Disney is a household name that is loved by millions of kids and adults alike all over the world. The company is in the business of manufacturing FUN. Yes, Disney is undoubtedly one of the largest entertainment companies in the world today. However, Disney’s history is not without its failure.

Prior to 2005, Disney’s stock value was stagnant. Its studios, networks and theme parks had lost some of their magic that has for decades, bedazzled kids from all over the world. Then Bob Iger took over as CEO and turned the company around. This is chronicled in his new business memoir, The Ride of a Lifetime: Lessons Learned from 15 Years as CEO of The Walt Disney Company.

Disney is the owner of an expansive library of proprietary content which includes well-known brands such as Disney, Marvel, Pixar, Lucasfilm as well as the ABC network. A recent key focus has been on the launch of Disney+, its Netflix-style streaming service. Disney+ can be bundled alongside ESPN+ and Hulu for a monthly subscription price of USD12.99/month.

The launch of Disney+ is expected to be a major milestone for the company and in Bob Iger’s own words: “it’s going to be the most important product our company has launched in a long time, certainly in my tenure”. And Bob Iger has been CEO of Disney for a long time.

Let’s evaluate Disney’s business using the Buffett methodology to analyse first its business moat followed by its pricing attractiveness.

Disney’s business analysis

Before we begin our price analysis, there are 9 questions that one would have to ask pertaining to the company’s business operations:

Does the company have any identifiable consumer monopolies or brand name products?

Who hasn’t heard of Disney or watch one of its hundreds if not thousands of movies over the past decades? How about a visit to Disneyland, known as “The happiest place on earth”. Its theme parks have the largest cumulative attendance in the world, with 726m visits since it opened (as of Dec 2018).

Most kids continue to adore Mickey Mouse and that iconic mascot has continue to represent Disney till today, since its creation back in 1928.

So yes, the company definitely has got a well-identifiable consumer brand that is difficult to miss, with a global presence that continues to strengthen every single year.

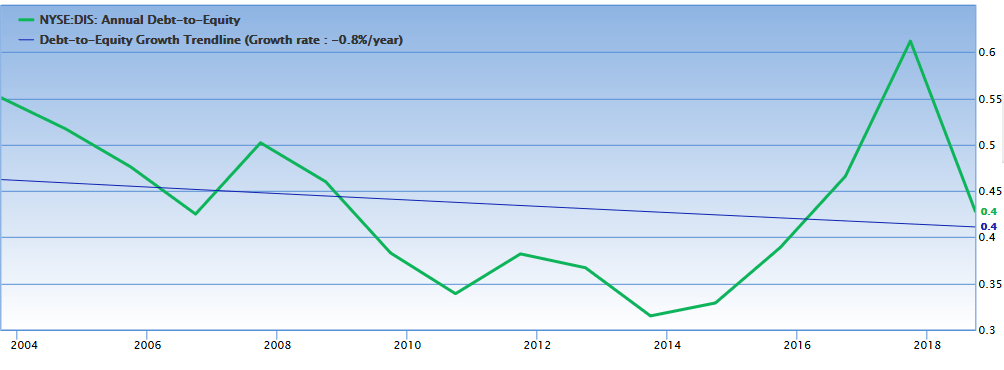

Is the company conservatively financed?

The company is conservatively financed with a debt/equity ratio of 0.4x as of its financial 2018 year-end, well below our 1.0x net debt/equity threshold. Even after its recent USD71.3bn mega acquisition of 21st Century Fox (21CF), its debt/equity gearing ratio of 0.60x as of end-June 2019 remains extremely manageable.

We believe that Disney will have very limited debt-related issues, considering the fact that it generates approx. USD14bn in operating cash flow a year and free cash flow of approx. USD10bn/annum relative to total long-term debt of USD30bn.

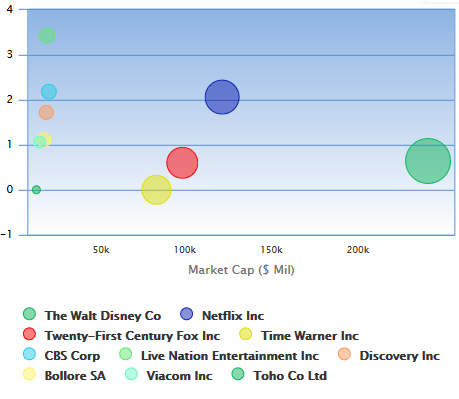

Among its peers, Disney has the largest market cap but yet spot among the lowest debt profile

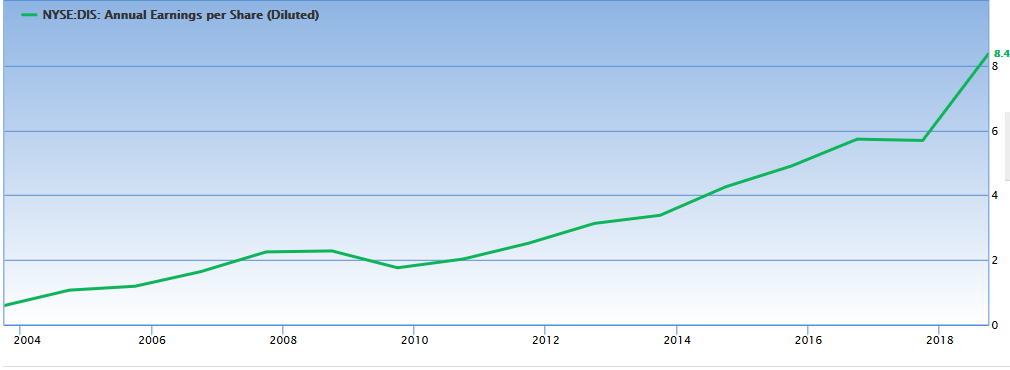

Are the earnings strong and do they show an uptrend?

A check of Disney’s per share earnings indicate that they have been growing at a rate of 14% annually. On an adjusted normalised basis, excluding some key one-offs in FY2018, its past 10-years CAGR would still have been a very decent 12%.

So earnings definitely has been strong and showing an uptrend over the past decade. Having said that, Disney’s FY2019 and FY2020 earnings will likely be negatively impacted by its recent acquisition of 21CF due to acquisition-related costs.

However, given the company’s long term earnings growth history, short-term earnings misses could be a valuable opportunity to get invested into the counter with a long-term outlook.

Is the company allocating capital to its realm of expertise?

Disney has been acquiring lots of high-profile companies since Bob Iger took over the reins back in 2005, starting with Pixar, followed by marvel, Lucasfilm and most recently 21CF. The wide array of proprietary media content from all these well-known brands will likely help Disney+ weather the competition of on-demand media that Netflix has been dominating all these years.

So yes, we believe that Disney has been allocating capital all these years to what it really knows best…. The business of MANUFACTURING FUN.

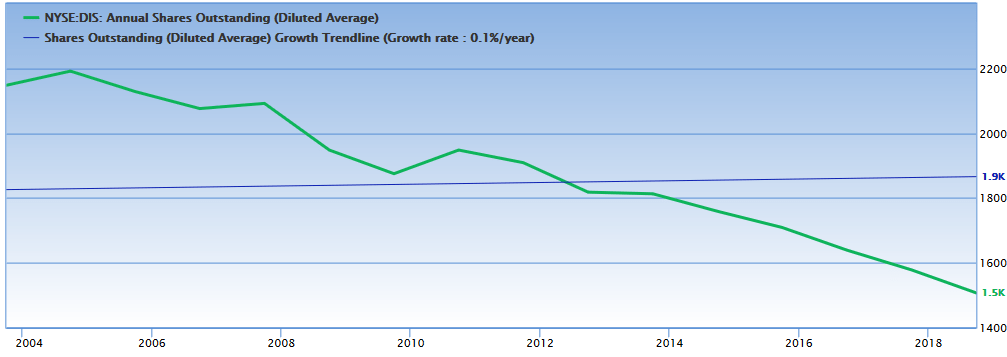

Is the company doing share buy backs?

Disney’s outstanding share base has been declining consistently over the past decade from 1.95bn shares back in FY2008 to 1.5bn shares as of FY2018. The company issued approx. 300m shares in early 2019 to finance the purchase of 21CF which resulted in its overall share-base increasing to 1.81bn as of end-June 2019.

This is a key reason why forward EPS, as forecasted by consensus, is likely to see a significant decline from a normalised adjusted figure of USD7.08/share in FY2018 to only USD5.79/share in FY2019F.

We will touch on this in our Pricing analysis in the next segment.

Is the company increasing shareholders’ value?

The company has generated a total of USD32.09/share in retained earnings over the period of 2008-2018. During this period, earnings per share (EPS) grew by USD6.08 from USD2.28 as of end-2008 to USD8.36 as of end-2018.

Thus we can argue that the retained earnings of USD32.09/share produced in 2018, an after- corporate tax return of USD6.08/share, which equates to a rate of return of 18.9%.

Rate of return = 6.08/32.09 = 18.9%

This indicates there has been a profitable allocation of retained earnings and a corresponding increase in earnings per share.

This has caused a similar increase in the market price for Disney’s stock, from approx. USD29.5 as of end-FY2008 to USD115 as of end-FY2018. Currently, the share price of Disney sits at USD130.

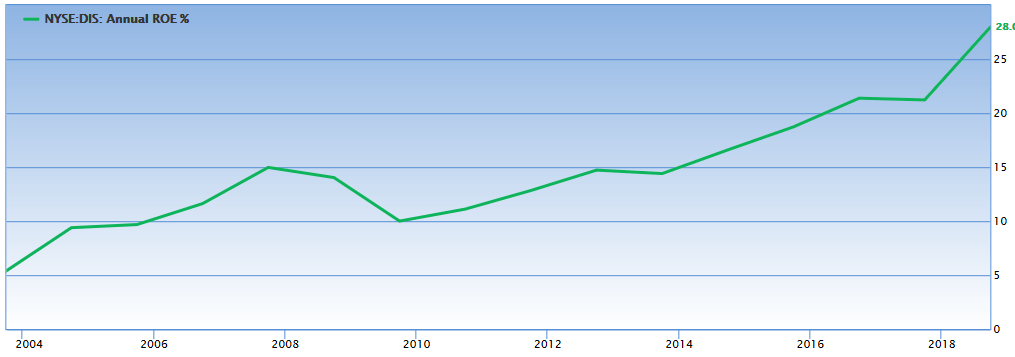

What is the ROE of the company?

Disney’s ROE has been on an uptrend over the past decade. As of end-FY2018, the reported ROE figure based on the formula:

ROE = Net Profit/Shareholder’s equity

Stands at an attractive 28%. This has been a strong improvement from its 2009 level of 9%. The strong uptrend seen in its reported ROE figure is due to a combination of improving business fundamentals as well as share buy back activities increasing its Treasury shares ownership (hence declining shareholder’s equity).

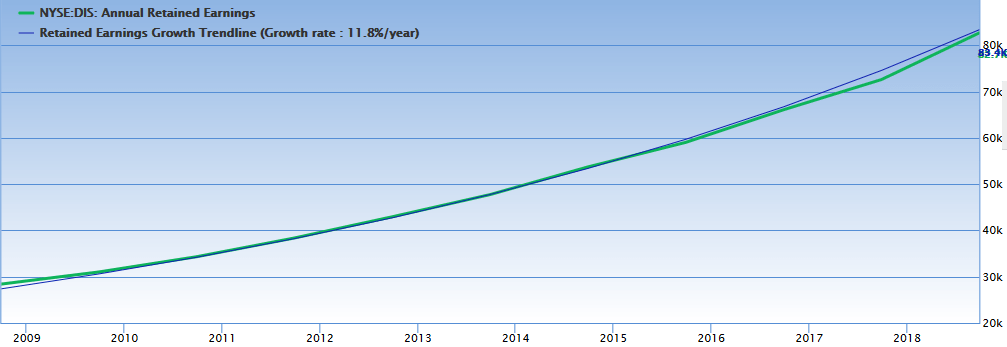

However, to remove the variability of share buy-back, we will use the company’s actual retained earnings as a proxy towards our estimation of the company’s equity value in our pricing analysis. Notice that the equity value (based on retained earnings) of Disney shows a very steady increment alongside higher earnings profile.

The stability of retained earnings in this case will be a better proxy to use vs. actual Shareholder’s equity. Based on this, ROE averages at about 13% over the past decade.

Is the company free to adjust prices to inflation?

Media content creation is not cheap. However, Disney likely has a strong pricing power in adjusting prices for its media content, based on its track record of churning out blockbuster movies year after year. Ticket prices for its theme parks are not likely to get any cheaper.

So yes, we believe the company is able to adjust its prices according to inflation.

Do operations require large capital expenditure?

Disney’s operations typically have annual capex ranging from USD3bn to USD5bn. This compares to USD14bn in operating cash flow as of end-FY18. Its strong free cash flow of USD10bn allows for a combination of debt repayment (USD2-3bn) as well as dividend payment (USD2.5bn).

Based on the above business assessment, we can safely say that Disney is one of those stocks that fits nicely in what Buffett might term as stocks with “high earnings visibility”. The low variability of the company’s earnings as illustrated over the past decade makes it a candidate for us to “credibly” forecast its earnings trend over the next 10-years.

However, due to the purchase of 21CF and the issuance of c.300m in shares for the acquisition, there will likely be major variation to its financial statement in FY2019 vs. FY2018.

We based our Pricing Analysis of Disney on some key assumptions which we highlight below.

Disney’s Price Analysis

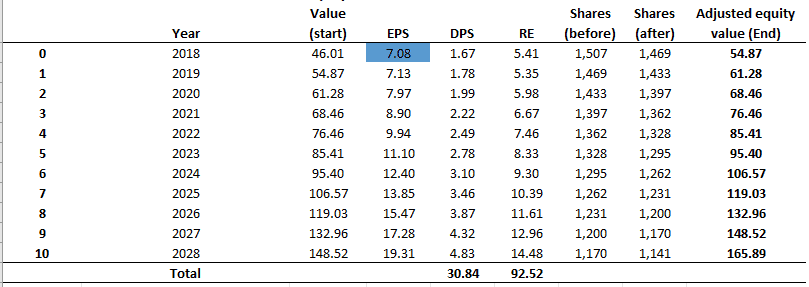

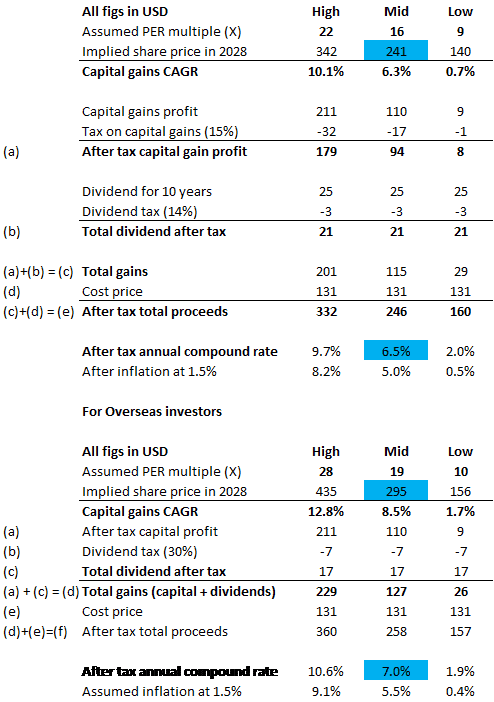

From a ROE standpoint, we can argue that as of end-2018, Disney has a per share equity value (retained earnings/outstanding shares) of USD54.87. The company’s 10-year average ROE is at 13.1%.

If Disney can maintain its 10-year ROE at 13% and retain approx. 80% of that return, with 20% being paid out as dividend, then Disney’s/share equity value should grow at an annual compounding rate of 12% (see example 1 below) which is pretty attractive.

This is also based on an assumed share base decline rate of 2.5%/annum. We notice that a 1% reduction in share base (in any particular year) will serve to boost the retained earnings per share by 8%.

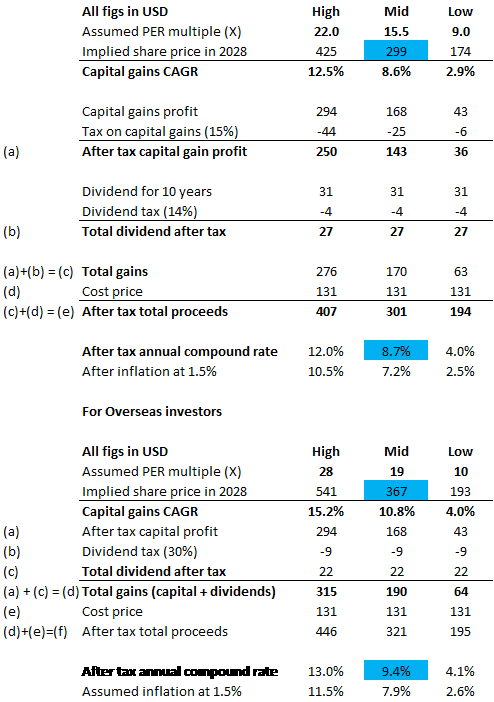

Example 1: No 300m shares increment

- *FY2018 starting EPS figure of USD7.08 based on adjusted normalized earnings

Based on such a forecast, the company will generate a per share equity value of c.USD148.52 by start-2028. If the company is still earning an ROE of 13%, then Disney should report an EPS of USD19.31.

EPS = Equity value per share * ROE (assume fixed at 13%)

In our example above, we assumed that the company did not issue the 300m shares for the 21CF acquisition and that the company will continue to engage in share buy backs, reducing outstanding shares by approx. 2.5% each year.

We start off with the adjusted EPS of 7.08 in 2018 and end up with an EPS of 19.31 by 2028F. This translates to a CAGR of 10.6%, slightly lower than its previous 10-year average of 12% but still a very decent figure.

Based on these figures, on a cost of USD131/share, the after-tax compound return works out to be 8.7% (7.2% after inflation).

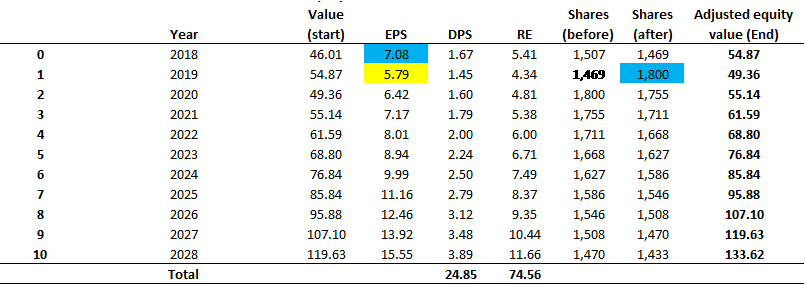

Example 2: With 300m shares increment

- *FY2018 starting EPS figure of USD7.08 based on adjusted normalized earnings

- *FY2019 EPS figure based on consensus forecast

- *End-FY2019 share count assumed at 1.8bn shares

However, if we were to take into account the 300m of new shares issued for the 21CF acquisition, then the valuation dynamics changed quite a fair bit.

On a like for like basis, EPS and per share equity value will be lower due to the higher share count base. However, if we assumed a similar ROE rate of 13%, the theoretical implied annual earnings should not have too much of a variation between example 1 and example 2.

However, on a valuation profile, using the same PER multiple, we get a different conclusion. At the same entry level of USD131/share, the after-tax compound return now drops to 6.5% (5% after inflation).

This is due to the lower EPS base without any form of PER or ROE expansion. The converse can be said in a scenario where there is a decline in share base boosting EPS. On a constant PER multiple basis, its valuation will be higher.

Conclusion

Disney is a stock that is worthy of a place in our portfolio based on our current analysis. However a key risk at present will be the integration of 21CF into its core business and how that might have a negative impact on Disney’s share price in the short-run.

The current assumption is that the 21CF will not significantly accrue to the earnings of the Disney Group (hence no ROE expansion). The company has just paid USD71bn which in the short course will not result in a significant jump in earnings, based on consensus earnings estimate.

Disney would have been better off in a status-co situation vs. purchasing 21CF.

On a long-run basis, we are confident that Disney’s management will have the foresight and expertise to realise the synergies of its latest acquisition, just like it has done for all its previous acquisitions since Bob Iger’s days as CEO of the company.

Our ideal target entry price will be at USD110/share. Based on that level, the after tax, after inflation annual compound return will equate to 6.7% based on Example 2.

See our other stocks write-up.

Disclosure: The accuracy of material found in this article cannot be guaranteed. Past performance is not an assurance of future results. This article is not to be construed as a recommendation to Buy or Sell any shares or derivative products and is solely for reference only.