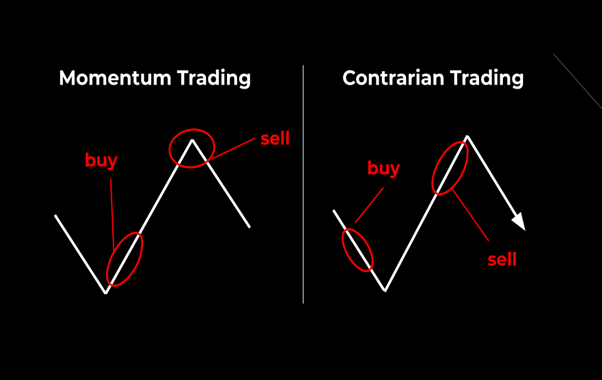

Momentum Investing vs. Contrarian Investing

Buy High, Sell High

Momentum trading, or trend trading, is an investment strategy that involves purchasing securities during an upward price trend, and selling when the momentum of the trend shows signs of weakening. This strategy is typically short-term in nature and tends to target growth stocks

Additional Reading: Growth Investing. How to find growth stocks to invest in

Buy Low, Sell High

Contrarian investing aims to buy undervalued stocks at a discounted price, usually when the price is downward trending – then make a profit by selling when the price trends upwards and returns to its fair value. This strategy is typically long-term in nature. A more common term for it is ‘value investing’ ie investing in stocks that have been unfairly beaten down and thus present a sizeable margin of safety (MOS).

Momentum Investing

History of momentum investing

Many know Benjamin Graham, the economist who famously mentored Warren Buffett, as the man who introduced the concept of value investing to the masses. His book “Security Analysis” remains THE must-read investment book till today.

However, are you aware that momentum trading has a history that precedes that of value investing?

As early as the 1700s, David Ricardo, one of the pioneers of classical economics, made a fortune in the stock market with momentum-based strategies.

Ricardo’s success was based on his observation that people tend to react excessively to events. His trading strategy was observed to be as follows:

If there was a small advance, he bought, certain that people would overreact and flock to purchase it, pushing prices to unreasonable heights; if stocks were falling, he sold in the conviction that fear and panic would cause an exaggerated downward trend.

Two of the oldest sayings in the stock market are “the trend is your friend” and “don’t fight the trend”.

Momentum investors embody this idea, making use of trends by taking short-term positions in stocks going up. As more buyers enter, price continues to rise. Eventually, when the price shows signs of decline, momentum traders sell and make a profit.

Note: Momentum traders also make use of downward trends by short-selling securities when the price is declining.

Momentum Indicators

Momentum traders make use of technical indicators to determine when to buy and sell to make a profit.

52-week high indicator

One method that momentum investors use is to look at stocks and ETFs trading close to their 52-week highs.

For a stock, the 52-week high is the strongest point of resistance over the past year. If a stock price manages to break through the resistance around its 52-week high, it will likely see significant gains in the future.

Take for example the counter GM below. It is worth monitoring to see if the 52-week high breakout materializes and if so, the counter’s price momentum might continue.

Momentum traders jump on this opportunity, buying the stocks near the 52-week high, and reap the rewards if resistance is broken. When price emerges above the resistance line, more investors are attracted, resulting in an exponential increase in share volume and price.

Investors who spotted trends early on and secured early positions are rewarded with the greatest profits.

A simplified momentum strategy is as follows:

- Buy stocks that continue to meet 12-month highs

- Sell the stocks if they hit a three-month low

This strategy aims to capitalize on the persistence of prevailing trends by following the long-time winners. The exit timing also ensures that the investor has exhausted the entire uptrend without selling out early.

Another momentum trading strategy could be combining highly-shorted stocks that are trading at a 52-week high. I cover that in the article: Most Shorted Stocks. A smart way to play the short squeeze game.

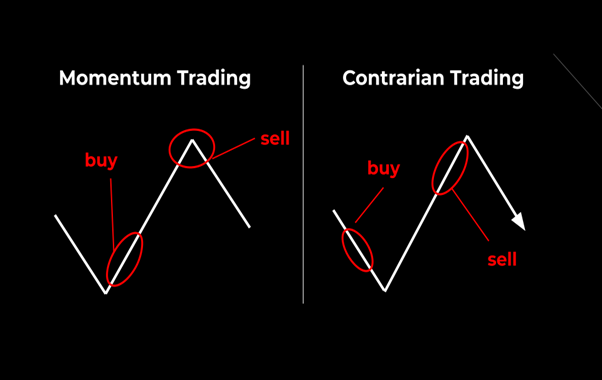

Moving Average Indicator

Moving Average(MA) is one of the most widely used indicators in technical analysis. A moving average is a line that succinctly displays the general trend of the market by eliminating small, insignificant price fluctuations.

An uptrend is reflected when a stock’s price maintains a position above a moving average; a downtrend is indicated by the price remaining consistently below a moving average.

The chart below shows an established uptrend. We can observe that the price, as indicated by the candlestick charts, is consistently above the moving averages after a certain point.

A commonly used strategy might be something like, “Buy when the 10-day EMA crosses the 20-day EMA. Sell when the former crosses down the latter”.

The success of momentum trading

In December 2019, Tesla stocks hit a new 52-week high. Investors who observed the technical indicator and were keen to ride on the momentum would have made tremendous gains from this trade.

By 2021, the share price of Tesla would have multiplied more than 10-fold.

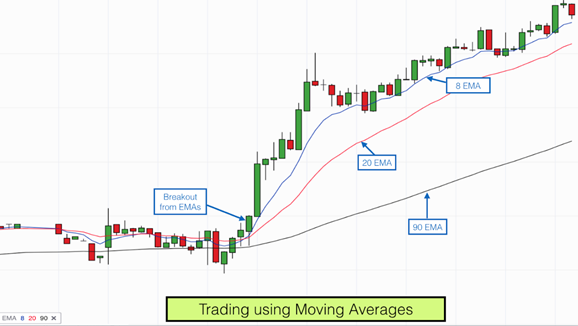

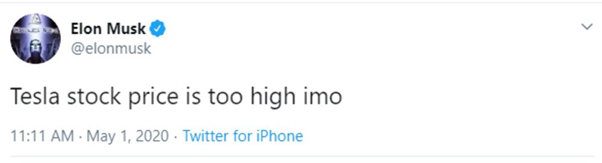

In May 2020, as Tesla continued to soar past all-time highs, its CEO Elon Musk posted the following statement on Twitter:

If you had bought a share of Tesla before that tweet, it would have cost you roughly 160 USD. In January 2021, just months later, the stock price of Tesla increased fivefold, to almost 800 USD.

For Tesla, the all-time highs were bullish indicators. It was happening because people were continuing to purchase Tesla shares at an alarming rate, putting immense pressure on the price to increase. It has since been proven that the sooner momentum investors latched onto the Electric Vehicle pioneer, the more they stood to gain.

Or perhaps Elon Musk is just the worst stock analyst in the world. He probably should just stick to making sexy cars or master the art of twittering.

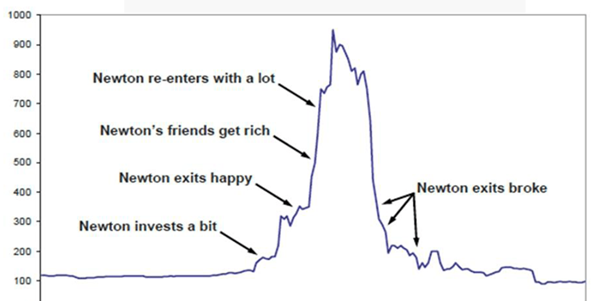

However, momentum investing does not always work. In extreme cases, the strategy can cause pandemonium in the stock market, as seen from the South Sea Bubble in 1720 and the tech bubble in the 1990s.

Since momentum investors disregard fundamentals and only focus on market trends, they would continue to buy stocks even when the company’s profits were unsustainable. This created bubbles that hurt small investors who could not react to a burst as quickly as the professional traders.

You don’t want to be Newton, the small-time investor.

You can’t stop bubbles from forming

This is not to say that momentum trading is bad or that momentum traders are silly to chase a bubble (and often get financially hurt in the process).

Bubbles form and they ultimately burst and the cycle repeats itself. This often results in a transfer of wealth from the “not-so-savvy” man-in-the-street investor to that of the institutional players or “big boys”.

Might the recent Gamestop fiasco be an example?

If one wishes to engage in momentum trading, he or she must recognize that the exit process is equally, if not more important than the initial entry decision.

When a major correction arrives, the retail momentum traders are often “frozen like a deer in headlights”. They chose not to cut their losses short, praying that the correction is all but momentary and that they will be able to exit their trade with a profit.

That scenario often does not have a good ending. Just like Newton.

The TradersGPS system, a momentum trading platform that identifies the RIGHT stock for you to enter at the RIGHT time, also highlights to you when you SHOULD exit a trade without being emotionally-attached to the counter.

The Systematic Trader

The Systematic Trader owns the proprietary platform, TradersGPS that seeks to identify momentum stocks in their infancy stages. Learn how to buy the RIGHT stock at the RIGHT time.

Investors who wish to follow a proven momentum trading platform could look to check out TradersGPS which is run by Collin Seow and his team. His course, The Systematic Trader is voted as the Best Investing Course by Seedly.

Contrarian Trading

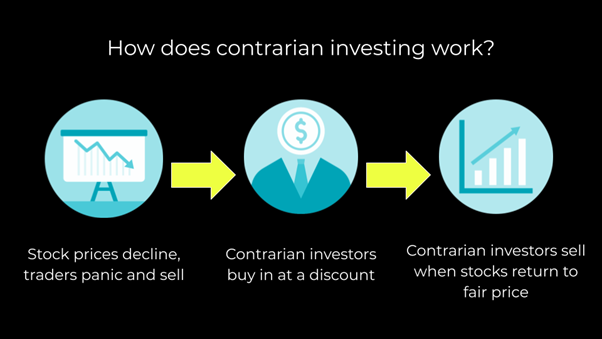

As its name suggests, contrarian trading involves making investment decisions that are contrary to current market sentiments. It advocates the idea of going against the trend by buying undervalued stocks that have tremendous potential in the long run.

There is a common saying that the greatest profits are made when the rest of the market is wrong and you’re right.

Warren Buffett put it succinctly: “Be fearful when there is greed, and be greedy when there is fear.”

How does it work?

To be a contrarian investor, note the following steps:

- Monitor a handful of strong companies you favor in your watchlist.

- When the market declines due to negative short-term news, a panic sell-off is triggered.

- Buy quality stock at a huge discount.

- Sell when eventually, share price returns to its true value, making multi-fold gains from the trade.

Additional Reading: How to prepare for a bear market. A simple 3-step process

Success In Contrarian Trading

Between 2002 and 2008, Warren Buffett netted a gain of 8 times his initial investment by purchasing a stake in PetroChina (PTR). A textbook example of successful value investing, this decision is made with surprisingly little due diligence.

It was reported that Buffett simply read the firm’s annual report, estimated the intrinsic value to be $100 billion; checked the price and found that it was selling for $35 billion, then proceeded to buy in without even checking with management.

Of course, Warren Buffett was able to make this lightning-quick decision because of his unparalleled foundation of fundamental analysis.

But the key takeaway is that although doing your due diligence is important for a successful contrarian trade, it need not be as over-complicated as some investors make it out to be. Often, the decision can be based on a few simple variables (but that will be a topic for another article).

Instances Of Failure In Contrarian Trading – The Value Trap

To be expected, contrarian trading has limitations. One of the most famous examples is seen from the ‘fall’ of Benjamin Graham.

After the stock bubble burst in 1929, Graham decided to buy low, hoping to sell for a profit in the future, as he always did. But in 4 years, his account was left with only 375 thousand dollars. This time, the market did not recover as quickly as he had anticipated.

Very often, contrarian investors fall victim to “the value trap”. This is when a stock that looks cheap on the surface (and hence tempting a contrarian investor to buy) will continue to become even “cheaper”, with no rebound in its share price.

There is a reason why the market is selling a stock down. As a contrarian investor, you are betting that you are RIGHT and the market is WRONG. However, when your assessment of a seemingly “cheap” stock is wrong, that is when you will fall victim to the classical “value trap” – buying a stock that looks cheap on “fundamental” ground but the business competitive advantage is constantly being eroded by its peers.

A classical example is that of the stock Intel. Take a look at its share price over the past 3 years.

Despite a massive boom in the semiconductor industry, the company has been constantly losing market share to its closest competitor AMD. Consequently, while AMD’s share price has appreciated by 8x over a 3-year horizon, Intel’s appreciation rate is just a paltry c.30% over the same horizon.

If one uses a contrarian approach, he/she would favor the purchase of Intel, whose valuation looks immensely attractive on fundamental grounds but could turn out to be a “value trap”, one whose valuation consistently remain cheap, if management has got no answer to adequately address its current operational issues.

To conform, or not to conform, that is the question.

So which is better – momentum or contrarian investing?

The truth is, there will always be two sides to a coin, and therefore no perfect investment strategy.

Each trading method has its own set of drawbacks that should be noted.

The Drawback of Momentum Trading

The tendency for late entry: Enter a position when a trend is dying out, and risk a loss when the stock price turns towards the opposite direction.

The Drawbacks of Contrarian Investing

The cheap can get cheaper: Just because a stock fell 50% in a year does not mean that it is a bargain. The greatest risk facing contrarian investors is that they misjudge a company’s potential. Prices, while cheap, can be poised to experience further declines instead of gains. A falling price does not equate to better value, and buying solely because of large price retreats is akin to catching falling knives.

Demands experience: You probably have to catch a few of these falling knives before you start to get a hang of contrarian investing. However, contrarian investing is extremely rewarding when done right.

Which kind of trading is best suited for you?

All in all, there is no perfect strategy. However, there could be a ‘right’ strategy that suits you personally. To determine which method is best for you, answer these two questions:

- Are you a long-term investor or a mid-to short-term investor?

In general, if you have a long time horizon in investing, contrarian or value investing would be more suited for you.

On the other hand, mid-and short-term investors would probably see higher gains in momentum investing.

- Which strategy suits your temperament?

If you are willing to do your due diligence in researching the fundamentals of the companies AND are mentally tough enough to be unwavering in your stance, even when markets go against you for prolonged periods, then you might want to consider contrarian investing.

However, if you couldn’t care less about a company’s fundamentals, if you have less cash in your pockets and prefer a less capital-intensive style of investment, and also prefer faster returns, you might want to lean towards momentum investing.

Conclusion

As of today, there is no standardized, one-size-fits-all way to invest. This is only natural – after all, one of the most alluring traits of the market is its unpredictability. It is this haziness that makes every trade unique, and every trader special.

Finding the method that suits you can help you go a long way in your investing journey.

Do Like Me on Facebook if you enjoy reading the various investment and personal finance articles at New Academy of Finance. I do post interesting articles on FB from time to time which might not be covered here in this website.

Join our Telegram broadcast: https://t.me/gemcomm

SEE OUR OTHER WRITE-UPS

- OCBC BCIP: Why should you Dollar Cost Average into OCBC Blue Chip Investment Plan

- Hang Seng Tech Index: A deep dive into the hottest tech stocks of Asia

- Top 4 Investment Tips For Beginners

- How to become a millionaire even with the worst market timing

- Are we in a bubble?

- FSMOne Singapore: Step-by-step guide to open your FSMOne account and start trading

Disclosure: The accuracy of the material found in this article cannot be guaranteed. Past performance is not an assurance of future results. This article is not to be construed as a recommendation to Buy or Sell any shares or derivative products and is solely for reference only.