1Q20 weak performance due to COVID-19 impact

Yangzijiang (YZJ) announced its 1Q20 results on 29 April. Its 1Q20 revenue declined by 44% YoY to CNY3.5bn while earnings dropped a more hefty 51% to CNY404m.

At this current run-rate, annualized earnings are expected to be at CNY1.6bn compared to the street estimate of approx CNY2.8bn prior to the latest announcement. I suspect that the street will be making pretty hefty earnings cut for FY2020 post this latest set of results which has likely underperformed their expectations. Granted that the weak shipbuilding revenue this quarter was due to production shut-down as a result of COVID-19.

Nonetheless, Yangzijiang (YZJ) shipbuilding revenue should trend below average over the coming quarters as a result of a weak order backlog.

Shipbuilding gross margins could remain at single digit ahead

In my previous Yangzijiang post relating to its 4Q19 financial performance, I highlighted that its core shipbuilding margin will decline to a single digit as early as 2Q20. The margin deterioration happened much faster than I expected, with its 1Q20 shipbuilding margin at a dismal 8%.

Management attributed the weak shipbuilding margin to lower work volume due to the COVID-19 stop-work order which significantly impacted Chinese yards in 1Q20. Beyond the volume factor, I believe that a second major factor is the reality that newbuild contracts are now fixed at a much lower margin than 2-3 years ago.

In fact, this quarter continues to benefit from CNY21m in provision write-back from previous onerous contracts. Such provision write-back should be fully completed by 1H20 and will not contribute positively to margins from 2H20 onwards, on my estimate. This would imply that margins will continue to trend lower, with my expectations that Yangzijiang (YZJ) core shipbuilding gross margin will “stabilize” at around the 6-7% mark in 2021 and beyond.

Compare this to the high-teens gross margins that the shipbuilding division used to enjoy in the past. Yangzijiang will now need to recognize at least 3-4x higher revenue in order to achieve the same level of gross profits vs. previous years. Is that possible with its order backlog at a record low of USD$2.9bn?

The company announced new order wins of USD0.36bn for 7 vessels in the current quarter. This includes 2 14,000 TEU container vessels which are part of a 10 vessel contract which the company announced back on 18 March where the total contract value was stated as USD$1.15bn. The remaining 8 vessels remain as options.

While its existing USD$2.9bn of backlog provides the company with revenue visibility into end-2021/ early-2022, that will likely imply weak quarterly revenue recognition.

Yangzijiang (YZJ) continues to be highly dependent on its Investment segment, which contributed CNY481m in gross profits this quarter, down 14% YoY. This segment now consists of 67% of the Group’s gross profit in 1Q20 vs. 48% in 1Q19. I believe this ratio will continue to trend higher, with the company being viewed more like a finance company rather than a shipbuilder.

The company recently announced on 7 April that its Executive Chairman, Mr. Ren Yuanlin, will be stepping down and relinquishing his position to his son, Mr. Ren Letian. Though the news likely came as a surprise, the market did not take the news negatively with the company’s share price continuing to appreciate from the recent-low in Mid-March.

The street remains overly bullish of Yangzijiang’s 2020 earnings?

The street continues to be rather bullish on Yangzijiang (YZJ) earnings prospect in 2020 and beyond based on their last update prior to the latest set of results. 2020 earnings were previously forecasted at CNY2.8bn with 2021 earnings improving to around the CNY2.9-3bn level.

This is just slightly lower than the 2019 “peak level” profit of CNY3.1bn which seems incredulously positive, given how weak the company’s order backlog has been (all-time low dating back to 2011) as well as how newbuild margins have deteriorated. This could only imply that the street is expecting a significant jump in new orders which will allow the company to be more aggressive in its revenue recognition profile.

However, with the global economy weakening to a level last seen in the great depression of the 1930s, it is hard to foresee how new orders might rebound significantly this year.

A second possibility could be high expectation of its investment segment plugging the profitability gap. Again, this will likely be a challenging feat unless its investment book balloons significantly in excess of CNY20bn.

Valuation

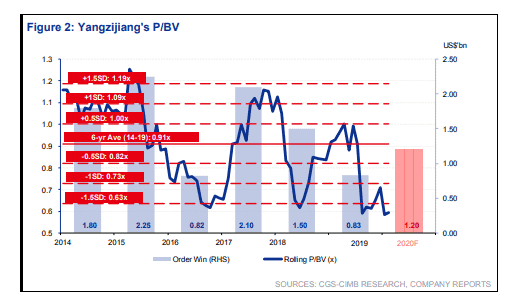

In terms of valuation, the counter currently spots a market cap value of S$3.9bn. With a book value of CNY32.5bn (approx. S$6.5bn), that will imply a price to book multiple of 0.6x.

According to CIMB, that is approx -1.5SD to its past 6-year average PBR multiple of 0.9x. While the company is definitely trading “cheaply” in terms of PBR multiple, there is now a lot more earnings uncertainty pertaining to its shipbuilding segment.

Nonetheless, Yangzijiang will likely survive this COVID-19 pandemic issue, even if a second-wave materialize in China. This is due to its strong balance sheet position with the company in a net cash position. Annual dividends of S$0.04-0.045/share should be pretty secure which translates to a current yield of 4-5%.

However, with a rather stormy shipbuilding outlook in 2020, it will likely take a while before the market gets comfortable in this 5% yielder.

Do Like Me on Facebook if you enjoy reading the various investment and personal finance articles at New Academy of Finance. I do post interesting articles on FB from time to time which might not be covered here in this website.

Join our Telegram broadcast: https://t.me/gemcomm

SEE OUR OTHER WRITE-UPS

- YANGZIJIANG (YZJ) 4Q19: STEADY SHIP HEADING INTO A STORM

- YANGZIJIANG’S SHARE PRICE IS UP 7%. CAN MOMENTUM PERSIST POST-RESULTS ON 7TH?

- 10 SINGAPORE BLUE-CHIP STOCKS YIELDING MORE THAN 5% (2020)

- TOP 5 RESILIENT SINGAPORE STOCKS TO BUY AMID COVID-19 UNCERTAINTY

Disclosure: The accuracy of the material found in this article cannot be guaranteed. Past performance is not an assurance of future results. This article is not to be construed as a recommendation to Buy or Sell any shares or derivative products and is solely for reference only.