We are just a few days left to the end of 2020. 2020 is likely to come down as one of the most “unforgettable” years for many, in both a good and bad sense.

While millions of jobs worldwide are lost to COVID-19, it also opens up new opportunities for those who are willing to venture beyond their existing comfort zone.

It is the first full-year for New Academy of Finance or NAOF for short and I will like to thank my readers for their continual support in the past one year and will strive to provide better and hopefully more “reader-friendly” content in the coming year.

I will just like to sum up 2020 with a summary of NAOF’s Top 10 most popular articles for 2020.

NAOF Most Popular articles for 2020

#10: Sembcorp Demerger deal passed. What is Temasek’s plan now?

The demerger deal between Sembcorp Industries and Sembcorp Marine is undoubtedly one of the most talked-about corporate deals in Singapore for 2020.

Shareholders of both Sembcorp Industries and Sembcorp Marine gave their full support for the demerger and all resolutions were successfully passed on 11 August 2020.

At the same time when the demerger was completed, Temasek surprised the market the day before by withdrawing its partial offer for Keppel, which if completed, would see Temasek becoming a 51% owner of Keppel. With that offer being withdrawn, Temasek’s stake in Keppel will remain at roughly 20% for now.

Not surprisingly, Keppel’s share price collapsed by more than 10% the next day when trading resumes post the announcement.

At the current juncture, it might seem that Keppel is receiving the short end of the stick due to Temasek’s withdrawal of its partial offer while the market will likely be cheering the outcome of the demerger.

Following the demerger, Sembcorp Industries is now a “cleaner” entity and the market loves its new structure as can be seen from its outstanding share price performance post-demerger.

Is Temasek’s next plan to separate Keppel’s offshore and marine entity as well?

Read More: Sembcorp Demerger deal passed. What is Temasek’s plan now?

#9: Keppel Corp deal abandoned. What to do next?

In a rather stunning turn of events, Keppel announced on 10 August 2020 that it will not be proceeding with the partial offer for Keppel Corp. Temasek’s decision to walk away outright is likely a huge negative surprise to the market as most in the street still expect the offer to proceed, albeit at a lower offer price from the original level of S$7.35/share.

I speculated that the decision to walk away from the long-awaited deal was to conserve capital on the part of Temasek, following a massive cash injection to save SIA not too long ago.

While it will be great for Temasek to have majority ownership of Keppel to facilitate the consolidation of our two yards, there is no saying that such an event will not happen without majority ownership.

Instead of purchasing a majority stake in Keppel, Temasek can simply choose to privatize its O&M division and possibly re-list it in the future?

In this scenario, Keppel’s shareholders will not benefit from the price premium associated with Temasek taking majority ownership of the company but might still benefit from the divestment premium associated with the sale of its O&M division.

Is that something about to happen with the Keppel re-organization still on the plate?

Read more: Keppel Corp deal abandoned. What to do next?

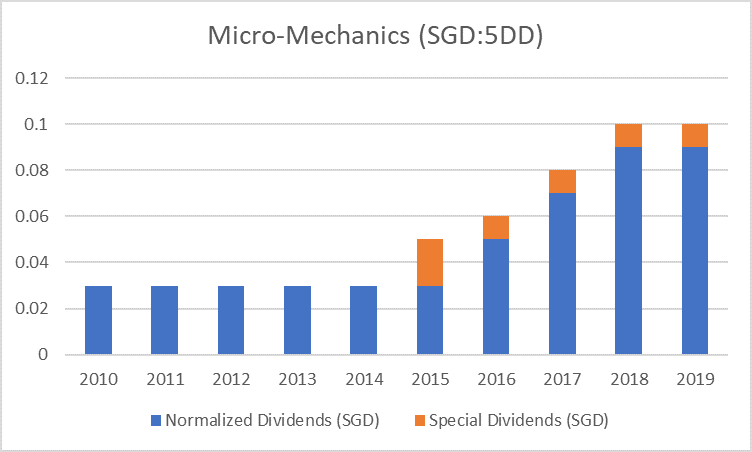

#8: 4 Singapore Dividend stocks with increasing dividends for the last 10 years. This streak could continue in 2020

It is pretty rare for Singapore stocks to have a consistent track record of paying dividends.

Unlike in the US where there are hundreds of companies classified as Dividend Aristocrats (companies that have increased their dividend payments for 25 consecutive years or more) and a handful of Dividend Kings (companies that have increased their dividend payments for 50 consecutive years or more), Singapore stocks typically do not have a good track record of consistent dividend payments.

In this list of 4 Singapore dividend stocks, these companies exhibit rising or stable normalized dividend payments (excluding special dividend payments in certain years) over the last 10 years.

I believe their dividend payment streak could continue in 2020, a year ravaged by COVID-19 which has seen the operations of many businesses being significantly impacted.

One of the key reasons why I believe some of these Singapore dividend stocks can extend their dividend-paying track record is because their balance sheet is in pristine condition, one where there are almost no financial liabilities and they are in a very comfortable net cash position to continue rewarding shareholders through dividends.

One of the stocks in this list is Micro-mechanics.

Read on to find out which are the 3 other stocks that have a good dividend-paying track record.

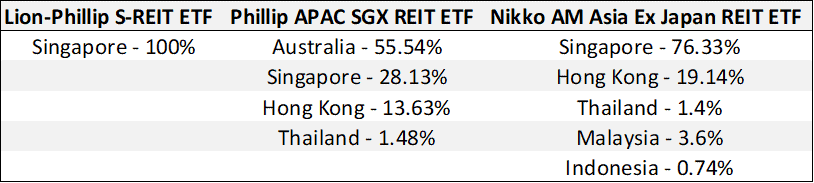

#7: Lion-Phillip S-REIT ETF. Should you be buying this REIT ETF?

Lion-Phillip S-Reit ETF is one of the only 3 REIT ETFs available here in Singapore. Given its 100% focus on Singapore REIT counters, it is not surprising that Singapore investors have a natural preference over this Reit vs. its two predecessors: Phillip SGX APAC Dividend Leaders REIT ETF and Nikko AM REIT ETF, both of which are more geographically diversified.

Should one be invested in this REIT ETF? I believe that Lion-Phillip S-REIT ETF is still attractive for those who wish to invest in a portfolio of predominantly blue-chip REIT counters, achieving diversification in the process.

For those who are not able (possibly due to compliance issues) or not willing to invest in individual REIT counters, investing in a REIT ETF might be the solution, although that entails paying a recurring fee of c.0.60%/annum.

An alternative might be to invest in REIT counters through SYFE REIT+ portfolio.

Syfe

Syfe is one of the more popular Robo Advisors here in Singapore. You can start investing in a basket of SG-REITs cheaply through Syfe today.

Read more: Lion-Phillip S-REIT ETF. Should you be buying this REIT ETF?

#6: Sembcorp Marine ex-rights tomorrow. Is there an arbitrage opportunity?

Following the successful demerger with its parent, Sembcorp Industries, Sembcorp Marine shares were expected to trade ex-rights 1 day after all the resolutions for the demerger were successfully passed.

I highlighted that there could be more pressure on Sembcorp Marine’s price when Sembcorp Industries public shareholders become entitled to their Sembcorp Marine shares, expected to be sometime around 11 September where they will be credited with their Sembcorp Marine shares.

At that point in time, there might again be substantial selling pressure, as Sembcorp Industries’ shareholders who do not wish to remain as Sembcorp Marine shareholders will start cashing out of their Sembcorp Marine shares.

True enough, the selling pressure on Sembcorp Marine shares continues months after the ex-rights and the counter is trading at just $0.14/share at present.

Will there be a revival in market interest for Sembcorp Marine’s shares?

That could be a possibility on the back of a possible merger with Keppel’s O&M division.

Read more: Sembcorp Marine ex-rights tomorrow. Is there an arbitrage opportunity?

#5: 5 undervalued stocks in Singapore to buy now

In this article, I identify 5 potentially undervalued stocks in Singapore that you should consider for your long-term portfolio.

My selection criteria weren’t based on the traditional “value” criteria which seek to identify stocks that fit certain “value” metrics such as low PER, low PBR, high dividend yield, low net debt/equity ratios, etc.

Instead, it is based on a combination of potential forward catalyst/s, taking into consideration its business resilience amid the current recessionary environment. These stocks are generally large-cap counters that one should be comfortable holding on to for the long-run.

Note that these undervalued Singapore stocks might not be suitable portfolio candidates if one’s holding horizon is too short.

I have excluded banks and REITs in this selection process. While Singapore is home to some of the strongest banks in the region such as DBS Holdings, I remain concerned over the potential “fall-out” from the double whammy of 1. Prolonged low-interest-rate environment and 2. Increased in non-performing loans in 2021 when the real impact of COVID-19 is felt after the positive impact stemming from stimulus effects has waned.

Many of them sport a dividend yield of at least 3% which means that investors are hence to paid to wait for these companies to revert to their fair value once the COVID-19 storm blows over.

Which are the 5 undervalued SG stocks that you should be looking to buy now?

Read more: 5 undervalued stocks in Singapore to buy now

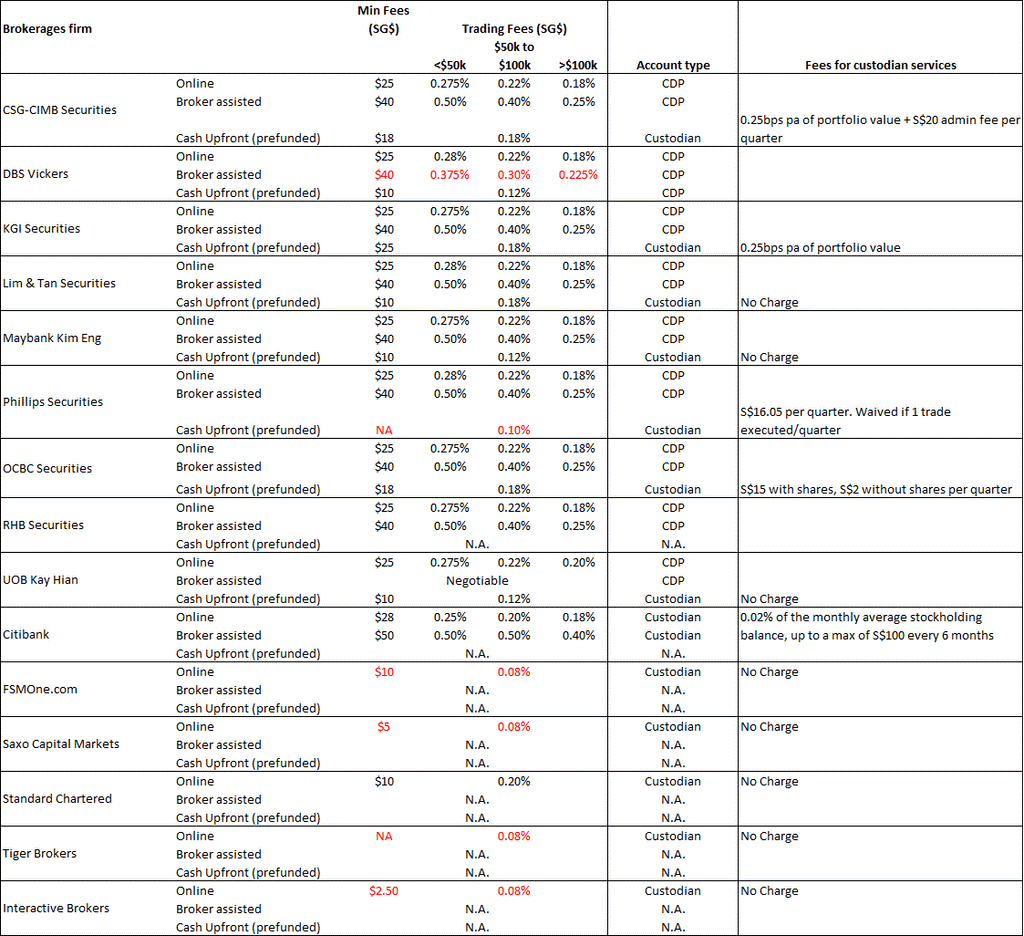

#4: Best stock brokerage in Singapore

We are already at the tail end of 2020 and assuming you are ready to kickstart your investment journey, it is now time to select a stock brokerage account. In this article, I evaluate the various brokerage houses available to Singapore investors, and ultimately, I pick my IDEAL brokerage combination for local (SG) and international (HK+US+UK) investing.

The bulk of the content here might not be new to those already familiar with the local brokerage landscape. However, I believe there might be pockets of information that even a seasoned and “cash-savvy” investor might have overlooked.

The information in this article will predominantly be focused on four commonly traded markets relevant to Singapore investors: SG, USA, HK, and UK.

I will be looking at areas such as stock brokerage fees, ownership of stocks (CDP vs. custodians), platforms to use for local and international trading while taking into account key items such as custodian costs, etc.

The article has just been updated in November 2020 to take into account changes made to the brokerage scene here in Singapore.

Read more: Best stock brokerage in Singapore (Update: November 2020)

#3: SIA Rights issue. Debunking the complication behind the maths

By now, most of you would probably have been aware of Singapore Airlines’ (SIA) plight and the need to do a massive fund-raising exercise, fully-backed by Temasek. This means that if Singaporeans are not willing to support our national carrier by subscribing to those new shares, Temasek will come in to backstop 100% of the issue.

SIA looks to raise a total amount of S$15bn (SIA Rights), through a combination of S$5.3bn in Rights Shares issuance and S$9.7bn via Rights mandatory convertible bonds or MCB for short.

In this article, I evaluated the two Rights issuance, first the SIA Rights Share followed by the SIA Rights mandatory Convertible Bonds.

I then follow up with 4 scenario analyses for a potential SIA shareholder and calculate what might the market value of the SIA Rights Shares and SIA Rights MCBs be worth when they start trading.

Read more: SIA Rights issue. Debunking the complication behind the maths

#2: 10 Singapore Blue-Chip stocks yielding more than 5%

Much has changed since I wrote this article back in March 2020 during the darkest hours of the global stock markets, with many driven into bear market territory due to COVID-19.

Plenty of SG blue-chip names were trading at a discount, with yields over 5%. Since then, global markets have stabilized and some of these Singapore blue-chip companies have also seen their share prices rebounding strongly.

This has resulted in yields falling back to more normalized levels. However, the challenging times have forced many companies to cut their dividends and many SG Blue-Chip companies are not spared either.

I provided an update in August 2020. Only 3 out of the original 10 counters made the cut of having a yield over 5%.

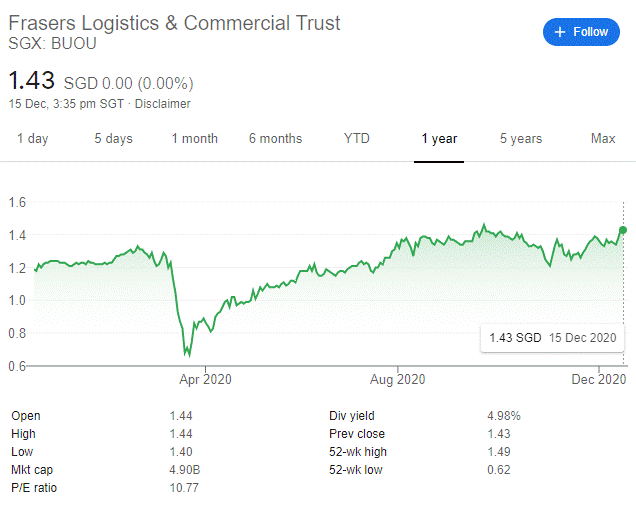

I also introduced another 5 Singapore blue-chip stocks that are not part of the STI component stocks but still yield more than 5%. One of that stock is Frasers Logistic and Commercial Trust which is also one of my favored REITs to own. This is highlighted in this article: Best Performing Singapore REITs [Update December 2020]

Read more: 10 Singapore Blue-Chip stocks yielding more than 5%

#1: Top 5 resilient Singapore stocks to buy amid COVID-19 uncertainty

This is the most popular NAOF article for 2020, garnering close to 60k views (and counting)

Amid the COVID-19 uncertainty, which are the best COVID-19 resilient Singapore stocks to buy? I identified 5 counters which I believe are generally resilient to the current economic fall-out and should be kept on one’s watch-list for potential price weakness.

The performance of the 5 original stocks in this list since the article was written ranges from -2% – +50%.

One of the stocks in that list is Keppel Corp. The company is back on my radar when I wrote about the 5 undervalued stocks in Singapore to consider back in October. The counter has since been quietly appreciating, with the next catalyst being the announcement of its restructuring conclusion, expected to be heard sometime by end-Dec 2020.

I bought into Keppel back in early-November when there was a signal to enter the counter at S$4.63, based on the proprietary TradersGPS signal developed by Collin Seow and his team. I will be on the lookout for another entry-level if the price does indeed breaches its previous high level of S$5.47 convincingly.

The Systematic Trader

The Systematic Trader is voted the best investing course by Seedly in 2020. Check out their proprietary screening software, Traders GPS which looks to help you identify the RIGHT time to buy the RIGHT stock

I have since updated the article in July 2020 and provided 2 additional stocks in that list, one of which has been a multi-bagger stock and could still be worth considering as we head into 2021. The second stock (my personal favorite) is looking to breach its last high, following a widely followed IPO of one of its key subsidiaries recently.

Conclusion

These are the Top 10 NAOF most popular articles for 2020.

While I am slightly disappointed that there are no US-focused content articles in this list (mostly are still SG-focused content), I will strive to provide better content for my internationally-based readers.

2021 is just a few days away and I will like to wish all my readers here at NAOF a Happy New Year and may 2021 be a better and more prosperous year for all of us. Hopefully by mid-2021, the horrors of COVID-19 are behind us and we can finally resume our normal lives.

For those whose livelihood has been significantly impacted by COVID-19, one should consider getting out of our comfort zone and learn a new skill to better tide over the current pandemic and what other uncertainties the future might behold.

Once again, all the best and God bless.