[Update 2021] Singapore REITs have generally underperformed in 2020 as a result of COVID-19. As we head into 2021, is there an opportunity to buy into Singapore REITs to play a recovery in this sector? In this update, I provide my thoughts on the Singapore REITs landscape as we start off 2021 and check to see if the 10 reasons to buy Singapore REITs and 3 reasons to remain cautious remain relevant in today’s context.

I have written previously on why I buy REITs despite them looking expensive.

I am going to add to that article 10 great reasons to buy REITs. I touch on topics such as why some triple net leases are not “ideal”, which are the highest yielding REITs within their individual industry, the correlation factor between different asset classes, the potential impact of inflation on REITs, etc.

On the flip side, I also highlight 3 reasons to be cautious about REITs at this juncture.

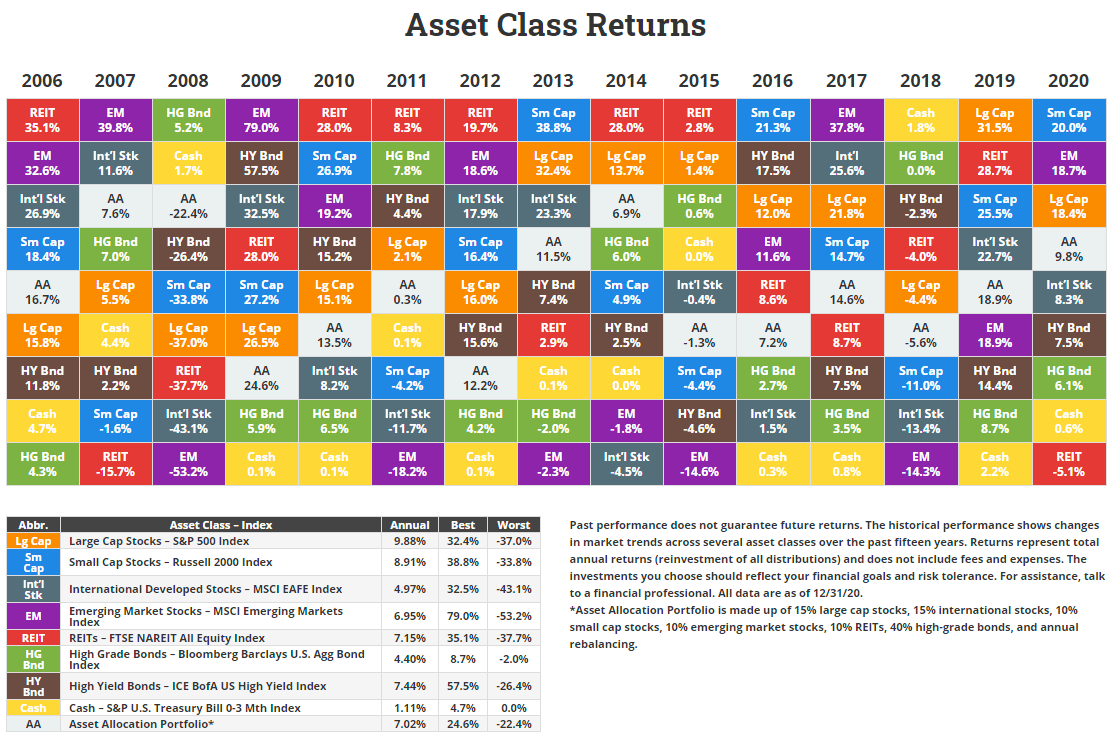

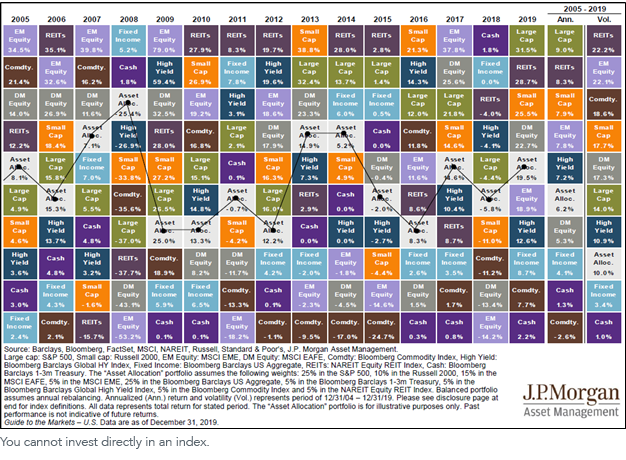

[Update 2021] 2020 has NOT been a good year for global REITs, S-REITs included. According to data from Novel Investor, REITs as an asset class declined by -5% in 2020, the worst performing asset class (not a comprehensive list). The only other time that REITs was the worst performing asset class was back in 2007 during the height of the GFC. As we head into 2021, will one see a strong rebound in REITs?

Source: NovelInvestor.com

Source: NovelInvestor.com

The BusinessTimes in late-2019 came out with a REITs article titled: Chase for Yields sends S-REITs on a Bull Ride this year. The article highlights the possibility of new asset classes such as self-storage, student accommodation, and multi-family homes joining the S-Reit universe in 2020.

That, however, did not materialize as new S-REITs IPO have generally been “put on hold” as a result of the unexpected COVID-19 event which devastated many S-REIT counters in 2020.

Nikkei Asian Review also released in early March 2020 an article, titled: Singapore REITs to keep market’s love after bulking up.

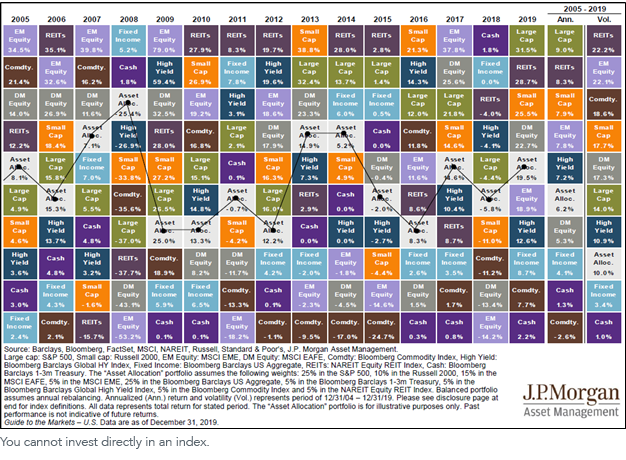

It seems like the market can’t get enough of REITs despite their general outperformance over the past 15-years against most other asset classes, based on data from JP Morgan asset management which highlighted that REITs have generated an annualized return of 8.3% from 2005-2019, second only to Large Cap stocks.

Can this outperformance last as we approach a new decade, starting from 2021?

10 Great Reasons to buy Singapore REITs

1. Offer access to real estate partial ownership that you might otherwise not be able to have.

One benefit of REITs for everyday investors is that they provide the opportunity to have partial ownership in real estate without the hassle of having to go out and actually buy one, even if you do have that kind of capital (then you probably do not fit the “everyday investors” category).

REITs are often a more efficient and immediate way to achieve a diverse real estate portfolio. By buying into a REIT counter, you can be the proud “owner” of numerous property assets.

If you prefer even more diversification, instead of buying in the individual REIT counters (tend to focus on a particular asset class such as commercial, industrial, retail, etc), one can choose to purchase a REIT ETF, which is a basket of the various REITs counters ALL-IN-ONE.

In Singapore, there are now three listed Singapore REIT ETFs with the Lion-Phillip S-REIT ETF focusing exclusively on Singapore listed REITs.

The three ETFs are:

- NikkoAM-Straits Trading Asia Ex-Japan REIT ETF

- Phillip SGX APAC Dividend Leader REIT ETF

- Lion-Phillip S-REIT ETF

While there are additional costs associated with investing in a Singapore REIT ETF such as management fee, trustee fee, custodian fee, administrative fee, etc, a Singapore REIT ETF might just be the instrument for the average Singapore retail investor to partake in the ownership of a diverse portfolio of real estate assets.

With the tax change announced in the 2018 Singapore Budget to allow distributions from S-REITs to ETFs to be made free of Singapore withholding tax of 17%, it is likely that more REIT ETFs may be listed in Singapore in the future.

[Update 2021]: This factor remains relevant and if you still wish to own a small piece of the real estate market, I believe now is the time to start dipping your toes into a diversified basket of REIT counters such as through the Lion-Phillip S-REIT ETF. I have written about this REIT in this article LION-PHILLIP S-REIT ETF: SHOULD YOU BE BUYING THIS REIT ETF?. Do check it out before you make a purchase.

Alternatively, another simple solution to purchase a basket of Singapore REITs will be through a Robo advisor such as SYFE REIT+ portfolio which seeks to invest your fund into the largest and most liquid Singapore REIT counters.

![10 Great Reasons to Buy Singapore REITs and 3 Reasons to be cautious [Update 2021] 1](https://newacademyoffinance.com/wp-content/uploads/2021/01/syfe-5.png)

Syfe Robo Advisor

The Syfe REIT+ portfolio allows an investor to cheaply and quickly invest in a portfolio consisting of 100% Singapore REIT counters.

This might be a cheap alternative vs. purchasing a Singapore REIT ETF.

2. Low effort vs. Purchasing a physical rental

The process of purchasing a physical investment/rental property can be lengthy, strenuous, and often a very costly affair. For a Singaporean looking to buy his/her second property to generate rental income, one will have to deal with the Additional Stamp Buyer Duty (ABSD) which is a 12% government tax on the higher of the purchase price or market value of the property.

In addition to the Buyer Stamp Duty of which ranges from 1% to 4%, the total amount of duties that one will be contributing to the government coffers could be approx. SGD$144,600 for an SGD$1m rental property. Yes, these are duties that you have to pay upfront, non-refundable whatsoever. Assuming your rental property generates SGD$3,500 in the monthly rental, you will need 3.4 years in order to break-even from the duties that you have paid.

![10 Great Reasons to Buy Singapore REITs and 3 Reasons to be cautious [Update 2021] 2](https://newacademyoffinance.com/wp-content/uploads/2019/12/reits-2.png)

We digress. Purchasing a rental property often entails a certain level of costly property maintenance and finding trustworthy tenants that will not wreck your beloved home.

Buying a REIT, on the other hand, achieves a similar effect of generating rental income without all the hassles and issues associated with physical properties. The table above provides a quick snapshot of the advantages of investing in REITs vs. Physical Properties.

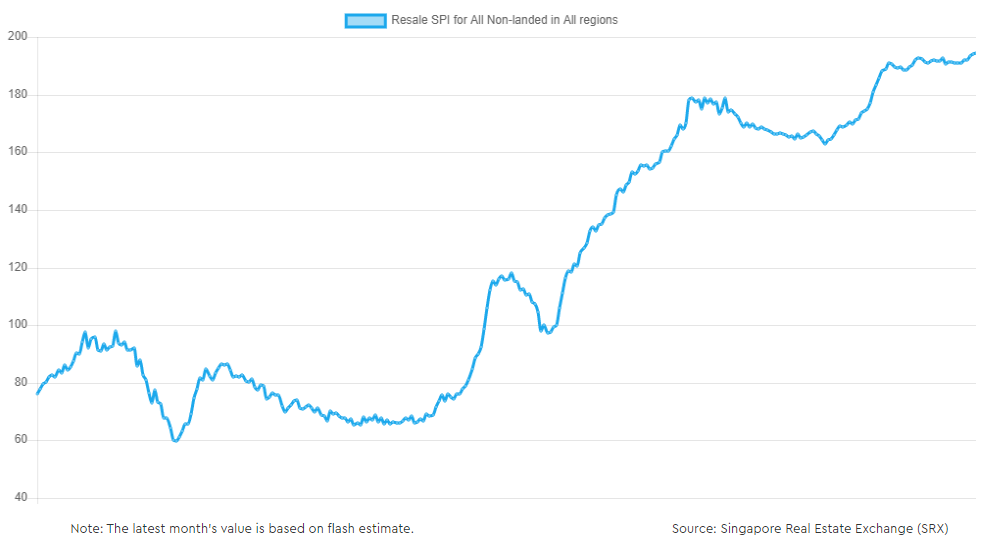

[Update 2021]: It is interesting to note that the residential property market in Singapore remains relatively “resilient” in 2020 despite the elevated unemployment rate as a result of COVID-19. This likely comes as a surprise to me. A possible and most likely reason is due to the unprecedented low-interest-rate not just within the Singapore context but globally as well. This has resulted in ultra-low mortgage rates which makes even the most expensive houses look affordable.

Will the residential property party continue in 2021? The team at OCBC believes so.

Even if a property price correction is to happen in 2021, the government can still remove the cooling measures (depend on their severity). SRX has also made a brief observation of the property market in Singapore which you can find the research note here.

While purchasing REITs is still a low-level effort to become a “property owner” compared to actually purchasing physical units, the recent price roller coaster might not be for the weak-hearted.

For those looking for exposure in the Singapore residential market, there is no S-REIT exposure in this particular segment, with the closest indirect exposure being an equity stake through Singapore property developers.

3. Higher yields vs. dividend stocks due to the requirement to pass through 90% of rental income.

REITs, in general, are required by law to redistribute at least 90% of their taxable income each year to their unitholders to enjoy tax-exempt status by the tax authorities. This is a key reason why they can offer investors a regular and predictable income stream.

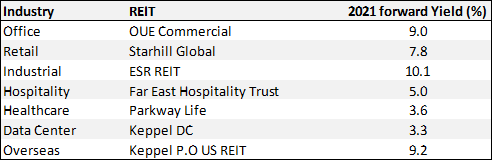

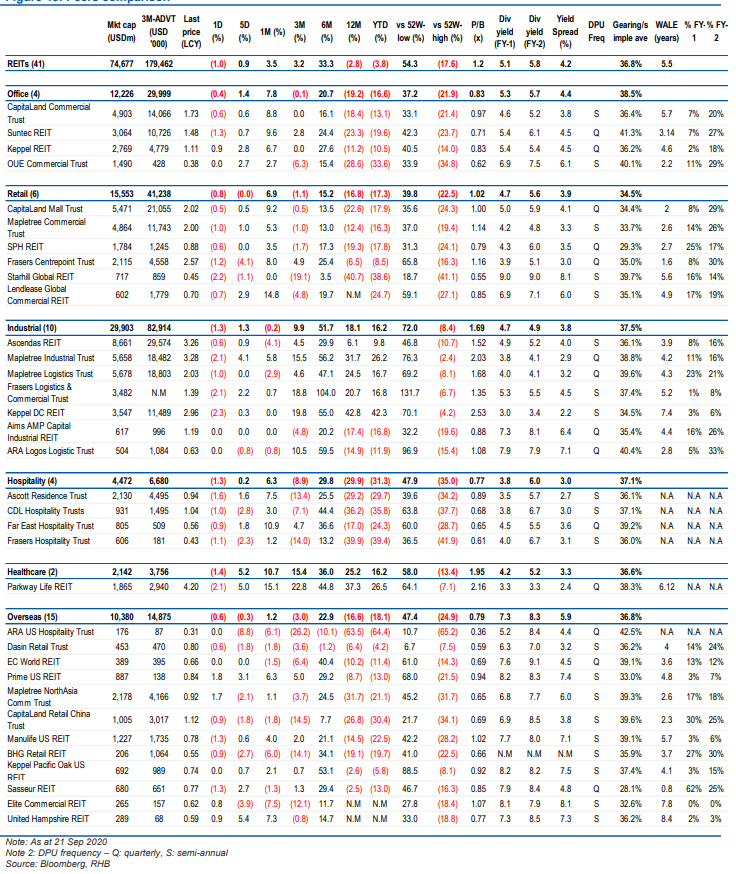

The table below shows the REITs with the highest distribution yields (data from Maybank), based on their respective industry:

However, a major downside is that because REITs distribute the bulk of their income generated to unitholders, they will often need to raise capital by issuing new shares as a means of inorganic growth.

[Update 2021]: No change in this aspect, with REITs remaining a superior income asset play vs. dividend stocks. However, do take note of potential cuts to REITs distribution as the COVID-19 wreaks havoc on their operations. For example, hospitality REITs have witnessed a major decline in earnings due to the tourism industry blow-up. Retail REITs have also seen their earnings being negatively impacted.

While there isn’t likely any single safe industry (maybe with the exception of Data Centre and Healthcare) as uncertainties remain abound pertaining to the impact from COVID-19 as we head into 2021, despite the availability of vaccines, one should seek safety from blue-chip REITs with a strong operational and balance sheet profile to weather the current health crisis in one-piece.

Additional Reading: How to Buy REITs in Singapore

4. Stable, consistent bond-like cash flow due to the structure of lease agreements. More attractive alternative compared to bonds in today’s low-interest-rate environment

Historically, REITs have been a reliable source of safe and growing income while delivering healthy total returns as well. According to data from JP Morgan, REITs were the second best-performing asset class in the US from 2005-2019, with annualized net returns of 8.3%.

As highlighted in point 3, REITs are appealing holdings in many retirement portfolios because they are required by law to payout at least 90% of their taxable income as dividends. Packaged this with a long WALE portfolio with a certain step-up in terms of lease rental and one can see the appeal of owning a REIT vs. a bond.

Some might view a “triple net lease” REIT as almost like a true bond alternative. This is a structure whereby the landlord bears zero responsibilities, requiring the tenant to pay directly for all maintenance, insurance, and taxes.

This results in a long-term, relatively predictable income stream for the landlord. These companies are like financing companies rather than operating ones, holding long-term capital-intensive real estate assets that other companies prefer not to hold on their balance sheet.

A negative triple net lease example?

In many ways, it is a landlord’s ideal structure until it becomes a “nightmare”. Look at Eagle Hospitality Trust, a recently-IPOed REIT that has garnered lots of attention, mostly for the wrong reasons. The Queen Mary, the key asset in question, was leased on a triple net basis to Eagle by its sponsor, Urban Commons.

Why did Urban Commons provide such good terms? So as to offload this asset to Eagle at a “premium” price of USD$140m perhaps (Valuation of the asset was at USD$159m)?

We are not looking to discuss the issues of Eagle Hospitality Trust in this article but it is worth-while to note that triple net leases that are leased back to the sponsors do raise two key questions/issues:

1) Were they structured as a triple net to increase the implicit value of the asset? and 2) The net lease is often only as good as the reputation/financial strength of the tenant, in this case, the sponsor, Urban Commons.

Again, we digress. In today’s low-interest-rate environment, holding a bond alternative such as a triple-net-lease REIT with strong tenants’ profile might be the ideal scenario to provide more current income while also offering the potential for income growth and capital appreciation.

[Update 2021]: REITs with a long WALE remain an attractive option in our opinion, as it increases the revenue visibility of the counter. REITs with long WALE include counters like Parkway Life (6.1 years), United Hampshire US REIT (8.4 years), Keppel DC REIT (7.4 years). These REITs have also been one of the most resilient in today’s COVID-19 sell-down. WALE data sourced from RHB report from Oct 2020.

5. Diversification of cash flow on a portfolio strategy basis

REITs have historically provided investors an efficient way to diversify their investments to reduce risk and increase long-term returns. REITs, as a distinct asset class, have demonstrated a low-to-moderate correlation with other sectors of the stock market as well as bonds and other assets.

In other words, REITs returns have tended to zig while returns of other asset classes have zagged, smoothing a diversified portfolio’s overall volatility.

![10 Great Reasons to Buy Singapore REITs and 3 Reasons to be cautious [Update 2021] 3](https://newacademyoffinance.com/wp-content/uploads/2019/12/reits-5-1.png)

However, low correlation does not mean no correlation or negative correlation (the key asset with a negative correlation to stocks are fixed-income assets with a long duration). In a significant market correction, REITs as an asset class will also see a drop in share prices, as evident in Mar/Apr 2020 where REITs were sold off alongside global equity markets at the peak of the COVID-19 crisis.

However, when we look at the recession of 2000-2002, while the stock market corrected significantly, REITs actually delivered positive returns.

![10 Great Reasons to Buy Singapore REITs and 3 Reasons to be cautious [Update 2021] 4](https://i1.wp.com/newacademyoffinance.com/wp-content/uploads/2019/12/reits-6.png?fit=1024%2C675&ssl=1)

Why the discrepancy? In both recessions, the Fed aggressively reduce interest rates. In 2000, interest rates peaked at 6.5% and were aggressively lowered to 2% by the time the recession ended in Nov 2001. Rates bottomed at 1% in June 2003. REITs likely benefitted from this aggressive rate lowering.

During GFC, despite rates being reduced significantly from 5.25% in Jun 2006 to 0.25% in Dec 2008, REITs’ performance strongly correlates with that of the equity market. My guess is that it was more of a banking liquidity and confidence issue. In Singapore, REITs at that time were highly geared and banks were reluctant to refinance them. This resulted in substantial equity raising which pressured REITs’ share prices.

[Update 2021]: Singapore REITs have been negatively impacted in 2020 which is understandably so as major sectors of our economy have been substantially affected as a result of various restrictive measures put in place to curb the spread of the virus. Retail, Office and Hospitality demand have seen a broad-based decline in 2020. This has negatively impacted the associated Singapore REITs in these industries.

As of this writing in early 2021, the Singapore REIT industry has pared most of its losses, with the industry (represented by the price of Lion Phillip S-REIT ETF) now at 7% off its 2020 peak. Over the past 1-year, the performance of the Singapore REIT still marginally outperforms that of the STI

So what happens if we have a recession in 2020?

For one, the effectiveness of propping up REITs prices by lowering rates is likely in question. We are already at a low 1.5%. Can driving rates down to 0% support REIT prices during a recession?

While we no longer face a banking liquidity and confidence issue, my sense is that REITs are unlikely to witness strong price appreciation like that of the 2000-2002 recession. Neither will it collapse like that of GFC. Moderate appreciation/depreciation is my best guess but that in itself warrants a position in one’s portfolio.

[Update 2021]: The Fed has kept its rate at ZERO and has no intention of raising this rate anytime soon unless there is unexpected inflation. This should be positive to REITs as borrowing costs will now be lower. We are already seeing SIBOR at record low levels

![10 Great Reasons to Buy Singapore REITs and 3 Reasons to be cautious [Update 2021] 5](https://newacademyoffinance.com/wp-content/uploads/2021/01/image-9-1024x222.png)

Singapore REITs who have been able to refinance their cost of borrowing will benefit from this trend of a prolonged low interest rate environment. These are typically your largest blue-chip Singapore REITs, many of which have merged of late to benefit from operational diversification as well as economies of scale.

6. Inflation hedge as assets and leases tend to appreciate along.

REITs provide natural protection against inflation because it is a vital and tangible asset to our society. With the printing presses around the world going out of control, owning a tangible asset (which cannot be easily “printed”) with limited supply will allow one to sleep well at night – knowing that they will always be valuable.

According to Ascendas REIT, they believe a key benefit of REITs is that they provide a natural hedge against inflation. When inflation rises, the value of real estate and real estate securities are expected to increase as well. REITs thus can be considered as a substitute for a fixed income portfolio during periods of expected and high inflation.

In the US, most leases are directly tied to an inflation index and rent increases can be automatically enforced. A practical way of measuring the inflation protection provided by REITs is to directly compare REIT dividend growth per share with inflation.

According to data from Nareit, in all but two of the last 20 years, REITs’ dividend increases have outpaced inflation as measured by the Consumer Price Index.

![10 Great Reasons to Buy Singapore REITs and 3 Reasons to be cautious [Update 2021] 6](https://newacademyoffinance.com/wp-content/uploads/2019/12/reits-7.png)

In Singapore, some REITs have fixed rental escalation clauses while others have a rental escalation that is pegged to the consumer price index. S-REITs are generally shorter-term in nature (approx. 3 years) and this will allow landlords greater flexibility to re-price rents to market rates more often which serves as a decent inflation hedge.

For those with long tenure leases, there tend to be mid-term reviews that allow the property owner to negotiate with the tenant to bring the rents in line with market rates.

How will inflation materialize?

The question often begets if a rise in inflation is demand-pull inflation or a supply push one? Are prices rising because of stronger demand for products/services as consumers are willing to pay more for the product or are they rising because of cost-push factors?

In the former scenario, where strong consumer demand pushes the prices of products/services higher, it is easier for REITs to justify increasing rents alongside an improvement in economic factors. However, in the latter case, where cost-push factor such as a rapid rise in oil prices (such as those witnessed in the 1970s) pushes up the cost of producing products and consequently their prices, consumers will suffer.

Products/services become increasingly unaffordable and this will affect tenant sales. In such a scenario, it could be difficult for landlords to justify rental increases.

In today’s context, inflation remains generally benign as demand-pull inflation is almost non- existence in the face of weak economic prospects while we are not yet seeing any evident cost-push factors.

My sense is that REITs’ DPU growth will generally be low to flat in a low inflation environment like what we are seeing today. It might be difficult for landlords to raise prices no doubt, but it is unlikely that we will see a massive drop in asset occupancy that will pressure rental rates, not at least for blue-chip REITs with assets in prime locations.

A demand-pull inflationary environment, one which might materialize when economic prospects improve, will allow landlords to constantly re-price rents in-line which serves as an inflation hedge while a sudden and subsequently prolong rise in inflation due to cost-push “shocks” will likely see broad-base suffering across all spectrums of the economy, REITs included.

Ultimately, as long as the property is in a good location and leased to a solid tenant, not much can go wrong in the long run, even with the negative impact of cost-push inflation. There is still a strong trend toward urbanization and desirable infill locations are becoming in ever-increasing demand. This will, in the long run, be reflected in higher rents and higher valuations for quality REITs.

[Update 2021]: Inflation risk at the moment remains benign globally as well as here in sunny Singapore but do not underestimate its risk. If inflation does materialize in 2021, it will be in the form of stagflation.

Additional Reading: Is stagflation the end game for the bull market?

In the event of stagflation, there will be little scope for REITs to raise their rentals. That will be a major “de-catalyst” for REITs to sell-off big time as that might mean that interest rates will be forced to rise, increasing their interest costs. At the current moment, we are mindful of stagflation risk amid a weak global economic recovery and rising commodity prices.

7. A form of passive and retirement income.

The concept of building a safe, growing stream of income that can one day meet one’s retirement needs is a really appealing message. However, with interest rates expected to go lower, investors are now faced with an income problem. Sticking with safe capital guaranteed products that generate 1-2% annualized returns is unlikely to be the ideal long-term solution of generating a growing stream of passive income.

Singapore REITs on the other hand, are currently yielding around 5% for 2020/21 (Yes, their yields have declined significantly, but nonetheless still an attractive offering compared to other alternatives) with potential for DPU growth, just like dividend stocks.

While dividend stocks are also excellent passive income sources, they tend to have lower yields compared to REITs, due to the structure of REITs which mandates them to payout 90% of their distributable income. Dividend stocks, on the other hand, do not have such mandates which increase the probability of DPS growth even in a recessionary scenario if their payout ratio is low in the first place.

![10 Great Reasons to Buy Singapore REITs and 3 Reasons to be cautious [Update 2021] 7](https://newacademyoffinance.com/wp-content/uploads/2019/12/reits-8.png)

Financial Samurai came out with a great piece on Ranking the best passive income investments, where real estate crowdsourcing and public REITs rank high on his list of passive income sources. Do check out that article.

[Update 2021]: The yield on S-REITs are expected to be around the 5-6% level for 2021/22, according to OCBC. For those looking at building a stream of passive income for their retirement years, now might just be the best time to enter selectively into REITs in-lieu of a potential recovery in 2021.

Alternatively, one could just achieve diversification through REITs ETF or through a Robo Advisor such as Syfe REIT+. Structuring a retirement portfolio with REITs as a major asset component will help to increase the income shield of the portfolio such that these stocks do not need to be liquidated during a market sell-off such as the current one so as to support one’s retirement expenses.

8. Greater return over the long term compared to stocks? Total return potential from both yield and capital appreciation

REITs are a total return investment, typically providing current income with the potential for long-term capital appreciation. It is clear that public REITs have a long-term track record of enhancing returns (evidenced by the chart below).

![10 Great Reasons to Buy Singapore REITs and 3 Reasons to be cautious [Update 2021] 8](https://newacademyoffinance.com/wp-content/uploads/2019/12/reits-9.png)

From 2000-1H19, US REIT generated an annualized return of 11.1% while global REIT generated a return of 10.6%. REITs as an asset classed has outperformed equities and bonds during this period.

We have also highlighted previously in our article: Why I am still buying REITs even when they look expensive, quoting data from Cohen & Streets which noted that REITs have outperformed the S&P 500 by more than 7% annually in late-cycle periods since 1991 and have offered meaningful downside protection in recessions, underscoring the potential value of defensive, lease-based revenues and high dividend yields in an environment of heightened uncertainty.

![10 Great Reasons to Buy Singapore REITs and 3 Reasons to be cautious [Update 2021] 9](https://newacademyoffinance.com/wp-content/uploads/2019/12/reits-10.png)

If you believe that we are heading into a recession, then most investment asset classes will take a hit, REITs included. However, they will likely be more resilient than the equity market with a lower decline in prices. Concurrently, notwithstanding volatility across stock prices, the income generated from holding REITs will comparatively be more stable.

[Update 2021]: Yes, REITs have indeed taken a hit in 2020. No, they have not declined significantly less than stocks (which we have explained why earlier). Looking ahead, I believe 2021 is the time to position yourself in Blue-Chip REITs with a strong balance sheet and access to CHEAP bank fundings. These REITs are unlikely to collapse if their business fundamentals remain resilient, particularly if they are not over-leveraged and with access to additional bank credit lines.

I have written about the best performing Singapore REITs in 2020 as well as provide some Singapore REITs ideas with potential upside in 2021.

9. REITs are in a financially stronger position now compared to GFC

The benefits of real estate and REIT investing is the ability to use leverage to compound your wealth.

However, using leverage to compound one’s wealth is often seen as a double-edged sword. In good times, it accelerates the returns. In bad times, leverage could translate into a financial nightmare. More than a decade after the financial crisis, REITs are reaping the benefits from steps taken to shore up their balance sheets by among other things, recalibrating levels of leverage.

According to Nareit data, debt relative to book assets for US equity REITs has come down from 58.3% at the peak in 2008 to 48.4%. Another metric that shows how REITs are in a better position to service that debt is interest expense as a percentage of net operating income (NOI), which has dropped from 38% to 22.4% over the past decade. Put in another way, the interest coverage ratio has improved from 2.6x to 4.5x

Singapore REITs are even more conservative, with the average debt-to-asset ratio at about 34-35% (based on companies data as of 1H19) with a current leverage limit of 45% (MAS has indicated that it is considering raising this limit to allow S-REITs to be more competitive when bidding for assets against foreign peers and private equity capital). The average Interest coverage ratio stands at 5.6x.

[Update 2021]: There doesn’t seem to be much credit issues present for Blue-Chip S-REITs at the moment. The same cannot be said for a Blue-Chip stock like SIA which has been over-leveraged and whose airline business has almost come to standstill and burning cash rapidly (but still its share price is at record levels which I view as extremely perplexing).

My only concern is if asset values start to deteriorate significantly due to a weak rental outlook, which could in turn negatively impact a REIT’s property asset value. This will immediately increase the gearing ratio of Singapore REITs and some might start breaching the 45% ceiling mandate set out by MAS which will then require them to shore up their balance sheet through equity raising.

I don’t think we are in the same “banking” crisis back in 2007-08 where banks start clawing back on loans to REITs which results in REITs having to do rights issues. We are not in a “banking” crisis per se and banks are still willing to open their credit lines for quality REITs. While I can’t say for sure that REITs will not engage in equity raising this time round (some weaker ones such as First REIT has already announced equity raising plans), I will be extremely disappointed in Blue-Chip REITs that are doing that when their share prices are “undervalued”.

Alternatively, look at the interest-coverage ratio of the REITs to spot potential credit-related and non-payment risks. REITs with an interest-coverage ratio above 7x are generally very safe, even after taking into context the deterioration in their business fundamentals. The table below shows the gearing ratio for Singapore REITs, based on an RHB report generated back in September 2020. Those with a gearing ratio below 35% are relatively safe.

10. REITs can continue to outperform stocks in a rising interest rate market

![10 Great Reasons to Buy Singapore REITs and 3 Reasons to be cautious [Update 2021] 12](https://newacademyoffinance.com/wp-content/uploads/2019/12/reits-13.png)

Counter-intuitive to popular beliefs that REITs can only do well in a falling interest rate environment (borrowing costs become cheaper which tends to benefit leverage plays like REITs), history shows that REIT share prices have often increased even during periods where interest rates are rising and has outperformed the S&P 500 in more than half of the episodes of rising Treasury yields.

![10 Great Reasons to Buy Singapore REITs and 3 Reasons to be cautious [Update 2021] 13](https://newacademyoffinance.com/wp-content/uploads/2019/12/reits-14-1.png)

According to data from Nareit, REITs had a total cumulative return of nearly 80% during the Fed tightening cycle which began in 2004 and ended in 2007, outperforming that of the S&P 500 which had total cumulative returns of less than 40%. This is due to the fact that rising interest rates often reflect economic growth that can boost REIT earnings and ultimately their share prices.

![10 Great Reasons to Buy Singapore REITs and 3 Reasons to be cautious [Update 2021] 14](https://newacademyoffinance.com/wp-content/uploads/2019/12/reits-15.png)

From 1992 to 2017, REITs posted positive total returns in 87% of episodes of rising Treasury yields.

REITs have also fortified their balance sheets as highlighted in our previous point to position themselves to continue delivering earnings growth despite rising interest rates. In the next recession, REITS, unlike the previous GFC where they were struggling to deleverage and recapitalize, will instead be in a position to fully capitalize their strong balance sheet to acquire assets on the cheap to ensure earnings growth continuity.

[Update 2021]: It will probably be in a long while before we see interest rates rising globally unless we witness a stagflation shock. If one assumes that low-interest rates will be the norm over 2020/21 with a gradual rise thereafter, REITs will not be significantly impacted by such a trend.

3 Reasons to be cautious

1. REITs have lower beta but still not enough diversification from stocks as a whole

In point 5, we highlighted that REITs as an investment class provides a certain degree of portfolio diversification. REIT investments have generally shown a beta of between 0.33 and 0.85 relative to the broad stock market, with a long-term median of 0.51.

![10 Great Reasons to Buy Singapore REITs and 3 Reasons to be cautious [Update 2021] 15](https://newacademyoffinance.com/wp-content/uploads/2019/12/reits-16-1.png)

In terms of correlation, it has a long-term median value of 59%. A low REIT-stock correlation and low REIT beta mean that investors with substantial holdings of REITs in their portfolio typically experience substantially less volatility than investors with holdings in the broad stock market but without a separate allocation to REITs.

![10 Great Reasons to Buy Singapore REITs and 3 Reasons to be cautious [Update 2021] 16](https://newacademyoffinance.com/wp-content/uploads/2019/12/reits-17.png)

However, low correlation and beta do not mean negative correlation and beta. Hence, in a significant bear market, REITs will still see a decline in value alongside stocks. The only asset class that has shown a strong negative correlation with that of stocks is long-duration fixed income.

[Update 2021]: We have seen all major asset classes being sold off in the current COVID-19 driven crisis, even safe-haven assets like Gold and Treasury. REITs were not spared either. Within the Singapore context, I believe S-REITs, post the deleveraging from private banks, will be in better shape, particularly if Singapore does a much better job in curbing the spread of COVID-19.

Singapore REITs, as represented by Lion-Phillip S-Reit ETF have recovered the bulk of their losses from the COVID-19 sell-off and is currently just 7% off its peak reached in Feb 2020. On a 1-year basis, S-REITs performance is still marginally better than the Straits Times Index. If the global stock market continues to appreciate amid monetary stimulus effect, REITs as an asset class should also benefit.

However, I remain concerned that the next catalyst that will trigger a major market sell-off will come in the form of stagflation. REITs will likely show little correlation benefit to stocks in this scenario.

2. REITs are looking over-valued at present

After the big run-up in REITs prices in 2019, the industry as a whole is relatively more expensive now as compared to the beginning of the year, based on the sector yield spread. Given that DPU growth is not expected to be strong ahead, it is justifiable to point out that REITs are looking over-valued at present.

However, according to Credit Suisse investment outlook for 2020, the firm sees the risk of Singapore REITs facing significant price corrections in the coming year as limited, as long as global borrowing rates stay low.

The firm believes that S-REITs with strong acquisition pipelines and those with opportunities to recycle and enhance their assets are likely to outperform.

While we don’t deny that REITs are looking over-valued at present, almost all major asset classes have also appreciated significantly of late. Bonds are today trading at some of the lowest yields ever and are generally considered to be extremely overpriced relative to their history. But again, no one would have expected interest rates to be so low (or even negative) for such a prolonged period of time.

![10 Great Reasons to Buy Singapore REITs and 3 Reasons to be cautious [Update 2021] 17](https://newacademyoffinance.com/wp-content/uploads/2019/12/reits-18.png)

While bonds are looking overvalued, you could make the same argument that stocks are not much better either. Valuations are at historically high levels despite being late into the cycle. The market is currently pricing the S&P 500 at over 23x earnings. On a long-term horizon, the mean S&P500 multiple is 16x. In that sense, the current ratio of 23x is almost a 50% premium to the long-term average multiple.

While there might have been better times to invest in REITs, you could say exactly the same for other major asset classes, including stocks and bonds. While REITs might be looking over-valued based on narrowing yield spread, this “over-valuation” might persist for a much longer-than-expected duration in a “lower-for-longer” interest rate environment.

[Update 2021]: Well, Credit Suisse did foresee low-interest rates but definitely not COVID-19 blowing up in such a major way. Post the sell-down in REITs, I believe that they are now much more attractively positioned in 2021 compared to 2020. This warrants progressive entry of some of the better and more resilient blue-chip REITs.

For those who are looking at a comprehensive write-up on how to buy Singapore REITs, you can refer to this massive guide on Singapore REITs

3. Lack of DPU growth. New deals might be increasingly expensive

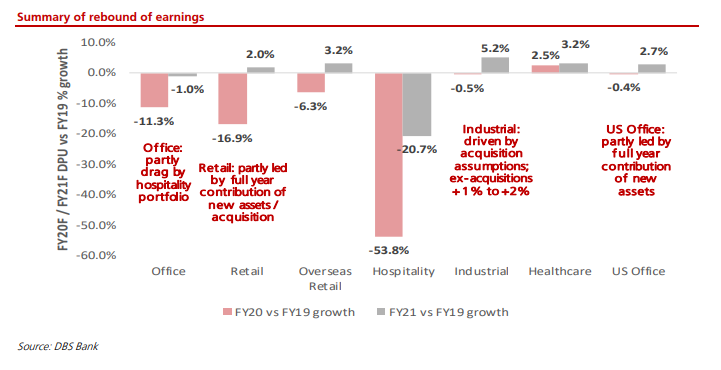

According to DBS, the brokerage firm expects DPU growth among the Singapore REITs to still be relatively weak as we exit 2020. This is in comparison to 2019.

Strongest growth among different industry

The industrial sector is expected to witness the strongest earnings rebound and consequently DPU growth in 2021. This is not surprising considering that this sector has been relatively resilient to the COVID-19 impact.

To generate DPU growth, REITs can engage in organic efforts such as asset enhancement to increase the appeal of its properties which should lead to higher rentals. Alternatively, they can go the route of inorganic mergers and acquisitions to boost their asset base. The latter typically entail some form of capital raising to acquire new properties.

However, with property prices appreciating across the global spectrum and capitalization rates (or cap rates for short) compressing, finding an asset whose cap rate is above that of the REIT’s own yield becomes increasingly challenging. This will make new deals increasingly expensive in a highly competitive environment.

On the other hand, REITs that have ample DPU growth potential from organic AEI initiatives and yet spot a strong balance sheet to capitalize on acquisition opportunities when they materialize (in a recession) will likely be the biggest winner ahead.

Which are these REITs? Well, it will be a topic for another day.

[Update 2021]: DPU will definitely take a hit for almost all the REITs in 2020, with the exception of counters such as Keppel DC and Parkway Life. However, so has their share prices. The key is to look for REITs who are fundamentally more resilient, whose business is less-impacted and the drawdown in their forward DPU is much less than their share price.

I have come out with a 10-factor quantitative screening process to identify some of the “best available REITs” in today’s context which I share with my readers:

HOW TO BUY REITS IN SINGAPORE. 10-KEY S-REIT QUANTITATIVE FILTER (PART 1)

I then follow up with a more in-depth analysis of those REITs that meet my quantitative filter criteria (with a score of 3.5 or more) to identify REITs that are truly worth investing in.

HOW TO BUY REITS IN SINGAPORE. 8 ADDITIONAL FACTORS TO CONSIDER (PART 2)

Conclusion

This is a pretty long article so I will keep the conclusion short. As I have previously concluded, having REITs as an asset class in one’s portfolio still makes sense in today’s context.

While the confirmation of the Phase 1 Trade deal between the US and China, just announced today might damper dovish interest rate expectations, the avoidance of a global recession as a consequence should bode well for business growth, which will translate to better rentals ahead.

I continue to like REITs as part of my portfolio diversification strategy and they should remain an integral part of my passive income generating source for years to come.

[Update 2021]: I still like the overall REITs fundamentals as we head into 2021. More so on blue-chip REITs that have seen a major correction in their share prices. These Blue-Chip REITs with a strong balance sheet will survive the COVID-19 mayhem, despite a continual hit on their operations in 2021.

Certain REITs might be worth bottom-fishing in 2021, particularly in the hospitality and retail industry. That will be a separate article for another day.

Do Like Me on Facebook if you enjoy reading the various investment and personal finance articles at New Academy of Finance. I do post interesting articles on FB from time to time which might not be covered here in this website.

Join our Telegram broadcast: https://t.me/gemcomm

SEE OUR OTHER WRITE-UPS

- DIVIDENDS ON STEROIDS: A LOW-RISK STRATEGY TO DOUBLE YOUR YIELD

- STASHAWAY SIMPLE. CAN YOU REALLY GENERATE 1.9% RETURN?

- WHY I AM STILL BUYING REITS EVEN WHEN THEY LOOK EXPENSIVE

- TOP 10 FOOD & BEVERAGE BRANDS. ARE THEY WORTHY RECESSION-PROOF STOCKS?

- THE BEST PREDICTOR OF STOCK PRICE PERFORMANCE, ACCORDING TO MORGAN STANLEY

- TOP 10 HOTTEST STOCKS THAT SUPER-INVESTORS ARE BUYING

Disclosure: The accuracy of the material found in this article cannot be guaranteed. Past performance is not an assurance of future results. This article is not to be construed as a recommendation to Buy or Sell any shares or derivative products and is solely for reference only.

![10 Great Reasons to Buy Singapore REITs and 3 Reasons to be cautious [Update 2021] 10](https://newacademyoffinance.com/wp-content/uploads/2019/12/reits-11.png)

![10 Great Reasons to Buy Singapore REITs and 3 Reasons to be cautious [Update 2021] 11](https://newacademyoffinance.com/wp-content/uploads/2019/12/reits-12.png)

3 thoughts on “10 Great Reasons to Buy Singapore REITs and 3 Reasons to be cautious [Update 2021]”

Hope the world can be healthy and beautiful again very soon. There is tons of opportunity waiting.

Chance upon your site. Great sharing. Very informative.

hey rick, thanks for stopping by