Keppel Corp: A gem that failed to sparkle

Readers of NAOF would be familiar with Keppel Corp, a company that I have been recommending over the past 3-4 months, starting when I first made an initial investment at the cost of S$4.40.

While I believe that the company remains undervalued, its recent results announcement made me reconsider my stance in the company, particularly with regard to its corporate activity, or frankly speaking, the lack of it.

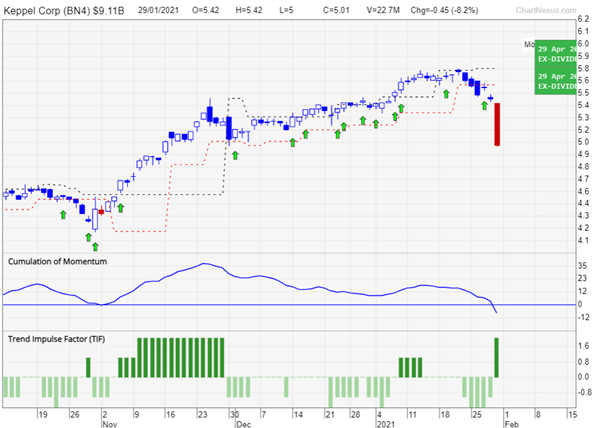

I decided to pare the bulk of my stakes in the company despite my latest entry price (S$5.46) being higher than the current sale price. While there is a reasonable possibility that Keppel can trend higher ahead, the initial “catalyst” momentum is lost.

And for that, I am willing to bite the bullet and say my partial “adios”.

What happened last Friday (29 Jan 2021) which resulted in its share price dropping by 8%?

Keppel announced exit of rig-building business

On Thursday, 28 Jan 2021, after market-hours, Keppel announced its full-year 2020 results. The full-year 2020 financial numbers that Keppel achieved played second-fiddle to its announcement that the company intends to exit its rig-building business altogether.

According to its CEO, Mr. Loh Chin Hua: “Keppel O&M will exit the offshore rig-building business and also progressively exit low-value-adding repairs and other activities with low bottom-line contribution”.

Once the largest rig-builder in the world and a company that holds the World Guinness Book of record for the most number of rigs delivered in a single year (21 rigs delivered in 2013), it is indeed a pity that even the “strongest rig-builder” of them all is being forced to close down its rig-building business that was one of the company’s key operating pillar.

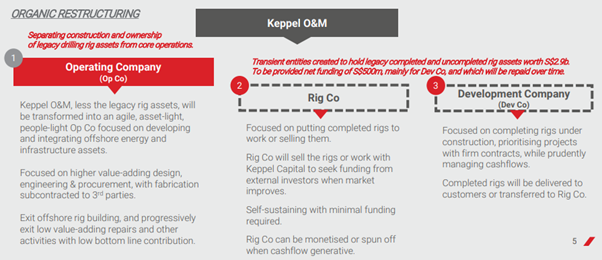

The new restructured Keppel will see the exit of the rig-building business entirely (no longer accepting orders from 3rd party to build rigs), with the operating company now consist of a:

1. Rig-ownership entity to charter out rigs under its name or sell them to a suitable owner and a

2. Development company with the aim to complete all the unfinished rigs in its portfolio.

This 100-day plan, which started back at the end-Sep 2020, was likely not the ideal result that the market and myself were hoping for.

Keppel disappoints with organic restructuring

Most in the market would likely be anticipating a merger between the now separated Sembcorp Marine entity (divestment between parent Sembcorp Industries and Sembcorp Marine took place in 2H20) and Keppel’s O&M division.

This would have been the ideal scenario for Keppel Group as a whole, as shareholders will likely be able to benefit from a “divestment premium” and from the fact that its O&M division is likely “undervalued” based on the transaction value accruing to Sembcorp Marine when it was demerged from parent Sembcorp Industries.

However, instead of an announced inorganic “merger” with Sembcorp Marine, which will likely require the “blessings” of Temasek, Keppel disappointed shareholders with an “organic restructuring” that doesn’t really change the status co.

Its rig-building business has not gotten any significant new orders over the past couple of years. The company’s completed (or almost completed rigs) originally intended for its clients are being “deferred”, likely due to the inability of the latter to make final payments for receipt of their rig orders.

Even if clients have the financial capability to take delivery, there is absolutely zero “need” to do so when they are not able to put these newbuild assets to work in today’s environment.

The organic restructuring also requires Keppel Group to pump in an additional S$500m into the development company for the completion of unfinished rigs, thus further sapping the Group’s cash flow.

While I understand that Keppel is stuck between a rock and a hard place, to either scrap/cold-stack its unfinished rigs or complete them by spending more money and hope that these rigs can find new buyers or drilling jobs ahead, it is not a restructuring conclusion that the market is hoping for.

Is the merger with Sembcorp Marine completely off the plate?

Keppel will not rule out any further inorganic options and mentioned that the company will continue to explore them.

This might mean that an ultimate merger between Sembcorp Marine and the now “leaner” Keppel entity might still be on the cards.

Some might still see Keppel’s current restructuring effort as a prelude towards the end-goal of a merger with Sembcorp Marine.

It is a matter of fact that there is excess rig-building capacity in the world currently, one which does not require new rigs to be built.

A merger between Keppel and Sembcorp Marine will ultimately result in stream-lining efforts to reduce rig-building capacity. This will necessitate job cuts affecting thousands of rig-building workers but will help improve the cash flow and profitability of the enlarged entity.

This entity will now be able to better positioned itself to ride on an industry upturn when it does happen.

Sembcorp Marine, with its “brand new” rig building facilities (which cost billions of dollars to construct and is currently a “white-elephant” status with no new jobs), will naturally be the one to keep its facility while Keppel will be tasked to close down its yards.

What Keppel is currently doing is essentially in “preparation” for that “still-yet-to-be-announced” merger that pools the knowledge and resources of both companies into a single enlarged corporation that will be able to better position itself to compete against the South Koreans and Chinese yards.

I still believe that a merger might still materialize down the road. The question however is when that might be?

Honestly, I was disappointed for the fact that after raising shareholders’/investors’ hope when the company announced the strategic 100-day plan, the “bold” transformation was that of a “non-event” essentially, in my view.

While I still harbor the hope that a merger might still be a possibility, it might be a distant one. I hence decided to pare my stakes in Keppel to capitalize on better opportunities in the market (more on that later).

The majority of the street still holding a neutral to positive stance

CIMB: Maintain ADD with an SOP target price of S$6.40.

UOB: Maintain BUY with a target price of S$6.10

DBS: Downgrade to Hold with a target price of S$5.85

OCBC: Maintain Hold with a target price of S$5.20

The main catalyst given by the street is the possibility of full divestment of Keppel O&M or a subsequent merger with Sembcorp Marine, something which I have alluded above as still a possibility.

For now, however, I will NOT give Keppel the benefit of the doubt that this restructuring can be achieved anytime soon, given how the company has disappointed the street time and again in its corporate action activities.

The company should not have “boldly” stated its 100-day transformation plan when all it is doing is to “shut-down” a money-losing entity.

Better trading opportunities?

My decision to enter into Keppel was made back in 2H20 when the company was still trading in the low-$4 and there was a signal given by the proprietary trading platform which I used called TradersGPS.

That platform is now highlighting that I should be exiting the position.

The TradersGPS platform is not meant to be a “crystal-ball” solution. It does not pick “winning” stocks with 100% accuracy. In fact, the platform’s win-rate is probably just north of 50%.

The Systematic Trader

The Systematic Trader course, which teaches the usage of the proprietary-developed Traders GPS platform is an investment/trading course that systematically identifies for you the RIGHT stock to buy at the RIGHT time.

However, the beauty is that the platform takes the “guess-work” out of when you should enter or exit the trade. Essentially it is structured as a systematic platform to facilitate your buying and selling decision.

While I am disappointed that Keppel did not materialize to be the “big winner” which I had originally hoped when I entered into the counter based on a positive “BUY” signal given by the platform, there is no regret in following a systematic process to trade stocks.

Some will work out beautifully, some won’t. That is just the nature of trading. There just isn’t going to be a perfect system with 100% accuracy.

For now, I am keeping a small stake in Keppel as an “incentive” to monitor the progress of the company.

I am redeploying the capital into another blue-chip counter, Thai Beverage which presents a trading opportunity, one with a short-term catalyst in place.

There is still a positive entry signal to get into Thai Beverage at the current price.

According to a Bloomberg report, the company is preparing to list its regional beer assets through a Singapore IPO that could raise S$2bn. This would be the largest deal in Singapore in more than 8-years.

The listed entity is likely to house Thai Beverage’s beer assets in its main markets of Thailand and Vietnam.

Thai Bev subsequently published an announcement with regard to the Bloomberg article, stating that there is no assurance that any listing will occur and details relating to the potential listing, including the timing of any filings or valuations, remain subject to finalization.

For now, the momentum is strong for the counter according to the TradersGPS platform and I would be looking to take a stake in it.

Do note that this article is not construed to “hard-sell” any specific stock recommendations, so readers please do your own due diligence.

The man behind the TradersGPS platform, Collin Seow will be holding a free online session tomorrow on 2nd Feb 2021 at 7 pm where he will look to explain more about the platform and identify stocks that you should be paying attention to at the moment.

Conclusion

Keppel has missed the opportunity to regain back investors’ trust and hope after the “failed” corporate structuring involving Temasek taking a majority stake in the company, first announced back in 2019.

The company ignited hope that a more “solid” restructuring plan (involving O&M) is imminent when it announced its 100-days plan back in September 2020.

Alas, that fell short when its bold plan is essentially a non-event, for now, in my own humble opinion.

While I still harbor hopes that an eventual merger with Sembcorp Marine will still materialize, I am paring my majority stake in Keppel at the moment and will look to re-enter if and when a more concrete announcement pertaining to a formalized merger is made.

I believe it will not be too late to revisit Keppel then.

For now, a better trading opportunity might be through Thai Beverage, which is looking at an SGX-listing of its Beer operations in Thailand and Vietnam.

Click on the link to find out more about the Systematic Trader course which uses the proprietary TradersGPS platform.

Do note that this article is neither a recommendation to Buy or Sell any of the counters highlighted above and is just for your reading pleasure.

Do Like Me on Facebook if you enjoy reading the various investment and personal finance articles at New Academy of Finance. I do post interesting articles on FB from time to time which might not be covered here in this website.

Join our Telegram broadcast: https://t.me/gemcomm

SEE OUR OTHER WRITE-UPS

- Motley Fool review: Getting multi-bagger ideas the easy way

- Hang Seng Tech Index: A deep dive into the hottest tech stocks of Asia

- Best Stock Brokerage in Singapore [Update Nov 2020]

- Syfe Equity100 review: Does this portfolio make sense to you?

- Tiger Brokers review: Possibly the cheapest brokerage in town. Is it right for you?

- FSMOne Singapore: Step-by-step guide to open your FSMOne account and start trading

Disclosure: The accuracy of the material found in this article cannot be guaranteed. Past performance is not an assurance of future results. This article is not to be construed as a recommendation to Buy or Sell any shares or derivative products and is solely for reference only.