Singapore Blue Chip Stocks to capitalize on rising momentum

Singapore stocks have been one of the more resilient performers since the start of 2022, with the Straits Times Index (STI) STI up a commendable 8%, one of the best stock market performers not just in the region, but on a global scale, an achievement that we have not seen for a pretty long time.

Only time will tell if that momentum can persist for the rest of 2022.

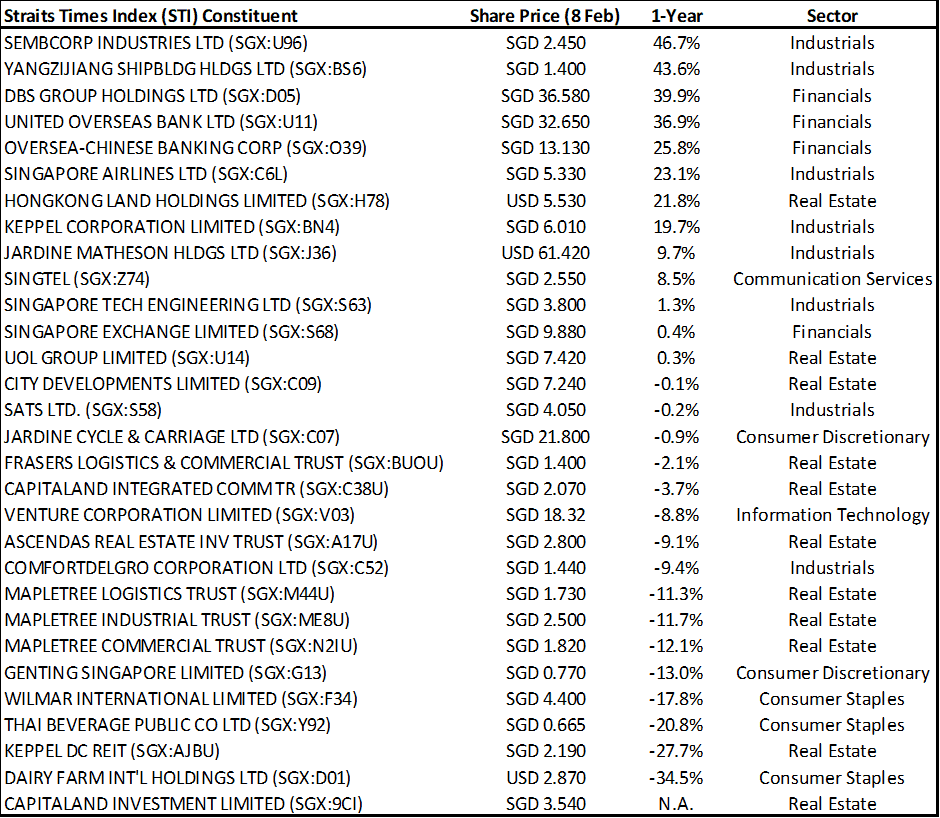

The stocks that composed of the STI are the 30 largest companies listed on the Singapore Exchange.

Of these 30 blue-chip companies, the best performers on a 1-year basis are Sembcorp Industries with a YTD return of 47%, followed closely by Yangzijiang Shipbuilding at 44% and DBS Group rounding up the Top 3 1-year performers with a return of 40%.

The Top 3 laggards on a YTD basis are Thai Beverage (-21%), Keppel DC Reit (-28%), and Dairy Farm (-35%)

Do note that the information above has been retrieved from SGinvestors.io

Dollar-Cost Average (DCA) into the STI

While not a very exciting one, my strategy over the past couple of years when it comes to partaking in the Singapore market has been to engage a Dollar Cost Average approach to buy into the STI index every single month.

This approach works for me as:

- It instills discipline in me to constantly invest in the market without looking to time a better entry

- It allows me to easily purchase with a click of a button the largest stocks listed on the SGX. While these stocks might not be the most exciting candidates in terms of their earnings growth potential out there, I can sleep well at night knowing that these blue-chip stocks are unlikely to “disappear” overnight.

- I did not have the time and resources to do a deeper dive into SGX counters. Since I hold a positive view on financial counters in-lieu of global rising interest rates, it will be natural to partake in buying the STI Index since the 3 major banks hold a weighting of c.50% in the index. Buying the STI Index is akin to having exposure to the banks.

- I can have fractional exposure to these blue-chip companies without requiring a large amount of capital every single month. This is very useful for new investors looking to gain their maiden exposure into the Singapore market.

While one is not able to buy the “index” per se, it is possible to have the exact exposure to companies in the Straits Times Index by purchasing the ETF tagged to it.

In this case, it is the SPDR Straits Times Index ETF (ES3) or commonly known as the STI ETF for short. One can get exposure to STI’s 30 companies by purchasing this STI ETF, which is also listed on the SGX.

One can choose to purchase the STI ETF on a lump sum basis through a low-commission cost brokerage firm such as Tiger Brokers or through a dollar-cost average approach (like myself) with a brokerage company like FSMOne, which has one of the lowest cost offerings when it comes to a DCA approach.

I have written about how when can go about opening an account with FSMOne as well as the process to fund your account and start the DCA process in this article.

The downside with FSMOne is that its platform is not as intuitive and simple as its peers/Robo advisors, with “too many” product offerings confusing a new investor.

Now, if you are looking out for shorter-term trading opportunities, where might they be?

Trading Opportunities in 3 Singapore Blue Chip Stocks

Earlier, I have highlighted some of the best and worst Singapore blue-chip stocks on a YTD basis. Some stocks such as Sembcorp Industries and DBS have done very well on a 1-year basis. A sizable return for these stocks has been generated on a YTD 2022 basis.

I have previously highlighted that my strategy when partaking in the Singapore market has been to engaged a DCA approach by purchasing a basket of blue-chip counters. This is more for investment purposes with a long-term time frame in mind.

On a shorter-term basis, I do tend to partake in some quick trades when the opportunity arises.

The big question now is: Can one still invest in some of the best performing blue-chip stocks that have generated strong returns over the past 1-year? Is that opportunity now over?

For such short-term trading opportunities, I turn to the TradersGPS platform to guide me on my entry.

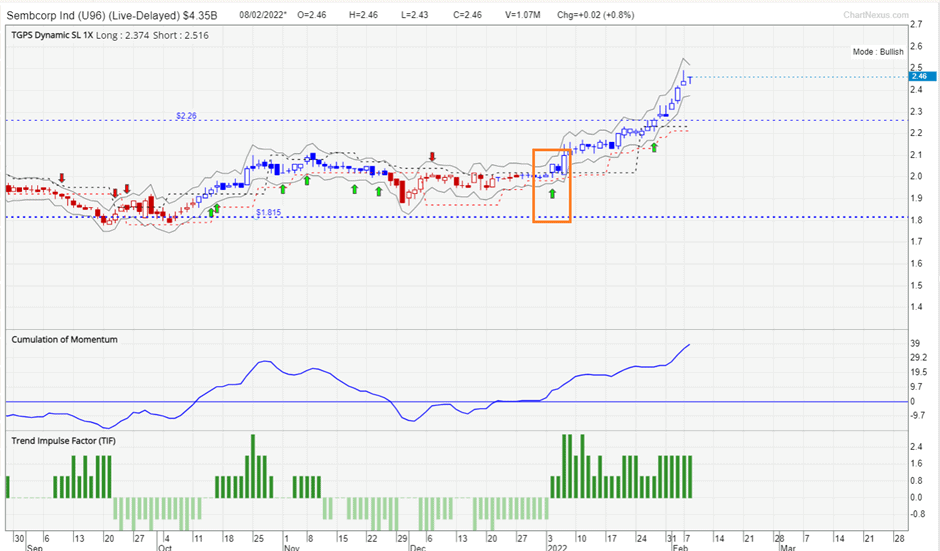

Some of the stocks highlighted above such as Sembcorp Industries, as an example, demonstrated a positive BUY entry at the start of 2022, with an entry price of $2.06/share. That would have generated a return of approx. 19% based on the latest closing price as of 7 Feb 2022.

However, might it be too late to partake in the rise of Sembcorp Industries if you have missed the 1st entry point at $2.06/share? Not necessarily so, with the second entry at $2.27/share on 28 Jan still generating positive returns as the system looks to ride the positive momentum in the counter.

So, which are the Singapore blue-chip stocks within the STI that might have the opportunity for further upside based on their rising momentum?

I have found 3 other Singapore blue stocks that fit this profile using the TradersGPS platform.

Do note that this is not a recommendation to be buying into these 3 counters. Please do your due diligence. However, I do like to show how easy it is to screen for some of these rising momentum counters using the TradersGPS platform.

The Systematic Trader

One of the most highly rated financial courses by Seedly, The Systematic Trader teaches the usage of the TradersGPS Platform, an intuitively simple stock platform for retail traders to find the RIGHT stock to buy/sell at the RIGHT time

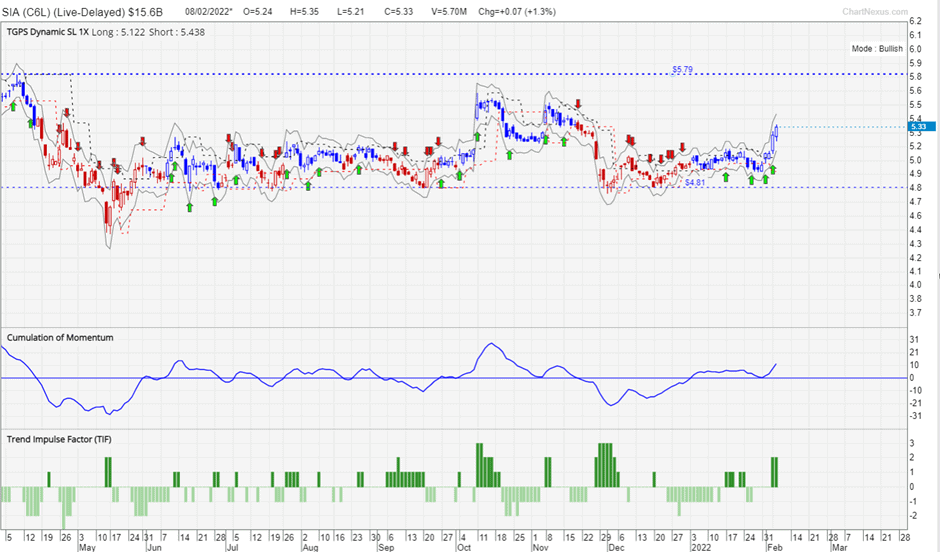

Singapore Blue Chip Stock with Rising Momentum #1: SIA

The first stock on the list is SIA which has a positive entry at $5.29/share, which is not very far from its current last close price of $5.33/share. While this is not the nicest trending chart, SIA is currently benefiting from positive sentiments stemming from re-opening plays as the effect of Omicron is not as bad as previously feared.

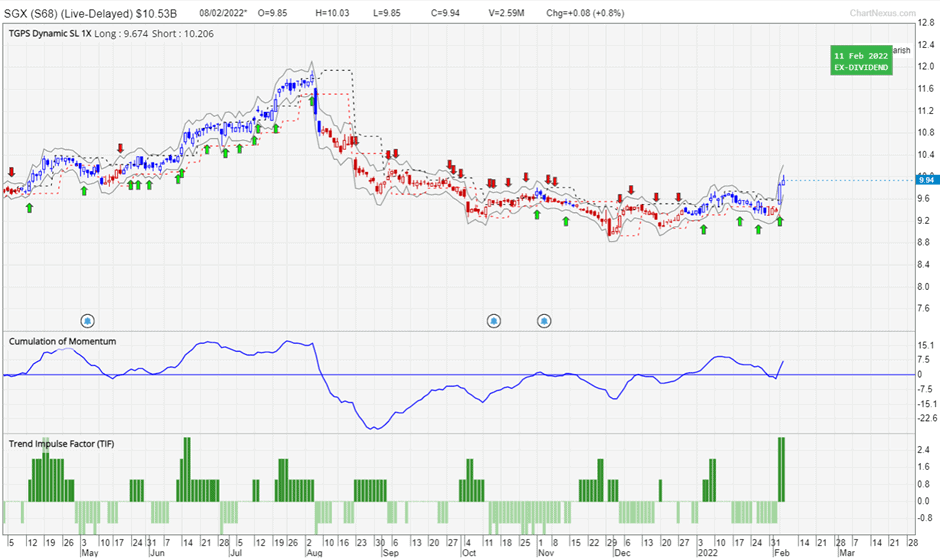

Singapore Blue Chip Stock with Rising Momentum #2: SGX

The second stock on the list is SGX. This looks to be a more interesting counter, with the stock breaking its near-term resistance and this could signal the start of a strong push-up again to the last high of $12/share or approx. 20%+ upside from its current level.

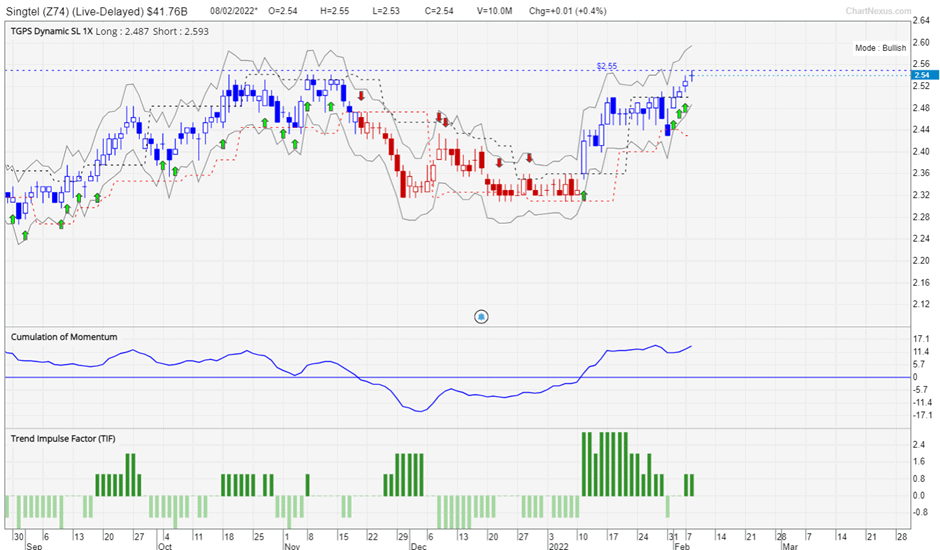

Singapore Blue Chip Stock with Rising Momentum #3: Singtel

The 3rd stock with rising momentum is Singtel and the set-up for this counter looks to be the best, with its latest entry signal indicating a BUY close to its last high of $2.55/share. If the counter can successfully breach this resistance level, that could continue to propel its momentum higher.

Conclusion

Singapore stocks have been playing catch-up since the start of 2022. Might this finally be the year where Singapore investors get to rejoice, after years of underperforming the more prolific US market?

Long-term investors can select to engage a DCA approach, like myself, to partake in the growth of the Singapore market by purchasing the STI ETF, a simple way to “buy into” the largest Singapore Blue Chip stocks we have got to offer.

For traders who are looking at more opportunistic and shorter-term entries, there seems to be an indication that the momentum for many of these blue-chip stocks is indeed rising.

For newbie traders, the TradersGPS platform is a simple and intuitive tool to have in your trading arsenal, to guide you to BUY the right stock at the right time.

For those who are interested in finding out more about this proprietary TradersGPS platform, Collin Seow, the founder and chief educator will conduct a FREE session to demonstrate how intuitively simple it is to use this platform to guide you in purchasing the RIGHT stock at the RIGHT time.

The above 3 Singapore blue-chip stocks caught my attention in terms of a possible rise in momentum sustaining which could translate into higher share prices.

I will be doing a video guide on the use of the TradersGPS platform in the future, so do look out for it.

Once again, this is not a recommendation for any purchase but an educational piece about the STI as well as the usage of the TradersGPS platform to identify some of the latest trending counters.

Please do your due diligence when engaging in these trades.

Do Like Me on Facebook if you enjoy reading the various investment and personal finance articles at New Academy of Finance. I do post interesting articles on FB from time to time that might not be covered here in this website.

Join our Instagram channel for more tidbits on all things finance!

Join our Youtube channel for short and sweet videos on all things finance!

SEE OUR OTHER WRITE-UPS

- Inflation: Don’t ignore this silent retirement killer

- Inflation at 5% in May: Transitory or a structural problem

- Pricing Power: Stocks that can do well amid inflation concerns

- 5 Small-Cap US Stocks with 10 years of consecutive earnings growth

- How to invest in Dividend stocks

- 9 Strong Free Cash Flow Stocks that you need to own

Disclosure: The accuracy of the material found in this article cannot be guaranteed. Past performance is not an assurance of future results. This article is not to be construed as a recommendation to Buy or Sell any shares or derivative products and is solely for reference only