Warning. This IS a click-bait article but that doesn’t necessarily mean that this information is untrue. Yes, you can possibly generate a “guaranteed” return of c.70% with StashAway. Before I discuss the high level of annualized return that you can generate with this Singapore Robo Advisor, let me first touch upon the topic of the cash management service offered by StashAway, widely termed as StashAway Simple which promises a return of 1.9%/annum. I explain how that is achievable in the content below.

Readers here at the New Academy of Finance will know that I place great importance on the transparency level of our Singapore Robo Advisors. In my latest article, I questioned if the high cash management rates offered by our Singapore Robo Advisors are just a marketing ploy to get your money.

Higher risk for higher returns

The gist of the article is this: In a declining interest-rate environment where banks are lowering their high-interest account savings rate, some of our Robo Advisors such as StashAway and Endowus have stepped up to offer retail investors/savers with attractive cash management savings rate as high as 2.2%.

My concern is how achievable are such rates and will achieving these “attractive” rates entail these Robo Advisors to take a higher risk? Are those figures even attainable consistently or it is just a ploy to get you to part with your money, with the ultimate realization that such rates are unattainable without taking on substantially higher risk?

Cash management accounts are typically vested in Cash Funds (CF) or Money Market Funds (MMF). These funds invest in highly liquid short-duration (3 months etc) government bonds or highly creditworthy investment-grade corporate bonds, many of which are government-linked entities. In short, credit-risk is almost negligible when it comes to these bonds.

However, these funds, in today’s context, typically return annualized rates of 0.7%-1.2%. Not very “appetizing” to say the least. For StashAway or Endowus to offer higher rates to consumers, they will need to invest in riskier funds that buy into corporate bonds. These are still investment-grade bonds and credit-risk generally is still manageable in a typical normal environment. However, we are not in a normal environment currently. There is a real concern of a protracted deep recessionary scenario triggered by COVID-19 that can drive up the default risk of some of these “blue-chip” companies.

Hence by vesting in these “higher-yielding” funds, there is a likelihood of some capital losses (albeit low), something which the Robo Advisors should communicate to the users of their cash management services.

For more information, readers can check out the article I have written here.

How StashAway Simple provides a “consistent” 1.9%/annum return

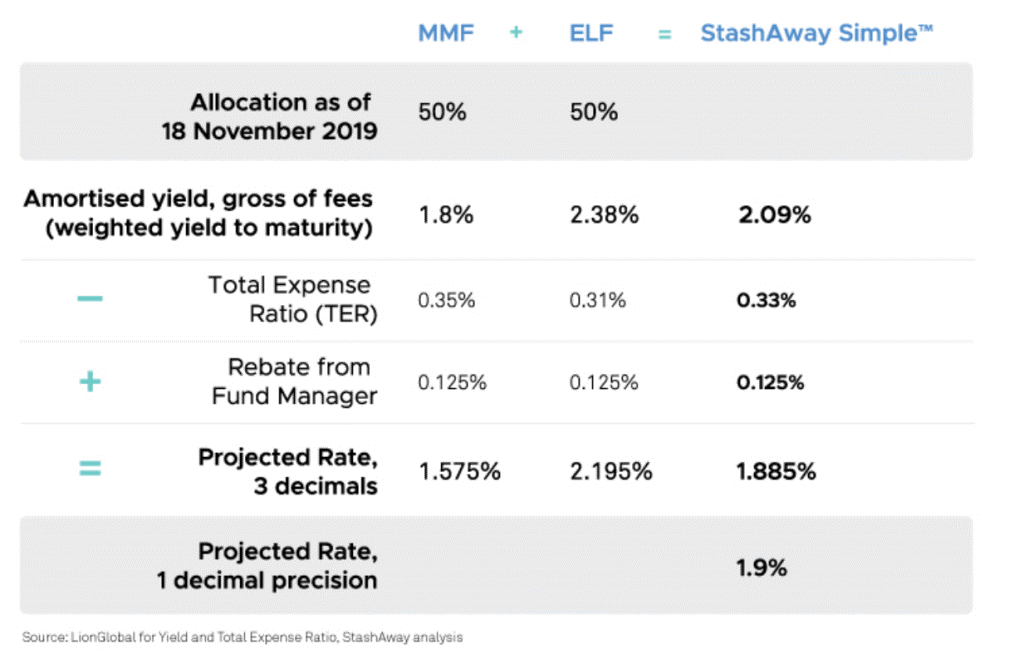

Since writing that article, Amanda from StashAway has reached out to me to further clarify how their 1.9% is achievable, even in today’s low-interest-rate environment. I have written numerous times that 1.9% is not achievable based on their previous disclosure using the table below:

Amanda has clarified that StashAway has since updated to remove the table and replaced it with this article: “How is StashAway Simple Projected Rate Calculated”

According to StashAway, the math on the projected rate of returns is quite straightforward: StashAway Simple™ returns are the sum of the amortized yield from the underlying funds, minus fees charged by the fund managers, plus any rebates.

In the case that one (or both) of the fund’s projected returns changes, we may decide to rebate you an additional amount in order to deliver the stated projected rate (in 3 decimals) at the time.

Herein lies the “difference” which I guess wasn’t effectively communicated to the public. StashAway provided an ADDITIONAL rebate on top of the rebate from the fund manager of 0.125%.

This means that if the rate of StashAway Simple comes out to only 1.7% for example, based on the calculation using the table above, StashAway will top up the difference of 0.2% to ensure that users of StashAway Simple continue to enjoy a cash management rate of 1.9%.

So, this is implicitly a “guaranteed” return from StashAway. Whether they are paying that rate, there is currently no way for me to verify that as I am not a user of StashAway at present and it is also further complicated by the timing difference of the fund manager rebate as well as when StashAway provides that additional rebate.

For now, I will like to give them the benefit of the doubt. Neither am I going to contest the business viability of such a rebate system on a long-term basis.

If short term interest rates are indeed on a steep downward trend, that will imply that the deficit that StashAway will have to “top-up” will continue to widen. Alternatively, they could switch to higher-yielding funds which will imply greater credit risk or the existing funds that they are currently vested in could buy “riskier” bonds that are still within the scope of their investment mandate to “juice-up” returns.

Again, my advice is not to lose focus on the big picture. Cash management services should just be one of the tangible offerings of a Robo Advisor. There are other important aspects that potential investors should also evaluate when it comes to investing with Singapore Robo Advisors such as their platform fees and investment style etc.

With that clarification on how StashAway can continue to generate 1.9% for their cash management users “de-mystified”, let’s move on to how one can generate a “guaranteed” annualized return of c.70% with StashAway.

Generating the guaranteed return of 70% from StashAway

ShopBack Promo

Before you get all “hyped-up” with the 70% guaranteed return, hold your horses for the moment. This is based on the current promotion on Shopback where first-time users of StashAway (you have not to deposit money with them before) can enjoy a guaranteed cash-rebate of S$38 for a minimum investment of $500. This rebate has been increased from S$30 to S$38 in the latest promotion.

For those who have not heard of Shopback, you are probably not a big fan of online shopping or shopping at all. Shopback is a cashback reward program across Asia-pacific with over 5m members on its platform. It allows online shoppers to receive a small percentage of their purchases on the platform, paid for through affiliate programs by the merchants.

In the highly unlikely scenario that you are not yet a ShopBack user and would like to sign up for it, you can use my referral code for a S$5 rebate for you.

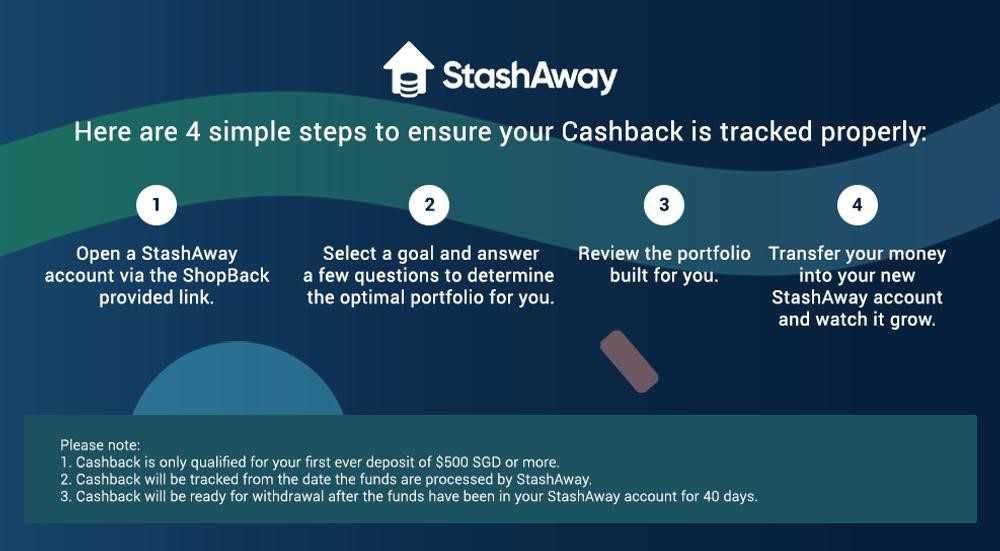

According to Shopback in their July 2020 promotion, there is now an upsized cashback of S$38 from the prior amount of S$30. Here are the 4 simple steps to take to ensure your cashback is tracked properly:

What you should DO:

- Click from ShopBack before you sign up or deposit the fund

- Make a one-time deposit into your StashAway account of S$500 or more

- Use only promo codes featured on ShopBack

- ShopBack must be the last link you clicked in order to get Cashback. If other website links are clicked after clicking through ShopBack, Cashback will not be tracked.

What you should NOT DO:

- Contributions below S$500

- Withdrawing funds before the 40 days have passed

- StashAway app sign-ups or deposits

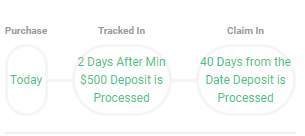

When will you get your Cashback?

Where is the 70% annualized return?

The calculation is simple. You get S$38 based on a fund contribution of S$500. 38/500 equates to a 7.6% yield.

However, you only need to keep your S$500 fund with StashAway Simple (not necessarily with their core investments, can choose their cash management) for a total duration of 40 days.

Therefore a 7.6% yield over 40 days annualized will imply a gross return of 70%.

At this juncture, you might be feeling a tad disappointed (I apologized if I have just wasted 2 mins of your life reading this article) or “excited” that you have just got yourself a free meal.

Conclusion

A key purpose of the article is to clarify how StashAway can consistently provide a cash management return of 1.9%/annum, although the title of the article might be considered “click-baity”. This article is by no means a recommendation in any part and it is up to readers to decide if the “guaranteed” 70% annualized return on your $500 capital is worth the hassle.

I have said it before and I would like to say it again. Transparency among our Singapore Robo Advisors is critical to gain trust among users and bring them a step closer towards their widespread adoption within the Singapore context.

It is a good way for a newbie investor to start his/her investment journey with a small sum of capital which significantly reduces the barrier of entry while inculcating a disciplined, consistent approach towards investing.

The focus should never be on how high the cash management returns are but if the investment philosophy of the Robo Advisors is a good fit for you based on your own “ideal” investing style and risk appetite.

Once again, for those who will like a better picture of the Robo Advisor scene in Singapore, you can refer to this article: ULTIMATE ROBO ADVISORS SINGAPORE GUIDE. KEY FACTS YOU NEED TO KNOW (2020) for a holistic view of all the Robo Advisors in Singapore.

Do Like Me on Facebook if you enjoy reading the various investment and personal finance articles at New Academy of Finance. I do post interesting articles on FB from time to time which might not be covered here in this website.

Join our Telegram broadcast: https://t.me/gemcomm

SEE OUR OTHER WRITE-UPS

- STASHAWAY SIMPLE REVIEW + OTHER NO FRILLS CASH SAVINGS [UPDATE MAY 2020]

- ULTIMATE ROBO ADVISORS SINGAPORE GUIDE. KEY FACTS YOU NEED TO KNOW (2020)

- DIY OR ROBO? THE 1.6% OPPORTUNITY COST DILEMMA

- CREATING THE BEST TAX EFFICIENT ETF PORTFOLIO TO INVEST IN?

- DIMENSIONAL FUNDS: ARE THEY WORTH THEIR WEIGHT IN GOLD?

- CHEAPEST WAY TO INVEST THROUGH RSP. SHOW ME HOW.

Disclosure: The accuracy of the material found in this article cannot be guaranteed. Past performance is not an assurance of future results. This article is not to be construed as a recommendation to Buy or Sell any shares or derivative products and is solely for reference only.