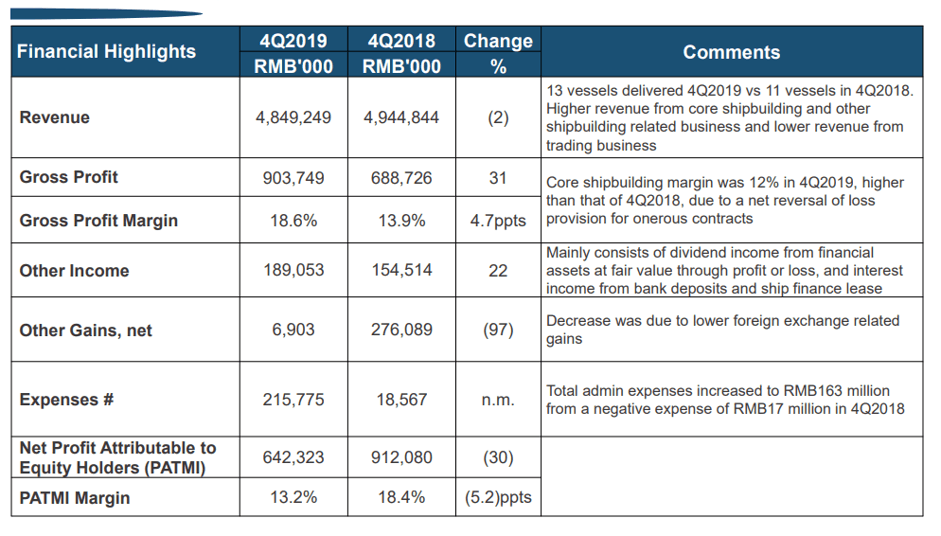

Yangzijiang announced its 4Q19 on 28 Feb 2020 where its earnings were down 30% YoY compared to 4Q18 to RMB642m. We see the company as a steady ship, but one that is heading into a major storm in 2020. Yangzijiang’s share price declined by approx 3% post-4Q19 results, slightly underperforming the broader market, which has been negatively impacted by the current US market sell-off.

We believe that there are a few key areas which investors should be aware of for Yangzijiang (YZJ) 4Q19 results:

YZJ: Gross margins

Firstly, the company recorded a Gross profit margin of 18.6% in 4Q19 vs. 13.9% in 4Q18. The huge gross margin improvement was due to the core shipbuilding margin of 12% vs 9% in 4Q18. Again, this improvement was attributable to a net reversal of loss provision for onerous contracts that were incurred amounting to RMB$85m

Without that net reversal, core shipbuilding gross margins would have been at 9.7%. We believe that new contracts were secured with gross margins of only around 5% or possibly even lower, so we do expect Yangzijiang’s (YZJ) shipbuilding gross margin to trend down to that mid-single % by 2H20, when the majority of the reversal for loss provision would have been completed.

1Q19 YZJ shipbuilding margin: 16%

2Q19 YZJ shipbuilding margin: 18%

3Q19 YZJ shipbuilding margin: 14%

4Q19 YZJ shipbuilding margin: 12%

The downward trend in its shipbuilding gross margin profile is particularly evident. We expect its shipbuilding margin to hit single-digit potentially by 2Q20 upon the full recognition of the reversal.

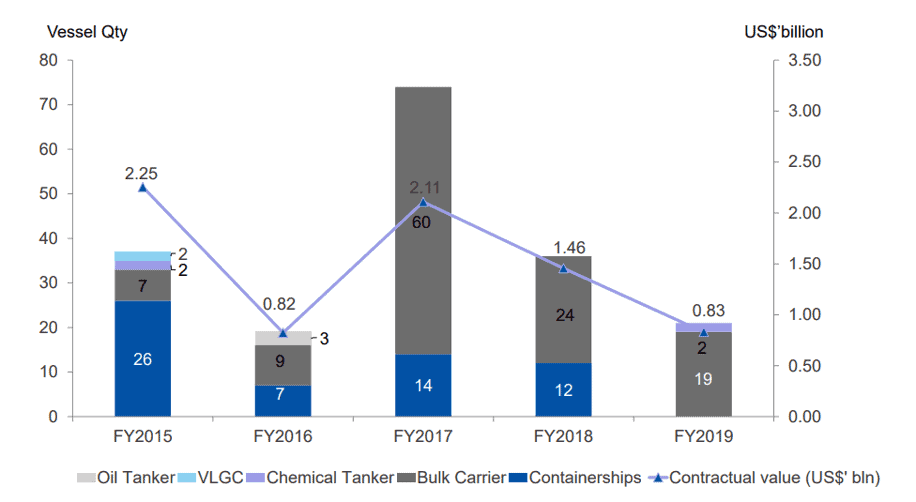

YZJ: New order wins and order backlog

Yangzijiang (YZJ) secured total new orders of USD$0.83bn in 2019, a far cry from its target of USD$1.5-2bn which it set previously. The new orders were mainly for bulk carriers (19 bulk carriers, 2 Chemical tankers) which we believe command a much lower margin vs. container vessels.

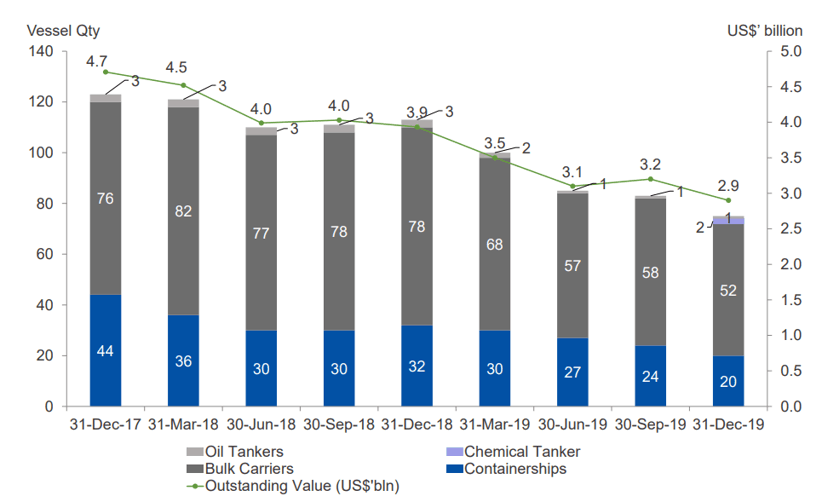

As a result of the weak new orders, the total new order backlog declined to USD2.9bn, a record low. With Yangzijiang’s (YZJ) revenue run-rate of approx. USD2bn a year, its backlog will be sufficient to last the company through to 1H21.

Management commented that YTD2020, the company secured a further US$104m in new orders which likely trails its revenue run-rate. Competition remains intense, with the COVID-19 issue depressing ship owners’ appetite for newbuild vessels.

This will likely translate to another year of weak new orders, raising concerns of Yangzijiang’s order backlog running dry.

A potential 50% decline in PBT in 2020

Assuming a shipbuilding revenue recognition run-rate of RMB$13bn in 2020 with an average gross margin profile of 8%, the company will generate FY2020 gross profits of approx. RMB$1bn. If we ignore profits from “other income/gains” and “losses from impairments”, the company will generate total profits before tax (PBT) of only RMB400m for its shipbuilding business.

Adding in contributions from its investment division (we forecast a run-rate of c.RMB$400m/quarter in operational profit) and total PBT of the group could amount to only RMB2bn vs. 2019 PBT of RMB$4.2bn, a more than 50% decline.

If its core shipbuilding margins are to decline to <5% by 2021, its core shipbuilding division would likely be in the red.

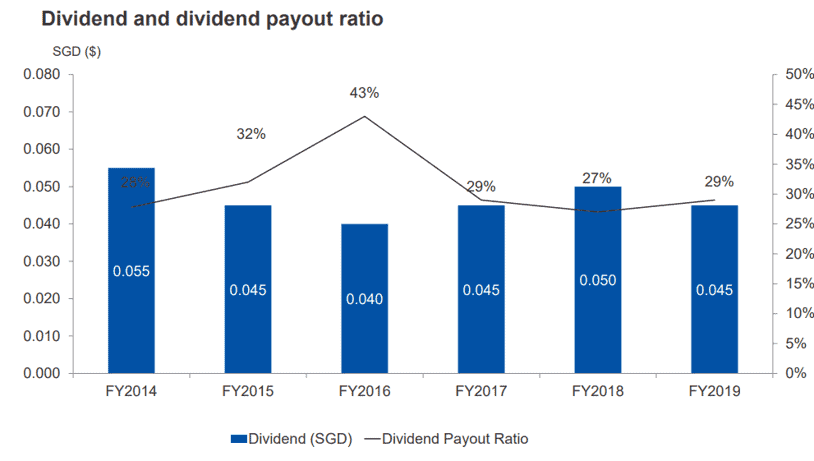

A lower dividend of S$0.045 for 2019 vs. S$0.050 for 2018

Yangzijiang declared a first and final DPS of S$0.045 which was a decline of half a cent vs. 2018 DPS of S$0.050.

Its balance sheet remains relatively robust, with the company in a net cash position to further support the payment of dividends.

A key risk is, however, the potential credit issues in relation to its more than RMB$14bn in both current and long-term debt investments. The current COVID-19 situation might increase the bad-debt situation in China.

This could result in a larger-than-expected bad debt provisions Yangzijiang would have to make in 2020.

Conclusion

Yangzijiang is currently enjoying the benefit of the strong USD vs. the CNY which has helped to buffer the decline in its shipbuilding gross margins. Nonetheless, the downward trend in gross margins remain extremely evident and we believe that percentage will hit single-digit in 2020.

The company is facing issues not just pertaining to the cyclical shipbuilding industry but also to its “lucrative” investment division, with the risk of higher-than-expected credit losses pertaining to bad-debts now elevated due to the COVID-19 issue.

Do Like Me on Facebook if you enjoy reading the various investment and personal finance articles at New Academy of Finance. I do post interesting articles on FB from time to time which might not be covered here in this website.

Join our Telegram broadcast: https://t.me/gemcomm

SEE OUR OTHER WRITE-UPS

- SEMBCORP MARINE 4Q19 LOSSES EXCEEDED EXPECTATIONS. WHAT YOU SHOULD KNOW

- WHICH S-REITS HAVE THE BEST RECORD OF DIVIDEND GROWTH?

- A BETTER ALTERNATIVE TO DOLLAR COST AVERAGING?

- DIVIDEND YIELD THEORY – THE UNDERAPPRECIATED VALUATION TOOL

- TOP 5 ANALYSTS OF THE DECADE AND THEIR CURRENT FAVORITE STOCKS

- IS DRINKING LATTE REALLY COSTING YOU $1 MILLION AND THE CHANCE TO RETIRE WELL?

Disclosure: The accuracy of the material found in this article cannot be guaranteed. Past performance is not an assurance of future results. This article is not to be construed as a recommendation to Buy or Sell any shares or derivative products and is solely for reference only.