Sea Limited Analysis

In part 1 of this 3-parts-series, I provided a brief overview of Sea Limited’s 3 main business pillars as well as do a deep dive on its profit-generating gaming business, Garena.

In part 2, I gave my 5-cents view on the negative impact that the ban of Free Fire in India might have on SEA Limited as well as a more thorough breakdown of its Shopee platform.

In the final part of this 3-parts-series on Sea Limited, I will highlight its final operational pillar, SeaMoney, which some referred to as the paypal of South East Asia. I will wrap up this series with a quick back-of-the-envelope calculation of what I believe SEA Limited is currently worth based on a sums-of-the-part valuation and provide my investment strategy on getting a position in the company.

Without further ado, let’s talk about SeaMoney.

SeaMoney (The “PayPal” of SEA)

Business Overview:

SeaMoney is the relatively nascent digital financial services arm of SEA.

SeaMoney offers a suite of digital financial services such as e-wallets (ShopeePay), credit services, and payment processing. Depending on the territory it operates in, SeaMoney also offers traditional banking services such as taking deposits, providing loans, offering insurance, and investment services, etc. to retail and business clients.

This provision of banking services is contingent on whether SeaMoney has a digital bank license in that particular country. SeaMoney recently obtained a digital full bank license from Singapore and has licenses to operate in Vietnam, Thailand, Indonesia, the Philippines, and Malaysia. It can provide loans in Thailand and Indonesia.

In recent years, SeaMoney has seen increasing use cases as more online and offline merchants are onboarded onto the system. Increasing third party use cases are also introduced which allow users to pay for a variety of their goods and services using SeaMoney’s e-wallet services.

These participating merchants and third party include but are not limited to the following: Telecoms, Food delivery services, movie theaters, retailers, banks, and car leasing companies.

Revenue & Profitability:

SeaMoney primarily makes money by charging commissions to 3rd party merchants with e-wallet services based on the value of merchandise sold by the merchant. Revenue is also generated by the monetization of its credit consumer business by charging interest on sums loaned to borrowers.

The business is currently loss-making as it reinvests revenue generated to grow the business by increasing Quarterly Paying Users (QPUs) and Total Payment Volume (TPV). It also looks to obtain more licenses to give it more freedom in offering a wider suite of financial products (insurance, loans, deposits, debit and credit cards processing, payroll services, etc.) in more countries.

However, given the myriad of revenue-generating opportunities available (such as fees income, interest income, and take rates) should the business offer more financial services, I am incredibly bullish on this business segment as it continues to grow well since its inception.

This is even more so when considering the profitability of these revenue opportunities with margins in the low 20%. Personally, I believe the sky is the limit for SeaMoney but there are certain key metrics that readers should monitor to ensure the business is executing well.

Two Key Metrics to watch out for:

QPUs: Quarterly Paying Users

This metric measures the number of paying users for SeaMoney’s mobile wallet services. Ideally, we would like to see a continued increase in this number as it would mean increasing adoption of SeaMoney’s mobile wallet services which would mean more paying users which leads to higher revenue. However, lockdowns being lifted might cause a slowdown in this metric. As always, a dramatic decrease in QPUs is not ideal as it would mean the wallet services are not desirable to merchants and users.

TPV: Total Payment Volume

This metric measures the total dollar amount of transactions processed by the business in the last 3 months. Ideally, we would like to see a sustained increase in this number as it would mean more transactions are made used SeaMoney’s offerings. This would see more revenue being generated as commissions are charged on transactions. Similar to the above, lockdowns being lifted might cause a slowdown in the metric. A dramatic decline in TPV is a cause for concern as it would mean fewer transactions are being conducted which suggests a lack of desirability to use SeaMoney’s offerings by users.

Risks to Consider:

Heavy Competition:

There is no shortage of digital financial service offerings these days; you have mobile wallet offerings from SEA’s e-commerce competitors (GrabPay) to digital payments offered by tech behemoths such as GooglePay and ApplePay. This is not even counting Singapore’s incumbent banks’ offerings such as DBS’ Paylah and OCBC’s Pay Anyone. SeaMoney will have a tough time competing in this arena but I am hopeful and bullish on the business succeeding in this front.

Digital financial service is an industry where there could be multiple big players in the industry and each player still does well. It is not a winner takes all game. In my humble opinion, SeaMoney has a shot in establishing itself as a top dog in this industry due to its other two arms. As mentioned above, SeaMoney provides a nice compliment to the gaming arm (Garena) and eCommerce arm (Shopee) of the business as payments made on them could be done through SeaMoney’s product offerings.

This creates a potential flywheel of benefits as a customer of any of the three business segments could be roped into the “SEA” ecosystem where a Garena gamer uses SeaMoney to purchase in-game credits and pay for her items bought on Shopee using ShopeePay. This would result in potential increased user engagement and adoption on SEA’s multiple platforms.

Regulatory Risk:

The financial services industry is one of the most heavily regulated industries out there. As such, countries always keep a tight leash on financial institutions operating in their territories. Slip-ups including: fraud, leak of confidential customer data, money laundering, etc. could result in SeaMoney losing its license to offer financial services in the country.

This withdrawal of license would be devastating for the business arm. As such, SeaMoney has to pay particularly close attention to ensure it is always in compliance with the countries’ laws and banking regulations.

Napkin Valuation

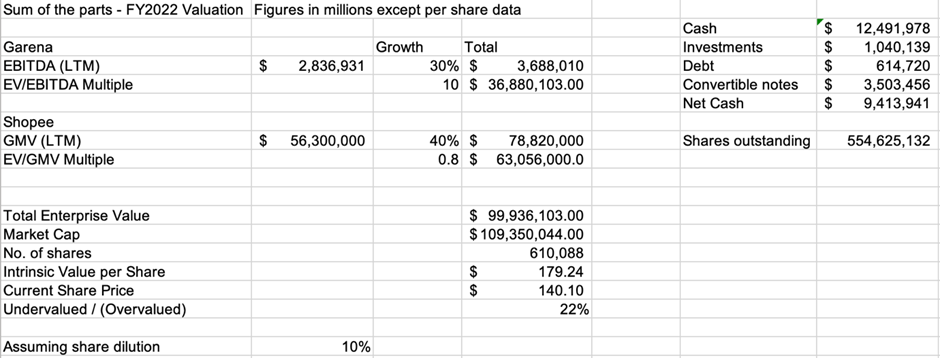

As SEA has 3 business arms, it makes sense to value the business using the sum of the parts valuation. This includes valuing 3 of the business arms separately before combining each one’s value to obtain a final value of the company. Do note that these figures represent my estimation of the business value and given that SEA is a hyper-growth company that has benefitted tremendously from the pandemic, the growth rates assumed might be inaccurate due to slower growth as a result of lockdowns being lifted.

Garena Assumptions:

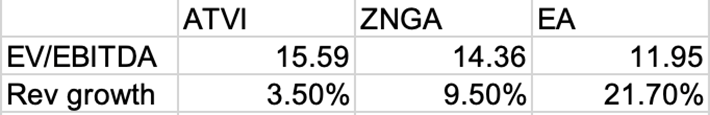

Garena grows EBITDA by 30% in FY22 led by increased monetization of Free Fire. EV / EBITDA multiple of 10 is assumed to generate a value of $36.8 billion for the business segment. The valuations of Garena’s competitors (Activision, EA, Zynga) are presented below. Note that these gaming companies have multiple titles that generate strong revenue and cashflow while Garena only has 1 golden cow which is Free Fire. The average EV / EBITDA ratio is 14. I assigned a multiple of 10 to Garena to take into account that Garena only has 1 strong revenue/profit generating IP in Free Fire.

Shopee Assumptions:

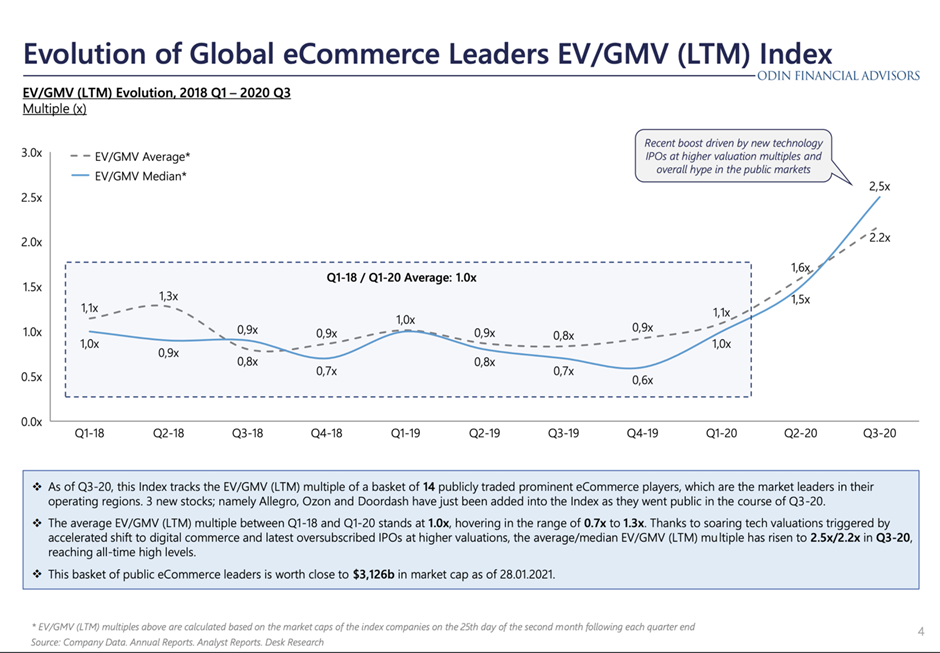

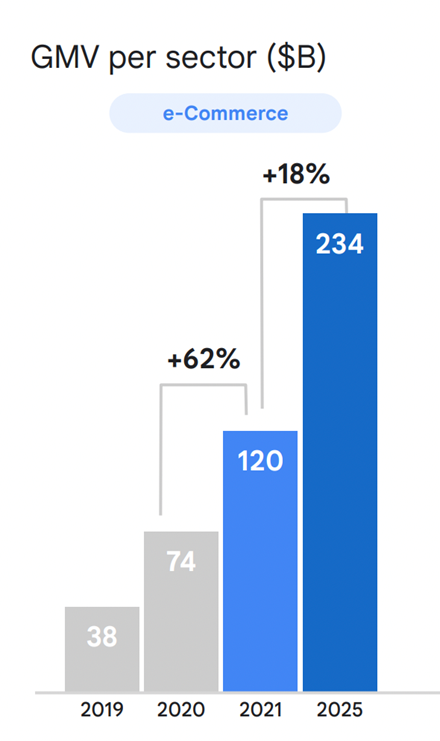

Shopee grows GMV by 40% in FY22 led by strong performance in Latin America (Brazil) and Southeast Asia (Indonesia). As Shopee is currently loss-making, I choose to value this business segment by assigning a multiple to its GMV. As seen in the picture below, most e-commerce businesses (Amazon, BABA, Shopify) were valued on an average of 0.8-1.0 EV/GMV multiple pre-covid. To be conservative, I have assigned a value of 0.8 to Shopee’s estimated 2022 GMV. This would result in a valuation of $63 billion for the eCommerce business segment.

SeaMoney Assumptions

As SeaMoney is still loss-making and in an attempt to be conservative with my valuation, I have decided not to assign a value to the business at the moment. However, if this business grows as expected, the business that it would most resemble to would be PayPal in my opinion. This would mean a 20% profit margin for this business segment. However, since it is still early days, I have decided not assign a value to it.

Final thoughts on valuation:

I have tried to be conservative in assuming growth rates for Garena and Shopee to account for the possible slowdown in both business segments due to lockdowns being raised. I have also decided to apply conservative multiples to value both businesses. After factoring in SEA’s net cash position and assuming a 10% share dilution (their average dilution for the past 3-4 years), I have reached an intrinsic value of $179.24 per SE share. Given SE’s recent trading price of $140.10 per share, this represents a potential 22% undervaluation of the market share price compared to the value of the business. This is even taking into account assigning a 0 value to SeaMoney. You are essentially getting SeaMoney for free in this scenario!

Again, these numbers reflect my value of the business. Always do your due diligence in trying to ascertain a value for the business.

Secular Tailwinds:

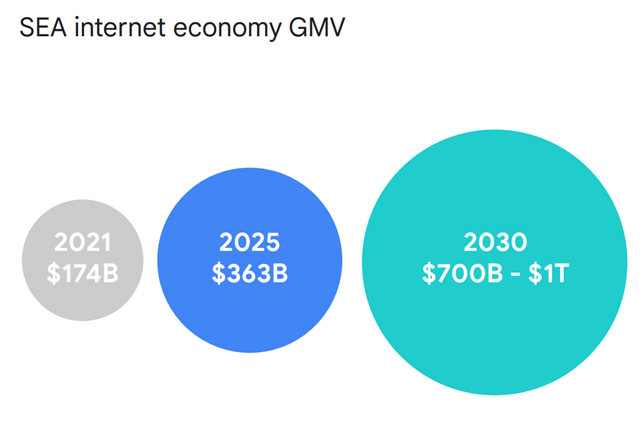

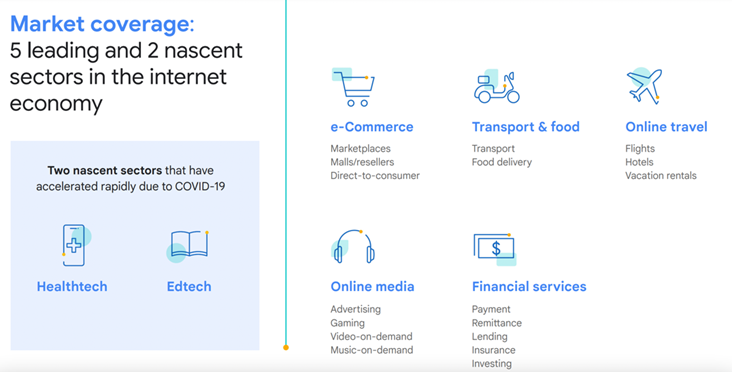

According to a Google, Temasek and Bain report, the digital economy of Southeast Asia region is projected to grow from $100 billion in 2019 to $363 billion in 2025. It is also estimated that it might hit $1 Trillion in 2030. This is fueled by the rise of middle-class consumers from a region that has a total of 600 million people and a total GDP of $3.6 Trillion. This growth is led by e-commerce, online gaming, ride-hailing, online travel, and online financial services.

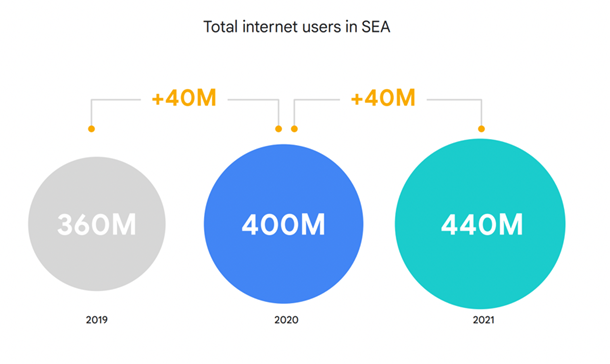

The region has a high penetration of internet users with 440 million total internet users of which at least 237 million own and use a smartphone. This fact is taken into account by management who focused on optimizing their platforms (Free Fire, Shopee, and ShopeePay) for mobile applications.

Gaming:

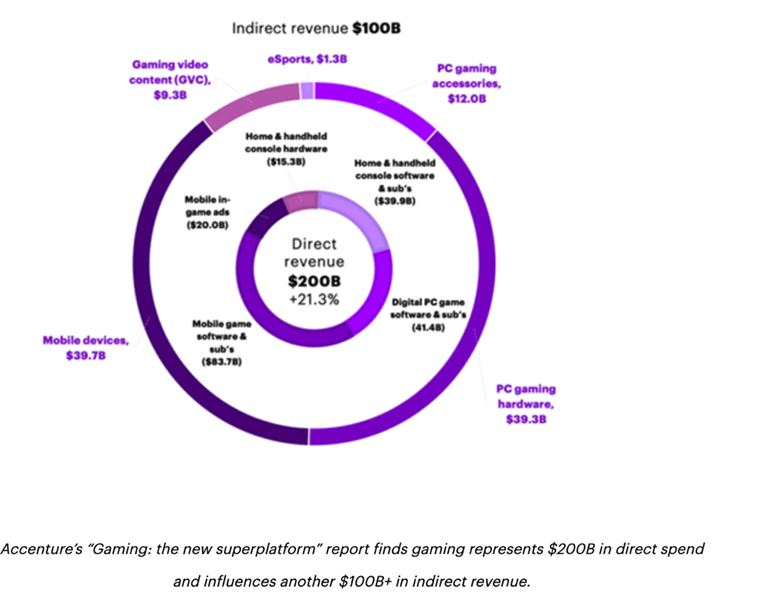

A report conducted by Accenture predicts that more than 400 million new gamers would join their friends online in playing video games by 2023. More and more people are looking at games as a way to connect with other people (new people, friends, people of similar interests) as well as a form of entertainment. This is not counting the fact that there are already 2.7 billion people who play video games globally. The entire video game industry is estimated to be worth >$300 billion.

E-commerce:

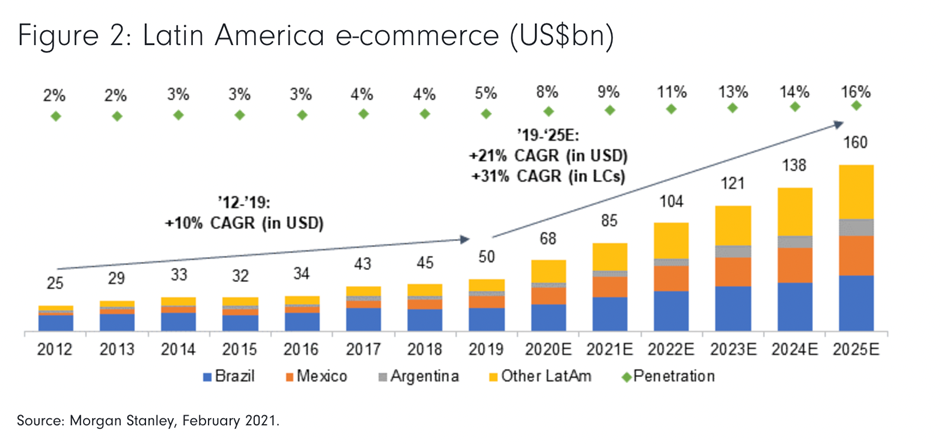

E-commerce in the Southeast Asia region is slated to grow to a stunning $234 billion GMV by 2025. Factoring in an estimated $160 billion e-commerce GMV of Latin America by 2025, SEA has plenty of total addressable market for it to penetrate and take share in these 2 massive regions. Reports have also shown that stickiness for e-commerce purchases is present, indicating a permanent shift in consumer behavior.

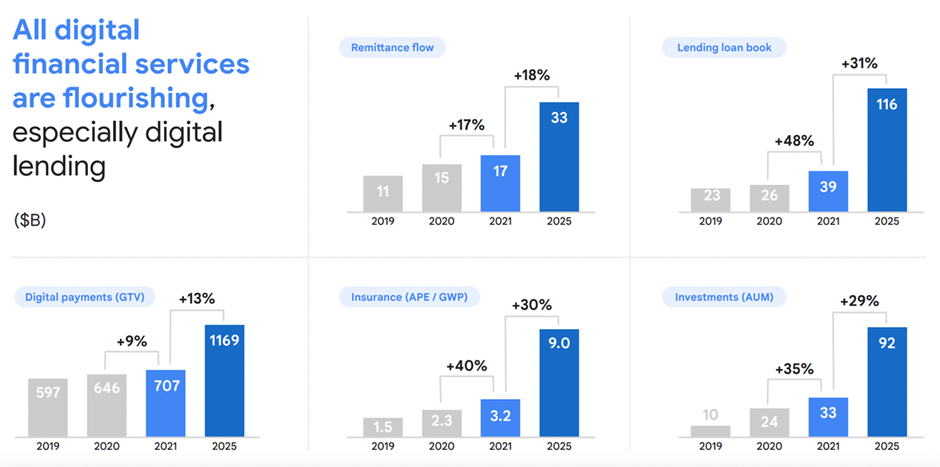

Digital Financial Services:

Digital Financial Services in Southeast Asia region is estimated to hit $1+ Trillion in 2025. Reports have also confirmed that adoption of digital financial services have been gaining momentum and that merchants and users are likely to continue using these online financial services. This presents a lucrative opportunity for SeaMoney to capitalize on and grow its business.

Given all these industrial tailwinds as well as the rise of Southeast Asia in economic prowess, the sky is the limit for SEA. These industries are likely to only get bigger in the years to come and if SEA can remain a market leader for all its current business segments (Gaming, Ecommerce, and Digital Financial Services), I believe it can attain a market capitalization of $1 Trillion within the next 10 – 15 years.

Of course, the road there will be full of bumps (business stalling, huge volatility in stock price, etc.) and there is the possibility that it might just fail in execution. However, given what the management has achieved thus far in a very short period of time, I remain confident in the long-term future of the company as long as management stays humble and continues executing as they have done thus far.

My investment strategy in SEA

SEA Limited, despite all its exciting growth potential, remains a loss-making entity at present. While that is typical of hyper-growth stocks where the focus is on revenue growth and market share gain vs. bottom-line profitability, this comes with the added share price volatility associated with such stocks.

As can be seen from the share price chart above, SEA Limited’s share price has declined by more than 60% from its 1-year price high achieved at the end of 2021.

While those in the bullish camp might argue that this is a tremendous opportunity to purchase SEA Limited’s stock when there is “fear in the street”, those in the bearish camp will highlight that there are better candidates such as PYPL that has witnessed a similar magnitude of price decline, but is a lot more profitable compared to SEA. It makes more sense to be buying shares of a profitable company such as PYPL than SEA.

While I remain positive on SEA Limited’s growth future over the coming decade, I am also well aware that there could be further downside risk to the counter, especially if growth in the coming quarters is not able to match up with the street’s expectations.

I am thus looking at a Dollar Cost Average approach to invest in SEA Limited, spreading out my expected investment amount over an investment horizon of 6 months. Every month I will look to dollar cost average $X amount in SEA Limited. If its price is lower, that allows me to buy more shares in SEA. If its price is higher, I reduce my share purchases.

Such a strategy will help me to ride out its near-term price volatility while yet being committed and disciplined in my investing approach. Do note that my positive thesis on SEA Limited might be proven wrong in the months/quarters ahead. Do track the key metrics that I have highlighted earlier to ensure that SEA Limited’s growth thesis remains in-tact.

Conclusion

I hope that these three articles have shown you why Sea Limited is one of my favorite loss-making technology stocks. It has 3 business segments that are well-positioned to capture secular industrial tailwinds in Gaming, eCommerce, and digital financial services. It is well-managed by an executive team that has significant ownership in the business which incentivizes them to run the company well.

No doubt the company is facing macro headwinds at the moment with rising interest rates and a slowdown in growth due to the unwinding of the pandemic which has resulted in a highly volatile stock price. However, I believe in the future of the company as well as the management running the business.

Personally, I find their shares trading at an attractive level to start a position in right now but having said that, it is perfectly conceivable to me that SEA experiences another -50% haircut from here which is part and parcel of holding a growth stock. As always, do your own diligence and ask yourself if you are comfortable stomaching these massive swings in stock prices before you invest in SEA limited. I would look to slowly DCA into the company over the months and years to come as long as the business keeps executing.

Part 1: Sea Ltd Analysis – A potential 10-bagger in the making

Part 2: Beginners’s Guide to Sea Limited

Do Like Me on Facebook if you enjoy reading the various investment and personal finance articles at New Academy of Finance. I do post interesting articles on FB from time to time that might not be covered here in this website.

Join our Instagram channel for more tidbits on all things finance!

Join our Youtube channel for short and sweet videos on all things finance!

SEE OUR OTHER WRITE-UPS

- Inflation: Don’t ignore this silent retirement killer

- Inflation at 5% in May: Transitory or a structural problem

- Pricing Power: Stocks that can do well amid inflation concerns

- 5 Small-Cap US Stocks with 10 years of consecutive earnings growth

- How to invest in Dividend stocks

- 9 Strong Free Cash Flow Stocks that you need to own

Disclosure: The accuracy of the material found in this article cannot be guaranteed. Past performance is not an assurance of future results. This article is not to be construed as a recommendation to Buy or Sell any shares or derivative products and is solely for reference only