Idexx laboratories: A company trading at 60x PER. Would you buy it? That was the first thought that cross my mind. To be honest, I have got no clue what the business of the company was. I was first introduced to this counter as it was a recommended Starter Stock by Motley Fools.

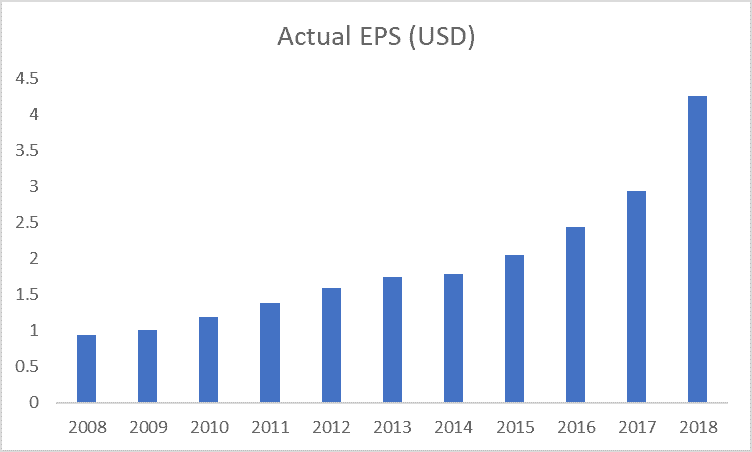

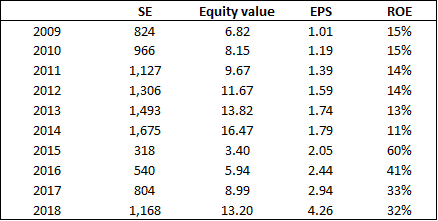

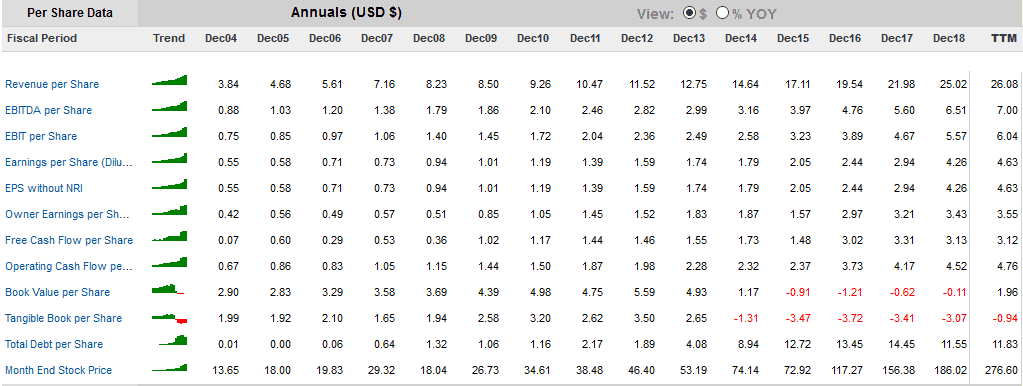

So I briefly took a look at its financials from Gurufocus and came away pretty impressed by its past decade of financial performance. The company registered earnings per share (EPS) growth in every single year over the past 10 years! Pretty impressive feat for a company that you probably would have no inklings what its business was about if you ain’t a pet owner.

In short, Idexx is an American multinational corporation (presence in over 175 countries around the world) engaged in the development, manufacture and distribution of products and services for the companion animal veterinary, livestock and poultry, water testing and dairy markets.

Ok to put it in an even clearer context, Idexx is a company that serves the mental health benefits of pet and livestock all over the world. And if your pets and poultry animals are well-taken care of, they indirectly enhance the well-being of people, or pet/poultry owners to be exact.

Doesn’t sound overly-complicated does it? More interestingly, approx. 85% of its USD$2.2 billion revenue generated in 2018 is recurring. Hmm, a highly recurring pet business with a secular growth runway but one that trades currently at 60x PER.

Would that make a good “value” purchase?

Idexx’s business analysis

Before we begin our price analysis, there are 9 questions that one would have to ask pertaining to the company’s business operations:

Does the company have any identifiable consumer monopolies or brand name products?

To be really honest, I have not heard about the company’s business nor brand solely because I am personally unfamiliar with the pet/veterinary market.

According to the company, the company is the largest spender among its peers in terms of R&D investment. This consistent investment in innovation creates a growing proprietary competitive gap between themselves and peers, thus driving growth for the organisation.

According to a 2017 report by Technavio, Idexx is one of the top 5 veterinary diagnostics market vendors in the world. The other 4 players are Abaxis, Heska, Thermo Fisher Scientific and Zoetis. Zoetis acquired Abaxis back in Mid-2018 and is currently the largest producer of medicine and vaccinations for pets and livestock.

So based on market cap, the company is likely ranked No.3 in this industry, behind both Thermo Fisher Scientific (much broader business scope) and Zoetis.

The brand of Idexx is definitely well-known within the veterinary diagnostic industry although there is unlikely to be a strong monopolistic power associated with it. I might be wrong on this as I am not too familiar with this industry, in all honesty.

Is the company conservatively financed?

The company has about USD$1 billion in terms of debt on its balance sheet. Given that its equity is negative (similar to McDonald and Disney which we have previously analysed using this same methodology), the usage of debt-equity ratio is not very meaningful.

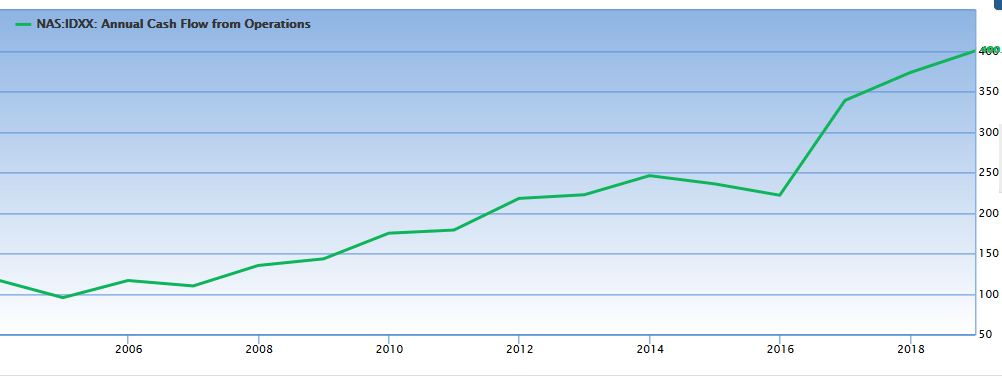

What is more meaningful is looking at the amount of operating cash flow that the company generates each year. That has been showing a very consistent uptrend alongside profit growth, the ideal scenario we will like to observe.

Based on its operating cash generation profile, it will take the company only 2.5 years to cover all its debt obligations.

Hence, we do not foresee any debt-related issues for the company.

Are the earnings strong and do they show an uptrend?

The earnings of Idexx are extremely impressive, to say the least. That is in fact the very reason that caught our attention and have us investigate the company a little further.

Its EPS has grown every single year for the last 10-years. In fact, it has been growing every year for the last 15-years. An extremely impressive feat. No wonder the company is trading at 60x PER. A good company ain’t cheap in this case.

Is the company allocating capital to its realm of expertise?

The company is one of the market leaders when it comes to allocating resources towards expanding its proprietary knowledge vs. its competitors. This could be a double-edged sword, one which requires constant R&D spending to stay ahead of the game.

In the case of Idexx, its strong operating cash profile affords the company the luxury to reinvest its capital into relevant proprietary knowledge that will remain with the company for a long time.

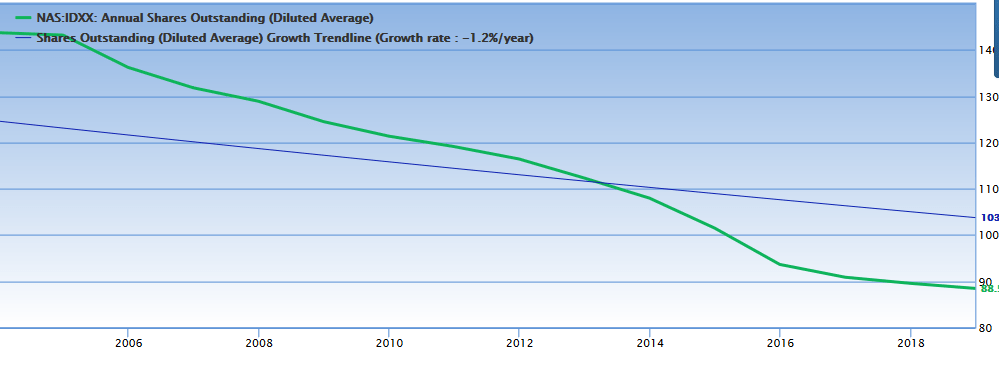

Is the company doing share buy backs?

Shares outstanding reduced from 143m back in end-2004 to 88.5m in end-2018. So yes, while the company does not pay a dividend, it is returning its capital to shareholders indirectly in the form of active share buy-backs.

However, given the elevated price of the company, share buyback activities might start to taper over the coming years. This is unless management believes that the intrinsic value of the company remains well above current level.

Is the company increasing shareholders’ value?

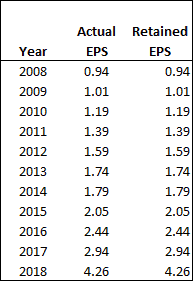

The company has generated a total of USD20.40/share in retained earnings over the period of 2008-2018. During this period, earnings per share (EPS) grew by USD3.32 from USD0.94 as of end-2008 to USD4.26 as of end-2018.

Thus we can argue that the retained earnings of USD20.40/share produced in 2018, an after- corporate tax return of USD3.32/share, which equates to a rate of return of 16.3%.

Rate of return = 3.32/20.40 = 16.3%

This indicates there has been a profitable allocation of retained earnings and a corresponding increase in earnings per share.

This has caused a much larger increase in the market price for Idexx’s stock, from approx. USD16 as of end-FY2008 to USD188 as of end-FY2018. Currently, the share price of Idexx sits at USD272.

What is the ROE of the company?

Idexx does not have a ROE figure as its equity is negative due to significant amount of share buybacks over the years which resulted in an accumulation of treasury shares.

Using retained earnings, Idexx’s ROE is at an elevated level of 32% based on 2018 figures. This is more than double our benchmark of at least 15%.

Is the company free to adjust prices to inflation?

According to management, the company is able to adjust its price by approx. 2-3% per annum based on the current trend that it is seeing. In total, company expects its recurring revenue for CAG Diagnostic (main segment which encompass c.75% of Group’s revenue) to be increasing at a rate of 11%.

Do operations require large capital expenditure?

The only significant capital expenditure for the business is R&D related expenses. The company generates strong free cash flow of close to USD$300m each year which offset concerns over high capex resulting in cash flow constraints.

Based on the above business assessment, we can safely say that Idexx is one of those stocks that fits nicely in what Buffett might term as stocks with “high earnings visibility”. The low variability of the company’s earnings as illustrated over the past decade makes it a candidate for us to “credibly” forecast its earnings trend over the next 10-years.

We based our Pricing Analysis of Idexx on some key assumptions which we highlight below.

Idexx’s Price Analysis

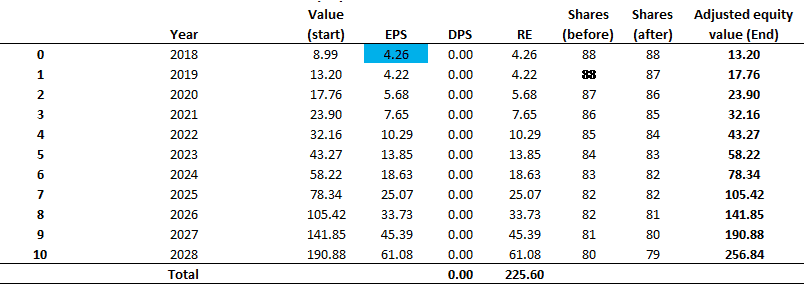

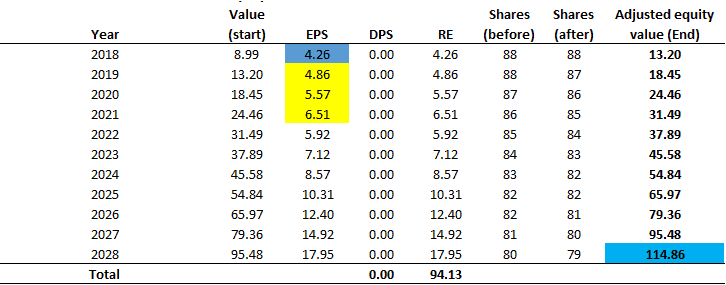

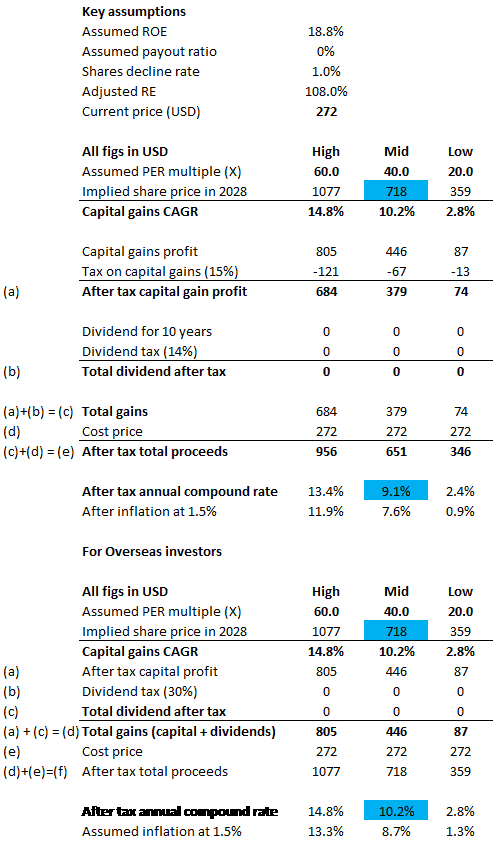

From a ROE standpoint, we can argue that as of end-2018, Idexx has a per share equity value (retained earnings/outstanding shares) of USD13.20. This per share equity value should theoretically be much higher if not for the fact that the company cancelled its treasury shares in 2015, thereby reducing its accumulated retained earnings in that year.

Consequently, adjusted ROE became extremely elevated for that year at 60% due to the low equity base. Current ROE based on our computation is at 32%.

If Idexx can maintain its 10-year ROE at 32% and retain 100% of that return (the company does not pay dividends), then Idexx’s/share equity value should grow at an annual compounding rate of 35% which is an insane rate.

This is also based on an assumed share base decline rate of 1%/annum. We notice that a 1% reduction in share base (in any particular year) will serve to boost the retained earnings per share by 8%.

Example 1:

Based on such a forecast, the company will generate a per share equity value of c.USD190.88 by start-2028. If the company is still earning a ROE of 32%, then Idexx should report an EPS of USD61.08.

EPS = Equity value per share * ROE (assume fixed at 32%)

We start off with the adjusted EPS of 4.26 in 2018 and end up with an EPS of 61.08 by 2028F. This translates to a CAGR of 30.5%!

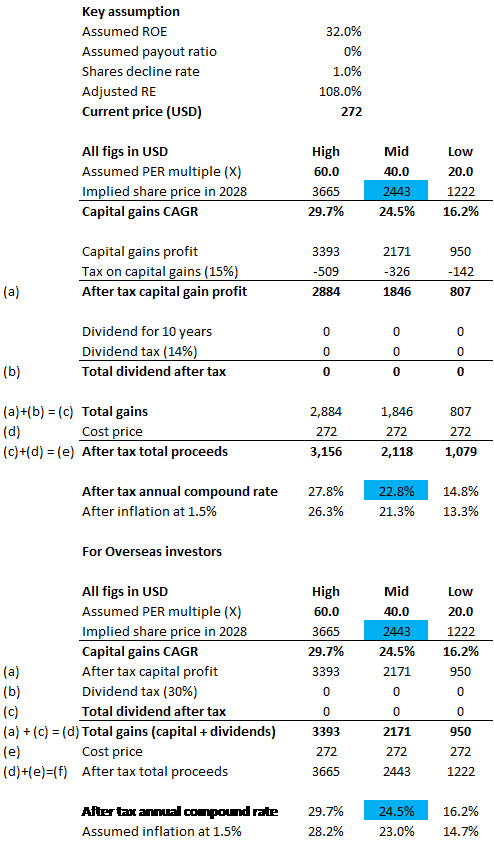

Based on these figures, on a cost of USD272/share, the after-tax compound return works out to be 22.8% (21.3% after inflation) for our base-case scenario. Even on our bearish case, that works out to be an after-inflation return of 13.3%.

This is a stock that is a BUY in almost any price based on this assumption. But before you get too hasty in triggering that buy button, take a look at example 2 which is a more realistic scenario.

Example 2:

However, the big variable in example 1 is if the company can maintain a high ROE of 32% every year for the next 10 years.

That is implying an EPS growth rate in excess of 30% every single year which is extremely unrealistic, in our view.

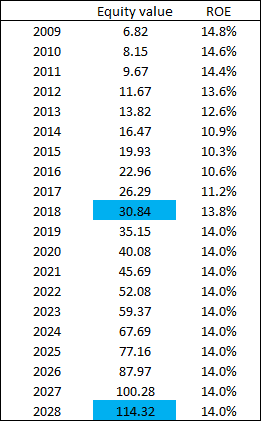

In a more realistic scenario, we assumed that there is no cancellation of treasury shares, hence no reduction in retained earnings.

Instead of the reported figure of USD$13.20 per share of equity value, the adjusted per share equity value would have been USD30.84 based on EPS generated.

That would have translated to an ROE figure of approx. 14%. We assumed a 14% ROE rate over the next 10 years which will translate to an end-2028 equity value of c.USD$114.32/share.

With that end-figure in mind, we derived a more appropriate ROE figure of 18.8% (we adjust 2019-21 figure based on consensus numbers).

Based on those numbers, we derived an after-inflation return of 7.6% on our base/mid case scenario based on today’s entry price of USD$272/share.

Conclusion

Hence, even at today’s elevated entry level of USD272/share, our analysis shows that investing in Idexx can generate an after inflation CAGR of 7.6% over the next 10-years, which is above our benchmark rate of 6.5%.

This is however still based on a PER assumption of 40x earnings. Can a recession-proof counter like Idexx with very consistent earnings growth (driven by recurring revenue) warrant such a multiple in the long run?

We believe there is a business case to it and will be taking a small position in the counter over the coming days.

See our other stocks write-up.

- BUFFETT SERIES: DISNEY

- 46 STOCKS IN BUFFETT PORTFOLIO

- BUFFETT SERIES: MCDONALD

- STRACO: IS IT A GOOD BUY NOW?

Disclosure: The accuracy of material found in this article cannot be guaranteed. Past performance is not an assurance of future results. This article is not to be construed as a recommendation to Buy or Sell any shares or derivative products and is solely for reference only.

1 thought on “Buffett series: Idexx Laboratories”