HDB Sales Proceeds vs. CPF accrued interest – What you need to know

Most of us Singaporeans go through a typical purchase process when it comes to making our first MAJOR purchase decision: buying a BTO or Build-to-order, which is an initiative taken by the government decades ago to allow the majority of Singaporeans to become “property owners” through this subsidized flat initiatives.

Whether we truly “own” our HDB is a topic for another day (given that the leases are 99 years).

A young Singaporean couple will look to settle down by first getting engaged before heading over to HDB to ballot for their BTO flat. They will look to “jointly-own” their BTO, which will allow both parties to use their CPF Ordinary Account (OA) to pay for the downpayment of the HDB. It might be a mistake to co-own the HDB property with your spouse but we will leave this discussion for another day.

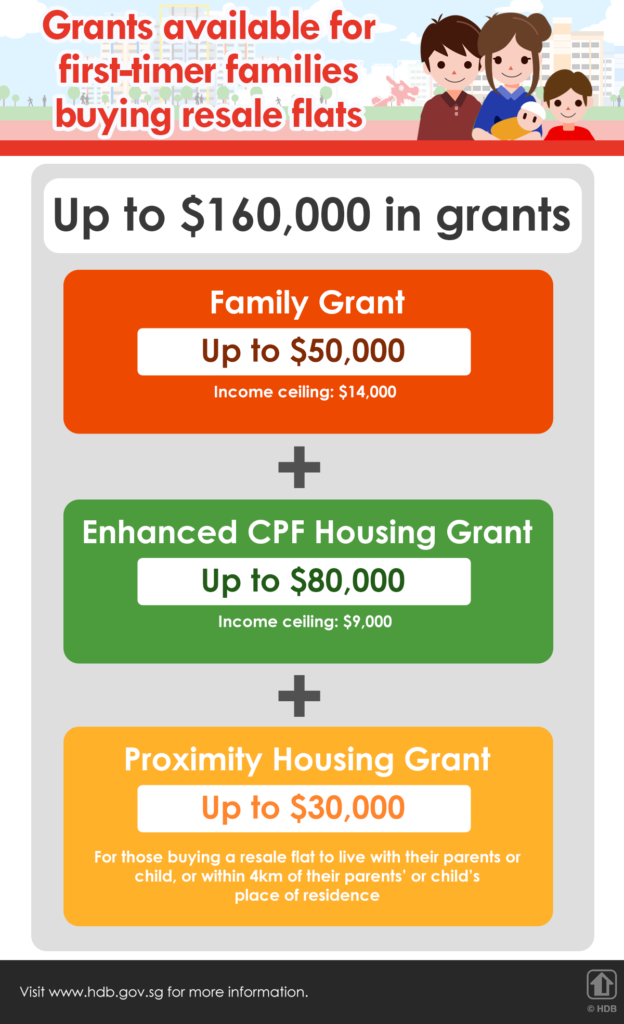

They will seek to take any “grants” offered by HDB to help subsidize their overall house purchase, not realizing that this grant amount is not exactly “free” money but has to be “returned with interest” to your CPF account upon the sale of your flat (more on this later).

They will also use their CPF OA account to pay for the monthly mortgage payment of their HDB loan.

In roughly about 4 years’ time, their HDB will TOP and they are officially proud owners of the brand-new subsidized property. Fast forward to 5 years after TOP, their HDB will have achieved MOP status (Minimum Occupation Period) and they can now sell their HDB flat and look to upgrade to a private condo with the sales proceeds from their sold HDB.

This is likely a familiar journey for most young Singaporean couples. Most of the time, a young Singaporean couple who aspire to upgrade their lifestyle from an HDB BTO to an EC or private condo would not find it too difficult, under the assumption that both are generating above-median income. This is despite the various cooling measures that the government has put in place.

Additional Reading: The average salary in Singapore 2021: Can you afford a condo with your income?

The reason is that one would expect a substantial appreciation in the price of the BTO flat upon its sale relative to the initial purchase cost. The “profit” will help fund the upgraded property. However, do note that your profit (sales price – cost price) does not equate to your “sales proceeds”, which is the actual cash you received from the sale. This sale proceeds amount will likely be way lower (or negative) vs. your profit due to accrued interest and possibly grant interest “eating” up your cash flow from the sale of your home.

I will look to illustrate this concept based on an article by Justin Kong which is republished with his permission. Unlike a couple that purchased a BTO flat, Justin’s example talks about one who bought a resale flat instead. Let’s see where the real issue might be.

CPF Accrued Interest: The Silent Killer of Sales Proceeds

In 2019, an old friend of mine, Amos, contacted me with the intention of selling his HDB and upgrading to a condominium. In our conversation, one phrase he mentioned caught my immediate attention. “I had fully paid my HDB with CPF when I bought the HDB flat,” he said. In the back of my mind, I knew instantly that CPF accrued interest will affect him.

Amos is happily married with 2 beautiful kids. His eldest son is 9 and his daughter 6 years old. We were schoolmates back in our poly days. He bought this resale 4 Room HDB flat about 8 years ago for $400,000 and had fully paid the flat with CPF funds from both Amos and his wife’s account? This is ideally the best arrangement, isn’t it? Or is it?

What are my sales proceeds?

We sat down for coffee that very weekend to do his financial calculations. Amos was very optimistic that he could at least get about $60,000 since he bought the property for $400,000 8 years ago and based on today’s average transaction price, it can be sold for $480,000 realistically. When I did the breakdown for him on paper he was shocked that he almost broke even without getting a single cent from the sale. What had eaten away his estimated difference of $70,000 given that he had no mortgage loan to service?

Estimated Sale Price: $480,000

Outstanding Loan: $0

CPF to be refunded: $487,361

Sales Proceeds: -$7,361

His eyes were glued to the amount of money to be refunded back into his CPF ordinary account. “Why is my CPF to be refunded to my CPF so much?” he asked.

What had happened is that CPF accrued interest has snowballed faster than the rate of HDB resale price appreciation.

CPF Accrued Interest Effect

Let us first understand that any monies withdrawn from the CPF account must be refunded back including CPF accrued interest. The moment we start taking out funds from our CPF it will start accumulating interest on a monthly basis.

Accrued interest is the interest amount that you would have earned if your CPF savings had not been withdrawn for housing. The interest is computed on the CPF principal amount withdrawn for housing on a monthly basis (at the current CPF Ordinary Account interest rate) and compounded yearly.

Let me do a simple illustration below to help you better understand. Assuming you are to withdraw $400,000 to fully pay for your HDB flat on 1 Jan 2021.

CPF Accrued Interest at the end of Year 1

$400,000 x 2.5% = $10,000

What this means is that at the end of year 1, you will have to return $410,000 if you sell your HDB flat. There is nothing scary about that, but let’s see what happens from Year 2 onwards.

CPF Accrued interest at the end of Year 2

($400,000 + $10,000) x 2.5% = $10,250

At the end of Year 2, you need to refund $400,000 + $10,000 + $10,250 = $420,250 back to your CPF account. Below illustrates what happens throughout the year till Year 8.

After looking at these numbers, Amos was very uncertain about what to do next. Should he breakeven and sell or just hold on to his HDB flat and upgrade?

What will happen if I don’t sell my flat?

Amos does have a choice of not selling his flat. What will happen if he doesn’t sell? The table below shows the amount of CPF accrued interest over the year until Year 20. In order not to have any shortfall, Amos will need to sell his current HDB flat at about $660,000 to breakeven with expenses included. Will our HDB flat keep appreciating at the same speed as the compounding CPF interest?

A. GAZING AHEAD 20 YEARS

Remember the accrued interest that we had calculated earlier, I will continue to calculate the estimated amount to refund till Year 20.

Looking at the final figures, in Year 20, our selling price must keep going up in order to match the refund of CPF including accrued interest. Charting the historical trend of HDB flat resale prices as it ages, their prices start slipping after 10 to 15-year mark. Even if I can magically keep the price constant from now to the next 20 years, we will still have a shortfall.

B. LET’S LOOK AT THE NUMBERS

Imagine that I REALLY have superpowers and I can hold the property prices today without changes for the next 20 years, because of CPF accrued interest, all sales proceeds will be wiped out and all funds from the sale will go back to Amos CPF account.

$480,000 – $655,447 (CPF returned at Year 20) = -$175,447

Assuming CPF policies don’t change for the next 20 years, Amos will have a deficit of $175,447 from his CPF account.

NAOF: If it’s any consolation, if the amount you have to refund CPF exceeds your cash proceeds (like in the above example where there is a deficit of $175,447), CPF will write off the excess amount (i.e. you’ll not be required to refund CPF beyond the HDB sale proceeds you receive). But take note that this is only in the case when you sell at or above your property’s market value*.

If you sell below market value and the amount owed to CPF (plus accrued interest) exceeds your cash proceeds, you’ll have to return 100% of what you owe CPF to your account by default, even if it means having to pay cash out of your own pocket.

That said, sellers can appeal to the CPF Board to waive this ‘debt’ and CPF will address this on a “case-by-case” basis. Bottom line: Don’t “fire-sale” your flat or be prepared to pay the consequences.

IT’S STILL MY CPF MONIES

Interestingly most people I chat with regarding CPF accrued interest will have a moment of unhappiness and will commonly state that “nevermind, my CPF is still ultimately my money at the end of the day” or similar permutations.

I definitely agree with that.

Remember that CPF accrued interest works as if your CPF monies have never left your CPF account.

Which situation do you prefer? 20 years from now, having $655,447 or just $480,000 sitting in your CPF Ordinary Account.

OKAY! LET’S GO!

After looking through all the calculations, Amos decided to sell his 4 Room HDB flat and we managed to sell it at $488,000.

Today, Amos is a proud owner of a 3 bedroom condominium he bought for about $1,000,000 and has taken a 75% loan to fund the purchase.

What he can enjoy now because of taking action is that he has about $255,000 sitting in his Ordinary Account that is still attracting interest. This buffer can in the future act as a safety net for up to 5 and a half years of installments.

Mortgage grants are not exactly “free” money

The above illustration by Justin with regard to your HDB sales proceeds being “eaten” up by your accrued interest typically have a more significant impact on you if you purchased an older resale HDB where the appreciation of your property on an annual basis is slower than your CPF OA accrued interest of 2.5%. This could result in “negative” sales proceeds, particularly if left “compounded” over a prolonged period of time.

Older couples who have fully paid for their HDB and expect a “cash-out” when they look to sell and downgrade subsequently might be in for a shock.

Another less known fact is that grants dished out by HDB to help subsidize the purchase of your flat will need to be refunded with interest to your CPF account as well.

If you apply for and receive a grant from CPF at any point in time to help pay for your HDB flat, you are required to return that amount, plus accrued interest to your CPF account when you sell your flat.

For example, if you take a grant of $5,000 today to help subsidize the purchase of your flat and decide to sell 20 years later, the total amount that you have to repay is now approx. $8,200 (accrued interest calculated at 2.5%). That will be $8,200 taken out from your sales proceeds to return this grant + interest.

Imagine taking that “up to $160,000” in grant amount and compound it at 2.5% interest over a duration of 20 years. That will be a grant repayment of c.$262,000 after 20 years. Can your HDB sales proceeds cover this grant amount + CPF OA accrued interest?

This grant is returned to your CPF account and not to the government which will go towards assisting you in your next house purchase but is not something that you can “cash-out” of from your sales proceeds. Also, I have earlier highlighted that if there is a deficit (negative cash), you do not need to top up this short-fall (CPF OA principal + CPF OA accrued interest + Grant principal + Grant accrued interest) if your property was sold at or above market valuation.

A step-by-step guide to compute your HDB Sales proceeds

Assume that you have purchased your HDB back in 2010 based on the following numbers:

- Purchase Price :$150,000

- CPF grant: $15,000

- CPF downpayment: $15,000

- Mortgage installments to be paid using CPF OA.

- After 10 years: outstanding loan = $50,000

You are now looking to sell after 10 years. You can check out what might be the valuation of your flat based on HDB’s past/recent transacted prices.

A) Sales Amount = $350,000

B) Outstanding loan amount = $50,000

C) CPF Principal amount used = $100,000 (mortgage and interest payment on house) + $15,000 (initial downpayment) + $15,000 (grant) = $130,000

D) CPF accrued interest = $50,000 (calculated using initial downpayment + grant + monthly mortgage payment, all accruing interest at 2.5%/annum) – note: this figure is just for illustration purpose and not a true reflection of the real amount.

E) HDB Resale levy $40,000 (assuming you are buying an EC or another BTO/SBF from HDB).

F) Sales Proceeds = A – B – C -D – E = $80,000

*You may also estimate your HDB sales’ proceeds using HDB improved sales proceeds calculator.

G) Agent fees = 2% of sales proceeds = $7,000

H) Legal fees = $2,500 (typically $2k-$3k)

Cash Proceeds = F – G – H = $70,500

This is the amount that you can “cash-out”, which is likely a much lower figure compared to your initial estimation, given that your property price has more than doubled from the cost of $150,000 to $350,000.

Conclusion

The mast majority of older Singaporeans who have been staying in their HDB flat for a long period of time will realize that they are not able to monetize their flats despite them having fully paid off the loan. This is due to the fact that accrued interest for the CPF OA account is growing at a much faster rate as compared to the price appreciation of their HDB property.

if you have gotten a grant, that will further curtail your cash proceeds amount upon sale.

If you find this article interesting and informative and will like Justin to help assess your current HDB situation, do fill up the questionnaire below and we will get in touch with you shortly.

SEE OUR OTHER WRITE-UPS

- HPS Singapore: Why pre-paying your home loan in 2021 is a mistake with Home Protection Scheme in place

- Upgrading From HDB Flat To Condo in 2021: Buy First or Sell First?

- Singapore Property: JP Morgan says a fall of 10% is likely. To buy or not to buy now?

- 12 Tips To Select A Good Unit At A New Launch Project

- The average salary in Singapore 2021: Can you afford a condo with your income?

- ABSD Singapore: Methods to Beat ABSD and Own Multiple Properties in 2021 (Updated)

Disclosure: The accuracy of the material found in this article cannot be guaranteed. Past performance is not an assurance of future results. This article is not to be construed as a recommendation to Buy or Sell any shares or derivative products and is solely for reference only.