Partaking in 3 hot asset classes to counter the effect of rising inflation

I have written about Tiger Brokers, one of the most affordable, low-commission cost fintech brokerage platform available to Singaporean investors in these 2 Tiger Brokers review articles:

- Possibly the cheapest brokerage in town. Is it right for you?

- How I use Tiger Brokers to find stock gems

The first article is an introductory piece where I provided a quick summary as to who the new kid on the block is as well as how this fintech brokerage platform is disrupting the status quo by bringing low-commission costs trading to Singaporean investors.

In the second article, I went a little more in-depth by introducing to my readers a key functionality of Tiger Brokers’ mobile platform to find stock gems and how I used its Options Trading platform to leverage these ideas.

In this article, I will be introducing to readers Tiger Brokers’ futures platform and how I might use it to partake in 3 of the hottest asset classes for 2021 to counter the effect of rising inflation.

Before I disclose which are the 3 asset classes that I can leverage on using Tiger Brokers’ futures platform, let me first provide readers with some basic understanding of what futures trading is all about.

This article will be broken down into 3 main segments:

- How futures trading works

- How to partake in the 3 hottest asset classes of 2021 using futures to counter the effect of rising inflation

- How to use Tiger Brokers’ futures platform

How future trading works

What are futures?

Futures also called futures contracts, are a form of derivative contracts, similar to options that obligate the parties to transact an underlying asset at a predetermined future date and price. Futures are identified by their expiration month. For example, a June natural gas futures contract expires in June.

There are many types of futures contracts available for trading with different underlying assets:

- Stock Index futures such as the S&P500 index

- Commodity futures such as natural gas, oil, wheat, corn

- Precious metal futures such as gold and silver

- Currency futures such as those for the USD and Euro

- Treasury futures for bonds and fixed-income products.

Stocks vs. Options vs. Futures

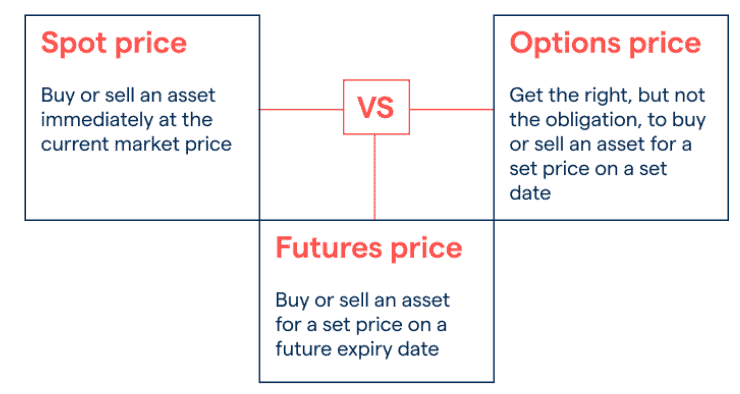

Futures work similarly to options in that both are derivative products that provide leverage to a certain asset class.

However, the key difference is that for an Option BUYER, he/she has the right (but not the obligation) to buy or sell the underlying asset at any time before the expiration date of the contract. The buyer of a futures contract, on the other hand, is obligated to take possession of the underlying commodity (or settle it in cash) only at the time of expiration. Of course, he/she can sell their position at any time before expiration and be free of that obligation.

Using Futures

The futures market is often associated with high leverage. This means that the trader does not need to put up 100% of the contract’s value amount when entering into the trade. Instead, the trader only has to fork out a small amount, termed as the initial margin amount.

As the prices of the underlying fluctuate and get too volatile, the broker may ask for additional funds to be deposited into the margin account. This is called maintenance margin.

It is important to note that trading on margin carries with it relatively high risk. You might potentially lose more than your initial capital.

Take, for example, a trader who has a $10,000 broker account balance and is in the trade for a long $100,000 position in natural gas (10x leverage). Should the price of the natural gas move against his/her trade, say 20% decline overnight, the loss on that $100,000 position is $20,000 (more than the capital of $10,000).

In this case, the broker would make a margin call requiring additional funds to be deposited to cover the market losses.

Another example of futures

Let say a trader wants to speculate on the price of crude oil. He enters into a futures contract, expiring in December, with the expectations that crude oil prices will appreciate substantially by the end of the year.

The December crude oil futures contract is currently traded at $56 and the trader wishes to “lock-in” that price.

Since oil is traded in increments of 1,000 barrels, the investor now has a position worth $56,000 (1,000 barrels * $56/barrel = $56,000). However, instead of forking out $56,000, the trader would need to only put up a small fraction, say $5,600 (10% of the value). This is the initial margin that is required to be deposited with the broker.

From now to December, if the price of oil declined substantially or prices get overly volatile, additional funds might be required in the form of the maintenance margin highlighted earlier.

In December, the futures contract will expire on the 3rd Friday of the month (similar to standard option contracts. If the price of crude oil has risen to $70/barrel, the trader can sell his futures contract and net $14,000 in profit ($70 – $56 =$14 *1,000 = $14,000), excluding any commission costs.

If the price of crude oil has collapsed to $40/barrel, then the investor would have lost $16,000 ($40 – $56 = -$15 *1,000 = -$16,000)

In most cases, futures are cash-settled. This means that if you hold onto the futures contract to expiration, the contract would be closed off with the profit/loss settled on a cash basis, as illustrated in the above example.

However, some futures contracts will require physical delivery. In this scenario, the investor holding the contract upon expiration would take ownership of the physical asset by paying the price which he “locked-in” earlier ($56/barrel of oil). He/She would then be responsible for finding storage for the underlying asset and has to also cover other miscellaneous costs such as transport, material handling, insurance, etc.

Futures for speculation and hedging

Speculators

Futures are common structures that traders use to speculate on the movement of commodity assets (as an example), both on the long and short sides.

If you believe that the price will head up, you can buy the futures contract and make money if the price does appreciate from your cost price. This is similar to stock buying. However, the key difference is that futures contracts have an expiration period and you cannot have direct commodities exposure through shares.

Speculators can also take a short or sell speculative position if they believe that the price of the underlying asset will fall. They will benefit when the price of the underlying asset falls below their initial cost entry price.

Overall the commission charges on futures trades are small relative to other investments, which allow speculators to “leverage-up” cheaply.

Hedgers

These are businesses or individuals that use futures contracts for protection against volatile price movements in the underlying commodity which is a quintessential component of their business.

For example, an airline company would want to hedge against the cost of oil increasing significantly in the future (oil is a major cost component of airlines). The company would thus purchase an oil futures contract, giving it the right to buy X barrels of oil at a later date for a pre-determined price which is fixed today.

If oil prices increase from $50 today to $70 when the futures contract expires, the airline company can then take ownership of X number of barrels of oil for $50 (fixed when the contract was first purchased), instead of paying the then market price of $70, thus benefiting from the $20 price differential.

Regulation of Futures and selecting a Futures Broker

The futures markets are regulated by the Commodity Futures Trading Commission (CFTC). Investing in futures is typically done through a brokerage company like Tiger Brokers. These brokerages provide access to the exchanges and markets where these investments are transacted.

We will talk more about Tiger Brokers’ futures platform in a later segment.

With a better understanding of the mechanism of futures trading, let me now highlight 3 exciting asset classes of 2021 in which one can partake using futures.

Countering the effect of rising inflation

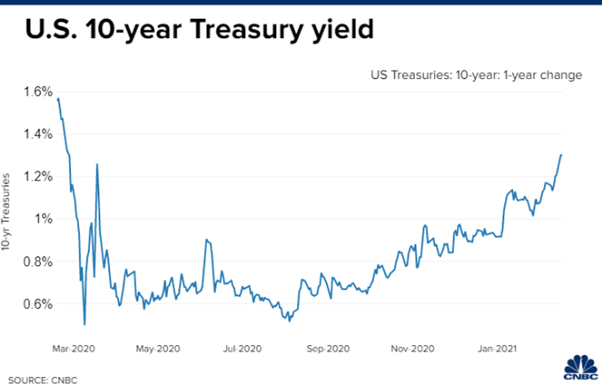

The rise in the 10-year bond yield (above 1.3% for the first time since early 2020 when the Fed started tapering due to COVID-19) is spooking the market, resulting in a sector rotation with a sell-off in tech counters as investors now favor laggards such as oil plays that have been the major laggard in 2020. Is this rotational play a temporary “phenomenon” just like what we witnessed in early 2021 or a prelude to a new bear market formation?

I have previously written that rising inflationary forces, while largely ignored by the masses and downplayed by governments, could be the key catalyst that triggers a massive sell-off, one where rising long-term yields force the hands of the US government to raise Fed rates to prevent runaway inflation.

We are witnessing early signs of that happening. While I have got no crystal ball in front of me to “foretell” if long-term yields will continue to rise, it is always prudent to hedge against the effect of rising inflation through certain asset classes.

There are 3 asset classes that one might consider having exposure to as a portfolio diversification strategy to combat the rise of inflation. One way to partake in having exposure to these asset classes is through the future’s platform.

This can be done through Tiger Brokers’ futures platform which is a simple and intuitive platform to use (more on that later).

Asset class #1: Soft and hard commodities

Exposure to commodities is typically done directly through commodities futures or the indirect method through stock exposure to commodity players.

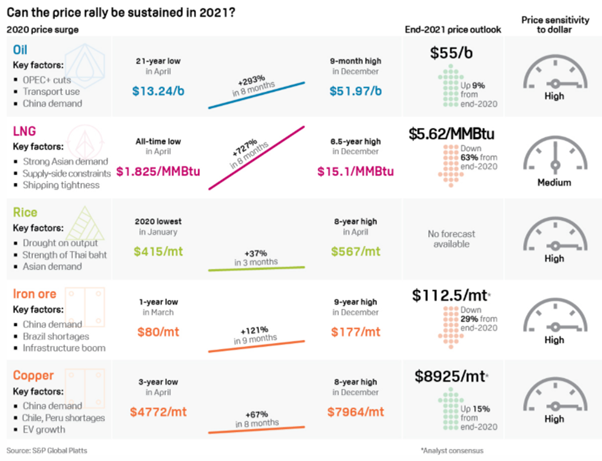

Both soft and hard commodity prices have been on a tear in 2021, with S&P Global Platts highlighting that a new supercycle might be upon us, driven by stimulus spending and a weaker US dollar.

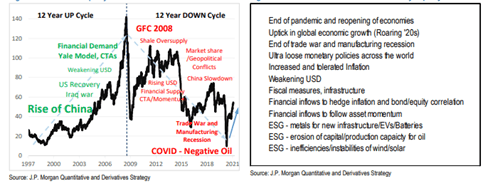

JP Morgan has the same view, believing that the commodity cycle bottomed in 2020 and that the new commodity upswing is now taking place.

Mostly, it will be the story of a post-pandemic recovery, ultra-loose monetary and fiscal policies, weak USD, stronger inflation, and unintended consequences of environmental policies and their friction with physical constraints related to energy consumption and production.

According to JPM, one way to hedge against inflation based on their investors’ survey is through exposure to commodities, with 42% of participants believing that to be the most effective way. They thus believe that global multi-asset portfolios will look to gradually increase their commodity exposure throughout 2021.

Copper rally

A hard commodity asset that investors might wish to partake in is Copper, where prices climbed to their highest level in nearly a decade as investors in the commodity anticipate rising demand for infrastructure and construction projects in the post-pandemic economy.

The copper rally is led by the return of Chinese demand which has resulted in the largest deficit in supply in a decade this year, with a high risk of scarcity over the coming months.

Sugar supply crunch

A soft commodity example is raw sugar.

Raw sugar prices extended gains to the highest in almost 4 years amid signs of near-term supply tightness and high energy prices that could stoke demand for cane-based ethanol.

While the near-term outlook for sugar remains positive, there are concerns that the supply crunch of late will be alleviated over the coming months as Brazil start its harvest and the North Hemisphere crops start to trickle in.

The above are just a couple of examples to play the commodity rally, some of which might be more sustainable than others.

One can have direct exposure to these commodities by buying futures contracts on specific commodity plays. I will elaborate more on that in the next segment on Tiger Brokers’ futures platform.

Asset Class #2: Precious metal

Precious metal such as Gold and Silver tends to do very well in an inflationary environment. One can also have exposure to these precious metals through futures.

Gold prices have been relatively weak, having peaked back in August 2020 but have since retreated by almost 15%.

However there seems to be a strong support level at the current $1,800/oz price and if the inflation story has legs, we could witness a strong rebound in gold prices.

Another precious metal that is currently favored by the market is silver.

The precious metal is preferred over Gold because unlike gold which has no real “operational use” besides being seen as a store of value and for ornaments/jewellery purposes, silver is a key component used in electric cars, the latter witnessing rising global demand as we shift towards a future with less dependency on oil.

Both gold and silver will likely witness stronger demand if inflationary pressure accelerates. One can have direct exposure to these precious metals through futures which is a leveraged way to play the rise in prices of these commodities.

Asset Class #3: Energy

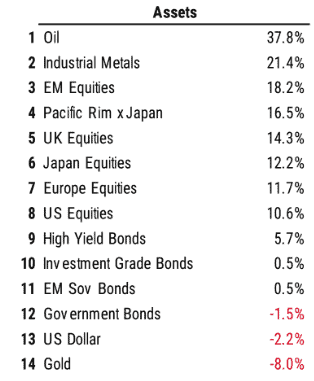

According to BOA, oil is the best performing asset class of 2021, having appreciated by close to 40% since the start of the year.

This asset class outperformance might continue in 2021, with the recent news that OPEC+ is not yet ready to turn on the supply spigot, providing a strong tailwind for oil prices to maintain its upward trajectory. The news is contrary to initial market expectations that OPEC+ is ready to ramp up its oil supply to make up for loss revenue in 2020.

Oil prices and levels of inflation are often seen as being connected in a cause-and-effect relationship. As oil prices move up, inflation—which is the measure of general price trends throughout the economy—follows in the same direction higher.

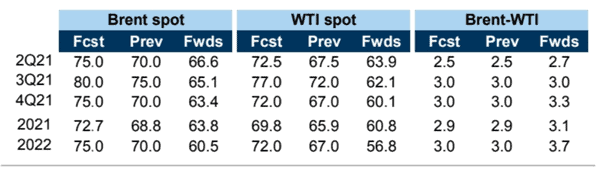

Another major investment bank, Goldman Sachs has recently raised its oil price forecast on the back of OPEC+ surprise move. The table below illustrates Goldman Sachs’ oil price forecast to 2022.

Is there more upside to oil prices in 2021? There is definitely no certainty pertaining to its long-term trajectory (given the prominence of renewables under the Biden administration), but oil short-term outlook remains a positive one. One can definitely partake in oil price movement through the futures’ market.

Tiger Brokers’ futures platform

One can partake in these 3 hot asset classes to combat inflationary forces through Tiger Brokers’ futures platform.

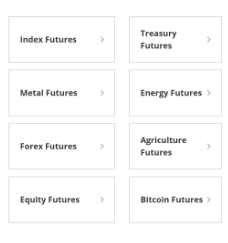

Tiger Brokers future platform allows one to participate in 8 different types of assets, as illustrated in the diagram below:

We have earlier highlighted a number of them, one being agriculture futures where you can use it to purchase soft commodities such as sugar or metal futures to buy hard commodities such as copper as well as precious metals like gold and silver.

One might not be aware but the Tiger Brokers’ futures platform also allows you to participate in bitcoin futures which is a trending asset class at the moment.

Other assets that can be leveraged using Tiger Brokers’ futures platform include index futures like the S&P500, Treasury futures like the 10-year Treasury bond, forex futures as well as individual stock equity futures although that is currently limited to just 3 HK counters (Tencent, Ping An and HK Exchange) at present.

Tiger Brokers: Low-cost commission structure

Tiger Brokers futures platform is not unique when compared to other brokerages which also provides future trading.

However, the key benefit is that it is relatively lower cost in nature. For the detailed commission cost structure of Tiger Brokers’ futures offerings, one can refer to this link.

On a typical index future, the commission cost associated with having an exposure to the E-mini S&P 500 index is USD$2.99/contract with an associated exchange fee of US$1.23, bringing the total cost to around US$4.22/contract.

By paying just US$4.22/contract, one can have a sizable leverage position, in most cases 10-20x of the nominal amount.

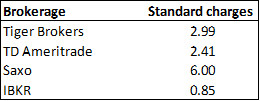

The table below shows the commission cost comparison (of a standard index future) with some of the major brokerage platforms which provide futures trading here in Singapore (excluding exchange fee).

IBKR is undoubtedly the cheapest platform to trade futures here in Singapore but its platform is not exactly user-friendly, particularly for a new investor.

Saxo is the most expensive in terms of commission charges and on top of that, it also levies an overnight charge for futures position, something which many of the other brokerages waived.

FAQs on Tiger Brokers Futures Trading

- Is there any overnight charge?

Tiger Brokers does not charge for overnight futures position but may raise margin requirements at the end of the day to manage trading risk better.

- Is $3000 the minimum deposit requirement for Tiger Brokers’ trading account?

An account of Tiger Brokers is subject to NO requirement for a minimum deposit.

- The occurrence of forced liquidation

According to trading rules, Tiger Brokers can conduct forced liquidation without notifying clients in advance.

The occurrence of forced liquidation, including but not limited to the following:

(1) Account risk ratio > 100%,

Explanation: The risk ratio represents the current account risk level. The smaller it is, the safer the account position is.

For Securities segment:RR = MM/ELV, Overnight RR = Overnight MM/ELV

For Futures segment:RR = MM/NLV, Overnight RR = Overnight MM/NLV

(2) 3 trading days before the Contract expiry date (first notice day or last trading day)

(3) Account risk ratio > 100% due to posting the debit interest and other fees at the beginning of the month;

(4) Other conditions caused by Exchange or regulatory authority regulations.

4. What are futures Main and Continuous Contract?

Each futures contract has a set expiry date, after which the contract is not tradable. It is usually traded for a few months from start to end.

To check the price movement of the Contract in a longer time range, the concept of ” Main and Continuous Contract” is created.

“main contract” refers to the Contract with the most active trading volume at present. “continuous” can be interpreted as “connecting” the market price of each most active trading contract together.

The Main and Continuous contract is not actually tradable. Trading the Main and Continuous contract is actually trading the currently most active contract. If you are trading in a Main and Continuous contract, please be aware of the impact of contract expiry and rollover.

5. Can the same contract be entered into both open long and short positions at the same time (locked position)?

Global futures do not support the same contract with both open long and short positions simultaneously.

- Can it trade 0.1 standard lot?

No, the minimum trading unit for a Futures contract is one standard lot.

The trading unit of futures is different than that of stock. In futures trading, “Contract” is the trading unit, and the minimum trading unit of futures is a standard contract which is normally called one standard lot. The contract size of different futures contracts varies differently

- Can I use leverage?

Futures trading itself is margin trading and cannot be further financed by using leverage.

The futures contracts are traded with margin, investors can enter a futures contract after fulfilling the initial margin requirement which is a certain percentage of contract value (margin ratio less than 50%, usually about 10%).

The exchange will conduct the settlement for investors’ position contracts daily, and issue a margin call to investors whose account cash collateral fails to meet the margin requirement requirements; futures merchants may require a higher overnight margin requirement.

- Are the trading hours of all futures products the same?

According to the Exchange rules, the trading hours of each future product vary differently; please refer to the details in the Tiger Trade App. You may take the Exchange announcement as confirmation.

Conclusion

Commodities, be they soft or hard, is often a key asset class that is seen to benefit in an inflationary environment.

Trading in futures contracts is an easy way to have direct exposure to some of the hottest commodities in the market.

However, do note that futures contracts at the end of the day are leveraged products, similar to options that might be a double-edged sword. Hence investors/trades should be fully aware of the risk when trading in futures.

Tiger brokers’ future platform allows an easy way for investors/traders to participate in some of the hottest futures products in a low-cost manner. While it might not be the cheapest out there, it does provide certain niche futures products that could serve as an inflationary hedge in today’s climate.

Do check out my comprehensive review on the Tiger Brokers platform.

This article is written in partnership withTiger Brokers

Do Like Me on Facebook if you enjoy reading the various investment and personal finance articles at New Academy of Finance. I do post interesting articles on FB from time to time which might not be covered here in this website.

Join our Telegram broadcast: https://t.me/gemcomm

SEE OUR OTHER WRITE-UPS

- Tiger Brokers review: Possibly the cheapest brokerage in town. Is it right for you?

- New IPO stocks performance in 2020

- Best China ETFs to buy [2020]

- Most Shorted Stocks: How to Profit from a Short Squeeze

- Best Stock Brokerage in Singapore [Update November 2020]

Disclosure: The accuracy of the material found in this article cannot be guaranteed. Past performance is not an assurance of future results. This article is not to be construed as a recommendation to Buy or Sell any shares or derivative products and is solely for reference only.