Summary

- Straco is a tourism-related play that generates a ton of operational cash flow

- Not without its challenges as storm clouds remain in the horizon

- Attractive valuation but lacks short-term re-rating catalyst

Wheeling in a Fortune?

That was likely the original intention of the owner of the Singapore Flyer when they constructed the SGD240m Singapore Flyer (165m tall) which began its maiden operation in 2008. Alas, the company went belly-up within a short span of 5-years and was put on LELONG (hokkien for cheap sale) in 2013.

In rode a white knight, literally, in the form of Merlin Entertainments, the company behind the famous London Eye and Legoland theme parks which was rumored to be interested in increasing its trophy collections of giant wheels. But talks fell through and the Singapore Flyer was eventually sold to Straco Corporation Limited for a significantly reduced sum of SGD140m.

While one might reckon that it was a bargain purchase (SGD100m haircut from its original construction cost), there were naysayers who felt that Straco had just bought a dud. The Singapore Flyer was deeply in the red and turning the attraction profitable seemed a tall order.

Summary of events that transpired since the Flyer purchase

Let’s fast forward and look at the sequence of events which transpired thereafter:

- 2014: Straco borrowed SGD84m to partially fund the SGD140m acquisition, resulting in net cash declining to c.SGD20m,

- 2015: The company turned the Flyer profitable within a year and achieved record Group profitability. Net cash increased to c.SGD63m,

- 2016: Profits took a hit due to weather-related issues in China affecting its aquarium business and start-up expenses incurred for the opening of a restaurant at the Flyer. Cash flow remained robust and net cash increased to c.SGD102m,

- 2017: Announced a 3% YoY improvement in net profits which was likely below expectations given that the company’s 1H17 performance was rather credible. Net cash position improved to SGD141m

- 2018: Operations at the Singapore Flyer was suspended for 2 months starting February which significantly impacted the Group’s operational performance for the year. Net profit declined by 12% YoY. Net cash position continued to show improvement at SGD165m.

- 1H19: Straco’s revenue saw an 8.4% improvement due to the negative impact of the Flyer suspension last year. Correspondingly, net profit saw a 22% YoY improvement. However, overall tourist numbers to China attractions have shown a decline, accelerating to 11% in 2Q19. Net cash position improved to SGD168m.

For those of you who are interested in getting a detailed analysis of Straco’s history, I recommend you to head straight to Mr Kyith Ng website at Investment Moats. He has done a fantastic job in our view in terms of tracking the developments of Straco and we believe it is well-worth the read for those interested in gaining a comprehensive understanding of the company’s background.

We shall not attempt to re-create Kyith’s insightful analysis of the counter but rather gaze into our “all-knowing” crystal ball to predict the future earnings of the company as well as determine the attractiveness of the company’s current valuation. Sounds good?

Straco: Brief background

But before we do that, let’s just take a step back and do a basic introduction of Straco’s business. The company is engaged in the development and management of tourism-related businesses. It operates in 3 divisions: Aquariums, GOW and Others. The Aquarium division consists of the Shanghai Ocean Aquarium (SOA) and the Underwater World Xiamen (UWX). The GOW division consists of the Singapore Flyer. The “Others” division, a small part of the Group’s business, consist of a cable-car facility asset (Lintong Lixing Cable Car) as well as the development rights to Chao Yuan Ge (CYG).

It is a relatively simple business to understand. Straco is a tourism-centric company and one that is exposed to the tourism industry of China and Singapore, to be specific. The tourism industry has always been lauded as one that is relatively resilient with steady long-term growth prospects. However, we are beginning to see cracks surfacing as the confluence of competition and a slowdown in macro economy rears its ugly head.

Dark clouds still present

I shall not go into details pertaining to the company’s “horrendous” performance in 2018 due to closure of the Singapore Flyer for 2 months due to technical problems. Those issues are now water under the bridge. Instead I will like to focus a little more on its 1H19 performance as well as future outlook and unfortunately, that ain’t exactly a rosy picture at present.

While 1H19 earnings performance improved by 22% YoY (largely due to one-off negative impact due to the suspension of the Flyer in 1H18), a worrisome trend has been the accelerating decline in tourist visitations for its key China attractions, a likely result of global trade tensions.

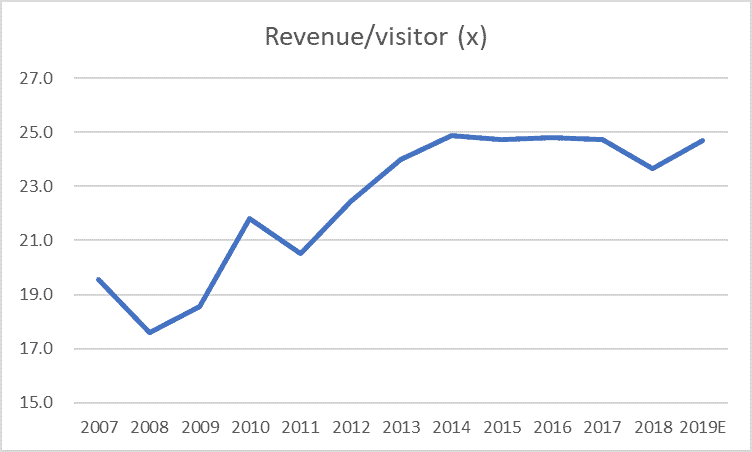

Revenue/tourist ratio expected to remain stable

We wish to bring your attention to the revenue/tourist ratio which has been relatively stable since 2014. Notice that the growth in this ratio was especially steep in 2012-14 (accelerated from 22.4 to 24.9), due to ticket price hikes in its China aquariums. However, that growth in spending/tourist has plateaued from 2015 onwards due to the Chinese government restrictions on ticket price hikes.

According to management in its FY2018 AGM, Straco is unlikely to see any significant ticket prices increment in 2019 due to the weak China economy. As such, we expect the revenue/tourist ratio to hover at the 24.7 region as our base case scenario. A significant decline in this ratio as a result of pricing weakness (more aggressive discounting) will be another major cause for concern.

We expect tourist visitations to the Group’s attractions to decline by 10% in 2H19 as our base case scenario and a potential 15% slide as our worst-case scenario. We see flat YoY tourist visitations as likely the best-case scenario for 2019.

SHOP to affect China performance

Our pretty somber outlook of tourist visitations takes into account elevated competitive pressure in China stemming from Shanghai Haichang Ocean Park (SHOP) which started operations in 4Q18, partially offset by the Singapore’s Mid-Sized Attraction, Time Capsule, which is slated to launch in 4Q19. This project will be part of the Bicentennial Community Calendar and will feature interactive exhibits and light shows to showcase Singapore’s history and development over the decades.

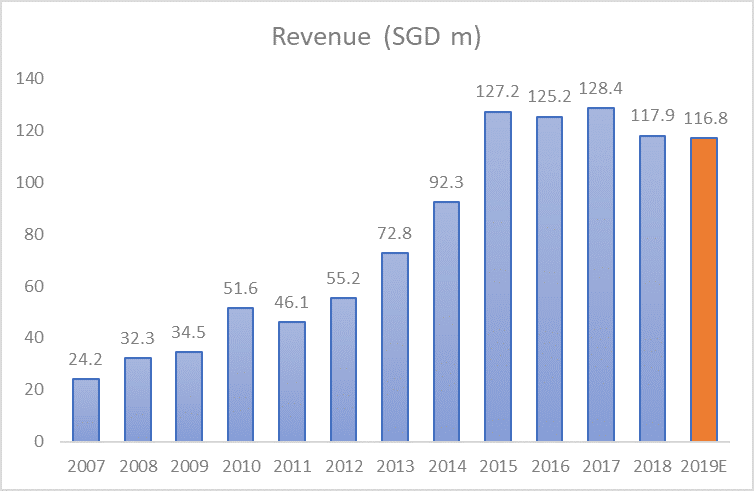

Straco: Revenue to remain flat in 2019

Consequently, our base case scenario calls for a flat revenue profile in 2019 vs. 2018. Unfortunately, due to operational deleverage, we expect operating performance decline to be more significant in 2H19 vs. 2H18, likely in the high single to low double-digit percentage decline. This operational deleveraging impact could get more severe in 2020.

This is due to our belief that (depreciation + operating lease) expenses will start picking up again in the later part of 2019, due to investments into MSA (4Q19) as well as CYG (2H19-2021) which management has guided to be in the arena of SGD10m and SGD20m respectively to be progressively incurred. Key operating expenses such as staff cost will likely continue to trend higher despite management’s best effort to keep them in check.

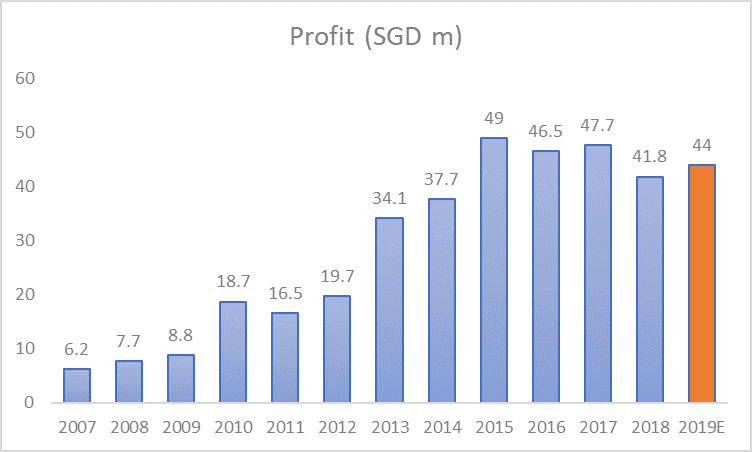

Straco: 2019-20 earnings unlikely to excite

Based on our assumptions, we derived a 2019 net profit of approx. SGD44m. While this is an improvement over 2018 net profit level of SGD41.8m, it is coming from an extremely low base (due to unforeseen Singapore Flyer operation disruption). We don’t expect 2020 to demonstrate significant operational out-performance base on our current outlook assessment of the company.

What could get us excited!

A major acquisition could change the current status co drastically and Straco definitely has the financial might to engage in one. Its net cash position of SGD168m as of end-1H19 is at record level. Assuming a similar acquisition target like the Singapore Flyer (purchased for SGD140m), we can expect such an acquisition to lift the Group’s bottom-line by c.20-25% (GOW contributed SGD12.3m in PBT. Assuming a corporate tax rate of 17%, net profit contribution will be approx. SGD10.2m or a return on capital of 7.3%).

Rinse and repeat the process every 3 years (cash increment of SGD40-45m/annum) and there is a high possibility that we are staring straight at a double-bagger. However, management’s conservative nature in terms of engaging in asset acquisitions could serve as a major impediment in terms of its short-term growth outlook.

Straco: Is valuation attractive?

Straco’s share price plummeted to SGD0.05 at the height of the Great Financial Crisis (GFC). Market capitalization then was approx. SGD43m. With a 2009 profit of SGD8.8m, the counter was trading at just a mere 5x PER for a hugely cash flow positive counter.

An investor with the foresight to recognize that Straco is in fact a cash generation monster, and the guts to dabble in the market when there was blood splattered all over the street, would have been amply rewarded with a 20-bagger when Straco’s price peaked in 2015 at slightly more than SGD1.00. That also coincides with its peak earnings.

With a current market capitalization value of SGD650m and potential earnings of c.SGD44m for 2019, the counter is trading at a 2019E PER of c.15x. Stripping out its forecasted net cash of SGD180m, that multiple reduces to 10.6x. This is based on a few key assumptions: 1) tourist visitation YoY decline of 5% in 2019, 2) Stable Revenue/tourist ratio of 24.7 in 2019, 3) Net margin of 37.7% in 2019 and 4) net cash increment of SGD15m in 2019.

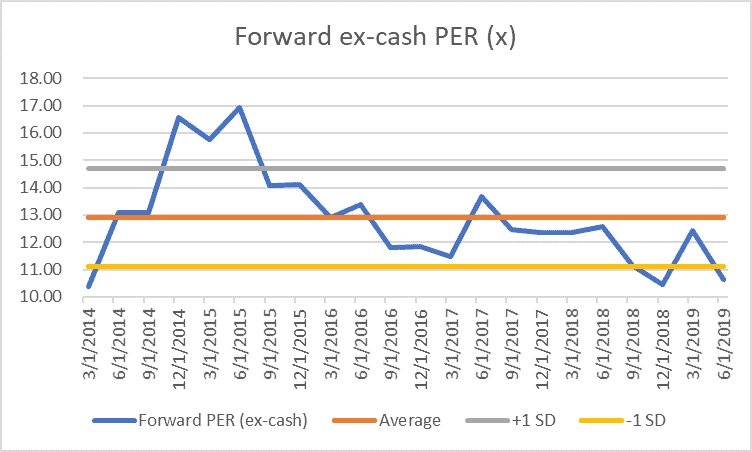

We look at the profile of the company’s historical PER trading range ex-cash. At a forward multiple of 10.6x, the company is trading at the low-end of its 5-years trading range. We believe the share price is undervalued at current levels but acknowledge that the counter lacks a major re-rating factor to bring its valuation multiples back to its average level of 12.9x (22% upside from current level) or even to the +1SD level of 14.7x (39% upside from current level) as seen in end-2014/2015 after its Singapore Flyer acquisition.

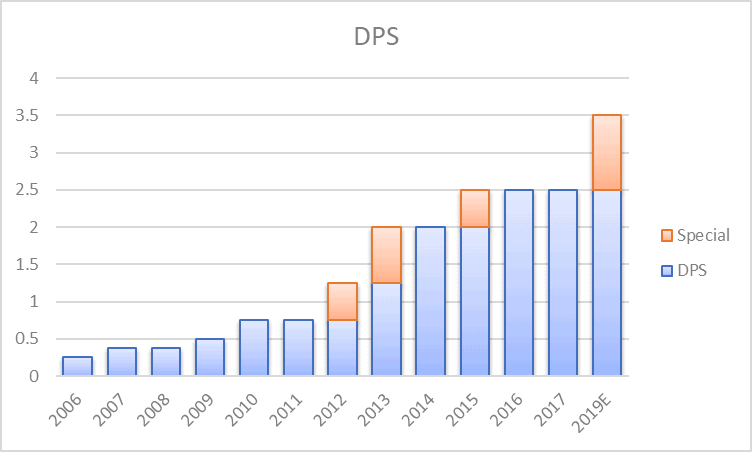

Straco: Dividend yield of 4.7% is attractive

Nonetheless, we expect the company to continue maintaining its dividend/share of at least 3.5 cents in 2019 and beyond, inclusive of special dividends. This equates to an attractive dividend yield of 4.7% at current share price of SGD0.75. Over the past decade, the company has not cut its dividend payment which goes to further highlight the strength of its balance sheet.

With a DPS of S3.5 cents, this equates to a total cash payment of c.SGD30m in dividends which is well-covered by its operating cash flow generation of c.SGD70-80m/annum. In fact, we believe there is a strong scope for gradual DPS increment as a manner to return excess cash to shareholders.

It does not hurt that management has also been active on the share buy-back front, although the amount is insignificant (approx. 100k shares bought back since July 2019).

Conclusion

I will be looking to monitor the counter and look to add a position if share price corrects to the SGD0.70 and then again at the SGD0.65. I will reassess the fundamentals of the company if a significant price correction beyond SGD0.65 is to happen. However, I believe a well-run company like Straco, albeit a tad conservative, with a strong yield profile of 4.7% is a Buy-and-Hold company for the patient long-term investor.

Disclosure: The accuracy of material found in this article cannot be guaranteed. Past performance is not an assurance of future results. This article is not to be construed as a recommendation to Buy or Sell any shares or derivative products and is solely for reference only.