Quick Intro:

I recently attended an event by one of the robo advisors here in Singapore, Endowus, jointly organised by Dollar and Sense (DNS). DNS Co-founder, Mr Timothy Ho hosted an informal session where Endowus management team, lead by Co-CEO/CFO, Mr Sun You Ning shared with us some insights on what it means to invest with a robo-advisor. (I will be looking to do another write-up specifically on Endowus in a separate article in due time).

I have previously written an in-depth article on robo-advisors that are available here in Singapore, where Endowus is one of the robo-advisors being evaluated.

While I have seek to evaluate key points such as trading platforms, commission charges etc associated with these robo advisors and how they measure up against each other, there is an area which I feel should warrant further discussions: the 30% WITHHOLDING TAX on dividends received overseas, particularly from US.

How significant is this withholding tax component when it comes to shareholders’ return? I did a little research and chanced upon Kyith’s (from Investmentmoats) massive research on Dimensional Funds where he highlighted the impact of withholding tax based on a fund structure.

Withholding tax on Equity funds

Using 3 different examples:

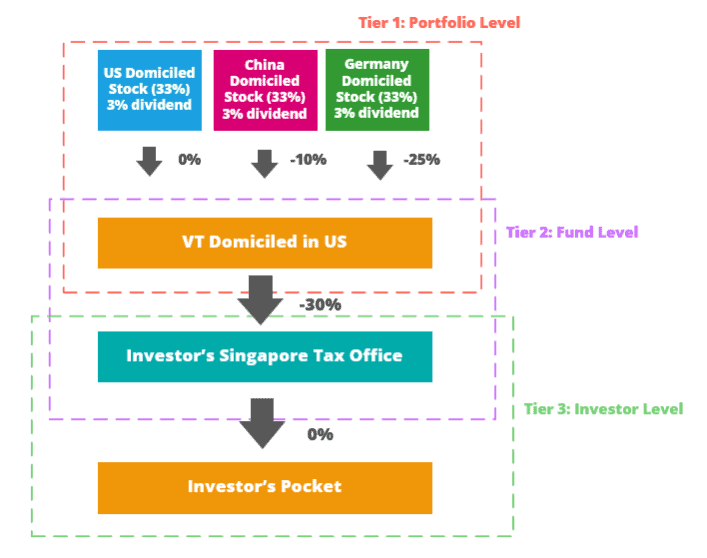

- Vanguard Total World Stock ETF (VT) – domiciled in US

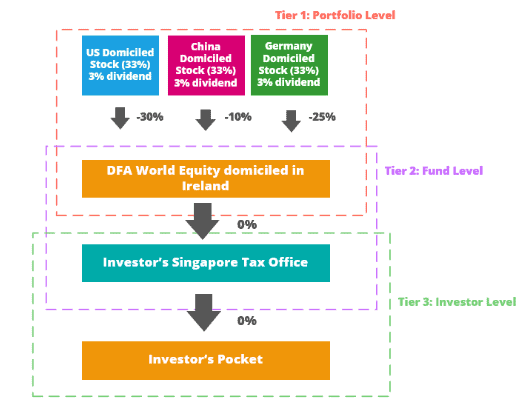

- DFA World Equity Fund – domiciled in Ireland (where endowus’s DFA funds are vested in)

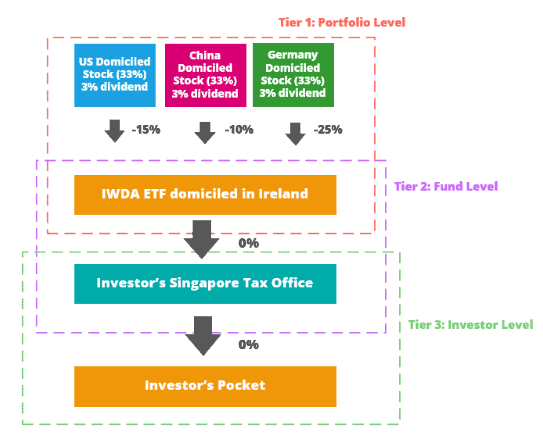

- iShares Core MSCI World UCITS ETF (IWDA) – domiciled in Ireland

I will not try to replicate his full content here (do head over to his website here to take a read, if you have not already done so) but the gist is that how the funds are structured and where it is domiciled will have an impact on the withholding tax component.

I am sure some of you would have known that fact. Let me just do a quick illustration:

Vanguard Total World Stock ETF (VT)

In these 3 examples, Kyith has calculated that the Vanguard fund, which is the cheapest based on expense ratio (only 0.09%) will result in the largest dividend withholding tax cost.

Note that VT is a US-domiciled ETF. The US regulations for funds and ETFs require a US-domiciled fund to pay dividends to holders at least annually. I have read in some articles/comments that VT is an accumulating ETF and hence does not pay dividends, so withholding tax is not applicable. This is inaccurate.

Hence, investors will be subject to paying withholding taxes on dividends if they invest into a US-domiciled ETF like VT.

While the expense ratio of VT might be low (0.09%), the withholding tax cost will probably be in the arena of 1.16%, based on the assumption of 3% dividend yield.

DFA World Equity Fund

An alternative will be to invest in a non-domiciled US ETF which is NOT under the US regulation that mandates the ETF to pay dividends. Hence these ETFs can be accumulating in nature, meaning that it does not distribute dividends to the fund holders. An example will be DFA World Equity that is domiciled in the Ireland and is an accumulating fund.

However, even if the fund itself is accumulating, because it is situated in Ireland, when a US company pays a dividend to the fund, there will be a withholding tax levied. This amount will be 30% for US companies in the DFA World Equity example. Again, assuming a 3% standardized yield, the withholding tax cost of investing in DFA World Equity will be approx. 0.67%. This is much lower as there is no double taxation incurred for China and Germany yield (only taxed once on the Portfolio Level) in this example.

iShares Core MSCI World UCITS ETF (IWDA)

To further reduce withholding taxes, one can invest in iShares Core MSCI World UCITS ETF – IWDA (also Ireland-domiciled) where the US stocks’ dividends are only taxed at 15% withholding tax rate. This is due to the double taxation treaty enjoyed by IWDA.

On a 3% yield assumption, the total withholding cost will be approx. 0.525%.

Quick summary

In a nutshell, the impact of withholding taxes will shave off approx. 16-23% of the distribution return, even in a scenario where the fund is structured in a tax-efficient location like in Ireland. This is likely the case even if the fund does not pay out any dividends (accumulating) as the taxes are incurred on the Portfolio level.

By just looking at the expense ratio of say VT (very low at 0.09%), one might make the erroneous assumption that VT is the ETF with the lowest ALL-IN cost. However, that is unlikely to be the case when we take into consideration the costs associated with withholding taxes.

In VT’s case, the total cost will be = Expense ratio of 0.09% + Withholding tax cost of 1.16% = Total cost of 1.25%

DFA total cost will be = Expense ratio of 0.43% + Withholding tax cost of 0.67% = Total cost of 1.1%

IWDA total cost will be = Expense ratio of 0.20% + Withholding tax cost of 0.525% = Total cost of 0.725%

Clearly, IWDA’s total cost is only 58% of VT’s total cost (assuming 3% yield), even if VT exhibits the lowest expense ratio among the three Fund/ETFs.

Conclusion: There is no way of avoiding some withholding taxes to be paid on dividends in an overseas EQUITY fund, even if it is one of an accumulating nature. The ideal scenario for a non-US investor is to invest in an Irish-domiciled ETF/Fund to avoid double taxation at both Portfolio Level and Fund Level.

Withholding tax on Bond funds

How about withholding tax on interest income of bond funds/ETFs? Will they be subjected to the same treatment?

The short answer, according to Kyith, is that ETFs that generate qualified interest income (QII) and short-term capital gains, may be exempted from US withholding tax when distributed to non-US holders.

- US Government Bond ETF are typically 100% qualified as QII, hence no withholding tax

- US Corporate Bond ETF are typically 70-80% qualified as QII

- International Bond ETF domiciled in USA is NOT qualified as QII.

Hence the most tax-efficient structure seems to be using a structure whereby the fund is domiciled in Ireland and invest in US Government bond ETF such as the iShares 10-20 year Treasury Bond ETF.

In this scenario, there is ZERO withholding tax at all levels for a Non-US investor. Note the difference between such a bond interest income distribution and that of equity dividend distribution. Dividend distribution typically are not categorised as QII.

Food for thought

However, is this the best solution to invest in a bond fund?

Should we be looking at only US Government bond ETFs as a good proxy for bond investing or should we be looking at a diversified basket of international bond assets?

Can tax benefit of US-Government bonds offset the fact that yields of such investment assets are now at or near record lows?

These are some questions to think about. Personally, I don’t have the all answers at hand currently. For one to make an informed decision, one will have to weigh the tax benefits of investing in US-domiciled bond funds such as the US Government bonds ETF (zero tax) and US corporate bonds ETF (minimal tax) VS. Ireland-domiciled bond funds which will likely incur higher withholding taxes but provide that additional global diversification.

To summarize, for a Non-US DIY investor:

Equity funds/ETFs:

- Look at reducing expense ratios,

- Avoid US-domiciled funds/ETFs even if they have low expense ratios as they are not tax efficient when it comes to withholding taxes on dividend distribution,

- Go for UCITS Ireland-domiciled funds

- Go for accumulating funds/ETFs to further compound returns unless you are looking for an immediate stream of passive income for retirement purpose

Bonds funds/ETFs:

- Look at reducing expense ratios,

- Choose US-domiciled government bond funds/ETFs or US-domiciled corporate bond funds/ETFs if they fit your requirement

- For international bond exposure, go for UCITS Ireland-domiciled funds/ETFs

- Go for accumulating funds/ETFs to further compound returns unless you are looking for an immediate stream of passive income for retirement purpose

How should one proceed?

The next step will be for me to choose the portfolio structure that best fits my needs at the moment.

My personal ideal portfolio structure (and I do stress that it is personal. Each one of us have got different financial viewpoint, risk-level and requirements etc) is one of 40% Equity : 60% Bonds

That could come as a surprise to some. While I do exhibit a higher risk-taking appetite, my strategy (given my rather cautious outlook of where equity markets are at the moment) will be leaning towards more of portfolio conservation strategy rather than a growth strategy.

In the event that the equity market corrects significant, the goal of the conservation portfolio is to have the bond position hedged against the downside risk stemming from the equity position.

Bonds tend to outperform equities in a market downturn, with investors flocking towards “safer haven assets”.

Following a significant market correction (50% or more…. Please don’t curse me for saying that), I will then convert my portfolio structure to one of 80% Equity: 20% Bonds or even to 100% Equity basis. That’s my personal plan.

Yours could be very different. It is very important to have this flexibility.

Some might argue that his/her CPF is essentially a bond-replica. However, there is limited flexibility to withdraw out the funds in your CPF during a downturn to invest into the RIGHT market (granted you can still use the funds to invest in a domestic ETF or gain international exposure through Robo-advisors).

Neither will your CPF funds generate higher returns in a downturn vs. perceived safe haven bonds.

What is my DIY approach? What will be the all-in expenses like for such a DIY portfolio?

Lets first talk about bonds

Returns from bonds are from a combination of 1) yield which tends to be relatively low in today’s context, particularly if they are government bonds and 2) capital appreciation from declining interest rates (bonds move inversely to interest rates).

As highlighted earlier, a bond portfolio is to hedge against significant equity downside risk, given that bonds tend to outperform equities in a recessionary/downturn scenario on the perceived notion that fixed income/bond investments are asset-backed and hence safer in nature.

To keep portfolio cost at the minimum, I will choose a local bond option such as the 1) ABF Singapore Bond Index Fund (A35) or the 2) Nikko AM SGD Investment Grade Corporate Bond ETF (MBH). In this way I do not have to incur any withholding taxes, with all-in expenses at only 0.25-0.30% (expense ratio).

While investing in a US government bond fund like the iShares 10-20 year Treasury Bond ETF also will not incur any withholding tax expenses with low expense ratio as well, it will be tedious to mitigate currency risk and might not be economically feasible to hedge such risks away.

The value-add associated with investing in a foreign government/corporate bond fund/ETF might also not be as appealing, given their relatively low yield nature, in my view.

Yields on bonds are already at/near historical low levels, hence it will be prudent to try to keep the cost at the lowest for a DIY investor.

DIY Solution: Buy ABF (A35) with an approx. yield of 2.2% and total cost of 0.20%. (60% of portfolio)

Proceeding to equities

Looking to underweight equities vs. bonds at present due to perceived market “peak”. I believe that a global diversified fund/ETF in this context will be helpful in mitigating country-risk. Hence my solution will be to go 50% in a Singapore equity index ETF and 50% in a global diversified equity ETF like IWDA where expense costs can be minimized to the lowest.

In our example previously with an assumed yield of 3%, IWDA total cost is approx. 0.725%.

For the domestic ETF, I am generally neutral between the two available options of 1) SPDR Straits Times Index ETF (ES3) with an expense ratio of 0.30% and yield of 3.80% or 2) Nikko AM Singapore STI ETF (G3B) with an expense ratio of 0.28% and yield of 3.71%. ES3 could be a better option for greater liquidity.

DIY Solution: Buy IWDA for global exposure (20% of portfolio) and ES3 for local exposure (20% of portfolio). Total weighted average cost for this equity portfolio will be approx. 0.50% which is not significantly higher than an All-local option but yet enjoy the diversification of a low-cost global equity fund.

“Pseudo” DIY Portfolio

That will be my “pseudo” DIY approach in terms of structuring a 3-fund bond/equity conservation portfolio, with a weighted average cost less than 0.35% on an annual basis (note that we have yet to take into account potential one-off commission charges).

While such a portfolio is likely to under-perform in a bull-market, given the low returns of the bond assets which encompass 60% of the portfolio, I am counting on it to outperform in a “impending” recessionary scenario.

However, the downside risk of such a DIY approach is the relative difficulty in re-balancing as well as engaging in a consistent dollar-cost averaging strategy.

This could be where a Robo-advisor might fit in. The ALL-IN expense ratio on a DIY basis as seen in the above example is relatively comparable to the expense ratio of funds offered by robo-advisors (approx. 0.4%) at first glance.

However, we have yet to take into account the potential withholding tax costs which could add up to another 0.6%-1.0% on average, even in a tax-efficient structure. Adding the administrative cost of robo-advisors of 0.6%-1.0% and total costs associated with Robo-investing could be a hefty 2% per annum!

Total cost = Fund expense ratio + Robo-advisors admin fee + Cost of Withholding taxes

==> 0.40% (average fund expense ratio) + 0.80% (average robo fees) + 0.80% (average withholding tax cost) = 2.0%

DIY or Robo? The 1.6% opportunity cost dilemma

The question then begets if it is worth paying the additional fees amounting to approx. 1.6% for the convenience of 1. portfolio re-balancing, 2. easy dollar-cost averaging and the 3. benefit of having all your passive investment managed in a single location. A DIY approach might entail using different brokerages as well which might be troublesome.

Conclusion

- Withholding taxes are often over-looked but could add a further 0.80% to your overall portfolio cost, even if one engages in a tax-efficient structure.

- For investors looking at global exposure, typically choose funds/ETF that are not domiciled in US (preferable Ireland or London) to avoid paying hefty withholding taxes of 30% on distributions.

- For the more investment savvy, a DIY approach could be the solution to reduce overall annual portfolio cost. However, this might not be cost-effective on a regular savings structure with a small investment amount.

- One will need to evaluate the benefits and convenience of using a robo-advisor vs. its real costs. The opportunity cost as we highlight could be as much as c.1.6%, when we take into account withholding tax effect on an annual basis.

Thanks all for reading. Any thoughts?

Do Like Me on Facebook if you enjoy reading the various investment and personal finance articles at New Academy of Finance. I do post interesting articles on FB from time to time which might not be covered here in this website.

3 thoughts on “DIY or Robo? The 1.6% opportunity cost dilemma”

What happens if in the next recession US markets correct by only 35%, and singapore market corrects by only 40%?

Hi Sinkie, thanks for the comment. The 50% correction i mentioned is only an arbitrary figure. No hard and fast rule. A strategy could be to incrementally increase my equity position as the market corrects. For example if the market drops by 20-30%, I could increase my portfolio position to 60% equity vs. bonds 40% and when it declines by 30-40%, I can increase it to 80% equity vs. 20% bonds etc. Its really based on one risk appetite. No saying that the market cannot drop beyond 50%.

Thank you for this interesting article. Some have argued that the bid-ask spread is wider for the equivalent Ireland-based ETF as compared to their US counterpart. Also the liquidity is much better for the US ETF. They feel that these 2 factors far outweigh the tax differential.

The other tax consideration is inheritance tax.