HDB loan vs Bank Loan: which should you choose today?

Deciding to buy an HDB flat in Singapore involves more than choosing the property size, number of rooms, and the right location. Unless you received millions of dollars in inheritance or won the TOTO jackpot, you have no choice but to think about your financing options.

Because purchasing your first home is one of the most serious financial commitments you will ever make in your adult life, choosing a home loan requires careful consideration. Ultimately, you need to decide whether you will apply for an HDB loan or a bank loan. Each type has its advantages and drawbacks, and it is up to you to carefully assess them so that you will be on the winning end.

If you want to know how securing a loan from the Housing Development Board differs from getting financing from a bank of your choice, read on. This piece will give you a rundown of the significant differences between the two to help you make an informed decision.

I would follow up with detailing my own experience when I took up an HDB loan a decade ago to help finance my BTO.

But before we even discuss the key differences between an HDB loan and a Bank loan, you should find out if you are eligible for an HDB loan in the very first place.

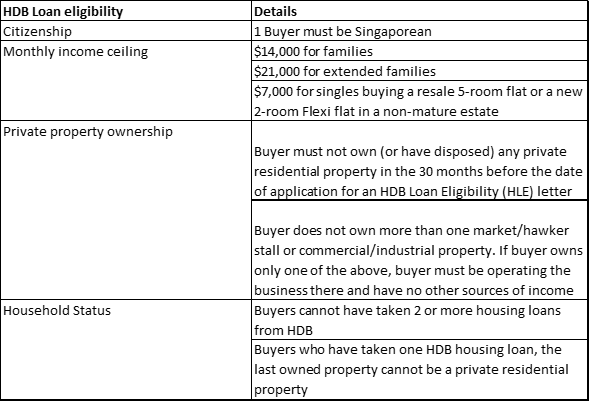

The table below summarizes the eligibility for a couple applying for an HDB loan.

For example, If you are a “high-earner” with your family gross monthly income exceeding $14,000 (calculated during your HLE application), then you will no longer be eligible to apply for an HDB loan. In this case, your only loan option is a bank loan.

Now that you are clear of the eligibility criteria for an HDB loan application, let’s take a closer look at the key salient differences between an HDB loan and a bank loan.

Which should you be selecting ultimately?

What Are the Key Differences Between HDB and Bank Home Loans?

There is no shortcut to finding the best home loan for your needs. While you can take into account the experiences of friends and relatives, you should keep in mind that just because one type of home loan works for them does not guarantee it will work for your situation. Here are the main differences between an HDB loan and a home loan so you can evaluate them based on their merits:

HDB Loans Have Stricter Eligibility Conditions

Before you lose sleep in deciding whether to take an HDB loan or bank loan, you should first examine the housing eligibility criteria for HDB financing to ascertain if you qualify. Unlike bank loans that generally focus on good credit scores and the client’s overall financial health, HDB housing loan eligibility requirements are much more stringent.

I have summarized the eligibility conditions for an HDB loan application in the earlier segment.

HDB Loans Have Higher Loan-to-Value Limit (LTV)

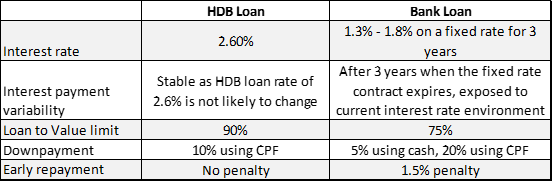

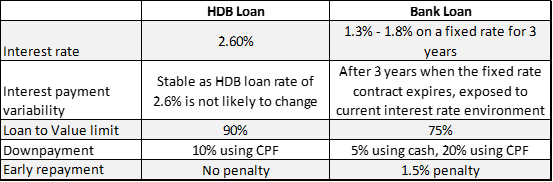

The loan-to-value (LTV) limit is the maximum amount of loan you can borrow to finance your home purchase. For an HDB housing loan, you can borrow up to 90% of the property value, while you can only get 75% for bank loans. This can be a significant difference, particularly for a cash-strapped family.

Let me illustrate with an example.

The latest Bidadari BTO that was launched in Feb 2021 saw 3-room prices starting at $312,000 and 5-room prices starting at $611,000. If you are to finance this HDB BTO purchase using an HDB loan, the downpayment for the flat would just be $31,200 (3-room) to $61,100 (5-room) vs. a bank loan where you will need to fork out $78,000 (3-room) to $152,750 (5-room) for the same flats.

The difference in downpayment can be rather substantial for young couples, especially if they are just starting in their career and do not have much savings in the CPF/bank account.

Although having a high LTV can help you achieve your homeownership dream much sooner, getting a bigger loan also means more risk. Moreover, you will most likely end up paying higher interest in total. To have an idea of how much funds you can borrow and afford to pay, you may want to use an HDB Loan Calculator CPF (Central Provident Fund) members typically use—or another similar financial tool.

You Can Use CPF to Pay Your HDB Loan Down Payment

Perhaps one of the upsides of securing an HDB loan is that you have the option to pay your down payment in full using CPF if you have enough funds in your Ordinary Account. That means you do not have to cough up thousands of dollars in cash for the initial payment. You can use whatever amount you saved up for other expenses, such as property taxes, renovation, and mortgage repayments.

Note that with an HDB concessionary loan, the down payment is 10% of the property valuation. For bank home loans, the down payment is much higher as it is set at 25% of the valuation. Unfortunately, you can only use your CPF funds to pay for the 20% as banks require 5% of the down payment in cash.

Using the above Bidadari example again, for the 5-room flat with prices starting from $611,000, you and your spouse, if you select to use HDB loans, can pay the full 10% downpayment using both your CPF OA balance. This amounts to $61,100.

If you select to use bank loans, you would need to fork out $30,550 in CASH and pay the remaining 20% of the downpayment of $122,200 in CPF.

Bank Loans Have Lower Interest Rates

HDB’s interest rate is pegged at 2.6% per annum, which is higher than what most banks offer. To date, the interest rate for bank loans typically ranges from 1.3 to 1.8% per annum. Although bank loans have lower interest rates, it does not necessarily mean that they are better because they can fluctuate depending on the market.

While one might argue that the borrower can convert their bank loan into a fixed-rate loan as low as 1.3-1.5% in some cases, the “lock-in” period is typically around 3-5 years (unlike in the US where you can lock in your mortgage loan for 20-30 years).

On contract expiration (3-5 years), one might be exposed to the current interest rate environment than which could translate to a much higher mortgage rate, thus impacting your affordability nature.

If you value stability, an HDB loan is a better choice as its interest rate has remained the same since 1999. As such, you are almost a 100% sure that your monthly repayments will stay unchanged during the entire loan term, which is something you cannot guarantee with bank loans.

HDB Loans Are More Lenient

If you ever get a windfall and want to pay off your home loan early, most banks will charge you with a prepayment penalty, usually around 1.5% of the loan amount. You will also pay a certain fee if you fall behind on mortgage payments ($50 late-payment fee).

Banks will also charge you a pre-payment fee if you sell your HDB flat and cut short your bank home loan within the lock-in period of 3-5 years where you are receiving the preferential loan rate. This scenario is something that most would have overlooked. One way to work around this pre-payment fee by the banks is to not have a “lock-in” contract if you are looking to sell your property after the initial 3-5 years period has ended.

All things considered, HDB loans are more lenient. You can pay back your home loan early with ZERO penalty fees. In case you face financial difficulties and fail to settle your dues on time, you can also expect more flexibility with HDB loans. Don’t expect that from your “fair-weather friendly-neighborhood” banker.

Summary of key differences between an HDB loan and a Bank loan

Which Type of Home Loan Is Best for You?

As mentioned earlier, there is no “best home loan option” for everyone. The ideal housing loan depends mostly on your situation, needs, motivation, and other factors.

For instance, if you want a hassle-free and less risky home loan, getting a loan from HDB may be better because its interest rates are stable. You know exactly how much money you need to make monthly repayments. Also, you do not have to worry about penalties if you settle your debt early or get behind for a few months.

Nonetheless, if you value savings and have a clear understanding of how the housing market works in Singapore, you may choose bank loans for their lower interest rates. If you do, make sure to review the terms and conditions before signing anything.

At the end of the day, the right home loan for you should be the result of a careful assessment of the pros and cons of each type and how each one fits your budget, addresses your financial goals, and gives you peace of mind. Take your time and evaluate objectively.

Why I took an HDB loan (with a slight tinge of “regret” in hindsight)

Just to share my own experience, me and my missus registered for our BTO almost a decade ago. Like many young couples, even though both of us were generating a steady stream of income from our first jobs, it was not much to shout about and cash was tight.

We hence decided to apply for an HDB loan which we were eligible for, which lowers our downpayment required significantly plus the fact that no cash outlay was needed.

I was a little apprehensive about paying the substantially higher HDB loan rate of 2.6% vs. the then mortgage rate of approx. 1.8% but decided that it was worth it for the peace of mind, knowing that my mortgage loan rate will be fixed at 2.6% for the next 30 years of the loan duration.

Over the next 2-3 years, we decided to prepay our HDB loan which will not incur any prepayment penalties. This was done using mostly my CPF OA.

One would argue against the notion of prepaying your mortgage loan using your CPF OA. I have previously written in this article: Why pre-paying your home loan in 2021 is a mistake with Home Protection Scheme in place

NAOF readers who might be interested to know the rationale behind that statement can check out that article.

While it might not be the most financially savvy solution to prepay your mortgage loan, knowing that you are mortgage-free is often a huge burden off the mind of most people and give them a certain level of financial security. One will no longer need to worry that you and your family will be left without shelter above your head in unfortunate circumstances such as a prolonged loss of income.

I took the “less financial savvy” decision and prepay the bulk of my HDB loan, resulting in <$100k mortgage outstanding.

This presented a couple of “problems”. First, the overall interest rate environment continued to favor mortgage borrowers, with interest rates continuing their downward trajectory. I was thus paying a substantially higher rate on my HDB loan (at 2.6%) vs. what my peers were paying (locked-in 1.3-1.5% for 3-5 years). I was paying almost double in interest!

When I thought about refinancing, it was no longer possible as most banks will not refinance your mortgage loan if your outstanding amount is less than $100k. Even if they do, the refinancing fees might no longer make sense relative to the monthly cost savings associated with a smaller mortgage loan amount.

Hence, although I do have the flexibility “on paper” to convert my HDB loan to a bank loan to capitalize on the low-interest environment, I wasn’t able to do so because of my circumstances.

Key Pointers:

- If you decide to prepay your HDB loan, do note that prepaying your loan below $100k might make subsequent refinancing into a bank loan not financially feasible

- If you have the intention and capability to prepay your mortgage loan (substantially), then it might be wiser to select the HDB loan option and retire the bulk of the loan without any prepayment penalties.

- For those who have a strong view on interest rates remaining lower for longer, then select the bank loan route will be the preferred option to capitalize on the low-interest rates, with subsequent refinancing also done at a low rate. Of course, this comes with the risk that the interest rate might spike substantially, pulling your mortgage loan higher. This could be a key risk for those on variable mortgage rates or whose fixed-rate contract is ending.

Conclusion

Making a home purchase is likely one of the largest expense decisions we have to make in our lives and for most Singaporeans, that usually begins with the purchase of a BTO.

To decide if you should select an HDB loan or Bank loan when you purchase your BTO, first determine if you are indeed eligible for an HDB loan in the first place, if not, the only “real” options are selecting between different bank loan packages.

If you do not have enough CPF or cash to pay the initial 25% downpayment required for selecting a bank loan, then you are probably “stuck” with an HDB loan which likely entails a higher mortgage rate of 2.6% (fixed for the entire duration, most likely)

If you have the “eligibility” and “financial capability” of selecting either an HDB loan or bank loan, then you need to prioritize. Which takes greater precedence? Capitalize on the low-interest-rate environment (select bank loan) or flexibility to prepay your loan with peace of mind that your monthly mortgage rate will always be kept constant (HDB loan).

If I was able to turn back time based on today’s interest rate context, I would select to go for the bank loan option vs. the HDB loan option, locking in a 5-year fixed-rate loan at 1.5%. This means that my interest payment will be a fixed 1.5%, starting from TOP to MOP.

Assuming a loan amount of $300k taken over 30 years, that will translate to a monthly interest payment of approx. $202.

Compare this to an HDB loan that charges 2.6%, the interest payment per month will translate to approx. $368 or $166 more in this case. Over a 5-years horizon, the total interest I would have saved based on the fixed bank loan rate of 1.5% vs. 2.6% HDB loan rate would be approx. $9,960.

What happens if the interest rate starts appreciating significantly and is now substantially more than the HDB loan rate of 2.6% (say 4%).

Recall that I no longer have the option to convert to an HDB loan after selecting the bank loan as my first option. In this case, I am prepared to prepay the entire outstanding loan quantum of approx. $237,900. This option might not be feasible for those who do not have access to capital, either in cash or CPF.

The 1.5% prepayment penalty on the outstanding amount of $237,900 quantum amounts to $3,569. However, I would still be better off given that my savings from selecting a low bank loan over the past 5 years have more than outweigh this prepayment penalty, translating to a net savings of $6,392.

The ability to capitalize on the low bank rate and yet be able to prepay the outstanding when interest rates appreciate significantly is likely only relevant to a small subset of homeowners. For the mass majority, this might not be a relevant option, particularly if the original loan quantum is large (think 5-room bidadari BTO).

In such instances, selecting an HDB loan will provide that additional peace of mind. While mortgage rates are still relatively low in today’s context, there is no guarantee that they can remain low over the foreseeable future, one where inflation sits atop as the No.1 risk in investors’ minds today.

If you enjoy this article and will like to find out more about your existing HDB or bank loan, do fill up the questionnaire below and we will get in touch with you shortly.

Do Like Me on Facebook if you enjoy reading the various investment and personal finance articles at New Academy of Finance. I do post interesting articles on FB from time to time which might not be covered here in this website.

SEE OUR OTHER WRITE-UPS

- HPS Singapore: Why pre-paying your home loan in 2021 is a mistake with Home Protection Scheme in place

- HDB Sales Proceeds “eaten” up by your CPF accrued interest and Mortgage Grants?

- 12 Tips To Select A Good Unit At A New Launch Project

- 6 Point Checklist For A Property Hotspot in Singapore 2021

- Upgrading From HDB Flat To Condo in 2021: Buy First or Sell First?

- Selling your EC Right after MOP or upon Privatisation? Which is better?

Disclosure: The accuracy of the material found in this article cannot be guaranteed. Past performance is not an assurance of future results. This article is not to be construed as a recommendation to Buy or Sell any shares or derivative products and is solely for reference only.

2 thoughts on “HDB Loan vs Bank Loan: Why I took an HDB loan with a slight tinge of regret”

I think it’s a bit weird with your articles on real estate. Like I read Stackedhomes for that, I come here for stocks and financial markets

Hi Ben, thanks for dropping by. Hopefully this is where you come in future as well for real estate info… yes but stackedhomes provide very good info…. I am looking to provide a basic real estate info for those looking to buy their first property and subsequently upgrade to a private one.