Should you be buying REITS today?

REITs have been one of the most popular investment assets to generate a passive stream of income. It is for this very reason (and maybe some others which I will elaborate) that I am looking to increase my portfolio exposure to this investment class.

This is despite REITs being an “expensive” asset due to its strong price appreciation in 2019.

OCBC recently came out with a REIT report: “Singapore REITs – Let’s go with the big guns”. Let me share a number of key charts in this article before I proceed.

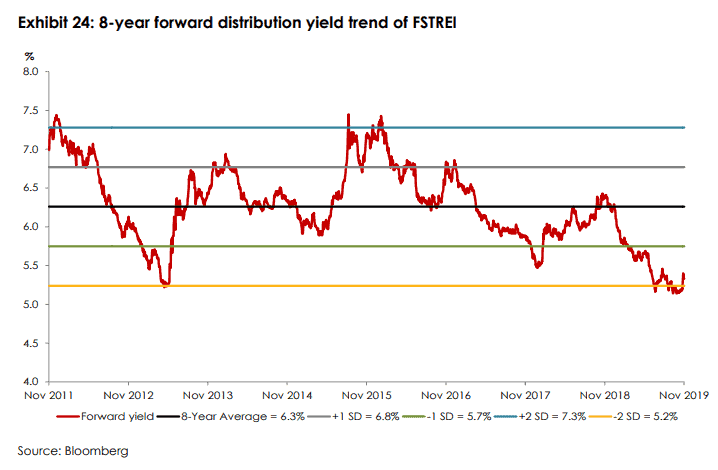

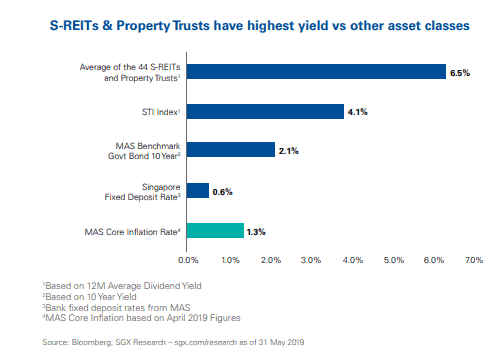

The forward yield of REITs, currently at approx 5.3%, is close to -2SD. This is definitely “not cheap”. But is it expensive considering that global interest rates are heading towards negative territory? I will touch on this topic in a later segment.

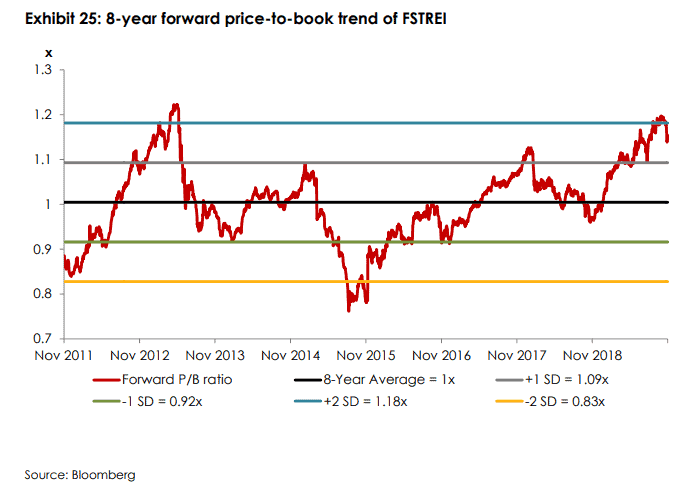

Another popular metric often used in determining the value of a REIT is its Price/Book ratio. This ratio currently sits at around 1.15x, close to 2SD above its 8-years mean. The odds of this ratio trending higher seem to be less than 50%, in our view. This is unless the Fed continues to cut interest rates.

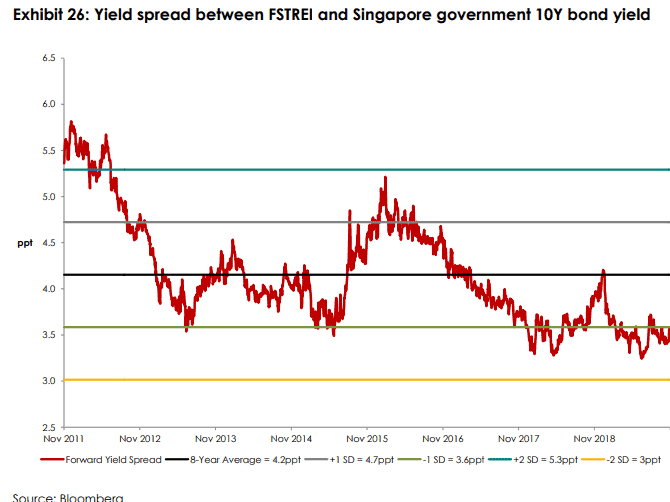

Lastly, the yield spread between the FSTREI and the Singapore government 10Y bond yield remains at -1SD which represents a spread of only around 3.5%. The average yield spread is approx. 4.2% based on the chart above while at +1 SD, the spread can be as wide at close to 5.4%.

Naysayers of REITs generally used this chart to illustrate why REITs are currently overvalued, given that it is a matter of time before the yield spread reverts back to average which represents significant price declines.

Unfortunately, the same commentary has been said of global interest rates being kept artificially low for years and it is also a matter of time before we see rates back at the long-term average of c.3%.

Well, we have now gone negative in key developed nations. The US seems to be following suit.

According to a Property research note by UBS dated 13 September, the brokerage believes that the SG 10-year bond yield could hit 1% at the end of 2019 from the current level of 1.7%. That will be the lowest on record.

Assuming that REITs yield does not change, the yield spread will increase from 3.5% to 4.2% (revert to average level) which will make REITs valuation more palatable. If the yield spread of 3.5% is maintained, that will mean REITs can still appreciate by c.15% from current levels.

Is buying REITs when they are “over-valued” a bad investment?

Based on the yield spread chart above, I did a little analysis on my own. What if I bought the FSTREI when it was at -1 SD in July 2013 (represents over-valued) and held on till today.

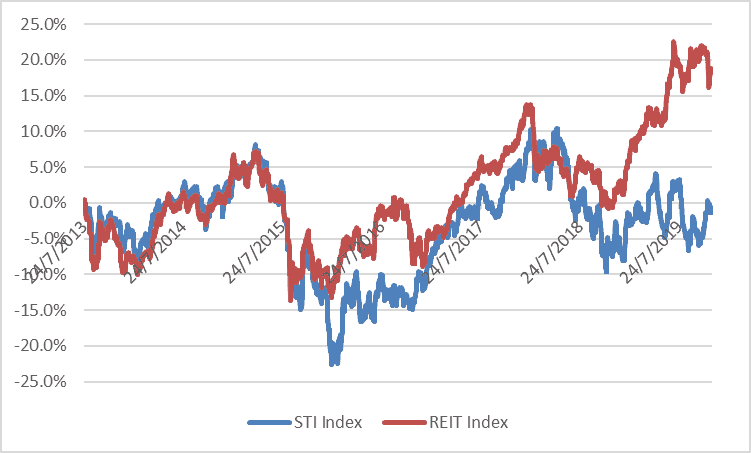

The value of FSTREI has appreciated by 18% during this period while the STI Index is marginally negative. The outperformance is pretty significant even when we exclude the returns from dividend yield.

If I bought the FSTREI when it was at +1 SD in Apr 2016 (represents under-valued) and held on till today, my return would have been around 27% during this period compared to 15% for the STI Index.

For sure if you purchase a REIT at +1 SD, the probability of outperformance is higher. However, buying at -1 SD does not necessarily dictate a bad investment, particularly if your comparison benchmark is the STI Index.

If we include the returns from yield (let’s assume 4% for FSTREI), even purchasing at its “peak” will generate a total return of approx. 7%/annum on a simple average basis over a 6-years horizon.

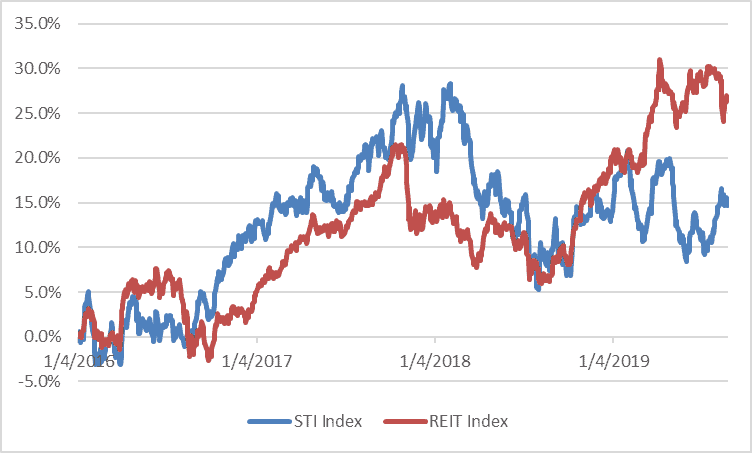

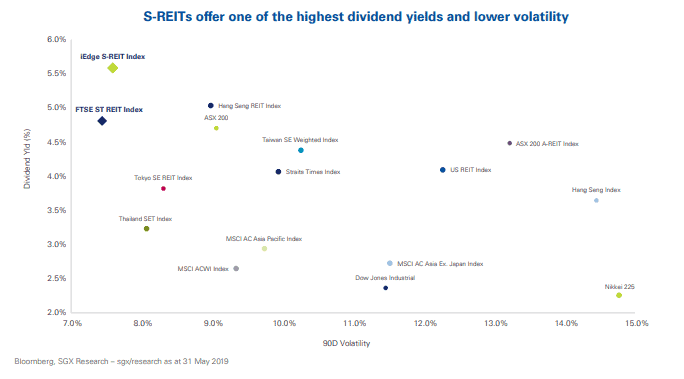

The chart seems to imply that REITs will lag equity in a strong bull-market but exhibits less volatility with greater outperformance in a dovish interest rate environment. This is supported by a KPMG research based on SGX data done back in May 2019.

Interim conclusion

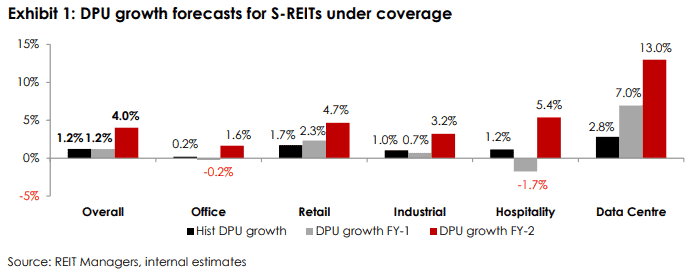

My initial stab in terms of the relative valuation of REITs is that while they ain’t cheap as an industry, particularly if you take into consideration the lack of DPU growth ahead (with the exception of data center REIT/s), according to data from OCBC, it is still a decent investment asset when benchmarking against the STI Index.

Where will REITs be heading next?

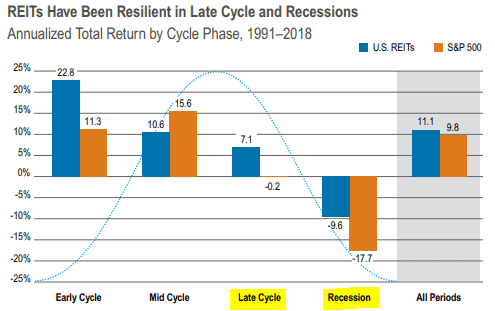

According to researchers from Cohen & Streets, they note that “REITs have outperformed the S&P 500 by more than 7% annually in late-cycle periods since 1991 and have offered meaningful downside protection in recessions, underscoring the potential value of defensive, lease-based revenues and high dividend yields in an environment of heightened uncertainty”.

Well, if you believe that we are heading into a recession, then most investment asset classes will take a hit, REITs included. However, they will likely be more resilient than the equity market with a lower decline in prices.

So should one be invested in REITs now?

For those whose portfolio is REITs heavy, it pays caution to trim your exposure to REIT and possibly hold some cash to wait for a better entry point to reinvest your capital again.

For those with existing REIT counters and a long investment horizon, it makes sense to remain vested in REITs as this investment class will continue to be a good source of passive income in a recession.

For those who are thinking about getting your feet wet in terms of starting your REIT investing journey, I don’t think it is too late for you to do so. As we have previously analyzed, even if you enter now when REITs are seemingly over-valued (based on the thinner yield spread), the longer-term returns are still decent vs. STI Index.

If you have a shorter-term holding horizon, then it depends on several factors. In the following segments, we highlight some of the key factors influencing the performance of REITs, particularly on 1) Interest rates and 2) Recessionary environment.

What is your view on interest rates?

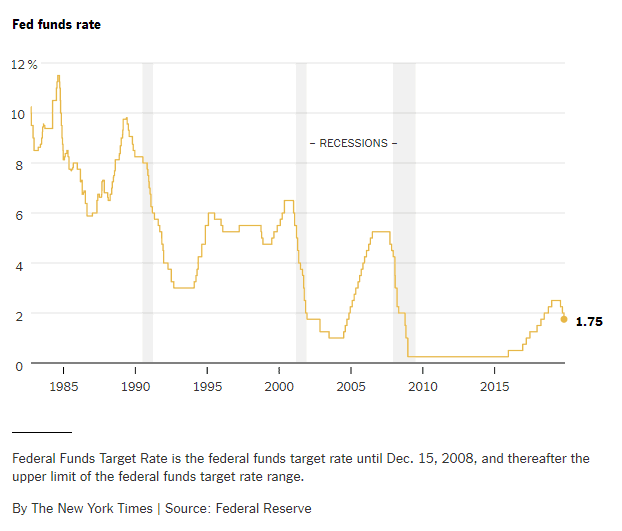

Given that REITs are particularly sensitive to interest rate movements, one will need to make an “educated guess” as to where interest rates might be trending, after 3 rate cuts done by the Fed in 2019. Fed Chair, Jerome Powell signaled that they would pause to assess incoming data before considering to lower borrowing costs again, in part because of a potential easing of trade tensions.

However, the US Senate unanimously passed a bill on Tuesday (19 Nov) aimed at supporting protestors in Hong Kong and warning China against a violent suppression of the demonstration. This drew China’s ire, with the country threatening to impose unspecified retaliation if the bill became law.

This might implicate the current “truce” in the US-China trade war saga where a “phase one” deal between China and the US is expected to be announced by mid-December. Trump has threatened higher tariffs if China doesn’t make a trade deal.

US intervention in Hong Kong might possibly blow this deal to smithereens. Even if a “phase one” trade deal is done, it might still not be sufficient to stem a slow-down in both US and global growth. However, the news of a DONE DEAL itself will be seen as a major breakthrough development by the market, further bolstering the positive market sentiments.

Based on this scenario, we see a further lowering of interest rates over the next 6-12 months as our base case scenario.

The Fed might hold pat on further lowering the benchmark interest rates if unemployment remains strong and US GDP shows sign of improvement from the current 1.9% level in 3Q19.

The likelihood of a US interest rate hike over the next 6-12 months is low unless global growth exhibits signs of a strong turnaround. That could result in a voluntary action by the Fed to raise rates.

An involuntary action might occur if there is a shock in the system that triggers the “unforeseen” scenario of stagflation (a combination of stagnant economic growth, high unemployment, and high inflation). Even if the government will like to keep rates low, they are forced to raise rates to combat inflation.

Given our view that interest rates will remain low for the foreseeable future, with a downward trending biased, it does make sense to still be positioned in REITs at the moment, despite the industry’s “lofty” valuation.

Lower for longer?

We are probably in an era where lower for longer, in the case of interest rate, is the new economic regime. While it makes no economic sense for us to be paying banks to hold our deposits, yet here we are, with Europeans falling in that situation.

The world is probably addicted to “stimulus”. Despite years of priming the economy with helicopter money, we are still in a weak growth environment. One might question the sustainability of a low-interest rate regime but I see nothing stopping governments all around the world to engage in another round of QE, or simply driving interest rates to zero or negative territory. The markets will love such an action and REITs will be a major key beneficiary

The music will only stop if inflation gets into the picture and result in the dreaded stagflation scenario. When whereby a slowing economy cannot be stimulated by lowering of interest rates due to run-away inflation that “corrodes” away from the purchasing power of the people. Inflation does not seem to be a problem, for now at least.

What if interest rates actually head higher?

In 2018 when the Fed got aggressive in raising rates, REITs were pummelled. This was when global growth was looking rosier. In such a scenario when the global growth engine is humming nicely, businesses are doing better and they can afford to pay higher rents to landlords.

Some market participants saw the price weaknesses in REITs as an opportunity to position more aggressively in them, particularly those that benefit from higher rental rates and yet have the bulk of their borrowings fixed on long-term rates.

Hence in this “unlikely” scenario of interest rate rising, this could imply that the economy is recovering faster than expected and while REITs as a whole might seem like a bad investment to be in, cherry-picking those that will see operational improvement from higher rents while benefitting from fixed interest costs will be the ideal REIT strategy.

If interest rates trend lower (on our base case) and we somehow manage to avoid a recession, then REITs will remain a huge winner.

What happens if we head into a recession?

The R-word has been thrown around for quite some time now. We have been in a bull stock market for more than a decade, with the last recession having ended in June 2009. Some market participants are expecting that the world will see a recession in 2020. If that happens, should you then be positioned in REITs?

If a global recession really is to materialize, we believe the simplest course of government action will be to engage a dovish stance and further lower interest rates to stimulate the economies.

The effectiveness of such a strategy is in question, given how low-interest rates already are globally, especially in major European nations where rates are in negative territory. This seems positive for REITs based on an interest rate angle, but one will also need to assess the negative impact pertaining to the business environment in a recession.

Businesses will get impacted and tenants will start negotiating for lower rentals. Occupancy could drop significantly and that’s going to hit both the top and bottom-line performance of the REIT.

The positive impact from lower interest rates might not be sufficient to stem an overall decline in earnings due to lower rentals and/or occupancy which will consequently lead to lower distributable income aka yield that a REIT dishes out.

SG REITs back in 2008 recession

Looking back at the last recession in 2007/08, SG REITs suffered significant price decline due to one key reason: over-leveraged balance sheet with a high degree of refinancing risk. When banks refuse to lend (due to liquidity crisis) or refinance an existing debt, highly geared companies, REITs included, found that their only solution was to tap the equity market to solve their liquidity issues. This resulted in substantial equity dilution and consequently led to share prices collapsing.

SG REITs in today’s context are less-geared, due to measures put in place by the government to restrict a REIT’s leverage limit to 45% (this limit could rise to 50-60% in due course). SG REITs maturities are also better spaced out with a combination of both fixed and floating rates.

Hence while REITs will still see their prices falling in the next recession, the drawdown will be less significant as compared to 2008, in our view.

One, REITs balance sheet is not heavily geared. Two, the lower cost of funding will partially mitigate rent decline. Our assumption is on the premise that banks are willing to continue to re-finance companies with a strong balance sheet at a lower cost.

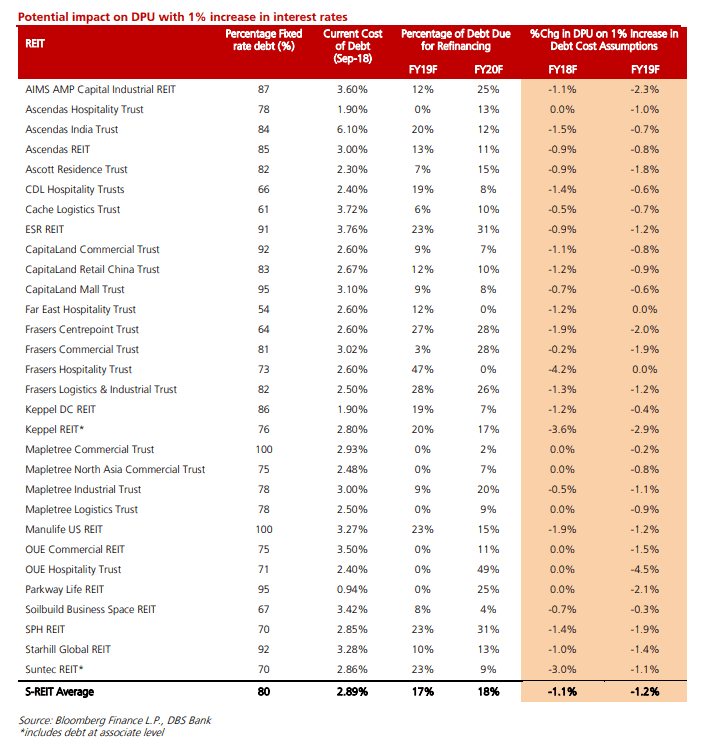

In considering REITs that will benefit from a lower interest rate environment, one will also need to assess their loan nature: how long are their loans structured for and are they on a fixed nature or floating nature. In this case, you will want your REITs to have loans structured on a floating nature such that they benefit when interest rates decline.

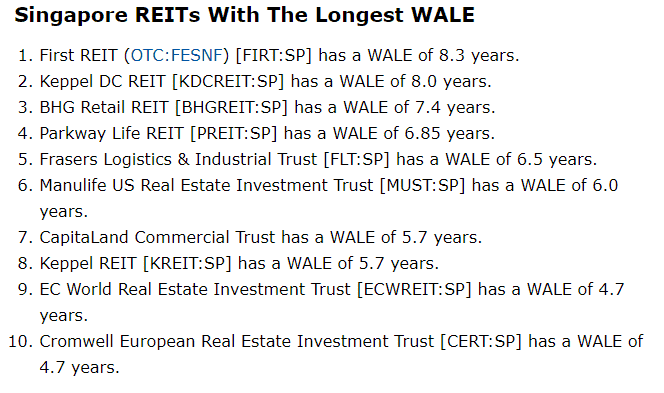

If a recession is to occur, REITs, like most asset classes, will be negatively impacted. However, the drawdown will be partially negated by the lowering of interest rates. REITs with long WALE and floating loans will benefit from such a scenario.

However, based on data from DBS done at the beginning of the year, it seems like most REITs have substantial fixed-rate loan (due likely to concerns over rising rates in 2018). Stocks like FCT, which has only 64% pegged to fixed rates and more than 50% of its loan up for refinancing in 2019/20 should benefit from a lower interest rate environment.

I have also gotten some data pertaining to Singapore REITs with the longest WALE from The Value Pendulum who contributes to SeekingAlpha.

Conclusion

So should one be buying REITs now? I think one will need to consider this question on a portfolio level. If your portfolio is already REIT-heavy, then it might not be prudent to further concentrate your investments in REITs. If your portfolio is under-weight in REITs, then choosing high-quality blue-chip REITs with a resilient business model that will also benefit from a low interest-rate environment could be the way to go.

On a stand-alone basis, I believe REITs is still a better investment choice compared to buying the STI Index. One: you get a higher yield in REITs. Two: REITs tend to perform better in the short-run in a declining interest rate environment and that is where we seem to be heading. Three: In a recessionary environment, REITs tend to outperform their equity counterparts. Four: In the early cycle, REITs again fare better than equity in terms of price performance.

We don’t have a crystal ball in front of us to tell us if a recession is in fact on the horizon. While the chance of experiencing a recession in the next 1-2 years is greater than 50% in my view, given that we are already in a bull-cycle for more than a decade, the late-cycle bull market party could still continue if governments continue to engage a dovish fiscal and monetary strategy and US-China conclude a trade deal.

One can stand on the side-line to wait for a major correction to happen (might not happen soon) while keeping their funds in Singapore Savings Bonds (currently yields 1.7% – 10-year horizon and could trend lower ahead) or choose a more aggressive approach to participate in REITs with yields of c.5%. The latter option might not be capital protected but let say if you are already choosing to invest in the STI Index anyway through an ETF like the Nikko AM STI ETF, then a better alternative might be through the REIT route.

Do Like Me on Facebook if you enjoy reading the various investment and personal finance articles at New Academy of Finance. I do post interesting articles on FB from time to time which might not be covered here in this website.

Join our whatsapp broadcast: txt hello to https://api.whatsapp.com/send?phone=6587407951&text=&source=&data=

SEE OUR OTHER WRITE-UPS

- TOP 10 FOOD & BEVERAGE BRANDS. ARE THEY WORTHY RECESSION-PROOF STOCKS?

- THE BEST PREDICTOR OF STOCK PRICE PERFORMANCE, ACCORDING TO MORGAN STANLEY

- TOP 10 HOTTEST STOCKS THAT SUPER-INVESTORS ARE BUYING

- SEMBCORP MARINE 3Q19 LOSSES BALLOONED TO S$53M. WHAT YOU SHOULD KNOW

- VENTURE 6% PRICE DECLINE POST-RESULTS; SATS’ 2QFY20 COULD REMAIN WEAK

- YANGZIJIANG’S SHARE PRICE IS UP 7%. CAN MOMENTUM PERSIST POST-RESULTS ON 7TH?

Disclosure: The accuracy of the material found in this article cannot be guaranteed. Past performance is not an assurance of future results. This article is not to be construed as a recommendation to Buy or Sell any shares or derivative products and is solely for reference only.

4 thoughts on “Why I am still buying REITs even when they look expensive”

I recently sold off some REITs yielding 5%.

REITs I sold:

– Frasers Ctr Tr 4% yield

– Mapletree Comm Tr 4% yield

Bond I bought in replacement was ARA 5.6%

– Bank also offered me Pimco global bond fund 4% unleveraged, with 50% leverage and financing rate of 2.5% can give me 5.5% nett yield so that might be another possible option

Hey Fan,

Thanks for dropping by and commenting. I am actually still holding on to my FCT. But do concur that yield is currently on the low side.

The PIMCO bond fund 4% un-levered is net yield after taking into account expense ratio? Would you know if there is any withholding tax impact on your coupon?

Thanks for sharing btw.