Quick Summary

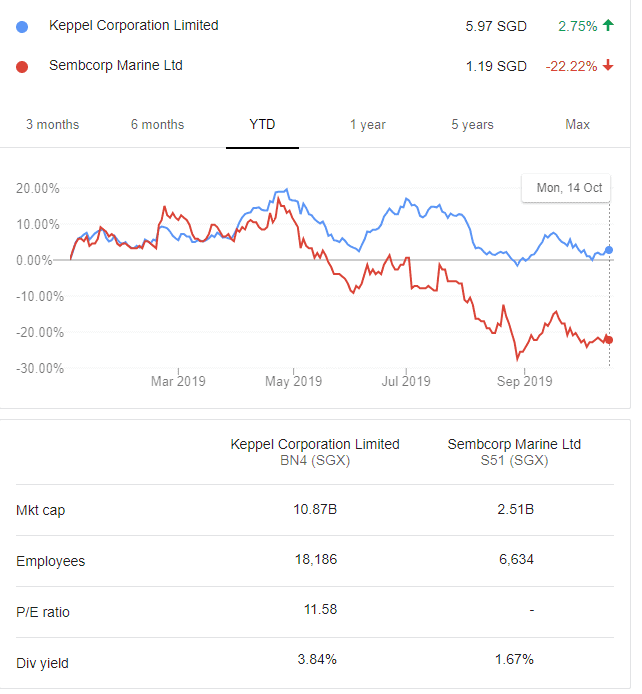

Keppel Corporation (Keppel), one of the largest conglomerates in Singapore, is expected to release its 3Q19 results tomorrow on 17th October 2019. Shares of Keppel (currently a shade below S$6) is hovering near its 52-weeks low of S$5.67. Should investors be looking to take a dip?

Compared to Sembcorp Marine, Keppel’s price performance has outperformed on a YTD basis, increasing by c.3% since the start of the year vs. Sembcorp Marine’s c.22% decline. However, the question begets if the company should still be viewed as an Offshore & Marine (O&M) company or as a Property Developer?

Oil or Property company? The confusion of a conglomerate

As a property development company, Keppel significantly underperforms peers such as CapitaLand, up c.17% YTD and City Development, up c.24% YTD.

Despite approx. 80% of the company’s profits now deriving from its property division, the market likely still has the vision of Keppel being an O&M player, once the pride of Singapore, holding the Guinness World of Record as the Largest Offshore Rig Manufacturer back in 2014.

Hence, the performance of its share price is unwittingly tied to the fortunes of volatile oil prices. One should be aware that Keppel does not benefit directly from higher oil prices. No component of its revenue is directly tied to oil price, unlike oil majors. Instead Keppel benefits indirectly in the form of new contract wins if oil prices are robust.

That is based on the assumption that oil companies are willing to open the spending spigot if oil prices are high. Unfortunately, new contracts have been few and far these couple of years, despite a recent rebound in new contracts towards the end of 2Q19. That momentum has since tapered off.

What to expect for 3Q19

Based on 1H19 performance, Keppel earnings are down 39% on a YoY basis, with the company generating approx. SGD150m in earnings for each of the first two quarters of the year. If that trend continues, the company will likely witness a 30% YoY decline in earnings when the company reports its 3Q19 results tomorrow.

O&M Division

Most in the street believes that Keppel’s O&M division has bottomed out, with this segment likely to remain marginally profitable in the coming quarters. YTD new order wins of close to S$2bn has been a refreshing turnaround from the lackluster years since 2015. However, that momentum has trickled down in the last couple of months. The market will be interested on management’s views pertaining to new orders outlook over the coming years. Has the long harsh winter finally ended?

Sete development

A recent development that has caught the market’s attention has been the long-awaited conclusion of the Sete rigs. Analysts in the street has taken this news positively, given that the fate of the uncompleted rigs to Sete has been in limbo for a very long time. With Keppel taking ownership of 4 out of the 6 rigs, with the remaining 2 being sold to Magni Partners, the market will be interested to find out what Keppel’s plans are for “extracting the best value” out of these rigs.

Property Division

Its Property Division should remain as the earnings bedrock of the Group. Sales momentum remain strong in China and Vietnam, two key markets which the company has been focusing on. However, despite last year relatively weak 3Q18 performance, there is a possibility that earnings from this division can still disappoint in 3Q19 due to the lack of property completion in China and Vietnam.

Infrastructure & Investment Division

Keppel’s Infrastructure Division should continue to be a steady contributor to earnings. Its Investment Division could be negatively impacted by its 40% stake in Kris Energy, which recently filed for bankruptcy protection. However, according to a UOB Kay Hian report dated 26 August, the brokerage believes that the impact to Keppel in a worst-case scenario will still be relatively minimal, given that its carrying value of Kris Energy only accounts for 1.7% of Keppel’s then market cap.

Full Year 2019 consensus outlook

Based on analysts forecast as compiled by Bloomberg, the street is expecting a full-year 2019 decline of 7% in earnings for 2019 vs. 2018. If 3Q19 earnings continue to underwhelm, there is a high likelihood of earnings downgrade post-result.

The majority of the analysts do however have a Positive rating on the counter (15 Buys, 2 Holds, 1 Sell), most citing the attractive valuation of the company with the worst being over for its O&M division. Key positive share price catalysts will be larger-than-expected new orders wins.

SEE OUR OTHER STOCKS WRITE-UP.

- BUFFETT SERIES: IDEXX LABORATORIES

- BUFFETT SERIES: DISNEY

- 46 STOCKS IN BUFFETT PORTFOLIO

- BUFFETT SERIES: MCDONALD

- STRACO: IS IT A GOOD BUY NOW?

Disclosure: The accuracy of material found in this article cannot be guaranteed. Past performance is not an assurance of future results. This article is not to be construed as a recommendation to Buy or Sell any shares or derivative products and is solely for reference only.