments, this approach to autonomous ride-hailing seems to be the most rigid and least scalable of the three.

ARK Invest Autonomous Ride-hailing stock: Baidu

Baidu is ARK Invest’s 6th largest holding across its portfolio. This counter could be ARK Invest’s way to play the autonomous ride-hailing market in China vs. Didi Chuxing, the latter being the largest ride-hailing company in China.

Of course, Baidu is more than a ride-hailing company, more famously known as the Google of China. A stake in Baidu could also be a way to play on the Big Data and Deep Learning theme.

Baidu is also planning to get into the EV market with the help from Geely. This seems logical, given that Baidu has spent years working on self-driving technology and is the leading Chinese company in the autonomous vehicle space.

ARK Invest Big Idea 2021 theme #10: Drone Delivery

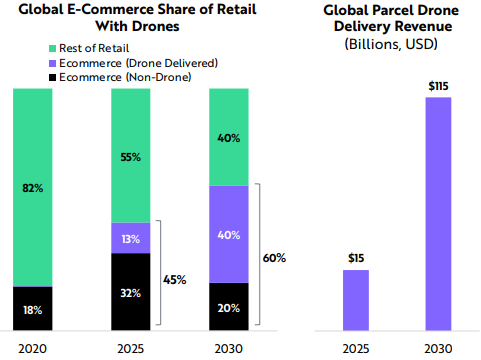

ARK Invest’s research on Drone Delivery, another big theme for disruptive innovation according to the firm, finds that drone delivery platforms will generate roughly USD275 billion in delivery revenues, USD50 billion in hardware sales, and USD12 billion in mapping revenue by 2030.

COVID-19 accelerated e-commerce experimentation and adoption with contactless drone deliveries. ARK Invest estimates that at some point during the next 5-years, drones will deliver more than 20% of parcel shipments.

By 2030, drone delivery platforms could scale another 4-fold, generating $275bn in revenues, while hardware sales grow nearly 3-fold to almost $50bn and mapping revenues nearly 4-fold to $12bn

ARK Invest drone delivery stock: JD

JD accounts for a 0.57% stake in ARK Invest portfolios.

JD.com is one of the largest e-commerce players in China, after Alibaba. The company has been very aggressive in terms of expanding its logistic services and is one of the first to potentially commercialize its unmanned aerial logistics services.

JD.com has completed the maiden flight of its new self-developed delivery drone in late 2020, codenamed JDY-500 which is designed to transport up to a few hundred kg of goods per flight with an ability to airdrop supplies in case of an emergency.

ARK Invest Big Idea 2021 theme #11: Orbital Aerospace

Thanks to advancements in deep learning, mobile connectivity, sensors, 3D printing, and robotics, costs that have been ballooning for decades are beginning to decline.

As a result, the number of satellite launches and rocket landings is proliferating.

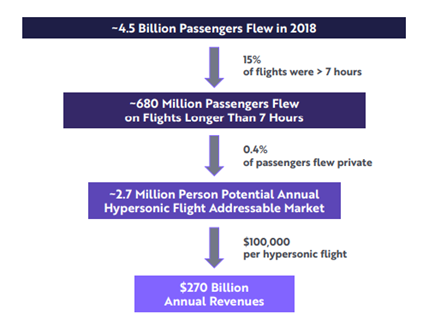

According to ARK Invest research, the orbital aerospace opportunity – including satellite connectivity and hypersonic flight – will exceed $370bn annually.

ARK Invest Orbital Aerospace stock: IRDM, SPCE (not yet)

This is ARK Invest 43rd largest holding, accounting for a 0.73% stake.

Iridium operates the Iridium satellite constellation, a system of 66 active satellites (and 9 spares in space) used for worldwide voice and data communication from hand-held satellite phones and other transceiver units.

Alternatively, one might also look to take a position in SPCE which might be one of the most prominent holdings in ARK Invest’s new space tech ETF, ARKX which has yet to be launched but is virtually certain to attract widespread attention and billions of dollars of assets.

ARK Invest Big Idea 2021 theme #12: 3D printing

3D printing collapses the time between design and production, shifts power to designers, and reduces supply chain complexity at a fraction of the cost of traditional manufacturing.

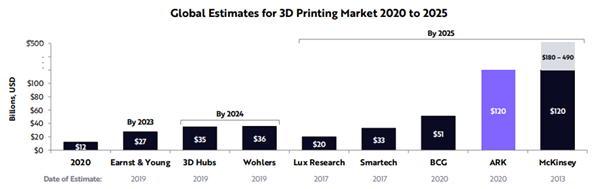

ARK Invest believes 3D printing will revolutionize manufacturing, growing at an annual rate of roughly 60% from $12bn in 2020 to $120bn in 2025.

ARK Invest 3D printing stock: Stratasys

Stratasys accounts for 0.68% of ARK Invest portfolio and is an American-Israeli manufacturer of 3D printers and 3D production systems for office-based rapid prototyping and direct digital manufacturing solutions.

Stratasys manufactures in-office prototyping and directs digital manufacturing systems for automotive, aerospace, industrial, recreational, electronic, medical, and consumer product OEMs

Its share price has been on a tear lately, notching an all-time high.

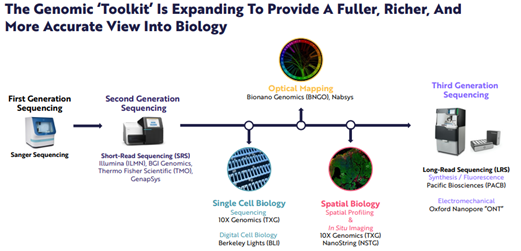

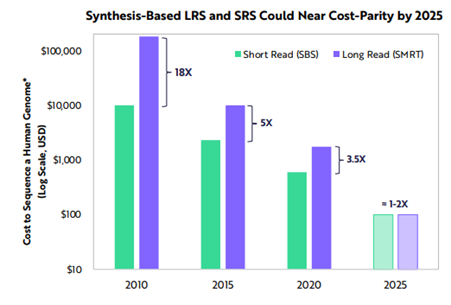

ARK Invest Big Idea 2021 theme #13: Long Read Sequencing

Next-generation DNA sequencing is the driving force behind the genomic revolution. Though historically dominated by short-read sequencing, ARK invest believes long-read sequencing will gain share at a rapid rate.

Long-read technology offers superior accuracy, more comprehensive variant detection, and a richer set of features than short-read platforms.

By the end of 2025, highly accurate long and short-read sequencing should approach cost-parity.

ARK Invest Long-read Sequencing stock: Pacific Biosciences

A top 12th holding in the ARK portfolio, Pacific Biosciences is a long-read sequencing player that is favored by ARK Invest.

In the biotech world of genome sequencing, Illumina may be the undisputed market leader. But when it comes to shareholder returns in the past year, Pacific Biosciences of California Inc was one of the top performers, rewarding investors lavishly. This could be due to the Cathie Wood’s effect

For the uninitiated, Pacific Biosciences (or PacBio) is a biotechnology company that develops gene sequencing systems and is a counter that specializes in long-read sequencing as opposed to Illumina’s short-read sequencing.

The company recently won approval from Softbank, with the latter looking to invest $900m n the company in the form of convertible debt. Softbank was reported to have previously taken a 6% take in the company in the prior month.

ARK Invest Big Idea 2021 theme #14: Multi cancer screening

According to ARK Invest research, the convergence of innovative technologies has pushed the cost of multi-cancer screening down by 20-fold from $30,000 in 2015 to 41,500 today and it should drop another 80% to $250 in 2025.

As a result, the multi-cancer screening market should scale to $150bn in the US alone.

As population-scale clinical utility data proliferates, ARK Invest believes a $1,500 price tag will unlock the multi-cancer screening market for those aged 65 to 80—the age range in which the incidence of cancer peaks.

As prices drop below $1,000, nearly all age groups above 40 years could be screened for cancer cost-effectively, potentially saving up to 1.4 million human life years in the US alone.

ARK Invest multi cancer screening stock: Exact Sciences Corporation

A core holding accounting for 1.85% stake in ARK Invest portfolio.

Getting ahead of cancer is crucial no matter where people are in their cancer journey. From earlier cancer detection to treatment guidance and monitoring, EXAS helps people get the answers they need to make more informed decisions across the cancer continuum.

With a leading portfolio of products for earlier detection and treatment guidance, the company helps people face the most challenging decisions with confidence.

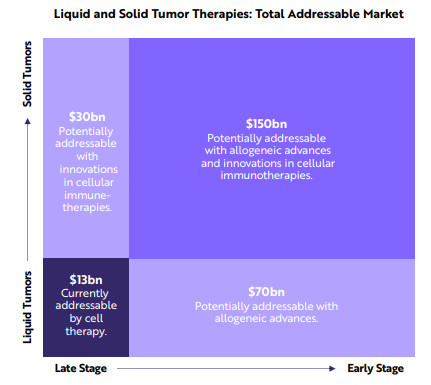

ARK Invest Big Idea 2021 theme #15: cell and Gene therapy

The second generation of cell and gene therapies should shift from:

-liquid to solid tumors

-autologous to allogeneic cell therapy

-ex vivo to in vivo gene editing

ARK Invest cell and gene therapy stock: CRISPR Therapeutics

CRISPR Therapeutics AG is at the forefront in developing products using the CRISPR approach to gene-editing. CRISPR stands for Clustered Regularly Interspaced Short Palindromic Repeat – a faster, easier, and less expensive technology than traditional techniques.

It is believed to be a potential game-changer in gene-editing technology.

CRISPR Therapeutics AG currently has nine product candidates in various stages of development or testing, targeting a wide range of disease areas that includes transfusion-dependent beta-thalassemia and sickle cell diseases, immuno-oncology, and regenerative conditions.

As in any new product to be introduced in the market, the one that gets to the finish line first has the definite advantage of being the market leader.

Compared to its competitors, CRISPR Therapeutics AG is ahead in terms of product development and testing. Two of its product candidates, CTX001 for treatment of transfusion-dependent beta-thalassemia and sickle cell disease, and CTX110 for CD19+B-cell malignancies are undergoing clinical trials for safety and efficacy.

Two other product candidates are in the near early testing stage.

Conclusion

These are the stocks that are leveraged to Ark Invest’s 15 Big Idea themes of 2021 that could continue to see strong structural growth over the coming 5-10 years.

ARK Invest’s goal is to invest in innovation. This means that many of these stocks highlighted cannot be evaluated solely from a historical financial standpoint. They will never be considered as great stocks to buy if you are evaluating them solely from a fundamental angle ie: earnings, cash flow, etc.

There are of course risks when it comes to investing in innovation.

Some of the risk factors include:

- Rapid Pace of change

- Uncertainty and unknowns

- Regulatory hurdles

- Political or legal pressure and

- Competitive landscape

I believe that the stocks mentioned in this article are great candidates for your portfolio.

I have a handful of them which I deemed as my “forever stocks”. A blue-chip stock that I like is Paypal, a company that is exposed to a handful of these big idea themes: Digital Wallets, Bitcoins, Deep Learning, etc.

Once again, this article is not meant to induce a recommendation of any kind but more of the big picture guidance for further investigation. Please do your due diligence when it comes to investing in these “high growth” stocks that are naturally susceptible to substantial price volatility.

I hope that this article has been useful in pointing you in the right direction in terms of identifying the key stocks that Ark Invest is currently vested to partake in these 15 big ideas theme.

Do Like Me on Facebook if you enjoy reading the various investment and personal finance articles at New Academy of Finance. I do post interesting articles on FB from time to time which might not be covered here in this website.

Join our Telegram broadcast: https://t.me/gemcomm

SEE OUR OTHER WRITE-UPS

- New IPO stocks performance in 2020

- Growth Investing: How to find growth stocks to invest in

- 6 Blue-Chip Dividend Growth Stocks with High Dividend Growth Rate

- Top 20 SaaS Stocks: Which are those with strong Gross Margins and Revenue Growth? [Part 1]

- Strong Dividend Growth Stocks Increasing Dividends by up to 19% in 2020

- FSMOne Singapore: Step-by-step guide to open your FSMOne account and start trading

Disclosure: The accuracy of the material found in this article cannot be guaranteed. Past performance is not an assurance of future results. This article is not to be construed as a recommendation to Buy or Sell any shares or derivative products and is solely for reference only.