Most of you would be familiar with the “Greatest” investor of all time, Mr. Warren Buffett. But you probably have not heard of Mr. Jim Simons, the hedge fund manager that charges a 5% management fee and 44% performance fee!!! Sounds like a scam in the making?

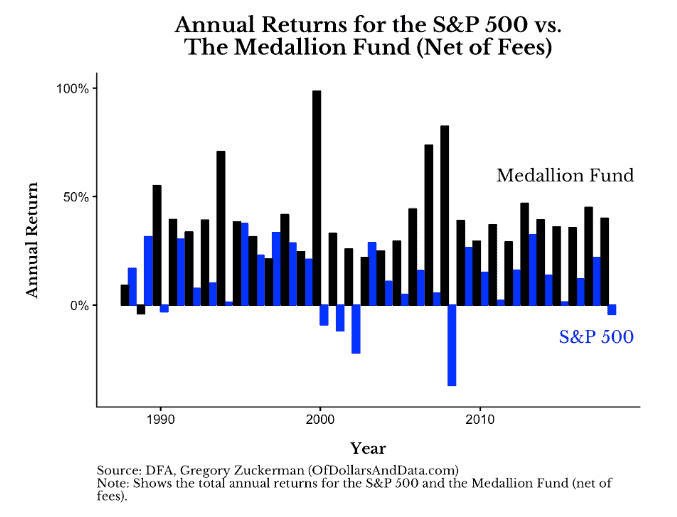

Well, you can’t be more wrong than that. Jim Simon’s flagship Medallion Fund generated a 39% average annual return from 1988 to 2018. And that is after taking into account all the hefty fees charged by the fund. Excluding those fees would have generated average annualized returns of 66%!

A $1 investment in the fund from 1988 would have hypothetically become $20,000, net of fees. Compare that to the S&P500 return of $20. Warren Buffett would have generated $100 during that period.

Jim Simons is often credited as the man behind the best hedge fund ever. Recently, Wall Street Journal reporter Greg Zuckerman wrote a book: The Man Who Solved the Market which details how mathematics prodigy Jim Simons built hedge fund Renaissance Technologies “into the greatest money-making machine in Wall Street history”.

While great investors such as Warren Buffett goes for “quality companies when they are marked down”, Jim Simons “spots patterns”. He started finding patterns in his early days through a manual process but subsequently handed that “job” to an algorithm that executed trades even when the logic was unclear to human minds.

Jim Simon Top 5 holdings

Jim Simons’s Renaissance Technologies fund is a broad-base fund that holds thousands of stocks with a total value of USD$118bn.

His Top 5 holdings are currently:

- Bristol-Myers Squibb with a US$1.66bn stake accounting for 1.41% of the portfolio

- Chipotle Mexican Grill with a US$1.61bn stake accounting for 1.36% of the portfolio

- Verisign with a US$1.56bn stake accounting for 1.32% of the portfolio

- Celgene with a US$1.54bn stake accounting for 1.31% of the portfolio (recently acquired by Bristol Myers Squibb)

- Novo Nordisk with a US1.28bn stake accounting for 1.08% of the portfolio.

These are all high-quality stocks that one can consider for addition in his/her portfolio.

To go one step further, we look at using the information from Gurufocus to identify High-Quality stocks (5-stars) that Jim Simons recently added into the portfolio.

What is considered as High Quality?

GuruFocus has a rating system which rates companies from zero to 5 stars. GuruFocus has found strong correlations between the Predictability of Businesses and the long-term return of stocks.

The higher the predictability (5 stars), the more likely a stock is to deliver higher returns over 10 years. And the higher the predictability, the less likely it is that share price will be below the buying price after 10 years.

Simply put, high quality means the highest probability a stock will earn above-average capital gains and the lowest probability of being underwater after a decade.

Combining the best of two worlds

So if we combine the algorithm prowess of Jim Simons’s hedge fund alongside the predictive power of GuruFocus high-quality companies with predictable business qualities, does it then make for a potent combination?

Below we present the 5 high-quality stocks which Jim Simons purchased in 3Q19 and 3 high-quality stocks which he doubled his stakes in the quarter.

The 5 High-Quality new holdings that Jim Simons recently purchased

#1 Telecom Argentina

Telecom Argentina is the major local telephone company for the northern part of Argentina, including the whole of the city of Buenos Aires. Briefly known as Sociedad Licenciataria Norte S.A.m it quickly changed its name and is usually known as simply “Telecom” within Argentina.

#2 UnitedHealth Group Inc

UnitedHealth Group is an American for-profit managed health care company based in Minnetonka, Minnesota. It offers health care products and insurance services. It is the largest healthcare company in the world by revenue, with 2018 revenue of US$226bn and 115m customers.

#3 Costco Wholesale Corp

Costco Wholesale Corp is an American multinational corporation that operates a chain of membership-only warehouse clubs. The company counts both Warren Buffett and Charlie Munger as shareholders of the company.

#4 Cerner Corp

Cerner Corporation is an American supplier of health information technology solutions, services, devices, and hardware. Its products were in use at more than 27,000 facilities around the world. The company had more than 28,000 employees globally, with over 13,000 in Kansas City.

#5 Accenture PLC

Accenture plc, stylized as Accenture, is an Irish-domiciled multinational professional services company that provides services in strategy, consulting, digital, technology and operations. A Fortune Global 500 company, it has been incorporated in Dublin, Ireland since Sep 1, 2009.

And 3 more High-Quality Holdings which he doubled his stakes

#1 NetEase Inc

NetEase Inc is a Chinese internet technology company providing online services centered on content, community, communications, and commerce. The company was founded in 1997 by Ding Lei. NetEase develops and operates online PC and mobile games, advertising services, email services and e-commerce platforms in China.

#2 W.W. Grainger Inc

W.W. Grainger is an American Fortune 500 industrial supply company founded in 1927 in Chicago by William W Grainger. he founded the company in order to provide customers with access to a consistent supply of motors.

#3 Gentex Corp

Gentex Corporation manufactures automatic-dimming rear-view mirrors, camera-based driver assistance systems and the HomeLink Wireless Control System for the global automotive industry.

Which is the best of the best?

While there really isn’t a clear answer to which of these 8 stocks are the best, the largest in terms of market cap is UnitedHealth Group and it is also the counter with the largest number of super-investors ownership (10), according to data from Dataroma.

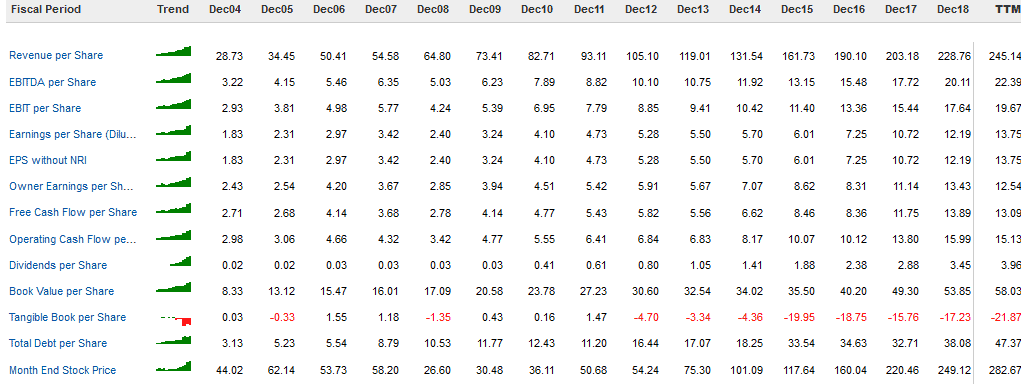

The company has consistently grew both revenue and earnings as illustrated in the table above. Not surprisingly, its share price has appreciated more than 10x since 2008.

With its current share price at US$282 and the counter expected to generate US$14.96/share in earnings for 2019 and US$16.44/share in earnings for 2020 (10% growth rate), the counter is currently trading at a forward 2019 PER of 18.8x and 2020 PER of 17.1x.

It’s PER ratio is slightly on the high side, considering that the median PER multiple over the past decade was 14.8x.

Conclusion

Do the stocks in this collection, Jim Simons’ High-Quality stocks constitute a reasonable consideration for one’s portfolio? Perhaps, but then again there is no one-size fit all solution.

Jim Simon has been credited as likely the greatest investor in this era who has perhaps found the “Holy Grail” to stock investing/trading by taking the human element out of investing.

While one is unlikely to achieve his kind of track record, it is perhaps useful to follow some of his trades. Packaged this alongside GuruFocus’s proprietary data when it comes to evaluating the predictability of businesses and there is a higher probability of selecting a long-term winner.

Do Like Me on Facebook if you enjoy reading the various investment and personal finance articles at New Academy of Finance. I do post interesting articles on FB from time to time which might not be covered here in this website.

Join our whatsapp broadcast: txt hello to https://api.whatsapp.com/send?phone=6587407951&text=&source=&data=

SEE OUR OTHER WRITE-UPS

- STASHAWAY SIMPLE. CAN YOU REALLY GENERATE 1.9% RETURN?

- WHY I AM STILL BUYING REITS EVEN WHEN THEY LOOK EXPENSIVE

- TOP 10 FOOD & BEVERAGE BRANDS. ARE THEY WORTHY RECESSION-PROOF STOCKS?

- THE BEST PREDICTOR OF STOCK PRICE PERFORMANCE, ACCORDING TO MORGAN STANLEY

- TOP 10 HOTTEST STOCKS THAT SUPER-INVESTORS ARE BUYING

- SEMBCORP MARINE 3Q19 LOSSES BALLOONED TO S$53M. WHAT YOU SHOULD KNOW

Disclosure: The accuracy of the material found in this article cannot be guaranteed. Past performance is not an assurance of future results. This article is not to be construed as a recommendation to Buy or Sell any shares or derivative products and is solely for reference only.