Sembcorp Demerger

In today’s Sembcorp group EGM, the Sembcorp demerger was duly passed, including the critical whitewash which Sembcorp Marine minorities have the final say. It was being approved by a resounding 88% of shareholders who participated in the voting process.

With that, the demerger between Sembcorp Industries and Sembcorp Marine has been formalized. Sembcorp Marine will be separated from its parent Sembcorp Industries which currently holds about 61% shareholding stake of the former.

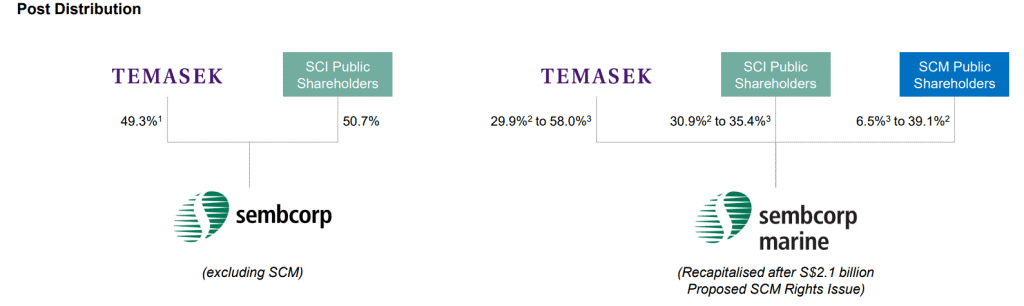

The new structure will be as such:

The ownership structure of Sembcorp Industries will not change. Temasek continues to hold 49.3% in Sembcorp Industries and the public holding 50.7%.

Sembcorp Industries will distribute its 60.9-69.9% equity stake in Sembcorp Marine to its shareholders on a pro-rata basis with every 100 Sembcorp Industries (SCI) shares will be entitled to 427-491 new Sembcorp Marine shares. This will result in Sembcorp Industries’ existing public shareholders holding between 30.9-35.4% equity stake in the new enlarged Sembcorp Marine.

Temasek’s stake will increase to between 29.9% to 58%. This is because Temasek is the largest shareholder of Sembcorp Industries, so at the minimum, it will have a close to 30% stake in Sembcorp Marine post demerger or up to 58% if no existing public Sembcorp Marine shareholders subscribe for the rights.

Should Sembcorp Marine shareholders subscribe to their rights?

So the question right now is whether Sembcorp Marine existing shareholders will choose to subscribe for the rights or choose to be diluted massively by Temasek by not subscribing to those rights.

Personally, at this stage, I believe that existing Sembcorp Marine public shareholders should fork out the additional dole and not get themselves significantly diluted. This is definitely not an easy situation to deal with. On one hand, they risk forking out additional capital which might potentially “go down the drain”.

Yes, Temasek is now a significant shareholder, hence the probability of them letting Sembcorp Marine collapse is low. However, there is no guarantee of how long that “pain” might last before Temasek steps in for a rescue package (if it comes down to that).

If Sembcorp Marine public shareholders allow themselves to be diluted to just 6.5% of outstanding shares, then even if a rescue package comes along, which might be in the form of a full privatization, it is not going to mean much to them.

Hence for the remaining (those who have not already sold out) Sembcorp Marine public shareholders who have already decided to stick with the company through “thick or thin”, it is probably a better choice to subscribe for the rights, in my view.

What might Temasek’s next course of action be?

Temasek surprised the market yesterday by withdrawing its partial offer for Keppel which if completed, would see Temasek becoming a 51% owner of Keppel. With that offer being withdrawn, Temasek’s stake in Keppel will remain at roughly 20% for now.

Not surprisingly, Keppel’s share price collapsed by c.10% this morning when trading resumes post the announcement. Keppel’s minorities will no longer enjoy the premium from divesting part of their stakes to Temasek at a price of S$7.35/share vs. pre-announcement level of S$5.40.

I have written about that announcement in this article: Keppel Corp deal abandoned. What to do next?

In that article, I highlighted the possibility that Temasek can still restructure our local offshore yards without the need to take majority ownership of both Keppel as well as Sembcorp Marine.

With Temasek now becoming the single largest shareholder of Sembcorp Marine, with the potential of its stake crossing the 50% threshold, it might not be long before a full privatization of Sembcorp Marine materializes, potentially at a much lower price than the current level.

Such a corporate action will not be done in solo, but to likely make an offer to buy out Keppel’s O&M division to combine them into a larger entity.

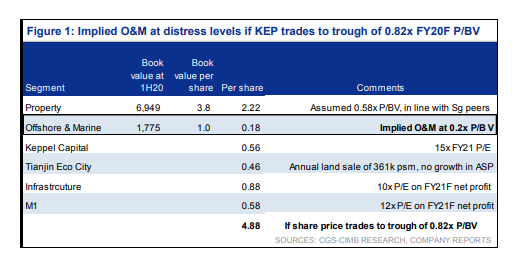

According to CIMB’s latest research report, at a price of S$4.88, it will imply that investors are only paying 0.2x P/B for its O&M division which seems like a huge bargain. This is especially so when compared to Sembcorp Marine’s current P/B of 0.4x. One can potentially argue that the asset quality of Keppel is now more robust than that of Sembcorp Marine after the latest round of kitchen sinking exercise done in 2Q20. Moreover, Keppel has already paid the massive fine pertaining to the Petrobras scandal, something which is still outstanding for Sembcorp Marine.

Hence, an offer for Keppel’s O&M division might likely be at least double the amount of its implied value of 0.2x P/B at present.

While no longer enjoying the upside from the partial sale premium, Keppel’s minorities can still look forward to the ultimate sale of its O&M division to Temasek, if that happens. However, a long wait it might be. Therefore, I also highlighted that investors wishing to buy into Keppel now should be confident of the conglomerate’s ability to ride out the current downturn in its O&M division.

This is my current conjecture of what Temasek might do now, following the successful demerger between Sembcorp Industries and Sembcorp Marine.

How might Sembcorp Industries and Sembcorp Marine share price react post the successful passing of all resolutions?

My initial gut is that the market will be positive of the conclusion, particularly on the part of Sembcorp Industries, given that shareholders of Sembcorp Industries will now confirm be entitled to “free shares” of Sembcorp Marine.

As I have previously highlighted, these shares are not free even though Sembcorp Industries’ minorities do not need to pay a dime for it. They “cost” Sembcorp Industries S$1.5bn. This is the shareholder’s loan owing to them by Sembcorp Marine which will now be converted into Sembcorp Marine shares.

Assuming that Sembcorp Industries public shareholders will now be entitled to roughly 33% of Sembcorp Marine (actual is somewhere between 30.9% and 35.4%) shareholding. Including Temasek minimum stake of 30% and the total implied value of Sembcorp Marine is approx S$2.4bn vs. the current market cap of S$730m.

However, that is likely not something that I feel the market will be concern about. As long as they are getting “free shares” of Sembcorp Marine which they can offload in the open market if they choose to do so, as well as having an entity that is now more “pure utilities”, it will likely be a good enough reason to push the price higher.

For Sembcorp Marine, their price will likely also appreciate in the short term, given the fact that there is now hope of Temasek supporting the company. However, the medium-term share price trend for Sembcorp Marine remains cloudy, particularly when shares are made available for Sembcorp Industries public shareholders to be sold in the open market.

Important dates to note

Sembcorp Marine shareholders need to note that the record date for the rights issue is on 14 August 2020. This will imply that the ex-right date is on 13 August which is 2 days from now. Those who are entitled to the rights can sell them in the open market at a later date to be announced.

For Sembcorp industries shareholders, further announcements will be made in due course on the proposed distribution, including among others, the distribution ratio and the SCI record date.

Conclusion

There is now clarity over the status of the demerger deal. At the current juncture, it might seem that Keppel is receiving the short end of the stick due to Temasek’s withdrawal of its partial offer while the market will likely be cheering the outcome of the demerger, positive that Sembcorp Industries is now a “cleaner” entity + free Sembcorp Marine shares while Sembcorp Marine is receiving the required funding to help it tide over the current O&M crisis as well as getting support from its banks.

However, Keppel’s shareholder should not lose faith and I believe that the ultimate consolidation between Keppel and Sembcorp Marine will still happen in the foreseeable future and Keppel’s shareholder will benefit from that divestment deal.

Once again, do note that the content in this article is purely an opinion piece from yours truly and there is no intent for a recommendation to buy or sell in any of the above entities stated.

Do Like Me on Facebook if you enjoy reading the various investment and personal finance articles at New Academy of Finance. I do post interesting articles on FB from time to time which might not be covered here in this website.

Join our Telegram broadcast: https://t.me/gemcomm

SEE OUR OTHER WRITE-UPS

- IS TIME RUNNING OUT FOR KEPPEL AND SEMBCORP MARINE AS OIL COLLAPSES BELOW ZERO?

- SEMBCORP INDUSTRIES 4Q19 BETTER THAN EXPECTED. SHENG SIONG MARGINALLY DISAPPOINTS

- SEMBCORP MARINE 4Q19 LOSSES EXCEEDED EXPECTATIONS. WHAT YOU SHOULD KNOW

- SEMBCORP INDUSTRIES: PROFIT WARNING A PRELUDE TO MORE PAIN IN 2020?

- SEMBCORP MARINE 3Q19 LOSSES BALLOONED TO S$53M. WHAT YOU SHOULD KNOW

- TOP 5 UNDERVALUED SINGAPORE DIVIDEND STOCKS (2020)

Disclosure: The accuracy of the material found in this article cannot be guaranteed. Past performance is not an assurance of future results. This article is not to be construed as a recommendation to Buy or Sell any shares or derivative products and is solely for reference only.