What to note when Sembcorp Marine goes ex-rights tomorrow

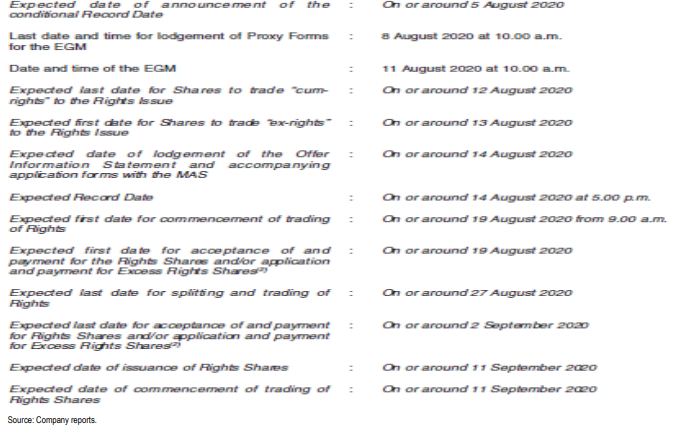

Sembcorp Marine shares are expected to trade ex-rights tomorrow. This means that today is the last day which Sembcorp Marine shares will be trading “cum-rights”. For those who are not familiar with these terms, simply put, if you are a Sembcorp Marine shareholder and did not sell your shares today on the 12 August, you will be entitled to the rights shares.

Recall that for every 1 shares of Sembcorp Marine that you own, you will be entitled to 5 rights shares. These right shares can be exercised at $0.20/rights. Meaning that if you wish to subscribe for these rights, you need to pay $0.20/rights to convert them into actual shares. If you own 1,000 shares of Sembcorp Marine, you will need to fork out (5,000 rights * 0.20) = S$1,000 if you wish to convert the 5,000 rights shares that you own into actual shares and avoid dilution. In this example, you will end up with 6,000 shares of Sembcorp Marine.

Given that the rights are renounceable, it means that you can SELL the right shares on the open market if you do not wish to pay S$0.20/rights to convert them into actual shares. You can start TRADING/SELLING the right shares on or around 19 August, which is the first day in which the rights are trade-able. The last day of trading these right shares will be on or around 27 August.

If you choose not to do anything ie: not subscribe nor sell the rights, you will essentially be giving away free money (unless Sembcorp Marine price is below S$0.20 during the entire duration that the rights are trade-able. More on this in the next segment).

How much might the right shares be worth?

So the next question might be: How much might these right shares be worth? The price of the right shares will essentially be the difference between the ex-right price of Sembcorp Marine and the exercise/issue price, which in this case is S$0.20. For example, if the ex-right price of Sembcorp Marine is S$0.25/share when the right become trade-able than the rights will be worth approximately S$0.05/rights. In this scenario, there is no arbitrage.

For illustration, assume that the ex-right price of Sembcorp Marine is at S$0.25 but the rights is trading at only S$0.02/right share. An investor can choose to purchase the right at S$0.02/right share, exercise it by paying the issue price of S$0.20 for a total cost consideration of S$0.22. At the same time he can choose to “Short Sell” the underlying share. Without taking into consideration any additional holding and borrowing cost, he can immediately profit from this arbitrage situation of “locking” in the price at S$0.25/share (sell) and when his shares, which he bought at S$0.22/share are delivered to him, he can use it to offset the short purchase, hence benefiting from a guaranteed arbitrage profit of S$0.03/share.

What happens if Sembcorp Marine ex-right price is less than S$0.20/share when the rights become trade-able? In this case, the right shares will be worthless. As the owner of the right shares, you choose to either exercise it at S$0.20/right or just forget about it.

What will the ex-rights price be?

So the third question might be, will Sembcorp Marine shares be trading significantly below S$0.20/share on an ex-rights basis? The answer will be known tomorrow.

Sembcorp Marine is trading at S$0.34/share today. At the current price, the market cap of Sembcorp Marine is approx S$720m. Just prior to the announcement of this massive rights issuance, the counter was last traded at S$0.85/share. This translates to a market cap of S$1.78bn based on 2.09bn outstanding shares.

Management highlighted that based on the last trading price of S$0.85/share, the theoretical ex-rights price (TERP) was S$0.31/share. How was this ex-rights price derived?

Its simply adding the then market cap of S$1.78bn by the capital infusion of S$2.1bn and dividing by the total number of outstanding shares after the rights issuance.

Number of shares post rights = 2.09bn * 6 = 12.54bn

TERP = (1.78+2.1)/12.54 = S$0.31/share

So, should Sembcorp Marine command a market cap of S$3.9bn after the capital infusion? If that is the case, then its share price will only correct marginally from the current price level of S$0.34. This will imply that the market has mostly accounted for the significant dilutive impact of the counter from the rights issue.

On the other hand, what if the current market cap of Sembcorp Marine (S$0.72bn) is its actual fair value? This will mean that post-infusion, it will only have a market cap of S$2.82bn, thus translating to a per-share value of S$0.22/share.

For Sembcorp Marine shares to trade below S$0.20/share, that will imply its current fair value should be S$400m or less.

At S$400m, the counter is essentially trading at only 0.2x P/B, given that its equity value is S$1.9bn.

Is this value absurdly low? Well according to CIMB research, they reckon that Keppel’s O&M division is currently valued at only 0.2x P/B based on the market price of S$4.88. So for Sembcorp Marine to be trading at only S$400m market cap doesn’t seem to be overly absurd. This is assuming that CIMB’s SOTP valuation of Keppel Group’s other divisions is accurate.

Potential arbitrage?

I believe that the actual TERP of Sembcorp Marine might likely be a number around S$0.22/share which we calculated based on the current price. We will know tomorrow. I will be very surprised if it trades significantly above that which might provide an arbitrage opportunity.

If you purchase 1000 shares of Sembcorp Marine today at S$0.34 a piece, it will be worth S$340. You will be entitled to 5000 rights which you can pay S$0.20/rights to convert them into actual shares. Your total outlay will be S$1,340 and you will own 6,000 shares. Your breakeven per share will essentially be S$0.22/share.

If Sembcorp Marine’s ex-right price is significantly above S$0.22, say at S$0.30, you can borrow and short-sell the shares at S$0.30, exercise your rights at S$0.20/rights on 19 August, wait for your shares to be delivered to you on 11 September and return the borrowed shares, thus benefitting from the price difference of S$0.08/share.

Of course, there is quite a number of hoops to jump, assuming that you can borrow shares to short sell in the first place for this arbitrage situation to work.

More downside risk to Sembcorp Marine ahead?

There could be more pressure on Sembcorp Marine’s price when Sembcorp Industries public shareholders become entitled to their Sembcorp Marine shares, expected to be sometime around 11 September where they will be credited with their Sembcorp Marine shares. At that point in time, there might again be substantial selling pressure, as Sembcorp Industries’ shareholders who do not wish to remain as Sembcorp Marine shareholders will start cashing out of their Sembcorp Marine shares.

Conclusion

As highlighted in my previous articles, existing Sembcorp Marine shareholders face a tough choice. They can choose to subscribe for the rights but risk seeing their share price under continual pressure, given the bleak outlook of the industry as well as potential selling pressure from Sembcorp Industries’ shareholders.

On the other hand, not subscribing to the rights will mean that Temasek now has the “cheap” option to gain approx 28% more shares in Sembcorp Marine by just forking out S$0.6bn. Note that Sembcorp Industries paid S$1.5bn for its 61% stake. Existing Sembcorp Marine shareholders, if none choose to subscribe for the rights, will see their stake being diluted from the current level of c.39% to just 6.5%. This means that even if a subsequent corporate action is to take place, for example, privatization by Temasek in due course, Sembcorp Marine shareholders will not significantly benefit from it.

For now, note that if you are a Sembcorp Marine shareholder at the end of today, for every 1 share of Sembcorp Marine shares that you own, you will be entitled to 5 right shares. You can choose to pay S$0.20/rights to convert them into actual shares or start selling them, both starting from 19 August, in the open market when the rights become trade-able.

Note that the price of Sembcorp Marine will go ex-rights tomorrow on the 13 August. This might potentially create an arbitrage opportunity if its share price is significantly above or below our calculated TERP of S$0.22/share.

Do Like Me on Facebook if you enjoy reading the various investment and personal finance articles at New Academy of Finance. I do post interesting articles on FB from time to time which might not be covered here in this website.

Join our Telegram broadcast: https://t.me/gemcomm

SEE OUR OTHER WRITE-UPS

- IS TIME RUNNING OUT FOR KEPPEL AND SEMBCORP MARINE AS OIL COLLAPSES BELOW ZERO?

- SEMBCORP INDUSTRIES 4Q19 BETTER THAN EXPECTED. SHENG SIONG MARGINALLY DISAPPOINTS

- SEMBCORP MARINE 4Q19 LOSSES EXCEEDED EXPECTATIONS. WHAT YOU SHOULD KNOW

- SEMBCORP INDUSTRIES: PROFIT WARNING A PRELUDE TO MORE PAIN IN 2020?

- SEMBCORP MARINE 3Q19 LOSSES BALLOONED TO S$53M. WHAT YOU SHOULD KNOW

- TOP 5 UNDERVALUED SINGAPORE DIVIDEND STOCKS (2020)

Disclosure: The accuracy of the material found in this article cannot be guaranteed. Past performance is not an assurance of future results. This article is not to be construed as a recommendation to Buy or Sell any shares or derivative products and is solely for reference only.